Appraisal of Real Property

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

WORKING DOCDRAFT Charter Directors Handbook .Docx

PPS Resource Guide A guide for new arrivals to Portland and the Pacific Northwest PPS Resource Guide PPS Resource Guide Portland Public Schools recognizes the diversity and worth of all individuals and groups and their roles in society. It is the policy of the Portland Public Schools Board of Education that there will be no discrimination or harassment of individuals or groups on the grounds of age, color, creed, disability, marital status, national origin, race, religion, sex or sexual orientation in any educational programs, activities or employment. 3 PPS Resource Guide Table of Contents How to Use this Guide ....................................................................................................................6 About Portland Public Schools (letter from HR) ...............................................................................7 Acknowledgements ........................................................................................................................8 Cities, Counties and School Districts .............................................................................................. 10 Multnomah County .............................................................................................................................. 10 Washington County ............................................................................................................................. 10 Clackamas County ............................................................................................................................... -

Portland State University Commencement 2020 Program

2020 Portland State University Commencement Sunday, June 14, 2020 Share the excitement of Commencement #2020PDXGRAD GET THE APP Download the PSU Mobile app to get instant access to commencement social feeds. my.pdx.edu TAKE A SELFIE We’re proud of you—fearless innovators, artists, leaders, thinkers and change makers. Share your fearless selfie—you did it! #PortlandState LINK UP Stay in touch with fellow grads. linkedin.com/company/portland-state-university RELIVE THE DAY Go to the PSU homepage after the ceremony for photos and video. pdx.edu 2 CONGRATULATIONS TO THE PSU CLASS OF 2020 Dear Members of the PSU Class of 2020, Commencement is the result of your hard work and dedication and the contributions of the family members, friends, mentors, and educators who supported you on your journey. Please take a moment to thank them. Members of the Class of 2020, you join a network of nearly 179,000 proud PSU alumni. I encourage you to take everything you have learned at PSU to improve the lives of others. I look forward to the day that your success stories will inspire future graduating classes. As you celebrate, please know how proud we are of you, your academic achievements, and your commitment to contributing to others. We hope you will stay in touch as members of our PSU family. Go Viks! Stephen Percy Interim President TABLE OF CONTENTS Portland State University .....................................................................2 School of Social Work ........................................................................ 78 History ...............................................................................................2 -

MK2 Inhibition Induces P53-Dependent Senescence in Glioblastoma Cells

cancers Article MK2 Inhibition Induces p53-Dependent Senescence in Glioblastoma Cells Athena F. Phoa 1, Ariadna Recasens 1 , Fadi M. S. Gurgis 1, Tara A. Betts 1, Sharleen V. Menezes 1, Diep Chau 2,3, Kristiina Nordfors 4,5,6, Joonas Haapasalo 6,7, Hannu Haapasalo 7, Terrance G. Johns 8, Brett W. Stringer 9 , Bryan W. Day 9, Michael E. Buckland 1,10 , Najoua Lalaoui 2,3 and Lenka Munoz 1,* 1 School of Medical Sciences, Charles Perkins Centre and Faculty of Medicine and Health, The University of Sydney, Sydney, New South Wales 2006, Australia; [email protected] (A.F.P.); [email protected] (A.R.); [email protected] (F.M.S.G.); [email protected] (T.A.B.); [email protected] (S.V.M.); [email protected] (M.E.B.) 2 Inflammation Division, The Walter and Eliza Hall Institute of Medical Research, Parkville, Victoria 3052, Australia; [email protected] (D.C.); [email protected] (N.L.) 3 Department of Medical Biology, University of Melbourne, Parkville, Victoria 3050, Australia 4 Department of Pediatrics, Tampere University Hospital, 33521 Tampere, Finland; [email protected] 5 Tampere Center for Child Health Research, University of Tampere, 33014 Tampere, Finland 6 The Arthur and Sonia Labatt Brain Tumour Research Centre, The Hospital for Sick Children, Toronto, ON M5G 0A4, Canada; [email protected] 7 Department of Pathology, Fimlab Laboratories, Tampere University Hospital, FI-33521 Tampere, Finland; hannu.haapasalo@fimlab.fi 8 Oncogenic Signalling Laboratory, Telethon Kids -

