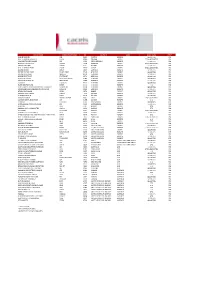

Country/Region Market Center Details Hours Arcaedge

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Tel Aviv Stock Exchange

Case Study Tel Aviv Stock Exchange migrates critical mainframe Objective applications with HPE Eliminate the risk of legacy mainframe environment operations while avoiding dependence on mainframe specialists Redefines its environment by implementing a and reducing costs low-risk, high-return mainframe migration Approach Leverage HPE Data Center Platform Consulting services to efficiently and safely migrate mainframe apps to distributed server infrastructure IT Matters • Migrating to standards-based solutions drives cost reductions • Shifting to open systems servers eliminates the need for hard-to-find mainframe specialists • Standardized Linux environment streamlines development, QA, and operations Business Matters • Migration and transformation was completed on time with no downtime or disruption The Tel Aviv Stock Exchange needed to The Tel Aviv Stock Exchange (TASE) is the • Management expects to continue to migrate its mission-critical applications from only stock exchange in Israel. It offers a “one- meet cost reduction and TCO objectives an IBM mainframe environment and turned to stop shop” that includes trading in equities, for the migration HPE Data Center Platform Consulting services bonds, and derivatives. TASE has 25 members • TASE expects a full return on to help plan and implement a platform including Israeli and international banks and investment for its migration within less migration strategy from its older, proprietary brokers, and TASE is trading in 1,900 equities than three years systems. With HPE Data Center Platform and bonds and 2,500 derivatives series. Consulting, the Tel-Aviv Stock Exchange was Its daily turnover in the equities market is also able to bring industry-leading availability, approximately 1.5 billion Israeli shekels, which increased performance, and uncompromising is about $400 million client choice to support all of its IT needs. -

Impact of the Transition to Continous Trading on Emerging financial Market’S Liquidity : Case Study of the West Africa Regional Exchange Market (BRVM)

CORE Metadata, citation and similar papers at core.ac.uk Provided by Munich Personal RePEc Archive MPRA Munich Personal RePEc Archive Impact of the transition to continous trading on emerging financial market's liquidity : Case study of the West Africa Regional Exchange Market (BRVM) Aboudou OUATTARA Centre Africain d'Etudes Sup´erieures en Gestion 2 December 2016 Online at https://mpra.ub.uni-muenchen.de/75391/ MPRA Paper No. 75391, posted 4 December 2016 06:04 UTC IMPACT OF THE TRANSITION TO CONTINUOUS TRADING ON EMERGING FINANCIAL MARKET’S LIQUIDITY : CASE STUDY OF WEST AFRICA REGIONAL EXCHANGE MARKET (BRVM) Aboudou OUATTARA, Assistant professor in finance1 African Center for Advanced Studies in Management (CESAG) Dakar, november 2016 SUMMARY After 18 years of activities and take-off difficulties due to socio-economic and political environment of the WAEMU zone, the west Africa regional exchange market (BRVM)’s authorities decided to move to continuous trading. The decision was effective on 16th september 2013. This action, beyond the upgrading of this stock exchange market to international standards, aims at improving market liquidity. Two years after its implementation, it seemed interesting to question the relevancy of this decision. In this empirical research, we are interested in evaluating the impact of the transition to continuous trading on market liquidity. Based on data collected from daily trading report and available databases, we mobilized the instrumental variables method to identify the part of the observed variation in liquidity due to the quotation mode change. This method was applied to evaluate the change in trading volume, TurnOver ratio, Martins index, Amihud ratio, Hui Heubel ratio and market impact due to quotation mode change. -

