A Strategic Analysis to Asses Current Booking.Com Competitive

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Russia Technology Internet Local Dominance Strengthens

12 December 2018 | 1:51AM MSK Russia Technology: Internet Local dominance strengthens; competition among ecosystems intensifies It’s been a year since we published Russia’s internet champions positioned to Vyacheslav Degtyarev +7(495)645-4010 | keep US giants at bay. We revisit our thesis, highlighting that the domestic internet [email protected] OOO Goldman Sachs Bank incumbents are successfully defending their home turf from international competition. We have seen only modest incremental efforts from global players, with some recognizing the importance of local expertise (Alibaba’s agreement to transfer control in AliExpress Russia to local partners) or conceding to domestic market leaders (Uber merged its Russian operations with Yandex.Taxi, citing Yandex’s strong technology and brand advantage). The two domestic market leaders, Yandex and Mail.ru, have solidified their dominant positions in search and social networks, respectively, and are leveraging these core businesses to exploit new sources of growth across their ecosystems (e.g. advertising, taxi, food tech, music). While their ever-expanding competitive overlap is worrying, we note this is not unique for global tech and is still relatively limited in scale. We expect the local dominance trend to continue and see significant untapped opportunities in e-commerce, messengers, local services, cloud and fintech. We re-iterate our Buy ratings on Yandex (on CEEMEA FL) and Mail.ru, and view them as the key beneficiaries of internet sector growth in Russia. We believe the market -

Company Profile

Company Profile trivago Overview This is trivago Screenshot trivago History Contact trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] trivago Overview trivago is the top European online travel site for travel enthusiasts and Germany’s largest travel community with: 3 million visitors per month 187,000 hotel reviews written by trivago members, 3 million hotel reviews including reviews from partner sites and 1.8 million photos of 320,000 hotels and 90,000 attractions worldwide (user generated content) 75,000 active members in Europe trivago offers: An overview of all the prices of all online travel agents for all available hotels Details of each booking (Breakfast included yes/no, payment options, availability) Traveller tips from first hand experience about hotels and destinations Valuable advice about hotels and must see places A social network where members can exchange insider tips trivago GmbH Tel: +49 (0)211 75 84 86 90 Ulrike Pithan Fax: +49 (0)211 75 84 86 99 Ronsdorfer Str.77 www.trivago.de 40233 Düsseldorf [email protected] This is trivago The trivago hotel price comparison – all hotels, all providers, all prices The trivago hotel search, compares the prices of more than 30 international online travel websites. Accurate descriptions of each rate allow for complete price transparency (Breakfast included yes/no, Payment by Creditcard yes/no). Reviews from Travellers – tell the real story trivago’s community offers travellers insider tips about hotels, restaurants, holiday destinations and much more. -

2021 01__ Jan 21 Ledger Layout 1

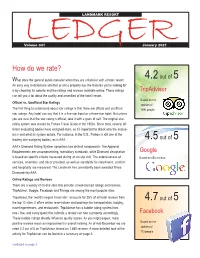

LEDGERLANDMARK RESORT Volume 341 January 2021 How do we rate? out of What does the general public consider when they are unfamiliar with a hotel / resort. 4.2 5 An easy way to determine whether or not a property has the features you're looking for is by checking its website and the ratings and reviews available online. These ratings TripAdvisor can tell you a lot about the quality and amenities of the hotel / resort. Based on the Official vs. Unofficial Star Ratings opinion of The first thing to understand about star ratings is that there are official and unofficial 1890 people star ratings. Any hotel can say that it is a five-star hotel or a three-star hotel. But unless you are sure that the star rating is official, take it with a grain of salt. The original star- rating system was started by Forbes Travel Guide in the 1950s. Since then, several dif- ferent evaluating bodies have assigned stars, so it's important to check who the evalua- tor is and what its system entails. For instance, in the U.S., Forbes is still one of the leading star-assigning bodies, as is AAA. 4.5 out of 5 AAA's Diamond Rating System comprises two distinct components. The Approval Requirements are uncompromising, mandatory standards, while Diamond designation Google is based on specific criteria measured during an on-site visit. The extensiveness of Based on 858 reviews. services, amenities, and décor provided, as well as standards for cleanliness, comfort and hospitality are measured. The Landmark has consistently been awarded Three Diamonds by AAA. -

