Steward Global Equity Income Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Does International Diversification Pay?

Does International Diversification Pay? Vivek Bhargava1, Daniel K. Konku2, and D. K. Malhotra3 Advances in computer and telecommunications technology have contributed to the emergence of more integrated global financial markets, allowing for the dissemination of information and the execution of transactions on a real-time basis around the clock and around the globe. To determine if an investor can gain additional diversification benefits by investing in today’s increasingly integrated global financial markets, returns on four different indexes—Standard & Poor’s Composite 500 (S&P 500); Morgan Stanley Capital International (MSCI) World Index; Europe, Australia, and Far East (EAFE) Index; and the MSCI Europe Index—are analyzed for a 22-year period, from 1978 to 2000. Although the benefits from international diversification are decreasing, an investor is better off investing a portion of his or her portfolio in international markets, especially the European markets. Keywords: Diversification, Mutual fund selection, Risk reduction Introduction The objective of this paper is to determine whether an Globalization of financial markets is one of the most investor today can still gain diversification benefits significant economic developments over the last by investing in international markets. The monthly decade. Advances in computer and returns of four different indexes--Standard & Poor’s telecommunications technology contributed to the 500 (S&P 500); Morgan Stanley Capital International emergence of global financial markets, permitting the (MSCI) World Index; the Europe, Australia and Far dissemination of information and execution of East (EAFE) Index; and the MSCI Europe Index— transactions on a real-time basis around the clock and are analyzed over a 22-year period, from 1978 to around the globe. -

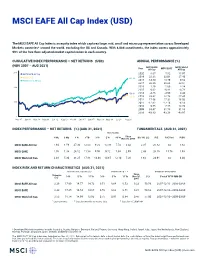

MSCI EAFE All Cap Index (USD)

MSCI EAFE All Cap Index (USD) The MSCI EAFE All Cap Index is an equity index which captures large, mid, small and micro cap representation across Developed Markets countries* around the world, excluding the US and Canada. With 8,088 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in each country. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (NOV 2007 – AUG 2021) MSCI EAFE MSCI World Year All Cap MSCI EAFE All Cap 300 MSCI EAFE All Cap 2020 8.67 7.82 15.97 2019 22.38 22.01 27.40 MSCI EAFE 262.28 MSCI World All Cap 2018 -14.50 -13.79 -9.52 2017 26.35 25.03 22.51 200 2016 1.29 1.00 8.24 2015 0.62 -0.81 -0.78 158.80 2014 -4.86 -4.90 4.44 149.91 2013 23.62 22.78 27.45 2012 17.56 17.32 16.03 100 2011 -12.62 -12.14 -6.13 2010 9.55 7.75 13.74 2009 33.47 31.78 31.83 2008 -43.83 -43.38 -40.97 0 Nov 07 Jan 09 Mar 10 May 11 Jun 12 Aug 13 Oct 14 Dec 15 Jan 17 Mar 18 May 19 Jul 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Nov 30, 2007 Div Yld (%) P/E P/E Fwd P/BV MSCI EAFE All Cap 1.94 1.59 27.30 12.03 9.20 10.09 7.74 3.42 2.35 20.82 na 1.82 MSCI EAFE 1.76 1.38 26.12 11.58 9.00 9.72 7.34 2.99 2.43 20.10 15.76 1.93 MSCI World All Cap 2.48 5.30 31.25 17.81 14.48 14.65 12.10 7.26 1.64 24.91 na 3.04 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Nov 30, (%) Period YYYY-MM-DD -

