VISA REFORM Much Ado About Nothing, Or a Nuclear Threat to the Indian Sourcing Model?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Lighthouse July 2020

July 2020 The Lighthouse Software Online & Digital Tech Enabled Business Services A Pharus Advisors Holdings, LLC Publication | www.pharus.com Pharus Observations Cloud Applications Seek Lofty Valuations The cloud application industry continues its ascent with robust M&A activity across a variety of cloud-based platforms and services. As companies around the globe continue to shift to the cloud, strategic and financial buyers are on the hunt for innovative cloud-based technology acquisitions. The global public cloud services market is estimated to be growing at 6.3% in 2020, bringing the total market size to $257.9 billion by the end of the year, up from $242.7 billion in 2019. Encumbered slightly during the first half of 2020 by the COVID-19 pandemic, cloud growth is still expected to increase to 19.0% in 2021 and 18.6% in 2022, with the overall market reaching an estimated $354.6 million in 2022. On July 28, 2020, Network International announced the acquisition of The Direct Pay Online Group (DPO Group) for $288 million. The DPO Group operates a cloud-based eCommerce processing platform that supports multiple transaction types with online and offline capabilities for consumers. As a leader within the eCommerce enablement space in Africa, The DPO Group will help expand Network International’s regional footprint and digital commerce capabilities. Also, in late July, ESW Capital announced its intention to acquire Optiva Inc. for an estimated $256 million. Optiva provides cloud-native revenue management software to communication service providers around the world. This acquisition adds to ESW Capital’s extensive portfolio of mature software companies across a range of verticals with cloud capabilities. -

Scoreboard 4.1.2021.Xlsm

Scoreboard Margin % Growth % Multiples IT & IT-ENABLED OUTSOURCED SERVICES GM EBITDA Revenue 5 Yr EPS EV/Revenue EV/EBITDA P/E IT Services - North America 30.4% 12.2% 19.7% 10.5% 1.45x 12.5x 19.7x IT Services - Europe 14.8 14.1 16.1 17.4 1.42 11.0 20.8 IT Services - India 23.7 17.4 24.5 14.7 2.93 12.5 20.3 IT Services - China 25.8 10.2 69.5 NA 1.20 16.3 20.4 IT Staff Augmentation 25.1 6.5 -4.3 15.0 0.84 12.3 19.0 IT SUPPLY CHAIN SERVICES IT Solution Providers - North America 17.4% 6.4% 20.9% 10.5% 0.52x 10.5x 17.3x IT Solution Providers - Europe 13.8 5.2 38.3 12.5 0.70 11.4 25.9 IT Products Distributors 10.5 3.3 -2.5 10.6 0.29 8.7 13.8 SOFTWARE SaaS 71.7% 15.0% 62.4% 20.0% 7.79x 28.3x 34.6x Enterprise Applications 77.1 28.5 36.7 14.5 6.49 15.9 25.6 Cyber Security 75.3 14.4 38.4 15.6 6.01 16.6 29.7 Please forward any questions to Patrick Jeffries at [email protected] Data Provided by FactSet IT Services - North America '20 - '21E As of April 1, 2021 Revenue Gross EBITDA Valuation Multiples EPS $ in millions except per share data Current % of 52 Market Value Revenue EBITDA Growth Margin Margin EV/Rev EV/EBITDA P/E Growth Company Price Wk. -

