Fraud Risk Management: a Guide to Good Practice

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Excesss Karaoke Master by Artist

XS Master by ARTIST Artist Song Title Artist Song Title (hed) Planet Earth Bartender TOOTIMETOOTIMETOOTIM ? & The Mysterians 96 Tears E 10 Years Beautiful UGH! Wasteland 1999 Man United Squad Lift It High (All About 10,000 Maniacs Candy Everybody Wants Belief) More Than This 2 Chainz Bigger Than You (feat. Drake & Quavo) [clean] Trouble Me I'm Different 100 Proof Aged In Soul Somebody's Been Sleeping I'm Different (explicit) 10cc Donna 2 Chainz & Chris Brown Countdown Dreadlock Holiday 2 Chainz & Kendrick Fuckin' Problems I'm Mandy Fly Me Lamar I'm Not In Love 2 Chainz & Pharrell Feds Watching (explicit) Rubber Bullets 2 Chainz feat Drake No Lie (explicit) Things We Do For Love, 2 Chainz feat Kanye West Birthday Song (explicit) The 2 Evisa Oh La La La Wall Street Shuffle 2 Live Crew Do Wah Diddy Diddy 112 Dance With Me Me So Horny It's Over Now We Want Some Pussy Peaches & Cream 2 Pac California Love U Already Know Changes 112 feat Mase Puff Daddy Only You & Notorious B.I.G. Dear Mama 12 Gauge Dunkie Butt I Get Around 12 Stones We Are One Thugz Mansion 1910 Fruitgum Co. Simon Says Until The End Of Time 1975, The Chocolate 2 Pistols & Ray J You Know Me City, The 2 Pistols & T-Pain & Tay She Got It Dizm Girls (clean) 2 Unlimited No Limits If You're Too Shy (Let Me Know) 20 Fingers Short Dick Man If You're Too Shy (Let Me 21 Savage & Offset &Metro Ghostface Killers Know) Boomin & Travis Scott It's Not Living (If It's Not 21st Century Girls 21st Century Girls With You 2am Club Too Fucked Up To Call It's Not Living (If It's Not 2AM Club Not -

And I Heard 'Em Say: Listening to the Black Prophetic Cameron J

Claremont Colleges Scholarship @ Claremont Pomona Senior Theses Pomona Student Scholarship 2015 And I Heard 'Em Say: Listening to the Black Prophetic Cameron J. Cook Pomona College Recommended Citation Cook, Cameron J., "And I Heard 'Em Say: Listening to the Black Prophetic" (2015). Pomona Senior Theses. Paper 138. http://scholarship.claremont.edu/pomona_theses/138 This Open Access Senior Thesis is brought to you for free and open access by the Pomona Student Scholarship at Scholarship @ Claremont. It has been accepted for inclusion in Pomona Senior Theses by an authorized administrator of Scholarship @ Claremont. For more information, please contact [email protected]. 1 And I Heard ‘Em Say: Listening to the Black Prophetic Cameron Cook Senior Thesis Class of 2015 Bachelor of Arts A thesis submitted in partial fulfillment of the Bachelor of Arts degree in Religious Studies Pomona College Spring 2015 2 Table of Contents Acknowledgements Chapter One: Introduction, Can You Hear It? Chapter Two: Nina Simone and the Prophetic Blues Chapter Three: Post-Racial Prophet: Kanye West and the Signs of Liberation Chapter Four: Conclusion, Are You Listening? Bibliography 3 Acknowledgments “In those days it was either live with music or die with noise, and we chose rather desperately to live.” Ralph Ellison, Shadow and Act There are too many people I’d like to thank and acknowledge in this section. I suppose I’ll jump right in. Thank you, Professor Darryl Smith, for being my Religious Studies guide and mentor during my time at Pomona. Your influence in my life is failed by words. Thank you, Professor John Seery, for never rebuking my theories, weird as they may be. -

