Summary of Disability-Related Complaint Data All Carriers Total Number of Complaints Submitted: 13,584

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

January 2002 Airport Statistics

DENVER INTERNATIONAL AIRPORT DOMESTIC MARKET SHARES OCTOBER 1997 VS. PREVIOUS MONTH AND PREVIOUS YEAR OCTOBER 1997 SEPTEMBER 1997 OCTOBER 1996 (1) REVENUE REVENUE REVENUE PASS. MARKET PASS. MARKET PASS. MARKET AIRLINE IN AND OUT SHARE MONTH AGO SHARE YEAR AGO SHARE AIR WISCONSIN/UAX 63,074 2.32% 71,152 2.60% 56,334 2.25% AMERICAN 106,579 3.91% 107,924 3.94% 96,044 3.84% AMERICAN TRANS AIR 1,092 0.04% 183 0.01% 0 0.00% AMERICA WEST 31,665 1.16% 33,864 1.24% 38,585 1.54% ASPEN MTN AIR 638 0.02% 1,843 0.07% 0 0.00% AV ATLANTIC 0 0.00% 0 0.00% 266 0.01% CARNIVAL AIRLINES 0 0.00% 0 0.00% 96 0.00% CASINO 302 0.01% 826 0.03% 0 0.00% CHAMPION AIR 595 0.02% 380 0.01% 389 0.02% CONTINENTAL 67,076 2.46% 71,538 2.61% 53,690 2.15% DELTA 118,999 4.37% 123,013 4.49% 116,024 4.64% FRONTIER AIRLINES 94,716 3.48% 93,135 3.40% 80,905 3.23% GREAT AMERICAN 0 0.00% 0 0.00% 207 0.01% GREAT LAKES/UAX 9,834 0.36% 12,839 0.47% 17,541 0.70% MESA/UAX 114,728 4.21% 98,407 3.59% 83,879 3.35% MIAMI AIRLINES 131 0.00% 913 0.03% 1,439 0.06% MOUNTAIN AIR EXPRESS 21,134 0.78% 18,074 0.66% 0 0.00% MIDWEST EXPRESS 4,963 0.18% 4,899 0.18% 4,547 0.18% NORTHWEST 57,515 2.11% 59,146 2.16% 50,675 2.03% RENO AIR 9,449 0.35% 10,562 0.39% 11,116 0.44% SUN COUNTRY 7,869 0.29% 4,323 0.16% 5,106 0.20% TWA 30,134 1.11% 32,424 1.18% 33,652 1.35% UNITED 1,794,759 65.91% 1,781,015 65.02% 1,795,290 71.78% US AIRWAYS 33,231 1.22% 38,101 1.39% 32,599 1.30% VANGUARD AIRLINES 12,099 0.44% 10,412 0.38% 22,586 0.90% WESTERN PACIFIC 142,388 5.23% 164,206 5.99% 0 0.00% TOTALS 2,722,970 100.00% 2,739,179 100.00% 2,500,970 100.00% (1) October 1996 revised. -

