SAMENA Trends May 2020.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Morocco-Telecoms-Mobile-And-Broadband-Statistics- And-Analyses

Report Information More information from: https://www.wiseguyreports.com/reports/2463445-morocco-telecoms-mobile-and-broadband-statistics- and-analyses Morocco - Telecoms, Mobile and Broadband - Statistics and Analyses Report / Search Code: WGR2463445 Publish Date: 10 November, 2019 Price 1-user PDF : $ 1150.0 Site PDF : $ 3450.0 Enterprise PDF : $ 4600.0 Description: Morocco makes progress in expanding tele-medicine facilities Morocco has developed one of the most advanced telecommunications markets in Africa, supported by the government’s Maroc Digital 2020 strategy to encourage the development of a digital economy and on the National Broadband Plan which aims to provide fixed or mobile broadband access to the entire population by 2022. The part-privatised incumbent telco Maroc Telecom remains the dominant player in the fixed-line sector though has effective competition in the mobile sector. A key regional player, Orange Group, entered the market through the acquisition of a major stake in the telco Médi Telecom. Morocco’s fixed-line broadband market is dominated by Maroc Telecom. Despite regulatory efforts to enforce LLU and wholesale pricing there is little in the way of access to its networks and as a result the fixed-line broadband market has not developed to its potential. Nevertheless, a small number of operators, including Inwi and Orange Morocco, have begun to offer competing DSL services, albeit limited in reach. Despite these market limitations and Maroc Telecom’s near monopoly, Morocco has developed some of the lowest broadband prices and highest penetration rates in Africa. This has been helped by the excellent connectivity to international fibre cables. The introduction and extension of mobile broadband services has gone far to improving access nationally. -

Executive Summary

Executive summary For more information, visit: www.vodafone.com/investor Highlights Group highlights for the 2010 financial year Revenue Financial highlights ■ Total revenue of £44.5 billion, up 8.4%, with improving trends in most £44.5bn markets through the year. 8.4% growth ■ Adjusted operating profit of £11.5 billion, a 2.5% decrease in a recessionary environment. ■ Data revenue exceeded £4 billion for the first time and is now 10% Adjusted operating profit of service revenue. ■ £1 billion cost reduction programme delivered a year ahead of schedule; £11.5bn further £1 billion programme now underway. 2.5% decrease ■ Final dividend per share of 5.65 pence, resulting in a total for the year of 8.31 pence, up 7%. ■ Higher dividends supported by £7.2 billion of free cash flow, an increase Free cash flow of 26.5%. £7.2bn Operational highlights 26.5% growth ■ We are one of the world’s largest mobile communications companies by revenue with 341.1 million proportionate mobile customers, up 12.7% during the year. Proportionate mobile customers ■ Improved performance in emerging markets with increasing revenue market share in India, Turkey and South Africa during the year. ■ Expanded fixed broadband customer base to 5.6 million, up 1 million 341.1m during the year. 12.7% growth ■ Comprehensive smartphone range, including the iPhone, BlackBerry® Bold and Samsung H1. ■ Launch of Vodafone 360, a new internet service for the mobile and internet. ■ High speed mobile broadband network with peak speeds of up to 28.8 Mbps. Vodafone Group Plc Annual Report 2010 1 Sir John Bond Chairman Chairman’s statement Your Company continues to deliver strong cash generation, is well positioned to benefit from economic recovery and looks to the future with confidence. -

Bachelor Theses 1996 - 2020

Bachelor Theses 1996 - 2020 ID Title Name Surname Year Supervisor Pages Notes Year 2020 Are individual stock prices more efficient than Jānis Beikmanis 2020 SSE Riga Student Research market-wide prices? Evidence on the evolution of 2020 Tālis Putniņš 49 01 Papers 2020 : 3 (225) Samuelson’s Dictum Pauls Sīlis 2020 Assessment of the Current Practices in the Justs Patmalnieks 2020 Viesturs Sosars 50 02 Magnetic Latvia Business Incubator Programs Kristaps Volks 2020 Banking business model development in Latvia Janis Cirulis 2020 Dmitrijs Kravceno 36 03 between 2014 and 2018 2020 Betting Markets and Market Efficiency: Evidence Laurynas Janusonis 2020 Tarass Buka 55 04 from Latvian Higher Football League Andrius Radiul 2020 Building a Roadmap for Candidate Experience in Jelizaveta Lebedeva 2020 Inga Gleizdane 53 05 the Recruitment Process Madara Osīte Company financial performance after receiving Ernests Pulks 2020 non-banking financing: Evidence from the Baltic 2020 Anete Pajuste 44 06 market Patriks Simsons Emīls Saulītis 2020 Consumer behavior change due to the emergence 2020 Aivars Timofejevs 41 07 of the free-floating car-sharing services in Riga Vitolds Škutāns 2020 Content Marketing in Latvian Tech Startups Dana Zueva 2020 Aivars Timofejevs 64 08 Corporate Social Responsibility: An Analysis of Laura Ramza 2020 Companies’ CSR Activities Relationship with Their 2020 Anete Pajuste 48 09 Financial Performance in the Baltic States Santa Usenko 2020 Determinants of default probabilities: Evidence Illia Hryzhenku 2020 Kārlis Vilerts 40 10 from -

