Regulatory Framework on Non-Bank Merchant

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Payment Processing European Acquiring

Payment Processing European Acquiring: Merchant Operating Guide Version 2.1 Latest Update 19-01-18 Paysafe Holdings UK Limited Page 1 <Document Name> Version <1.0> Paysafe Group Plc Date dd.mm.yyyy CONTENTS IMPORTANT INFORMATION ............................................................................. 3 PURPOSE OF THIS GUIDE .................................................................................. 3 CNP TRANSACTION (CARD NOT PRESENT (CNP) – E-COMMERCE, MAIL AND TELEPHONE ORDER ................................................................................................ 3 3D SECURE .................................................................................................................................................. 4 CARD SECURITY CODE (CSC)/ CARD VERIFICATION VALUE (CVC) AND ADDRESS ................................................. 4 NEGATIVE LIST .............................................................................................................................................. 5 ORDER VELOCITY MONITORING ....................................................................................................................... 5 IP ADDRESS AND BLOCK LISTS .......................................................................................................................... 5 FURTHER ADVICE ........................................................................................................................................... 7 SHIPPING GOODS AND PROVIDING SERVICES ....................................................................................................... -

Merchant Integration Guide

PAYFORT Merchant Integration Guide Document Version: 10.0 July, 2019 PayFort PayFort Merchant Integration Guide Copyright Statement All rights reserved. No part of this document may be reproduced in any form or by any means or used to make any derivative such as translation, transformation, or adaptation without the prior written permission from PayFort Corporation. Trademark 2014-2019 PayFort ©, all rights reserved. Contents are subject to change without prior notice. Contact Us [email protected] www.PayFort.com 2014-2019 PayFort ©, all rights reserved 2 PayFort PayFort Merchant Integration Guide Contents 1. FORT in a Glimpse .......................................................................................................................... 11 2. About this Document ........................................................................................................................ 12 2.1 Intended Audience .................................................................................................................... 12 3. Request/ Response Value Type ....................................................................................................... 13 4. Before Starting the Integration with FORT........................................................................................ 14 5. Redirection ....................................................................................................................................... 15 Authorization/ Purchase URLs ................................................................................................. -

Terminal Payment Services

Terminal Payment Services www.netpay.co.uk/bookerintelligent payments www.netpay.co.uk Terminal Payment Services Terminal payment services, also commonly referred to as CHP or Cardholder Present, are those that provide the capability for a purchase to be made on a payment terminal with the card holder present, it is also possible to take payments over the telephone or by mail order (MOTO) subject to a suitable setup of the merchant account. It is important to remember, as with any payment service, that there are 2 aspects involved in terminal payments, these are; Processing - This is the part of the transaction that gets the customer making the purchase routed through to the acquiring bank. Simply, the software which sits on the terminal enabling payment options to be securely routed to the acquiring bank. Acquisition - This is simply the banking aspect of the payments service. When the payment service provider processes the transaction, it is passed through to an acquiring bank for the credit or debit card transaction to be processed. This process is essentially no different to an online transaction replacing the software application for a physical terminal to deliver the capability to process a card transaction and deliver it to the acquiring bank. It is important to note that CHP & CNP services require 2 separate merchant ID’s and need to be set up with the acquirer accordingly. Additional merchant ID’s will be required for other card schemes such as AMEX. NetPay also offers an additional service on selected terminals, namely Mobile Top-up (MTU). This is the service that enables merchants to process mobile phone top-ups via their terminal to a large number of mobile networks. -

Myths and Facts

Interchange Myths and Facts Myth: Interchange fees are a “hidden tax” on consumers. FACT: Interchange fees are neither hidden nor a tax, and are not paid by consumers. An interchange fee is a small fee paid by a merchant’s acquiring bank to a cardholder’s issuing bank as part of an electronic payment card transaction. Interchange facilitates the global electronic payments system and serves as a critical tool to balance the benefits and costs of that system among its participants. This fee allows merchants to enjoy all the benefits they seek from card acceptance, including security, guaranteed payment, fraud protection and speed of service. Each merchant is able to negotiate its own card acceptance costs with its acquiring bank, and similarly, the merchant’s bank and card-issuing bank are also able to bilaterally negotiate their fees. To overcome the inefficiency of thousands of separate negotiations, however, MasterCard sets “default” interchange rates that may be used in the absence of separately negotiated arrangements. MasterCard publicly discloses all of its interchange rates on its website, and merchants are free to disclose these fees to their customers. For further information, please visit www.mastercardmerchant.com. Myth: Reducing and capping interchange will benefit consumers, so enacting the Durbin Amendment is a positive development. FACT: For more than four decades, interchange has been set to balance the costs, risks and rewards of electronic payments for cardholders, merchants and issuing banks. Even prior to the price caps enacted by the Durbin Amendment’s implementation, consumers saw the unintended negative impact as banks anticipated regulations by limiting cardholder benefits and raising fees. -

