UCLB's 25Th Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Departmental Manager Reference: 1721203 Grade: 8 Salary

London Centre for Nanotechnology 17-19 Gordon Street London WC1H 0AH www.london-nano.com Title: Departmental Manager Reference: 1721203 Grade: 8 Salary: £43,023-£50,753 per annum including London Allowance Terms and Conditions: In accordance with the conditions of employment as laid down in the relevant UCL Staff policies Accountable to: Director of LCN for operations Faculty Manager for professional services support Responsible for: Departmental professional support services staff Key Working Relationships: Staff and students within the LCN at UCL; Faculty Manager; Faculty Dean; Deans of other stakeholder Faculties; Heads of UCL partner departments (especially those sharing staff with the LCN); School Finance Director; School-facing Business Partners within Professional Services (Finance, Human Resources, Research, Enterprise, Registry); peers across the Departments of UCL; Directors and senior staff of LCN at Imperial College London and King’s College London; funders and commercial partners. Job Summary: Summary of the Post: The main purposes of the role of Departmental Manager are: 1. To lead the professional service operations of the Centre, delivering operational excellence across all administrative activities. 2. To determine and implement the Centre’s support strategy for research and enterprise, developing and evolving administrative policies and procedures and implementing those already established. 3. To manage and co-ordinate with the stakeholder Faculties, Schools and UCL to ensure effective administrative support for the Centre. 4. To represent the LCN to its stakeholders and partners. Key responsibilities: Strategic Development and Planning To advise and assist the Director in identifying short, medium and long term strategic objectives and priorities, providing relevant background data as appropriate to support the decision-making processes. -

Undergraduate Prospectus 2021 Entry

Undergraduate 2021 Entry Prospectus Image captions p15 p30–31 p44 p56–57 – The Marmor Homericum, located in the – Bornean orangutan. Courtesy of USO – UCL alumnus, Christopher Nolan. Courtesy – Students collecting beetles to quantify – Students create a bespoke programme South Cloisters of the Wilkins Building, depicts Homer reciting the Iliad to the – Saltburn Mine water treatment scheme. of Kirsten Holst their dispersion on a beach at Atlanterra, incorporating both arts and science and credits accompaniment of a lyre. Courtesy Courtesy of Onya McCausland – Recent graduates celebrating at their Spain with a European mantis, Mantis subjects. Courtesy of Mat Wright religiosa, in the foreground. Courtesy of Mat Wright – Community mappers holding the drone that graduation ceremony. Courtesy of John – There are a number of study spaces of UCL Life Sciences Front cover captured the point clouds and aerial images Moloney Photography on campus, including the JBS Haldane p71 – Students in a UCL laboratory. Study Hub. Courtesy of Mat Wright – UCL Portico. Courtesy of Matt Clayton of their settlements on the peripheral slopes – Students in a Hungarian language class p32–33 Courtesy of Mat Wright of José Carlos Mariátegui in Lima, Peru. – The Arts and Sciences Common Room – one of ten languages taught by the UCL Inside front cover Courtesy of Rita Lambert – Our Student Ambassador team help out in Malet Place. The mural on the wall is p45 School of Slavonic and East European at events like Open Days and Graduation. a commissioned illustration for the UCL St Paul’s River – Aerial photograph showing UCL’s location – Prosthetic hand. Courtesy of UCL Studies. -

Annual Report and Financial Statements for the Year Ended 31 July 2012

LONDON‟S GLOBAL UNIVERSITY Annual Report and Financial Statements for the year ended 31 July 2012 UNIVERSITY COLLEGE LONDON ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 31 JULY 2012 MISSION STATEMENT UCL is London's Global University OUR VISION An outstanding institution, recognised as one of the world‟s most advanced universities and valued highly by its community of staff, students, alumni, donors and partners and by the wider community; Providing an outstanding education to students from across the globe that imparts the knowledge, wisdom and skills needed by them to thrive as global citizens; Committed to leadership in the advancement, dissemination and application of knowledge within and across disciplines; Committed to achieving maximum positive social, environmental and economic benefit through its achievements in education, scholarship, research, discovery and collaboration; Developing future generations of leaders in scholarship, research, the learned professions, the public sector, business and innovation; Tackling global challenges with confidence; As London‟s global university, leading through collaboration across London and worldwide in the advancement of knowledge, research, opportunity and sustainable economic prosperity; Operating ethically and at the highest standards of efficiency, and investing sufficiently today to sustain the vision for future generations. OUR VALUES Commitment to excellence and advancement on merit Fairness and equality Diversity Collegiality and community-building Inclusiveness Openness -