Quarterly Market Review

Quarterly Market Review [Third Quarter 2018] www.rathbonewarwick.com Quarterly Market Review [Third Quarter 2018] This report features world capital market performance Overview: and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and Market Summary bond asset classes in the US and international markets. World Stock Market Performance The report also illustrates the impact of globally diversified portfolios and features a quarterly topic. World Asset Classes US Stocks International Developed Stocks Emerging Markets Stocks Select Country Performance Select Currency Performance vs. US Dollar Real Estate Investment Trusts (REITs) Commodities Fixed Income Impact of Diversification Rathbone Warwick Investment Management (“RWIM”) is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where RWIM and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RWIM unless a client service agreement is in place. www.rathbonewarwick.com Market Summary [Index Returns] Global International Emerging Global Bond US Stock Developed Markets Real US Bond Market Market Stocks Stocks Estate Market ex US Q3 2018 STOCKS BONDS 7.12% 1.31% -1.09% -0.03% 0.02% -0.17% Since Jan. 2001 Avg. Quarterly Return 2.0% 1.5% 2.9% 2.6% 1.1% 1.1% Best 16.8% 25.9% 34.7% 32.3% 4.6% 4.6% Quarter 2009 Q2 2009 Q2 2009 Q2 2009 Q3 2001 Q3 2008 Q4 Worst -22.8% -21.2% -27.6% -36.1% -3.0% -2.7% Quarter 2008 Q4 2008 Q4 2008 Q4 2008 Q4 2016 Q4 2015 Q2 Past performance is not a guarantee of future results. -

The Case for a Global Perspective

Schwab Center for Financial Research The case for a global perspective Jeffrey Kleintop, CFA Chief Global Investment Strategist What the Masters can teach us about investing Global stocks have tended to provide returns similar to those of U.S. stocks over long-term periods in the Markets have become more globally diversified of late, forcing investors to adopt a past. Valuations point to similar 5—10% annualized broader, worldwide perspective. This is a theme relevant even in championship golf, total returns across the world’s major regions in the where the national diversity of players in the 2015 Masters tournament bears an uncanny future (page 10). resemblance to stocks in the MSCI All Country World Index. Just as top players can be found on the world’s golf courses, savvy investors can be found on the world’s stock exchanges. But the lessons don’t stop there. 5–10% Geographic distribution of players at the Masters Annualized and stocks in the MSCI All Country World Index total returns Masters players MSCI AC World Index 50% U.S. 51% 16% Europe* 16% Avoiding the traps During the worst 10-year period for 13% Emerging Markets 14% stocks over the past 45 years, U.S. stocks fell an annualized 4.2%, 1.0% 12% U.K. 7% while global stocks lost 2.5% and International international stocks measured by 7% Asia Pacific 9% the MSCI EAFE Index lost only 2.5% 1.0% (page 6). Global 2% Canada 3% 4.2% * Excluding the U.K. Source: Charles Schwab, MSCI data as of April 10, 2015. -

MSCI ACWI Ex Ireland Index (USD)

MSCI ACWI ex Ireland Index (USD) The MSCI ACWI ex Ireland Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding Ireland) and 27 Emerging Markets (EM) countries*. With 2,959 constituents, the index covers approximately 85% of the global equity opportunity set outside Ireland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI ACWI Year ex Ireland MSCI World MSCI ACWI MSCI ACWI ex Ireland 2020 16.83 16.50 16.82 MSCI World 338.06 2019 27.28 28.40 27.30 MSCI ACWI 325.46 2018 -8.90 -8.20 -8.93 300 324.55 2017 24.63 23.07 24.62 2016 8.51 8.15 8.48 2015 -1.86 -0.32 -1.84 2014 4.71 5.50 4.71 200 2013 23.42 27.37 23.44 2012 16.81 16.54 16.80 2011 -6.88 -5.02 -6.86 2010 13.25 12.34 13.21 100 2009 35.44 30.79 35.41 2008 -41.76 -40.33 -41.85 50 2007 12.31 9.57 12.18 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 31, 1998 Div Yld (%) P/E P/E Fwd P/BV MSCI ACWI ex Ireland 2.53 4.66 29.18 16.24 14.91 14.88 11.86 6.98 1.71 22.52 18.45 3.07 MSCI World 2.52 5.97 30.33 18.29 15.56 15.44 12.76 6.98 1.66 23.87 19.54 3.31 MSCI ACWI 2.53 4.67 29.18 16.24 14.91 14.88 11.86 6.97 1.71 22.54 18.46 3.07 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 31, (%) Period YYYY-MM-DD -

