German Industrials / Tech

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

DWS Equity Funds Semiannual Reports 2010/2011

DWS Investment GmbH DWS Equity Funds Semiannual Reports 2010/2011 ■ DWS Deutschland ■ DWS Investa ■ DWS Aktien Strategie Deutschland ■ DWS European Opportunities ■ DWS Intervest ■ DWS Akkumula : The DWS/DB Group is the largest German mutual fund company according to assets under management. Source: BVI. As of: March 31, 2011. 4/2011 DWS Deutschland DWS Investa DWS Aktien Strategie Deutschland DWS European Opportunities DWS Intervest DWS Akkumula Contents Semiannual reports 2010/2011 for the period from October 1, 2010, through March 31, 2011 (in accordance with article 44 (2) of the German Investment Act (InvG)) TOP 50 Europa 00 General information 2 Semiannual reports 2010 DWS Deutschland 4 DWS Investa 10 2011 DWS Aktien Strategie Deutschland 16 DWS European Opportunities 22 DWS Intervest 28 DWS Akkumula 36 1 General information Performance ing benchmarks – if available – are also b) any taxes that may arise in connec- The investment return, or performance, presented in the report. All financial tion with administrative and custodial of a mutual fund investment is meas - data in this publication is as of costs; ured by the change in value of the March 31, 2011. c) the costs of asserting and enforcing fund’s units. The net asset values per the legal claims of the investment unit (= redemption prices) with the addi- Sales prospectuses fund. tion of intervening distributions, which The sole binding basis for a purchase are, for example, reinvested free of are the current versions of the simpli- The details of the fee structure are set charge within the scope of investment fied and the detailed sales prospec - forth in the current detailed sales accounts at DWS, are used as the basis tuses, which are available from DWS, prospectus. -

CCP Instruments As of 2003 03 27 Engl

First introduction sequence of CCP instruments as of March 27, 2003 CCP Instruments DAX Block Crossing DAX (Xetra XXL) + corresponding instruments 1 DE0008232125 LHA LUFTHANSA AG VNA O.N. 1 BC0008232125 BCLHA LUFTHANSA AG VNA O.N. 2 DE0007172009 SCH SCHERING AG O.N. 2 BC0007172009 BCSCH SCHERING AG O.N. CCP Instruments MDAX + corresponding instruments Block Crossing MDAX (Xetra XXL) 1 DE0002457561 HEIJ HEIDELBERGCEMENT O.N. NST 2 DE0005072102 BZL BERU AG O.N. 1 BC0005072102 BCBZL BERU AG 3 DE0005085906 AWD AWD HOLDING AG O.N. 2 BC0005085906 BCAWD AWD HOLDING AG O.N. 4 DE0005200000 BEI BEIERSDORF AG O.N. 3 BC0005200000 BCBEI BEIERSDORF AG O.N. 5 DE0005245500 BOS HUGO BOSS AG ST O.N. 6 DE0005245534 BOS3 HUGO BOSS AG VZO O.N. 4 BC0005245534 BBOS3 HUGO BOSS AG VZO O.N. 7 DE0005278006 BUD BUDERUS AG O.N. 5 BC0005278006 BCBUD BUDERUS AG O.N. 8 DE0005408116 ARL AAREAL BANK AG 6 BC0005408116 BCARL AAREAL BANK AG 9 DE0005408884 LEO LEONI AG NA O.N. 7 BC0005408884 BCLEO LEONI AG 10 DE0005421903 DGX DEGUSSA AG O.N. 8 BC0005421903 BCDGX DEGUSSA AG O.N. 11 DE0005439004 CON CONTINENTAL AG O.N. 9 BC0005439004 BCCON CONTINENTAL AG O.N. 12 DE0005471601 TNH TECHEM O.N. 10 BC0005471601 BCTNH TECHEM O.N. 13 DE0005591002 DYK DYCKERHOFF ST O.N. 14 DE0005591036 DYK3 DYCKERHOFF VZO O.N. 11 BC0005591036 BDYK3 DYCKERHOFF VZO O.N. 15 DE0005753008 CZZ CELANESE AG O.N. 12 BC0005753008 BCCZZ CELANESE AG O.N. 16 DE0005773303 FRA FRAPORT AG FFM.AIRPORT 13 BC0005773303 BCFRA FRAPORT AG 17 DE0005785604 FRE FRESENIUS AG O.N. -

