Banking Services for Small Business Owners

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Navigating the Emv Implementation Process

PARTNERING FOR SUCCESS: NAVIGATING THE EMV IMPLEMENTATION PROCESS A Mercator Advisory Group Research Brief Sponsored by Moneris Solutions November 2014 Partnering for Success: Navigating the EMV ImplementationProcess A Mercator Advisory Group Research Brief Sponsored by Moneris Solutions Contents The EMV Standard .............................................................................................................................3 Reducing Counterfeit Card Fraud .......................................................................................................... 3 Reducing Card Theft Fraud .................................................................................................................... 3 Chip and PIN vs. Chip and Signature ...................................................................................................... 3 Card Network EMV Road Maps ............................................................................................................. 4 Outlook: EMV Adoption in the United States ......................................................................................5 Credit Card Issuance .............................................................................................................................. 5 Debit Card Issuance ............................................................................................................................... 6 Acceptance ........................................................................................................................................... -

City Council Report

City Council Report Date: December 9, 2019 To: City Council Through: Michael Kennington, Deputy City Manager/Chief Financial Officer From: Edward Quedens, Business Services Director Matt Bauer, Procurement Administrator Subject: Five-Year Term Contract with Five Years of Renewal Options for Banking Services (Service Groups 1, 2 and 4) for the Financial Services Department (Citywide) Recommendation Council is requested to approve the award as recommended. A committee representing Financial Services Department and Purchasing evaluated responses. The evaluation committee recommends awarding the contracts to the highest scored proposals from the following vendors: General Banking – JP Morgan Chase at $120,000 annually; Merchant Card Processing – U.S. Bank / Elavon at $18,000 annually; and Paying Agent Services – UMB Bank, N.A. at $18,000 annually; with an annual increase allowance of up to 5% or the adjusted Consumer Price Index. Background / Discussion The City of Mesa makes extensive use of banking services to collect, disburse and manage its cash and investments. Comprehensive banking services includes general banking services, merchant card processing, institutional custody and payment agent services. General banking services includes cash services, deposit services, disbursement services, electronic transfer of funds and general reporting - JP Morgan Chase is the incumbent for general banking services. Merchant card services represent the City’s ability to process credit card transactions - US Bank / Elavon is the incumbent for merchant card services. Institutional custody services represent the safekeeping of the assets/securities in the City’s investment portfolio - Wells Fargo Bank, N.A. is the incumbent for institutional custody services. The City requires the services of a qualified paying agent, registrar, transfer agent, filing agent, and trustee for current and future bond issues - US Bancorp is the incumbent for Paying agent services. -

BMO Harris Bank World Mastercard® Credit Card Application

® BMO Harris Bank World MasterCard Credit Card Application FILL OUT THIS APPLICATION TODAY FOR A BMO HARRIS BANK WORLD MASTERCARD CREDIT CARD ® Please send BMO Harris Bank BMO Harris Bank Select World MasterCard I would like to apply for: ® completed forms to: P.O. Box 2035 BMO Harris Bank Premier World MasterCard Milwaukee, WI 53201-9919 PRIMARY APPLICANT Please print or type all information NAME BIRTH DATE SOCIAL SECURITY NUMBER ADDRESS (No P.O. Boxes) CITY STATE ZIP E-MAIL ADDRESS HOME PHONE How long have you lived at your current address? Do you? MONTHLY PAYMENT years months Rent Own Other $ CURRENT EMPLOYER How long have you worked at your employer? EMPLOYER PHONE years months INDIVIDUAL GROSS EMPLOYMENT INCOME OTHER INCOME* SOURCE OF OTHER INCOME $ Annually Monthly $ Annually Monthly PRIMARY BANK NAME TYPE OF ACCOUNT MARITAL STATUS (Please check if you are a resident of AZ, WI, NV, or other Checking Savings Loan community property state): Married Unmarried Separated * Alimony, separate maintenance, or child support need not be revealed if you do not wish to have it considered as a basis for repayment. CO-APPLICANT/SPOUSE Please print or type all information Provide this information for: 1) a co-applicant or 2) a non-applicant spouse if you are a married resident of WI, AZ, NV or other community property state and are applying for individual credit. If you intend to apply for joint credit, please check the “co-applicant” box in this section, and you and your co- applicant must sign this application. INFORMATION PROVIDED FOR: CO-APPLICANT SPOUSE (not a co-applicant) NAME BIRTH DATE SOCIAL SECURITY NUMBER ADDRESS (No P.O. -

