Conservative Battleline 2009 Jan-Dec

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

PERFORMED IDENTITIES: HEAVY METAL MUSICIANS BETWEEN 1984 and 1991 Bradley C. Klypchak a Dissertation Submitted to the Graduate

PERFORMED IDENTITIES: HEAVY METAL MUSICIANS BETWEEN 1984 AND 1991 Bradley C. Klypchak A Dissertation Submitted to the Graduate College of Bowling Green State University in partial fulfillment of the requirements for the degree of DOCTOR OF PHILOSOPHY May 2007 Committee: Dr. Jeffrey A. Brown, Advisor Dr. John Makay Graduate Faculty Representative Dr. Ron E. Shields Dr. Don McQuarie © 2007 Bradley C. Klypchak All Rights Reserved iii ABSTRACT Dr. Jeffrey A. Brown, Advisor Between 1984 and 1991, heavy metal became one of the most publicly popular and commercially successful rock music subgenres. The focus of this dissertation is to explore the following research questions: How did the subculture of heavy metal music between 1984 and 1991 evolve and what meanings can be derived from this ongoing process? How did the contextual circumstances surrounding heavy metal music during this period impact the performative choices exhibited by artists, and from a position of retrospection, what lasting significance does this particular era of heavy metal merit today? A textual analysis of metal- related materials fostered the development of themes relating to the selective choices made and performances enacted by metal artists. These themes were then considered in terms of gender, sexuality, race, and age constructions as well as the ongoing negotiations of the metal artist within multiple performative realms. Occurring at the juncture of art and commerce, heavy metal music is a purposeful construction. Metal musicians made performative choices for serving particular aims, be it fame, wealth, or art. These same individuals worked within a greater system of influence. Metal bands were the contracted employees of record labels whose own corporate aims needed to be recognized. -

For the Year Ended December 31, 2010 (Ninety-First Edition)

State of Delaware Office of the State Bank Commissioner Annual Report For the Year Ended December 31, 2010 (Ninety-first Edition) Robert A. Glen Commissioner The Honorable Jack A. Markell Governor of the State of Delaware Tatnall Building Dover, Delaware 19901 Dear Governor Markell: I have the honor of presenting the 91st Annual Report of the State Bank Commissioner for the year ending December 31, 2010. This annual report includes the highlights for 2010, and an overview of our work in maintaining a strong financial services industry and protecting consumers. Detailed financial information about Delaware banks, trust companies, and building and loan associations is included in this report, together with tables, charts and graphs that show the strength of the banking industry in our State. The report also includes information regarding the non-bank businesses and individuals we license to provide financial services to consumers in Delaware. Respectfully submitted, Robert A. Glen State Bank Commissioner TABLE OF CONTENTS Page Year 2010 Highlights 1 Overview of the Office of the State Bank Commissioner Approving Bank and Trust Company Applications 2 Examining Financial Institutions 2 Administering the Bank Franchise Tax 3 Licensing Non-Depository Institutions 3 Licensing Individual Mortgage Loan Originators 4 Responding to Consumer Questions and Complaints 4 Providing Consumer Education 4 The State Banking Code and Regulations The State Banking Code 5 State Bank Commissioner Regulations 5 Organizational Chart 6 State Bank Commissioners 7 Council on Banking 8 Banks, Trust Companies, and Building and Loan Associations Bank and Trust Company Changes 9 Number of Type of Institutions 2009 vs. 2010 11 Assets and Income 2006 – 2010 12 Assets 2006-2010 13 Income 2006-2010 14 Delaware Bank Employees 1987 – 2010 15 Bank Franchise Tax Collections by Fiscal Year 16 List of Institutions 17 Financial Statements of Institutions 20 Edge Act Corporations Located in Delaware 104 Licensed Non-Depository Financial Institutions Number of Non-Depository Institutions 2009 vs. -

Obama's Insurrection

Preface to Matthew Vadum’s Obama’s Insurrection By David Horowitz It is not the proper role of an opposition party in a democracy to mount a “resistance” to a duly elected government and press for its overthrow at the very outset of its tenure. But that is precisely what the Democrats have done in the first months of the Trump administration. For the second time in its history, the Democratic Party has opted to secede from the Union and its social contract. This time there is not going to be an actual civil war because the federal government is now so powerful that whoever controls it will decide the outcome. The passions of an irreconcilable conflict are still present but they are channeled into a political confrontation over the executive power. In launching their resistance, Democrats rejected the honeymoon normally afforded 1 to incoming presidents. Until now this tradition has functioned as something of a sacred political rite. Campaigns are by their nature divisive, and they inevitably exaggerate the differences between factions of the electorate. The presidential honeymoon is designed to reunite the contending factions as constituents of a shared constitutional republic. It allows an incoming president to take his place as the chief executive of all the people, to have his cabinet confirmed, and to launch his agendas before the normal contentions of a democracy resume. It ratifies the peaceful transition of power and reasserts the principle that as Americans we are one. According to the Gallup organization, the normal duration of a presidential honeymoon in recent times has been seven months. -