0221-PT-A Section.Indd

Rock and rope YOUR ONLINE LOCAL Man of Oregon Popular Portland gym DAILY NEWS Homegrown Helfrich settles celebrates 25th year www.portlandtribune.com in as Ducks’ main man Portland— See LIFE, B1 Tribune— See SPORTS, B10 THURSDAY, FEBRUARY 21, 2013 • TWICE CHOSEN THE NATION’S BEST NONDAILY PAPER • WWW.PORTLANDTRIBUNE.COM • PUBLISHED THURSDAY “We really want it to be a walking tourist attraction, so people don’t have to drive from one side of the road to another.”— Dan Cogan, 82nd Avenue of Roses Business Association TRIBUNE PHOTO: CHRISTOPHER ONSTOTT PPS TAG chief Kim Matier is working to fi x problems with the program, including $100,000 in TAG funds that went unspent by schools last year. TAG tries to fi nd a way out of ‘crisis’ Budget control, TRIBUNE PHOTOS: CHRISTOPHER ONSTOTT more outreach focus The O’Sushi restaurant, in the Fubonn Shopping Center on Southeast 82nd Avenue, is bustling with business as customers watch plates of fresh sushi roll by on a of proposed changes conveyor belt. By JENNIFER ANDERSON The Tribune New Jade District another Nearly one in fi ve students in Portland Public Schools carries a badge of honor that is also somewhat of an enig- ma for district leaders. Eight thousand PPS students gem in Portland’s crown — and 40,000 statewide — are identifi ed as Talented and Gift- ed learners, a label that can mean a lot or a little, depending ■ 82nd Avenue emerges as the Pearl’s Asian counterpart on what school they attend. Some schools use all or most of the $2,000 to $4,000 they are allotted in TAG funds each ometimes a name It may seem audacious now, year, while other schools don’t change helps give an ar- but organizers hope it will one spend a dime of it. -

Facilities Permit Program 10/2/2020 Client and Building List Page 1 of 99

Facilities Permit Program 10/2/2020 Client and Building List Page 1 of 99 111 SW 5th Ave Investors LLC 19-134770-000-00-FC YORDANOS LONG UNICO PROPERTIES Building/Mechanical Inspector: Jeffrey Rago 4364025 Work: (503) 275-7461 Electrical Inspector: David Scranton [email protected] Plumbing Inspector: Chuck Luttmann M Fire Marshal: Mark Cole Building Address Folder Master US Bancorp Plaza:Unico Prop 555 SW OAK ST 19-134803-FC 19-134804-FA US Bancorp Prkng Struct:Unico Prop 129 SW 4TH AVE 20-101725-FC 20-101726-FA US Bancorp Tower:Unico Prop 111 SW 5TH AVE 19-134793-FC 19-134794-FA 200 Market Assoc. 99-125363-000-00-FC LAURA HUNDTOFT CUSHMAN & WAKEFIELD Building/Mechanical Inspector: Jeffrey Rago 2001906 Work: (503) 228-8666 Electrical Inspector: David Scranton Home: (503) 227-2549 Plumbing Inspector: Chuck Luttmann [email protected] Fire Marshal: Mark Cole Building Address Folder Master 200 MarketBldg:200 Market 200 SW MARKET ST 99-125649-FC 04-055199-FA Dielschneider:200 MARKET 71 SW OAK ST 09-124819-FC 09-124820-FA Fechheimer:200 MARKET 233 SW NAITO PKY 09-124830-FC 09-124831-FA FreimannKitchen:200 MARKET 79 SW OAK ST 09-124810-FC 09-124811-FA FreimannRestaurant:200 MARKET 240 SW 1ST AVE 09-124805-FC 09-124806-FA Hallock & McMillan:200 MARKET 237 SW NAITO PKWY 10-198884-FC 10-198885-FA Generated 10/02/2020 11:46 AM by CREPORTS_SVC from DSPPROD City of Portland, BDS - Report Code: 1109007 Facilities Permit Program 10/2/2020 Client and Building List Page 2 of 99 2020 Portland LLC c/o SKB 19-107059-000-00-FC Christina -