Lieux Exécution 201904

VENUE NAME VENUE SHORTNAME MIC COUNTRY ZONE ASSET CLASS TYPE * WIENER BOERSE WB XWBO AUSTRIA EUROPE SECURITIES RM NYSE EURONEXT BRUSSELS ENXBE XBRU BELGIUM EUROPE ETD & SECURITIES RM PRAGUE STOCK EXCHANGE PSE XPRA CZECH REPUBLIC EUROPE SECURITIES RM NASDAQ COPENHAGEN OMX DK XCSE DENMARK EUROPE ETD & SECURITIES RM NASDAQ HELSINKI OMX FI XHEL FINLAND EUROPE SECURITIES RM NYSE EURONEXT PARIS ENXFR XPAR FRANCE EUROPE ETD & SECURITIES RM BOERSE BERLIN BERLIN XBER GERMANY EUROPE SECURITIES RM BOERSE DUESSELDORF DUSSELDORF XDUS GERMANY EUROPE SECURITIES RM BOERSE MUENCHEN MUNICH XMUN GERMANY EUROPE SECURITIES RM BOERSE STUTTGART STUTTGART XSTU GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE DEUTSCHE BOERSE XFRA GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE AG FRANCFORT XFRA GERMANY EUROPE SECURITIES RM EQUIDUCT EQUIDUCT XBER GERMANY EUROPE SECURITIES RM EUREX DEUTSCHLAND EUREX XEUR GERMANY EUROPE ETD RM HANSEATISCHE WERTPAPIERBOERSE HAMBURG HAMBOURG XHAM GERMANY EUROPE SECURITIES RM NIEDERSAECHSISCHE BOERSE ZU HANNOVER HANOVRE XHAN GERMANY EUROPE SECURITIES RM ATHENS EXCHANGE ATHEX XATH GREECE EUROPE SECURITIES RM NASDAQ OMX ICELAND OMX IC XICE ICELAND EUROPE SECURITIES RM EURONEXT DUBLIN ENXIE XDUB IRELAND EUROPE SECURITIES RM BORSA ITALIANA BORSA ITALIANA XMIL ITALY EUROPE ETD & SECURITIES RM LONDON METAL EXCHANGE LME XLME LONDON EUROPE ETD RM EURO MTF EURO MTF XLUX LUXEMBOURG EUROPE SECURITIES MTF LUXEMBOURG STOCK EXCHANGE BDL XLUX LUXEMBOURG EUROPE SECURITIES RM FISH POOL FISH FISH NORWAY EUROPE ETD RM NASDAQ OMX COMMODITIES OMX CO NORX NORWAY -

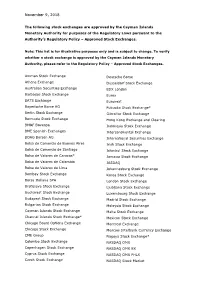

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX -

List of Execution Venues

List of Execution Venues Version 2.0 Effective January 2019 Bank of America Merrill Lynch (“BofAML”) (including its affiliates) uses the following execution venues when obtaining best execution as defined by MiFID. The list detailed below is not exhaustive and may be subject to change and reissued from time to time, as set out in BofAML’s Policy. BofAML may also use other execution venues where it deems appropriate from time to time in accordance with the guidelines set out in the Policy. Regulated Markets of which MLI is a direct member and MTFs Asset class Region accessed by MLI Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Paris Equities EMEA Euronext Lisbon Equities EMEA Irish Stock Exchange Equities EMEA ITG Posit Equities EMEA London Stock Exchange Equities EMEA NASDAQ OMX Nordic- Copenhagen Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA Oslo Børs Equities EMEA Six Swiss Exchange Equities EMEA Tel Aviv Stock Exchange Equities EMEA Trade Web UK Equities EMEA Version 2.0 – January 2019 ©2019 Bank of America Corporation 1 Proprietary List of Execution Venues Version 2.0 Effective January 2019 Turquoise Equities EMEA UBS Equities EMEA Warsaw Stock Exchange Equities EMEA Wiener Börse Equities EMEA Regulated Markets of which BofASE is/will be a direct member and MTFs that are/will be accessed by BofASE subject to BofASE Asset class Region membership approval. -

