200Th Annual Report 2017 TOMORROW TODAY STARTS We Aren’T Waiting Marla Philpot Associate Project Manager Chicago, IL for the Future to Arrive

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Navigating the Emv Implementation Process

PARTNERING FOR SUCCESS: NAVIGATING THE EMV IMPLEMENTATION PROCESS A Mercator Advisory Group Research Brief Sponsored by Moneris Solutions November 2014 Partnering for Success: Navigating the EMV ImplementationProcess A Mercator Advisory Group Research Brief Sponsored by Moneris Solutions Contents The EMV Standard .............................................................................................................................3 Reducing Counterfeit Card Fraud .......................................................................................................... 3 Reducing Card Theft Fraud .................................................................................................................... 3 Chip and PIN vs. Chip and Signature ...................................................................................................... 3 Card Network EMV Road Maps ............................................................................................................. 4 Outlook: EMV Adoption in the United States ......................................................................................5 Credit Card Issuance .............................................................................................................................. 5 Debit Card Issuance ............................................................................................................................... 6 Acceptance ........................................................................................................................................... -

To Consult DPQ/Moneris Preferred Pricing

Preferred Rates For Your Business Les Dentistes propriétaires du Québec (DPQ) and Moneris® are pleased to introduce preferred card payment processing rates for your business.† Moneris Transaction 1 Interac Per Transaction Rate Card Type * Assessment Fee Interchange Fee Fee Debit Card $0.040 VISA 0.10% 0.09% Foreign Assessment Fee (VISA) of 0.40% will apply to all gross foreign sales dollar volume processed. Card Brand Fee (Interac) of $0.0085 will apply to each Interac transaction. An Interac fee of $0.035 Mastercard 0.10% 0.08% per transaction will apply to each Interac Flash® (contactless) transaction. Foreign Assessment Fee (Mastercard) of 0.60% will apply to all gross foreign sales dollar volume processed. For more information about the applicable Discover 0.10% 0.063% Interchange rates, Foreign Assessment Fee (Discover) of 0.40% will apply to all gross foreign sales dollar volume processed. please visit moneris.com/interchange POS Solution(s) Rates Union Pay 0.10% 0.1% Standalone $22.00/month Foreign Assessment Fee (UnionPay) of 0.10% will apply to all gross foreign sales dollar volume processed. PIN Pad $16.00/month Visa Debit 0.10% Short Range Wireless $45.00/month Debit MasterCard 0.10% $50.00/month * You agree that you are responsible for the fulfillment of any increase imposed by the Long Range Wireless (plus $75.00 one time activation fee) Card Brand and any fees, fines, penalties, or assessments levied by the Card Brands on us or our parent banks, RBC and BMO, in connection with the processing of your transactions. -

2008 Annual Report to Shareholders

191ST ANNUAL REPORT 2008 Defining great customer experience I value a clear plan for the retirement I want. I appreciate a bank that can help my company in good times and bad. Who will explain all my mortgage options so that I actually understand? Thanks for giving me the advice that makes sense for me. Defining great customer experience begins with making sense of it all. BMO’s vision – to be the bank that defines great customer experience – galvanizes our organization and encourages every one of our 37,000 employees to help us succeed. In everything we do, we define great customer experience. We do so by helping our customers make sense of their financial lives, and by bringing clarity to the complexities of money. BMO gratefully acknowledges our customers who so generously gave their time and portraits to this annual report. Adolphe A. Tinling Linda Knight Scott Saxberg Maria Monreal-Cameron President and Principal Designer CEO, President and CEO, President and CEO, Adolphe Anthony T. Design CarePartners Crescent Point Energy Trust Hispanic Chamber of Commerce International and Associates Waterloo, Ontario Calgary, Alberta of Wisconsin Montreal, Quebec Milwaukee, Wisconsin Who We Are A Canadian-based North American bank, established in 1817, BMO® Financial Group is highly diversified. We work with millions of personal, commercial, corporate and institutional customers through our operating groups: Personal and Commercial Banking Canada, Personal and Commercial Banking U.S., Private Client Group and BMO Capital Markets. Our 37,000 employees are dedicated to making BMO the bank that defines great customer experience. Our approach is relationship-driven. -

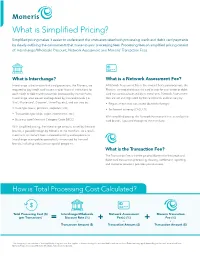

What Is Simplified Pricing?