IATA CLEARING HOUSE PAGE 1 of 21 2021-09-08 14:22 EST Member List Report

IATA CLEARING HOUSE PAGE 1 OF 21 2021-09-08 14:22 EST Member List Report AGREEMENT : Standard PERIOD: P01 September 2021 MEMBER CODE MEMBER NAME ZONE STATUS CATEGORY XB-B72 "INTERAVIA" LIMITED LIABILITY COMPANY B Live Associate Member FV-195 "ROSSIYA AIRLINES" JSC D Live IATA Airline 2I-681 21 AIR LLC C Live ACH XD-A39 617436 BC LTD DBA FREIGHTLINK EXPRESS C Live ACH 4O-837 ABC AEROLINEAS S.A. DE C.V. B Suspended Non-IATA Airline M3-549 ABSA - AEROLINHAS BRASILEIRAS S.A. C Live ACH XB-B11 ACCELYA AMERICA B Live Associate Member XB-B81 ACCELYA FRANCE S.A.S D Live Associate Member XB-B05 ACCELYA MIDDLE EAST FZE B Live Associate Member XB-B40 ACCELYA SOLUTIONS AMERICAS INC B Live Associate Member XB-B52 ACCELYA SOLUTIONS INDIA LTD. D Live Associate Member XB-B28 ACCELYA SOLUTIONS UK LIMITED A Live Associate Member XB-B70 ACCELYA UK LIMITED A Live Associate Member XB-B86 ACCELYA WORLD, S.L.U D Live Associate Member 9B-450 ACCESRAIL AND PARTNER RAILWAYS D Live Associate Member XB-280 ACCOUNTING CENTRE OF CHINA AVIATION B Live Associate Member XB-M30 ACNA D Live Associate Member XB-B31 ADB SAFEGATE AIRPORT SYSTEMS UK LTD. A Live Associate Member JP-165 ADRIA AIRWAYS D.O.O. D Suspended Non-IATA Airline A3-390 AEGEAN AIRLINES S.A. D Live IATA Airline KH-687 AEKO KULA LLC C Live ACH EI-053 AER LINGUS LIMITED B Live IATA Airline XB-B74 AERCAP HOLDINGS NV B Live Associate Member 7T-144 AERO EXPRESS DEL ECUADOR - TRANS AM B Live Non-IATA Airline XB-B13 AERO INDUSTRIAL SALES COMPANY B Live Associate Member P5-845 AERO REPUBLICA S.A. -

G410020002/A N/A Client Ref

Solicitation No. - N° de l'invitation Amd. No. - N° de la modif. Buyer ID - Id de l'acheteur G410020002/A N/A Client Ref. No. - N° de réf. du client File No. - N° du dossier CCC No./N° CCC - FMS No./N° VME G410020002 G410020002 RETURN BIDS TO: Title – Sujet: RETOURNER LES SOUMISSIONS À: PURCHASE OF AIR CARRIER FLIGHT MOVEMENT DATA AND AIR COMPANY PROFILE DATA Bids are to be submitted electronically Solicitation No. – N° de l’invitation Date by e-mail to the following addresses: G410020002 July 8, 2019 Client Reference No. – N° référence du client Attn : [email protected] GETS Reference No. – N° de reference de SEAG Bids will not be accepted by any File No. – N° de dossier CCC No. / N° CCC - FMS No. / N° VME other methods of delivery. G410020002 N/A Time Zone REQUEST FOR PROPOSAL Sollicitation Closes – L’invitation prend fin Fuseau horaire DEMANDE DE PROPOSITION at – à 02 :00 PM Eastern Standard on – le August 19, 2019 Time EST F.O.B. - F.A.B. Proposal To: Plant-Usine: Destination: Other-Autre: Canadian Transportation Agency Address Inquiries to : - Adresser toutes questions à: Email: We hereby offer to sell to Her Majesty the Queen in right [email protected] of Canada, in accordance with the terms and conditions set out herein, referred to herein or attached hereto, the Telephone No. –de téléphone : FAX No. – N° de FAX goods, services, and construction listed herein and on any Destination – of Goods, Services, and Construction: attached sheets at the price(s) set out thereof. -