Foreign Equityequity

ForeignForeign EquityEquity • All ETFs providers are placed in alphabetical order. • Click logo to buy ETF through EasyEquities website. • Risk profile included. • Research from Intellidex is included for most ETFs available on the EasyEquities site. • Provider logos click through to ETFs information on provider’s home page. • Providers Fact sheets are included. • The Total Expense Ratios (TERs) for each ETF is shown (as at March 2018). - Total Expense Ratios (TERs) Measure the costs of operating the ETF portfolios, including the management fees and costs of the issuing company. The TER is included in price of the ETF product and is not paid directly by the investor. The Ashburton Global 1200 ETF provides investors with efficient exposure RISK to the global equity market by tracking the S&P Global 1200. Ashburton Global 1200 ETF houses various global indices under one fund. Ashburton ETF Global 1200 ETF combines seven indices: the S&P 500 (US); S&P Europe Aggressive Global 1200 350; S&P TOPIX 150 (Japan); S&P/TSX 60 (Canada); S&P/ASX All Australian 50; S&P Asia 50; and S&P Latin America 40 FACT SHEET TER: 0,45% The Cloud Atlas Big50 ex-SA ETF is an investment product that invests in RISK the 50 most representative companies across the African continent. The 50 companies in this ETF track the Cloud Atlas AMI Big50 ex-SA index (beta+), which is an enhanced index designed to maximize sector and Moderate ETF country exposure Big 50 FACT SHEET TER: 0,75% The CoreShares S&P 500 ETF tracks the S&P 500® Index. -

Global Equity Allocation

Index Report Global Equity Allocation Analysis of Issues Related to Geographic Allocation of Equities Prepared for the Ministry of Finance of Norway March 2012 msci.com Global Equity Allocation March 2012 Contents Contents ..................................................................................... 2 Executive Summary ................................................................... 4 Section I: The Globalization of Equity Portfolios ....................... 6 A Globalized Opportunity Set: Reducing Home Bias ............................................... 6 The Expansion of the Global Opportunity Set: Evolution of Market Portfolio ..... 7 Globalization and Liberalization ................................................................................ 8 The Increasing Role of Emerging Markets ............................................................ 10 Changing Approaches to Equity Allocation ........................................................... 12 Summary ................................................................................................................... 15 Section II: Alternative Weighting Schemes: Market-Cap Weighting versus GDP Weighting ........................................... 16 Market Capitalization Weighting versus Alternative Weighting Schemes ....... 16 GDP Weighting of Global Equities ......................................................................... 16 Risk and Return ........................................................................................................ 19 Attributing -

MSCI on Datastream, Issue 5

Morgan Stanley Capital International on Datastream www.thomson.com/financial © Thomson Financial Limited, 2002 - 2005 Datastream and IBES are the trade marks of Thomson Financial Limited MSCI is a service mark of Morgan Stanley Capital International Inc. Windows is a trademark of the Microsoft Corporation. All Thomson Financial's services, databases (including the data contained therein), programs, facilities, publications, manuals and user guides ("Proprietary Information"), are proprietary and confidential and may not be reproduced, re-published, redistributed, resold or loaded on to a commercial network (e.g. Internet) without the prior written permission of Thomson Financial Limited ("Thomson Financial"). Data contained in Thomson Financial's databases has been compiled by Thomson Financial in good faith from sources believed to be reliable, but no representation or warranty express or implied is made as to its accuracy, completeness or correctness. All data obtained from Thomson Financial's databases is for the assistance of users but is not to be relied upon as authoritative or taken in substitution for the exercise of judgement or financial skills by users. Your use of Thomson Financial’s services and Thomson Financial’s liability to you is subject to the terms of your subscriber agreement. About this pdf This Adobe Acrobat pdf file has been generated with Acrobat 6. It has been saved for compatibility with Acrobat 5. This means that all essential features will be usable with Acrobat Reader 5 or later. To ensure that you are able to use all features and extract maximum value from the file, we recommend that you install Acrobat Reader 6. -