What is Simplified Pricing? Simplified pricing makes it easier to understand the costs associated with processing credit and debit card payments by clearly outlining the components that make up your processing fees. Processing fees on simplified pricing consist of: Interchange/Wholesale Discount, Network Assessment and Moneris® Transaction Fees. What is Interchange? What is a Network Assessment Fee? Interchange is the amount that card processors, like Moneris, are A Network Assessment Fee is the amount that card processors, like required to pay credit card issuers and/or financial institutions for Moneris, are required to pay the card brands for each credit or debit each credit or debit card transaction processed by its merchants. card transaction processed by its merchants. Network Assessment Interchange rates are set and regulated by the card brands (i.e. fees are set and regulated by the card brands and can vary by: ® ® ® Visa , Mastercard , Discover , UnionPay, etc.), and can vary by: • Region where card was issued (domestic/foreign) • Card type (basic, premium, corporate, etc.) • Settlement currency (CAD, US) • Transaction type (chip, swipe, ecommerce, etc.) With simplified pricing, the Network Assessment Fee, as set by the • Business type/Merchant Category Code (MCC) card brands, is passed through to the merchant. With simplified pricing, the interchange amount, as set by the card brands, is passed through by Moneris to the merchant. As a result, merchants will benefit from increased visibility and exposure to interchange rate updates periodically announced by the card brands, including reductions or special programs. What is the Transaction Fee? The Transaction Fee is the fee paid to Moneris for the credit and debit card transaction processing, clearing, settlement, reporting and customer service it provides your business. -

For Apple® Ipad®, Iphone® and Ipod Touch®

For Apple® iPad®, iPhone® and iPod touch® (11/17) For more information and assistance: Web: getpayd.com/paydpro/support Email: [email protected] Toll-free: 1-855-423-PAYD (7293) Record your Moneris® merchant ID here: __________________________________________ Contents Introduction ................................................................................................ 6 Before you get started .............................................................................. 7 Activating your PAYD Pro store .............................................................. 8 Setting up the PAYD App on your mobile device .............................. 9 Downloading and installing the PAYD App from the App Store SM 10 Setting up the PAYD PIN Pad ................................................................. 11 Pairing a new PAYD PIN Pad with your mobile device 12 Pairing an initialized PAYD PIN Pad with a different mobile device 19 Pairing a replacement PAYD PIN Pad with your mobile device 22 Other PAYD PIN Pad settings 24 Changing an initialized PAYD PIN Pad's default language 24 Bluetooth pairing in Legacy mode 26 Ready to use the PAYD App? 30 Optional features ..................................................................................... 31 Setting the transaction details level 31 Setting a default payment device 32 1 Enabling Pre-Authorizations 32 Enabling tip prompting 33 Setting a tax rate 34 Location-mapping transactions 35 Viewing a location map 35 Setting a quick PIN for sign-in 36 Pre-filling the employee ID/store ID at -

193Rd Annual Report 2010 “It Was My Privilege This Year to Introduce New Customers, Employees and Communities to Harris

