Notice of Acquisition of Assets (Ikebukuro East)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CTBUH Journal

About the Council The Council on Tall Buildings and Urban Habitat is the world’s leading resource for professionals CTBUH Journal focused on the inception, design, construction, and International Journal on Tall Buildings and Urban Habitat operation of tall buildings and future cities. A not-for-profi t organization, founded in 1969 and based at the Illinois Institute of Technology, Chicago, CTBUH has an Asia offi ce at Tongji University, Shanghai, and a research offi ce at Iuav Tall buildings: design, construction, and operation | 2015 Issue II University, Venice, Italy. CTBUH facilitates the exchange of the latest knowledge available on tall buildings around the world through publications, Special Issue: Focus on Japan research, events, working groups, web resources, and its extensive network of international representatives. The Council’s research department Case Study: Abenos Harukas, Osaka is spearheading the investigation of the next generation of tall buildings by aiding original Advanced Structural Technologies research on sustainability and key development For High-Rise Buildings In Japan issues. The free database on tall buildings, The Skyscraper Center, is updated daily with detailed Next Tokyo 2045: A Mile-High Tower information, images, data, and news. The CTBUH Rooted In Intersecting Ecologies also developed the international standards for measuring tall building height and is recognized as Application of Seismic Isolation Systems the arbiter for bestowing such designations as “The World’s Tallest Building.” In Japanese High-Rise -

Annual Report 2013 1

Otemachi Building, 6-1, Otemachi 1-chome, Chiyoda-ku, Tokyo 100-8133, Japan http://www.mec.co.jp/index_e.html ANNUAL REPORT2013 Approx. 296m Approx. 240m Approx. Approx. 205m 180m Approx. 36m Approx. 20m Yokohama Landmark Tower Sunshine 60 McGraw-Hill Building Marunouchi Building Paternoster Square Mitsubishi Ichigokan ANNUAL REPORT This report is printed using paper that con- This report has been prepared using tains raw materials certified by the Forest 100% vegetable ink. Every effort is Stewardship Council (FSC)®. FSC ® certifi cation made to contain the incidence of vol- Fiscal Year ended ensures that materials have been harvested atile organic compounds (VOCs) and from properly managed forests. to preserve petroleum resources. Printed in Japan March 31, 2013 2013 113mec_ar表紙英文0815_初戻P.indd3mec_ar表紙英文0815_初戻P.indd 11-2-2 113/09/063/09/06 116:376:37 MITSUBISHI ESTATE CO., LTD. ANNUAL REPORT 2013 1 A Love for People A Love for the City Forever Taking on New Challenges–The Mitsubishi Estate Group Our wish is to provide people who live in, work in and visit the city with enriching and fulfi lling lives, full of stimulating opportunities to meet. The Mitsubishi Estate Group has always pursued the genuine value sought by people in the environments and services it provides. With an eye to the future, we carefully listen to each and every customer, and create the true value they seek. We wish to share with our customers the inspiration and passion we derive from our work. We will constantly take on new challenges to achieve this vision, and through it, we will continuously evolve. -

Tokyo Office June 2017 Marketbeat

TOKYO OFFICE JUNE 2017 MARKETBEAT 1.47% 3.73 % 1.77 msf RENT GROWTH VACANCY RATE NEW COMPLETIONS (YOY) (Q2 2017) (YTD Rentable) Macroeconomic Indicators One Year Q4 16 Q1 17 HIGHLIGHTS Forecast Real GDP Growth 1.4% 1.0% Positive Signs from Corporate Japan Inflation The Japanese economy has posted positive economic growth for the fifth quarter in a 0.3% 0.2% row. Meanwhile corporate profits have shown improvement across three quarters, Unemployment 3.1% 2.8% rising 26% year on year in the first quarter, after a dip in late 2015 and early 2016. Source: Cabinet Office, Statistics Bureau Top Heavy in the Central 5 Wards Central 5 Wards Grade A Rent vs. Vacancy Average asking rents ticked upwards softly after remaining essentially flat for four C&W Forecast 40,000 10 consecutive quarters. Leasing activity has been lively but some landlords, looking to 8 35,000 6 Tsubo 2018 and beyond, are softening their formerly hardline stances on rent and incentives. % 30,000 4 While this is particularly true for larger spaces, for smaller spaces in buildings with JPY/ 2 25,000 0 higher occupancy, rent is still increasing. In general, the upwards pressure on asking rents has eased compared to last year and we are nearing an inflection point. Asking Rent (LHS) Vacancy Rate (RHS) Source: Cushman & Wakefield A Cushman & Wakefield “I know; It’s been comin’ for some time” Central 5 Wards New Supply C&W Forecast Research Publication As we enter into the second half of 2017, the looming supply influx coming in the next 250,000 200,000 few years will weigh heavier on negotiations and relocation decisions, and the market 150,000 DATA 100,000 will start to turn further in favor of tenants. -

