China's Low Carbon Finance and Investment Pathway

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

List of CMU Members 2021-08-18

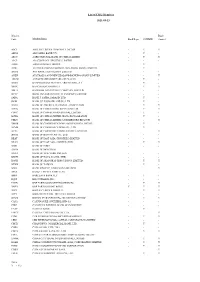

List of CMU Members 2021-09-23 Member Bond Code Member Name Bank Repo CMUBID Connect ABCI ABCI SECURITIES COMPANY LIMITED - Y Y ABNA ABN AMRO BANK N.V. - Y - ABOC AGRICULTURAL BANK OF CHINA LIMITED - Y Y AIAT AIA COMPANY (TRUSTEE) LIMITED - - - ASBK AIRSTAR BANK LIMITED - Y - ACRL ALLIED BANKING CORPORATION (HONG KONG) LIMITED - Y - ANTB ANT BANK (HONG KONG) LIMITED - - - ANZH AUSTRALIA AND NEW ZEALAND BANKING GROUP LIMITED - - Y AMCM AUTORIDADE MONETARIA DE MACAU - Y - BEXH BANCO BILBAO VIZCAYA ARGENTARIA, S.A. - Y - BSHK BANCO SANTANDER S.A. - Y Y BBLH BANGKOK BANK PUBLIC COMPANY LIMITED - - - BCTC BANK CONSORTIUM TRUST COMPANY LIMITED - - - SARA BANK J. SAFRA SARASIN LTD - Y - JBHK BANK JULIUS BAER AND CO. LTD. - Y - BAHK BANK OF AMERICA, NATIONAL ASSOCIATION - Y Y BCHK BANK OF CHINA (HONG KONG) LIMITED - Y Y CDFC BANK OF CHINA INTERNATIONAL LIMITED - Y - BCHB BANK OF CHINA LIMITED, HONG KONG BRANCH - Y - CHLU BANK OF CHINA LIMITED, LUXEMBOURG BRANCH - - Y BMHK BANK OF COMMUNICATIONS (HONG KONG) LIMITED - Y - BCMK BANK OF COMMUNICATIONS CO., LTD. - Y - BCTL BANK OF COMMUNICATIONS TRUSTEE LIMITED - - Y DGCB BANK OF DONGGUAN CO., LTD. - - - BEAT BANK OF EAST ASIA (TRUSTEES) LIMITED - - - BEAH BANK OF EAST ASIA, LIMITED (THE) - Y Y BOIH BANK OF INDIA - - - BOFM BANK OF MONTREAL - - - BNYH BANK OF NEW YORK MELLON - - - BNSH BANK OF NOVA SCOTIA (THE) - - - BOSH BANK OF SHANGHAI (HONG KONG) LIMITED - Y Y BTWH BANK OF TAIWAN - Y - SINO BANK SINOPAC, HONG KONG BRANCH - - Y BPSA BANQUE PICTET AND CIE SA - - - BBID BARCLAYS BANK PLC - Y - EQUI BDO UNIBANK, INC. -

Made in China, Financed in Hong Kong

China Perspectives 2007/2 | 2007 Hong Kong. Ten Years Later Made in China, financed in Hong Kong Anne-Laure Delatte et Maud Savary-Mornet Édition électronique URL : http://journals.openedition.org/chinaperspectives/1703 DOI : 10.4000/chinaperspectives.1703 ISSN : 1996-4617 Éditeur Centre d'étude français sur la Chine contemporaine Édition imprimée Date de publication : 15 avril 2007 ISSN : 2070-3449 Référence électronique Anne-Laure Delatte et Maud Savary-Mornet, « Made in China, financed in Hong Kong », China Perspectives [En ligne], 2007/2 | 2007, mis en ligne le 08 avril 2008, consulté le 28 octobre 2019. URL : http://journals.openedition.org/chinaperspectives/1703 ; DOI : 10.4000/chinaperspectives.1703 © All rights reserved Special feature s e v Made In China, Financed i a t c n i e In Hong Kong h p s c r e ANNE-LAURE DELATTE p AND MAUD SAVARY-MORNET Later, I saw the outside world, and I began to wonder how economic zones and then progressively the Pearl River it could be that the English, who were foreigners, were Delta area. In 1990, total Hong Kong investments repre - able to achieve what they had achieved over 70 or 80 sented 80% of all foreign investment in the Chinese years with the sterile rock of Hong Kong, while China had province. The Hong Kong economy experienced an accel - produced nothing to equal it in 4,000 years… We must erated transformation—instead of an Asian dragon specialis - draw inspiration from the English and transpose their ex - ing in electronics, it became a service economy (90% of ample of good government into every region of China. -