193 RD ANNUAL REPORT 2010 Financial Snapshot 2010 Performance For the year ended October 31 (Canadian $ in millions, except as noted) 2010 2009 2008 billion Revenue (p 37) 12,210 11,064 10,205 $ Total provision for credit losses (p 40) 1,049 1,603 1,330 2.8 BMO Financial Group Net Income Non-interest expense (p 41) 7,590 7,381 6,894 Net income rose by 57%, or more than $1 billion, driven by reduced provisions Net income (p 33) 2,810 1,787 1,978 for credit losses and stronger results in P&C Canada. P 33 Earnings per share – diluted ($) (p 33) 4.75 3.08 3.76 Return on equity (ROE) (p 34) 14.9% 9.9% 13.0% Cash operating leverage1 (p 41) 7.5% 1.3% 4.7% % Tier 1 Capital Ratio (p 60) 13.45% 12.24% 9.77% 10.4 Revenue Growth Net Income by Segment Revenue rose by more than $1.1 billion, or 10.4%, after having grown 8.4% P&C Canada (p 47) 1,644 1,415 1,153 and 9.2% in the past two years, demonstrating the benefits of our P&C U.S. (p 50) 175 286 242 diversified business mix. Private Client Group (p 53) 470 359 426 P 37 BMO Capital Markets (p 56) 820 873 568 Corporate Services, including % Technology and Operations (T&O) (p 57) (299) (1,146) (411) 13.45 Net Income (p 33) 2,810 1,787 1,978 Tier 1 Capital Ratio The Tier 1 Capital Ratio increased from 12.24% in 2009, providing greater 1 This is a non-GAAP measure. -

The Cord (March 30, 2011)

CORD THEThe tie that binds Laurier since Wilfrid University 1926 Volume 51, Issue 28 Wednesday, March 30, 2011 thecord.ca Take a look back A retrospective look at a year of events that shook our campus, community and world. The Cord gives a comprehensive look at the events of the last school year and outlines developing stories you'll want to follow. News, page 3 National, page 8 Arts, page 14 Local, page 6 World, page 9 Sports, page 24 2 EDITOR'S PAGE THE CORD Wednesday, March 30, 2011 Editor's Choice News 3 Arts 14 Editor's Choice Dan MangamNo road Local 6 Classifieds 17 Photo gallery:Radio National 8 Opinion 18 Laurier's regrets World 10 Sports 23 Dirty Bingo Arts, page 15 In Depth 12 thecord.ca/ Editor-in-Chief Alanna Wallace • [email protected] THE CORD Bag O' Crime Vocal Cord The tie that binds Wilfrid Laurier University since 1926 75 University Ave W Intoxicated Person Intoxicated Person identification purposes. He was cel- What was the biggest Waterloo ON N2L3C5 Location: Bricker Residence Location: FNCC ebrating his birthday at Phil's Bar, news story on campus 519-884-0710 X3564 Occurred: Mar. 26,2011 (a) 3:45 a.m. Reported: Mar. 24,2011 (a) 3:20 a.m. and had been separated from his this While attending to another matter SCS officers attended to Wilf's Pub friends. The male's sister came to year? March 16,2011 at a Residence, Special Constables in response to a complaint of a WLU to pick up her brother and take Volume 51, Issue 28 found a male passed out under the person passed out in the women's responsibility for him. -

BMO Financial Group Reports Third Quarter 2018 Results

BMO Financial Group Reports Third Quarter 2018 Results REPORT TO SHAREHOLDERS Financial Results Highlights Third Quarter 2018 Compared With Third Quarter 2017: • Net income of $1,536 million, up 11%; adjusted net income1 of $1,565 million, up 14% • EPS2 of $2.31, up 13%; adjusted EPS1,2 of $2.36, up 16% • ROE of 14.7%, up from 13.4%; adjusted ROE1 of 15.0%, up from 13.3% • Provision for credit losses3 (PCL) of $186 million compared with $202 million on an adjusted basis in the prior year and $126 million on a reported basis; prior year reported provision for credit losses includes a decrease in the collective allowance of $76 million pre-tax • Common Equity Tier 1 Ratio of 11.4% Year-to-Date 2018 Compared With Year-to-Date 2017: • Net income of $3,755 million, down 9%, reflecting the revaluation of our U.S. net deferred tax asset4 and a restructuring charge in the current year5 and a net gain6 in the prior year; adjusted net income1 of $4,450 million, up 6% • EPS2,4,5 of $5.59, down 8%; adjusted EPS1,2 of $6.67, up 7% • ROE of 12.3%, compared with 13.7%; adjusted ROE1 of 14.6%, up from 13.9% • Provision for credit losses of $487 million3 compared with $620 million on an adjusted basis and $544 million on a reported basis Toronto, August 28, 2018 – For the third quarter ended July 31, 2018, BMO Financial Group recorded net income of $1,536 million or $2.31 per share on a reported basis, and net income of $1,565 million or $2.36 per share on an adjusted basis. -

