Invesco MSCI World SRI Index Fund•

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Vanguard® 500 Index Fund - Admiral™ Shares 06-30-21

Release Date Vanguard® 500 Index Fund - Admiral™ Shares 06-30-21 .......................................................................................................................................................................................................................................................................................................................................... Category Large Blend Investment Objective & Strategy Portfolio Analysis From the investment's prospectus Composition as of 06-30-21 % Assets Morningstar Style Box™ as of 06-30-21 % Mkt Cap The investment seeks to track the performance of the U.S. Stocks 99.0 Large Giant 51.39 .......................................................... Standard & Poor‘s 500 Index that measures the investment Non-U.S. Stocks 1.0 Mid Large 33.89 return of large-capitalization stocks. Bonds 0.0 Medium 14.65 The fund employs an indexing investment approach Cash 0.0 Small Small 0.07 designed to track the performance of the Standard & Poor's Other 0.0 .......................................................... Micro 0.00 500 Index, a widely recognized benchmark of U.S. stock Value Blend Growth market performance that is dominated by the stocks of large U.S. companies. The advisor attempts to replicate the target Top 10 Holdings as of 06-30-21 % Assets Morningstar Equity Sectors as of 06-30-21 % Fund index by investing all, or substantially all, of its assets in the Apple Inc 5.92 h Cyclical 31.06 ....................................................................................................... -

Equity Index Fund Profile Information Current As of 03/31/2021

Equity Index Fund Profile Information current as of 03/31/2021 Risk/Reward Indicator Lower Risk/Reward Higher Risk/Reward Investment Objective Investment Managers The investment objective of the Equity Index Fund is to replicate the The Equity Index Fund is comprised of the following manager: return of the Standard & Poor’s (S&P) 500 Index. The Equity Index BNY Mellon Fund offers participants exposure to the stocks of large corporations through a passive investment vehicle. Returns on large cap equities Current Allocation have historically exceeded inflation, but with substantial volatility over short and even intermediate holding periods (risk as measured by standard deviation). Investment Guidelines The Equity Index Fund will invest in a portfolio of equity securities of companies listed on the U. S. securities exchanges that replicates the composition and characteristics of the S&P 500 Index. Fees: NYCDCP Fee versus Institutional Fund Fee NYCDCP Equity Index Fund 0.05% Institutional Median Equity Index Fund 0.07% Performance History After Fee Cumulative$IWHU)HH&XPXODWLYH5HWXUQV(QGLQJ0DUFK Returns Ending March 31, 2021 ,QFHSWLRQ 0R 5DQN <U 5DQN <UV 5DQN <UV 5DQN <UV 5DQN <UV 5DQN <UV 5DQN <UV 5DQN ,QFHSWLRQ 'DWH B (TXLW\,QGH[)XQG -DQ 6 3 -DQ ;;;;; After Fee Year-to-Date$IWHU)HH<HDUWR'DWHDQG$QQXDO5HWXUQV(QGLQJ0DUFK and Annual Returns Ending March 31, 2021 <7' B (TXLW\,QGH[)XQG 6 3 ;;;;; Cumulative Returns vs. Benchmark Top Holdings 7RS+ROGLQJV $33/(,1& 0,&5262)7&253 $0$=21&20,1& )$&(%22.,1& $/3+$%(7,1& $/3+$%(7,1& 7(6/$,1& %(5.6+,5(+$7+$:$<,1& -3025*$1&+$6( &2 -2+1621 -2+1621 Disclaimer Note: The past performance of this Fund does not guarantee future results. -

Evaluating Hedge Fund Performance in the Decade Since the Global Financial Crisis