Employees' 401(K) Savings Plan of the Bank of Montreal/Harris Stable

Employees’ 401(k) Savings Plan of the Bank of Montreal/Harris Stable Principal Fund Quarterly Update as of June 30, 2020 BMO Harris is committed to providing you with the tools, resources and information you need to prepare for your financial security when you retire. Enclosed you will find a fund fact sheet provided by BMO Asset Management, the underlying fund manager, for the Stable Principal Fund. The fact sheet provides the fund’s objective, strategy, top holdings, principal risks, and portfolio characteristics. Fund Performance Investment returns for the calendar quarter as well as annualized returns for the previous 1, 5, and 10 years are as follows: Performance as of June 30, 2020 QTD 1 Year 5 Year 10 Year Fund Performance* 0.40% 1.82% 1.68% 1.88% Benchmark – ICE BofAML 1-3 Year US Corporate & 1.22% 4.18% 2.11% 1.67% Government Index The Stable Principal Fund was added to the Plan as of December 19, 2014 but these returns reflect the historical performance of the fund’s underlying asset, the BMO Stable Value Fund – Class I. *These returns differ from the Net of Fees returns on the attached fact sheet due to a 0.15% reduction in the total annual expense ratio applicable to Plan assets. As always, it’s important to keep in mind that past performance is no guarantee of future results. Total Annual Operating Expense Ratio Reporting as of June 30, 2020 % Per $1,000 Total Annual Operating Expense Ratio 0.445% $4.45 This expense ratio is inclusive of the 0.15% discount applicable to Plan assets. -

BMO Financial Group's Procurement Governance Process

Where to send invoices? If you are invoicing the following companies: Mail your invoices to: Bank of Montreal Accounts Payable BMO Asset Management Inc. P.O. Box 370 BMO Harris Financing, Inc. Succursale St-Jacques BMO Harris Investment Management. Inc. Montreal, Québec BMO Investments Inc. H3C 2T1 BMO InvestorLine Inc. Canada BMO Life Assurance Company BMO Nesbitt Burns Corporation Limited BMO Nesbitt Burns Fahnestock International Ltd. BMO Nesbitt Burns Financial Services Inc BMO Nesbitt Burns Inc. BMO Nesbitt Burns Ltd. BMO Nesbitt Burns Securities Ltd BMO Private Equity (Canada) Inc. BMO Trust Company Jones Heward Investment Inc Bank of Montreal (US) BMO Accounts Payable BMO (US) Credit Corporation P.O. Box 0010 BMO Asset Management Corp. (Formerly Harris Investment Chicago, Illinois Management Inc.) 60690 U.S.A. BMO Bankcorp, Inc. (formerly Harris Bankcorp Inc.) BMO Capital Markets Corp. BMO Capital Markets GKST Inc. BMO Financial Corp. (formerly Harris Financial Corp.) BMO Harris Bank NA (formerly Harris N.A.) Clark Street Holdings, LLC Dearborn Street Holdings, Inc. Delaware Trust Company Harris Capital Holdings, Inc. Harris Investors Services Inc. Harris MyCFO LLC Harris Preferred Capital Trust LaSalle 115 Holdings, LLC psps Holdings, LLC Stoker Ostler Wealth Advisors, Inc. Sullivan, Bruyette, Speros & Blayney Inc. BMO Financial Corp. Accounts Payable BMO Harris Bank NA P.O. Box 659 BMO Harris Bank NA (formerly Marshall & Ilsley Corporation) Chicago, Illinois Dearborn Street Holdings, LLC 60690 U.S.A. Louisville Realty Corporation M&I Community Development M&I Dealer Finance, Inc. M&I Equipment Finance Company (Wi) M&I Financial Advisors Inc M&I Investment Management Corp. -

Some Implications of the Tensions in Ukraine After a Tense Start to the Week, Market Angst Over the Tensions Between Ukraine ECONOMIC RESEARCH and Russia Has Eased

A timely analysis of recent economic events March 4, 2014 Some Implications of the Tensions in Ukraine After a tense start to the week, market angst over the tensions between Ukraine ECONOMIC RESEARCH and Russia has eased. Russia’s stock market retraced half of Monday’s losses, www.bmocm.com/economics the ruble firmed from record lows, and the Ukrainian hryvnia has stabilized. 1-800-613-0205 While Russia’s troops on the border with Ukraine have returned to their bases, Benjamin Reitzes, the risk is clearly that the situation destabilizes further. Indeed, fears remain Senior Economist that Russia could make a push (official or unofficial) into other Russian- [email protected] speaking provinces in Ukraine under the guise of protecting Russian interests. 416-359-5628 And, the standoff over Crimea is not over yet, though a referendum due March 30 in this Russian speaking province points to increasing Russian influence at the expense of Ukraine’s central government. This crisis is not over yet. As such, it’s worthwhile to take account of the potential economic ramifications. Clearly, an intensified conflict would be negative for the region and global economy. The steep deterioration in relations with Russia is broadly a negative. More specifically, the U.S., EU and Western allies have threatened Russia with economic sanctions and potential expulsion from the G8. The consequences could be quite severe for the Russian economy, depending on the extent of the sanctions. However, Russia is a key supplier of oil and natural gas to Europe, which, along with extensive direct business interest in the country, could make the EU reluctant to apply harsh sanctions. -

To Consult DPQ/Moneris Preferred Pricing

Preferred Rates For Your Business Les Dentistes propriétaires du Québec (DPQ) and Moneris® are pleased to introduce preferred card payment processing rates for your business.† Moneris Transaction 1 Interac Per Transaction Rate Card Type * Assessment Fee Interchange Fee Fee Debit Card $0.040 VISA 0.10% 0.09% Foreign Assessment Fee (VISA) of 0.40% will apply to all gross foreign sales dollar volume processed. Card Brand Fee (Interac) of $0.0085 will apply to each Interac transaction. An Interac fee of $0.035 Mastercard 0.10% 0.08% per transaction will apply to each Interac Flash® (contactless) transaction. Foreign Assessment Fee (Mastercard) of 0.60% will apply to all gross foreign sales dollar volume processed. For more information about the applicable Discover 0.10% 0.063% Interchange rates, Foreign Assessment Fee (Discover) of 0.40% will apply to all gross foreign sales dollar volume processed. please visit moneris.com/interchange POS Solution(s) Rates Union Pay 0.10% 0.1% Standalone $22.00/month Foreign Assessment Fee (UnionPay) of 0.10% will apply to all gross foreign sales dollar volume processed. PIN Pad $16.00/month Visa Debit 0.10% Short Range Wireless $45.00/month Debit MasterCard 0.10% $50.00/month * You agree that you are responsible for the fulfillment of any increase imposed by the Long Range Wireless (plus $75.00 one time activation fee) Card Brand and any fees, fines, penalties, or assessments levied by the Card Brands on us or our parent banks, RBC and BMO, in connection with the processing of your transactions. -

2008 Annual Report to Shareholders

191ST ANNUAL REPORT 2008 Defining great customer experience I value a clear plan for the retirement I want. I appreciate a bank that can help my company in good times and bad. Who will explain all my mortgage options so that I actually understand? Thanks for giving me the advice that makes sense for me. Defining great customer experience begins with making sense of it all. BMO’s vision – to be the bank that defines great customer experience – galvanizes our organization and encourages every one of our 37,000 employees to help us succeed. In everything we do, we define great customer experience. We do so by helping our customers make sense of their financial lives, and by bringing clarity to the complexities of money. BMO gratefully acknowledges our customers who so generously gave their time and portraits to this annual report. Adolphe A. Tinling Linda Knight Scott Saxberg Maria Monreal-Cameron President and Principal Designer CEO, President and CEO, President and CEO, Adolphe Anthony T. Design CarePartners Crescent Point Energy Trust Hispanic Chamber of Commerce International and Associates Waterloo, Ontario Calgary, Alberta of Wisconsin Montreal, Quebec Milwaukee, Wisconsin Who We Are A Canadian-based North American bank, established in 1817, BMO® Financial Group is highly diversified. We work with millions of personal, commercial, corporate and institutional customers through our operating groups: Personal and Commercial Banking Canada, Personal and Commercial Banking U.S., Private Client Group and BMO Capital Markets. Our 37,000 employees are dedicated to making BMO the bank that defines great customer experience. Our approach is relationship-driven. -

BMO Harris Bank and the Illinois Housing Development Authority

For Immediate Release IHDA: Andrew Field - (312) 833-6083 April 13, 2018 [email protected] BMO: Emily Penate - (312) 461-7956 [email protected] BMO Harris Bank and the Illinois Housing Development Authority Partner to Help Underwater Homeowners The I-Refi program provides $50,000 in forgivable assistance to help borrowers reduce what they owe on their mortgage and refinance into a new, affordable loan. CHICAGO – The Illinois Housing Development Authority (“IHDA”) today announced that BMO Harris Bank will participate in the I-Refi refinance program for the second year in a row to assist struggling homeowners. The program provides up to $50,000 in forgivable assistance to eligible homeowners to reduce the balance owed on their mortgage and refinance into a new affordable loan based on the current appraised value of the home. “We believe this program can make a difference for hundreds of families across Illinois and we are proud to partner with IHDA for a second year to raise awareness and connect people to the program,” said Ernie Johannson, Group Head, U.S. Personal and Business Banking, BMO Harris Bank. “This is an opportunity for people who meet the criteria for the assistance to speak to one of our BMO Harris Mortgage Bankers and get informed.” According to a report from the property data firm CoreLogic, the Chicagoland area has more than 135,000 underwater homeowners, more than any other metro area in the nation. Since launching in August of 2016, I-Refi has offered a critical lifeline to homeowners who owe more on their mortgage than their home is worth. -

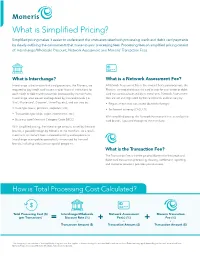

What Is Simplified Pricing?