Flowers for Algernon.Pdf

SHORT STORY FFlowerslowers fforor AAlgernonlgernon by Daniel Keyes When is knowledge power? When is ignorance bliss? QuickWrite Why might a person hesitate to tell a friend something upsetting? Write down your thoughts. 52 Unit 1 • Collection 1 SKILLS FOCUS Literary Skills Understand subplots and Reader/Writer parallel episodes. Reading Skills Track story events. Notebook Use your RWN to complete the activities for this selection. Vocabulary Subplots and Parallel Episodes A long short story, like the misled (mihs LEHD) v.: fooled; led to believe one that follows, sometimes has a complex plot, a plot that con- something wrong. Joe and Frank misled sists of intertwined stories. A complex plot may include Charlie into believing they were his friends. • subplots—less important plots that are part of the larger story regression (rih GREHSH uhn) n.: return to an earlier or less advanced condition. • parallel episodes—deliberately repeated plot events After its regression, the mouse could no As you read “Flowers for Algernon,” watch for new settings, charac- longer fi nd its way through a maze. ters, or confl icts that are introduced into the story. These may sig- obscure (uhb SKYOOR) v.: hide. He wanted nal that a subplot is beginning. To identify parallel episodes, take to obscure the fact that he was losing his note of similar situations or events that occur in the story. intelligence. Literary Perspectives Apply the literary perspective described deterioration (dih tihr ee uh RAY shuhn) on page 55 as you read this story. n. used as an adj: worsening; declining. Charlie could predict mental deterioration syndromes by using his formula. -

Failing in Corporate Governance and Warning Signs of a Corporate Collapse

A Service of Leibniz-Informationszentrum econstor Wirtschaft Leibniz Information Centre Make Your Publications Visible. zbw for Economics Abid, Ghulam; Ahmed, Alia Article Failing in corporate governance and warning signs of a corporate collapse Pakistan Journal of Commerce and Social Sciences (PJCSS) Provided in Cooperation with: Johar Education Society, Pakistan (JESPK) Suggested Citation: Abid, Ghulam; Ahmed, Alia (2014) : Failing in corporate governance and warning signs of a corporate collapse, Pakistan Journal of Commerce and Social Sciences (PJCSS), ISSN 2309-8619, Johar Education Society, Pakistan (JESPK), Lahore, Vol. 8, Iss. 3, pp. 846-866 This Version is available at: http://hdl.handle.net/10419/188173 Standard-Nutzungsbedingungen: Terms of use: Die Dokumente auf EconStor dürfen zu eigenen wissenschaftlichen Documents in EconStor may be saved and copied for your Zwecken und zum Privatgebrauch gespeichert und kopiert werden. personal and scholarly purposes. Sie dürfen die Dokumente nicht für öffentliche oder kommerzielle You are not to copy documents for public or commercial Zwecke vervielfältigen, öffentlich ausstellen, öffentlich zugänglich purposes, to exhibit the documents publicly, to make them machen, vertreiben oder anderweitig nutzen. publicly available on the internet, or to distribute or otherwise use the documents in public. Sofern die Verfasser die Dokumente unter Open-Content-Lizenzen (insbesondere CC-Lizenzen) zur Verfügung gestellt haben sollten, If the documents have been made available under an Open gelten abweichend von diesen Nutzungsbedingungen die in der dort Content Licence (especially Creative Commons Licences), you genannten Lizenz gewährten Nutzungsrechte. may exercise further usage rights as specified in the indicated licence. https://creativecommons.org/licenses/by-nc/4.0/ www.econstor.eu Pak J Commer Soc Sci Pakistan Journal of Commerce and Social Sciences 2014, Vol. -

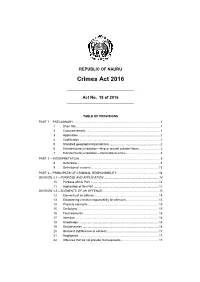

Crimes Act 2016

REPUBLIC OF NAURU Crimes Act 2016 ______________________________ Act No. 18 of 2016 ______________________________ TABLE OF PROVISIONS PART 1 – PRELIMINARY ....................................................................................................... 1 1 Short title .................................................................................................... 1 2 Commencement ......................................................................................... 1 3 Application ................................................................................................. 1 4 Codification ................................................................................................ 1 5 Standard geographical jurisdiction ............................................................. 2 6 Extraterritorial jurisdiction—ship or aircraft outside Nauru ......................... 2 7 Extraterritorial jurisdiction—transnational crime ......................................... 4 PART 2 – INTERPRETATION ................................................................................................ 6 8 Definitions .................................................................................................. 6 9 Definition of consent ................................................................................ 13 PART 3 – PRINCIPLES OF CRIMINAL RESPONSIBILITY ................................................. 14 DIVISION 3.1 – PURPOSE AND APPLICATION ................................................................. 14 10 Purpose -