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

APR 2009 Stats Rpts

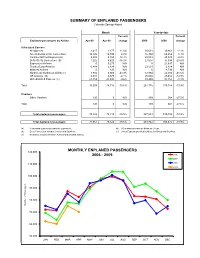

SUMMARY OF ENPLANED PASSENGERS Colorado Springs Airport Month Year-to-date Percent Percent Enplaned passengers by Airline Apr-09 Apr-08 change 2009 2008 change Scheduled Carriers Allegiant Air 2,417 2,177 11.0% 10,631 10,861 -2.1% American/American Connection 14,126 14,749 -4.2% 55,394 60,259 -8.1% Continental/Cont Express (a) 5,808 5,165 12.4% 22,544 23,049 -2.2% Delta /Delta Connection (b) 7,222 8,620 -16.2% 27,007 37,838 -28.6% ExpressJet Airlines 0 5,275 N/A 0 21,647 N/A Frontier/Lynx Aviation 6,888 2,874 N/A 23,531 2,874 N/A Midwest Airlines 0 120 N/A 0 4,793 N/A Northwest/ Northwest Airlink (c) 3,882 6,920 -43.9% 12,864 22,030 -41.6% US Airways (d) 6,301 6,570 -4.1% 25,665 29,462 -12.9% United/United Express (e) 23,359 25,845 -9.6% 89,499 97,355 -8.1% Total 70,003 78,315 -10.6% 267,135 310,168 -13.9% Charters Other Charters 120 0 N/A 409 564 -27.5% Total 120 0 N/A 409 564 -27.5% Total enplaned passengers 70,123 78,315 -10.5% 267,544 310,732 -13.9% Total deplaned passengers 71,061 79,522 -10.6% 263,922 306,475 -13.9% (a) Continental Express provided by ExpressJet. (d) US Airways provided by Mesa Air Group. (b) Delta Connection includes Comair and SkyWest . (e) United Express provided by Mesa Air Group and SkyWest. -

Airline Quarterly Financial Review

AIRLINE QUARTERLY FINANCIAL REVIEW FOURTH QUARTER 2019 PASSENGER NATIONALS DEPARTMENT OF TRANSPORTATION OFFICE OF AVIATION ANALYSIS: COMPETITION AND POLICY ANALYIS DIVISION Table of Contents INTRODUCTION ........................................................................................................................................................................................................................... 2 SYSTEM PASSENGER NATIONALS ................................................................................................................................................................................................ 3 Chart 1. Operating Profit and Net Income (Loss) for the Quarter .................................................................................................................................. 4 Chart 2. Operating Profit and Net Income (Loss) for the Year Ended ............................................................................................................................ 4 Chart 3. Operating Profit (Loss) by Quarter ................................................................................................................................................................... 5 Chart 4. Net Income (Loss) by Quarter .......................................................................................................................................................................... 5 Chart 5. Operating Profit (Loss) Year Ended by Quarter ............................................................................................................................................... -

Global Leaders in Innovative Full Service Airline Training

Global Leaders in Innovative Full Service Airline Training committed to excellence Welcome At CTC we are proud of the reputation that we have built over time as worldwide providers of innovative training solutions. This reputation is founded on the delivery of our core values: expertise, quality, innovation and flexibility. With our state-of-the-art Crew Training Centres across the globe and specialist training personnel, we are able to provide our client airlines with every element of airline crew training. We offer a wide range of training options from basic CPL/IR licence through to Type Rating on the most popular commercial aircraft today including Boeing and Airbus, and onwards to training airline instructors and examiners. From crew selection through to crew supply and from CRM courses to Command Training, CTC can deliver all your needs; we are truly a ‘full service’ airline training specialist. To do this we enjoy comprehensive Joint Aviation Authority approvals as a Type-Rating Training Organisation and Flight Training Organisation and we have received approvals from many other regulatory authorities around the world. Equally as important, we enjoy the trust and loyalty of many of the world’s leading airlines – whether it be for the supply of a standalone training course, or for the outsourcing of all of their crew training needs. These factors make CTC your first choice partner to provide specialist aviation training and support – worldwide – for all your aircrew requirements. We look forward to being of service to you. Captain Chris Clarke Group Chairman CTC Aviation Group plc 1 WELCOME ‘CTC has supported us throughout our growth. -