What is Simplified Pricing? Simplified pricing makes it easier to understand the costs associated with processing credit and debit card payments by clearly outlining the components that make up your processing fees. Processing fees on simplified pricing consist of: Interchange/Wholesale Discount, Network Assessment and Moneris® Transaction Fees. What is Interchange? What is a Network Assessment Fee? Interchange is the amount that card processors, like Moneris, are A Network Assessment Fee is the amount that card processors, like required to pay credit card issuers and/or financial institutions for Moneris, are required to pay the card brands for each credit or debit each credit or debit card transaction processed by its merchants. card transaction processed by its merchants. Network Assessment Interchange rates are set and regulated by the card brands (i.e. fees are set and regulated by the card brands and can vary by: ® ® ® Visa , Mastercard , Discover , UnionPay, etc.), and can vary by: • Region where card was issued (domestic/foreign) • Card type (basic, premium, corporate, etc.) • Settlement currency (CAD, US) • Transaction type (chip, swipe, ecommerce, etc.) With simplified pricing, the Network Assessment Fee, as set by the • Business type/Merchant Category Code (MCC) card brands, is passed through to the merchant. With simplified pricing, the interchange amount, as set by the card brands, is passed through by Moneris to the merchant. As a result, merchants will benefit from increased visibility and exposure to interchange rate updates periodically announced by the card brands, including reductions or special programs. What is the Transaction Fee? The Transaction Fee is the fee paid to Moneris for the credit and debit card transaction processing, clearing, settlement, reporting and customer service it provides your business. -

For Apple® Ipad®, Iphone® and Ipod Touch®

For Apple® iPad®, iPhone® and iPod touch® (11/17) For more information and assistance: Web: getpayd.com/paydpro/support Email: [email protected] Toll-free: 1-855-423-PAYD (7293) Record your Moneris® merchant ID here: __________________________________________ Contents Introduction ................................................................................................ 6 Before you get started .............................................................................. 7 Activating your PAYD Pro store .............................................................. 8 Setting up the PAYD App on your mobile device .............................. 9 Downloading and installing the PAYD App from the App Store SM 10 Setting up the PAYD PIN Pad ................................................................. 11 Pairing a new PAYD PIN Pad with your mobile device 12 Pairing an initialized PAYD PIN Pad with a different mobile device 19 Pairing a replacement PAYD PIN Pad with your mobile device 22 Other PAYD PIN Pad settings 24 Changing an initialized PAYD PIN Pad's default language 24 Bluetooth pairing in Legacy mode 26 Ready to use the PAYD App? 30 Optional features ..................................................................................... 31 Setting the transaction details level 31 Setting a default payment device 32 1 Enabling Pre-Authorizations 32 Enabling tip prompting 33 Setting a tax rate 34 Location-mapping transactions 35 Viewing a location map 35 Setting a quick PIN for sign-in 36 Pre-filling the employee ID/store ID at -

NAME TYPE ENHANCED 1934 First American Bank Banks and Credit

NAME TYPE ENHANCED 1934 First American Bank Banks and Credit Cards 1st Bank Banks and Credit Cards 1st Bank Credit Card (First Data) Banks and Credit Cards 1st Century Bank Banks and Credit Cards Access National Bank Banks and Credit Cards Alliant Credit Union Banks and Credit Cards Ally Bank Banks and Credit Cards Alpine Bank (Colorado) (Business) Banks and Credit Cards Alterna Savings Banks and Credit Cards Amazon.ca Rewards Visa from Chase Banks and Credit Cards America First Credit Union Banks and Credit Cards American Airlines Aviator Business Card Banks and Credit Cards American Express (Canada) Banks and Credit Cards YES American Express (USA) Banks and Credit Cards YES American Express Merchant Services (EUR) Banks and Credit Cards American Funds (Individual) Banks and Credit Cards American Heritage Federal Credit Union Banks and Credit Cards American National Bank and Trust (Virginia) Banks and Credit Cards American Riviera Bank Banks and Credit Cards Anchor Bank Banks and Credit Cards ANZ (NZ) Banks and Credit Cards Arvest Bank Banks and Credit Cards Assiniboine Credit Union Banks and Credit Cards Associated Bank Banks and Credit Cards ATB Financial (Business) Banks and Credit Cards YES ATB Financial (Personal) Banks and Credit Cards Atlantic Capital Bank Banks and Credit Cards Bank of America Banks and Credit Cards YES Bank of Ann Arbor (Business) Banks and Credit Cards YES Bank of Belleville Banks and Credit Cards Bank of Hawaii (Business) Banks and Credit Cards Bank of North Carolina Banks and Credit Cards Bank of Oklahoma