HW&Co. Industry Reader Template

INDUSTRIAL TECHNOLOGY INDUSTRY UPDATE │ FALL 2015 www.harriswilliams.de Harris Williams & Co. Ltd is a private limited company incorporated under English law having its registered office at 5th Floor, 6 St. Andrew Street, London EC4A 3AE, UK, registered with the Registrar of Companies for England and Wales under company number 7078852. Directors: Mr. Christopher Williams, Mr. Ned Valentine, Mr. Paul Poggi and Mr. Thierry Monjauze, authorised and regulated by the Financial Conduct Authority. Harris Williams & Co. Ltd Niederlassung Frankfurt (German branch) is registered in the Commercial Register (Handelsregister) of the Local Court (Amtsgericht) of Frankfurt am Main, Germany, under registration number HRB 96687, having its business address at Bockenheimer Landstrasse 33-35, 60325 Frankfurt am Main, Germany. Permanent Representative (Ständiger Vertreter) of the Branch Niederlassung: Mr. Jeffery H. Perkins. INDUSTRIAL TECHNOLOGY INDUSTRY UPDATE │ FALL 2015 SUMMARY CONTENTS M&A | SELECT RECENT ACTIVITY . RECENT M&A ACTIVITY OMRON Corporation (TSE:6645) has signed an agreement to purchase Adept . WHAT WE’RE READING Technology, Inc. (“Adept”), a leading provider of intelligent robots, autonomous . PUBLIC MARKETS mobile robotic solutions and services. The acquisition of Adept will enhance . M&A MARKET TRENDS OMRON’s advanced automation technology solutions offering. ECONOMIC UPDATE Source . PUBLIC COMPARABLES Honeywell International Inc. (NYSE:HON) has announced an agreement to acquire the Elster Division (“Elster”) of Melrose Industries plc (LSE:MRO) for $5.1 billion. Elster CONTACTS is a leading provider of gas, water, and electricity meters for residential, commercial, and industrial markets globally. Jeffery Perkins Source Managing Director [email protected] +49 (69) 3650638 13 Hillenbrand, Inc. (NYSE:HI) has completed the acquisition of ABEL Pumps LP and certain of its affiliates (“ABEL”) from Roper Technologies, Inc. -

INVITATION and AGENDA Annual General Meeting 2020

INVITATION AND AGENDA Annual General Meeting 2020 The Quality Connection Content ISIN DE 000 540888 4 Securities Identification Number 540 888 Agenda ................................................................................ 4 Further information on candidate Ms Regine Stachelhaus as proposed under item 5 of the agenda ................. 14 Annex to agenda item 8 ..................................................................... 16 Reports by the Board of Directors to the Annual General Meeting ........................................ 32 More information and notes concerning the invitation ...............................................40 Invitation to the Annual General Meeting of LEONI AG, Nuremberg Invitation to the Annual General Meeting of LEONI AG, Nuremberg, which will take place on Thursday, 23 July 2020 at 10:00 hours (CEST) as a virtual annual general meeting without the physical presence of shareholders or their proxies. In keeping with the German Stock Corporation Act, the Annual General Meeting will be based at NürnbergMesse GmbH, Messezentrum, 90471 Nürnberg. Shareholders and their proxies (with the exception of proxies appointed by the Company) will not be entitled or have any option to attend the meeting on site. More detail on this virtual Annual General Meeting, especially on exercise of voting rights and other shareholder rights, is contained in the section headed More information and notes concerning the invitation after the agenda. www.leoni.com/en/agm2020/ 4 | Agenda Agenda | 5 Agenda 1. Presentation of the -