Significantly Regulated Organizations Added ‐ August 2018

Significantly Regulated Organizations Added ‐ August 2018 DUNS COUNTRY TICKER BUSINESS NAME EXCHANGE NAME NUMBER NAME SYMBOL 782619647 Hudson Technologies, Inc. USA HDSN NASDAQ 080631744 Meiragtx Holdings PLC USA MGTX NASDAQ 081176417 Scholar Rock Holding Corporation USA SRRK NASDAQ 968721535 Exicure, Inc. USA XCUR Over The Counter 355839643 SOK MARKETLER TICARET ANONIM SIRKETI TURKEY SOKM Istanbul Stock Exchange 487848061 Polyphor AG SWITZERLAND POLN Swiss Exchange 366940997 VIPO a. s. SLOVAKIA 1VIP01AE Bratislava Stock Exchange 366942928 ZTS Sabinov, a. s. SLOVAKIA 1ZTS01NE Bratislava Stock Exchange 645775110 AGP LIMITED PAKISTAN AGP Karachi Stock Exchange 631064672 Genoray Co., Ltd. KOREA REP OF 122310 Korea Stock Exchange 690482309 M&C Life Science Co., Ltd KOREA REP OF 225860 Korea Stock Exchange 689514413 WOOJUNG BIO, Inc. KOREA REP OF 215380 Korea Stock Exchange 692550817 DAISHIN CHEMICAL CO., LTD. JAPAN 4629 Tokyo Stock Exchange 690757745 KOTOBUKI SPIRITS CO.,LTD. JAPAN 2222 Tokyo Stock Exchange 690864525 NISSIN SHOJI CO., LTD. JAPAN 7490 Tokyo Stock Exchange 693684383 SHIP HEALTHCARE HOLDINGS,INC. JAPAN 3360 Tokyo Stock Exchange 691163927 TAKEMOTO YOHKI CO.,LTD. JAPAN 4248 Tokyo Stock Exchange London Stock Exchange 600214837 BATM ADVANCED COMMUNICATIONS LTD. ISRAEL BVC (LON) 600183149 NICE LTD ISRAEL NICE NASDAQ 600566152 ON TRACK INNOVATIONS LTD ISRAEL OTIV NASDAQ 514903863 RADWARE LTD. ISRAEL RDWR NASDAQ 600072078 TARO PHARMACEUTICAL INDUSTRIES LTD. ISRAEL TARO New York Stock Exchange 534085188 PIMI AGRO CLEANTECH LTD ISRAEL -

Execution Venues Equities and Fixed Income

UBS AG London Branch 5 Broadgate London EC2M 2QS United Kingdom UBS Europe SE OpernTurm Bockenheimer Landstraße 2-4 60306 Frankfurt am Main Germany www.ubs.com/ibterms Execution venues Equities and fixed income Version: December 2020 For information about our investment bank entities, visit www.ubs.com/ibterms Execution venues This is a non-exhaustive list of the main execution venues that we use outside UBS and our own systematic internalisers. We will review and update it from time to time in accordance with our UK and EEA MiFID Order Handling & Execution Policy. We may use other execution venues where appropriate. Equities Cash Equities Direct access Aquis Exchange Europe Aquis Exchange PlcAthens Stock Exchange BATS Europe, a CBOE Company Borsa Italiana CBOE NL CBOE UK Citadel Securities (Europe) Limited SI Deutsche Börse Group - Xetra Euronext Amsterdam Stock Exchange Euronext Brussels Stock Exchange Euronext Lisbon Stock Exchange Euronext Paris Stock Exchange Instinet Blockmatch Euronext DublinITG Posit London Stock Exchange Madrid Stock Exchange Nasdaq Copenhagen Nasdaq Helsinki Nasdaq Stockholm Oslo Bors Sigma X Europe Sigma X MTFTower Research Capital Europe Limited SI Turquoise Europe TurquoiseUBS Investment Bank UBS MTF Vienna Stock Exchange Virtu Financial Ireland Limited Warsaw Stock Exchange Via intermediate broker Budapest Stock Exchange Cairo & Alexandria Stock Exchange Deutsche Börse - Frankfurt Stock Exchange Istanbul Stock Exchange Johannesburg Stock Exchange Moscow Exchange Prague Stock Exchange SIX Swiss Exchange Tel Aviv Stock Exchange Structured Products Direct access Börse Frankfurt (Zertifikate Premium) Börse Stuttgart (EUWAX) Xetra SIX Swiss Exchange SeDeX Milan Euronext Amsterdam London Stock Exchange Madrid Stock Exchange NASDAQ OMX Stockholm JSE Johannesburg Stock Exchange OTC matching CATS-OS Fixed Income Cash bonds Via Bond Port Bloomberg EuroTLX Euronext ICE (KCG) BondPoint Market Axess MOT MTS BondsPro 1 © UBS 2020. -