Frequently Asked Questions About Oneworld, Codeshare and Other Partner Airlines

FREQUENTLY ASKED QUESTIONS ABOUT ONEWORLD, CODESHARE AND OTHER PARTNER AIRLINES 1. What will happen to AA’s participation in the oneworld Alliance and its relationships with its codeshare partners or other partner airlines? We expect our participation in oneworld and our relationships with our other partners to remain unchanged. 2. Can I still accrue miles and redeem mileage awards through oneworld and American's frequent flyer air partners? Yes, we expect our partnerships with airlines such as British Airways, Cathay Pacific, Finnair, Iberia, Japan Airlines (JAL), LAN, Malév, Qantas, Royal Jordanian and S7 Airlines and others remain unchanged as a result of the Chapter 11 filing. 3. Will my elite status with AAdvantage still be recognized by oneworld Alliance partners? Yes, we expect that your elite status with AAdvantage will continue to be recognized by our oneworld partners, and that the benefits you receive when flying with them will not change as a result of the Chapter 11 filing. 4. Will there be a reduction of routes that AA currently offers through oneworld and its codeshare partners? We remain deeply committed to meeting your travel needs with the same standards of safe, secure and reliable service, and intend to maintain a strong presence in domestic and international markets. As we and all airlines routinely do, we will continue to evaluate our operations and service, assuring that our network is as efficient and productive as possible. 5. Will AA’s airline partners continue to honor their ticket reservation and baggage transfer commitments? Yes. We expect that all benefits with partner airlines will remain intact. -

S:\Sean Cowley\Yahya V. Yemenia-Yemen Airways NWA's M

2:08-cv-14789-SFC-MKM Doc # 29 Filed 08/25/09 Pg 1 of 12 Pg ID 464 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION ABDEL MONEN YAHYA, Individually Case No. 08-14789 and as Personal Representative of the Estate of SAID MOSHIN YAHYA, DECEASED HONORABLE SEAN F. COX United States District Judge Plaintiffs, v. YEMENIA-YEMEN AIRWAYS, a Foreign Corporation for Profit; NORTHWEST AIRLINES, INC., a wholly-owned subsidiary of Delta Airlines, Inc., a Foreign Corporation for Profit; and GSA-ARABIAN HORIZONS TRAVEL AND TOURISM, a Foreign Corporation,, Defendants. _____________________________________/ AMENDED OPINION & ORDER GRANTING, WITH LEAVE TO AMEND, DEFENDANT NORTHWEST AIRLINES, INC.’S MOTION TO DISMISS [Doc. No. 6] Plaintiff Abdel Monen Yahya (“Plaintiff”), as personal representative of the Estate of Said Mohsin Yahya (“Yahya”) filed this cause of action on November 14, 2008 [Doc. No. 1], alleging that the defendant’s refusal to land an international flight during a health emergency caused Yahya’s death. The matter is before the Court on Defendant Northwest Airlines, Inc.’s (“Northwest”) Motion to Dismiss1 [Doc. No. 6], in which Northwest argues Plaintiff’s causes of action against Northwest are preempted by the Montreal Convention2. The parties have fully 1 The remaining defendants are not a party to Northwest’s Motion to Dismiss. 2 The Convention for the Unification of Certain Rules for International Carriage by Air, May 28, 1999, S.Treaty Doc. No. 106-45, 2422 U.N.T.S. 350, commonly referred to as the “Montreal Convention.” 1 2:08-cv-14789-SFC-MKM Doc # 29 Filed 08/25/09 Pg 2 of 12 Pg ID 465 briefed the issues, and a hearing was held on May 21, 2009. -

Cathay Pacific Airways – What Next?

International Journal of Case Method Research & Application (2005) XVII, 4 © 2005 WACRA®. All rights reserved ISSN 1554-7752 CATHAY PACIFIC AIRWAYS – WHAT NEXT? Madhu Malkani, John Hulpke, Cubie Lau Hong Kong University of Science & Technology HONG KONG, CHINA Teresa Ho Teleadapt HONG KONG, CHINA Abstract Cathay Pacific Airways has grown from humble beginnings in Hong Kong in 1946 to become one of the world’s premier airlines. After tough times in the early 2000s, the airline faced the future. NOTE: The case hints but does not state that Cathay faces choices and challenges in China, and must decide to remain a premium carrier or somehow get into the low cost carrier arena. Exhibits and video of Philip Chen’s speech are available to those interested. The case is best suited for an undergraduate strategy or international business course. A detailed Teaching Note is available from the authors. KEY WORDS: Cathay Pacific Airways, airline industry, China INTRODUCTION What an industry! A hundred years after the first powered flight by the Wright Brothers an industry had developed that shrunk the globe, allowing millions of people to travel distances never imagined before. And as Chief Executive Officer of Hong Kong’s flag carrier Cathay Pacific, Philip Chen knew his airline had been a part of the amazing history of the industry. After humble beginnings in Hong Kong immediately after World War II, Cathay had become one of the world’s most respected carriers. Cathay serves more than 75 destinations world wide with cargo routes and award winning passenger service. The industry had achieved amazing success, as had Cathay. -