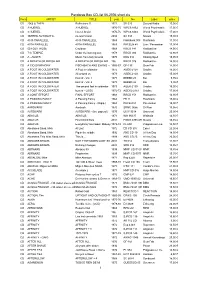

Pandoras Box CD-List 06-2006 Short

Pandoras Box CD-list 06-2006 short.xls Form ARTIST TITLE year No Label price CD 2066 & THEN Reflections !! 1971 SB 025 Second Battle 15,00 € CD 3 HUEREL 3 HUEREL 1970-75 WPC6 8462 World Psychedelic 17,00 € CD 3 HUEREL Huerel Arisivi 1970-75 WPC6 8463 World Psychedelic 17,00 € CD 3SPEED AUTOMATIC no man's land 2004 SA 333 Nasoni 15,00 € CD 49 th PARALLELL 49 th PARALLELL 1969 Flashback 008 Flashback 11,90 € CD 49TH PARALLEL 49TH PARALLEL 1969 PACELN 48 Lion / Pacemaker 17,90 € CD 50 FOOT HOSE Cauldron 1968 RRCD 141 Radioactive 14,90 € CD 7 th TEMPLE Under the burning sun 1978 RRCD 084 Radioactive 14,90 € CD A - AUSTR Music from holy Ground 1970 KSG 014 Kissing Spell 19,95 € CD A BREATH OF FRESH AIR A BREATH OF FRESH AIR 196 RRCD 076 Radioactive 14,90 € CD A CID SYMPHONY FISCHBACH AND EWING - (21966CD) -67 GF-135 Gear Fab 14,90 € CD A FOOT IN COLDWATER A Foot in coldwater 1972 AGEK-2158 Unidisc 15,00 € CD A FOOT IN COLDWATER All around us 1973 AGEK-2160 Unidisc 15,00 € CD A FOOT IN COLDWATER best of - Vol. 1 1973 BEBBD 25 Bei 9,95 € CD A FOOT IN COLDWATER best of - Vol. 2 1973 BEBBD 26 Bei 9,95 € CD A FOOT IN COLDWATER The second foot in coldwater 1973 AGEK-2159 Unidisc 15,00 € CD A FOOT IN COLDWATER best of - (2CD) 1972-73 AGEK2-2161 Unidisc 17,90 € CD A JOINT EFFORT FINAL EFFORT 1968 RRCD 153 Radioactive 14,90 € CD A PASSING FANCY A Passing Fancy 1968 FB 11 Flashback 15,00 € CD A PASSING FANCY A Passing Fancy - (Digip.) 1968 PACE-034 Pacemaker 15,90 € CD AARDVARK Aardvark 1970 SRMC 0056 Si-Wan 19,95 € CD AARDVARK AARDVARK - (lim. -

Examining Turnover in the New York State Legislature: 2009-2010 Update," Feb 2011

A Report of Citizens Union of the City of New York EXAMINING TURNOVER IN THE NEW YORK STATE LEGISLATURE: 2009 – 2010 Update Research and Policy Analysis by Citizens Union Foundation Written and Published by Citizens Union FEBRUARY 2011 Endorsed By: Brennan Center for Justice at NYU School of Law Common Cause NY League of Women Voters of New York State New York Public Interest Research Group Citizens Union of the City of New York 299 Broadway, Suite 700 New York, NY 10007-1976 phone 212-227-0342 • fax 212-227-0345 • [email protected] • www.citizensunion.org www.gothamgazette.com Peter J.W. Sherwin, Chair • Dick Dadey, Executive Director TABLE OF CONTENTS I. Executive Summary Page 1 II. Introduction and Methodology Page 3 III. Acknowledgments Page 5 IV. Major Findings on Legislative Turnover, 2009-2010 Page 6 V. Findings on the Causes of Turnover, 1999-2010 Page 8 VI. Opportunities for Reform Page 16 VII. Appendices A. Percentage of Seats Turned Over in the New York State Legislature, 1999-2010 B. Causes of Turnover by Percentage of Total Turnover, 1999-2010 C. Total Causes of Turnover, 1999-2010 D. Ethical and Criminal Issues Resulting in Turnover, 1999-2010 E. Ethical and Criminal Issues Resulting in Turnover Accelerates: Triples in Most Recent 6-Year Period F. Table of Individual Legislators Who Have Left Due to Ethical or Criminal Issues, 1999-2010 G. Table of Causes of Turnover in Individual Assembly and Senate Districts, 2009 – 2010 Citizens Union Examining Legislative Turnover: 2009 - 2010 Update February 2011 Page 1 I. Executive Summary The New York State Legislature looked far different in January 2011 than it did in January 2009, as there were 47 fresh faces out of 212, when the new legislative session began compared to two years ago. -

