ROBO Global® LIST of ELIGIBLE EXCHANGES

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Scanned Image

3130 W 57th St, Suite 105 Sioux Falls, SD 57108 Voice: 605-373-0201 Fax: 605-271-5721 [email protected] www.greatplainsfa.com Securities offered through First Heartland Capital, Inc. Member FINRA & SIPC. Advisory Services offered through First Heartland Consultants, Inc. Great Plains Financial Advisors, LLC is not affiliated with First Heartland Capital, Inc. In this month’s recap: the Federal Reserve eases, stocks reach historic peaks, and face-to-face U.S.-China trade talks formally resume. Monthly Economic Update Presented by Craig Heien with Great Plains Financial Advisors, August 2019 THE MONTH IN BRIEF July was a positive month for stocks and a notable month for news impacting the financial markets. The S&P 500 topped the 3,000 level for the first time. The Federal Reserve cut the country’s benchmark interest rate. Consumer confidence remained strong. Trade representatives from China and the U.S. once again sat down at the negotiating table, as new data showed China’s economy lagging. In Europe, Brexit advocate Boris Johnson was elected as the new Prime Minister of the United Kingdom, and the European Central Bank indicated that it was open to using various options to stimulate economic activity.1 DOMESTIC ECONOMIC HEALTH On July 31, the Federal Reserve cut interest rates for the first time in more than a decade. The Federal Open Market Committee approved a quarter-point reduction to the federal funds rate by a vote of 8-2. Typically, the central bank eases borrowing costs when it senses the business cycle is slowing. As the country has gone ten years without a recession, some analysts viewed this rate cut as a preventative measure. -

New Years Trading Schedule 2021

New Years Trading Schedule 2021 Product Thurs Dec 31st Fri Jan 1st Mon Jan 4th Tues Jan 5th Australian Securities Exchange | ASX 9:30pm Wednesday Night All Products Early Close Closed Normal Hours Normal Hours Chicago Mercantile Exchange | CME Currency & Eurodollar Normal Hours Closed Normal Hours Normal Hours Equity Index Normal Hours Closed Normal Hours Normal Hours Livestock 8:30am Livestock & Lumber Normal Hours Closed Open/Lumber 9am Open Normal Hours Dairy 1:55pm Early Close Closed Normal Hours Normal Hours Globex Bitcoin Normal Hours Closed Normal Hours Normal Hours Globex Currency & Eurodollar Normal Hours Closed Normal Hours Normal Hours Globex Equity Index Normal Hours Closed Normal Hours Normal Hours Pre-Open 8am - Livestock 8:30am Open/Pre-Open Globex Livestock & Lumber Normal Hours Closed 6am - Lumber 9am Open Normal Hours Globex Dairy 1:55pm Early Close Closed Normal Hours Normal Hours Chicago Board of Options Exchange | CBOE CBOE/CFE 12:15pm Early Close Closed Normal Hours Normal Hours Chicago Board of Trade | CBOT Treasuries Normal Hours Closed Normal Hours Normal Hours Grains Normal Hours Closed 8:30am Open Normal Hours Globex Treasuries Normal Hours Closed Normal Hours Normal Hours MGEX Wheat Pre-Open 7:45am/Pre-Open 8:00am - Globex Grains Normal Hours Closed 8:30am Open Normal Hours Montreal Exchange | MX Interest Rates 12:30pm Early Close Closed Normal Hours Normal Hours Stock Indices Normal Hours Closed Normal Hours Normal Hours ICE Futures Canada | ICE All Products Normal Hours Closed Normal Hours Normal Hours European -

Additional Provisions Applicable When Trading Asian Markets Using Electronic Connectivity

ADDITIONAL PROVISIONS APPLICABLE WHEN TRADING ASIAN MARKETS USING ELECTRONIC CONNECTIVITY A. Rules for Trading on Asian markets 1. Applicable Law You acknowledge and agree that you must comply in all respects with Applicable Law, including in relation to short sales of securities when using the Trading System. 2. Asian Exchange “Asian Exchange” means exchanges, markets or associations of dealers to which the Relevant JPMorgan Entity (either directly or through its agents) from time to time provides DMA to Client for the purchase and sale of securities, including, without limitation, exchanges in Australia, Hong Kong, Japan, Korea, Singapore, Taiwan, India, Indonesia, Malaysia, Thailand and/or such other countries as may be determined from time to time. 3. Relevant JPMorgan Entity “Relevant JPMorgan Entity” means any one or more of the JPMorgan brokers with whom you have a contractual relationship to trade securities electronically, and for the avoidance of doubt may include, without limitation, any one or more of the following: J.P. Morgan Securities Australia Limited, J.P. Morgan Securities Singapore Private Limited, JPMorgan Securities Japan Co. Ltd., J.P. Morgan Securities (Asia Pacific) Limited, J.P. Morgan Broking (Hong Kong) Limited, J.P. Morgan Securities (Far East) Ltd., Seoul Branch, J.P. Morgan Securities (Taiwan) Limited, J.P. Morgan India Private Limited, PT J.P. Morgan Securities Indonesia, JPMorgan Securities (Malaysia) Sdn. Bhd., JPMorgan Securities (Thailand) Limited and any of their successors or assigns. B. Rules for Trading on Australian Markets 1. Prohibited conduct 1.1 You must not, and must procure that your Representatives do not, take any action or omit to take any action so that you breach any Applicable Law and in particular you must advise Relevant JPMorgan Entity immediately if you believe that you or any of your Representatives have breached, or may breach, any provision of this Clause 1.1. -

