Sl Green Annual Report 2019 Sl Green Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sl Green Realty Corp

SL GREEN REALTY CORP FORM DEF 14A (Proxy Statement (definitive)) Filed 04/25/19 for the Period Ending 05/30/19 Address 420 LEXINGTON AVENUE NEW YORK, NY, 10170 Telephone 2125942700 CIK 0001040971 Symbol SLG SIC Code 6798 - Real Estate Investment Trusts Industry Commercial REITs Sector Financials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2019, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) ☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant CHECK THE APPROPRIATE BOX: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Under Rule 14a-12 SL Green Realty Corp. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): ☑ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials: ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. -

SL Green Realty Corp 2015 Annual Institutional Investor Conference on December 07, 2015 / 6:00PM

THOMSON REUTERS STREETEVENTS EDITED TRANSCRIPT SLG - SL Green Realty Corp 2015 Annual Institutional Investor Conference EVENT DATE/TIME: DECEMBER 07, 2015 / 6:00PM GMT THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us ©2015 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies. DECEMBER 07, 2015 / 6:00PM, SLG - SL Green Realty Corp 2015 Annual Institutional Investor Conference CORPORATE PARTICIPANTS Marc Holliday SL Green Realty Corp. - CEO Andrew Mathias SL Green Realty Corp. - President Steve Durels SL Green Realty Corp. - EVP, Director of Leasing and Real Property Isaac Zion SL Green Realty Corp. - Co-Chief Investment Officer David Schonbraun SL Green Realty Corp. - Co-Chief Investment Officer Brett Herschenfeld SL Green Realty Corp. - Managing Director, SL Green Retail Matt DiLiberto SL Green Realty Corp. - CFO CONFERENCE CALL PARTICIPANTS Steve Sakwa Evercore ISI - Analyst John Guinee Stifel Nicolaus - Analyst Jed Reagan Green Street Advisors - Analyst Alex Goldfarb Sandler O'Neill - Analyst John Kim BMO Capital Markets - Analyst Ian Weissman Credit Suisse - Analyst PRESENTATION Marc Holliday - SL Green Realty Corp. - CEO Okay. Well, everyone here? Terrific. I want to welcome all of you, and thank you for attending this year's investor conference. As always, we've invested a great deal of time and effort in preparations for today's presentation to ensure that you will find it very informative, extremely relevant, and hopefully highly entertaining. The montage you just saw presented clips from the videos we used to open the three prior investor conferences. -

DECLINE HOME Top Property Sales One New Yorkers P

20160725-NEWS--0001-NAT-CCI-CN_-- 7/22/2016 6:55 PM Page 1 CRAINS ® JULY 25-AUGUST 7, 2016 | PRICE $3.00 DOUBLE ISSUE NEW YORK BUSINESS DONALD THE LIST Two stores TRUMP Top Manhattan for the CALLS Office Leases P.12 price of DECLINE HOME Top Property Sales one New Yorkers P. 6 P.14 P. 2 0 just aren’t dying like they used to. OF THE That’s trouble for some, opportunity for others PAGE 16 VOL. XXXII, NOS. 29, 30 WWW.CRAINSNEWYORK.COM DEATH BUSINESS 0 71486 01068 5 30 NEWSPAPER T:10.875” S:10.25” America’s best network just made a good plan even better. T:14.5” S:14” Introducing the new Verizon Plan for Business. Now with up to 200GB of data and more ways to control it. Carryover Data lets you roll over any unused gigs to the next month. And, when you choose Safety Mode, you can stay connected if you use all your data without surprise overages – or worries. And now get $100 when you buy a new 4G LTE smartphone. New 2-yr or device payment activation on $34.99 + plan req’d. $100 applied as a bill credit within 2-3 billing cycles. Our Surcharges (incl. Fed. Univ. Svc. of 17.9% of interstate & int’l telecom charges (varies quarterly), 21¢ Regulatory & $1.23 Administrative/line/mo., & others by area) are not taxes (details: 1-888-684-1888); gov’t taxes & our surcharges could add 7% - 46% Activation/upgrade fee/line: Up to $40 IMPORTANT CONSUMER INFORMATION: Subject to VZW Agmts, Calling Plan & credit approval. -

