Annual Report 2019

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

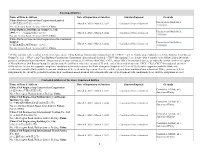

Sanctioned Entities Name of Firm & Address Date

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Construction Corporation Limited Procurement Guidelines, (中国铁建股份有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway 23rd Bureau Group Co., Ltd. Procurement Guidelines, (中铁二十三局集团有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway Construction Corporation (International) Limited Procurement Guidelines, March 4, 2020 - March 3, 2022 Conditional Non-debarment (中国铁建国际集团有限公司)*38 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China *38 This sanction is the result of a Settlement Agreement. China Railway Construction Corporation Ltd. (“CRCC”) and its wholly-owned subsidiaries, China Railway 23rd Bureau Group Co., Ltd. (“CR23”) and China Railway Construction Corporation (International) Limited (“CRCC International”), are debarred for 9 months, to be followed by a 24- month period of conditional non-debarment. This period of sanction extends to all affiliates that CRCC, CR23, and/or CRCC International directly or indirectly control, with the exception of China Railway 20th Bureau Group Co. and its controlled affiliates, which are exempted. If, at the end of the period of sanction, CRCC, CR23, CRCC International, and their affiliates have (a) met the corporate compliance conditions to the satisfaction of the Bank’s Integrity Compliance Officer (ICO); (b) fully cooperated with the Bank; and (c) otherwise complied fully with the terms and conditions of the Settlement Agreement, then they will be released from conditional non-debarment. If they do not meet these obligations by the end of the period of sanction, their conditional non-debarment will automatically convert to debarment with conditional release until the obligations are met. -

CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A Joint Stock Company Incorporated in the People’S Republic of China with Limited Liability) (Stock Code: 2202)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. CHINA VANKE CO., LTD.* 萬科企業股份有限公司 (A joint stock company incorporated in the People’s Republic of China with limited liability) (Stock Code: 2202) 2019 ANNUAL RESULTS ANNOUNCEMENT The board of directors (the “Board”) of China Vanke Co., Ltd.* (the “Company”) is pleased to announce the audited results of the Company and its subsidiaries for the year ended 31 December 2019. This announcement, containing the full text of the 2019 Annual Report of the Company, complies with the relevant requirements of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited in relation to information to accompany preliminary announcement of annual results. Printed version of the Company’s 2019 Annual Report will be delivered to the H-Share Holders of the Company and available for viewing on the websites of The Stock Exchange of Hong Kong Limited (www.hkexnews.hk) and of the Company (www.vanke.com) in April 2020. Both the Chinese and English versions of this results announcement are available on the websites of the Company (www.vanke.com) and The Stock Exchange of Hong Kong Limited (www.hkexnews.hk). In the event of any discrepancies in interpretations between the English version and Chinese version, the Chinese version shall prevail, except for the financial report prepared in accordance with International Financial Reporting Standards, of which the English version shall prevail. -

Feasibility Study on Launching of Shared New Energy Vehicles in Wuxi City

2018 9th International Symposium on Advanced Education and Management (ISAEM 2018) Feasibility Study on Launching of Shared New Energy Vehicles in Wuxi City Feng Xia School of Automotive Technology, Wuxi Vocational Institute of Commerce, Wuxi, Jiangsu, 214153, China [email protected] Keywords: Shared vehicles; Status quo; Development studies Abstract: Shared vehicles not only bring convenience to urban people to use cars, but also meet the needs of "car-free people", and have been recognized among many citizens. This paper discusses the status quo and development of shared vehicles in Wuxi city, and provides reference for the future entrepreneurship of shared vehicles. Through scientific design of research content and reasonable development of practice plan, different objects were investigated and surveyed in the form of field visit and consultation of users, by distribution of survey questionnaire. 1. Introduction High oil prices have led to a shift in many people’s attitudes towards car-sharing, and they tend to join the “car-sharing” team. The number of car-sharing members in the United States, Canada and other countries has increased rapidly, with nearly 100,000 members in the United States. “Car-sharing” is also booming in countries such as the Netherlands, Belgium, Denmark, Italy and the United Kingdom. Major cities in Belgium have set up special parking spaces for shared vehicles like taxis [1]. The government wants the number of “car-sharing members” to triple by 2010. The Dutch capital, Amsterdam, has 310 shared car stops. Germany is considering amending its laws, allowing special parking spaces for shared cars in residential areas. In the future, "car-sharing" could develop into a daily car service that is more flexible in terms of time, more spatial and less expensive than traditional car rental services, according to George Welk, a sociology and automotive expert at the Institute of Climate, Environment and Energy in Upetal, Germany [2]. -