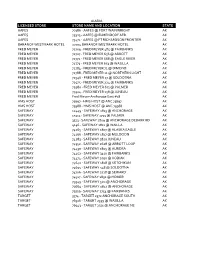

Licensed Store Store Name and Location State

ALASKA LICENSED STORE STORE NAME AND LOCATION STATE AAFES 70386 - AAFES @ FORT WAINWRIGHT AK AAFES 75323 - AAFES @ ELMENDORF AFB AK AAFES 75471 - AAFES @ FT RICHARDSON FRONTIER AK BARANOF WESTMARK HOTEL 22704 BARANOF WESTMARK HOTEL AK FRED MEYER 72709 - FRED MEYER 485 @ FAIRBANKS AK FRED MEYER 72727 - FRED MEYER 656 @ ABBOTT AK FRED MEYER 72772 - FRED MEYER 668 @ EAGLE RIVER AK FRED MEYER 72773 - FRED MEYER 653 @ WASILLA AK FRED MEYER 72784 - FRED MEYER 71 @ DIMOND AK FRED MEYER 72788 - FRED MEYER 11 @ NORTHERN LIGHT AK FRED MEYER 72946 - FRED MEYER 17 @ SOLDOTNA AK FRED MEYER 72975 - FRED MEYER 224 @ FAIRBANKS AK FRED MEYER 72980 - FRED MEYER 671 @ PALMER AK FRED MEYER 79324 - FRED MEYER 158 @ JUNEAU AK FRED MEYER Fred Meyer-Anchorage East #18 AK HMS HOST 75697 - HMS HOST @ ANC 75697 AK HMS HOST 75988 - HMS HOST @ ANC 75988 AK SAFEWAY 12449 - SAFEWAY 1813 @ ANCHORAGE AK SAFEWAY 15313 - SAFEWAY 1739 @ PALMER AK SAFEWAY 3513 - SAFEWAY 1809 @ ANCHORAGE DEBARR RD AK SAFEWAY 4146 - SAFEWAY 1811 @ WAILLA AK SAFEWAY 74265 - SAFEWAY 1807 @ ALASKA EAGLE AK SAFEWAY 74266 - SAFEWAY 1817 @ MULDOON AK SAFEWAY 74283 - SAFEWAY 1820 JUNEAU AK SAFEWAY 74352 - SAFEWAY 2628 @ ABBOTT LOOP AK SAFEWAY 74430 - SAFEWAY 1805 @ AURORA AK SAFEWAY 74452 - SAFEWAY 3410 @ FAIRBANKS AK SAFEWAY 74474 - SAFEWAY 1090 @ KODIAK AK SAFEWAY 74640 - SAFEWAY 1818 @ KETCHIKAN AK SAFEWAY 74695 - SAFEWAY 548 @ SOLDOTNA AK SAFEWAY 74706 - SAFEWAY 2728 @ SEWARD AK SAFEWAY 74917 - SAFEWAY 1832 @ HOMER AK SAFEWAY 79549 - SAFEWAY 520 @ ANCHORAGE AK SAFEWAY 79664 - SAFEWAY 1812 @ ANCHORAGE -