The Armenian Cause in America Today

THE ARMENIAN CAUSE IN AMERICA TODAY While meager Turkish American NGO assets are dedicated to cultural events and providing education on a wide range of political issues, approximately $40 million in Armenian American NGO assets are primarily dedicated to what is referred to in Armenian as Hai Tahd, ‘The Armenian Cause’. Hai Tahd includes three policy objectives: Recognition that the 1885-1919 Armenian tragedy constitutes genocide; Reparations from Turkey; and, Restitution of the eastern provinces of Turkey to Armenia. This paper examines the Armenian American strategy and the response of Turkish American via the Assembly of Turkish American Associations (ATAA). Günay Evinch Gunay Evinch (Övünç) practices international public law at Saltzman & Evinch and serves as Assembly of Turkish American Associations (ATAA) Vice-President for the Capital Region. He researched the Armenian case in Turkey as a U.S. Congressional Fulbright Scholar and Japan Sasakawa Peace Foundation Scholar in international law in 1991-93. To view media coverage and photographs associated with this article, please see, Günay Evinch, “The Armenian Cause Today,” The Turkish American, Vol. 2, No. 8 (Summer 2005), pp. 22-29. Also viewable at www.ATAA.org The Ottoman Armenian tragedy of 1880-1919 is a dark episode in the history of Turkish and Armenian relations. Over one million Muslims, mostly Kurds, Turks, and Arabs, and almost 600,000 Armenians perished in eastern Anatolia alone. WWI took the lives of 10 million combatants and 50 million civilians. While Russia suffered the greatest population deficit, the Ottoman Empire lost over five million, of which nearly 4 million were Muslims, 600,000 were Armenian, 300,000 were Greek, and 100,000 were Ottoman Jews.1 Moreover, the millennial Armenian presence in eastern Anatolia ended. -

John Doe #1 State &

Doe v. Reed Claims of Harassment, Intimidation, etc. 1 of 204 Document Review 4/5/2010 Source: ProtectMarriage.com v. Bowen, Ex. 12 Page # in Filing: 1-8 Type of Document: Affidavit Name: John Doe #1 State & Campaign: CA, Prop 8 Incident Date: 10/2008 Location: CA, Declarant's store Search Terms: self-employed Was the individual a donor: Y Is the incident related to donation only: Y Is the incident related to petitions: N Is the incident related to yard signs or bumper stickers only: Y Is the incident related to other campaign activities: N If yes, explain involvement in campaign: Was the incident described in the media: N Is the incident referenced in other sources: N NOTES Economic Retaliation Flyers put on customers' car referencing declarant's support for Prop 8 and donation amount. Store picked twice. Nov. 2008 picketers were "aggressive" standing in front of store door and trying to give flyers to customers saying not to shop there b/c declarant supports Prop 8. Second picket- people blocked doorway of store and tried to get customers to sign petition. Police called but public space so protesters not forced to leave store. Unwanted Communication Three Facebook groups urged boycott of declarant's business. Someone paid for a google sponsor link that urged people to boycott declarant's business and listed her donation to Prop 8. Negative business reviews on yelp.com because declarant supports Prop 8. Other website published negative reviews of store because support Prop 8. Declarant received letter, hundreds of emails and numerous harassing phone calls because of Prop 8 support. -