Hedge funds for the future Evaluating hedge fund performance in the decade since the global financial crisis Russell Investments Research russellinvestments.com Contents Introduction 3 Has hedge fund performance “disappointed”? 3 The decade since the Global Financial Crisis 4 Level-setting hedge fund performance expectations 4 Performance evaluation 6 Summary of performance versus objectives 6 Details of evaluation versus each objective 8 Conclusions 13 Why the split in performance over the five years periods? 13 Guidance in determining the role of hedge funds going forward 14 Russell Investments / Hedge funds for the future: Evaluating hedge fund performance in the decade since the GFC / 2 Hedge funds for the future Evaluating hedge fund performance in the decade since the global financial crisis Kerry Galvin, CFA, Senior Consultant Over the past decade and a half, hedge funds have become commonplace in institutional investors’ portfolios. During that time, Russell Investments has been working with its clients to implement and monitor hedge fund portfolios; however, the hedge funds that we are evaluating today in investors’ portfolios are not the same as they were 10 or 15 years ago. As hedge funds have grown in asset size and their investor changed to include more institutional investors, Russell Investments has observed many managers increasing their emphasis on operational structure, risk management procedures, transparency, counter party risk and leverage. The evaluation set forth in this paper is meant to assess hedge funds as they exist today: strategies that are meant to provide a reasonable level of return, a high level of alpha and a low level of volatility, by utilizing a variety of investment instruments (e.g., stocks, bonds, futures, forwards) and shorting (i.e., the hedge). -

Does International Diversification Pay?

Does International Diversification Pay? Vivek Bhargava1, Daniel K. Konku2, and D. K. Malhotra3 Advances in computer and telecommunications technology have contributed to the emergence of more integrated global financial markets, allowing for the dissemination of information and the execution of transactions on a real-time basis around the clock and around the globe. To determine if an investor can gain additional diversification benefits by investing in today’s increasingly integrated global financial markets, returns on four different indexes—Standard & Poor’s Composite 500 (S&P 500); Morgan Stanley Capital International (MSCI) World Index; Europe, Australia, and Far East (EAFE) Index; and the MSCI Europe Index—are analyzed for a 22-year period, from 1978 to 2000. Although the benefits from international diversification are decreasing, an investor is better off investing a portion of his or her portfolio in international markets, especially the European markets. Keywords: Diversification, Mutual fund selection, Risk reduction Introduction The objective of this paper is to determine whether an Globalization of financial markets is one of the most investor today can still gain diversification benefits significant economic developments over the last by investing in international markets. The monthly decade. Advances in computer and returns of four different indexes--Standard & Poor’s telecommunications technology contributed to the 500 (S&P 500); Morgan Stanley Capital International emergence of global financial markets, permitting the (MSCI) World Index; the Europe, Australia and Far dissemination of information and execution of East (EAFE) Index; and the MSCI Europe Index— transactions on a real-time basis around the clock and are analyzed over a 22-year period, from 1978 to around the globe. -

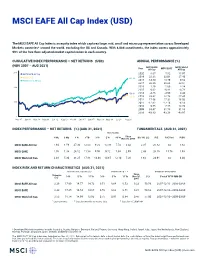

MSCI EAFE All Cap Index (USD)

MSCI EAFE All Cap Index (USD) The MSCI EAFE All Cap Index is an equity index which captures large, mid, small and micro cap representation across Developed Markets countries* around the world, excluding the US and Canada. With 8,088 constituents, the index covers approximately 99% of the free float-adjusted market capitalization in each country. CUMULATIVE INDEX PERFORMANCE — NET RETURNS (USD) ANNUAL PERFORMANCE (%) (NOV 2007 – AUG 2021) MSCI EAFE MSCI World Year All Cap MSCI EAFE All Cap 300 MSCI EAFE All Cap 2020 8.67 7.82 15.97 2019 22.38 22.01 27.40 MSCI EAFE 262.28 MSCI World All Cap 2018 -14.50 -13.79 -9.52 2017 26.35 25.03 22.51 200 2016 1.29 1.00 8.24 2015 0.62 -0.81 -0.78 158.80 2014 -4.86 -4.90 4.44 149.91 2013 23.62 22.78 27.45 2012 17.56 17.32 16.03 100 2011 -12.62 -12.14 -6.13 2010 9.55 7.75 13.74 2009 33.47 31.78 31.83 2008 -43.83 -43.38 -40.97 0 Nov 07 Jan 09 Mar 10 May 11 Jun 12 Aug 13 Oct 14 Dec 15 Jan 17 Mar 18 May 19 Jul 20 Aug 21 INDEX PERFORMANCE — NET RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Nov 30, 2007 Div Yld (%) P/E P/E Fwd P/BV MSCI EAFE All Cap 1.94 1.59 27.30 12.03 9.20 10.09 7.74 3.42 2.35 20.82 na 1.82 MSCI EAFE 1.76 1.38 26.12 11.58 9.00 9.72 7.34 2.99 2.43 20.10 15.76 1.93 MSCI World All Cap 2.48 5.30 31.25 17.81 14.48 14.65 12.10 7.26 1.64 24.91 na 3.04 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Nov 30, (%) Period YYYY-MM-DD -