Undergraduate Prospectus 2021 Entry

Undergraduate 2021 Entry Prospectus Image captions p15 p30–31 p44 p56–57 – The Marmor Homericum, located in the – Bornean orangutan. Courtesy of USO – UCL alumnus, Christopher Nolan. Courtesy – Students collecting beetles to quantify – Students create a bespoke programme South Cloisters of the Wilkins Building, depicts Homer reciting the Iliad to the – Saltburn Mine water treatment scheme. of Kirsten Holst their dispersion on a beach at Atlanterra, incorporating both arts and science and credits accompaniment of a lyre. Courtesy Courtesy of Onya McCausland – Recent graduates celebrating at their Spain with a European mantis, Mantis subjects. Courtesy of Mat Wright religiosa, in the foreground. Courtesy of Mat Wright – Community mappers holding the drone that graduation ceremony. Courtesy of John – There are a number of study spaces of UCL Life Sciences Front cover captured the point clouds and aerial images Moloney Photography on campus, including the JBS Haldane p71 – Students in a UCL laboratory. Study Hub. Courtesy of Mat Wright – UCL Portico. Courtesy of Matt Clayton of their settlements on the peripheral slopes – Students in a Hungarian language class p32–33 Courtesy of Mat Wright of José Carlos Mariátegui in Lima, Peru. – The Arts and Sciences Common Room – one of ten languages taught by the UCL Inside front cover Courtesy of Rita Lambert – Our Student Ambassador team help out in Malet Place. The mural on the wall is p45 School of Slavonic and East European at events like Open Days and Graduation. a commissioned illustration for the UCL St Paul’s River – Aerial photograph showing UCL’s location – Prosthetic hand. Courtesy of UCL Studies. -

Review 2011 1 Research

LONDON’S GLOBAL UNIVERSITY ReviewHighlights 2011 2011 Walking on Mars © Angeliki Kapoglou Over summer 2011, UCL Communications held a The winning entry was by Angeliki Kapoglou (UCL Space photography competition, open to all students, calling for & Climate Physics), who was selected to serve as a member images that demonstrated how UCL students contribute of an international crew on the Mars Desert Research Station, to society as global citizens. The term ‘education for global which simulates the Mars environment in the Utah desert. citizenship’ encapsulates all that UCL does to enable Researchers at the station work to develop key knowledge students to respond to the intellectual, social and personal needed to prepare for the human exploration of Mars. challenges that they will encounter throughout their future careers and lives. The runners-up and other images of UCL life can be seen at: www.flickr.com/uclnews Contents Research 2 Follow UCL news www.ucl.ac.uk Health 5 Insights: a fortnightly email summary Global 8 of news, comment and events: www.ucl.ac.uk/news/insights Teaching & Learning 11 Events calendar: Enterprise 14 www.events.ucl.ac.uk Highlights 2011 17 Twitter: @uclnews UCL Council White Paper 2011–2021 YouTube: UCLTV Community 21 In images: www.flickr.com/uclnews Finance & Investment 25 SoundCloud: Awards & Appointments 30 www.soundcloud.com/uclsound iTunes U: People 36 http://itunes.ucl.ac.uk Leadership 37 UCL – London’s Global University Our vision Our values • An outstanding institution, recognised as one of the world’s -