Long-Term Missing Child Guide for Law Enforcement

Long-term missing child guide for law enforcement: Strategies for finding long-term missing children Long-term missing child guide for law enforcement: Strategies for finding long-term missing children 2016 Edited by Robert G. Lowery, Jr., and Robert Hoever National Center for Missing & Exploited Children® www.missingkids.org 1-800-THE-LOST® or 1-800-843-5678 ORI VA007019W Copyright © 2016 National Center for Missing & Exploited Children. All rights reserved. This project was supported by Grant No. 2015-MC-CX-K001 awarded by the Office of Juvenile Justice and Delinquency Prevention, Office of Justice Programs, U.S. Department of Justice. This document is provided for informational purposes only and does not constitute legal advice or professional opinion about specific facts. Information provided in this document may not remain current or accurate, so recipients should use this document only as a starting point for their own independent research and analysis. If legal advice or other expert assistance is required, the services of a competent professional should be sought. Points of view or opinions in this document are those of the author and do not necessarily represent the official position or policies of the U.S. Department of Justice. CyberTipline®, National Center for Missing & Exploited Children®, 1-800-THE-LOST® and Project ALERT® are registered trademarks of the National Center for Missing & Exploited Children. LONG-TERM MISSING CHILD GUIDE FOR LAW ENFORCEMENT - 2 Contents Acknowledgments.....10 Letter from John Walsh.....15 Foreword by Patty Wetterling.....16 Chapter 1: Introduction by Robert G. Lowery, Jr......18 Quick reference.....18 We are finding more long-term missing children now.....19 Are we doing enough?.....21 Chapter 2: Overview of missing children cases by Robert G. -

War in Pakistan: the Effects of the Pakistani-American War on Terror in Pakistan

WAR IN PAKISTAN: THE EFFECTS OF THE PAKISTANI-AMERICAN WAR ON TERROR IN PAKISTAN by AKHTAR QURESHI A thesis submitted in partial fulfillment of the requirements for the Honors in the Major Program in Political Science in the College of Science and in the Burnett Honors College at the University of Central Florida Orlando, FL Spring Term 2011 Thesis Chair: Dr. Houman Sadri ABSTRACT This research paper investigates the current turmoil in Pakistan and how much of it has been caused by the joint American-Pakistani War on Terror. The United States’ portion of the War on Terror is in Afghanistan against the Al-Qaeda and Taliban forces that began after the September 11th attacks in 2001, as well as in Pakistan with unmanned drone attacks. Pakistan’s portion of this war includes the support to the U.S. in Afghanistan and military campaigns within it’s own borders against Taliban forces. Taliban forces have fought back against Pakistan with terrorist attacks and bombings that continue to ravage the nation. There have been a number of consequences from this war upon Pakistani society, one of particular importance to the U.S. is the increased anti-American sentiment. The war has also resulted in weak and widely unpopular leaders. The final major consequence this study examines is the increased conflict amongst the many ethnicities within Pakistan. The consequences of this war have had an effect on local, regional, American, and international politics. ii ACKNOWLEDGMENTS I express sincere thanks and gratitude to my committee members, who have been gracious enough to enable this project with their guidance, wisdom, and experience. -

Council Hires Gould As New City Manager

SM to Andrew Thurm LAX Coldwell Banker 310-444-4444 In today's challenging real estate market, $30 work with Andrew Thurm, an award winning agent 310.442.1651 Hybrid • Mercedes-Benz w w w . a n d r e w t h u r m . c o m SantaMonicaTaxi.com not valid from hotels or with other offers • SM residents only • Expires 5/31/09 representing Santa Monica and the Westside! Visit us online at smdp.com THURSDAY, DECEMBER 10, 2009 Volume 9 Issue 24 Santa Monica Daily Press IN THE MONEY SEE PAGE 11 We have you covered THE NEW FACE ISSUE Council hires Gould as new city manager BY KEVIN HERRERA Editor in Chief CITY HALL With a unanimous vote, the City Council Tuesday selected Rod Gould to serve as the new city manager, City Hall’s most senior position, making him responsible for day-to-day operations and the formation of the city’s roughly $500-million budget. Gould, 52, is currently the city manager of Poway, Calif., also known as “The City in the Country,”located in northeast San Diego County, with a population of roughly 50,000. Gould will earn a base salary of GOULD $285,000, receive Brandon Wise [email protected] relocation assistance and be eligible for a MAN AT WORK: Executive Chef Felix Lopez works with a large bowl full of mashed plantains at The Border Grill on Wednesday afternoon. $1.3 million loan at a fixed 3.27 percent interest rate from City Hall to help him pur- chase a home in Santa Monica, according to Study: Businesses not harmed by emissions bill a contract approved by the council. -