DICE Best Practice Guide.Pdf

BEST PRACTICE GUIDE Interactive Service, Frequency Social Business Migration, Policy & Platforms Acceptance Models Implementation Regulation & Business Opportunities BEST PRACTICE GUIDE FOREWORD As Lead Partner of DICE I am happy to present this We all want to reap the economic benefi ts of dig- best practice guide. Its contents are based on the ital convergence. The development and successful outputs of fi ve workgroups and countless discus- implementation of new services need extended sions in the course of the project and in conferences markets, however; markets which often have to be and workshops with the broad participation of in- larger than those of the individual member states. dustry representatives, broadcasters and political The sooner Europe moves towards digital switcho- institutions. ver the sooner the advantages of released spectrum can be realised. The DICE Project – Digital Innovation through Co- operation in Europe – is an interregional network We have to recognise that a pan-European telecom funded by the European Commission. INTERREG as and media industry is emerging. The search for an EU community initiative helps Europe’s regions economies of scale is driving the industry into busi- form partnerships to work together on common nesses outside their home country and to strategies projects. By sharing knowledge and experience, beyond their national market. these partnerships enable the regions involved to develop new solutions to economic, social and envi- It is therefore a pure necessity that regional political ronmental challenges. institutions look across the border and aim to learn from each other and develop a common under- DICE focuses on facilitating the exchange of experi- standing. -

Telia Company Law Enforcement Disclosure Report July to December 2017

Telia Company Law Enforcement Disclosure Report July-December 2017 TELIA COMPANY LAW ENFORCEMENT DISCLOSURE REPORT JULY TO DECEMBER 2017 Executive summary This is Telia Company’s eighth six-monthly Law Enforcement Disclosure Report. The report aims to offer detailed in- sights into the context and extent of surveillance and collection of, customer data in most of Telia Company’s main markets. It includes statistics on conventional requests in eight of our markets as well as information, as regards all of our markets, on legislation regarding ‘direct access’ and unconventional requests (‘major events’). A summarized version of this report is published in the Telia Company 2018 Annual and Sustainability Report available at annualreports.teliacompany.com. This full report includes more context, including such as information on main goals, definitions, challenges as well as omissions related to our reporting and a list of laws providing governments with direct access, and – added in this report - national laws on mandatory data retention for law enforcement purposes. 1 Telia Company Law Enforcement Disclosure Report July-December 2017 CONTENTS Letter from the general counsel ...................................................................................................................................... 3 About this report ............................................................................................................................................................. 4 What we report ........................................................................................................................................................... -

Stream Name Category Name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---TNT-SAT ---|EU| FRANCE TNTSAT TF1 SD |EU|