Ishares International Equity Etfs Product Disclosure Statement

iShares International Equity ETFs Product Disclosure Statement Dated: 8 June 2021 iShares Asia 50 ETF ASX: IAA / ARSN: 625 112 950 iShares China Large-Cap ETF ASX: IZZ / ARSN: 625 114 052 iShares Core MSCI World Ex Australia ESG Leaders ETF ASX: IWLD / ARSN: 610 786 171 iShares Core MSCI World ex Australia ESG Leaders (AUD Hedged) ETF ASX: IHWL / ARSN: 607 996 458 iShares Edge MSCI World Minimum Volatility ETF ASX: WVOL / ARSN: 614 057 831 iShares Edge MSCI World Multifactor ETF ASX: WDMF / ARSN: 614 058 301 iShares Europe ETF ASX: IEU / ARSN: 625 113 528 iShares Global 100 ETF ASX: IOO / ARSN: 625 113 911 iShares Global 100 (AUD Hedged) ETF ASX: IHOO / ARSN 602 618 744 iShares Global Consumer Staples ETF ASX: IXI / ARSN: 625 114 552 iShares Global Healthcare ETF ASX: IXJ / ARSN: 625 114 347 iShares S&P 500 ETF ASX: IVV / ARSN: 625 112 370 iShares S&P 500 (AUD Hedged) ETF ASX: IHVV / ARSN 602 618 691 iShares S&P Mid-Cap ETF ASX: IJH / ARSN: 625 114 061 iShares S&P Small-Cap ETF ASX: IJR / ARSN: 625 113 886 iShares MSCI EAFE ETF ASX: IVE / ARSN: 625 116 887 iShares MSCI Emerging Markets ETF ASX: IEM / ARSN: 625 115 844 BlackRock Investment Management (Australia) Limited iShares MSCI Japan ETF ABN 13 006 165 975 ASX: IJP / ARSN 625 114 687 Australian Financial Services Licence No 230523 iShares MSCI South Korea ETF ASX: IKO / ARSN: 625 114 212 iShares International Equity ETFs 1. Before you start ............................................................................................................................................................................................. 3 2. About BlackRock and iShares ......................................................................................................................................................................... -

Invesco MSCI World SRI Index Fund•

Mutual Fund Retail Share Classes Invesco MSCI World Data as of June 30, 2021 SRI Index Fund• Quarterly Performance Limited Offering Commentary Investment objective Market overview The fund seeks long-term growth of capital. + US equity markets hit record highs during the recovery in corporate earnings, improved investor quarter thanks to a third round of pandemic-relief sentiment, vaccine rollouts and the easing of Portfolio management checks, healthy corporate earnings reports and an pandemic restrictions. However, inflation aggressive vaccination program. Increased remained a top concern in Europe due to figures Su-Jin Fabian, Nils Huter, Robert Nakouzi, Daniel economic activity raised inflation concerns, but released by Germany, Italy and Spain that Tsai, Ahmadreza Vafaeimehr investors were not deterred. President Biden's demonstrated continued price pressure. At the agreement on a $1.2 trillion infrastructure plan end of June, European stocks fell on concerns sent stocks higher at the end of the June. about the spread of the COVID-19 Delta variant. Fund facts European equity markets also rose, driven by a Nasdaq A: VSQAX C: VSQCX Y: VSQYX Positioning and outlook Total Net Assets $11,702,613 + The fund is a passively managed portfolio seeking + The MSCI World SRI Index targets about 25% of Total Number of Holdings 355 to closely track the MSCI World SRI Index. the parent index (MSCI World Index) market capitalization in companies with high ESG ratings Annual Turnover (as of 118% + Country, sector and security weights will closely mirror those of the index. compared to their sector peers, and applies a list 10/31/20) of values-based exclusion criteria, such as + As of quarter end, the largest sector weights were controversial weapons, tobacco, alcohol, gambling, in IT, financials, consumer discretionary and health etc. -