Bank of Shanghai (Hong Kong) Limited

BANK OF SHANGHAI (HONG KONG) LIMITED DIRECTORS’ REPORT AND CONSOLIDATED FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 DECEMBER 2020 Bank of Shanghai (Hong Kong) Limited Year ended 31 December 2020 CONTENTS Page(s) Report of the directors 1 Independent auditor’s report 4 Consolidated statement of profit or loss and other comprehensive income 7 Consolidated statement of financial position 8 Consolidated statement of changes in equity 10 Consolidated statement of cash flows 11 Notes to the consolidated financial statements 12 Corporate Governance Report (unaudited) 89 Bank of Shanghai (Hong Kong) Limited Year ended 31 December 2020 Report of the directors The directors submit herewith their annual report together with the audited financial statements for the year ended 31 December 2020. Principal place of business Bank of Shanghai (Hong Kong) Limited (the Company) is a restricted licence bank incorporated and domiciled in Hong Kong and has its registered office and principal place of business at 34th Floor, Champion Tower, 3 Garden Road, Central, Hong Kong. Principal activities The principal activities of the Company are to provide financial services to corporations and individuals. The principal activities and other particulars of the Company’s subsidiaries are stated in Note 19 to the financial statements. Transfer to reserves The profit attributable to shareholders of HK$227,808,000 (2019: HK$308,294,000) has been transferred to reserves. Other movements in reserves are shown in the consolidated statement of changes in equity on page 10. Recommended dividend The directors do not recommend payment of a final dividend for the financial year ended 31 December2020 (2019: Nil). -

Mainland China

Asia Market Intelligence Mainland China Presence Population: 1.33 billion HSBC Bank (China) Company Limited started Total Area: operations in Shanghai in April 2007 as a wholly- 9.60 million sq km foreign owned bank, solely owned by The Currency: Hongkong and Shanghai Banking Corporation Renminbi (RMB) Limited. As HSBC China, the Bank incorporates the Capital: previous mainland China offices of The Hongkong Beijing and Shanghai Banking Corporation Limited. Gross Domestic Product: 6,991.0bn total (2007 est.); 11.4% real growth rate (2007 The Hongkong and Shanghai Banking Corporation est.); 5,292 per capita (2007 est.) Limited has been present in mainland China for 144 Major Language(s): years. It is one of the largest investors among Putonghua (Mandarin) foreign banks in mainland China, having invested Time zone: over USD5 billion in select mainland financial GMT +8 hrs services entities and in the growth of its own Central Bank: operations. These include a 19.0% stake in Bank of The People’s Bank of China Communications, a 16.8% stake in Ping An Inflation rate (consumer prices): Insurance, and an 8.0% stake in Bank of Shanghai. 4.8% (2007 est.) There is also a branch in Shanghai, which conducts a foreign currency wholesale banking business. HSBC China has one of the largest service networks among foreign banks in mainland China. Our current network comprises 82 outlets, including 19 branches in Beijing, Changsha, Chengdu, Chongqing, Dalian, Dongguan, Guangzhou, Hangzhou, Ningbo, Qingdao, Shanghai, Shenyang, Shenzhen, Suzhou, Tianjin, Wuhan, Xiamen, Xi'an and Zhengzhou and 63 sub-branches in Beijing, Chengdu, Chongqing, Dalian, Guangzhou, Hangzhou, Qingdao, Shenzhen, Shanghai, Shenyang, Suzhou, Tianjin, Wuhan, Ximan and Mainland China Xi’an. -