Edison Research Template

German industrials spotlight Industrial machinery 15 May 2013 . Industrial machinery stocks are attracting EPS upgrades. Export growth and falling metal prices are positive for earnings. Analysts Graeme Kyle +44 (0)20 3077 5700 . We highlight three companies that may interest investors. Roger Johnston +44 (0)20 3077 5722 Grinding on [email protected] Click here to access industrials research We find it interesting that several industrial machinery stocks appear at the top of our rising revisions screen this month. Earnings in this sector are sensitive to the economic cycle, which appears at odds with weak macroeconomic data released in MDAX Industrials Index recent weeks. In particular, German GDP fell by -0.6% in Q412 and the Ifo business 210 expectations survey fell to 101.6 in April (vs 103.6 in March). In addition, GDP 190 170 growth in China slowed to +7.7% year-on-year in Q1 vs market expectations of 150 +8%. We believe there are other, more specific, factors at play including the 130 110 continued success of German global exports and the potential for gross margins 90 across the sector to expand as metal prices decline. On a wider scale, central 70 banks continue to provide ongoing liquidity and maintain interest rates at low levels; 50 Nov/09 Nov/10 Nov/11 Nov/12 Nov/08 this encourages capital flow into cheaper, riskier assets such as industrial May/08 May/09 May/10 May/11 May/12 May/13 machinery stocks. We identify three companies in this sector that screen well and Ifo Business Expectations should attract investors; Koenig & Bauer, KSB and Schaltbau. -

SRO List EFDS Posting Feb 2019.Xlsx

Significantly Regulated Organizations Added ‐ February 2019 DUNS TICKER BUSINESS NAME COUNTRY NAME EXCHANGE NAME NUMBER SYMBOL 220117440 MEDAPHOR GROUP PLC WALES MED London Stock Exchange (LON) 555278141 CAI LAY VETERINARY PHARMACY JOINT STOCK COMPANY VIETNAM MKV Hanoi Stock Exchange 555295156 CAN THO MINERAL AND CEMENT JOINT STOCK COMPANY VIETNAM CCM Hanoi Stock Exchange 555519774 CENTRAL PETROCHEMICAL AND FERTILIZER JOINT STOCK COMPANY VIETNAM PCE Hanoi Stock Exchange 555537308 HIEP KHANH TEA JOINT‐STOCK COMPANY VIETNAM HKT Hanoi Stock Exchange 555530218 HVA INVESTMENT JOINT STOCK COMPANY VIETNAM HVA Hanoi Stock Exchange 555242481 KIM VI INOX IMPORT EXPORT PRODUCTION JOINT STOCK COMPANY VIETNAM KVC Hanoi Stock Exchange 555322911 LILAMA 45.4 JOINT ‐ STOCK COMPANY VIETNAM L44 Hanoi Stock Exchange 555242771 MY XUAN BRICK TILE POTTERY AND CONSTRUCTION JOINT STOCK COMPANY VIETNAM GMX Hanoi Stock Exchange 555319545 NGAN SON JOINT STOCK COMPANY VIETNAM NST Hanoi Stock Exchange 555399648 NHA BE WATER SUPPLY JOINT STOCK COMPANY VIETNAM NBW Hanoi Stock Exchange 555290113 PETROVIETNAM TECHNICAL SERVICES CORPORATION VIETNAM PVS Hanoi Stock Exchange 555295524 PHUONG DONG PETROLEUM TOURISM JOINT STOCK COMPANY VIETNAM PDC Hanoi Stock Exchange 555265232 PP.PHARCO VIETNAM PPP Hanoi Stock Exchange 555431882 SAI GON VEGETABLE OIL JOINT STOCK COMPANY VIETNAM SGO Hanoi Stock Exchange 555304039 SAIGON HOTEL CORPORATION VIETNAM SGH Hanoi Stock Exchange 555295100 SIMCO SONGDA JOINT STOCK COMPANY VIETNAM SDA Hanoi Stock Exchange 555319875 SONG DA NO 11 JOINT -