Annual Report 2018

CHINA VANKE CO., LTD.* (a joint stock company incorporated in the People’s Republic of China with limited liability) (Stock code: 2202) ANNUAL REPORT 2018 *For identification purpose only Important Notice: 1. The Board, the Supervisory Committee and the Directors, members of the Supervisory Committee and senior management of the Company warrant that in respect of the information contained in 2018 Annual Report (the “Report”, or “Annual Report”), there are no misrepresentations, misleading statements or material omission, and individually and collectively accept full responsibility for the authenticity, accuracy and completeness of the information contained in the Report. 2. The Report has been approved by the 18th meeting of the 18th session of the Board (the “Meeting”) convened on 25 March 2019. Mr. LIN Maode, vice chairman of the Board and a non-executive director, did not attend the Meeting due to business engagement, and had authorized Mr. CHEN Xianjun, a non-executive director, to attend the Meeting and execute voting rights on his behalf. All other directors attended the Meeting in person. 3. The Company’s proposal on dividend distribution for the year of 2018: The total amount of cash dividends proposed for distribution for 2018 will be RMB11,811,892,641.07 (inclusive of tax), accounting for 34.97% of the net profit for the year attributable to equity shareholders of the Company for 2018, without any bonus shares or transfer of equity reserve to the share capital. Based on the Company’s total number of 11,039,152,001 shares at the end of 2018, a cash dividend of RMB10.7 (inclusive of tax) will be distributed for each 10 shares. -

Waiting for End of COVID19 in Wuxi

16 | Thursday, March 26, 2020 HONG KONG EDITION | CHINA DAILY LIFE Mystery neighbor’s sporadic performances give pointers on excellence It has happened a few times in er, the pyrotechnics leave plenty of The only problem is, unlike my pianist, he or she must be Chinese, many more of these young piano ago about the great Polish Ameri- the three years I’ve been living in room for expressivity. neighbor, I have no skill whatsoever. because, aside from my family, I’ve lions. can pianist Arthur Rubinstein. my apartment. My guess — because it’s not a fre- Maybe that’s a bit harsh. Let’s just not seen any other foreigners in the But not all great Chinese pianists If memory serves me, Rubinstein I’ll be sitting in the back room, quent occurrence, but with months say that my playing continues to compound where I live. are young. This is a trend that has was touring Asia many years ago usually with the between each time I’ve heard it — is advance to ever-more complicated I’m often amazed at how readily been going on for some time. and agreed to an acquaintance’s windows open, and that this must be a gifted, advanced pieces that I’m unable to play. Chinese and other Asian peoples Five or six years ago, I had the request that he give a lecture-per- suddenly hear the conservatory student practicing on It’s taken me years to get there. have stepped to the forefront of great privilege of hearing a grand formance for piano students at the faint tones of a the family piano during a visit Nowadays, I’m able to mercilessly Western classical music concert sta- tone poet among pianists, Fou Shanghai Conservatory. -

SUN ART RETAIL GROUP LIMITED 高鑫零售有限公司 (Incorporated in Hong Kong with Limited Liability) (Stock Code: 06808)

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. SUN ART RETAIL GROUP LIMITED 高鑫零售有限公司 (incorporated in Hong Kong with limited liability) (Stock Code: 06808) PROPERTY VALUATION REPORT Reference is made to a summary of the property valuation report (the “Property Valuation Report”) dated 22 December 2017 issued by Cushman & Wakefield Limited (an independent property valuer), which is enclosed in “Appendix V – Summary of Property Valuation Report” to the composite offer and response document dated 22 December 2017 (the “Composite Document”) jointly issued by Sun Art Retail Group Limited (the “Company”) and Taobao China Holding Limited (the “Offeror”) in relation to the mandatory unconditional cash offer by China International Capital Corporation Hong Kong Securities Limited on behalf of the Offeror to acquire all the issued Shares in the Company (other than those Shares already owned or agreed to be acquired by the Offeror and parties acting in concert with it). Unless otherwise defined, terms used herein shall have the same meanings as those defined in the Composite Document. The Company sets out the full text of the Property Valuation Report in Appendix I of this announcement for the attention of the Shareholders and potential investors in the Company. The full text of the Property Valuation Report will be available for inspection (i) on the website of the SFC at http://www.sfc.hk; (ii) on the website of the Company at www.sunartretail.com; and (iii) (during normal business hours from 9:00 a.m. -

Annual Report

Important Notice: 1. The Board, the Supervisory Committee and the Directors, members of the Supervisory Committee and senior management of the Company warrant that in respect of the information contained in 2020 Annual Report (the “Report”, or “Annual Report”), there are no misrepresentations, misleading statements or material omission, and individually and collectively accept full responsibility for the authenticity, accuracy and completeness of the information contained in the Report. 2. The Report has been approved by the sixth meeting of the 19th session of the Board (the “Meeting”) convened on 30 March 2021. Mr. XIN Jie and Mr. TANG Shaojie, both being Non-executive Directors, did not attend the Meeting due to business engagement, and had authorised Mr. LI Qiangqiang, also a Non-executive Director, to attend the Meeting and executed voting rights on their behalf. All other Directors attended the Meeting in person. 3. The Company’s proposal on dividend distribution for the year of 2020: Based on the total share capital on the equity registration date when dividends are paid, the total amount of cash dividends proposed for distribution for 2020 will be RMB14,522,165,251.25 (inclusive of tax), accounting for 34.98% of the net profit attributable to equity shareholders of the Company for 2020, without any bonus shares or transfer of equity reserve to the share capital. Based on the Company’s total number of 11,617,732,201 shares at the end of 2020, a cash dividend of RMB12.5 (inclusive of tax) will be distributed for each 10 shares. If any circumstances, such as issuance of new shares, share repurchase or conversion of any convertible bonds into share capital before the record date for dividend distribution, results in the changes in our total number of shares on record date for dividend distribution, dividend per share shall be adjusted accordingly on the premise that the total dividends amount remains unchanged. -

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Constructio

Sanctioned Entities Name of Firm & Address Date of Imposition of Sanction Sanction Imposed Grounds China Railway Construction Corporation Limited Procurement Guidelines, (中国铁建股份有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway 23rd Bureau Group Co., Ltd. Procurement Guidelines, (中铁二十三局集团有限公司)*38 March 4, 2020 - March 3, 2022 Conditional Non-debarment 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China China Railway Construction Corporation (International) Limited Procurement Guidelines, March 4, 2020 - March 3, 2022 Conditional Non-debarment (中国铁建国际集团有限公司)*38 1.16(a)(ii) No. 40, Fuxing Road, Beijing 100855, China *38 This sanction is the result of a Settlement Agreement. China Railway Construction Corporation Ltd. (“CRCC”) and its wholly-owned subsidiaries, China Railway 23rd Bureau Group Co., Ltd. (“CR23”) and China Railway Construction Corporation (International) Limited (“CRCC International”), are debarred for 9 months, to be followed by a 24- month period of conditional non-debarment. This period of sanction extends to all affiliates that CRCC, CR23, and/or CRCC International directly or indirectly control, with the exception of China Railway 20th Bureau Group Co. and its controlled affiliates, which are exempted. If, at the end of the period of sanction, CRCC, CR23, CRCC International, and their affiliates have (a) met the corporate compliance conditions to the satisfaction of the Bank’s Integrity Compliance Officer (ICO); (b) fully cooperated with the Bank; and (c) otherwise complied fully with the terms and conditions of the Settlement Agreement, then they will be released from conditional non-debarment. If they do not meet these obligations by the end of the period of sanction, their conditional non-debarment will automatically convert to debarment with conditional release until the obligations are met. -

Annual Report 年報 Contents

YINCHENG INTERNATIONAL HOLDING CO.,LTD. YINCHENG INTERNATIONAL HOLDING CO.,LTD. (於開曼群島註冊成立之有限公司) (Incorporated in the Cayman Islands with limited liability) 股份代號 : 1902 Stock Code: 1902 2018 2018 ANNUAL REPORT 年報 CONTENTS 02 Corporate information 04 Financial highlights 05 Financial Summary 06 Chairman’s Statement 09 Management Discussion and Analysis 30 Biographical Details of Directors and Senior Management 35 Corporate Governance Report 47 Directors’ Report 63 Independent Auditor’s Report 68 Consolidated Statement of Profit or Loss and Other Comprehensive Income 69 Consolidated Statement of Financial Position 71 Consolidated Statement of Changes in Equity 73 Consolidated Statement of Cash Flows 76 Notes to Financial Statements CORPORATE INFORMATION BOARD OF DIRECTORS REGISTERED OFFICE Non-executive Directors Sertus Chambers Governors Square, Suite #5-204, HUANG Qingping (黃清平) (Chairman) 23 Lime Tree Bay Avenue XIE Chenguang (謝晨光) P.O. Box 2547, Grand Cayman, KY1-1104 Cayman Islands Executive Directors MA Baohua (馬保華) HEADQUARTERS AND PRINCIPAL ZHU Li (朱力) PLACE OF BUSINESS IN THE PRC WANG Zheng (王政) Part of 19–21 Floors SHAO Lei (邵磊) Block A Yincheng Plaza 289 Jiangdongbeilu Independent Non-executive Directors Nanjing CHEN Shimin (陳世敏) People’s Republic of China CHAN Peng Kuan (陳炳鈞) LAM Ming Fai (林名輝) PRINCIPAL PLACE OF BUSINESS IN HONG KONG AUDIT COMMITTEE Room 4502, 45/F CHEN Shimin (陳世敏) (Chairman) Far East Finance Centre CHAN Peng Kuan (陳炳鈞) 16 Harcourt Road HUANG Qingping (黃清平) Admiralty Hong Kong NOMINATION COMMITTEE HONG KONG -

PUBLIC City Branch/Sub-Branch Name Address Telephone

City Branch/Sub-branch Name Address Telephone Unit 102, 1F, Unit 01-03, 05-08, 16F, 17F & 18F, Fortune Financial Center, No.5 Beijing Branch* (010) 5999 8888 Dongsanhuan Zhong Road, Chaoyang District, Beijing Beijing Lufthansa Center Sub-branch* Shop No.3&4, Kempinski hotel No.50, Liangmaqiao Road, Chaoyang District, Beijing (010) 5999 7900 Unit01-02,1/F Block B China Electronics Plaza, No.3 Dan Ling Street, Haidian District, Beijing Zhong Guan Cun West Sub-Branch (010) 5999 7288 Beijing Unit W-2~6, G/F, No.3 Jian Guo Men Wai Avenue, Jing Lun Hotel, Chao Yang District, Beijing Jing Lun Sub-branch* (010) 5999 7500 Beijing No.208 1st/F & No.200 2nd/F Lido Commercial Building(A2),No. 6, Jiangtai Road, Chaoyang Beijing Lido Place Sub-branch (010) 5999 7588 District, Beijing Beijing China Central Place Sub-branch Shop L9, B1/F & 1/F, Block 13, No 89 Jianguo Road, Chaoyang District, Beijing (010) 5999 7268 Block 1002.1003.1003N G/F Jin Yuan Yan Sha Mall No.1 Yuan Da road,Hai Dian District, Beijing Yuan Da Road Sub-branch[1]* (010) 5999 7888 Beijing Beijing North Star Sub-Branch* Unit 0101,1/F North Star Times Tower, No.8 Bei Chen Dong Lu, ChaoYang District, Beijing (010) 5999 7711 Beijing UNIT 102, Guohua Investment Tower, NO.3 DONGZHIMEN SOUTH STREET, DONGCHENG DIS., Beijing Dong Zhi Men Sub-branch (010) 5999 6589 BEIJING Beijing Winland International Finance G/F of Unit F109-F110 & South office building of Unit F721-723, F725-726, F919, Winland (010) 5999 7477 Centre Sub-branch International Finance Centre No. -