Investments in the Fourth Industrial Revolution

THE NATIONAL SECURITY INNOVATION BASE: INVESTMENTS IN THE FOURTH INDUSTRIAL REVOLUTION Foreword by Chris Taylor, CEO COMPANIES INCLUDED AASKI Technology Inc. ERAPSCO Red River Inc. Abbott Laboratories (ABT) Esri RELX Group (RELX) Accenture PLC (ACN) Falcon Fuels Inc. Research Triangle Institute ActioNet Inc. FCN Inc. Rockwell Collins Inc. (COL) ADS Tactical Inc. FEi Systems Safran SA (SAF) AECOM (ACM) Fluor Corp. (FLR) SAIC Corp. (SAIC) Aerojet Rocketdyne Inc. (AJRD) Four Points Technology LLC Sanofi Pasteur (SNY) AeroVironment Inc. (AVAV) Fred Hutchinson Cancer Research Center SAP SE (SAP) AI Solutions Inc. Galois Inc. Savannah River AKESOgen Inc. General Atomics Inc. Science Systems and Applications Inc. Alion Science & Technology Corp. General Dynamics Corp. (GD) Serco Inc. American Type Culture Collection GlaxoSmithKline PLC (GSK) SGT Inc. Analytic Services Inc. Great Lakes Dredge & Dock Corp. Siemens Corp. (SIE) Analytical Mechanics Associates Inc. Harris Corp. Sierra Lobo Inc. Aptima Inc. Hewlett-Packard Co. (HPQ) Sigma Space Corp. Archer Western Aviation Partners Honeywell International Inc. (HON) Smartronix Inc. Arctic Slope Regional Corp. HRL Laboratories Soar Technology Inc. Astrazeneca PLC (AZN) Huntington Ingalls (HII) Sprint Corp. (S) AT&T Inc. (T) HydroGeoLogic Inc. Technologies Forensic AURA International Business Machines Corp. (IBM) Teledyne Technologies Inc. BAE Systems Inc. (BA) immixGroup Inc. Textron (TXT) Balfour Beatty PLC (BBY) InfoReliance Corp. The Shaw Group (CBI) Ball Aerospace & Technologies Corp. Insight Public Sector Inc. (NSIT) The Walsh Group Co. Battelle Memorial Institute Intelligent Automation Inc. Thermo Fisher Scientific (TMO) Bell-Boeing JP Intelligent Software Solutions Inc. Thomson Reuters Corp. (TRI) Boeing Co. (BA) Iridium Communications Inc. (IRDM) Torch Technologies Inc. Booz Allen Hamilton Inc. -

EAGLE Vendor List, Functional Category

Department of Homeland Security EAGLE CONTRACTOR – UNRESTRICTED TRACK Accenture LLP 11951 Freedom Dr Reston, VA 20190 Contract Number: HSHQDC-06-D-00029 URL: http://www.accenture.com/xd/xd.asp?it=enweb&xd=industries\government\eagle\EAGL E_pmo_home_xml&c=gov_epdem_0606&n=eml Contractor in Functional Categories: FC4, FC5 CONTACT INFORMATION FOR Accenture LLP CONTRACTS MANAGER Stanley S. Mate Telephone Number: 703-947-2176 Facsimile Number: e-mail Address: [email protected] or [email protected] PROGRAM MANAGER Gayle S. Nix Telephone Number: 703-947-2419 Facsimile Number: e-mail Address: [email protected] or [email protected] TEAMING COORDINATOR Teaming Coordinator Point of Contact Name: Mark Wisniewski Telephone Number: 703-947-4666 Facsimile Number: 703-947-2200 e-mail Address: [email protected] or [email protected] Department of Homeland Security EAGLE CONTRACTOR – UNRESTRICTED TRACK AT&T Government Solutions, National Information Systems 7125 Columbia Gateway Drive Columbia, MD 21046-2035 Contract Number: HSHQDC-06-D-00040 URL: http://www.att.com/gov/contracts/Eagle/ Contractor in Functional Categories: FC1 CONTACT INFORMATION FOR AT&T Government Solutions, National Information Systems CONTRACTS MANAGER Leonard M. Zeitschel Telephone Number: 443-896-5368 Facsimile Number: e-mail Address: [email protected] Sandra Derricott Telephone Number: 443-896-5366 Facsimile Number: 443-259-8457 e-mail Address: [email protected] PROGRAM MANAGER Robert L. Caffrey Telephone Number: 703-691-5091 Facsimile -