Glossary of Payment and Information Security Terms

PAYMENT CARD INDUSTRY SECURITY STANDARDS COUNCIL Glossary of Payment and Information Security Terms DATA SECURITY ESSENTIALS FOR SMALL MERCHANTS A PRODUCT OF THE PAYMENT CARD INDUSTRY SMALL MERCHANT TASK FORCE VERSION 2.0 | AUGUST 2018 Introduction This Glossary of Payment and Information Security Terms is a supplement to the Guide to Safe Payments, part of the Data Security Essentials for Small Merchants. Its intent is to explain relevant Payment Card Industry (PCI) and information security terms in easy-to-understand language. Definitions for terms marked with an asterisk (*) are based on or derived from definitions in the Payment Card Industry (PCI) Data Security Standard (DSS) and Payment Application Data Security Standard (PA-DSS): Glossary of Terms, Abbreviations, and Acronyms. The latest version of this glossary is considered the authoritative source, and must be referred to for the current and complete PCI DSS and PA-DSS definitions. Please refer to the Data Security Essentials for Small Merchants at the following: RESOURCE URL Guide to Safe Payments https://www.pcisecuritystandards.org/pdfs/Small_ Merchant_Guide_to_Safe_Payments.pdf Common Payment Systems https://www.pcisecuritystandards.org/pdfs/Small_ Merchant_Common_Payment_Systems.pdf Questions to Ask Your Vendors https://www.pcisecuritystandards.org/pdfs/Small_ Merchant_Questions_To_Ask_Your_Vendors.pdf Evaluation Tool https://www.pcisecuritystandards.org/merchants/ This tool is provided for merchant information only. An option for merchants is to use it as a first step to gain insight about security practices relevant to the way they accept payments, to provide their initial responses, and to see their results. Data Security Essentials for Small Merchants: Glossary of Payment and Information Security Terms | August 2018 Copyright 2018 PCI Security Standards Council, LLC. -

The Chargeback Process

THE CHARGEBACK PROCESS Below are answers to some of the most commonly asked questions about chargebacks. If you don’t see the answer to your question, let us know at [email protected] or call our support line at (800) 405-4818. WHAT IS A CHARGEBACK? To understand the chargeback process, we first need to understand what a chargeback is. In simplest terms, a chargeback is a disputed charge made using a credit card. The cardholder (that’s the person whose credit card we’re talking about) is basically saying, “There’s a charge on my credit card and I’m not taking responsibility for it for [xyz] reason.” The chargeback process is the process by which all the many parties involved – yes, there’s a few – investigate and figure out whether a charge is valid or not. WHO ARE THE PARTIES INVOLVED? In any credit card transaction, there’s going to be several parties involved. We can start with the cardholder and the bank where he or she holds an account. The cardholder’s bank is called the issuing bank. That’s the one side of a credit card transaction. On the other side of a transaction, you have the merchant; this is usually a business where the transaction was made. Like the cardholder, the merchant is also going to have a bank; the merchant’s bank is the acquiring bank. Time to go another level deeper. Let’s talk about the card networks. Visa, Mastercard, American Express are all card brands, or card networks, that you probably recognize. -