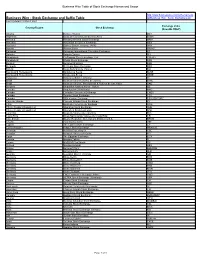

Stock Exchange and Suffix Table Ml/Business Wire Stock Exchanges.Pdf Last Updated 12 March 2021

Business Wire Table of Stock Exchange Names and Usage http://www.businesswire.com/schema/news Business Wire - Stock Exchange and Suffix Table ml/Business_Wire_Stock_Exchanges.pdf Last Updated 12 March 2021 Exchange Value Country/Region Stock Exchange (NewsML ONLY) Albania Bursa e Tiranës BET Argentina Bolsa de Comercio de Buenos Aires BCBA Armenia Nasdaq Armenia Stock Exchange ARM Australia Australian Securities Exchange ASX Australia Sydney Stock Exchange (APX) APX Austria Wiener Börse WBAG Bahamas Bahamas International Securities Exchange BS Bahrain Bahrain Bourse BH Bangladesh Chittagong Stock Exchange, Ltd. CSEBD Bangladesh Dhaka Stock Exchange DSE Belgium Euronext Brussels BSE Bermuda Bermuda Stock Exchange BSX Bolivia Bolsa Boliviana de Valores BO Bosnia and Herzegovina Banjalucka Berza BLSE Bosnia and Herzegovina Sarajevska Berza SASE Botswana Botswana Stock Exchange BT Brazil Bolsa de Valores do Rio de Janeiro BVRJ Brazil Bolsa de Valores, Mercadorias & Futuros de Sao Paulo SAO Bulgaria Balgarska fondova borsa - Sofiya BB Canada Aequitas NEO Exchange NEO Canada Canadian Securities Exchange CNSX Canada Toronto Stock Exchange TSX Canada TSX Venture Exchange TSX VENTURE Cayman Islands Cayman Islands Stock Exchange KY Chile Bolsa de Comercio de Santiago SGO China, People's Republic of Shanghai Stock Exchange SHH China, People's Republic of Shenzhen Stock Exchange SHZ Colombia Bolsa de Valores de Colombia BVC Costa Rica Bolsa Nacional de Valores de Costa Rica CR Cote d'Ivoire Bourse Regionale Des Valeurs Mobilieres S.A. BRVM Croatia -