Getting Started Intermediate Advanced

TUESDAY March 27 7:00 a.m. - 5:00 p.m. Registration, Austin Convention Center, 1st Floor CONFERENC E SERIES 7:00 a.m. - 8:30 a.m. Continental Breakfast, Ballroom D/E/F/G - 4th Floor 7:15 a.m. - 8:00 a.m. SEI Breakfast Series, Sally Cunningham, SEI Hilton Austin, TBD 8:15 a.m. - 8:30 a.m. Opening remarks: Paul D. Nielsen, Director, Ballroom D/E/F/G Software Engineering Institute 8:30 a.m. - 10:00 a.m. Keynote presentations 8:30 a.m.: TBD 9:15 a.m.: TBD 9:30 a.m. - 4:30 p.m. Exhibit Showcase, Exhibit Hall 4, 1st Floor 10:00 a.m. - 10:30 a.m. Morning Break, Exhibit Hall 4, 1st Floor PRESENTATIONS AND MODELS, FRAMEWORKS, DEPLOYMENT AND ADOPTION GETTING STARTED SECURITY HIGH MATURITY MEASUREMENT AND ANALYSIS BENEfiTS AND IMPACT PEOPLE PANEL SESSIONS TECHNOLOGIES, AND STANDARDS 10:30 am - 11:10 am Global Capabilities: CMMI Around EXECUTION - The Key to Success! Five Critical Questions in Process Insider Threats in the SDLC Tangible business benefits Measurement: Making Sense Why Can't Johnny Improve? Secrets of a Process Wisperer The World John Voss, Accenture Improvement Dawn Capelli, SEI through higher process maturity - of the Myths and Madness Rick Hefner, Northrop Grumman Stan Rifkin, Master Systems, Inc. John Vu, The Boeing Company sepg121 Richard Waina, Multi-Dimensional sepg500 Infosys Case Study Paul Kimmerly, U.S. Marine Corporation sepg038 sepg401 Maturity Satyendra Kumar, Infosys Corps sepg410 sepg067 Technologies Ltd. sepg226 Sepg365 11:20 am - 12 noon 20 Questions - A Diabolical CMMI CMMI Survival: Principles to How to Start and -

Edward S. Caso, Jr., CFA Technology & Services

Edward S. Caso, Jr., CFA 443-263-6524 | [email protected] Technology & Services - Equity IT & BPO Services Ed Caso is a managing director and Senior Analyst in the Equity Research department of Wells Fargo Securities, leading a team of equity analysts covering the Information Technology/Business Process Outsourcing (IT/BPO) Services sector. He has more than 25 years of equity research experience working for Wells Fargo (and predecessors, 1999-present), Alex. Brown (1995-1999) and Goldman Sachs (1984-1995). Ed is considered one of the leading IT/BPO services equity research analysts, which is an area he has covered since 1995. His team’s weekly email is read by over 3,000 investors and industry participants. Ed was recognized for stock picking in the annual Wall Street Journal poll for 2010, 2006, and 1996. Ed holds a BA in mathematics/economics (computer sciences minor) from Bucknell University (1980) and an MBA in finance/accounting from the Johnson Graduate School of Management at Cornell University (1984). Ed holds the Chartered Financial Analyst designation. Coverage List Business Process Outsourcing IT Service Providers Automatic Data Processing ADP Accenture plc ACN ExlService Holdings, Inc. EXLS CGI Group, Inc. GIB.A Genpact Ltd. G Cognizant Technology Solutions Corp. CTSH Paychex, Inc. PAYX Computer Sciences Corporation CSC Performant Financial Corp. PFMT Infosys Technologies Ltd. INFY WNS Holdings Ltd. WNS On Assignment, Inc. ASGN Syntel, Inc. SYNT Government Services Wipro Ltd. WIT Booz Allen Hamilton Holding Corporation BAH CACI International Inc. CACI ICF International, Inc. ICFI Leidos Holdings, Inc. LDOS ManTech International Corporation MANT NCI, Inc. -

