The Power 100 April 25, 2018

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBUH Journal

About the Council The Council on Tall Buildings and Urban Habitat, based at the Illinois Institute of Technology in CTBUH Journal Chicago and with a China offi ce at Tongji International Journal on Tall Buildings and Urban Habitat University in Shanghai, is an international not-for-profi t organization supported by architecture, engineering, planning, development, and construction professionals. Founded in 1969, the Council’s mission is to disseminate multi- Tall buildings: design, construction, and operation | 2014 Issue IV disciplinary information on tall buildings and sustainable urban environments, to maximize the international interaction of professionals involved Case Study: One Central Park, Sydney in creating the built environment, and to make the latest knowledge available to professionals in High-Rise Housing: The Singapore Experience a useful form. The Emergence of Asian Supertalls The CTBUH disseminates its fi ndings, and facilitates business exchange, through: the Achieving Six Stars in Sydney publication of books, monographs, proceedings, and reports; the organization of world congresses, Ethical Implications of international, regional, and specialty conferences The Skyscraper Race and workshops; the maintaining of an extensive website and tall building databases of built, under Tall Buildings in Numbers: construction, and proposed buildings; the Unfi nished Projects distribution of a monthly international tall building e-newsletter; the maintaining of an Talking Tall: Ben van Berkel international resource center; the bestowing of annual awards for design and construction excellence and individual lifetime achievement; the management of special task forces/working groups; the hosting of technical forums; and the publication of the CTBUH Journal, a professional journal containing refereed papers written by researchers, scholars, and practicing professionals. -

Macerich Names Will Voegele to New Position of Chief Development Officer

Macerich Names Will Voegele to New Position of Chief Development Officer August 8, 2019 SANTA MONICA, Calif., Aug. 8, 2019 /PRNewswire/ -- Macerich (NYSE:MAC), one of the nation's leading owners, operators and developers of exceptional retail properties in top markets, today announced the appointment of Will Voegele to the new position of Executive Vice President, Chief Development Officer. Voegele's responsibilities will include overseeing and facilitating all aspects of mixed-use and master planned project development, assessing opportunities across the portfolio for multi-use potential and driving the creative design process that conceives and realizes exceptional place-making environments where consumers want to live, work, stay and play. He will report to Macerich's President Ed Coppola. As a 35-year veteran of the shopping center industry, Voegele brings to Macerich a broad base of experience managing large-scale retail and mixed-use developments as well as renovation and re-development of commercial and retail assets. Recent projects include Ballston Quarter, Arlington, VA, Short Pump Town Center renovation, Richmond, VA, and Station Square, Pittsburgh, PA. A visionary and passionate development executive, Voegele has extensive experience in the conception, master planning and execution of complex mixed-use developments incorporating retail, entertainment, office, hotel and residential uses; securing complicated entitlements; structuring public- private partnerships; and overall development oversight to ensure adherence to project goals and return on investment objectives. Previously, Voegele served as Senior Vice President, Mixed-Use Development for Brookfield Properties and Senior Vice President, Commercial Development for Forest City Realty Trust. "As we seize opportunities to add even more value to our high-quality portfolio of A-level properties in attractive, largely urban markets – including recapturing well-placed Sears boxes – we are very pleased to welcome Will Voegele to our senior executive team," said Coppola. -

Sl Green Realty Corp

SL GREEN REALTY CORP FORM DEF 14A (Proxy Statement (definitive)) Filed 04/25/19 for the Period Ending 05/30/19 Address 420 LEXINGTON AVENUE NEW YORK, NY, 10170 Telephone 2125942700 CIK 0001040971 Symbol SLG SIC Code 6798 - Real Estate Investment Trusts Industry Commercial REITs Sector Financials Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2019, EDGAR Online, a division of Donnelley Financial Solutions. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, a division of Donnelley Financial Solutions, Terms of Use. Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 SCHEDULE 14A Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) ☑ Filed by the Registrant ☐ Filed by a Party other than the Registrant CHECK THE APPROPRIATE BOX: ☐ Preliminary Proxy Statement ☐ Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) ☑ Definitive Proxy Statement ☐ Definitive Additional Materials ☐ Soliciting Material Under Rule 14a-12 SL Green Realty Corp. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement, if Other Than the Registrant) PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): ☑ No fee required. ☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. 1) Title of each class of securities to which transaction applies: 2) Aggregate number of securities to which transaction applies: 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): 4) Proposed maximum aggregate value of transaction: 5) Total fee paid: ☐ Fee paid previously with preliminary materials: ☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. -