Cantech International May 2020

CANTECH INTERNATIONAL MAY 2020 MAY CANTECH INTERNATIONAL www.cantechonline.com TechTech Can INTERNATIONAL Can MAY2020 CT-COVER MAY20.indd 1 22/04/2020 10:16 Working on the future with Koenig & Bauer MetalPrint. Koenig & Bauer MetalPrint GmbH T +49 711 699 71-0 [email protected] metalprint.koenig-bauer.com Anzeige_Intelligence_CanTech_Apr2020_RZ-3_print.indd 1 17.03.2020 12:55:04 CONTENTS MAY 2020 May 2020 CONTENTS Volume 27, Number 8 22 CANTECH INTERNATIONAL MAY 2020 MAY CANTECH INTERNATIONAL 20 www.cantechonline.com Tech Can INTERNATIONAL Can MAY2020 CT-COVER MAY20.indd 1 22/04/2020 10:16 40 Subscription Information DON’T MISS IT! 17 An annual subscription to CanTech International includes; direct priority mail delivery of 11 issues per year, weekly email newsletter and online access to digital back issues. Print & Digital Issue One Year: £175 UK; £186 Europe; $275 Rest of World Print & Digital Issue Two Years: £302 UK; £320 Europe; $473 Rest of World Digital Issue Only (One year): REGULARS 31 £166/$270 5 Comment To subscribe please email The news as we have it [email protected] or go to www.cantechonline.com/ 7 World News subscribe. Including Twitter Trade Talk 22 COVID-19 10 ways Covid-19 has Send address changes to: 48 New Products changed the can making CanTech International, The latest products available industry forever The Maltings, 57 Bath Street, 40 NEW ZEALAND Gravesend, Kent DA11 0DF, UK. 51 Buyer’s Guide 24 COVID-19 China’s can making industry is Evert van de Weg examines entering a new development 66 The Can Man the consequences for can phase as several of the A sideways look at the world makers due to the Covid-19 country’s leading can © Bell Publishing Ltd 2020. -

Online-Appendix Zu

Online-Appendix zu „Impact of Weather on the Stock Market Returns of Different Industries in Germany“ Astrid Schulte-Huermann WHU – Otto Beisheim School of Management Junior Management Science 5(3) (2020) 295-311 Appendix Appendix A. List of companies included in each sector Financials Telecommunication Technology Consumer Non- Industrials Healthcare Basic Materials Consumer Cyclicals Utilities Cyclicals ALLIANZ SE DT TELEKOM N INFINEON TECH BEIERSDORF DEUTSCHE POST BAYER N AG BASF SE ADIDAS N RWE DEUTSCHE BANK 1&1 DRILLISCH SAP SE BAYWA N DT LUFTHANSA A FRESENIUS MEDI HEIDELBERGCEMEBAY MOT WERKE ENCAVIS DT BOERSE N FREENET N AG BECHTLE KWS SAAT SIEMENS N FRESENIUS SE HENKEL AG&CO V CONTINENTAL AG E ON MUENCH. RUECK UNITED INTERNE DIALOG SEMICON SUEDZUCKER WIRE CARD MERCK KGAA LINDE PLC DAIMLER AG N AAREAL BANK NEMETSCHEK AIRBUS SE CARL ZEISS MED THYSSENKRUPP A VOLKSWAGEN VZ ALSTRIA OFF RE SOFTWARE DUERR AG EVOTEC AURUBIS A SPRINGER SE COMMERZBANK ADVA OPTICAL N FRAPORT GERRESHEIMER FUCHS PETRO VZ FIELMANN DEUTSCHE WOHNE AIXTRON NA GEA GROUP MORPHOSYS K+S AG NA HUGO BOSS N DT EUROSHOP NA CANCOM SE HOCHTIEF QIAGEN NV LANXESS PROSIEBENSAT1 HANNOVER RUECK COMPUGROUP MED MTU AERO ENGIN SARTORIUS VZ SYMRISE AG PUMA TAG IMMOBILIEN ISRA VISION AMADEUS FIRE DRAEGERWERK VZ WACKER CHEMIE RHEINMETALL ADLER REAL ES S&T AG BERTRANDT RHOEN KLINIKUM KLOECKNER + CO RTL GROUP DIC ASSET SMA SOLAR TECH BILFINGER SALZGITTER BOR. DORTMUND DT BETEIL AG TAKKT CEWE STIFTUNG SGL CARBON CECONOMY GRENKE XING DEUTZ CTS EVENTIM HAMBORNER REIT ZOOPLUS DR HOENLE HORNBACH HYPOPORT AG HAMBURGER HAFE RATIONAL PATRIZIA IMMOB HEIDELBERG DRU SAF HOLLAND SA WUESTENR&WUERT INDUS HOLDING STEINHOFF JENOPTIK JUNGHEINRICH V KOENIG & BAUER KRONES AG LEONI AG N NORDEX PFEIFFER VACUU SIXT SE VOSSLOH AG WACKER NEUSON WASHTEC Company data retrieved from Thomson Reuters Datastream, 2019 40 Appendix B. -