stream_name category_name Coronavirus (COVID-19) |EU| FRANCE TNTSAT ---------- TNT-SAT ---------- |EU| FRANCE TNTSAT TF1 SD |EU| FRANCE TNTSAT TF1 HD |EU| FRANCE TNTSAT TF1 FULL HD |EU| FRANCE TNTSAT TF1 FULL HD 1 |EU| FRANCE TNTSAT FRANCE 2 SD |EU| FRANCE TNTSAT FRANCE 2 HD |EU| FRANCE TNTSAT FRANCE 2 FULL HD |EU| FRANCE TNTSAT FRANCE 3 SD |EU| FRANCE TNTSAT FRANCE 3 HD |EU| FRANCE TNTSAT FRANCE 3 FULL HD |EU| FRANCE TNTSAT FRANCE 4 SD |EU| FRANCE TNTSAT FRANCE 4 HD |EU| FRANCE TNTSAT FRANCE 4 FULL HD |EU| FRANCE TNTSAT FRANCE 5 SD |EU| FRANCE TNTSAT FRANCE 5 HD |EU| FRANCE TNTSAT FRANCE 5 FULL HD |EU| FRANCE TNTSAT FRANCE O SD |EU| FRANCE TNTSAT FRANCE O HD |EU| FRANCE TNTSAT FRANCE O FULL HD |EU| FRANCE TNTSAT M6 SD |EU| FRANCE TNTSAT M6 HD |EU| FRANCE TNTSAT M6 FHD |EU| FRANCE TNTSAT PARIS PREMIERE |EU| FRANCE TNTSAT PARIS PREMIERE FULL HD |EU| FRANCE TNTSAT TMC SD |EU| FRANCE TNTSAT TMC HD |EU| FRANCE TNTSAT TMC FULL HD |EU| FRANCE TNTSAT TMC 1 FULL HD |EU| FRANCE TNTSAT 6TER SD |EU| FRANCE TNTSAT 6TER HD |EU| FRANCE TNTSAT 6TER FULL HD |EU| FRANCE TNTSAT CHERIE 25 SD |EU| FRANCE TNTSAT CHERIE 25 |EU| FRANCE TNTSAT CHERIE 25 FULL HD |EU| FRANCE TNTSAT ARTE SD |EU| FRANCE TNTSAT ARTE FR |EU| FRANCE TNTSAT RMC STORY |EU| FRANCE TNTSAT RMC STORY SD |EU| FRANCE TNTSAT ---------- Information ---------- |EU| FRANCE TNTSAT TV5 |EU| FRANCE TNTSAT TV5 MONDE FBS HD |EU| FRANCE TNTSAT CNEWS SD |EU| FRANCE TNTSAT CNEWS |EU| FRANCE TNTSAT CNEWS HD |EU| FRANCE TNTSAT France 24 |EU| FRANCE TNTSAT FRANCE INFO SD |EU| FRANCE TNTSAT FRANCE INFO HD -

Katso Televisiota, Maksukanavia Ja Makuunin Vuokravideoita 4/2017 Missä Ja Millä Vain

KATSO TELEVISIOTA, MAKSUKANAVIA JA MAKUUNIN VUOKRAVIDEOITA 4/2017 MISSÄ JA MILLÄ VAIN. WATSON TOIMII TIETOKONEELLA, TABLETISSA JA ÄLYPUHELIMESSA SEKÄ TV-TIKUN TAI WATSON-BOKSIN KANSSA TELEVISIOSSA. WATSON-PERUSPALVELUN KANAVAT 1 Yle TV1 12 FOX WATSONISSA 2 Yle TV2 13 AVA MYÖS 3 MTV3 14 Hero 4 Nelonen 16 Frii MAKUUNIN 5 Yle Fem / SVT World 18 TLC UUTUUSLEFFAT! 6 Sub 20 National Geographic 7 Yle Teema Channel 8 Liv 31 Yle TV1 HD 9 JIM 32 Yle TV2 HD Powered by 10 TV5 35 Yle Fem HD 11 KUTONEN 37 Yle Teema HD Live-tv-katselu. Ohjelma/ohjelmasarjakohtainen tallennus. Live-tv-katselu tv-tikun tai Watson-boksin kautta. Ohjelma/ohjelmasarjakohtainen tallennus. Live-tv-katselu Watson-boksin kautta. Ohjelma/ohjelmasarjakohtainen tallennus. Vain live-tv-katselu Watson-boksin kautta. Vain live-tv-katselu. KANAVAPAKETTI €/KK, KANAVAPAIKKA, KANAVA Next 21 Discovery Channel C 60 C More First Sports 121 Eurosport 1 HD *1 0,00 € 22 Eurosport 1 C 61 C More First HD 8,90 € 122 Eurosport 2 HD 23 MTV C 62 C More Series 123 Eurosport 2 24 Travel Channel C 63 C More Series HD 159 Fuel TV HD 25 Euronews C 64 C More Stars 160 Motors TV HD 27 TV7 C 66 C More Hits 163 Extreme Sports HD Start 33 MTV3 HD *1 C 67 SF Kanalen 200 Nautical Channel 0,00 € C 75 C More Juniori Base 126 MTV Live HD *1 C More Sport S Pakettiin sisältyy oheisella 8,90 € 150 VH1 Swedish 40 SVT1 4,30 € 41 SVT2 24,95 € tunnuksella merkityt 151 Nick Jr. -