VA Lieux Exécution

VENUE NAME VENUE SHORTNAME MIC COUNTRY ZONE ASSET CLASS TYPE * WIENER BOERSE WB XWBO AUSTRIA EUROPE SECURITIES RM NYSE EURONEXT BRUSSELS ENXBE XBRU BELGIUM EUROPE ETD & SECURITIES RM PRUE STOCK EXCHANGE PSE XPRA CZECH REPUBLIC EUROPE ETD RM NASDAQ COPENHEN OMX DK XCSE DENMARK EUROPE ETD & SECURITIES RM NASDAQ HELSINKI OMX FI XHEL FINLAND EUROPE SECURITIES RM NYSE EURONEXT PARIS ENXFR XPAR FRANCE EUROPE ETD & SECURITIES RM DEUTSCHE BOERSE DEUTSCHE BOERSE XFRA GERMANY EUROPE SECURITIES RM BOERSE BERLIN BERLIN XBER GERMANY EUROPE SECURITIES RM BOERSE DUESSELDORF DUSSELDORF XDUS GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE AG FRANCFORT XFRA GERMANY EUROPE SECURITIES RM HANSEATISCHE WERTPAPIERBOERSE HAMBURG HAMBOURG XHAM GERMANY EUROPE SECURITIES RM NIEDERSAECHSISCHE BOERSE ZU HANNOVER HANOVRE XHAN GERMANY EUROPE SECURITIES RM BOERSE MUENCHEN MUNICH XMUN GERMANY EUROPE SECURITIES RM BOERSE STUTTGART STUTTGART XSTU GERMANY EUROPE SECURITIES RM EQUIDUCT EQUIDUCT XBER GERMANY EUROPE SECURITIES MTF EUREX DEUTSCHLAND EUREX XEUR GERMANY EUROPE ETD RM ATHENS EXCHANGE ATHEX XATH GREECE EUROPE SECURITIES RM NASDAQ OMX ICELAND OMX IC XICE ICELAND EUROPE SECURITIES RM IRISH STOCK EXCHANGE ISE XDUB IRELAND EUROPE SECURITIES RM BORSA ITALIANA BORSA ITALIANA XMIL ITALY EUROPE ETD & SECURITIES RM LONDON METAL EXCHANGE LME XLME LONDON EUROPE ETD RM FISH POOL FISH FISH NORWAY EUROPE ETD RM NASDAQ OMX COMMODITIES OMX CO NORX NORWAY EUROPE ETD RM OSLO BORS OSLO BORS XOSL NORWAY EUROPE ETD & SECURITIES RM WARSAW STOCK EXCHANGE WSE XWAR POLAND EUROPE SECURITIES -

ROBO Global® LIST of ELIGIBLE EXCHANGES

ROBO Global® LIST OF ELIGIBLE EXCHANGES Bloomberg Code Exchange Country 1) NA Equity Euronext Amsterdam Netherlands 2) EN Equity Euronext Paris France 3) FH Equity Helsinki Stock Exchange Finland 4) HK Equity Hong Kong Stock Exchange China 5) KQ Equity Korea Exchange Korea 6) LN Equity London Stock Exchange United Kingdom 7) UQ Equity Nasdaq Global Market United States 8) UW Equity Nasdaq Global Select Market United States 9) UN Equity New York Stock Exchange United States 10) NO Equity Oslo Norway 11) VX Equity SIX Swiss (formerly Virt-X) Switzerland 12) SW Equity SIX Swiss Exchange Switzerland 13) SS Equity Stockholm Stock Exchange Sweden 14) TT Equity Taiwan Stock Exchange Taiwan 15) IT Equity Tel Aviv Stock Exchange Israel 16) JT Equity Tokyo Stock Exchange Japan 17) TO Equity Toronto Stock Exchange Canada 18) GY Equity Xetra Germany 19) LI Equity London International Exchange (added 22nd December, 2015) 20) AH Equity Australian Securities Exchange Australia (added 30th June 2017) 21) AV Equity Vienna Stock Exchange Austria (added 30th June 2017) 22) NZ Equity New Zealand Exchange (added 30th June 2017) 23) ID Equity Irish Stock Exchange Ireland (added 30th June 2017) 24) DC Equity NASDAQ OMX Copenhagen Denmark (added 30th June 2017) 25) SB Equity Barcelona Stock Exchange Spain (added 30th June 2017) 26) SN Equity Madrid Stock Exchange Spain (added 30th June 2017) 27) SQ Equity Sociedad de Bolsas Spain (added 30th June 2017) 28) IM Equity Borsa Italiana Italy (added 30th June 2017) 29) PL Equity Euronext Lisbon Portugal (added 30th June 2017) 30) SP Equity Singapore Exchange Singapore (added 30th June 2017) ROBO Global® defines the universe of robotics & automation for investors.