Lenka Lenka 2008 Flac

Lenka - Lenka (2008) FLAC Lenka - Lenka (2008) FLAC 1 / 3 2 / 3 Lenka - Lenka (2008)EAC Rip FLAC (Img) + Cue + Log 373 Mb . which introduces Lenka as one of 2008's strongest newcomers. Horns, cellos, violas .... Lenka Kripac. Profile: Australian singer-songwriter and actress, born 19 March 1978 in Bega, New South Wales. Lead singer of Decoder Ring, until 2007. Sites:.. Lenka - Lenka (Album) 2008 Flac. Flac || 933 kbps || 16 bit || 44.1 kHz. Artist : Lenka Album : Lenka Released : 23 September 2008. Label : Epic. Lenka - Lenka (2008) FLAC Ana.Foxxx.FullHD.mp4 windows 8 arabic language changer torrent download. La Caution, Asphalte Hurlante full .... The Show" is the first single by the Australian singer/songwriter Lenka, produced by Stuart Brawley. It was released in December 2008 - June 2009. The song is .... Lenka - Lenka (2008) FLAC Lenka - Lenka (2008) FLAC Artist: Lenka Title Of Album: Shadow.... Lenka - Lenka.flac 258.25 MB; Covers/lenka1280x1024c.jpg 214.3 KB; ... (Rock, Pop, Adult Contemporary) Lenka - Lenka - 2008, FLAC (image+.cue) lossless .... Artist: Lenka Album: Lenka Released: 2008. Genre: Pop Country: Australia Duration: 00:38:42. Tracklisting: 01. The Show (3:56) 02. Bring Me .... Album Lenka Shadows 2013 flac. by music papa ... Nothing Here But Love.flac. 2. Faster With You. Faster With ... Album Lenka Lenka 2008 flac. by music papa.. Lenka is the debut studio album by Australian recording artist Lenka. It was released on 23 September 2008 by Epic Records. The first single .... thx 2 the original uploader from the national torrent tracker flac 285 Mb 38:36 min http://narod.ru/disk/17979827000/Lenka-2008-Lenka.zip.html. -

Keynotes EBHS Past Meetings

Keynotes Anne E.C. McCants (MIT) Eline Poelmans (KU Leuven) and Jason Taylor (Central Michigan University) Michael Haupert (University of Wisconsin-La Crosse) and Claude Diebolt (French National Centre for Scientific Research) Paul Rhode (University of Michigan) EBHS Past Meetings 2020 Atlanta, Georgia (Covid-19) 2005 High Point, North Carolina 1990 Lexington, Kentucky 2019 Detroit, Michigan 2004 Anaheim, California 1989 Charleston, South Carolina 2018 University of Jyväskylä, Finland 2003 Memphis, Tennessee 1988 Toronto, Ontario, Canada 2017 Oklahoma City, Oklahoma 2002 Chicago, Illinois 1987 San Francisco, California 2016 Montreal, Canada 2001 Albany, New York 1986 Atlanta, Georgia 2015 La Crosse, Wisconsin 2000 San Diego, California 1985 Chicago, Illinois 2014 Manchester, England 1999 San Antonio, Texas 1984 Salt Lake City, Utah 2013 Baltimore, Maryland 1998 Milwaukee, Wisconsin 1983 San Antonio, Texas 2012 Las Vegas, Nevada 1997 Richmond, Virginia 1982 St. Paul, Minnesota 2011 Columbus, Ohio 1996 Savannah, Georgia 1981 Portland, Oregon 2010 Braga, Portugal 1995 Boulder, Colorado 1980 Billings, Montana 2009 Grand Rapids, Michigan 1994 Santa Fe, New Mexico 1979 Los Angeles, California 2008 Montgomery, Alabama 1993 Nashville, Tennessee 1978 Denver, Colorado 2007 Providence, Rhode Island 1992 Seattle, Washington 1977 Denver, Colorado 2006 Pittsburg, Pennsylvania 1991 Houston, Texas 1976 Tempe, Arizona EBHS President 2021 Program Chair Lisa Baillargeon, Université du Québec à Montréal Chris Corker, University of York Virtual Conference -