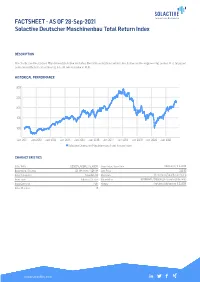

FACTSHEET - AS of 28-Sep-2021 Solactive Deutscher Maschinenbau Total Return Index

FACTSHEET - AS OF 28-Sep-2021 Solactive Deutscher Maschinenbau Total Return Index DESCRIPTION The Solactive Deutscher Maschinenbau Index includes German companies which are active in the engineering sector. It is adjusted semi-annually and calculated as a total return index in EUR. HISTORICAL PERFORMANCE 300 250 200 150 100 Jan-2011 Jan-2012 Jan-2013 Jan-2014 Jan-2015 Jan-2016 Jan-2017 Jan-2018 Jan-2019 Jan-2020 Jan-2021 Solactive Deutscher Maschinenbau Total Return Index CHARACTERISTICS ISIN / WKN DE000SLA0DM2 / SLA0DM Base Value / Base Date 100 Points / 11.03.2011 Bloomberg / Reuters SOLDM Index / .SOLDM Last Price 223.58 Index Calculator Solactive AG Dividends Reinvested (Total Return Index) Index Type Industry / Sector Calculation 09:00am to 10:30pm (CET), every 60 seconds Index Currency EUR History Available daily back to 11.03.2011 Index Members 15 FACTSHEET - AS OF 28-Sep-2021 Solactive Deutscher Maschinenbau Total Return Index STATISTICS 30D 90D 180D 360D YTD Since Inception Performance -2.89% 10.42% 10.21% 42.72% 24.64% 129.03% Performance (p.a.) - - - - - 8.18% Volatility (p.a.) 17.80% 18.17% 18.66% 20.77% 20.53% 22.13% High 236.57 236.57 236.57 236.57 236.57 291.85 Low 223.58 200.01 193.49 142.44 179.38 68.83 Sharpe Ratio -1.65 2.76 1.20 2.12 1.71 0.39 Max. Drawdown -5.49% -5.49% -6.64% -12.85% -11.21% -65.94% VaR 95 \ 99 -38.7% \ -52.1% -36.9% \ -63.0% CVaR 95 \ 99 -45.8% \ -54.4% -53.7% \ -84.3% COMPOSITION BY CURRENCIES COMPOSITION BY COUNTRIES EUR 100.0% DE 100.0% TOP COMPONENTS AS OF 28-Sep-2021 Company Ticker Country Currency -

18Th German Corporate Conference

18th German Corporate Conference Programme Frankfurt, 21 – 23 January 2019 More than 170 companies confirmed their participation Tue 1&1 Drillisch AG* Mon, Tue Covestro AG Mon Hamburger Hafen und Logistik AG Wed Munich Re* Mon Ströer SE & Co. KGaA Wed Aareal Bank AG Wed CropEnergies AG Wed Hannover Rück SE Tue Mutares AG Tue Südzucker AG* Mon-Wed adidas Group* Mon CTS EVENTIM AG & Co. KG aA* Wed Hapag-Lloyd Aktiengesellschaft Tue NEMETSCHEK SE Tue Symrise AG Wed Adler Modemärkte AG Wed Delivery Hero SE Wed Hawesko Holding AG* Tue Nordex SE Mon TAG Immobilien AG Mon ADLER Real Estate AG* Wed Deutsche Börse AG Mon HeidelbergCement AG Mon, Wed NORMA Group SE Wed TAKKT AG Wed AGRANA Beteiligungs-AG* Tue Deutsche EuroShop AG* Mon Heidelberger Druckmaschinen AG Tue OSRAM Licht AG Wed Talanx AG* Wed AIXTRON SE* Tue, Wed Deutsche Lufthansa AG Tue HELLA KGaA Hueck & Co.* Tue PALFINGER AG Tue Tele Columbus AG* Wed Allianz SE* Wed Deutsche Pfandbriefbank AG Tue HOCHTIEF Aktiengesellschaft* Mon PATRIZIA Immobilien AG Tue Telefónica Deutschland Holding AG Tue alstria office REIT-AG* Mon Deutsche Telekom AG* Tue, Wed Hugo Boss AG Mon Pfeiffer Vacuum Technology AG* Tue thyssenkrupp AG* Wed ANDRITZ AG* Mon, Tue Deutsche Wohnen SE Tue IMMOFINANZ AG Tue PORR AG Tue TLG IMMOBILIEN AG Tue Aroundtown S.A. Mon Deutz AG Mon innogy SE* Tue Porsche Automobil Holding SE* Wed TOM TAILOR Holding SE* Mon AT&S AG Mon, Tue Dialog Semiconductor plc Mon Instone Real Estate Group AG Tue, Wed ProCredit Holding AG & Co. KGaA Tue, Wed TUI Group Tue Aurubis AG Wed Drägerwerk AG & Co. -