Hsbc and Bank of Communications Plan to Create Jv for Chinese Credit Card Operation

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. The following is the text of an announcement released to the other stock exchanges on which HSBC Holdings plc is listed. 28 October 2009 HSBC AND BANK OF COMMUNICATIONS PLAN TO CREATE JV FOR CHINESE CREDIT CARD OPERATION *** Expands HSBC’s footprint in the world’s fastest growing emerging market *** *** Maximises opportunities in China’s fast developing consumer mass market *** *** Cements strategic tie-up with China’s fifth largest bank *** The Hongkong and Shanghai Banking Corporation Limited and the Bank of Communications Co. Ltd. (BoCom) are in advanced discussions to transfer their existing joint credit card activities in China to a newly established joint venture company. HSBC has been a strategic investor of BoCom, China’s fifth largest bank by total assets, since 2004. It holds a 19.01 per cent interest in BoCom and, through various agreements, co- operates with BoCom on over 60 initiatives including renminbi trade settlement, payments and cash management services and credit cards. The proposed new joint venture company will be an extension of HSBC’s co-operation agreement with BoCom’s Pacific Credit Card unit, which already has over 11 million cards in force. HSBC and BoCom entered into this agreement in 2004 following HSBC’s acquisition of a stake in BoCom. -

Eswar S. Prasad February 4, 2016

CHINA’S EFFORTS TO EXPAND THE INTERNATIONAL USE OF THE RENMINBI Eswar S. Prasad February 4, 2016 Report prepared for the U.S.-China Economic and Security Review Commission CHINA’S EFFORTS TO EXPAND THE INTERNATIONAL USE OF THE RENMINBI Eswar Prasad1 February 4, 2016 Disclaimer: This research report was prepared at the request of the U.S.-China Economic and Security Review Commission to support its deliberations. Posting of the report to the Commission's website is intended to promote greater public understanding of the issues addressed by the Commission in its ongoing assessment of U.S.-China economic relations and their implications for U.S. security, as mandated by Public Law 106-398 and Public Law 108-7. However, it does not necessarily imply an endorsement by the Commission or any individual Commissioner of the views or conclusions expressed in this commissioned research report. Disclaimer: The Brookings Institution is a private non-profit organization. Its mission is to conduct high- quality, independent research and, based on that research, to provide innovative, practical recommendations for policymakers and the public. The conclusions and recommendations of any Brookings publication are solely those of its author(s), and do not reflect the views of the Institution, its management, or its other scholars. 1 Cornell University, Brookings Institution, and NBER. The author is grateful to members and staff of the Commission for their thoughtful and constructive comments on an earlier draft of this report. Audrey Breitwieser, Karim Foda, and Tao Wang provided excellent research assistance. William Barnett and Christina Golubski provided editorial assistance. -

Listing PRC Companies in Hong Kong Using VIE Structures

Listing PRC Companies in Hong Kong Using VIE Structures October 2014 www.charltonslaw.com 0 Index Page Executive summary 2 Contents 。 Hong Kong Stock Exchange (HKEx)’s background information 4 。 Introduction to listing of PRC companies on HKEx 15 。 VIE structure 21 。 Key requirement of Main Board listing on HKEx 30 。 Requirements for a listing – Hong Kong vs U.S. 39 About Charltons 46 Disclaimer 47 1 Executive summary Hong Kong market is the 6th largest stock market in the world Hong Kong ranked 3rd worldwide in terms of IPO funds raised (only after NYSE and Nasdaq) in 2013 VIE structures can be listed on The Hong Kong Stock Exchange (HKEx) subject to complying with requirements of listing decision ○ certain businesses maybe subject to PRC’s foreign investment restriction if they belong to certain industry sectors (Restricted Industries) ○ Restricted industries include compulsory education, news agencies and internet-related services Key Hong Kong listing requirements: ○ three financial criteria: (1) the profit test ; (2) the market capitalisation/revenue test; or (3) the market capitalisation/revenue/ cashflow test ○ A 3-year track record period requirement is usually applied to a listing applicant * HKEx may also accept a shorter trading record period and/or may vary or waive the financial standards requirements on certain circumstances ○ Maintain at all times a minimum public float of 25% of the Company’s total issued share capital 2 Executive summary Key U.S. listing requirements ○ minimum quantitative requirements, which -

The Annual Report on the World's Most Valuable Chinese Brands March 2017

China 100 2017 The annual report on the world’s most valuable Chinese brands March 2017 Foreword Contents steady downward spiral of poor communication, Foreword 2 wasted resources and a negative impact on the bottom line. Definitions 4 Methodology 6 Brand Finance bridges the gap between the marketing and financial worlds. Our teams have Analysis - China 100 8 experience across a wide range of disciplines from market research and visual identity to tax and Full Table (USDm) 14 accounting. We understand the importance of design, advertising and marketing, but we also Full Table (CNYm) 16 believe that the ultimate and overriding purpose of Understand Your Brand’s Value 18 brands is to make money. That is why we connect brands to the bottom line. How We Can Help 20 By valuing brands, we provide a mutually intelligible Contact Details 21 language for marketers and finance teams. David Haigh, CEO, Brand Finance Marketers then have the ability to communicate the What is the purpose of a strong brand; to attract significance of what they do and boards can use customers, to build loyalty, to motivate staff? All the information to chart a course that maximises true, but for a commercial brand at least, the first profits. answer must always be ‘to make money’. Without knowing the precise, financial value of an asset, how can you know if you are maximising your Huge investments are made in the design, launch returns? If you are intending to license a brand, how and ongoing promotion of brands. Given their can you know you are getting a fair price? If you are potential financial value, this makes sense. -

Banking Newsletter

September 2017 Banking Newsletter Review and Outlook of China’s Banking Industry for the First Half of 2017 www.pwccn.com Editorial Team Editor-in-Chief:Vivian Ma Deputy Editor-in-Chief:Haiping Tang, Carly Guan Members of the editorial team: Cynthia Chen, Jeff Deng, Carly Guan, Tina Lu, Haiping Tang (in alphabetical order of last names) Advisory Board Jimmy Leung, Margarita Ho, Richard Zhu, David Wu, Yuqing Guo, Jianping Wang, William Yung, Mary Wong, Michael Hu, James Tam, Raymond Poon About this newsletter The Banking Newsletter, PwC’s analysis of China’s listed banks and the wider industry, is now in its 32nd edition. Over the past one year there have been several IPOs for small-and-medium-sized banks, increasing the universe of listed banks in China. This analysis covers 39 A-share and/or H-share listed banks that have released their 2017 first half results. Those banks are categorized into four groups as defined by the China Banking Regulatory Commission (CBRC): Large Commercial Joint-Stock Commercial City Commercial Banks Rural Commercial Banks Banks (6) Banks (9) (16) (8) Industrial and Commercial Chongqing Rural Commercial Bank Bank of China (ICBC) China Industrial Bank (CIB) Bank of Beijing (Beijing) (CQRCB) China Construction Bank China Merchants Bank (CMB) Bank of Shanghai (Shanghai) (CCB) Guangzhou Rural Commercial Bank SPD Bank (SPDB) Bank of Hangzhou (Hangzhou) Agricultural Bank of China (GZRCB) (ABC) China Minsheng Bank Corporation Bank of Jiangsu (Jiangsu) (CMBC) Jiutai Rural Commercial Bank Bank of China (BOC) Bank of -