Hudson Yards 2019-30HY Mortgage Trust Table of Contents

JUNE 2019 STRUCTURED FINANCE: CMBS PRESALE REPORT Hudson Yards 2019-30HY Mortgage Trust Table of Contents Capital Structure 3 Transaction Summary 3 Rating Considerations 5 DBRS Viewpoint 5 Strengths 6 Challenges & Considerations 6 Property Description 8 Tenant and Lease Summary 9 Market Overview 10 Local Economy 10 Office Market 11 Office Submarket Description 12 Competitive Set 13 5 Manhattan West 13 55 Hudson Yards 13 10 Hudson Yards 13 441 Ninth Avenue 13 1 Manhattan West 14 The Farley Building 14 50 Hudson Yards 14 Sponsorship 14 DBRS Analysis 15 Site Inspection Summary 15 DBRS NCF Summary 16 DBRS Value Analysis 17 DBRS Sizing Hurdles 17 Loan Detail & Structural Features 18 Transaction Structural Features 19 Methodology 20 Surveillance 21 Chandan Banerjee Edward Dittmer Senior Vice President Senior Vice President +1 (212) 806 3901 +1 212 806 3285 [email protected] [email protected] Kevin Mammoser Erin Stafford Managing Director Managing Director +1 312 332 0136 +1 312 332 3291 [email protected] [email protected] HUDSON YARDS 2019-30HY JUNE 2019 Capital Structure Description Rating Action Class Amount Subordination DBRS Rating Trend Class A New Rating – Provisional 348,695,000 35.831% AAA (sf) Stable Class X New Rating – Provisional 389,169,000 -- AAA (sf) Stable Class B New Rating – Provisional 40,474,000 28.383% AA (high) (sf) Stable Class C New Rating – Provisional 38,758,000 21.507% A (high) (sf) Stable Class D New Rating – Provisional 147,887,000 10.621% A (low) sf Stable Class E New Rating – Provisional 144,286,000 0.000% BBB (sf) Stable Class RR NR 30,320,000 0 NR Stable RR Interest NR 7,580,000 0 NR Stable 1. -

Walkup Wake-Up Call: New York © the George Washington University School of Business 2017 3 Introduction

By Christopher B. Leinberger & Patrick Lynch The George Washington University School of Business Christopher B. Leinberger, Michael Rodriguez & Tracy Loh By CENTER FOR REAL ESTATE & URBAN ANALYSIS THE GEORGE WASHINGTON UNIVERSITY SCHOOL OF BUSINESS 1 Table of Contents I. INTRODUCTION .......................................... 4 Executive Summary........................................... 5 II. LAND USE DEFINED ....................................... 8 A New Lens for Understanding the Tri-State Region ................. 9 Form Meets Function ......................................... 10 Methodology................................................ 12 The Eight Types of WalkUPs.................................... 15 III. LAND USE IN METRO NEW YORK .......................... 21 Maps: Where the WalkUPs Are in the Tri-State Region .............. 22 Geographic Findings .......................................... 25 Product Findings ............................................. 26 Findings in Real Estate Trends................................... 30 IV. WALKUP PERFORMANCE & RANKINGS .................... 31 Economic Performance ........................................ 32 Economic Rankings ........................................... 39 Social Equity Performance ..................................... 41 Social Equity Rankings ........................................ 50 V. FUTURE WALKUPS ........................................ 53 Emerging & Potential WalkUPs ................................. 54 VI. NEXT STEPS ............................................. -

A Blueprint for Cronyism President Trump’S Illegal Infrastructure Plan to Enrich His Friends