SYGWD MSCIR CLOSE MSCI World Index (Rands) 44,275.64 SYGEU EUROSTOXX50R Euro Stoxx 50 (Rands) 69,741.36 SYGUS MSCIUS R MSCI US I

FUND CODE BENCHMARK CODE BENCHMARK NAME 2021/07/15 SYGWD MSCIR_CLOSE MSCI World Index (Rands) 44,275.64 SYGEU EUROSTOXX50R Euro Stoxx 50 (Rands) 69,741.36 SYGUS MSCIUS_R MSCI US Index (Rands) 61,605.51 SYGUK FTSE100R FTSE100 Index (Rands) 141,433.21 SYGJP MSCIJPYR MSCI Japan Index (Rands) 157.32 SYGT40 J200 FTSE/JSE Top 40 Index (Price) 61,439.11 SYGSW4 J400 FTSE/JSE Share Weight 40 Index (Price) 12,061.89 SYG500 S&P500R S&P 500 Index (Rands) 63,427.54 SYG4IR KNEXPR Kensho Composite Index Price (Rands) 4,848.97 S&P Global Property 40 Index Price SYGP SPGP40R 43,766.56 (Rands) SYGESG SPESGPR S&P Global 1200 Index (Rands) 3,629.84 SYGEMF MSCIEM50R MSCI Emerging Markets 50 Index (Rands) 19,277.62 Disclaimer for Index data JSE/FTSE Source: FTSE International Limited (“FTSE”) © FTSE 2017 “FTSE®” is a trade mark of the London Stock Exchange Group Companies and is used by FTSE under licence. “JSE” is a trade mark of the JSE Limited and is used by FTSE under licence. The FTSE/JSE [name of Index] is calculated by FTSE in conjunction with the JSE. All intellectual property rights in the index values and constituent list vests in FTSE and the JSE. Neither FTSE nor its licensors accept any liability for any errors or omissions in the FTSE/JSE Indices and/or FTSE ratings or underlying data. No further distribution of JSE Indices Data is permitted without the JSE’s express written consent. MSCI: The funds or securities referred to herein are not sponsored, endorsed, or promoted by MSCI, and MSCI bears no liability with respect to any such funds or securities or any index on which such funds or securities are based. -

STRS MSCI World Ex USA Index Choice INTERNATIONAL

STRS MSCI World ex USA Index Choice INTERNATIONAL Investment Objective Country/Region Weightings The primary objective of the STRS MSCI World ex USA as of March 31, 2021 Index Choice is long-term capital appreciation. This investment choice is intended to closely match the Country/Region % of Index return of the Morgan Stanley Capital International (MSCI) World ex USA Index, before fees. Japan .................................................................22.40% United Kingdom ............................................12.90% France ................................................................10.05% Investment Characteristics Canada ................................................................ 9.72% STRS MSCI World ex USA Index Choice is based on the Germany ............................................................. 8.58% share price of approximately 1,000 companies listed on Switzerland ....................................................... 8.29% stock exchanges in 22 different developed countries. Australia ............................................................. 6.35% The return is comprised of capital appreciation plus dividend yield. Netherlands ...................................................... 3.80% Sweden ............................................................... 3.25% Hong Kong ........................................................ 3.05% Risk Italy ...................................................................... 2.27% An investment in the STRS MSCI World ex USA Index Denmark ...........................................................