Quick Reference Booklet 11 August 2020

Quick Reference Booklet 11 August 2020 QR Summary of Changes, 11 August 2020 Summary of Changes, 11 August 2020 This document reflects updates effective since the 15 October 2019 version. Table 1: Descriptions of Changes Description of Change Where to Look Chapter 3—Card Acceptor Business Codes Card Acceptor Business (CAB) Programs and (MCCs) Descriptions Updated country-specific CAB program to include Throughout AUS4, Australia transit 4. Added Macedonia to MCC 9406. MCC 9406—Government-owned Lottery (Specific Countries) Added MCC 9406 Government-owned Lottery Card Acceptor Business Codes (MCCs)— (Specific Countries) to All Transaction Category Transaction Category Codes Codes. Removed vending machines from MCC 5499. MCC 5499—Miscellaneous Food Stores— Convenience Stores, Markets, Specialty Stores Added P for MCC 9399 and MCC 7800. Removed Card Acceptor Business Codes (MCCs)— note in MCC Description. Abbreviated Removed sentence: “This MCC may also be used MCC 9399—Government Services—not to identify U.S. state lottery ticket sales by elsewhere classified merchants properly registered with Mastercard as set forth in section 9.4.5 of the Security Rules and Proceduresmanual.” Added MCC—Electric Vehicle Charging. MCC 5552—Electric Vehicle Charging Added Card Acceptor Business Segment codes for Card Acceptor Business (CAB) Programs and Uruguay. Descriptions Added Card Acceptor Business program, MON2, Throughout to MCC 4829 and MCC 6540. Added 2021 holiday schedule Holiday Processing Schedule ©1990–©2020 Mastercard. Proprietary. All rights reserved. Quick Reference Booklet • 11 August 2020 2 Contents Contents Summary of Changes, 11 August 2020.............................................................2 Chapter 1: Holiday Processing Schedule........................................................ 12 Overview Settlement U.S. Dollar Holiday Schedule............................................................13 Settlement Holidays........................................................................................................ -

What Is Simplified Pricing?

What is Simplified Pricing? Simplified pricing makes it easier to understand the costs associated with processing credit and debit card payments by clearly outlining the components that make up your processing fees. Processing fees on simplified pricing consist of: Interchange/Wholesale Discount, Network Assessment and Moneris® Transaction Fees. What is Interchange? What is a Network Assessment Fee? Interchange is the amount that card processors, like Moneris, are A Network Assessment Fee is the amount that card processors, required to pay credit card issuers and/or financial institutions for like Moneris, are required to pay the card brands for each credit or each credit or debit card transaction processed by its merchants. debit card transaction processed by its merchants. Network Interchange rates are set and regulated by the card brands (i.e. Assessment fees are set and regulated by the card brands and can Visa®, Mastercard®, Discover®, UnionPay, etc.), and can vary by: vary by: • Card type (basic, premium, corporate, etc.) • Region where card was issued (domestic/foreign) • Transaction type (chip, swipe, ecommerce, etc.) • Settlement currency (CAD, US) • Business type/Merchant Category Code (MCC) With simplified pricing, the Network Assessment Fee, as set by With simplified pricing, the interchange amount, as set by the the card brands, is passed through to the merchant. card brands, is passed through by Moneris to the merchant. As a result, merchants will benefit from increased visibility and exposure to interchange rate updates periodically announced by the card brands, including reductions or special programs. What is the Transaction Fee? The Transaction Fee is the fee paid to Moneris for the credit and debit card transaction processing, clearing, settlement, reporting and customer service it provides your business. -