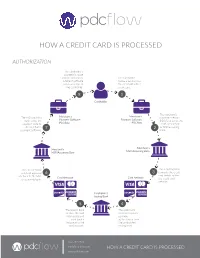

How a Credit Card Is Processed

HOW A CREDIT CARD IS PROCESSED AUTHORIZATION The cardholder’s payment is made and the merchant’s The cardholder payment software makes a payment to sends a receipt to the merchant with a the cardholder. credit card. 8 1 Cardholder The merchant’s The MSP/aquiring Merchant’s Merchant’s payment software bank sends the Payment Software Payment Software (PDCflow) sends the approval code to PDCflow PDCflow credit card details the merchant’s 7 2 to MSP/acquiring payment software. bank. Merchant’s Merchant’s MSP/Acquiring Bank MSP/Acquiring Bank The card network The acquiring bank sends an approval 6 3 forwards the credit code back to the MSP card details to the Card Network Card Network or acquiring bank. the credit card network. Cardholder’s Issuing Bank 5 4 The issuing bank The credit card verifies the card network requests information and payment send back a authorization from response to the the cardholder’s card network. issuing bank. 877.732.4814 [email protected] HOW A CREDIT CARD IS PROCESSED www.pdcflow.com BATCHING & FUNDING The merchant’s payment software The msp/acquiring sends the batch of all bank transmit the The credit card network approved batch to the sends each approved transactions to the appropriate card transaction to the msp/acquiring bank. networks. appropriate issuing bank. 1 2 3 Merchant’s Payment Software Merchant’s MSP/Acquiring Bank Card Network Cardholder’s Issuing Bank (PDCflow) 6 5 4 The msp/acquiring bank The card network routes The issuing bank transfers deposits the funds into the the funds to the the funds to the merchants bank account msp/acquiring bank. -

Payments Industry Report

10 Nov 2018 Sections in this report: Total Addressable Market Why Does Cash Persist? Payments Industry Report Value Chain Introduction to the payments Global consumers are increasingly paying for goods Drivers with non-cash/cheque electronic methods such as mobile wallets, credit cards, carrier billing and direct 1: E-commerce transfers. What exactly goes on when a consumer pays 2a: Europe electronically? Six parties are usually involved: card 2b: Emerging Markets issuers, card processors, networks, merchant processors, and point-of-sale terminal providers. To 3: Low-Cost Merchant Acceptance understand how they interact, consider buying a coffee 4: Financial Inclusion from a neighbourhood coffee shop. 5: B2B When I pay with my card, I tap it on a point-of-sale terminal, provided by Worldpay, or Square. The transaction is first processed by the coffee shop’s bank, Moats i.e. the merchant acquiring bank, before being sent 1: Network effects through the payments network, such as Visa’s VisaNet. 2: Brand preference Visa checks for fraud, and then checks with my card issuer, or issuing bank, Bank of America, whether I 3: Technology have the funds required. It might extend me a credit loan. If I am paying with debit, Bank of America puts the money on hold, and the authorisation is relayed Regulation back to the merchant acquirer via the network again. The acquirer sends the approval to the coffee shop and the barista lets me know that payment has gone Technology and Disruption through, a few seconds after the first tap. Some time after I leave the coffee shop, payments are then cleared: they are batched and processed by the payments network, who sends a global consolidated Portfolio Managers statement to all issuers. -

Credit Card Schemes in Australia

Submission to the Reserve Bank of Australia Credit Card Schemes in Australia By The Australian Retailers Association CONFIDENTIAL H.2 CONFIDENTIAL Interchange Fees & Access Prepared with the assistance of TransAction Resources Pty Ltd Australian Retailers Association 2 H.2 CONFIDENTIAL Interchange Fees & Access Contents Executive Summary .................................................................................................. 4 1. Introduction ........................................................................................................... 5 1.1 Confidentiality .................................................................................................. 5 1.2 The Australian Retailers Association................................................................ 5 2. Objectives ............................................................................................................. 5 3. Credit Cards.......................................................................................................... 6 3.1 Interchange Relevance .................................................................................... 6 3.2 Interchange Cost Justification .......................................................................... 7 3.3 Five Party Credit Card Schemes.................................................................... 12 3.4 Interchange & Merchant Relationships........................................................... 13 3.5 Interchange Fixing Methodology ................................................................... -