Fact Book 2007 (Pdf)

FACT BOOK 2006–2007 FACT BOOK GENERAL INSURANCE IN JAPAN THE GENERAL INSURANCE ASSOCIATION OF JAPAN CONTENTS Part I Business Results Page I. Key Figures of the General Insurance Business for Fiscal 2006 1. The Number of General Insurance Companies ........................................................................................... 2 2. The Number of Agencies and Sales Staff of Agencies ............................................................................... 2 3. Premiums ........................................................................................................................................................ 3 4. The Amount of Claims Paid .......................................................................................................................... 3 5. Assets and Investment ................................................................................................................................... 4 6. Ordinary Profits and Net Profits for the Current Year ................................................................................ 4 7. Loss Ratio and Operating Expenses Ratio .................................................................................................... 5 8. Ownership of General Insurance Policies ..................................................................................................... 5 II. Major Events ............................................................................................................................................... 6 III. Statistics -

Senkawa, Takamatsu, Chihaya, Kanamecho Ikebukuro Station's

Sunshine City is one of the largest multi-facility urban complex Ikebukuro Station is said to be one of the biggest railway terminals in Tokyo, Japan. in Japan. It consists of 5 buildings, including Sunshine It contains the JR Yamanote Line, the JR Saikyo Line, the Tobu Tojo Line, the Seibu Ikebukuro Ikebukuro Station’s 60, a landmark of Ikebukuro, at its center. It is made up of Line, Tokyo Metro Marunouchi Line, Yurakucho Line, Fukutoshin Line, etc., Sunshine City shops and restaurants, an aquarium, a planetarium, indoor Narita Express directly connects Ikebukuro Station and Narita International Airport. West Exit theme parks etc., A variety of fairs and events are held at It is a very convenient place for shopping and people can get whichever they might require Funsui-hiroba (the Fountain Plaza) in ALPA. because the station buildings and department stores are directly connected, such as Tobu Department Store, LUMINE, TOBU HOPE CENTER, Echika, Esola, etc., Jiyu Gakuen Myōnichi-kan Funsui-hiroba (the Fountain Plaza) In addition, various cultural events are held at Tokyo Metropolitan eater and Ikebukuro Nishiguchi Park on the west side of Ikebukuro Station. A ten-minute-walk from the West Exit will bring you to historic buildings such as Jiyu Gakuen Myōnichi-kan, a pioneering school of liberal education for Japan’s women and designed by Frank Lloyd Wright, Rikkyo University, the oldest Christianity University, and the Former Residence of Rampo Edogawa, a leading author of Japanese detective stories. J-WORLD TOKYO Sunshine City Rikkyo University and “Suzukake-no- michi” ©尾 田 栄 一 郎 / 集 英 社・フ ジ テ レ ビ・東 映 ア ニ メ ー シ ョ ン Pokémon Center MEGA TOKYO Tokyo Yosakoi Former Residence of Rampo Edogawa Konica Minolta Planetarium “Manten” Sunshine Aquarium Senkawa, Takamatsu, NAMJATOWN Chihaya, Kanamecho Tokyo Metropolitan Theater Ikebukuro Station’s Until about 1950, there were many ateliers around this area, and young painters and East Exit sculptors worked hard. -