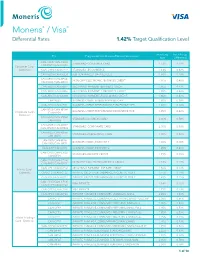

Moneris® / Visa® Differential Rates 1.42% Target Qualification Level

Moneris® / Visa® Differential Rates 1.42% Target Qualification Level Interchange Interchange Fee Program As Identified on Moneris Statements: Rate Differential CAN-CS01/CAN-CS02/ STANDARD–CONSUMER CARD 1.52% 0.10% CAN-DS01/CAN-DS02 Consumer Card - Domestic CAN-C918/CAN-C919 STANDARD -ECOMMERCE 1.44% 0.02% CAN-XED3/CAN-XED4 B2B - ENHANCED DATA LEVEL 2 1.60% 0.18% CAN-XE03/CAN-XE04/ NON-CHIP ELECTRONIC–BUSINESS CREDIT 1.90% 0.48% CAN-VE03/CAN-WE03 CAN-XB03/CAN-XB04 RECURRING PAYMENT–BUSINESS CREDIT 1.85% 0.43% CAN-XB05/CAN-XB06 RECURRING PAYMENT–CORPORATE CREDIT 1.85% 0.43% CAN-XB07/CAN-XB08 RECURRING PAYMENT–PURCHASING CREDIT 1.85% 0.43% CAN-XE33 BUSINESS CREDIT EMERGING NNSS-CHIP 1.80% 0.38% CAN-XP01/CAN-XP02 BUSINESS CREDIT PERFORMANCE INCENTIVE TIER 1.80% 0.38% CAN-XP03/CAN-XP04/ BUSINESS CREDIT,PERFORMANC EINCENTIVE TIER 1.85% 0.43% Corporate Card - CAN-VP04 Domestic CAN-XS03/CAN-XS04/ STANDARD–BUSINESS CARD 2.00% 0.58% CAN-WS03 CAN-XS05/CAN-XS06/ STANDARD–CORPORATE CARD 2.00% 0.58% CAN-WS05/CAN-WS06 CAN-XS07/CAN-XS08/ STANDARD–PURCHASING CARD 2.00% 0.58% CAN-WS07 CAN-XI05/CAN-XI06/ BUSINESS CREDIT,INDUSTRY 1 1.80% 0.38% CAN-VI05/CAN-WI05 CAN-XI07/CAN-XI08 BUSINESS CREDIT,INDUSTRY 2 1.85% 0.43% CAN-CF01/CAN-CF02/ STANDARD–INFINITE CREDIT 1.71% 0.29% CAN-DF01 CAN-CF07/CAN-CF08/ NON-CHIP ELECTRONIC–INFINITE CREDIT 1.61% 0.19% CAN-EF07/CAN-DF07 CAN-CF11/CAN-CF12 RECURRING PAYMENT–INFINITE CREDIT 1.56% 0.14% Infinite Card - Domestic CAN-CF21/CAN-CF22 INFINITE CREDIT PERFORMANCE INCENTIVE TIER 1 1.56% 0.14% CAN-CF23/CAN-CF24 INFINITE CREDIT -

First Quarter 2017 Report to Shareholders

First Quarter 2017 Report to Shareholders BMO Financial Group Reports Net Income of $1.5 Billion for First Quarter of 2017 Financial Results Highlights: First Quarter 2017 Compared with First Quarter 2016: 1 • Net income of $1,488 million, up 39%; adjusted net income of $1,530 million, up 30% • EPS2 of $2.22, up 40%; adjusted EPS1,2 of $2.28, up 30% 1 • ROE of 14.9%, compared with 10.9%; adjusted ROE of 15.3%, compared with 12.1% • Provisions for credit losses of $173 million, compared with $183 million • Common Equity Tier 1 Ratio of 11.1% Toronto, February 28, 2017 – For the first quarter ended January 31, 2017, BMO Financial Group reported net income of $1,488 million or $2.22 per share on a reported basis, and net income of $1,530 million or $2.28 per share on an adjusted basis. “BMO’s performance this quarter is strong and broad-based, we delivered adjusted earnings of $1.5 billion and adjusted earnings per share of $2.28,” said Bill Downe, Chief Executive Officer, BMO Financial Group. “The good momentum in the business is the consequence of a clear strategy and consistent execution, doing what we said we would do. Our roadmap is focused on providing customers with intuitive products and services that meet their evolving preferences, while improving efficiency in all of our channels. “Our commitment to the success of our customers and employees, and contributing to their communities, is also unwavering. It is the cornerstone of what we have built over 200 years since our founding; it is a commitment that continues to grow,” concluded Mr.