NIHR University College London Hospitals Biomedical Research Centre

NIHR University College London Hospitals Biomedical Research Centre Progress on implementing our revised strategic plan NIHR University College London Hospitals Biomedical Research Centre At the NIHR University College medicine activities and ensure we can make a London Hospitals BRC we have leading contribution to national rare disease been making brisk progress in our initiatives. UCL’s first rare diseases conference took relentless focus on world-class place in February 2013. activity of greatest therapeutic or Professor Bryan Williams’ appointment to the new diagnostic potential. As we enter our BRC Director post has strengthened our leadership. new phase we have expanded this Since August the four programmes have been led focus to drive forward strong and by substantive programme directors (PDs). The PD enduring partnerships with the role has required significant commitment (four life-sciences industry, both in the UK consultant PAs) from four outstanding international and internationally. leaders in experimental medicine: David Linch; Nick Wood; Bryan Williams; Deenan Pillay. All four are or As we push through home grown scientific have been NIHR investigators. discoveries into patient care, we are partnering Our new resource allocation models explicitly small medium enterprises (SMEs) and major target the translational potential of activities industry to share expertise, infrastructure and in nanotechnology, gene therapy, cell therapy/ resources. We are going to be flexible and creative regenerative medicine, bioengineering and in the ways we help create health and wealth. computer science. There are signs that the We are signing major new strategic partnerships increased focus on experimental medicine is with global pharmaceutical companies. A new impacting on the UCLH research portfolio. -

Annual Report

Annual Report 2002/2003 The academic year 2002/2003 was marked by continued excellence in research, teaching and outreach, in service of humanity’s intellectual, social and technological needs. Provost & President’s Outreach Statement In accordance with its UCL is committed to founding principles, UCL using its excellence in continued to share the research and teaching highest quality research to enrich society’s and teaching with those intellectual, cultural, who could most benefit scientific, economic, from it, regardless of environmental and their background or medical spheres. circumstances. See page 2 See page 8 Research & Teaching Achievements UCL continued to UCL’s academics challenge the boundaries conducted pioneering of knowledge through its work at the forefront programmes of research, of their disciplines while ensuring that the during this year. most promising students See page 12 could benefit from its intense research-led teaching environment. See page 4 The UCL Community Financial Information UCL’s staff, students, UCL’s annual income has alumni and members of grown by almost 30% in Council form a community the last five years. The which works closely largest component of this together to achieve income remains research the university’s goals. grants and contracts. See page 18 See page 24 Supporting UCL Contacting UCL UCL pays tribute to Join the many current those individuals and and former students and organisations who staff, friends, businesses, have made substantial funding councils and financial contributions agencies, governments, in support of its research foundations, trusts and and teaching. charities that are See page 22 involved with UCL. See page 25 Developing UCL With the help of its supporters, UCL is investing in facilities fit for the finest research and teaching in decades to come. -

Translational Research Office, UK

Impact Objectives • Use the Therapeutic Innovation Networks (TINs) to harness the translational experience and infrastructure of UCL and its NIHR Biomedical Research Centres to provide education, support and encouragement to early career scientists to translate their novel science • Maximise University College London’s ability to quickly and efficiently translate disease-related discoveries into high-quality therapeutic interventions and tangible treatments for patients • Ensure all TINs have an industry network with the aim of using their know-how and resource to aid the development of the portfolio The innovation game Professor David Lomas discusses the Therapeutic Innovation Networks (TINs), which are facilitating and accelerating enterprise at University College London (UCL), UK Can you begin by commercialising biomedical therapies. These of our national and international standing. introducing yourself? forums are also used to discuss barriers and For example, we have used the TINs to hurdles, and approaches to overcome them. assess our strengths and weaknesses in cell, I am Vice-Provost The Cell, Gene & Regenerative Medicine gene and regenerative therapies, and work (Health) at UCL, Head TIN has been very effective in pulling out how we can collaborate effectively with of the School of Life & the community together and articulating industry and our London partners: King’s Medical Sciences and our strengths in this area. UCL has more College London, Imperial College London Head of the UCL Medical School. I also serve research and clinical activity in the area of cell and Queen Mary University of London. This as the Academic Director of UCL Partners’ and gene therapy than any other university allows for economy of scale, more rapid Academic Health Science Centre and as a in the UK and, indeed, has a clinical portfolio translation and more effective competition Director of The Francis Crick Institute, Africa of comparable size to that of the whole of for research and enterprise income, Health Research Institute, MedCity, Non- Spain or Italy. -