Tall Buildings and Elevators: a Review of Recent Technological Advances

Buildings 2015, 5, 1070-1104; doi:10.3390/buildings5031070 OPEN ACCESS buildings ISSN 2075-5309 www.mdpi.com/journal/buildings/ Review Tall Buildings and Elevators: A Review of Recent Technological Advances Kheir Al-Kodmany Department of Urban Planning and Policy, College of Urban Planning and Public Affairs, University of Illinois at Chicago, Chicago, IL 60607, USA; E-Mail: [email protected] Academic Editor: Chimay J. Anumba Received: 26 June 2015 / Accepted: 31 August 2015 / Published: 17 September 2015 Abstract: Efficient vertical mobility is a critical component of tall building development and construction. This paper investigates recent advances in elevator technology and examines their impact on tall building development. It maps out, organizes, and collates complex and scattered information on multiple aspects of elevator design, and presents them in an accessible and non-technical discourse. Importantly, the paper contextualizes recent technological innovations by examining their implementations in recent major projects including One World Trade Center in New York; Shanghai Tower in Shanghai; Burj Khalifa in Dubai; Kingdom Tower in Jeddah, Saudi Arabia; and the green retrofit project of the Empire State Building in New York. Further, the paper discusses future vertical transportation models including a vertical subway concept, a space lift, and electromagnetic levitation technology. As these new technological advancements in elevator design empower architects to create new forms and shapes of large-scale, mixed-use developments, this paper concludes by highlighting the need for interdisciplinary research in incorporating elevators in skyscrapers. Keywords: energy saving; efficiency; speed; long distances; comfort; safety; security 1. Introduction When people think about the development of cities, rarely do they contemplate the critical role of vertical transportation. -

The Imperial Ghost in the Neoliberal Machine

Sunshine 60 – a soaring sixty-story mega complex in the entertainment district of Ikebukuro, Tokyo – was the tallest skyscraper in Asia at the time of its completion in 1978. ÊÊÊÊÊÊÊÊÊÊFrom the day its doors opened, businesspeople began complaining about peculiar visions and sounds. Shoppers reported 01/12 fleeting apparitions or disembodied faces wafting down the hallways and into secluded areas such as dressing rooms or bathrooms. People traded tales of sudden, unexplained gusts of chilled air, and instances of feeling pushed or trapped in physical encounters with invisible entities. Visitors heard unintelligible whispers in their ears. Store clerks grew Koichiro Osaka accustomed to hearing haunting moans, the closing of iron gates, or the groan of hangman’s ropes. At the start of their mornings, they would The Imperial find items disorganized on the shelves or objects toppled from where they’d been placed the night Ghost in the before. ÊÊÊÊÊÊÊÊÊÊLocals knew about the Sugamo Prison, Neoliberal which had originally stood on the site. Until the end of World War II, the former edifice was a penitentiary that detained and executed inmates Machine charged with “ideological” offenses: from communist intellectuals and political agitators, (Figuring the to leaders of occult or religious sects. As the war came to an end in 1945, the prison was seized by the Allied forces – flipping the coin to the other CIA) side. The detention center was transformed into a jail for top military and government officials ) including Hideki Tojo, wartime Prime Minister A I C and general of the Imperial Japanese Army. e h t ÊÊÊÊÊÊÊÊÊÊA dark shadow lurks in the foundations of g n i the bright, lively shopping mall at Sunshine 60. -

Tallest Buildings Constructed in 1970-1980

This PDF was downloaded from The Skyscraper Center on 2018/01/11 UTC For the most up to date version, please visit http://skyscrapercenter.com Building List All Regions, All Companies, 200m+, 1970-1980 Completed Architecturally Topped Structurally Topped Under On Never Proposed Vision Demolished Out Out Construction Hold Completed # Building Name City Height (m) Height (ft) Floors Completed Material Use 1 Willis Tower Chicago 442.1 1,451 108 1974 steel office 2 Aon Center Chicago 346.3 1,136 83 1973 steel office 3 First Canadian Place Toronto 298.1 978 72 1975 steel office 4 601 Lexington New York City 278.9 915 63 1977 steel office 5 Water Tower Place Chicago 261.9 859 74 1976 concrete residential / hotel / retail 6 Aon Center Los Angeles 261.5 858 62 1974 steel office 7 Transamerica Pyramid Center San Francisco 260 853 48 1972 composite office 8 U.S. Steel Tower Pittsburgh 256.3 841 64 1970 steel office 9 IDS Center Minneapolis 241.4 792 55 1973 composite office 10 200 Clarendon Boston 240.8 790 62 1976 steel office 11 Sunshine 60 Tower Tokyo 240 787 60 1978 composite office 12 Commerce Court West Toronto 239 784 57 1973 composite office 13 Enterprise Plaza Houston 230.4 756 55 1980 composite office 14 One Penn Plaza New York City 228.6 750 57 1972 steel office 15 1251 Avenue of the Americas New York City 228.6 750 54 1972 steel office 16 MLC Centre Sydney 228 748 60 1977 concrete office 17 One Astor Plaza New York City 227.1 745 54 1972 composite office 18 One Liberty Plaza New York City 226.5 743 54 1972 steel office 19 Parque Central -

