Mark D. Pflug Partner

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

OSB Representative Participant List by Industry

OSB Representative Participant List by Industry Aerospace • KAWASAKI • VOLVO • CATERPILLAR • ADVANCED COATING • KEDDEG COMPANY • XI'AN AIRCRAFT INDUSTRY • CHINA FAW GROUP TECHNOLOGIES GROUP • KOREAN AIRLINES • CHINA INTERNATIONAL Agriculture • AIRBUS MARINE CONTAINERS • L3 COMMUNICATIONS • AIRCELLE • AGRICOLA FORNACE • CHRYSLER • LOCKHEED MARTIN • ALLIANT TECHSYSTEMS • CARGILL • COMMERCIAL VEHICLE • M7 AEROSPACE GROUP • AVICHINA • E. RITTER & COMPANY • • MESSIER-BUGATTI- CONTINENTAL AIRLINES • BAE SYSTEMS • EXOPLAST DOWTY • CONTINENTAL • BE AEROSPACE • MITSUBISHI HEAVY • JOHN DEERE AUTOMOTIVE INDUSTRIES • • BELL HELICOPTER • MAUI PINEAPPLE CONTINENTAL • NASA COMPANY AUTOMOTIVE SYSTEMS • BOMBARDIER • • NGC INTEGRATED • USDA COOPER-STANDARD • CAE SYSTEMS AUTOMOTIVE Automotive • • CORNING • CESSNA AIRCRAFT NORTHROP GRUMMAN • AGCO • COMPANY • PRECISION CASTPARTS COSMA INDUSTRIAL DO • COBHAM CORP. • ALLIED SPECIALTY BRASIL • VEHICLES • CRP INDUSTRIES • COMAC RAYTHEON • AMSTED INDUSTRIES • • CUMMINS • DANAHER RAYTHEON E-SYSTEMS • ANHUI JIANGHUAI • • DAF TRUCKS • DASSAULT AVIATION RAYTHEON MISSLE AUTOMOBILE SYSTEMS COMPANY • • ARVINMERITOR DAIHATSU MOTOR • EATON • RAYTHEON NCS • • ASHOK LEYLAND DAIMLER • EMBRAER • RAYTHEON RMS • • ATC LOGISTICS & DALPHI METAL ESPANA • EUROPEAN AERONAUTIC • ROLLS-ROYCE DEFENCE AND SPACE ELECTRONICS • DANA HOLDING COMPANY • ROTORCRAFT • AUDI CORPORATION • FINMECCANICA ENTERPRISES • • AUTOZONE DANA INDÚSTRIAS • SAAB • FLIR SYSTEMS • • BAE SYSTEMS DELPHI • SMITH'S DETECTION • FUJI • • BECK/ARNLEY DENSO CORPORATION -

OSB Participant List by Research Area

OSB Participant List by Research Area Contact Centers (CC) • AARP • Air Products and • American Drug Stores Chemicals • AAA • ABB • American Electric Power • Airbus • Accor • Abbott • American Express • Alcatel Lucent • American Electric Power • Abengoa • American International • Alcoa Group • American International • Abu Dhabi National Group Energy Company • Alcon • American Stores Company • Austin Energy • ACC Limited • Alfa • American Water • Bank of America • Access Insurance Holdings • Algonquin Power & • Amgen Utilities • Blue Cross Blue Shield • Accord Holdings • AMIL • ALH Group • Charles Schwab & • ACE • AmInvestment Bank Company • Alitalia • Acea • AMR • Citigroup • ALK Abello • Acer • Amssi • Citizens Gas • Alkermes • Acxiom • Amtran Logistics • Clarke American • Allergan • Adelaide Clinic Holdings • Andrew Corporation • CPS Energy • Alliance & Leicester • Adidas • Anglian Water Services • Direct Energy • Alliance Boots • Advance Food Company • Anritsu • Federal Reserve Bank of • Alliant Techsystems Minneapolis • Advance Publications • Anschutz • Allianz • John Deere • Advanced Coating • Apache • Allied Irish Banks • Technologies Louisville Water Company • Apex Equity Holdings • Advanced Semiconductor • Allstate Insurance • Manila Electric Company Engineering Company • Apple • • • Mellon Financial Adventist Health System Ally Financial • Arcadia Housing • • • MetLife Aegon Alon USA Energy • Arcos Dorados Holdings • • • Morgan Stanley AEON AlpTransit Gotthard • Ardent Health Services • • • NetBank Aera Energy Alstom • Argos • -