University College London Bloomsbury Campus Masterplan

July 2014 UNIVERSITY COLLEGE LONDON BLOOMSBURY CAMPUS MASTERPLAN CONSTRUCTION MANAGEMENT PLAN Revision 2.0 – 29.07.14 CONSTRUCTION MANAGEMENT PLAN DOCUMENT CONTROL Document Title : UCL Bloomsbury Campus Masterplan - Construction Management Plan Revision Date Description Prepared by Checked by Approved by 01 27.05.14 Draft UCL / PB IS RJK 01.1 28.07.14 Draft UCL / PB 02 29.07.14 Update UCL / PB BC - UCL GB - UCL Changes : Aligned following highways logistics meeting with LB of Camden and thus the final version of this overarching CMP Control Schedule First Issue Revision 01 Revision 02 Date of Purpose of Date of Issued To Purpose Date of Purpose Issue Issue Issue of Issue Issue of Issue UCL Estates GB & LL 21.05.14 D UCL Estates GB & LL 22.05.14 R UCL Estates 27.04.14 R UCL Estates 28.07.14 R UCL Estates 29.07.14 A Purpose of Issue Code: D Draft for Comment A For Approval R For Review I For Information G Approved For General Issue Construction Management Plan UCL Construction Management Plan Finalised Version Revision 02.docx Prepared by Parsons Brinckerhoff May 2014 - 4 - Construction Management Plan CONTENTS Page Document Control 3 1 Introduction 7 1.1 Introduction 7 1.2 Project Construction Management Plans 7 1.3 Programme Control 7 2 ManagementOfTheEnvironment 8 2.1 Ecology Management 8 2.2 Arboriculture 9 2.3 Landscape And Townscape 11 2.4 Water Resources And Management 11 2.5 Noise And Vibration 13 2.6 Air Quality 18 2.7 Light Pollution 22 2.8 Ground Settlement And Land Contamination 22 2.9 Waste Management 24 2.10 Archaeology 27 -

UCL and to UCL's Graduate School

UCL GRADUATE SCHOOL T H E A R T OF RESEARCH G R A D U A T E S C H O O L HANDBOOK 2 0 1 1 / 1 2 Term Dates & Contacts Academic Term Dates and Useful Contacts First Term: Monday 26 September 2011 – Friday 16 December 2011 Second Term: Monday 9 January 2012 – Friday 23 March 2012 Third Term: Monday 23 April 2012 – Friday 8 June 2012 Some programmes of study have non-standard starting dates. Please refer to your offer letter for the starting date of your programme of study. Please consult the appropriate web site before using email addresses or telephone numbers. UCL Email and Telephone Directory UCL Careers Service Website: www.ucl.ac.uk/directory Website: www.ucl.ac.uk/careers Tel: +44 (0) 20 7679 2000 Tel: +44 (0) 20 7866 3600 Fax: +44 (0) 20 7866 3601 Graduate School Email: [email protected] Website: www.ucl.ac.uk/gradschool Tel: +44 (0) 20 7679 7840 Dean of Students (Welfare) Fax: + 44 (0) 20 7679 7043 Website: www.ucl.ac.uk/dean-of-students Email: [email protected] Tel: +44 (0) 20 7679 4545 Email: [email protected] International Office Website: www.ucl.ac.uk/prospective-students/ UCL Union international-students Website: www.uclu.org Tel: +44 (0) 20 7679 7765 Tel: +44 (0) 20 7387 3611 (Union Reception) Fax: +44 (0) 20 7679 3001 Tel: +44 (0) 20 7679 2998 (Rights and Advice Enquiries) Email: [email protected] Tel: +44 (0) 20 7679 2512 (Voluntary Services Unit) Scholarships Office ULU (University of London Union) Website: www.ucl.ac.uk/prospective-students/scholarships Website: www.ulu.co.uk Tel: +44 (0) 20 7679 2005 / -