AP Photo/Charles Rex Arbogast A Blueprint For Cronyism President Trump’s Illegal Infrastructure Plan to Enrich His Friends JANUARY 30, 2018 1 A Blueprint For Cronyism President Trump’s Illegal Infrastructure Plan to Enrich His Friends President Trump made rebuilding America’s infrastructure a central part of his campaign, promising to invest in “the next generation of roads, bridges, railways, tunnels, sea ports, and airports.” But that’s not the President’s plan. Instead, what President Trump will outline is a blueprint for cronyism: An infrastructure proposal illegally developed in secret that is designed to further enrich people like President Trump, his business associates, and his friends. The proposal, details of which have been slowly leaked to the press, follows months of closed-door meetings by Pres- AP Photo/Carolyn Kaster ident Trump’s “Infrastructure Council,” a group of well-con- President Trump’s infrastructure plan is the capstone of nected individuals tasked by the President to design and these efforts. The plan appears to allow the Administration direct federal infrastructure policy. Members of the Infra- to award new infrastructure grants directly to private com- structure Council are long-time friends and business asso- panies, empower companies to charge tolls and fees on ciates of President Trump and his family, are unfettered by America’s roads and bridges, cut career officials and agency conflict-of-interest rules designed to prevent corruption, and experts out of project and permitting decisions, and elim- stand to benefit from the President’s infrastructure policies. inate regulatory and legal safeguards that protect against We’ve already seen the consequences of President Trump’s corruption. -

Spitzer's Aides Find It Difficult to Start Anew

CNYB 07-07-08 A 1 7/3/2008 7:17 PM Page 1 SPECIAL SECTION NBA BETS 2008 ON OLYMPICS; ALL-STAR GAME HITS HOME RUN IN NEW YORK ® PAGE 3 AN EASY-TO-USE GUIDE TO THE VOL. XXIV, NO. 27 WWW.CRAINSNEWYORK.COM JULY 7-13, 2008 PRICE: $3.00 STATISTICS Egos keep THAT MATTER THIS Spitzer’s aides YEAR IN NEW YORK newspaper PAGES 9-43 find it difficult presses INCLUDING: ECONOMY rolling FINANCIAL to start anew HEALTH CARE Taking time off to decompress Local moguls spend REAL ESTATE millions even as TOURISM life. Paul Francis, whose last day business turns south & MORE BY ERIK ENGQUIST as director of operations will be July 11, plans to take his time three months after Eliot before embarking on his next BY MATTHEW FLAMM Spitzer’s stunning demise left endeavor, which he expects will them rudderless,many members be in the private sector. Senior ap images across the country,the newspa- of the ex-governor’s inner circle adviser Lloyd Constantine,who per industry is going through ar- have yet to restart their careers. followed Mr. Spitzer to Albany TEAM SPITZER: guably the darkest period in its A few from the brain trust that and bought a house there, has THEN AND NOW history, with publishers slashing once seemed destined to reshape yet to return to his Manhattan newsroom staff and giants like Tri- the state have moved on to oth- law firm, Constantine Cannon. RICH BAUM bune Co.standing on shaky ground. AT DEADLINE er jobs, but others are taking Working for the hard-driv- WAS The governor’s Things are different in New time off to decompress from the ing Mr.Spitzer,“you really don’t secretary York. -

Q1 2016 New York Office Outlook

Office Outlook New York | Q1 2016 Vacancy moves higher as large blocks are added to the market • The Manhattan office market showed signs of caution in the first quarter of 2016 as vacancy moved higher and renewal activity increased. • While there have been concerns about slower expansion in the tech sector—as a result of a potential pullback in venture capital—the TAMI sector remained strong in Midtown South. • Investment sales activity slowed in the first quarter of the year after a strong 2015 with 120 sales totaling $12.3 billion, down nearly 20 percent year-over-year. JLL • Office Outlook • New York • Q1 2016 2 New York overview The Manhattan office market showed signs of caution in the first comprised the majority of leasing activity. McGraw Hill Financial Inc. quarter of 2016 as vacancy moved higher and renewal activity—rather renewed at 55 Water Street in Lower Manhattan for 900,027 square feet than relocations and expansions—captured the bulk of top in the largest lease of the quarter. Salesforce.com subleased 202,678 transactions. Manhattan Class A vacancy rose as several large blocks square feet at 1095 Avenue of the Americas in a transaction that were returned to the market. The vacancy rate for Midtown Class A included a provision to replace MetLife’s name atop the building with its space increased to 11.6 percent, up from 10.4 percent at year-end own, in full view of highly-trafficked Bryant Park. In Midtown South, 2015. Average asking rents were also higher as a result of newer and Facebook continued its massive expansion in a 200,668-square-foot higher quality product becoming available. -