ANGEBOTSUNTERLAGE Freiwilliges Öffentliches

Pflichtveröffentlichung gemäß §§ 34, 14 Abs. 2 und 3 Wertpapiererwerbs- und Übernahmegesetz (WpÜG) Aktionäre der WMF Württembergische Metallwarenfabrik Aktiengesellschaft, insbesondere mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrep ublik Deutschland, sollten die Hinweise in Abschnitt 1 "Allgemeine Hinweise, insbesondere für Aktionäre mit Wohnsitz, Sitz oder gewöhnlichem Aufenthalt außerhalb der Bundesrepublik Deutschland" auf den Seiten 4 ff. dieser Angebotsunterlage sowie in Abschnitt 23 "Wichtige Hinweise für US-Aktionäre" auf den Sei- ten 48 ff. dieser Angebotsunterlage besonders beachten. ANGEBOTSUNTERLAGE Freiwilliges öffentliches Übernahmeangebot (Barangebot) der Finedining Capital GmbH Leopoldstraße 8-10, 80802 München, Deutschland an die Aktionäre der WMF Württembergische Metallwarenfabrik Aktiengesellschaft Eberhardstraße 17-47, 73309 Geislingen an der Steige, Deutschland zum Erwerb ihrer auf den Inhaber lautenden Stammaktien und ihrer auf den Inhaber lautenden Vor- zugsaktien an der WMF Württembergische Metallwarenfabrik Aktiengesellschaft gegen Zahlung einer Geldleistung in Höhe von EUR 47,00 je Stammaktie und EUR 31,80 je Vorzugsaktie der WMF Württembergische Metallwarenfabrik Aktiengesellschaft Die Annahmefrist läuft vom 16. August 2012 bis 20. September 2012, 24:00 Uhr (Ortszeit Frankfurt am Main) / 18:00 Uhr (Ortszeit New York) Aktien der WMF Württembergische Metallwarenfabrik Aktiengesellschaft: International Securities Identification Number (ISIN) DE0007803009 (Stammaktien) und DE0007803033 (Vorzugsaktien) -

Annual Report – Year Ending 31 January 2013

Annual Report AND Audited Consolidated Financial Statements 31 JANUARY 2 013 Contents 01 Key Highlights and Strategic Initiatives Key Highlights Strategic Initiatives 04 Chairman’s Letter 08 Investment Manager’s Review Results for the Financial Year Ended 31 January 2013 The Investment Manager Market Review Changes in Investment Portfolio Investment and Commitment Activity Portfolio Review Realisation Activity Cash Flows Balance Sheet Management and Commitments Fees Recent Events 38 Supplemental Data 43 Directors’ Report at 31 January 2013 Board of Directors Directors’ Report 49 Audited Consolidated Financial Statements Independent Auditor’s Report to the Members of HarbourVest Global Private Equity Limited Consolidated Financial Statements Notes to Consolidated Financial Statements 65 Disclosures COMPANY OVERVIEW HarbourVest Global Private Equity Limited (“HVPE” or the “Company”) is a Guernsey-incorporated company listed on the Specialist Fund Market of the London Stock Exchange and Euronext Amsterdam by NYSE Euronext, the regulated market of Euronext Amsterdam, registered with the Netherlands Authority for the Financial Markets as a closed-end investment company pursuant to section 1:107 of the Dutch Financial Markets Supervision Act, and authorised as a closed-ended investment scheme in accordance with section 8 of the Protection of Investors (Bailiwick of Guernsey) Law, 1987, as amended, and rule 6.02 of the Authorised Closed-ended Investment Scheme Rules 2008. HVPE is managed by HarbourVest Advisers L.P. (the “Investment Manager”), an affiliate of HarbourVest Partners, LLC (“HarbourVest”), a private equity firm whose history dates back to 1982. HarbourVest is headquartered in Boston and has committed more than $30 billion to investments. The Company issued 83,000,000 shares at $10.00 per share in December 2007. -

Winners and Losers: Fallout from KKR’S Race for Profit Contents

Winners and Losers: Fallout from KKR’s Race for Profit Contents Introduction ......................................................................................5 The U.S. Economy .............................................................................9 The KKR Workforce ........................................................................13 Consumers .....................................................................................17 Environment ...................................................................................23 Conclusion .....................................................................................27 Appendices ....................................................................................28 Endnotes ........................................................................................32 Introduction KKR’s Race for Profit 5 Winners and Losers: Fallout from KKR’s Race for Profit The buyout industry and its harmful practices are receiving greater scrutiny as Americans struggle with a growing sense of anxiety over the state of the economy and the expanding income gap between the richest 10th of Americans and those in the middle class. How does the buyout industry’s “see no evil, accept no responsibility” approach to business really impact Main Street America? With hundreds of thousands of employees, KKR portfolio companies together employ one of the largest private workforces of any U.S.-based firm. While recent reports have focused on the net job loss resulting from leveraged buyouts, there -