Quarterly Market Review

Quarterly Market Review [Third Quarter 2018] www.rathbonewarwick.com Quarterly Market Review [Third Quarter 2018] This report features world capital market performance Overview: and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and Market Summary bond asset classes in the US and international markets. World Stock Market Performance The report also illustrates the impact of globally diversified portfolios and features a quarterly topic. World Asset Classes US Stocks International Developed Stocks Emerging Markets Stocks Select Country Performance Select Currency Performance vs. US Dollar Real Estate Investment Trusts (REITs) Commodities Fixed Income Impact of Diversification Rathbone Warwick Investment Management (“RWIM”) is a Registered Investment Adviser. This document is solely for informational purposes. Advisory services are only offered to clients or prospective clients where RWIM and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by RWIM unless a client service agreement is in place. www.rathbonewarwick.com Market Summary [Index Returns] Global International Emerging Global Bond US Stock Developed Markets Real US Bond Market Market Stocks Stocks Estate Market ex US Q3 2018 STOCKS BONDS 7.12% 1.31% -1.09% -0.03% 0.02% -0.17% Since Jan. 2001 Avg. Quarterly Return 2.0% 1.5% 2.9% 2.6% 1.1% 1.1% Best 16.8% 25.9% 34.7% 32.3% 4.6% 4.6% Quarter 2009 Q2 2009 Q2 2009 Q2 2009 Q3 2001 Q3 2008 Q4 Worst -22.8% -21.2% -27.6% -36.1% -3.0% -2.7% Quarter 2008 Q4 2008 Q4 2008 Q4 2008 Q4 2016 Q4 2015 Q2 Past performance is not a guarantee of future results. -

The Case for a Global Perspective

Schwab Center for Financial Research The case for a global perspective Jeffrey Kleintop, CFA Chief Global Investment Strategist What the Masters can teach us about investing Global stocks have tended to provide returns similar to those of U.S. stocks over long-term periods in the Markets have become more globally diversified of late, forcing investors to adopt a past. Valuations point to similar 5—10% annualized broader, worldwide perspective. This is a theme relevant even in championship golf, total returns across the world’s major regions in the where the national diversity of players in the 2015 Masters tournament bears an uncanny future (page 10). resemblance to stocks in the MSCI All Country World Index. Just as top players can be found on the world’s golf courses, savvy investors can be found on the world’s stock exchanges. But the lessons don’t stop there. 5–10% Geographic distribution of players at the Masters Annualized and stocks in the MSCI All Country World Index total returns Masters players MSCI AC World Index 50% U.S. 51% 16% Europe* 16% Avoiding the traps During the worst 10-year period for 13% Emerging Markets 14% stocks over the past 45 years, U.S. stocks fell an annualized 4.2%, 1.0% 12% U.K. 7% while global stocks lost 2.5% and International international stocks measured by 7% Asia Pacific 9% the MSCI EAFE Index lost only 2.5% 1.0% (page 6). Global 2% Canada 3% 4.2% * Excluding the U.K. Source: Charles Schwab, MSCI data as of April 10, 2015. -

MSCI ACWI Ex Ireland Index (USD)