Kevin Brown2

Transcript of the Testimony of Kevin Brown Date: May 22, 2010 Case: Printed On: May 26, 2010 Sargent's Court Reporting Services, Inc. Phone: 814-536-8908 Fax: 814-536-4968 Email: [email protected] Internet: www.sargents.com Page 1 STATEMENT UNDER OATH OF KEVIN BROWN taken pursuant to Notice by Brett Steele, a Court Reporter and Notary Public in and for the State of West Virginia, at the National Mine Health and Safety Academy, 1301 Airport Road, Room C-123, Beaver, West Virginia, on Saturday, May 22, 2010, beginning at 5:50 p.m. Any reproduction of this transcript is prohibited without authorization by the certifying agency. SARGENT'S COURT REPORTING SERVICES, INC. (814) 536-8908 Page 2 1 A P P E A R A N C E S 2 3 DEREK J. BAXTER, ESQUIRE 4 U.S. Department of Labor 5 Office of the Regional Solicitor 6 1100 Wilson Boulevard 7 22nd Floor West 8 Arlington, VA 22209-2247 9 10 TERRY FARLEY 11 West Virginia Office of Miners' Health, 12 Safety and Training 13 1615 Washington Street East 14 Charleston, WV 25311 15 16 NORMAN PAGE 17 Mine Safety and Health Administration 18 20 21 BETH SPENCE 22 West Virginia Independent Investigation 23 25 SARGENT'S COURT REPORTING SERVICES, INC. (814) 536-8908 Page 3 1 I N D E X 2 3 OPENING STATEMENT 4 By Attorney Baxter 5 - 9 5 WITNESS: KEVIN BROWN 6 EXAMINATION 7 By Mr. Farley 10 - 30 8 EXAMINATION 9 By Mr. Page 30 - 48 10 EXAMINATION 11 By Ms. -

1. Summer Rain by Carl Thomas 2. Kiss Kiss by Chris Brown Feat T Pain 3

1. Summer Rain By Carl Thomas 2. Kiss Kiss By Chris Brown feat T Pain 3. You Know What's Up By Donell Jones 4. I Believe By Fantasia By Rhythm and Blues 5. Pyramids (Explicit) By Frank Ocean 6. Under The Sea By The Little Mermaid 7. Do What It Do By Jamie Foxx 8. Slow Jamz By Twista feat. Kanye West And Jamie Foxx 9. Calling All Hearts By DJ Cassidy Feat. Robin Thicke & Jessie J 10. I'd Really Love To See You Tonight By England Dan & John Ford Coley 11. I Wanna Be Loved By Eric Benet 12. Where Does The Love Go By Eric Benet with Yvonne Catterfeld 13. Freek'n You By Jodeci By Rhythm and Blues 14. If You Think You're Lonely Now By K-Ci Hailey Of Jodeci 15. All The Things (Your Man Don't Do) By Joe 16. All Or Nothing By JOE By Rhythm and Blues 17. Do It Like A Dude By Jessie J 18. Make You Sweat By Keith Sweat 19. Forever, For Always, For Love By Luther Vandros 20. The Glow Of Love By Luther Vandross 21. Nobody But You By Mary J. Blige 22. I'm Going Down By Mary J Blige 23. I Like By Montell Jordan Feat. Slick Rick 24. If You Don't Know Me By Now By Patti LaBelle 25. There's A Winner In You By Patti LaBelle 26. When A Woman's Fed Up By R. Kelly 27. I Like By Shanice 28. Hot Sugar - Tamar Braxton - Rhythm and Blues3005 (clean) by Childish Gambino 29. -