Bilancio Di Sostenibilità 2020

Bilancio di Sostenibilità 2020 Fondo Pensione Nazionale BCC/CRA Contenuti Discorso Direttore Generale pag. 3 Fondo Pensione Nazionale BCC/CRA in numeri pag. 4 I Fondi contattati per l’analisi pag. 11 Come leggere l’analisi pag. 13 Highlights ESG pag. 14 Analisi Sustainable Development Goals pag. 15 Analisi ESG pag. 16 Risultati di sostenibilità pag. 26 La nostra metodologia di valutazione ESG pag. 28 Business Cases pag. 29 Appendice pag. 35 2 Nel lontano 2009, quando non era ancora di moda Tutti i futuri sforzi del Fondo Pensione il trend dell’ESG e la giurisdizione italiana ed proseguiranno in questa direzione, con europea guardavano ancora da lontano una l’obiettivo non solo di implementare un numero eventuale introduzione di normative volte a sempre crescente di metriche di rilevazione ESG, regolamentare tali aspetti all’interno del processo ma anche di estendere le stesse a tutti gli asset decisionale degli investitori istituzionali, il Fondo detenuti, liquidi ed illiquidi. A tal proposito si Pensione Nazionale BCC/CRA, grazie alla visione evidenzia che i mandati di gestione presenti in lungimirante del Direttore Generale Sergio Carfizzi, portafoglio, pur non prevedendo ancora del tutto nonché al costante appoggio e sostegno da parte nelle attuali convenzioni delle specifiche della Governance, iniziava a muovere i primi passi strategie a benchmark ESG, stanno verso la tematica della sostenibilità. progressivamente introducendo tali parametri La forte diversificazione del portafoglio dispiegata nel loro processo strategico grazie ad esempio nel corso degli anni ed i conseguenti investimenti all’adozione di Exclusion Policies legate al rischio nel “decorrelato” hanno consentito al Fondo di far climatico o a Standard ESG proprietari estesi sentire la propria voce in merito alle tematiche anche nell’ambito del processo di selezione dei ambientali, sociali e di governance, alimentando titoli detenuti in nome e per conto del Fondo un graduale processo di sensibilizzazione ed Pensione. -

OSB Participant List by Research Area and Industry

OSB Participant List by Research Area and Industry Contact Centers (CC) • CPS Energy • Beijing Benz Automotive • Mack Trucks Consumer Products/Packaged • Direct Energy • Beiqi Foton Motor • Magna Goods Company • Louisville Water Company • Mazda Motor Corporation • Clarke American • BMW • Manila Electric Company • Navistar International • Newell Rubbermaid • Bosch Engineering Financial Management (FM) Solutions • Nissan Financial Services/Banking • Aerospace Brembo • Opel • Bank of America • • Advanced Coating Caterpillar • Paccar • Charles Schwab & Technologies • Company China FAW Group • Porsche Automobil • Airbus • Citigroup • China International • Proeza • Alliant Techsystems Marine Containers • Federal Reserve Bank of • • Proton Holdings Minneapolis • BE Aerospace Chrysler • John Deere • • PSA Peugeot Citroën • Bombardier Commercial Vehicle Group • Mellon Financial • PT Astra International • Cobham • Daihatsu Motor • Morgan Stanley • Rane Engine Valves • Dassault Aviation • Daimler • NetBank • Renault • European Aeronautic • Delphi • Sterling Bank Defence and Space • Robert Bosch Company • DENSO Corporation • TIAA-CREF • SAIC Motor • Finmeccanica • Denway Motors • Union National Bank • SG&G • Fuji • DGP Hinoday Industries • Washington Mutual • Sinotruk Group Jinan • General Dynamics • Eaton Commercial Vehicle • Wells Fargo • General Electric • FAW Jiefang Automotive • Ssangyong Motor Industrial Products Company • IHI Corporation • Fiat • Suzuki Motor • John Deere • Kawasaki • Ford Motor Company • Tenedora Nemark Insurance • Korean -