2018 Sustainability Report Page 1

BUILDING A NEW VISION FOR NEW YORK SL GREEN REALTY CORP. 2018 SUSTAINABILITY REPORT PAGE 1 TABLE 02 CEO Letter 22 Social Responsibility OF 04 Key Achievements 24 Our People CONTENTS 06 One Vanderbilt 26 Living Green 08 Environmental Sustainability 28 Community Engagement 10 Our Approach 30 Strong Governance 12 Our Carbon Strategy 32 Management Principles 14 LEED 34 Stakeholder Engagement 16 Energy Star 35 Materiality Matrix 18 Efficiency Strategy 36 About This Report 20 Partnering with Our Tenants SL GREEN RECOGNIZES THAT OUR INFLUENCE EXTENDS BEYOND A PHYSICAL FOOTPRINT. ENVIRONMENTAL SUSTAINABILITY, SOCIAL RESPONSIBILITY, AND SOUND GOVERNANCE ARE AT THE CORE OF OUR BUSINESS STRATEGY. SL GREEN REALTY CORP. 2018 SUSTAINABILITY REPORT CEO LETTER KEY ACHIEVEMENTS ENVIRONMENTAL SOCIAL GOVERNANCE PAGE 3 Marc Holliday community than SL Green — a home- development of One Vanderbilt, Chief Executive Officer A MESSAGE FROM SL Green Realty Corp. grown company that is unsurpassed where all design, construction, and OUR CHIEF EXECUTIVE in demonstrating leadership in both operational elements prioritize OFFICER AND financial performance and social environmental stewardship and CHAIRMAN ELECT responsibility. SL Greenʼs strategy is societal responsibility. aligned with future resiliency of New York City as we meet citywide carbon Marking two decades as a publicly- Our unwavering commitment reduction goals, deploy cutting-edge traded REIT, I am focused on to New Yorkers is imperative to technology, and operate around the SL Greenʼs commitment to corporate SL Greenʼs long-term business transportation hubs that are at the sustainability now more than ever. strategy. At SL Green, our vision is heart of the cityʼs vitality. As we approach a new era of sustain- to build an environmentally and ability where Environmental, Social, socially sustainable legacy for the and Governance (ESG) decisions are As a native New Yorker, it is of the city I love. -

Manhattan Office Market

Manhattan Offi ce Market 1 ST QUARTER 2016 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 915 Broadway Looking Ahead Finance Department’s Tentative Assessment Roll Takes High Retail Rents into Account Consumers are not the only ones attracted by the luxury offerings along the city’s prime 5th Avenue retail corridor between 48th and 59th Streets where activity has raised retail rents. The city’s Department of Finance is getting in on the action, prompting the agency to increase tax assessments on some of the high-profi le properties. A tentative tax roll released last month for the 2016-2017 tax year brings the total market value of New York City’s real estate to over $1 trillion — reportedly for the fi rst time. The overall taxable assessed values for the city would increase 8.10%. Brooklyn’s assessed values accounted for the sharpest rise of 9.83% from FY 2015/2016, followed by Manhattan’s 8.47% increase. Although some properties along the 5th Avenue corridor had a reduction in valuations the properties were primarily offi ce, not retail according to a reported analysis of the tentative tax roll details. Building owners have the opportunity to appeal the increase; but an unexpected rise in market value — and hence real estate taxes, will negatively impact the building’s bottom line and value. Typically tenants incur the burden of most of the tax increases from the time the lease is signed, and the landlord pays the taxes that existed before the signing; but in some cases the tenant increase in capped, leaving the burden of the additional expense on the landlord. -

2010 ANNUAL REPORT • Full Ownership Through Foreclosure of 100 Church Street

SL GREEN REALTY CORP. ANNUAL REPORT 2010 A PORTFOLIO OF OPPORTUNITY SL GREEN REALTY CORP. SL GREEN REALTY CORP. CORP. SL GREEN REALTY ANNUAL REPORT 2010 420 Lexington Avenue New York, NY 10170 A PORTFOLIO OF 212 594 2700 www.slgreen.com OPPORTUNITY SL Green Realty Corp., New York City’s largest offi ce landlord, is the only fully integrated real estate investment trust, or REIT, that is focused primarily on acquiring, managing and maximizing the value of Manhattan commercial offi ce properties. As of December 31, 2010, SL Green owned interests in 59 Manhattan properties totaling more than 31.5 mil- lion square feet. This included ownership interests in 23.5 million square feet of offi ce buildings, ownership interests in 405,362 square feet of freestanding and condominium retail properties, and debt and preferred equity investments secured by 8.3 million square feet of prop- erties. In addition to its Manhattan investments, SL Green holds interests in 31 suburban assets totaling 6.8 million square feet in Brooklyn, Queens, Long Island, Westchester County, Connecticut and New Jersey, along with four development properties encompassing approximately 465,441 square feet, and three land interests. DESIGN Addison www.addison.com PRINCIPAL PHOTOGRAPHY Nikolas Koenig A PORTFOLIO OF OPPORTUNITY WE DON’T JUST FIND OPPORTUNITIES, WE CREATE THEM. 1 TO OUR FELLOW SHAREHOLDERS Leadership is not just about fi nding opportunities. More importantly, it’s also will, when combined with the prevalence of balance sheet lenders, reduce about creating them at the right moments in time. And make no mistake about borrowing costs and encourage more transactional activity. -