January 26 – 27, 2012

NATIONAL FEDERATION OF MUNICIPAL ANALYSTS ADVANCED SEMINAR ON REAL ESTATE BACKED BONDS JANUARY 26 – 27, 2012 LIST OF REGISTRANTS Jay Abrams Gregory Aikman FMSbonds, Inc. BNY Mellon Wealth Management Chief Municipal Credit Analyst VP The FMS Building 4775 Technology Way One Boston Place 7th Fl 024-0071 Boca Raton, FL 33431 Boston, MA 02108-4402 (561) 893-6115 (617) 722-7168 [email protected] [email protected] Scott Andreson Todd Anson Hartford Investment Management Company Common Bond Capital Partners, LLC SVP & Head of Municipal Bond Research Managing Director 55 Farmington Ave 720 Glorietta Blvd Hartford, CT 06105 Coronado, CA 92118 (860) 297-6833 619-319-5319 [email protected] [email protected] Lee Arnold Evan Arrowsmith T. Rowe Price George K. Baum & Co. Credit Analyst VP 100 E. Pratt St 1400 Wewatta St Ste 800 Baltimore, MD 21202 Denver, CO 80202 410-345-2480 (303) 391-5483 [email protected] [email protected] Christina Ashmore Jon Barasch Raymond James and Associates Interactive Data Corp Assoc. Muni Desk Analyst Director 880 Carillon Parkway 100 Church St, 11th fl St. Petersburg, FL 33716 New York, NY 10007 727-567-2896 (212) 497-3266 [email protected] [email protected] Vincent Barberio Scott Bayliss Fitch Ratings Saybrook Capital Managing Director Managing Director One State St Plaza 401 Wilshire Blvd #850 New York, NY 10004 Santa Monica, CA 90401 (212) 908-0505 310-899-9200 [email protected] [email protected] Thomas Bell Douglas Benton Assured Guaranty Cavanal Hill Investment Management Director VP/Senior Municipal Credit Manager One Market, 1550 Spear Tower 333 W. -

Investment Manager Summary

Item No. 1: Annual Presentation by Dimensional Fund Advisors – Active Global Real Estate Securities Manager (August 10, 2016, Regular Retirement Board Meeting) INVESTMENT MANAGER SUMMARY MANAGEMENT Firm Name Dimensional Fund Advisors (DFA) Manager Tenure with Fund 3.5 Years Investment Strategy/Vehicle Global Real Estate Securities Contract Expiration 2/28/2019 ASSETS Total Firm AUM (as of 6/30/16) $415 Billion Total Firm Assets in Strategy (as of 6/30/16) $8.6 Billion RP - $ 24.1 Million Total Assets Managed for the Plan HP - $ 6.0 Million PERFORMANCE as of 6/30/16 YTD 1-Year 3-Year ITD¹ DFA Global Real Estate (est. gross) 12.69% 18.13% 11.58% 9.28% DFA Global Real Estate (net) 12.56% 17.85% 11.22% 8.94% FTSE EPRA/NAREIT Developed Index 9.38% 12.57% 8.94% 7.00% Difference (net) 3.18% 5.28% 2.28% 1.94% ¹ Inception to date 3/31/2013 FEES Current Fee 0.24% Net Expense Ratio WATCH STATUS N/A PREVIOUSLY DISCLOSED LITIGATION N/A 1 Los Angeles Water and Power Employees’ Retirement Plan August 10, 2016 Joseph Chi, CFA, Co-Head of Portfolio Management and Vice President Glenn S. Granz, CFA, Regional Director This information is provided for registered investment advisors and institutional investors, and is not intended for public use. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. -