82Nd Avenue Retail Corridor in Unincorporated Clackamas County

82nd Avenue Commercial Corridor RETAIL MARKET ANALYSIS Prepared by City of Portland Bureau of Planning January 2007 Acknowledgments City of Portland Bureau of Planning Staff Tina M. Mosca Alma Flores Amy Koski Erin Grushon Steve Kountz Gary Odenthal Christine Rains Barry Manning Debbie Bischoff 82nd Avenue of Roses Business District Association Board Ken Turner Victoria Oglesbee Paul Ellison Members at Large Joel Grayson/Janet Grayson, Alternate Julie Wolleck Gary Sargent Richard Kiely Organizational Support The Supoprt Group Special thanks to Mark Hanna of Washman LLC for donating free car washes for distribution to customer survey participants. Staff also wishes to thank Food-4- Less, Walgreens and Fubonn Shopping Center for allowing us to conduct on-site customer surveys. For More Information, contact: Alma FLores Bureau of Planning 1900 SW 4th Avenue, Suite 7100 Portland, OR 97201-5380 (503) 823-7801 [email protected] Table of Contents Study Overview 1 Methodology 3 Existing Conditions 4 Overview of the 82nd Avenue Corridor 4 Transportation 4 Land use 5 Recent development 6 Mix Of Businesses And Land Uses 7 82nd Avenue In Relation To Other Corridors 7 Land Use Inventory 9 Industry Mix 14 Demographics 18 Population And Housing Trends 19 Business Environment 26 Business And Customer Perceptions 26 Crime Statistics 28 Corridor Performance 30 Retail Gap Analysis 30 Neighborhood Trade Area Gap Analysis 31 Community Trade Area Gap Analysis 36 Competitive Strengths And Weaknesses 41 82nd Avenue Corridor Retail Market Analysis 82nd Avenue Corridor Retail Market Analysis Study Overview Study Overview his report is part of the second phase of a proj- ect that started in 2004. -

Damian Taylor Selected Producer, Mixer & Remixer Credits

DAMIAN TAYLOR SELECTED PRODUCER, MIXER & REMIXER CREDITS: Louise Burns Young Mopes (Light Organ) P M Odette Forthcoming Album (EMI Australia) P M Evanescence Synthesis (BMG) M Ad-Prog Kirin J. Callinan S.A.D. (Universal Australia) M TRUST Bicep (Perfect Bloom) Co-P E M Ad-Prog Petra Glynt "This Trip" Stone Lions Dub (Vibe Over Method) M Prog The Range Potential (Domino) Ad-P M Arcade Fire (Ft. Mavis Staples) " I Give You Power" single (Arcade Fire) Ad-Prog Braids Companion (Arbutus) M Zack Lopez Bloodlines (Bright Antenna) M The Temper Trap Thick As Thieves (Liberation/Glassnote) P M Prog Mark Stoermer "Are Your Stars Out" from Dark Arts (St. August) M Björk Biophilia (One Little Indian) E M Prog Co-W *Grammy nominated Best Alternative Album 2012 Björk Volta* (Atlantic) Co-P E Prog *Grammy nominated Best Alternative Album 2008 Björk Volta Live 18 Month World Tour 2007-2008 MD Björk Vespertine* (Elektra) E Prog *Grammy nominated Best Alternative Album 2001 The Killers Battle Born (Island Def Jam) P, Co-P M Prog Arcade Fire "Sprawl II" & "Ready To Start" Remixes (Merge) P Rmx Arcade Fire Reflektor (Arcade Fire Music) Voc-P E *Grammy nominated Best Alternative Album 2015 Braids Deep in the Iris (Arbutus) M *Juno award winner for Alternative Album of the Year 2015* Braids Companion EP (Arbutus) M Kimbra "Two Way Street" Remix from Vows Remixes (Warner Bros.) P M Kimbra "With My Hands" from Frankenweenie Film (Warner Bros.) P E M Prog Co-W Gems Kill the One You Love (Carpark) M Foxtrott "A Taller Us" (One Little Indan) M Foxtrott Shields EP -