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C

Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 In the Matter of ) ) Telia Company AB, Transferor ) WC Docket No. 20-___ ) Telia Carrier U.S. Inc., Licensee ) ) and Oura BidCo US, Inc., Transferee ) ITC-T/C-2020-_____ ) Joint Application for Consent to Transfer ) Control of International and Domestic Authority ) Pursuant to Section 214 of the ) Communications Act of 1934, as Amended ) JOINT APPLICATION FOR CONSENT TO TRANSFER CONTROL OF DOMESTIC AND INTERNATIONAL AUTHORITY PURSUANT TO SECTION 214 OF THE COMMUNICATIONS ACT OF 1934, AS AMENDED Pursuant to Section 214 of the Communications Act of 1934, as amended, ("the Act"), 47 U.S.C. § 214, and Sections 63.04 and 63.24 of the Commission's rules, 47 C.F.R. §§ 63.04 and 63.24, Telia Company AB (“Transferor” or “Telia Company”), Telia Carrier U.S. Inc. (“Licensee” or “Telia Carrier”), and Oura BidCo US, Inc. (“Transferee” or “BidCo US”) hereby request Commission consent to the transfer of control of domestic and international Section 214 authority held by Telia Carrier from Telia Company to Oura BidCo US, Inc., which is an indirect wholly owned U.S. subsidiary of Polhem Infra KB.1 This Joint Application is being filed simultaneously with the Wireline Competition Bureau and the International Bureau. I. Description of the Applicants A. Transferor and Licensee 1 Transferor, Licensee and Transferee may be collectively referred to as the “Applicants” herein. Licensee Telia Carrier has operated in the U.S. since 1996 and operates a nationwide fiber-optic communications network. Licensee historically has provided carrier-grade or “wholesale” services to carriers, content providers, operators and enterprises and offers a range of information services and telecommunications services. -

Power, Communication, and Politics in the Nordic Countries

POWER, COMMUNICATION, AND POLITICS IN THE NORDIC COUNTRIES POWER, COMMUNICATION, POWER, COMMUNICATION, AND POLITICS IN THE NORDIC COUNTRIES The Nordic countries are stable democracies with solid infrastructures for political dia- logue and negotiations. However, both the “Nordic model” and Nordic media systems are under pressure as the conditions for political communication change – not least due to weakened political parties and the widespread use of digital communication media. In this anthology, the similarities and differences in political communication across the Nordic countries are studied. Traditional corporatist mechanisms in the Nordic countries are increasingly challenged by professionals, such as lobbyists, a development that has consequences for the processes and forms of political communication. Populist polit- ical parties have increased their media presence and political influence, whereas the news media have lost readers, viewers, listeners, and advertisers. These developments influence societal power relations and restructure the ways in which political actors • Edited by: Eli Skogerbø, Øyvind Ihlen, Nete Nørgaard Kristensen, & Lars Nord • Edited by: Eli Skogerbø, Øyvind Ihlen, Nete Nørgaard communicate about political issues. This book is a key reference for all who are interested in current trends and develop- ments in the Nordic countries. The editors, Eli Skogerbø, Øyvind Ihlen, Nete Nørgaard Kristensen, and Lars Nord, have published extensively on political communication, and the authors are all scholars based in the Nordic countries with specialist knowledge in their fields. Power, Communication, and Politics in the Nordic Nordicom is a centre for Nordic media research at the University of Gothenburg, Nordicomsupported is a bycentre the Nordic for CouncilNordic of mediaMinisters. research at the University of Gothenburg, supported by the Nordic Council of Ministers. -

Fibre Towards a Gigabit Society Report

Fibre towards a Gigabit society June 2020 Economic & Financial Analysis Credit Research and Strategy 22 June 2020 Telecoms T Fibre towards a Gigabit society Coverage diverges significantly in Europe Fixed networks have gained significant importance during the outbreak of Covid- 19. Fixed data usage surged by up to 80%, as a result of people working from home and increased demand for home entertainment. We believe that one of the effects from Covid-19 is that many companies will adopt best practices learned during the lockdown period and that these will be structurally incorporated in their business models. This includes working more from home. Therefore, we expect there will be more demand for higher network speeds. Fibre-to-the-home (FTTH) networks will become increasingly important in a Gigabit society, but there is still a large divergence in coverage among European countries and operators need to invest significantly to make their networks future-proof. Telecom companies are increasingly focusing on FTTH and cable operators are upgrading their networks to Docsis3.1 in order to be able to offer 1Gbps broadband download speeds in the future. FTTH passive and active technologies are also able to support the back-haul and front-haul telecom networks more efficiently when rolling out 5G. A fibre network is a long-term investment, with an anticipated lifetime of at least 25 years. Furthermore, quality infrastructure and higher download speeds are an important element in the convergence strategies of providers as consumer experience is key. In Europe, there is still a big divergence in FTTH coverage among the countries. -