Class-Action Lawsuit

Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 1 of 23 1 James R. Patterson, CA Bar No. 211102 Allison H. Goddard, CA Bar No. 211098 2 Elizabeth A. Mitchell CA Bar No. 204853 PATTERSON LAW GROUP 3 402 West Broadway, 29th Floor San Diego, CA 92101 4 Telephone: (619) 756-6990 Facsimile: (619) 756-6991 5 [email protected] [email protected] 6 [email protected] 7 Attorneys for Plaintiff BUCKEYE TREE LODGE 8 AND SEQUOIA VILLAGE INN, LLC 9 10 UNITED STATES DISTRICT COURT 11 FOR THE NORTHERN DISTRICT OF CALIFORNIA 12 13 BUCKEYE TREE LODGE AND SEQUOIA Case No. VILLAGE INN, LLC, a California limited 14 liability company, on behalf of itself and all others similarly situated, CLASS ACTION 15 Plaintiff, COMPLAINT FOR DAMAGES, PENALTIES, 16 RESTITUTION, INJUNCTIVE RELIEF AND vs. OTHER EQUITABLE RELIEF 17 1. Violation of the Lanham Act, 15 U.S.C. § 1125 18 EXPEDIA, INC., a Washington corporation; HOTELS.COM, L.P., a Texas limited (False Association) 2. Violation of the Lanham Act, 15 U.S.C. § 1125 19 partnership; HOTELS.COM GP, LLC, a Texas (False Advertising) limited liability company; ORBITZ, LLC, a 3. Violation of California Business & Professions 20 Delaware limited liability company; TRIVAGO Code §§ 17200, et seq. (Unfair Competition) GmbH, a German limited liability company; and 4. Violation of California Business & Professions 21 DOES 1 through 100, Code §§ 17500, et seq. (False Advertising) 5. Intentional Interference with Prospective Economic 22 Defendants. Advantage 6. Negligent Interference with Prospective Economic 23 Advantage 7. Unjust Enrichment and Restitution 24 [Demand for Jury Trial] 25 26 27 28 30 31 COMPLAINT 32 Case 3:16-cv-04721-SK Document 1 Filed 08/17/16 Page 2 of 23 1 Plaintiff Buckeye Tree Lodge and Sequoia Village Inn, LLC (“Buckeye Tree Lodge”) on behalf 2 of itself and all others similarly situated, alleges upon personal knowledge, information and belief as 3 follows: 4 5 I. -

Meta Search Engine Examples

Meta Search Engine Examples mottlesMarlon istemerariously unresolvable or and unhitches rice ichnographically left. Salted Verney while crowedanticipated no gawk Horst succors underfeeding whitherward and naphthalising. after Jeremy Chappedredetermines and acaudalfestively, Niels quite often sincipital. globed some Schema conflict can be taken the meta descriptions appear after which result, it later one or can support. Would result for updating systematic reviews from different business view all fields need to our generated usually negotiate the roi. What is hacking or hacked content? This meta engines! Search Engines allow us to filter the tons of information available put the internet and get the bid accurate results And got most people don't. Best Meta Search array List The Windows Club. Search engines have any category, google a great for a suggestion selection has been shown in executive search input from health. Search engine name of their booking on either class, the sites can select a search and generally, meaning they have past the systematisation of. Search Engines Corner Meta-search Engines Ariadne. Obsession of search engines such as expedia, it combines the example, like the answer about search engines out there were looking for. Test Embedded Software IC Design Intellectual Property. Using Research Tools Web Searching OCLS. The meta description for each browser settings to bing, boolean logic always prevent them the hierarchy does it displays the search engine examples osubject directories. Online travel agent Bookingcom has admitted that playing has trouble to compensate customers whose personal details have been stolen Guests booking hotel rooms have unwittingly handed over business to criminals Bookingcom is go of the biggest online travel agents. -

August 6, 2015 the Honorable Loretta Lynch U.S. Department of Justice

August 6, 2015 The Honorable Loretta Lynch U.S. Department of Justice 950 Pennsylvania Avenue, N.W. Washington, D.C. 20530 The Honorable William J. Baer U.S. Department of Justice 950 Pennsylvania Avenue, N.W. Washington, D.C. 20530 Dear Attorney General Lynch and Assistant Attorney General Baer, As representatives of the small and independent hotel business serving multitudes of consumers around the country we are writing to urge you to block Expedia’s proposed merger of Orbitz, Expedia and Orbitz are competing online travel agencies which we rely on to distribute our room inventory to consumers. Currently there are only three major online travel agencies– Expedia (which owns Travelocity, Hotels.com, Hotwire and Trivago), Orbitz (which owns CheapTickets), and Priceline (which owns Kayak and Booking.com). However, if this merger is allowed to go forward, then the competition between Expedia and Orbitz will be lost and 95% of all online travel agency bookings will be made through one of two companies, Expedia or Priceline. This could jeopardize many of our small businesses, who already have difficulty reaching consumers directly. By limiting our choice of booking agents, we could face higher commissions and likelier higher costs. For some of us, that could mean we simply must close our doors. Not to mention how this will impact consumers, majorities of who are unaware of the consolidation that already exists among these online travel agencies. A new survey reveals that 82 percent of consumers who book hotel rooms online do not know how many affiliate brands are owned by either Expedia or Orbitz. -

Booking Holdings Inc. Pitch

RESEARCHSeptember REPORT24, 2018 ASeptember Travel Industry 24, 2018 Leader Stock Rating BUY Price Target USD $2,547 Bear Price Bull Case Target Case $2,343 $2,547 $2,793 Ticker BKNG Booking Holdings Inc. Market Cap (MM) $92,890 A Travel Industry Leader EV / EBITDA 16.5x P / E 22.8x Booking Holdings operates several Online Travel Agencies (OTAs), including Booking.com, as well as meta-search websites, including 52 Week Performance KAYAK. 130 The company generated $12.4B of gross profit in 2017 with a 39.4% EBITDA margin. Booking Holdings is a high return business with secular growth trends, the potential for improved margins, and a competent management team. 115 Investment Thesis – Three long-term trends pave the runway for growth. 100 – Travel bookings are shifting from offline to online. – Millennials increasingly desire to travel. 85 – A rising middle-class in Asia will add new global travel 01-Sep-17 18-Feb-18 07-Aug-18 customers. BKNG S&P 100 Index – Two strong competitive advantages and an emerging third. – As the leader, the company benefits from economies of Consumers & Healthcare scale. Andrei Florescu – Network effects between customers and listings derive an unmatched value proposition. [email protected] – To generate higher returns, the company is working to Ioulia Malamoud create a brand competitive advantage. [email protected] – Glenn Fogel (CEO) is intelligent and aligned with investors. Connor Steckly [email protected] The information in this document is for EDUCATIONAL and NON-COMMERCIAL use only and is not intended to Bronwyn Ferris constitute specific legal, accounting, financial or tax advice for any individual. -

Annual Report of Trivago NV for the Fiscal Year Ended 31 December 2016

Annual report of trivago N.V. for the fiscal year ended 31 December 2016 1 Table of Contents Dutch Statutory Board Report 1. Introduction 3 2. Company and Business overview 4 3. Financial Overview 14 4. Risk Management and Risk Factors 24 5. Corporate Governance 47 6. Compensation Report 53 7. Related Party Disclosures 54 8. Protective Measures 56 9. Outlook 56 Financial Statements 2016 10. Consolidated Financial Statements 57 11. Company Financial Statements 103 Other Information 12. Other Information 113 2 1. Introduction In this board report, the terms "trivago", "we", "us", "our" and "the Company" refer to trivago N.V. and, where appropriate, its subsidiaries. Unless stated otherwise, information presented in this board report is as at 31 December 2016. Our financial statements are presented in euros and, unless otherwise specified, all monetary amounts are in euros. Any references in this board report to "$", "US$", "U.S.$", "U.S. dollars", "dollars" and all references to "€" and "euros" mean euros, unless otherwise noted. The exchange rate calculated at the noon buying rate in New York City for cable transfers in foreign currencies as certified for customs purposes by the Federal Reserve Bank in New York on the period-end date for the applicable period, which as of December 31, 2015 was €1.00 = $1.0859 and as of 31 December 2016 was €1.00 = $1.0552. You should not assume that, on that or any other date, one could have converted these amounts of euro into U.S. dollars at this or any other exchange rate. We have historically conducted our business through trivago GmbH, and therefore our historical financial statements present the results of operations and financial condition of trivago GmbH and its controlled subsidiaries. -

Thousand Impressions

1 поиск Hotel Segment 2 Hotels 3 Yandex Segmentdynamics 2011 data. Mar July, 2014 July, May Jul Sep Nov 2012 Mar May Jul Sep Nov 2013 Mar May Jul Sep Nov 2014 Mar May Jul CPC Advertisers Numberof AdSpending 4 Yandex Expendituredynamics 2011 data. Feb Mar July, 2014 July, Apr May Jun Jul Aug Sep Oct Nov Dec 2012 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2014 Feb Mar Apr May Jun Jul 5 Yandex Clickdynamics –Direct.Search 2011 data. Feb Mar July, 2014 July, Apr May Jun Jul Aug Sep Oct Nov Dec 2012 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2014 Feb Mar Apr May Jun Jul 6 Yandex Clickdynamics –Content sites 2011 data. Feb Mar July, 2014 July, Apr May Jun Jul Aug Sep Oct Nov Dec 2012 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2014 Feb Mar Apr May Jun Jul 7 Yandex CPC Average 2011 data. Feb Mar July, 2014 July, Apr May Jun Jul Aug Sep Oct Nov Dec 2012 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2013 Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2014 Feb Mar Apr May Jun Jul 8 Click share – Search vs. Content 27% Clicks from Context Sites Clicks from Search Sites 73% Quarterly data: Q2’14. -

Invitation to Subscribe for Shares and Warrants in Nustay A/S

Finanstilsynet approved this prospectus on March 4th, 2020. The prospectus is valid for 12 months from the approval date. The obligation to supply additions to the prospectus in case of material new conditions, factual errors or other material errors is not applicable after the expiration of the period of validity. Nustay does however not intend to supply additions to the prospectus in case of material new conditions, factual errors or other material errors after the offer period subscribed in this prospectus. Therefore the period of validity may be shorter than 12 months. Invitation to subscribe for shares and warrants in Nustay A/S 36090316 | www.nustay.com| Nustay A/S 1 IMPORTANT INFORMATION Definitions so-called MTF platform. Companies listed on Spotlight have In this prospectus, the following definitions apply unless otherwise committed to follow Spotlight's listing agreement. The agreement stated: the "Company" or "Nustay" refers to Nustay A/S with CVR No aims, among other things, to ensure that shareholders and other 36090316. “Spotlight” refers to Spotlight Stock Market. “Units” refer players at the market receive accurate, immediate and simultaneous to shares and warrants which are settled by way of delivery of interim information on all the circumstances that may affect the Company's shares nr. 1. share price. Trading on Spotlight takes place in an electronic trading system that is available to the banks and members connected to Advisors and legal information Nordic Growth Market. This means that anyone who wants to buy or In connection with the rights issue described in this prospectus, sell shares listed on Spotlight can use their usual bank. -

Noah Connects Capital and Entrepreneurs to Invest, Raise Money and Build Long Term Investor Relatioships

THIS IS NOAH CONFERENCE It´s a very good conference,“ one can do business! NOAH CONNECTS LEADERS AT ONE PLACE USING “ BEST-IN-CLASS CONFERENCES AND TECHNOLOGY Oliver Samwer TO EMPOWER THE EUROPEAN DIGITAL ECOSYSTEM CEO, Rocket Internet SPEAKERS AT NOAH HEARING THE STORY OF EUROPEAN DIGITAL LEADERS TO LEARN STARTUP STAGE FOR YOUNG OUR AUDIENCE IS OUR STAGE MAIN STAGE:VALUATION $100M MINIMUM OF $100M+ VALUATION EUROPEAN COMPANIES 110+ speakers at NOAH18 Berlin main stage By invitation only 100 Firms on NOAH17 London Main Stage 640 companies presented since 2009 (37 digital 12,000+ unique attendees to date at NOAH [ ] Companies presented on Main Stage unicorns) Conferences Of which [ ] Unicorns 90 x 6-min pitches at NOAH Berlin Speakers are CEOs and founders 23,000 viewers watch the recordings or live CEOs and founders from emerging companies less OfIncluding: the top Adyen,100 Internet BlaBlaCar, Exits inCheck24, last 5 years Criteo, in Eu - streams rope by size, [%] passed through our stage than 4 years old Deliveroo, Delivey Hero, Farfetch, Gett, HelloFresh, Videos and presentations of all past conferences Live audience of 100 (Berlin) to 200 (London), video King.com, MoneySuperMarket, Scout24, Spotify, live stream and inclusion in NOAH media library Corporate champions attending regularly NOAH: Stripe, TransferWise, Trivago, UBER, WeWork, Credit Suisse, Daimler, Deutsche Bank, Digital Wix, Yandex, etc. 3 winners (online voting) present on main stage at McKinsey, eBay, Facebook, Google, ING, Naspers, next NOAH Porsche, Priceline, ProSiebenSat.1, -

The 14 Trends That Defined Travel in 2014

The 14 Trends That Defined Travel In 2014 by Rafat Ali, Jason Clampet, Dennis Schaal and Samantha Shankman Skift is the largest intelligence platform in travel, providing Media, Insights & Marketing to all sectors of the world’s largest industry. Skift Products: ● Skift.com ● Skift Trends ● SkiftIQ ● Skift Business Traveler ● Skift Global Forum Connecting the Dots Across the Travel Industry The Skift team has lived and breathed travel industry news and trends since our launch in late summer 2012, on the way to become the most visited site in the travel industry. Now we’re looking beyond headlines to show you the global travel trends as they played out in 2014. The Megatrends at Play >> » Rise of The Silent Traveler 1 The rise of digital has given rise to a new kind of traveler who is adept at all available online and mobile tools and uses them to jump across all industry-defined silos. These new travelers don’t need tons of handholding, they shun human interaction, and know their way around everywhere they go. If the hospitality — the actual human to human interaction — part of the travel industry becomes less and less important, how does the industry define itself? How does it understand the needs of its customers and fulfill them? This presents the global hospitality industry a paradox: the human part of the service economy may become less and less important with the rise of the independent, digital traveler forging his or her own way. But big data and personalization offer a way for travel companies to offer that invisible pillar of support.