MSCI ACWI ex Ireland Index (USD) The MSCI ACWI ex Ireland Index captures large and mid cap representation across 22 of 23 Developed Markets (DM) countries (excluding Ireland) and 27 Emerging Markets (EM) countries*. With 2,959 constituents, the index covers approximately 85% of the global equity opportunity set outside Ireland. CUMULATIVE INDEX PERFORMANCE — GROSS RETURNS (USD) ANNUAL PERFORMANCE (%) (AUG 2006 – AUG 2021) MSCI ACWI Year ex Ireland MSCI World MSCI ACWI MSCI ACWI ex Ireland 2020 16.83 16.50 16.82 MSCI World 338.06 2019 27.28 28.40 27.30 MSCI ACWI 325.46 2018 -8.90 -8.20 -8.93 300 324.55 2017 24.63 23.07 24.62 2016 8.51 8.15 8.48 2015 -1.86 -0.32 -1.84 2014 4.71 5.50 4.71 200 2013 23.42 27.37 23.44 2012 16.81 16.54 16.80 2011 -6.88 -5.02 -6.86 2010 13.25 12.34 13.21 100 2009 35.44 30.79 35.41 2008 -41.76 -40.33 -41.85 50 2007 12.31 9.57 12.18 Aug 06 Nov 07 Feb 09 May 10 Aug 11 Nov 12 Feb 14 May 15 Aug 16 Nov 17 Feb 19 May 20 Aug 21 INDEX PERFORMANCE — GROSS RETURNS (%) (AUG 31, 2021) FUNDAMENTALS (AUG 31, 2021) ANNUALIZED Since 1 Mo 3 Mo 1 Yr YTD 3 Yr 5 Yr 10 Yr Dec 31, 1998 Div Yld (%) P/E P/E Fwd P/BV MSCI ACWI ex Ireland 2.53 4.66 29.18 16.24 14.91 14.88 11.86 6.98 1.71 22.52 18.45 3.07 MSCI World 2.52 5.97 30.33 18.29 15.56 15.44 12.76 6.98 1.66 23.87 19.54 3.31 MSCI ACWI 2.53 4.67 29.18 16.24 14.91 14.88 11.86 6.97 1.71 22.54 18.46 3.07 INDEX RISK AND RETURN CHARACTERISTICS (AUG 31, 2021) ANNUALIZED STD DEV (%) 2 SHARPE RATIO 2 , 3 MAXIMUM DRAWDOWN Turnover Since 1 3 Yr 5 Yr 10 Yr 3 Yr 5 Yr 10 Yr Dec 31, (%) Period YYYY-MM-DD -

Index Investing and Asset Pricing Under Information Asymmetry and Ambiguity Aversion

Index Investing and Asset Pricing under Information Asymmetry and Ambiguity Aversion David Hirshleifer Chong Huang Siew Hong Teoh∗ April 7, 2019 Abstract In a setting with information asymmetry and a tradable value-weighted market index, ambiguity averse investors hold undiversified portfolios, and assets have non-zero alphas. But when a passive fund offers the risk-adjusted market port- folio (RAMP) whose weights depend on information precisions as well as market values, all investors hold the same portfolios as in the economy without model un- certainty and thus engage in index investing. So RAMP improves participation and risk sharing. Asset alphas are zero with RAMP as pricing portfolio. RAMP can be implemented by a fund of funds even if no single manager has sufficient knowledge to do so. ∗Paul Merage School of Business, University of California, Irvine. David Hirshleifer, [email protected]; Chong Huang, [email protected]; Siew Hong Teoh, [email protected]. We thank Hengjie Ai (discussant), David Dicks, David Easley (discussant), Bing Han, Jiasun Li (discussant), Stefan Nagel, Olivia Mitchell, Stijn Van Nieuwerburgh, Yajun Wang (discussant), Liyan Yang, and seminar and conference participants at UC Irvine, National University of Singapore, Hong Kong Polytechnic University, the 27th Annual Con- ference on Financial Economics and Accounting, the American Finance Association 2017 Annual Meeting, the 12th Annual Conference of the Financial Intermediation Research Society, 2018 Western Finance As- sociation Annual Meeting, and 2018 Stanford Institute -