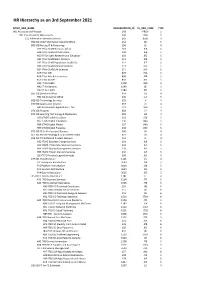

HR Hierarchy As on 3Rd September 2021

HR Hierarchy as on 3rd September 2021 MYHR_ORG_NAME ORGANIZATION_ID RL_ORG_CODE TYPE A01 President and Provost 243 PROV 1 B01 Vice-President (Operations) 244 VPA 2 C11 Information Services Division 265 JEISD 3 H38 ISD Chief Information Security Office 118 JID 5 D03 ISD Faculty IT & Partnering 290 JE 4 H27 IT for SLMS Directors Office 107 JEA 5 H28 IT for SLMS Infrastructure 108 JEB 5 H29 IT For SLMS Research and Education 109 JEC 5 H31 IT for SLMS Brain Sciences 111 JEE 5 H32 IT for SLMS Population Health Sci 112 JEF 5 H33 IT for SLMS Medical Sciences 113 JEG 5 H34 IT for SLMS Life Sciences 114 JEH 5 K49 IT for IOE 829 JRA 5 K50 IT for Arts & Humanities 830 JRB 5 K51 IT for SLASH 831 JRC 5 HA1 IT for SSEES 1548 JRD 5 HA2 IT for Bartlett 1549 JEI 5 DG2 IT for LAWS 1583 JRE 5 D67 ISD Directors Office 354 JQ 4 H51 ISD Divisional Office 130 JLA 5 D68 ISD Technology Services 355 JI 4 D70 ISD Application Services 357 JK 4 H43 AS Research Applications - Ops 123 JKH 5 D71 ISD Projects 358 JP 4 D72 ISD Learning Technology & Media Serv 359 JM 4 H30 LTMS Health Creatives 110 JED 5 H57 LTMS Digital Education 136 JMA 5 H58 LTMS Digital Media 137 JMB 5 H59 LTMS Digital Presence 138 JMC 5 D73 ISD IT for Professional Services 360 JN 4 DF1 ISD Service Strategy & Improvement Dept 621 JO 4 DF5 ISD IT Portfolio & Product Delivery 704 JL 4 H52 ITCPD Business Change Services 131 JLB 5 H53 ITCPD IT Portfolio Management Serv 132 JLC 5 H54 ITCPD Quality Management Services 133 JLD 5 H55 ITCPD Project Delivery Services 134 JLE 5 J16 ITCPD Project Support Services -

Data First 2019 UCL Research Data Strategy

RESEARCH DOMAINS eRESEARCH Data First 2019 UCL Research Data Strategy Report by the UCL eResearch Domain: Co-chairs: Prof Phil Luthert and Prof Jonathan Tennyson Strategic Research Coordinator: Dr Louise Chisholm Executive summary Our vision is for UCL to create an environment that optimises researchers’ capacity to flourish using data. This includes external data created in a non-research context which is used as the starting point for research and data generated during the research process. Uniquely, data can be reused without being degraded and its reuse can create new value. Our aim is for UCL to be the leading institution for data-focused research and to inspire and empower our research community for the long-term benefit of humanity. Effective harnessing of research data can lead to increased research funding, publications, citations, and socio-economic impact. This supports key institutional strategies including UCL 2034, UCL Research Data Policy (2018), and the Innovation and Enterprise Strategy (2016). Responding to a new landscape Technological advances have expanded the number of disciplines which use data and associated methodologies. More external organisations are collecting data which can be used as a basis of new research. Open Science encourages data to be shared as openly as possible and as closed as necessary. This impacts all faculties, the UCL’s broad corpus of data can initiate new interdisciplinary research. Research funders and the UK government promote the use of data in research by launching new funding opportunities via the Industrial Strategy Challenge Fund, Research Councils, and Alan Turing Institute. At the same time, the regulatory and legal environment is becoming increasingly complex for researchers to navigate, following GDPR and similar legislation.