Report to the President: MIT and the Prosecution of Aaron Swartz

Report to the President MIT and the Prosecution of Aaron Swartz Review Panel Harold Abelson Peter A. Diamond Andrew Grosso Douglas W. Pfeiffer (support) July 26, 2013 © Copyright 2013, Massachusetts Institute of Technology This worK is licensed under a Creative Commons Attribution 3.0 Unported License. PRESIDENT REIF’S CHARGE TO HAL ABELSON | iii L. Rafael Reif, President 77 Massachusetts Avenue, Building 3-208 Cambridge, MA 02139-4307 U.S.A. Phone 1-617-253-0148 !"#$"%&'(()'(*+,' ' -."%'/%01.220%'34.520#6' ' 78#9.'1"55'(*+*)':;<'="2'4..#'8#>05>.?'8#'.>.#@2'"%828#A'1%0B'"9@80#2'@"C.#'4&'3"%0#'7D"%@E'@0' "99.22'!7<FG'@=%0$A='@=.':;<'90BH$@.%'#.@D0%CI';'=">.'"2C.?'&0$)'"#?'&0$'=">.'A%"980$25&' "A%..?)'@0'%.>8.D':;<J2'8#>05>.B.#@I' ' <=.'H$%H02.'01'@=82'%.>8.D'82'@0'?.29%84.':;<J2'"9@80#2'"#?'@0'5."%#'1%0B'@=.BI'K0$%'%.>8.D' 2=0$5?'L+M'?.29%84.':;<J2'"9@80#2'"#?'?.98280#2'?$%8#A'@=.'H.%80?'4.A8##8#A'D=.#':;<'18%2@' 4.9"B.'"D"%.'01'$#$2$"5'!7<FGN%.5"@.?'"9@8>8@&'0#'8@2'#.@D0%C'4&'"'@=.#N$#8?.#@818.?'H.%20#)' $#@85'@=.'?."@='01'3"%0#'7D"%@E'0#'!"#$"%&'++)'(*+,)'L(M'%.>8.D'@=.'90#@.O@'01'@=.2.'?.98280#2'"#?' @=.'0H@80#2'@="@':;<'90#28?.%.?)'"#?'L,M'8?.#@81&'@=.'822$.2'@="@'D"%%"#@'1$%@=.%'"#"5&282'8#'0%?.%' @0'5."%#'1%0B'@=.2.'.>.#@2I' ' ;'@%$2@'@="@'@=.':;<'90BB$#8@&)'8#95$?8#A'@=02.'8#>05>.?'8#'@=.2.'.>.#@2)'"5D"&2'"9@2'D8@='=8A=' H%01.2280#"5'8#@.A%8@&'"#?'"'2@%0#A'2.#2.'01'%.2H0#284858@&'@0':;<I'P0D.>.%)':;<'@%8.2'90#@8#$0$25&' @0'8BH%0>.'"#?'@0'B..@'8@2'=8A=.2@'"2H8%"@80#2I';@'82'8#'@="@'2H8%8@'@="@';'"2C'&0$'@0'=.5H':;<'5."%#' 1%0B'@=.2.'.>.#@2I' -

The Effect of FOMO on Stakeholder Enrollment

The Effect of FOMO on Stakeholder Enrollment Susan L. Young, PhD Kennesaw State University Kennesaw, GA Ph: 470-578-4536 [email protected] Birton Cowden, PhD Kennesaw State University Kennesaw, GA Ph: 470-578-36781 [email protected] 1 The Effect of FOMO on Stakeholder Enrollment Abstract Stakeholder theory suggests dishonest ventures would struggle with stakeholder enrollment, limiting resource access and ultimately failing. Yet cases exist where amoral entrepreneurs do enroll stakeholders through deceit. We propose “fear of missing out” on an opportunity facilitates enrollment by encouraging stakeholder acceptance of information asymmetry. To illustrate we use exemplar Theranos: a biotech firm which convinced stakeholders it would revolutionize healthcare, rising to a $10 billion valuation through 15 years of sustained deceit. We contribute to theory by demonstrating the dark side of stakeholder enrollment, where opportunism increases venture power over stakeholders, and deceit can endure long past start up. Keywords: stakeholder theory, stakeholder enrollment, entrepreneurial deceit, fear of missing out, legitimacy 2 The Effect of FOMO on Stakeholder Enrollment “Theranos had demonstrated a commitment to investing in and developing technologies that can make a difference in people’s lives, including for the severely wounded and ill. I had quickly seen tremendous potential in the technologies Theranos develops, and I have the greatest respect for the company’s mission and integrity.” (Johnson, 2015) — 4-star General Jim Mattis, U.S. Marine Corps, Retired U.S. Secretary of Defense, 2017-2019 The Securities and Exchange Commission today charged Silicon Valley-based private company Theranos Inc., its founder and CEO Elizabeth Holmes, and its former President Ramesh “Sunny” Balwani with raising more than $700 million from investors through an elaborate, years-long fraud in which they exaggerated or made false statements about the company’s technology, business, and financial performance.