Invesco S&P 500 Index Fund

Mutual Fund Retirement Share Classes Invesco S&P 500 Data as of June 30, 2021 Index Fund Large-cap blend Investment objective A passively managed large-cap blend strategy that purchases the stocks of the companies that constitute the The fund seeks total return through growth of capital S&P 500 Index. and current income. Investment results Portfolio management Average annual total returns (%) as of June 30, 2021 Pratik Doshi, Peter Hubbard, Michael Jeanette, Tony Class A Shares Class Y Shares Class R6 Shares Seisser Inception: Inception: Inception: Style-Specific 09/26/97 09/26/97 04/04/17 Index Fund facts S&P 500 Nasdaq A: SPIAX C: SPICX Y: SPIDX Period NAV NAV NAV Index R6: SPISX Inception 7.98 8.24 -- Total Net Assets $2,127,536,385 10 Years 14.19 14.48 14.34 14.84 Total Number of Holdings 506 5 Years 17.00 17.29 17.31 17.65 Annual Turnover (as of 3 Years 18.05 18.32 18.40 18.67 08/31/20) 2% 1 Year 40.07 40.39 40.45 40.79 Distribution Frequency Annually Quarter 8.40 8.45 8.49 8.55 Performance quoted is past performance and cannot guarantee comparable future results; current performance Top 10 holdings (% of total net assets) may be lower or higher. Visit invesco.com/performance for the most recent month-end performance. Apple 5.77 Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary, and you may have a gain or a loss when you sell shares. -

The Case for Low-Cost Index-Fund Investing

The case for low-cost index-fund investing Vanguard Research April 2019 James J. Rowley Jr., CFA, David J. Walker, CFA, and Carol Zhu ■ Due to governmental regulatory changes, the introduction of exchange-traded funds (ETFs), and a growing awareness of the benefits of low-cost investing, the growth of index investing has become a global trend over the last several years, with a large and growing investor base. ■ This paper discusses why we expect index investing to continue to be effective over the long term—a rationale grounded in the zero-sum game, the effect of costs, and the challenge of obtaining persistent outperformance. ■ We examine how indexing performs in a variety of circumstances, including diverse time periods and market cycles, and we provide investors with points to consider when evaluating different investment strategies. Acknowledgments: The authors thank Garrett L. Harbron and Daren R. Roberts for their valuable contributions. This paper is a revision of Vanguard research first published in 2004 as The Case for Indexing by Nelson Wicas and Christopher B. Philips, updated in succeeding years by Mr. Philips and other co-authors. The current authors acknowledge and thank Mr. Philips and Francis M. Kinniry Jr. for their extensive contributions and original research on this topic. Index investing1 was first made broadly available to U.S. segment with minimal expected deviations (and, by investors with the launch of the first index mutual fund in extension, no positive excess return) before costs, 1976. Since then, low-cost index investing has proven to by assembling a portfolio that invests in the securities, be an effective investment strategy over the long term, or a sampling of the securities, that compose the outperforming the majority of active managers across market. -

Amundi Enlarges Its SRI Range with a New Fixed Income ETF

Press Release Amundi enlarges its SRI range with a new fixed income ETF London, 17/09/2019 – Amundi, Europe’s largest asset manager with over 1,487 billion1 euros of assets under management, including 297 billion in Responsible Investment assets, completes its SRI ETF range by launching the “Amundi Index Euro Corporate SRI 0-3Y – UCITS ETF DR”. This new ETF provides diversified exposure to short-dated Euro denominated corporate bonds from issuers with strong ESG credentials. Amundi Index Euro Corporate SRI 0-3Y – UCITS ETF DR gives exposure to investment grade corporate bonds with a maturity between 0 and 3 years. Issuers are scored according to their ESG performance and those involved in alcohol, tobacco, military weapons, civilian firearms, gambling, adult entertainment, GMO and nuclear power are excluded. The result is a portfolio of over 690 2 Euro-denominated Corporate Bonds from issuers with an outstanding ESG rating. The ETF tracks the Bloomberg Barclays MSCI Euro Corporate ESG BB+ Sustainability SRI 0-3 Year Index. It is offered to investors with a highly competitive ongoing charge3 of 0.12% per year, which makes it the lowest cost4 SRI-focused fixed income ETF in Europe. Amundi Index Euro Corporate SRI 0-3Y – UCITS ETF DR is part of a range of Low Carbon and SRI equity and fixed income ETFs that Amundi started back in 2015. The expansion of Amundi’s SRI ETF range follows investor’s growing demand for passive Responsible Investment solutions. Fannie Wurtz, Head of Amundi ETF, Indexing & Smart Beta, commented: “Having been a pioneer in responsible investment, Amundi continues to expand its SRI offering.