Se Bilaga 1 Tillstånd Att Sända Tv Och Sökbar Text-Tv

1/13 Dnr 19/02700 m.fl. BESLUT 2020-02-18 PARTER Se bilaga 1 SAKEN Tillstånd att sända tv och sökbar text-tv __________________ BESLUT Ansökningar om tillstånd som beviljas Myndigheten för press, radio och tv beviljar tillstånd att sända tv och sökbar text-tv för de programtjänster som anges i uppställningen nedan. Förutsättningarna för sändningarna framgår av respektive programtjänsts villkorsbilaga. De anmälda beteckningarna för programtjänster som omfattas av svensk jurisdiktion godkänns. För övriga programtjänster registreras beteckningen. Programtjänstens beteckning Villkors- Dnr Tillståndshavare Inom parentes anges bilaga sändningskvalitet 19/03283 Al Jazeera Media Network Al Jazeera English (sd) tv2020:1 19/03201 Axess Publishing AB Axess (sd) tv2020:2 19/03204 BBC Studios Distribution Ltd BBC Earth (sd) tv2020:3 19/03209 BBC Global News Ltd BBC World News (sd) tv2020:4 19/03237 C More Entertainment AB C More First (sd) tv2020:5 19/03241 C More Entertainment AB C More Fotboll & Stars HD (hd) tv2020:6 19/03242 C More Entertainment AB C More Golf & SF-kanalen (sd) tv2020:7 19/03240 C More Entertainment AB C More Hockey & Hits (sd) tv2020:8 19/03243 C More Entertainment AB C More Live (sd) tv2020:9 19/03238 C More Entertainment AB C More Series (sd) tv2020:10 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | -

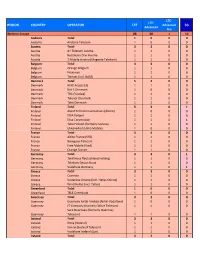

Prepared for Upload GCD Wls Networks

LTE‐ LTE‐ REGION COUNTRY OPERATOR LTE Advanced 5G Advanced Pro Western Europe 88 68 1 10 Andorra Total 10 0 0 Andorra Andorra Telecom 10 0 0 Austria Total 33 0 0 Austria A1 Telekom Austria 11 0 0 Austria Hutchison Drei Austria 11 0 0 Austria T‐Mobile Austria (Magenta Telekom) 11 0 0 Belgium Total 33 0 0 Belgium Orange Belgium 11 0 0 Belgium Proximus 11 0 0 Belgium Telenet (incl. BASE) 11 0 0 Denmark Total 54 0 0 Denmark Hi3G Access (3) 11 0 0 Denmark Net 1 Denmark 10 0 0 Denmark TDC (YouSee) 11 0 0 Denmark Telenor Denmark 11 0 0 Denmark Telia Denmark 11 0 0 Finland Total 53 0 1 Finland Aland Telecommunications (Alcom) 10 0 0 Finland DNA Finland 11 0 0 Finland Elisa Corporation 11 0 1 Finland Telia Finland (formerly Sonera) 11 0 0 Finland Ukkoverkot (Ukko Mobile) 10 0 0 France Total 44 0 0 France Altice France (SFR) 11 0 0 France Bouygues Telecom 11 0 0 France Free Mobile (Iliad) 11 0 0 France Orange France 11 0 0 Germany Total 33 0 1 Germany Telefonica Deutschland Holding 11 0 0 Germany Telekom Deutschland 11 0 0 Germany Vodafone Germany 11 0 1 Greece Total 33 0 0 Greece Cosmote 11 0 0 Greece Vodafone Greece (incl. Hellas Online) 11 0 0 Greece Wind Hellas (incl. Tellas) 11 0 0 Greenland Total 10 0 0 Greenland TELE Greenland 10 0 0 Guernsey Total 32 0 0 Guernsey Guernsey Airtel Limited (Airtel‐Vodafone) 10 0 0 Guernsey JT Guernsey (formerly Wave Telecom) 11 0 0 Sure Guernsey (formerly Guernsey Guernsey Telecom) 11 0 0 Iceland Total 33 0 0 Iceland Nova (Iceland) 11 0 0 Iceland Siminn (Iceland Telecom) 11 0 0 Iceland Vodafone Iceland (Syn)