Facilities Permit Program 8/3/2020 Client and Building List Page 1 of 97

Facilities Permit Program 8/3/2020 Client and Building List Page 1 of 97 111 SW 5th Ave Investors LLC 19-134770-000-00-FC YORDANOS LONG UNICO PROPERTIES Building/Mechanical Inspector: Jeffrey Rago 4364025 Work: (503) 275-7461 Electrical Inspector: David Scranton [email protected] Plumbing Inspector: Chuck Luttmann M Fire Marshal: Todd Barto Building Address Folder Master US Bancorp Plaza:Unico Prop 555 SW OAK ST 19-134803-FC 19-134804-FA US Bancorp Prkng Struct:Unico Prop 129 SW 4TH AVE 20-101725-FC 20-101726-FA US Bancorp Tower:Unico Prop 111 SW 5TH AVE 19-134793-FC 19-134794-FA 200 Market Assoc. 99-125363-000-00-FC LAURA HUNDTOFT CUSHMAN & WAKEFIELD Building/Mechanical Inspector: Jeffrey Rago 2001906 Work: (503) 228-8666 Electrical Inspector: David Scranton Home: (503) 227-2549 Plumbing Inspector: Chuck Luttmann [email protected] Fire Marshal: Todd Barto Building Address Folder Master 200 MarketBldg:200 Market 200 SW MARKET ST 99-125649-FC 04-055199-FA Dielschneider:200 MARKET 71 SW OAK ST 09-124819-FC 09-124820-FA Fechheimer:200 MARKET 233 SW NAITO PKY 09-124830-FC 09-124831-FA FreimannKitchen:200 MARKET 79 SW OAK ST 09-124810-FC 09-124811-FA FreimannRestaurant:200 MARKET 240 SW 1ST AVE 09-124805-FC 09-124806-FA Hallock & McMillan:200 MARKET 237 SW NAITO PKWY 10-198884-FC 10-198885-FA Generated 08/03/2020 07:09 AM by CREPORTS_SVC from DSPPROD City of Portland, BDS - Report Code: 1109007 Facilities Permit Program 8/3/2020 Client and Building List Page 2 of 97 2020 Portland LLC c/o SKB 19-107059-000-00-FC Christina -

Student and Employee Diversity and Multicultural Resources

OHSU Center for Diversity Inclusion Student andand Employee Diversity and Multicultural Resources Table of Contents Welcome 1 About This Guide OHSU’s Center for Diversity and Center for Diversity & Inclusion 2 Inclusion (CDI) offers this new Student and Employee Guide for OHSU Resources 3 general information only. CDI is Oregon Information 4 not endorsing or warranting any of the services or service providers Sports & Outdoors 6 listed in this guide. This guide does not serve as a complete guide of all Resources for Parents 7 available resources. Community Organizations 10 Contributors Leadership Development 13 Naod Aynalem Surya Joshi Chambers & Commissions 14 Dessa Salavedra Churches & Congregations 15 Editors Maileen Hamto Restaurants 19 Diversity Communications Manager Cultural Grocery Stores 20 Jillian Toda Communications Assistant Beauticians, Barbers & Supplies 22 Creative Production Cultural Festivals 23 GoodWorks Design Studio Native American Tribes 28 Revised and Edited in 2018 by Diversity Media 29 Gabrielle Martinez deCastro International Resources 30 Arts & Cultural Institutions 31 WELCOME OHSU’s Center for Diversity and Inclusion created this guide as part of DIVERSITY AT OHSU our warm welcome to everyone within OHSU’s diverse community of At OHSU, we embrace the full spectrum of students, staff and faculty. diversity, including age, color, culture, disability, ethnicity, gender identity or expression, marital We hope you’ll use it to build relationships, connect with new people, status, national origin, race, religion, sex, sexual organizations and networks, and explore the places that make the orientation, and socioeconomic status. We respect Portland-area and Oregon special. and support diversity of thought, ideas and more. If you’re new to Portland or the OHSU community, the guide will help you COMMITMENT TO INCLUSION get your bearings, connect with a diverse array of resources, and discover To fully leverage the richness of our diversity at the many services and opportunities available throughout the area.