Tel Aviv Stock Exchange

Case Study Tel Aviv Stock Exchange migrates critical mainframe Objective applications with HPE Eliminate the risk of legacy mainframe environment operations while avoiding dependence on mainframe specialists Redefines its environment by implementing a and reducing costs low-risk, high-return mainframe migration Approach Leverage HPE Data Center Platform Consulting services to efficiently and safely migrate mainframe apps to distributed server infrastructure IT Matters • Migrating to standards-based solutions drives cost reductions • Shifting to open systems servers eliminates the need for hard-to-find mainframe specialists • Standardized Linux environment streamlines development, QA, and operations Business Matters • Migration and transformation was completed on time with no downtime or disruption The Tel Aviv Stock Exchange needed to The Tel Aviv Stock Exchange (TASE) is the • Management expects to continue to migrate its mission-critical applications from only stock exchange in Israel. It offers a “one- meet cost reduction and TCO objectives an IBM mainframe environment and turned to stop shop” that includes trading in equities, for the migration HPE Data Center Platform Consulting services bonds, and derivatives. TASE has 25 members • TASE expects a full return on to help plan and implement a platform including Israeli and international banks and investment for its migration within less migration strategy from its older, proprietary brokers, and TASE is trading in 1,900 equities than three years systems. With HPE Data Center Platform and bonds and 2,500 derivatives series. Consulting, the Tel-Aviv Stock Exchange was Its daily turnover in the equities market is also able to bring industry-leading availability, approximately 1.5 billion Israeli shekels, which increased performance, and uncompromising is about $400 million client choice to support all of its IT needs. -

Impact of the Transition to Continous Trading on Emerging financial Market’S Liquidity : Case Study of the West Africa Regional Exchange Market (BRVM)

CORE Metadata, citation and similar papers at core.ac.uk Provided by Munich Personal RePEc Archive MPRA Munich Personal RePEc Archive Impact of the transition to continous trading on emerging financial market's liquidity : Case study of the West Africa Regional Exchange Market (BRVM) Aboudou OUATTARA Centre Africain d'Etudes Sup´erieures en Gestion 2 December 2016 Online at https://mpra.ub.uni-muenchen.de/75391/ MPRA Paper No. 75391, posted 4 December 2016 06:04 UTC IMPACT OF THE TRANSITION TO CONTINUOUS TRADING ON EMERGING FINANCIAL MARKET’S LIQUIDITY : CASE STUDY OF WEST AFRICA REGIONAL EXCHANGE MARKET (BRVM) Aboudou OUATTARA, Assistant professor in finance1 African Center for Advanced Studies in Management (CESAG) Dakar, november 2016 SUMMARY After 18 years of activities and take-off difficulties due to socio-economic and political environment of the WAEMU zone, the west Africa regional exchange market (BRVM)’s authorities decided to move to continuous trading. The decision was effective on 16th september 2013. This action, beyond the upgrading of this stock exchange market to international standards, aims at improving market liquidity. Two years after its implementation, it seemed interesting to question the relevancy of this decision. In this empirical research, we are interested in evaluating the impact of the transition to continuous trading on market liquidity. Based on data collected from daily trading report and available databases, we mobilized the instrumental variables method to identify the part of the observed variation in liquidity due to the quotation mode change. This method was applied to evaluate the change in trading volume, TurnOver ratio, Martins index, Amihud ratio, Hui Heubel ratio and market impact due to quotation mode change. -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