Company Presentation FCF Fox Corporate Finance Gmbh

FCF Fox Corporate Finance GmbH Growth & Multiple Regression Analysis Supporting Document to FCF Valuation Monitor German Small- / Midcap Companies Q1 2017 Data as of March 31, 2017 Published as of April 26, 2017 Executive Summary I. FCF Overview II. Sector Overview III. Sector Regression Analysis a) Automotive Supply b) Communications Services c) Construction Products / Services d) Consumer Products / Services e) H i g h t e c h / Advanced Machinery f) Industrial / Business Services g) Industrial Machinery h) Industrial Materials i) Industrial Products j) Internet Products / Services k) IT Services l) Media & Entertainment m) P h a r m a & Healthcare n) Renewable Products / Services o) S o f t w a r e p) T e c h n o l o g y q) Transportation & Logistics 2 Executive Summary I. FCF Overview II. Sector Overview III. Sector Regression Analysis a) Automotive Supply b) Communications Services c) Construction Products / Services d) Consumer Products / Services e) H i g h t e c h / Advanced Machinery f) Industrial / Business Services g) Industrial Machinery h) Industrial Materials i) Industrial Products j) Internet Products / Services k) IT Services l) Media & Entertainment m) P h a r m a & Healthcare n) Renewable Products / Services o) S o f t w a r e p) T e c h n o l o g y q) Transportation & Logistics 3 Executive Summary The Growth & Executive Summary Multiple Regression . The Growth & Multiple Regression Analysis is a standardized publication and a supporting document to the FCF Valuation Monitor Analysis is a supporting document . The analysis offers further information of the current valuation levels of German listed small and midcap companies to the FCF Valuation . -

Annual Report (PDF)

SYSTEMATIC ANNUAL REPORT 2014 GROWTH INFINEON TECHNOLOGIES AG AG TECHNOLOGIES INFINEON Infineon Technologies AG Annual Report 2014 INFINEON AT A GLANCE Page 40 Page 46 INDUSTRIAL AUTOMOTIVE POWER CONTROL Applications Applications • Chassis and comfort electronics • Charger station for electric vehicles • Electric and hybrid vehicles • Energy transmission and conversion • Powertrain • Home appliances • Safety • Industrial drives • Security • Industrial vehicles • Renewable energy generation • Traction • Uninterruptable power supplies Product range Product range • Microcontroller (8-bit, 16-bit, 32-bit) • IGBT module solutions including IGBT stacks for automotive and industrial applications • IGBT modules (high-power, medium-power, • Software development platform DAVE™ low-power) • Discrete power semiconductors • Discrete IGBTs • IGBT modules • Bare die business • Voltage regulators • Driver ICs • Power ICs • Bus interface devices (CAN, LIN, FlexRay) • Magnetic and pressure sensors • Wireless transmit and receive ICs (RF, radar) Key customers ¹ Key customers ¹ Autoliv / Bosch / Continental / Delphi / Denso / ABB / Alstom / Bombardier / CSR Times / Delta / Hella / Hitachi / Hyundai / Lear / Mando / Mitsubishi / Emerson / Goldwind / Rockwell / Schneider Electric / TRW / Valeo Semikron / Siemens / SMA Solar Technology / Tesla / Vestas Market position ² Market position ² 2 1 with a market share of 9.6 % with a market share of 12.3 % Source: Strategy Analytics, April 2014 for discrete power semiconductors and modules Source: IHS Inc., September 2014 1 In alphabetical order. Infineon’s major distributions customers are Arrow, Avnet, Beijing Jingchuan, Tomen and WPG Holding. 2 All figures for 2013 calendar year. The market share of the five largest competitors is shown in the “Market position” section of the relevant segment. The figures provided in those sections with respect to changes in market share relate to the 2012 and 2013 market share figures as calculated in 2014.