Corporate History 1800S in 2009, Kajima Corporation Celebrated Its 170Th Anniversary

CORPORATE HISTORY 1800s IN 2009, KAJIMA CORPORATION CELEBRATED ITS 170TH ANNIVERSARY. From the historic Edo period to today, Kajima has played a vital role in developing the social capital essential to 1860 Ei-Ichiban Kan Japan’s industrial and eco- 1880 Began construction of Yanagase nomic advancement, and an Railroad improved standard of living for Iwazo Kajima its citizens. Naturally, times [JAPAN] have not always been generous, and countless chal- 1860 Ei-Ichiban Kan lenges have arisen over the years. To face them, our 1872 Houraisha Office predecessors pooled their knowledge and strengths 1874 Papermaking Company (Oji to anticipate the needs of the era, turning the tables Paper) Factory on adversity to embark on a bold wave of manage- 1878 Okayama Prefectural Office 1880 Began construction of ment innovation. Yanagase Railroad 1872 Houraisha Office The key to Kajima’s ongoing development is a bold 1891 Began construction of Usui and vigorous enterprising spirit that runs through the Railway Line veins of our managers and employees. Our corporate philosophy is “As a group of individuals working together as one, we pursue creative progress and development founded on both rational, scientific 1874 Papermaking Company (Oji Paper) principles and a humanitarian outlook, through which Factory we strive to continually advance our business operations and con- tribute to society.” While times may change, our unyield- 1878 Okayama Prefectural Office ing commitment to this philosophy never will. [OVERSEAS] 1899 Built railroads in Taiwan, Korea, etc. 1899 Built railroads in Taiwan, Korea, etc. 82 KAJIMA CORPORATION ANNUAL REPORT 2011 1900-1959 1960-1969 1918 Began construction of 1963 New Tanna Tunnel Tanna Tunnel (17-year project) 1924 Ohmine Dam 1968 Kasumigaseki Building 1918 Began construction of 1960 Yamashina construction Tanna Tunnel (17-year zone on the Meishin project) Expressway 1924 Ohmine Dam 1961 Okutadami Dam 1934 Ueno Station 1962 Tobata Iron Mill, Yawata Iron 1957 No.1 Reactor, Japan Nuclear and Steel Co., Ltd. -

Letter Head Created in a Table

Sponsored by the Government of Japan OECD-ADBI High-Level Panel on Institutional Investors and Long-Term Investment Financing 13 March 2015 Tokyo, Japan INFORMATION NOTE FOR PARTICIPANTS The High-Level Panel on Institutional Investors and Long-Term Investment Financing will be held on 13 March 2015 at the Asian Development Bank Institute (ADBI) in Tokyo. The event will be jointly organised and sponsored by the ADBI and the OECD, in co-operation with the Government of Japan. REGISTRATION Please note that participation is by invitation only. Delegates must register for this conference. To do so, please send your registration form (attached to your invitation letter) by 9 February 2015, to: Ms. Morven Alexander, OECD E-mail: [email protected]; Tel: +33 1 45 24 88 36 Event website: http://www.oecd.org/daf/fin/private-pensions/oecdadbihigh-levelpanellti.htm Please note that as seating will be limited for this event, early registration is advised. CONFERENCE VENUE The High-Level Panel will be held at the Asian Development Bank Institute, Tokyo. Please find below the address and contact person at the ADBI. Ms. Mihoko Saito, ADBI Tel: 81-3-3593-5548 (Direct) ; Email: [email protected] Asian Development Bank Institute Kasumigaseki Building, 8th Floor, 3-2-5 Kasumigaseki, Chiyoda-ku, Tokyo, Japan Website: http://www.adbi.org/ 1 FOR FURTHER ENQUIRIES PLEASE CONTACT: For issues regarding the agenda: For logistical matters: Mrs. Mamiko Yokoi-Arai Ms. Morven Alexander-Drane Principal Administrator, Project Co-ordinator, OECD Financial Affairs Division, OECD E-mail: [email protected] E-mail: [email protected] Tel.: +(33-1) 45 24 88 36 Tel: +(33 1) 45 24 75 26 Ms. -

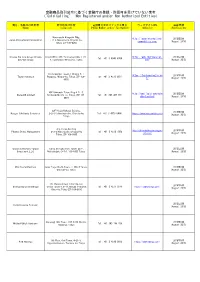

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered And/Or Non-Authorized Entities)

金融商品取引法令に基づく金融庁の登録・許認可を受けていない業者 ("Cold Calling" - Non-Registered and/or Non-Authorized Entities) 商号、名称又は氏名等 所在地又は住所 電話番号又はファックス番号 ウェブサイトURL 掲載時期 (Name) (Location) (Phone Number and/or Fax Number) (Website) (Publication) Marunouchi Kitaguchi Bldg. http://japaninternational 2018年8月 Japan International Commodities 1-6-5, Marunouchi, Chiyoda-ku, commodities.com/ (August 2018) Tokyo, ZIP 100-8262 Resona Dai-Ichi Group/Resona Head Office: 32F, Toranomon Hills, 1-23- https://www.rdgfinancial. 2018年8月 Tel: +81 3 4540 6704 Day-Ichi Group 4, Toranomon, Minato-ku, Tokyo com/ (August 2018) Izumi Garden Tower, 1 Chome-6-1 https://taylormckenzie.ne 2018年8月 Taylor mckenzie Roppongi, Minato-ku, Tokyo, ZIP 106- Tel: +81 3 4579 5691 t/ (August 2018) 0032 48F Shinbashi Tokyu Bldg 4-21-3, http://www.fsajp.com/delw 2018年8月 Delwebb Limited Shinbashi Minato-ku, Tokyo, ZIP 105- Tel: +81 345 405 931 ebb-limited/ (August 2018) 0004 22F Hibiya Kokusai Building, 2018年8月 Kangyo Yokohama Securities 2-2-3 Uchisaiwai-cho, Chiyoda-ku, Tel: +81 3 4579 0434 https://www.kysecurities.com (August 2018) Tokyo 4FL Yusen Building http://phoenixdirectmanagem 2018年8月 Phoenix Direct Management 2-3-2 Marunouchi, Chiyoda-ku Tel: +81 3 4578 7985 ent.com/ (August 2018) Tokyo, ZIP 100-0005 Grace Investment/ Grace Tokyo Shinjuku Park Tower, 29/F, 2018年8月 Investment L.L.C Nishishinjuku 3-7-1, 163-1055 Tokyo (August 2018) IBG Capital Partners Gran Tokyo North Tower, 1-208-5 Yaesu, 2018年8月 Chiyoda-ku, Tokyo (August 2018) 13F Harumi Island Triton Square 2018年8月 Shinhan Daiwa Brokerage Office -

Otome Road" in Ikebukuro

K-BOOKS Hi, I'm Federica from Italy. Girls are longing to visit 3 Ikebukuro "Otome Road" in Ikebukuro. I had been wanting to visit VOICE store here since childhood. We can stick to our Plus 1 Day favorite genre or just browse any kind of in Start shops as we like. IKEBUKURO East exit of 1 Ikebukuro 4 Swallowtail Butlers Cafe Station Ikefukuro We felt very nervous when the butler welcomed us home. Otome Road Sunshine 60 St. Otome Road Street Vending machines decorated with animation characters and posters on the walls turn us on spontaneously. ACOS Ikebukuro Main Store 2 5 HACOSTADIUM Ikebukuro Cosset We can choose our favorite color of wig from a wide variety of options. Animate Ikebukuro 6 Main Store Cute and reasonable items and sweets including chocolate and cookies are perfect for souvenirs. 7 CHARACRO feat. Gintama 8 Naka- Goal Ikebukuro Park You should definitely visit Otome Road and enjoy the latest culture scene in Japan! Otome Road Naka-Ikebukuro Park "Otome Road" is a mecca hankered after Plus 1 Day in "Shiro Fukuro" (white owl) in by "Otome" (romantic girls) around the IKEBUKURO world who love Japanese "anime" and Naka-Ikebukuro Park is the cartoons. Special stores and cafes stand guardian god of Otome girls. in a row on one side of a 200m-long street and its back street overlooked by Otome Road Sunshine 60, the landmark of Ikebukuro. CHARACRO feat. Gintama CHARACRO feat. Gintama East exit of is a café & bar with the Ikebukuro concept of Japanese style bar that Gin-san, the main Station character of a popular Ikefukuro cartoon & anime 'Gintama', "Ikefukuro", a meeting Meiji Dori St.