Lieux Exécution 201904

VENUE NAME VENUE SHORTNAME MIC COUNTRY ZONE ASSET CLASS TYPE * WIENER BOERSE WB XWBO AUSTRIA EUROPE SECURITIES RM NYSE EURONEXT BRUSSELS ENXBE XBRU BELGIUM EUROPE ETD & SECURITIES RM PRAGUE STOCK EXCHANGE PSE XPRA CZECH REPUBLIC EUROPE SECURITIES RM NASDAQ COPENHAGEN OMX DK XCSE DENMARK EUROPE ETD & SECURITIES RM NASDAQ HELSINKI OMX FI XHEL FINLAND EUROPE SECURITIES RM NYSE EURONEXT PARIS ENXFR XPAR FRANCE EUROPE ETD & SECURITIES RM BOERSE BERLIN BERLIN XBER GERMANY EUROPE SECURITIES RM BOERSE DUESSELDORF DUSSELDORF XDUS GERMANY EUROPE SECURITIES RM BOERSE MUENCHEN MUNICH XMUN GERMANY EUROPE SECURITIES RM BOERSE STUTTGART STUTTGART XSTU GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE DEUTSCHE BOERSE XFRA GERMANY EUROPE SECURITIES RM DEUTSCHE BOERSE AG FRANCFORT XFRA GERMANY EUROPE SECURITIES RM EQUIDUCT EQUIDUCT XBER GERMANY EUROPE SECURITIES RM EUREX DEUTSCHLAND EUREX XEUR GERMANY EUROPE ETD RM HANSEATISCHE WERTPAPIERBOERSE HAMBURG HAMBOURG XHAM GERMANY EUROPE SECURITIES RM NIEDERSAECHSISCHE BOERSE ZU HANNOVER HANOVRE XHAN GERMANY EUROPE SECURITIES RM ATHENS EXCHANGE ATHEX XATH GREECE EUROPE SECURITIES RM NASDAQ OMX ICELAND OMX IC XICE ICELAND EUROPE SECURITIES RM EURONEXT DUBLIN ENXIE XDUB IRELAND EUROPE SECURITIES RM BORSA ITALIANA BORSA ITALIANA XMIL ITALY EUROPE ETD & SECURITIES RM LONDON METAL EXCHANGE LME XLME LONDON EUROPE ETD RM EURO MTF EURO MTF XLUX LUXEMBOURG EUROPE SECURITIES MTF LUXEMBOURG STOCK EXCHANGE BDL XLUX LUXEMBOURG EUROPE SECURITIES RM FISH POOL FISH FISH NORWAY EUROPE ETD RM NASDAQ OMX COMMODITIES OMX CO NORX NORWAY -

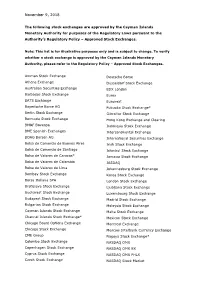

The List of Approved Stock Exchanges

November 9, 2018 The following stock exchanges are approved by the Cayman Islands Monetary Authority for purposes of the Regulatory Laws pursuant to the Authority’s Regulatory Policy – Approved Stock Exchanges. Note: This list is for illustrative purposes only and is subject to change. To verify whether a stock exchange is approved by the Cayman Islands Monetary Authority, please refer to the Regulatory Policy – Approved Stock Exchanges. Amman Stock Exchange Deutsche Borse Athens Exchange Dusseldorf Stock Exchange Australian Securities Exchange EDX London Barbados Stock Exchange Eurex BATS Exchange Euronext Bayerische Borse AG Fukuoka Stock Exchange* Berlin Stock Exchange Gibraltar Stock Exchange Bermuda Stock Exchange Hong Kong Exchange and Clearing BM&F Bovespa Indonesia Stock Exchange BME Spanish Exchanges Intercontinental Exchange BOAG Borsen AG International Securities Exchange Bolsa de Comercio de Buenos Aires Irish Stock Exchange Bolsa de Comercio de Santiago Istanbul Stock Exchange Bolsa de Valores de Caracas* Jamaica Stock Exchange Bolsa de Valores de Colombia JASDAQ Bolsa de Valores de Lima Johannesburg Stock Exchange Bombay Stock Exchange Korea Stock Exchange Borsa Italiana SPA London Stock Exchange Bratislava Stock Exchange Ljubljana Stock Exchange Bucharest Stock Exchange Luxembourg Stock Exchange Budapest Stock Exchange Madrid Stock Exchange Bulgarian Stock Exchange Malaysia Stock Exchange Cayman Islands Stock Exchange Malta Stock Exchange Channel Islands Stock Exchange* Mexican Stock Exchange Chicago Board Options Exchange -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

Voluntary Delisting in Korea: Causes and Impact on Company Performance Sun Min Kang, Ph.D., Chung-Ang University, South Korea

The Journal of Applied Business Research – March/April 2017 Volume 33, Number 2 Voluntary Delisting In Korea: Causes And Impact On Company Performance Sun Min Kang, Ph.D., Chung-Ang University, South Korea ABSTRACT This research investigates the attributes of firms that choose to voluntarily delist in Korea, including the evolution of firms after delisting, using performance indicators such as total assets, revenue, and net income. Empirical evidence suggests that the higher the shareholding ratio of the largest shareholder and the higher the growth prospects and liquidity, the greater the incentive for voluntary delisting. In addition, firms in non-high-tech industries choose to delist more often than those in high-tech industries. Further, firms that have delisted show lower total assets, revenues, and net incomes than listed firms, and these gaps increase over time. Keywords: Voluntary Delisting; The Largest Shareholder Ratio; Growth Prospect; Performance INTRODUCTION elisting refers to the loss of the trading eligibility of a listed company’s marketable securities and the cancellation of a qualified listing. Generally, delisting happens under the authority of a stock exchange. When a serious management problem occurs (e.g., bankruptcy) and investors incur losses, Dor when there is a risk of undermining the order of the stock market, the stock exchange will delist a company that meets the delisting criteria in order to protect investors, unless the reason for delisting is resolved during a certain grace period. Alternatively, a company may voluntarily delist itself through the public purchase of treasury stock. Many unlisted companies undertake an initial public offering (IPO) to obtain funding without debt by issuing shares, despite the complicated conditions and procedures of IPOs. -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX