長沙遠大住宅工業集團股份有限公司 Changsha Broad Homes Industrial Group Co., Ltd

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

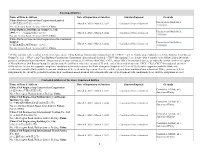

Sanctioned Entities Name of Firm & Address Date

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Construction Corporation Limited Procurement Guidelines, (中国铁建股份有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway 23rd Bureau Group Co., Ltd. Procurement Guidelines, (中铁二十三局集团有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway Construction Corporation (International) Limited Procurement Guidelines, March 4, 2020 - March 3, 2022 Conditional Non-debarment (中国铁建国际集团有限公司)*38 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China *38 This sanction is the result of a Settlement Agreement. China Railway Construction Corporation Ltd. (“CRCC”) and its wholly-owned subsidiaries, China Railway 23rd Bureau Group Co., Ltd. (“CR23”) and China Railway Construction Corporation (International) Limited (“CRCC International”), are debarred for 9 months, to be followed by a 24- month period of conditional non-debarment. This period of sanction extends to all affiliates that CRCC, CR23, and/or CRCC International directly or indirectly control, with the exception of China Railway 20th Bureau Group Co. and its controlled affiliates, which are exempted. If, at the end of the period of sanction, CRCC, CR23, CRCC International, and their affiliates have (a) met the corporate compliance conditions to the satisfaction of the Bank’s Integrity Compliance Officer (ICO); (b) fully cooperated with the Bank; and (c) otherwise complied fully with the terms and conditions of the Settlement Agreement, then they will be released from conditional non-debarment. If they do not meet these obligations by the end of the period of sanction, their conditional non-debarment will automatically convert to debarment with conditional release until the obligations are met. -

Analysis of the Characteristics in a Strong Convective Weather Process

Analysis of the characteristics in a strong convective weather process in China Li Zuxian Huang Xiaoyu Deng Zhaoping Xu Lin Hunan Meteorological Observatory, Changsha, China, 410007 ABSTRACT Introduction From the mid-70s, through the double Doppler By using the numerical forecasting product, the weather radar observation to understand thunderstorm convention, the automatic weather station and system's internal structure, especially the system Doppler weather radar materials, it analyzed interior's three dimensional wind field (Ray et al.1975), Hunan strong convective weather process on April 4, discovered particularly the hail storms wind field has 2006. The result indicated: The preliminary weather the cyclone type circulation characteristic, the returns to warmer continually, and accumulate ascendant current located at the weak echo region. massive unstable energies, the vertical wind shear, Chisholm and Renick (1972) and Browning(1977) the power, the thermal energy and the water vapor divides into the multi-monomer storm and the super condition are advantageous to the strong convection monomer storm the storm through using the past storm weather production; During this process, ground and research and the recognition of the storm power and the upper air temperature, the humidity, the kinetic the structure of Micro physics ; The storm has four energy perturbation quantity, the ground temperature stages: initial development period, the beginning of perturbation is bigger than each level upper air of echo characteristic, mature stage, dissipation stage. the temperature perturbation obviously, it explained Klemp(1987) reorganizes many year findings, showing that the ground thermal energy function is bigger that the Mesoscale cyclone in the fierce convection than that of the high level; In the disturbance storm is the horizontal direction scroll which cuts by moisture field, transfers the weather to have the the environment vertical wind forms does after the region each level humidity is smaller than the convection development reverse creates. -

Changsha:Gateway to Inland China

0 ︱Changsha: Gateway to Inland China Changsha Gateway to Inland China Changsha Investment Environment Report 2013 0 1 ︱ Changsha: Gateway to Inland China Changsha Changsha is a central link between the coastal areas and inland China ■ Changsha is the capital as well as the economic, political and cultural centre of Hunan province. It is also one of the largest cities in central China(a) ■ Changsha is located at the intersection of three major national high- speed railways: Beijing-Guangzhou railway, Shanghai-Kunming railway (to commence in 2014) and Chongqing-Xiamen railway (scheduled to start construction before 2016) ■ As one of China’s 17 major regional logistics hubs, Changsha offers convenient access to China’s coastal areas; Hong Kong is reachable by a 1.5-hour flight or a 3-hour ride by CRH (China Railways High-speed) Changsha is well connected to inland China and the world economy(b) Domestic trade (total retail Total value of imports and CNY 245.5 billion USD 8.7 billion sales of consumer goods) exports Value of foreign direct Total value of logistics goods CNY 2 trillion, 19.3% investment and y-o-y USD 3.0 billion, 14.4% and y-o-y growth rate growth rate Total number of domestic Number of Fortune 500 79.9 million, 34.7% tourists and y-o-y growth rate companies with direct 49 investment in Changsha Notes: (a) Central China area includes Hunan Province, Hubei Province, Jiangxi Province, Anhui Province, Henan Province and Shanxi Province (b) Figures come from 2012 statistics Sources: Changsha Bureau of Commerce; Changsha 2012 National Economic and Social Development Report © 2013 KPMG Advisory (China) Limited, a wholly foreign owned enterprise in China and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative ("KPMG International"), a Swiss entity. -

Supplemental Information

Supplemental information Table S1 Sample information for the 36 Bactrocera minax populations and 8 Bactrocera tsuneonis populations used in this study Species Collection site Code Latitude Longitude Accession number B. minax Shimen County, Changde SM 29.6536°N 111.0646°E MK121987 - City, Hunan Province MK122016 Hongjiang County, HJ 27.2104°N 109.7884°E MK122052 - Huaihua City, Hunan MK122111 Province 27.2208°N 109.7694°E MK122112 - MK122144 Jingzhou Miao and Dong JZ 26.6774°N 109.7341°E MK122145 - Autonomous County, MK122174 Huaihua City, Hunan Province Mayang Miao MY 27.8036°N 109.8247°E MK122175 - Autonomous County, MK122204 Huaihua City, Hunan Province Luodian county, Qiannan LD 25.3426°N 106.6638°E MK124218 - Buyi and Miao MK124245 Autonomous Prefecture, Guizhou Province Dongkou County, DK 27.0806°N 110.7209°E MK122205 - Shaoyang City, Hunan MK122234 Province Shaodong County, SD 27.2478°N 111.8964°E MK122235 - Shaoyang City, Hunan MK122264 Province 27.2056°N 111.8245°E MK122265 - MK122284 Xinning County, XN 26.4652°N 110.7256°E MK122022 - Shaoyang City,Hunan MK122051 Province 26.5387°N 110.7586°E MK122285 - MK122298 Baojing County, Xiangxi BJ 28.6154°N 109.4081°E MK122299 - Tujia and Miao MK122328 Autonomous Prefecture, Hunan Province 28.2802°N 109.4581°E MK122329 - MK122358 Guzhang County, GZ 28.6171°N 109.9508°E MK122359 - Xiangxi Tujia and Miao MK122388 Autonomous Prefecture, Hunan Province Luxi County, Xiangxi LX 28.2341°N 110.0571°E MK122389 - Tujia and Miao MK122407 Autonomous Prefecture, Hunan Province Yongshun County, YS 29.0023°N -

Pdf | 267.25 Kb

China: Floods "An estimated 255,300 people are reported to be IFRC Information Bulletin No. 1 homeless in China's Hunan province alone as a result of Issued 3 June 2005 severe flooding." GLIDE: FL-2005-000081-CHN Nei Mongol SITUATION Shijiazhuang Taiyuan Severe flooding destroyed around 30,000 homes and Yinchuan damaged thousands more. Rural farmers in Hunan, Ningxia Hebei Sichuan and Guizhou provinces have seen their crops, Shaanxi Shanxi Hui livestock, homes and belongings washed away by floods Xining Lanzhou triggered by heavy rains which began on Tuesday 31 May. Gansu ACTION Xi'an Luoyang Zhengzhou RCSC branch has distributed quilts, tents and disinfectant to flood victims. The branch is continuing to Henan run further checks on the disaster conditions and death CCHHIINNAA Anhui toll and has requested quilts, rice, tents, clothing and disinfectant from the RCSC’s headquarters-based relief Hubei division in Beijing. Sichuan Chengdu Dead: 47 Wuhan Map projection: Geographic Missing: 53 Map data source: ESRI. Xizang Dead: 4 Chongqing 590,000 people Code: IFRC Bulletin No. 01/2005 Missing: 5 Chongqing in need of food Hunan Yiyang Nanchang Neighbouring Countries Loudi Changsha Affected Provinces Dead: 17 INDIA Provinces Missing: 4 Xiangxi Huaihua Tujia-Miao Jiangxi Guizhou Worst Affected Prefectures Shaoyang Guiyang Populated Places Kunming Yunnan Guangxi Zhuang Guangdong Guangzhou Nanning Macau MYANMAR Fangcheng Gang Hong Kong VIETNAM LAO 0 100 200 300 Produced by the ReliefWeb Map Centre Km P.D.R Office for the Coordination of Humanitarian Affairs The names shown and the designations used on this map do not imply official endorsement or acceptance by the United Nations. -

Xiang Dialects Xiāng Fāngyán 湘方言

◀ Xiang Comprehensive index starts in volume 5, page 2667. Xiang Dialects Xiāng fāngyán 湘方言 Mandarin 普通话 (putonghua, literally “com- kingdom, which was established in the third century ce, moner’s language”) is the standard Chinese but it was greatly influenced by northern Chinese (Man- language. Apart from Mandarin, there are darin) at various times. The Chu kingdom occupied mod- other languages and dialects spoken in China. ern Hubei and Hunan provinces. Some records of the vocabulary used in the Chu kingdom areas can be found 湘 汉 Xiang is one of the ten main Chinese Han in Fangyan, compiled by Yang Xiong (53 bce– 18 ce), and dialects, and is spoken primarily throughout Shuowen jiezi, compiled by Xu Shen in 100 ce. Both works Hunan Province. give the impression that the dialect spoken in the Chu kingdom had some strong local features. The dialects spoken in Chu were influenced strongly he Xiang dialect group is one of the recognized by northern Chinese migrants. The first group of mi- ten dialect groups of spoken Chinese. Some 34 grants came into Hunan in 307– 312 ce. Most of them million people throughout Hunan Province came from Henan and Shanxi provinces and occupied speak one of the Xiang dialects. Speakers are also found Anxiang, Huarong, and Lixian in Hunan. In the mid- in Sichuan and Guangxi provinces. Tang dynasty, a large group of northern people came to The Xiang dialect group is further divided into New Hunan following the Yuan River into western Hunan. The Xiang (spoken in the north) and Old Xiang (spoken in the third wave of migrants arrived at the end of the Northern south). -

Ethnic Minority Development Plan

Ethnic Minority Development Plan May 2018 People’s Republic of China: Hunan Xiangjiang River Watershed Existing Solid Waste Comprehensive Treatment Project Prepared by the ADB-financed Project Management Office of the Lanshan County Government and the Yongzhou City Government for the Asian Development Bank. CURRENCY EQUIVALENTS (as of 30 April 2018) Currency unit – yuan (CNY) CNY1.00 = $0.158 $1.00 = CNY6.3 34 ABBREVIATIONS 3R – reduce, reuse, and recycle ADB – Asian Development Bank ACWF – All China Women’s Federat ion DI – design institute EMDP – ethnic minority development plan EM – ethnic minority EMG – ethnic minority group EMT – ethnic minority township EMAC – ethnic minority autonomous county EMP – environmental management plan EMRA O – Ethnic Minority and Religion Affairs Office ESB – Environment Sanitation Bureau FGD – focus group discussion GDP – gross domestic product GRM – Grievance redress mechanism HH – household HIV – human immunodeficiency virus HPMO – Hunan project management office IA – Implementing agency IP – indigenous pe oples LSSB – Labor and Social Security Bureau MSW – Municipal solid waste PA – Project areas PRC – People’s Republic of China PMO – project management office SPS – Safeguard Policy Statement STI – sexually transmitted infection TA – technic al assistance XRW – Xiangjiang River watershed YME – Yao minority township NOTE In this report, "$" refers to United States dollars. This ethnic minority development plan is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. Your attention is directed to the “terms of use” section of this website. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. -

Evaluating Economic Growth, Industrial Structure, and Water Quality of the Xiangjiang River Basin in China Based on a Spatial Econometric Approach

International Journal of Environmental Research and Public Health Article Evaluating Economic Growth, Industrial Structure, and Water Quality of the Xiangjiang River Basin in China Based on a Spatial Econometric Approach Xiaohong Chen 1,2, Guodong Yi 1,2, Jia Liu 3,*, Xiang Liu 4,* and Yang Chen 1,2 1 School of Business, Central South University, Changsha 410083, China; [email protected] (X.C.); [email protected] (G.Y.); [email protected] (Y.C.) 2 Institute of Big Data and Internet Innovation, Hunan University of Commerce, Changsha 410205, China 3 School of Information and Safety Engineering, Zhongnan University of Economics and Law, Wuhan 430073, China 4 Institute of Finance, Guangzhou University, Guangzhou 510006, China * Correspondence: [email protected] (J.L.); [email protected] (X.L.); Tel.: +86-130-3711-0850 (J.L.); +86-185-7153-0906 (X.L.) Received: 30 July 2018; Accepted: 20 September 2018; Published: 25 September 2018 Abstract: This research utilizes the environmental Kuznets curve to demonstrate the interrelationship between economic growth, industrial structure, and water quality of the Xiangjiang river basin in China by employing spatial panel data models. First, it obtains two variables (namely, CODMn, which represents the chemical oxygen demand of using KMnO4 as chemical oxidant, and NH3-N, which represents the ammonia nitrogen content index of wastewater) by pretreating the data of 42 environmental monitoring stations in the Xiangjiang river basin from 2005 to 2015. Afterward, Moran’s I index is adopted to analyze the spatial autocorrelation of CODMn and NH3-N concentration. Then, a comparative analysis of the nonspatial panel model and spatial panel model is conducted. -

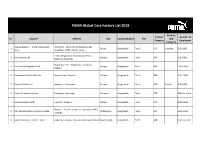

PUMA Global Core Factory List 2019

PUMA Global Core Factory List 2019 Product Product Number of Nr. Supplier Address City Country/Region Tier Sub Category Employees Category Avery Dennison - (Paxar Bangladesh Plot # 167 - 169, DEPZ (Extension Area), 1 Dhaka Bangladesh Tier 2 ACC Labeling 501-1000 Ltd.) Ganakbari, DEPZ, Ashulia, Savar 228/2, Mogorkhal, Dhaka Bipass Road, 2 Eco Couture Ltd. Gazipur Bangladesh Tier 1 APP 501-1000 National University, Begumpur, P.O. : Begumpur, Hotapara, 3 Ever Smart Bangladesh Ltd. Gazipur Bangladesh Tier 1 APP 1001-2000 Gazipur 4 Fakhruddin Textile Mills Ltd. Mouza-kewa, Sreepur Gazipur Bangladesh Tier 1 APP 3501-5000 5 Hamza Textiles Ltd. Nayapara, Kashimpur Gazipur Bangladesh Tier 2 APP Textile 501-1000 6 Jinnat Knitwears Limited Sardagonj, Kashimpur Gazipure Bangladesh Tier 1 APP 5001 or more 7 Mawna Fashions Ltd. Tepirbari, Sreepur Gazipur Bangladesh Tier 1 APP 2001-3500 Plot No. - 7 to 11, Sector - 01, Karnaphuli EPZ, 8 Park (Bangladesh) Company Limited Chattogram Bangladesh Tier 1 ACC 3501-5000 Patenga, 9 Square FashionS Limited - Unit 1 Habir Bari, Valuka, Jamirdia, Habir Bari, Valuka Mymensingh Bangladesh Tier 1 APP 5001 or more Product Product Number of Nr. Supplier Address City Country/Region Tier Sub Category Employees Category Chandana, Basan Union, Dhaka By-Pass Road, 10 Square Fashions Limited -Unit 2 Gazipur Bangladesh Tier 1 APP 3501-5000 Vogra, Gazipur 297, Khortoil,Tongi, DBA - 11 Viyellatex Ltd. Gazipure Bangladesh Tier 1 APP 5001 or more Viyellatex/Youngones Fashion Ltd. National Road No.22, Phum Thnung Roling, 12 Beautiful -

Hunan Roads Development Ii Project

RESETTLEMENT PLAN on the HUNAN ROADS DEVELOPMENT II PROJECT in THE PEOPLE’S REPUBLIC OF CHINA (PRC) Changde-Jishou Expressway Construction and Development Co. Ltd. Hunan, PRC This report was prepared by the Borrower and is not an ADB document. Version dated: 28 June 2004 PREFACE This Resettlement Plan (RP) has been prepared by the Hunan Provincial Expressway Construction and Development Co. Ltd. (HPEC) with assistance provided under the Project Preparation Technical Assistance (PPTA). The RP has been formulated based on the PRC laws and local regulations and the Asian Development Bank’s (ADB’s) Policy on Involuntary Resettlement. The RP addresses the land acquisition and resettlement aspects of the Changde-Jishou Expressway Project (the Project). The RP is based on socio-economic assessment and 657 households sample surveys of potentially affected persons (APs) according to the preliminary design. The overall impacts reported here are based on the reliable Detailed Measurement survey, and field surveys carried out during the PPTA work. After concurrence from ADB, the RP will then be approved by HPCD on behalf of Hunan People’s Government. 2 BRIEF INTRODUCTION AND APPROVAL OF THE RP HPCD has received approval to construct the Changji expressway, which is expected to commence in March 2004 and be completed by end of 2007. HPCD, through MOC/MOF, has requested a loan from ADB to finance part of the project. Accordingly, the Project must be implemented in compliance with ADB social safeguard policies. This RP represents a key requirement of ADB and will constitute the basis for land acquisition, compensation and resettlement. -

Copyright by James Joshua Hudson 2015

Copyright by James Joshua Hudson 2015 The Dissertation Committee for James Joshua Hudson Certifies that this is the approved version of the following dissertation: River Sands/Urban Spaces: Changsha in Modern Chinese History Committee: Huaiyin Li, Supervisor Mark Metzler Mary Neuburger David Sena William Hurst River Sands/Urban Spaces: Changsha in Modern Chinese History by James Joshua Hudson, B.A.; M.A. Dissertation Presented to the Faculty of the Graduate School of The University of Texas at Austin in Partial Fulfillment of the Requirements for the Degree of Doctor of Philosophy The University of Texas at Austin May 2015 Dedication For my good friend Hou Xiaohua River Sands/Urban Spaces: Changsha in Modern Chinese History James Joshua Hudson, PhD. The University of Texas at Austin, 2015 Supervisor: Huaiyin Li This work is a modern history of Changsha, the capital city of Hunan province, from the late nineteenth to mid twentieth centuries. The story begins by discussing a battle that occurred in the city during the Taiping Rebellion (1850-1864), a civil war that erupted in China during the mid nineteenth century. The events of this battle, but especially its memorialization in local temples in the years following the rebellion, established a local identity of resistance to Christianity and western imperialism. By the 1890’s this culture of resistance contributed to a series of riots that erupted in south China, related to the distribution of anti-Christian tracts and placards from publishing houses in Changsha. During these years a local gentry named Ye Dehui (1864-1927) emerged as a prominent businessman, grain merchant, and community leader. -

Dongting Lake Newsletter, July 2020

Dongting Lake Newsletter July 2020 - Issue #5 © FAO © Protection and Management Progress Review of 2019 Winter GCP/CPR/043/GFF Highlights Officer of the Asia-Pacific Regional Office of Food and Agriculture Organization of the United Nations 1. The fourth Project Steering Committee meeting was (FAO), Yao Chunsheng, Global Environment Facility successfully held in Changsha. (GEF) Project Officer of the FAO China Office, Deng Weiping, Director of Finance Department of Hunan 2. The Management Plan of four Nature Reserves in Province, Tang Yu, Director of Department of Dongting Lake has been drafted. Ecological Environment of Hunan Province, other members of the Project Steering Committee, and 3. The capacity building for staff of Project Management representatives of project technical experts participated Office (PMO) and four Nature Reserves has been gradually in the meeting. enhanced. The agenda of the meeting includes: 1) review the project 4. The international and domestic exchange activities and work in 2019; 2) arrange the work plan and budget trainings have been carried out. for 2020; 3) discuss financial management, mid- term evaluation of the project, and promotion of 5. Publicity and promotion activities proceed steadily. project achievements; 4) review the progress made by community co-management; 5) discuss the compilation 1. PROJECT MANAGEMENT of teaching materials for biodiversity conservation in Dongting Lake. 1.1 Fourth Meeting of Project Steering Participants also carried out on-site investigation Committee on ecological fishery in Qingshan Island and bird- friendly comprehensive agriculture co-management In January 2020, the fourth Project Steering model in Yueyang County. Committee meeting of the project was held in Changsha, Hunan Province.