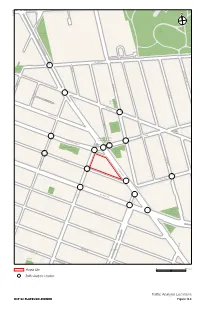

Draft EIS ECF 80 Flatbush Avenue Part 4

WILLOUGHBY STFLEET PL 2/5/2018 FLEET ST Fort Greene University Park Place FLATBUSH AVE EXTENSION DE KALB AVE HUDSON AVE Albee Square SOUTH PORTLAND AVE ASHLAND PL BOND ST SOUTH ELLIOTT PL HANOVER PL GROVE PL 230 Ashland Place POPS FULTON ST LIVINGSTON ST ST FELIX ST ROCKWELL PL Theatre for a New Audience Fowler Square VE TTE A FAYE Rockwell Place Bears LA SCHERMERHORN ST Community Garden Seating Sixteen Sycamores Area 2 Playground 300 Ashland Place Plaza FT GREENE PL STATE ST NEVINS ST FLATBUSH AVE HANSON PL North Pacific Plgd ATLANTIC AVE 3 AVE Atlantic PACIFIC ST Terminal Mall Plaza Barclay's Center DEAN ST Plaza 4 AVE E V A 5 BERGEN ST WYCKOFF ST Greenstreet Wykoff ST MARK'S PL Gardens Open Space Project Site 0 400 FEET Traffic Analysis Location Traffic Analysis Locations ECF 80 FLATBUSH AVENUE Figure 11-4 Chapter 11: Transportation Table 11-8 Traffic Level 2 Screening Analysis Results—Analysis Locations Incremental Vehicle Trips (Weekday) Intersection AM Midday PM Analysis Locations Fulton Street and DeKalb Avenue 0 0 0 Livingston Street and Bond Street 4 1 4 Schermerhorn Street and Bond Street 35 9 23 Flatbush Avenue and DeKalb Avenue 57 14 57 ✓ Flatbush Avenue and Fulton Street 72 19 92 ✓ Flatbush Avenue and Nevins Street 37 9 52 Livingston Street and Nevins Street 30 6 32 Schermerhorn Street and Nevins Street 61 13 51 ✓ State Street and Nevins Street 51 8 49 ✓ Atlantic Avenue and Nevins Street 32 7 36 Pacific Street and Nevins Street 10 0 7 DeKalb Avenue and Hudson Avenue 6 0 1 Hudson Avenue and Fulton Street 35 13 58 Flatbush -

The MHNA Discount Program

Information that may be of interest...March 25, 2019 The information in this eblast is provided by The Murray Hill Neighborhood Association. We are sharing the information as a service to our members. If this notice does not interest you, please disregard it. You can also find these eblasts online in PDF (printable) format at www.murrayhillnyc.org in the News section, look for Weekly Eblasts 2018. The MHNA Discount Program Please be prepared to show proof of membership when you ask for a discount. New Zumba Classes led by Talin Avakian on Thursday evenings at 7:30pm at the Armenian Evangelical Church, 152 East 34th Street (between Lexington & 3rd Avenue), First class free/$10 per class, group rates available, contact Talin at [email protected]. Changed Shelburne Hotel, 303 Lexington Avenue (37th Street), for online reservations visit www.affinia.com/shelburne select Rate Preference "Best Available" and use Promo Code NEIGH for up to 20% off. Please show proof of membership when checking in. Full list of discounts offered to MHNA members: Restaurant and Food Discounts General Discounts For Murray Hill street closures, see Traffic Updates on www.murrayhillnyc.org. If you would like to join a committee, please send an email to [email protected]. Information about the MHNA committees can be found on www.murrayhillnyc.org. Click About > Committees. Shop amazon.com via this link, and support The Murray Hill Neighborhood Association! Read our Privacy Statement Murray Hill Photo Album New Citibike stand on Lexington Avenue, corner of 36th Street. I have not seen more than 2 bikes at this stand.