Manhattan Office Market

Manhattan Offi ce Market 2 ND QUARTER 2015 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 1001 Avenue of the Americas Looking Ahead Partnership for New York City: New York’s Future as the World Financial Capital The report released in June concluded that while New York City remains the preferred location of global fi nancial companies to establish their headquarters, there is a growing trend to relocate jobs and business operations to lower cost, more business-friendly locations that are beyond the city’s border. A comprehensive survey was conducted in collaboration with Gerson Lehrman Group (GRG), intending to better understand how the fi nancial industry is evolving; and what measures are required to solidify New York’s competitive advantage as a global fi nancial center. Collected data represents an overview of the responses from 50-fi rm respondents that included large banks, insurance companies and asset managers, private equity fi rms, hedge funds, and fi nancial technology (FinTech) startups; and represent about 1/3rd of the total industry employment in the city. Additionally, observations were included from 8-real estate fi rms that were surveyed; along with interviews from other related experts in the fi eld. Financial Industry – an economic snapshot • Contributes 20% of the city’s economic output, representing twice that of the next top-grossing industry. • Accounts for nearly 1/3rd of the city’s private sector payroll, despite accounting for only 8%, or about 310,000 of the city’s private sector jobs in 2013; of which 23,000 jobs are high-technology in the areas of software, data processing and network management. -

As Filed with the Securities and Exchange Commission on May 7, 1998

AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 7, 1998 REGISTRATION NO. 333-50311 - -------------------------------------------------------------------------------- - -------------------------------------------------------------------------------- SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 -------------------------- AMENDMENT NO. 2 TO FORM S-11 REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933 -------------------------- SL GREEN REALTY CORP. (Exact name of registrant as specified in its governing instrument) 70 WEST 36TH STREET NEW YORK, NY 10018 (Address of principal executive offices) -------------------------- STEPHEN L. GREEN CHAIRMAN, PRESIDENT AND CHIEF EXECUTIVE OFFICER SL GREEN REALTY CORP. 70 WEST 36TH STREET NEW YORK, NY 10018 (Name and address of agent for service) -------------------------- Copies to: MICHAEL F. TAYLOR, ESQ. ALAN L. GOSULE, ESQ. BROWN & WOOD LLP ROBERT E. KING, JR., ESQ. ONE WORLD TRADE CENTER ROGERS & WELLS LLP NEW YORK, NEW YORK 200 PARK AVENUE 10048-0557 NEW YORK, NEW YORK 10166 (212) 839-5300 (212) 878-8000 APPROXIMATE DATE OF COMMENCEMENT OF PROPOSED SALE TO THE PUBLIC: As soon as practicable after this Registration Statement becomes effective. If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / / If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. / / If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. -

Manhattan Office Market

Manhattan Off ce Market 3 RD QUARTER 2016 REPORT A NEWS RECAP AND MARKET SNAPSHOT Pictured: 200 Park Avenue South Looking Ahead Tax Plan Proposal Could Potentially Help Leveraged RE Firms An emerging tax plan proposed by Republican candidate Donald Trump could reportedly benef t debt-laden real estate companies by coupling 2-policies — letting businesses deduct interest and allowing expensing, or immediate write-offs, for investments in equipment and buildings. The proposal would “provide negative tax rates for investments f nanced with debt, creating incentives for companies to pursue projects that wouldn’t make sense economically without the tax benef ts.” Currently tax law requires businesses to spread the deductions over multiple years, but under Trump’s proposed plan “a business would be able to generate signif cant losses in the f rst year of an investment and then generate ongoing interest deductions. Those losses could be carried forward and used to offset future income.” It is reportedly the intended goal of the tax plan, which is still a work-in-progress, to “tie expensing to job creation and new investment and not, for example, purchases of existing leveraged real estate portfolios,” according to reported comments by a Trump advisor. Interest Deductions: The pairing of an end to interest deductions and expensing is typically done to prevent giving an extra subsidy according to some sources, however it is anticipated that the taking away of interest deductibility would make it hard for businesses to capitalize; and with that in mind Trump had proposed an unspecif ed “reasonable cap” in an earlier proposed tax plan. -