Logic and Sets Clast Mathematics Competencies

5 LOGIC AND SETS CLAST MATHEMATICS COMPETENCIES IE1: Deduce facts of set inclusion or set non-inclusion from a diagram IIE1: Identify statements equivalent to the negations of simple and compound statements IIE2: Determine equivalence or non-equivalence of statements IIE3: Draw logical conclusions from data IIE4: Recognize that an argument may not be valid even though its conclusion is true IIIE1: Recognize valid reasoning patterns as illustrated by valid arguments in everyday language IIIE2: Select applicable rules for transforming statements without affecting their meaning IVE1: Draw logical conclusions when facts warrant them 226 5.1 EQUIVALENT STATEMENTS The word logic is derived from the Greek word logos which may be interpreted to mean reason or discourse. Most of the study of logic revolves around the idea of a statement which we shall discuss next. T TERMINOLOGY -- STATEMENTS DEFINITION OF A STATEMENT EXAMPLES A statement is a declarative sentence which I will study today. can be classified as true or false. 2 is an even number. CONJUNCTIONS (p and q) Let e represent the statement "2 is an even If two statements are connected by the word Let w represent the statement "and" (or an equivalent word such as "but"), "2 is a whole number". The statement: the resulting statement is called a conjunction "2 is an even number and 2 is a whole and is denoted by p ∧ q. number" is a conjunction which can be written The CLAST simply uses the notation p and q. as "e ∧ w" or as "e and w". DISJUNCTIONS (p or q) Let h be: I will study hard If two statements are connected by the word and f be: I will fail the test "or" (or an equivalent word), the resulting The statement "I will study hard or I will fail statement is called a disjunction and is denoted the test" is a disjunction which can be written by p ∨ q. -

Criminal Law: Conspiracy to Defraud

CRIMINAL LAW: CONSPIRACY TO DEFRAUD LAW COMMISSION LAW COM No 228 The Law Commission (LAW COM. No. 228) CRIMINAL LAW: CONSPIRACY TO DEFRAUD Item 5 of the Fourth Programme of Law Reform: Criminal Law Laid before Parliament bj the Lord High Chancellor pursuant to sc :tion 3(2) of the Law Commissions Act 1965 Ordered by The House of Commons to be printed 6 December 1994 LONDON: 11 HMSO E10.85 net The Law Commission was set up by section 1 of the Law Commissions Act 1965 for the purpose of promoting the reform of the law. The Commissioners are: The Honourable Mr Justice Brooke, Chairman Professor Andrew Burrows Miss Diana Faber Mr Charles Harpum Mr Stephen Silber QC The Secretary of the Law Commission is Mr Michael Sayers and its offices are at Conquest House, 37-38 John Street, Theobalds Road, London, WClN 2BQ. 11 LAW COMMISSION CRIMINAL LAW: CONSPIRACY TO DEFRAUD CONTENTS Paragraph Page PART I: INTRODUCTION 1.1 1 A. Background to the report 1. Our work on conspiracy generally 1.2 1 2. Restrictions on charging conspiracy to defraud following the Criminal Law Act 1977 1.8 3 3. The Roskill Report 1.10 4 4. The statutory reversal of Ayres 1.11 4 5. Law Commission Working Paper No 104 1.12 5 6. Developments in the law after publication of Working Paper No 104 1.13 6 7. Our subsequent work on the project 1.14 6 B. A general review of dishonesty offences 1.16 7 C. Summary of our conclusions 1.20 9 D. -