Prof. Paul Stephen Dempsey

AIRLINE ALLIANCES by Paul Stephen Dempsey Director, Institute of Air & Space Law McGill University Copyright © 2008 by Paul Stephen Dempsey Before Alliances, there was Pan American World Airways . and Trans World Airlines. Before the mega- Alliances, there was interlining, facilitated by IATA Like dogs marking territory, airlines around the world are sniffing each other's tail fins looking for partners." Daniel Riordan “The hardest thing in working on an alliance is to coordinate the activities of people who have different instincts and a different language, and maybe worship slightly different travel gods, to get them to work together in a culture that allows them to respect each other’s habits and convictions, and yet work productively together in an environment in which you can’t specify everything in advance.” Michael E. Levine “Beware a pact with the devil.” Martin Shugrue Airline Motivations For Alliances • the desire to achieve greater economies of scale, scope, and density; • the desire to reduce costs by consolidating redundant operations; • the need to improve revenue by reducing the level of competition wherever possible as markets are liberalized; and • the desire to skirt around the nationality rules which prohibit multinational ownership and cabotage. Intercarrier Agreements · Ticketing-and-Baggage Agreements · Joint-Fare Agreements · Reciprocal Airport Agreements · Blocked Space Relationships · Computer Reservations Systems Joint Ventures · Joint Sales Offices and Telephone Centers · E-Commerce Joint Ventures · Frequent Flyer Program Alliances · Pooling Traffic & Revenue · Code-Sharing Code Sharing The term "code" refers to the identifier used in flight schedule, generally the 2-character IATA carrier designator code and flight number. Thus, XX123, flight 123 operated by the airline XX, might also be sold by airline YY as YY456 and by ZZ as ZZ9876. -

Annual Report 2007

EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 1 Analyses of the European air transport market Annual Report 2007 EUROPEAN COMMISSION EU_ENTWURF_08:00_ENTWURF_01 01.04.2026 13:07 Uhr Seite 2 Air Transport and Airport Research Annual analyses of the European air transport market Annual Report 2007 German Aerospace Center Deutsches Zentrum German Aerospace für Luft- und Raumfahrt e.V. Center in the Helmholtz-Association Air Transport and Airport Research December 2008 Linder Hoehe 51147 Cologne Germany Head: Prof. Dr. Johannes Reichmuth Authors: Erik Grunewald, Amir Ayazkhani, Dr. Peter Berster, Gregor Bischoff, Prof. Dr. Hansjochen Ehmer, Dr. Marc Gelhausen, Wolfgang Grimme, Michael Hepting, Hermann Keimel, Petra Kokus, Dr. Peter Meincke, Holger Pabst, Dr. Janina Scheelhaase web: http://www.dlr.de/fw Annual Report 2007 2008-12-02 Release: 2.2 Page 1 Annual analyses of the European air transport market Annual Report 2007 Document Control Information Responsible project manager: DG Energy and Transport Project task: Annual analyses of the European air transport market 2007 EC contract number: TREN/05/MD/S07.74176 Release: 2.2 Save date: 2008-12-02 Total pages: 222 Change Log Release Date Changed Pages or Chapters Comments 1.2 2008-06-20 Final Report 2.0 2008-10-10 chapters 1,2,3 Final Report - full year 2007 draft 2.1 2008-11-20 chapters 1,2,3,5 Final updated Report 2.2 2008-12-02 all Layout items Disclaimer and copyright: This report has been carried out for the Directorate-General for Energy and Transport in the European Commission and expresses the opinion of the organisation undertaking the contract TREN/05/MD/S07.74176.