Digital Merchant Acquiring Futuristic Digital Payment Solution Table of Contents

WHITE PAPER Digital Merchant Acquiring futuristic digital payment solution Table of Contents Executive summary How a traditional process poses problems Smart solution and business flow Benefits EVRY’s offerings Introducing a rapid evolution to payments Adoption of QR codes for transactions Simpler way to transfer funds Card Interchange Network v/s Digital Interchange Network Traditional landscape and digital landscape Conclusion About EVRY and EVRY’s BFS offerings DIGITAL MERCHANT ACQUIRING - WHITE PAPER Executive Summary Over the past few decades, plastic money has been facilitating Merchant Acquirer business between merchants and customers. The collaboration between card organizations and terminal operators is enabling transaction acquiring to develop into a prominent business among the financial institutions acting as merchant banks (acquirers) and customer banks (issuers). Card In this equation, to exchange the card information among various holder financial stakeholders, issuers and acquirers have to share reasona- ble revenue with card organizations in conducting this business. Card organizations charge a certain percentage of amount for every transaction. These factors have made card organizations a monopolized segment today. Issuer Card network In addition to these overheads, neither the acquirer nor the merchant is benefiting, owing to huge maintenance costs within With an aim to generate measurable business impact, Digital the transaction processing landscape. It further leads to delayed Acquiring using digital QR code interchange network can make financial settlements with merchants. All these factors result in high a substantial difference. It can reduce the number of stakeholders transaction fees for merchants. in the business chain, which in-turn generates big revenue. The digital acquiring solution also features new techniques that help The present day’s digital world brings across various smart transa- in achieving direct business transaction between merchants ction acquiring solutions like NFC payments, fingerprint payments, and customers. -

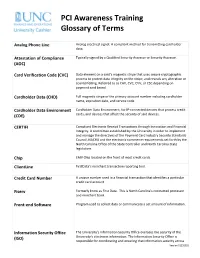

PCI Awareness Training Glossary of Terms

PCI Awareness Training Glossary of Terms Analog Phone Line Analog electrical signal; A compliant method for transmitting cardholder data. Attestation of Compliance Typically signed by a Qualified Security Assessor or Security Assessor. (AOC) Card Verification Code (CVC) Data element on a card's magnetic stripe that uses secure cryptographic process to protect data integrity on the stripe, and reveals any alteration or counterfeiting. Referred to as CAV, CVC, CVV, or CSC depending on payment card brand. Cardholder Data (CHD) Full magnetic stripe or the primary account number including cardholder name, expiration date, and service code. Cardholder Data Environment Cardholder Data Environment, for IP-connected devices that process credit (CDE) cards, and devices that affect the security of said devices. CERTIFI Compliant Electronic Receipt Transactions through Innovation and Financial Integrity. A committee established by the University in order to implement and manage the directives of the Payment Card Industry Security Standards Council, NACHA and the electronic commerce requirements set forth by the North Carolina Office of the State Controller and North Carolina State legislature. EMV Chip located on the front of most credit cards. Chip ClientLine FirstData’s merchant transaction reporting tool. Credit Card Number A unique number used in a financial transaction that identifies a particular credit card account. Fiserv Formerly know as First Data. This is North Carolina's contracted processor and merchant bank. Front-end Software Program used to collect data or communicate a set amount of information. Information Security Office The University’s Information Security Office oversees the security of the University’s electronic information. The Information Security Office is (ISO) responsible for coordinating and ensuring that information security across Version 01292020 PCI Awareness Training Glossary of Terms the University is consistent with industry best practices and the University’s compliance obligations. -

Konkurrenceforholdene På Betalingskortmarkedet 2002

Konkurrenceforholdene på betalingskortmarkedet 2002 2002 2 Konkurrenceforholdene på betalingskortmarkedet 2002 1 RESUME OG VURDERING ………. .............................................................................10 1.1 INDLEDNING......................................................................................................................... 10 1.2 STATUS FOR DE 4 FORUDSÆTNINGER............................................................................... 10 1.3 ANDRE BARRIERER FOR KONKURRENCE ............................................................................ 15 1.4 GENEREL KONKURRENCEVURDERING................................................................................. 17 1.5 KAN PENGEINSTITUTTERNE FÅ GEBYRINDTÆGTER AF DETAILHANDELEN VED EN FASTHOLDELSE AF § 14 ?.............................................................................................................. 20 1.6. CHIP ......................................................................................................................................... 20 1.7 FORHOLDENE I ANDRE LANDE .............................................................................................. 23 1.8 REGULERING I ANDRE LANDE ............................................................................................... 25 1.9 KONKLUSION........................................................................................................................... 26 2 HVORDAN FUNGERER B ETALINGSKORT?..........................................................28 2.1 RAPPORTENS