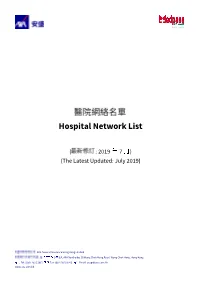

Hospital Network List

Hospital Network List ( : 2019 7 ) (The Latest Updated: July 2019) AXA General Insurance Hong Kong Limited 38 5 5/F, AXA Southside, 38 Wong Chuk Hang Road, Wong Chuk Hang, Hong Kong Tel: (852) 2523 3061 Fax: (852) 2810 0706 Email: [email protected] www.axa.com.hk Index / Province/City Page Shandong 2 Shanghai 2 - 3 Tianjin 3 Sichuan 3 Beijing 3 - 5 Jiangsu 5 - 6 Hebei 6 Chongqing 6 Shanxi 6 Zhejiang 6 Hubei 6 Hunan 6 Yunnan 6 - 7 Heilongjiang 7 Xinjiang 7 Guangxi 7 Guangdong 7 Liaoning 7 1 / Province/City Hospital Name Address 19 Shandong Qingdao women& Infants Hospital No. 19, Zhongshan Road, Shinan District, Qingdao. (3A) 105 Jinan Central Hospital No. 105, Jiefang Road, Lixia District, Jinan (3A) 16766 Shandong Qianfoshan Hospital No. 16766, Jingshi Road, Lixia District, Jinan, Shandong (3A) 5 Qingdao Municipal Hospital (East Department) No. 5, Donghaizhong Road, Shinan District, Qingdao (3A) 127 Qingdao Center Hospital No. 127, Si Liu South Road, Shibei District, Qingdao (Private) 319 Qingdao United Family Hospital No. 319, Hong Kong East Road, Laoshan District, Qingdao (Private) 1 Jinan Aima Maternity Hospital No.1, Yaotou Road, Lixia District, Jinan (Private) 8 Yantai Luye-Bobath Rehab Hospital No. 8, Haibo Road, High-tech Zone, Yantai, Shandong (3A) 16 The Affiliated Hospital of Qingdao University International Medical Center No. 16, Jiangsu Road, Shinan District, Qingdao (3A) 12 Shanghai Huashan Hospital affiliated to Fudan University No. 12, Wulumuqi Middle Road, Shanghai (Private) 170 3 Parkway Health Medical Centers – Specialty and Inpatient Center 3/F, No.170, Danshui Road, Luwan District, Shanghai (Private) 551 Shanghai East International Medical Center No. -

Research on HOV Lane Priority Dynamic Control Under Connected Vehicle Environment

Hindawi Journal of Advanced Transportation Volume 2020, Article ID 8892859, 12 pages https://doi.org/10.1155/2020/8892859 Research Article Research on HOV Lane Priority Dynamic Control under Connected Vehicle Environment Guiliang Zhou ,1,2 Lina Mao ,1,3 Pengsen Hu,4 Feng Sun,5 and Xu Bao1 1Jiangsu Key Laboratory of Traffic and Transportation Security, Huaiyin Institute of Technology, Huaian 223003, China 2School of Automotive and Traffic Engineering, Jiangsu University, Zhenjiang 212013, China 3School of Transportation, Southeast University, Nanjing 210096, China 4Department of Civil and Environmental Engineering, .e Pensylvania State University, University Park, PA 16802, USA 5School of Transportation and Vehicle Engineering, Shandong University of Technology, Zibo, Shandong 255049, China Correspondence should be addressed to Guiliang Zhou; [email protected] and Lina Mao; [email protected] Received 5 May 2020; Revised 16 July 2020; Accepted 23 July 2020; Published 8 August 2020 Academic Editor: Zhuping Zhou Copyright © 2020 Guiliang Zhou et al. -is is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. -e optimization of high-occupancy vehicle (HOV) lane management can better improve the efficiency of road resources. -is paper first summarized the current research on HOV lane implementation and analyzed and identifies the threshold of setting road HOV lane dynamic control under the connected vehicle environment. -en, the HOV lane priority dynamic control process was determined, and the operating efficiency and energy consumption evaluation method was proposed. Moreover, a case study in Wuxi City, China, was carried out.