HSBC to Subscribe to Bank of Communications Right Issue Shares

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. The following is the text of an announcement released to the other stock exchanges on which HSBC Holdings plc is listed. 6 June 2010 HSBC TO SUBSCRIBE TO BANK OF COMMUNICATIONS RIGHTS ISSUE SHARES IN FULL HSBC, through its wholly owned subsidiary The Hongkong and Shanghai Banking Corporation Limited, has undertaken to subscribe for its full entitlement of H-shares in the planned Bank of Communications rights issue of new A- and H-shares, details of which were announced by Bank of Communications today. Under the terms of the transaction, HSBC has agreed to subscribe for 1,396,802,037 H-rights shares at HK$5.14 per share. The transaction represents a consideration of approximately HK$7,180 million (approximately US$921 million), which will be funded from internal Group resources. Michael Geoghegan, HSBC’s Group Chief Executive and Chairman of The Hongkong and Shanghai Banking Corporation, said: “Bank of Communications is our strategic banking partner in mainland China and we are very pleased with the progress we have made together over the last six years. HSBC is already the leading international bank in China, and our strategy is to expand through a range of strategic partnerships and by further developing our own HSBC network, which will shortly reach 100 outlets.” HSBC made its first investment in Bank of Communications, China’s fifth largest bank by total assets, in August 2004, and its current shareholding in Bank of Communications is 19.01 per cent. -

Preparing for Trade with China Cbbc China Business Guide

PREPARING FOR TRADE WITH CHINA CBBC CHINA BUSINESS GUIDE Advice 建议 Analysis 解析 Access 渠道 CONTENTS ROUTES TO MARKET AND FINDING AND MANAGING DISTRIBUTORS --- 1 E-COMMERCE GUIDE ---------------------------------------------------------------- 9 CROSS-BORDER TRADE TRANSACTIONS ---------------------------------------29 CHINESE CUSTOMS COMPLIANCE -----------------------------------------------32 LOGISTICS -----------------------------------------------------------------------------38 SOURCING FROM CHINA AND QUALITY ASSURANCE -----------------------44 SMES: TRADE ADVICE AND AVAILABLE SUPPORT ---------------------------52 VISITING CHINA ----------------------------------------------------------------------54 SOURCES ------------------------------------------------------------------------------61 The exchange rate used in this document is £1 = RMB 8.7 = $1.3 = €1.1 Advice 建议 Analysis 解析 Access 渠道 ROUTES TO MARKET AND FINDING AND MANAGING DISTRIBUTORS This section was written by CBBC ROUTES TO MARKET The Chinese market can be complex and challenging, and choosing the most suitable route to market is the first step to success. The key factors that often influence a decision on the correct route-to-market strategy are regulatory and market access, the identity of the target consumer(s), the required upfront investment, and supply chain and logistics issues. REGULATORY AND MARKET ACCESS Different routes to market have different regulatory requirements, so it is important to check whether the product in question is allowed to be imported into China -

Delivering Growth in Asia

GOLDMAN SACHS CHINA INVESTMENT FRONTIER CONFERENCE 2009 Delivering growth in Asia IAIN MACKAY NOVEMBER 2009 CHIEF FINANCIAL OFFICER THE HONGKONG AND SHANGHAI BANKING CORPORATION LIMITED Forward-looking statements This presentation and subsequent discussion may contain certain forward- looking statements with respect to the financial condition, results of operations and business of the Group. These forward-looking statements represent the Group’s expectations or beliefs concerning future events and involve known and unknown risks and uncertainty that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Additional detailed information concerning important factors that could cause actual results to differ materially is available in our Interim Report. Past performance cannot be relied on as a guide to future performance. All financial information used in this presentation is reported in accordance with IFRS and extracted from HSBC Holdings plc’s 2009 Interim Report unless indicated otherwise. ‘Hong Kong’ includes Hang Seng Bank and ‘Asia-Pacific’ includes Hong Kong and the rest of Asia-Pacific. 2 Agenda HSBC Group overview Presence in Asia-Pacific Mainland China Hong Kong Rest of Asia-Pacific Opportunity Strategy Summary 3 HSBC Group overview Leading emerging markets international bank Linking developing and developed markets Global footprint • 8,500 offices in 86 countries and territories • Listings in London, Hong Kong, New York, Paris and Bermuda • 220,000 shareholders