Savanna Recaps One Court Square in $880M Deal FINANCE WEEKLY

FINANCE WEEKLY The Insider’s Weekly Guide to the Commercial Mortgage Industry In This Issue 6 Capital One refis Upper Manhattan rental building with $46M HUD loan 8 Debt on Kushner’s Times Square retail condominium hits special servicing 10 Rockrose gets $255M Wells Fargo loan for Hudson Yards-area resi project 12 Rabsky, Spencer Equity fund Brooklyn Triangle project with $71M loan 14 LibreMax Capital lends $64M on Williamsburg condo project Oxford Properties, CPPIB Seeking $975M Construction Loan for St. John’s Terminal Oxford Properties Group and the Canadian Pension Plan Investment Board are in the mar- ket for a $975 million construction loan to finance the development of St. John’s EXCLUSIVE Terminal, Commercial Observer has learned. Lenders familiar with the financing request One Court Square. told CO that the loan works out at roughly 55 per- COURTESY SAVANNA COURTESY cent loan to cost and is being very heavily com- peted, with one interested party telling CO that Savanna Recaps One Court “every major bank is fighting to get a piece” of the high-profile deal. The debt assignment is being run by CBRE’s Square in $880M Deal James Millon, Tom Traynor and P.J. Finley, sources said, with bids due Jan 31. CBRE offi- Savanna has closed an $880 million recap- Junius Real Estate Partners provided the cials did not immediately respond to a request italization of its One Court Square in Long remaining $200 million in the form of a pre- for comment. Island City, nearly a year after Amazon backed ferred equity stake, which it converted from a The financing request follows Google’s away from a plan to lease previous ownership position. -

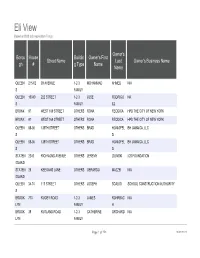

Eli View Based on DOB Job Application Filings

Eli View Based on DOB Job Application Filings Owner's Borou House Buildin Owner's First Street Name Last Owner's Business Name gh # g Type Name Name QUEEN 215-02 93 AVENUE 1-2-3 MOHAMMAD AHMED N/A S FAMILY QUEEN 10040 222 STREET 1-2-3 JOSE RODRIGU NA S FAMILY EZ BRONX 97 WEST 169 STREET OTHERS RONA REODICA HPD THE CITY OF NEW YORK BRONX 97 WEST 169 STREET OTHERS RONA REODICA HPD THE CITY OF NEW YORK QUEEN 88-36 139TH STREET OTHERS BRAD HONIGFEL BH JAMAICA, LLC S D QUEEN 88-36 139TH STREET OTHERS BRAD HONIGFEL BH JAMAICA, LLC S D STATEN 2245 RICHMOND AVENUE OTHERS JEREMY ZILINSKI ICS FOUNDATION ISLAND STATEN 26 KEEGANS LANE OTHERS GERARDO MAZZEI N/A ISLAND QUEEN 34-74 113 STREET OTHERS JOSEPH SCALISI SCHOOL CONSTRUCTION AUTHORITY S BROOK 770 RUGBY ROAD 1-2-3 JAMES ROHRBAC N/A LYN FAMILY H BROOK 39 RUTLAND ROAD 1-2-3 CATHERINE ORCHARD N/A LYN FAMILY Page 1 of 758 10/02/2021 Eli View Based on DOB Job Application Filings Owner 's Owner'sHouse Street Owner'sPh House City State Zip Name one # Numb er 6466575108 6467122941 2128638576 2128638576 9735976433 9735976433 9176828725 7186056119 7184728000 4153122979 3474747144 Page 2 of 758 10/02/2021 Eli View Based on DOB Job Application Filings BRONX 1000 EAST TREMONT OTHERS ROBERT MURPHY NY SCHOOL CONSTRUCTION AVENUE AUTHORITY BROOK 200 LINCOLN ROAD 1-2-3 ERIC BAKER N/A LYN FAMILY BROOK 94 DOUGLASS STREET 1-2-3 OMRI BAR- 94 DOUGLASS LLC LYN FAMILY MASHIAH STATEN 667 HUNTER AVENUE 1-2-3 MILENA KOSZALK NOT APPLICABLE ISLAND FAMILY A BROOK 5909 BEVERLY ROAD OTHERS COLIN ALBERT NYC SCHOOL CONSTRUCTION -

United States Securities and Exchange Commission Sl

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): October 16, 2019 SL GREEN REALTY CORP. (Exact name of registrant as specified in its charter) Maryland (State of Incorporation) 1-13199 13-3956775 (Commission File Number) (I.R.S. employer identification number) 420 Lexington Avenue 10170 New York, New York (Zip Code) (Address of principal executive offices) (212) 594-2700 (Registrant's telephone number, including area code) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: [☐] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) [☐] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) [☐] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) [☐] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company [☐] If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act [ ] Item 2.02.