Dr Stephen Copp and Alison Cronin, 'The Failure of Criminal Law To

Dr Stephen Copp and Alison Cronin, ‘The Failure of Criminal Law to Control the Use of Off Balance Sheet Finance During the Banking Crisis’ (2015) 36 The Company Lawyer, Issue 4, 99, reproduced with permission of Thomson Reuters (Professional) UK Ltd. This extract is taken from the author’s original manuscript and has not been edited. The definitive, published, version of record is available here: http://login.westlaw.co.uk/maf/wluk/app/document?&srguid=i0ad8289e0000014eca3cbb3f02 6cd4c4&docguid=I83C7BE20C70F11E48380F725F1B325FB&hitguid=I83C7BE20C70F11 E48380F725F1B325FB&rank=1&spos=1&epos=1&td=25&crumb- action=append&context=6&resolvein=true THE FAILURE OF CRIMINAL LAW TO CONTROL THE USE OF OFF BALANCE SHEET FINANCE DURING THE BANKING CRISIS Dr Stephen Copp & Alison Cronin1 30th May 2014 Introduction A fundamental flaw at the heart of the corporate structure is the scope for fraud based on the provision of misinformation to investors, actual or potential. The scope for fraud arises because the separation of ownership and control in the company facilitates asymmetric information2 in two key circumstances: when a company seeks to raise capital from outside investors and when a company provides information to its owners for stewardship purposes.3 Corporate misinformation, such as the use of off balance sheet finance (OBSF), can distort the allocation of investment funding so that money gets attracted into less well performing enterprises (which may be highly geared and more risky, enhancing the risk of multiple failures). Insofar as it creates a market for lemons it risks damaging confidence in the stock markets themselves since the essence of a market for lemons is that bad drives out good from the market, since sellers of the good have less incentive to sell than sellers of the bad.4 The neo-classical model of perfect competition assumes that there will be perfect information. -

8Th Grade Text Structure Lesson, Practice, and Answer Key (Study Island) 1

8th Grade Text Structure Lesson, Practice, and Answer Key (Study Island) 1 Text Structure When you understand how the writer has organized information, you will understand and remember the text better. Writers organize text in several different ways. Cause/Effect The text shows that one event causes another thing to happen. Look for words like "because," "then," "since," and "as a result." Example: It rained for the first few days of the camping trip. As a result, most of the campers were restless and wanted to go home. Comparison/Contrast The text shows how ideas or things are alike or different. Look for words like "best," "more," "better," "less," "worse," "easier," and "than." Example: The best time to visit the Rocky Mountains is early fall. The weather is cooler in the fall than in the summer. You will see fewer people and more animals. The fall colors are more beautiful. Description When you want to paint a picture with words, use description to organize your ideas. To make the picture come alive in your reader's mind, use a lot of adjectives and describe what you would see, taste, smell, feel, or hear. Adjectives are words like "pretty," "sweet," "smooth," and "loud." Example: The cellar was cold, damp, and dark. It smelled musty and old. Problem/Solution The text is split into two parts: One part presents a problem, and the other part gives the solution to the problem. Look for words like "problem," "solution," "solve," and "plan." Example: The city of Taylor has fifteen public swimming pools. In the past, plenty of lifeguards have been available for staffing the pools throughout the summer. -

Phishing and Email Spoofing

NCUA LETTER TO CREDIT UNIONS NATIONAL CREDIT UNION ADMINISTRATION 1775 Duke Street, Alexandria, VA 22314 DATE: December 2005 LETTER NO.: 05-CU-20 TO: Federally Insured Credit Unions SUBJ: Phishing Guidance for Credit Unions And Their Members REF: Letter to Credit Unions #04-CU-12 Phishing Guidance for Credit Union Members DEAR BOARD OF DIRECTORS: In our Letter to Credit Unions #04-CU-12 Phishing Guidance for Credit Union Members, we highlighted the need to educate your membership about phishing activities. As the number and sophistication of phishing scams continues to increase, we would like to emphasize the importance of educating your employees and members on how to avoid phishing scams as well as action you and/or your members may take should they become a victim. Appendix A of this document contains information you may share with your members to help them from becoming a victim of phishing scams. Appendix B contains information you may share with your members who may have become a victim of phishing scams. Background Phishing is a form of social engineering, characterized by attempts to fraudulently acquire sensitive information, such as passwords, account, credit card details, etc. by masquerading as a trustworthy person or business in an apparently official electronic communication, such as an e-mail or an instant message. Often the message includes a warning regarding a problem related to the recipient’s account and requests the recipient to respond by following a link to a fraudulent website and providing specific confidential information. The format of the e-mail typically includes proprietary logos and branding, such as a “From” line disguised to appear as if the message came from a legitimate sender, and a link to a website or a link to an e-mail address.