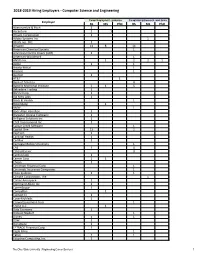

Computer Science and Engineering

2018-2019 Hiring Employers - Computer Science and Engineering Career Employment - graduates Co-op/intern/pt/research- work terms Employer BS MS PhD BS MS PhD Abercrombie & Fitch 3 Accenture 2 1 Acuant Corporation 1 Adobe Systems Inc 1 AEGIS.net, INC. 1 Amazon 14 8 14 American Chemical Society 1 American Electric Power (AEP) 2 American Woodmark 1 ANSYS Inc. 1 2 2 1 Apple 1 1 ArcelorMittal 1 Arconic 1 Asurion 1 AT&T 1 Bank of America 4 Battelle Memorial Institute 3 1 5 Belvedere Trading 1 Bertec Corp 1 Big Kitty Labs 1 Black & Veatch 1 Bloomberg 1 BMW 1 Booz Allen Hamilton 3 Brewster Cheese Company 1 Brilligent Solutions Inc 1 CACI International Inc 1 Caesar Creek Software 1 Capital One 13 2 CapTech 3 Cardinal Health 1 CarMax 1 Carnegie Mellon University 1 CAS 1 4 Caterpillar Inc 3 CenturyLink 1 Cerner Corp 2 1 Chepri 1 Cincinnati Financial Corp 1 Cincinnati Insurance Companies 1 Cisco Systems 2 1 Climate Corporation, The 1 Collins Aerospace 1 Command Alkon Inc 1 CommScope 1 Compellon 1 Contact CI 1 CoverMyMeds 1 Crown Equipment Corp 1 Cruise LLC 1 Data Economy 1 Diebold Nixdorf 1 Disney 1 1 DSW 1 Dynatrace 1 E*TRADE Financial Corp 1 Eagle Mine 1 Eaton 1 1 Edaptive Computing, Inc. 1 The Ohio State University | Engineering Career Services 1 2018-2019 Hiring Employers - Computer Science and Engineering Career Employment - graduates Co-op/intern/pt/research- work terms Employer BS MS PhD BS MS PhD Epic 4 1 ESPN 1 Expedia Group 1 1 Expeditors 1 Facebook 1 1 4 2 1 1 FedEx 1 Flatiron Health 1 Freddie Mac 1 Gap Inc 1 Garmin International 1 1 GE -

![IT Consulting December 2018 IT Consulting December 2018 Sector Dashboard [4]](https://docslib.b-cdn.net/cover/4013/it-consulting-december-2018-it-consulting-december-2018-sector-dashboard-4-3494013.webp)

IT Consulting December 2018 IT Consulting December 2018 Sector Dashboard [4]

Sectorwatch: IT Consulting December 2018 IT Consulting December 2018 Sector Dashboard [4] Public Basket Performance [5] Operational Metrics [7] Valuation Comparison [10] Recent Deals [13] Appendix [15] 7 Mile Advisors appreciates the opportunity to present this confidential information to the Company. This document is meant to be delivered only in conjunction with a verbal presentation, and is not authorized for distribution. Please see the Confidentiality Notice & Disclaimer at the end of the document. All data cited in this document was believed to be accurate at the time of authorship and came from publicly available sources. Neither 7 Mile Advisors nor 7M Securities make warranties or representations as to the accuracy or completeness of third-party data contained herein. This document should be treated as confidential and for the use of the intended recipient only. Please notify 7 Mile Advisors if it was distributed in error. 2 Overview 7MA provides Investment Banking & Advisory Services to the Business Services and Technology Industries globally. We advise on M&A and private capital transactions, and provide market assessments and benchmarking. As a close knit team with a long history together and a laser focus on our target markets, we help our clients sell their companies, raise capital, grow through acquisitions, and evaluate new markets. We publish our sectorwatch, a review of M&A and operational trends in the industries we focus. Dashboard Valuation Comparison • Summary metrics on the sector • Graphical, detailed comparison of valuation • Commentary on market momentum by multiples for the public basket comparing the most recent 12-month performance against the last 3-year averages. -

![IT Consulting April 2018 IT Consulting April 2018 Sector Dashboard [4]](https://docslib.b-cdn.net/cover/8226/it-consulting-april-2018-it-consulting-april-2018-sector-dashboard-4-3898226.webp)

IT Consulting April 2018 IT Consulting April 2018 Sector Dashboard [4]

Sectorwatch: IT Consulting April 2018 IT Consulting April 2018 Sector Dashboard [4] Public Basket Performance [5] Operational Metrics [7] Valuation Comparison [10] Recent Deals [13] Appendix [14] 7 Mile Advisors appreciates the opportunity to present this confidential information to the Company. This document is meant to be delivered only in conjunction with a verbal presentation, and is not authorized for distribution. Please see the Confidentiality Notice & Disclaimer at the end of the document. All data cited in this document was believed to be accurate at the time of authorship and came from publicly available sources. Neither 7 Mile Advisors nor 7M Securities make warranties or representations as to the accuracy or completeness of third-party data contained herein. This document should be treated as confidential and for the use of the intended recipient only. Please notify 7 Mile Advisors if it was distributed in error. 2 Overview 7MA provides Investment Banking & Advisory Services to the Business Services and Technology Industries globally. We advise on M&A and private capital transactions, and provide market assessments and benchmarking. As a close knit team with a long history together and a laser focus on our target markets, we help our clients sell their companies, raise capital, grow through acquisitions, and evaluate new markets. We publish our sectorwatch, a review of M&A and operational trends in the industries we focus. Dashboard Valuation Comparison • Summary metrics on the sector • Graphical, detailed comparison of valuation • Commentary on market momentum by multiples for the public basket comparing the most recent 12-month performance against the last 3-year averages. -

Functional Category 1 EAGLE II

FUNCTIONAL CATEGORY 1 HUBZone Track Prime Contractor Contract Number Corporate Email EAGLE II Website Ardent Eagle, JV, LLC HSHQDC-13-D-E2042 [email protected] http://www.ardentmc.com/eagle-ii/ Computer World Services, HSHQDC-13-D-E2041 [email protected] http://www.cwsc.com/eagle-ii Corporation http://www.logistics- Logistics Systems, Inc. HSHQDC-13-D-E2040 [email protected] sys.com/contracts/DHS_EAGLE_II.html http://www.sitec- SI Tec Consulting, LLC HSHQDC-13-D-E2039 [email protected] consulting.net/index.php/contract- vehicles/eagle-ii T-Rex Consulting Corporation HSHQDC-13-D-E2043 [email protected] http://www.trexcorporation.com/eagle2/ TSymmetry, Inc. HSHQDC-13-D-E2038 [email protected] http://tsymmetry.com/dhs-eagle-ii/ http://www.variq.com/contract- VariQ Corporation HSHQDC-13-D-E2044 [email protected] vehicles/eagle-ii.html SDVOSB Track Prime Contractor Contract Number Corporate Email EAGLE II Website Cambridge International HSHQDC-13-D-E2030 [email protected] http://www.cbridgeinc.com/EAGLEII Systems, Inc. EDC Consulting, LLC HSHQDC-13-D-E2031 [email protected] http://www.edcconsulting.net/eagle2.php Knight Point Systems, LLC HSHQDC-13-D-E2032 [email protected] http://www.knightpoint.com/eagle-ii Leader Communications, Inc. HSHQDC-13-D-E2033 [email protected] http://www.lcibest.com/dhseagle2.aspx http://www.technatomy.com/contracts/d Technatomy Corporation HSHQDC-13-D-E2034 [email protected] hs-eagle-ii/ TRI-COR Industries HSHQDC-13-D-E2035 [email protected] http://www.tricorind.com/eagle-ii/ http://www.trofholz.com/doing-business-with- Trofholz Technologies, Inc. -

Valuation Pulse – IT and Ites Industry

Valuation Pulse – IT and ITeS industry Q4 FY20 ©2020 Grant Thornton India LLP. All rights reserved. Foreword We are pleased to present Valuation Pulse for the financial year ending 2019-2020 (FY20). The COVID-19 pandemic has impacted the entire world, including Indian IT companies that have considerable exposure to global economies such as the United States of America (USA) and Europe. However, the valuations of tech companies globally, and in India, have seen resilience and outperformed the larger stock market. In India, despite Nifty IT dropping by 18.5% during the period between 31 December 2019 and 31 March 2020, it outperformed Nifty 50 by ~10%. The global tech companies have performed even better with the S&P 500 IT dropping by 12.2% during the same period versus 20.0% Manish Saxena decline in the S&P 500. Partner Some resilience from the Indian IT companies compared with the overall Nifty index can be explained by Grant Thornton India LLP ~5% depreciation in INR versus USD (between 31 December 2019 and 31 March 2020) and also E: [email protected] expectations from certain core verticals, such as healthcare, utilities and telecom, to drive the growth in H1 FY21. The decline in valuation multiples of IT companies in the recent quarter is primarily on account of: • Loss in revenue, primarily in March 2020, due to lockdown in India and globally • Inability to ramp-up projects due to employee utilisation issues caused by work from home policy implemented during the later stages of Q4 FY20 • Segments, BFSI, manufacturing, retail, aerospace and automobile, witnessing severe impact due to COVID-19 On the transactions front (M&A and funding), in FY20, the transaction activity in the IT sector improved marginally compared with FY19, both in volume and value terms (after adjusting for HCL-IBM transaction in FY19 which was an outlier). -

Strategic Sourcing: EAGLE II Metrics

Strategic Sourcing: EAGLE II Metrics Year(s) Selected: All Years Quarter(s) Selected: All Quarters Task Orders and Obligated Amount by FC and Track FC Track TO Awards % of TO Awards Obligated Amount Base + All Options % to Total FC1 8(a) 58 15% $292,486,964 $772,544,197 13% HubZone 36 9% $284,242,935 $482,686,224 8% Other SB 49 13% $317,572,558 $610,072,792 10% SDVOSB 27 7% $151,792,894 $269,085,747 5% UNR 78 20% $1,503,522,169 $2,603,644,177 44% FC2 SB 92 24% $347,324,749 $645,871,084 11% UNR 13 3% $80,809,679 $142,148,097 2% FC3 SB 21 5% $79,617,347 $142,896,135 2% UNR 11 3% $126,165,984 $231,222,171 4% Total 385 100% $3,183,535,278 $5,900,170,624 100% Total Spend: Unrestricted vs. Small Business Business Size TO Awards % of TO Awards Obligated Amount Base + All Options % to Total Large Business 102 26% $1,710,497,832 $2,977,014,445 50% Small Business 283 74% $1,473,037,446 $2,923,156,179 50% Total 385 100% $3,183,535,278 $5,900,170,624 100% Task Orders and Obligated Amount by Contracting Agency Contracting TO Awards % of TO Awards Obligated Amount Base + All Options % to Total Activity CBP 41 11% $520,170,466 $1,108,794,205 19% FEMA 30 8% $119,096,922 $231,938,688 4% FLETC 11 3% $5,330,821 $10,578,658 0% ICE 37 10% $173,712,686 $602,618,085 10% OPO 155 40% $1,334,380,920 $2,343,782,480 40% TSA 51 13% $797,312,309 $1,235,787,599 21% USCG 38 10% $184,423,307 $304,474,194 5% USSS 22 6% $49,107,847 $62,196,714 1% Total 385 100% $3,183,535,278 $5,900,170,624 100% Distribution of Awards and Average Number of Offers *Cumulative Prime Prime Average Bids FC Track TO Awards Contractors Contractors per TO Page 1 of 17 Report Name: SSPO_Eagle2 7/6/2018 10:19:56 AM w/ TO Awards FC1 8(a) 16 58 13 4 HubZone 7 36 7 2 Other SB 12 49 12 3 SDVOSB 7 27 4 2 UNR 68 78 37 3 FC2 SB 15 92 12 3 UNR 11 13 8 2 FC3 SB 7 21 6 4 UNR 7 11 5 2 Total 150 385 104 Task Orders Order number Contracting Contractor FC Track Obligated Total Value w/ Activity Amount Options 70B03C18F00000209 CBP SOFT TECH CONSULTING, INC.