Deutsche Bank AG, London Branch

Securities Note & Summary 18 January 2008 Deutsche Bank AG, London Branch Issue of U.S.$30,000,000 108% Capital Protected Notes due 2021 linked to the KKR Protected Private Equity Index (to be consolidated and form a single series with the existing U.S.$10,000,000 108% Capital Protected Notes due 2021 linked to the KKR Protected Private Equity Index issued on 30 November 2007) Issue Price 100% The issuer (the “Issuer”) of the securities described in the “Prospectus” (consisting of a registration document dated 3 May 2007 (the “Registration Document”) and this Securities Note & Summary) is Deutsche Bank Aktiengesellschaft, acting through its London branch (“Deutsche Bank AG, London Branch”). Application has been made to the Commission de Surveillance du Secteur Financier (the "CSSF") in its capacity as competent authority under the Luxembourg Act relating to prospectuses for securities (Loi relative aux Prospectus pour valeurs mobilières) to approve the Prospectus as a prospectus for the purposes of Directive 2003/71/EC (the "Prospectus Directive"). Application has also been made to the Luxembourg Stock Exchange for the admission to trading on the Bourse de Luxembourg (“Regulated Market”) of the Luxembourg Stock Exchange and the listing on the Official List of the Luxembourg Stock Exchange of the Notes (as defined below) which are to be issued by the Issuer pursuant to its U.S.$40,000,000,000 Global Structured Note Programme (the “Programme”). This is an offering of U.S.$30,000,000 in aggregate principal amount of 108% Capital Protected Notes due 2021 issued on 12 December 2007 (the “Notes”, ) linked to the KKR Protected Private Equity Index (the “Index”), which is an index established and administered by Deutsche Bank AG, London Branch as index sponsor (the “Index Sponsor”) and index administrator (the “Index Administrator”) and managed by Kohlberg Kravis Roberts & Co. -

ESG Report Download the Complete

CREATING SUSTAINABLE VALUE PROGRESS THROUGH PARTNERSHIP 2012 ESG AND CITIZENSHIP REPORT Achieving Meaningful Progress The world continues to change and we do too. As operating conditions and stakeholder expectations have transformed over recent years, KKR’s approach to investing has evolved also. As part of this evolution, we have worked to thoughtfully incorporate environmental, social, and governance (ESG) factors in our decision- making processes. We know that our decisions can have enormous impacts on companies and communities, and believe that the inclusion of ESG considerations leads to smarter, more responsible investing. We also believe that by being smarter investors, we can better achieve our greatest social impact, which are the returns generated for millions of retirees and pensioners around the world. This 2012 ESG report, our third annual, demonstrates our progress, highlights our partners who make this work possible, and lays out our vision for the future. Thank you for being with us onCREATING this journey as we work to improve uponSUSTAINABLE the foundation we have built. VALUE PROGRESS THROUGH PARTNERSHIP ACHIEVING MEANINGFUL PROGRESS 1 KKR at a Glance 2 KKR by the Numbers 4 Letter From Our Founders 7 2012 ESG Progress and Highlights 9 SECTION 1: OUR COMMITMENT AND APPROACH 10 The Importance of ESG Management 11 Identifying Shared Priorities 12 Engaging Our Stakeholders 13 Our Approach to ESG Management in Private Equity 14 Partnerships for ESG Expertise 16 Private Equity’s Role in a Healthy Global Economy 19 SECTION -

Private Equity 14 Partnerships for ESG Expertise 16 Private Equity’S Role in a Healthy Global Economy

CREATING SUSTAINABLE VALUE PROGRESS THROUGH PARTNERSHIP 2012 ESG AND CITIZENSHIP REPORT Achieving Meaningful Progress The world continues to change and we do too. As operating conditions and stakeholder expectations have transformed over recent years, KKR’s approach to investing has evolved also. As part of this evolution, we have worked to thoughtfully incorporate environmental, social, and governance (ESG) factors in our decision- making processes. We know that our decisions can have enormous impacts on companies and communities, and believe that the inclusion of ESG considerations leads to smarter, more responsible investing. We also believe that by being smarter investors, we can better achieve our greatest social impact, which are the returns generated for millions of retirees and pensioners around the world. This 2012 ESG report, our third annual, demonstrates our progress, highlights our partners who make this work possible, and lays out our vision for the future. Thank you for being with us onCREATING this journey as we work to improve uponSUSTAINABLE the foundation we have built. VALUE PROGRESS THROUGH PARTNERSHIP ACHIEVING MEANINGFUL PROGRESS 1 KKR at a Glance 2 KKR by the Numbers 4 Letter From Our Founders 7 2012 ESG Progress and Highlights 9 SECTION 1: OUR COMMITMENT AND APPROACH 10 The Importance of ESG Management 11 Identifying Shared Priorities 12 Engaging Our Stakeholders 13 Our Approach to ESG Management in Private Equity 14 Partnerships for ESG Expertise 16 Private Equity’s Role in a Healthy Global Economy 19 SECTION -

Participant List

PARTICIPANT LIST TABLE 4.1 PARTICIPANT LIST Company name Super sector Sector 3M Australia Other Manufacturing Other Manufacturing 7-Eleven Stores Retail & Wholesale Convenience Retail A Menarini Australia Life Sciences Pharmaceutical A.P.Moller-Maersk AS (AU) Logistics Shipping Abbott Australasia Services (Non-Financial) Healthcare Services AbbVie Life Sciences Pharmaceutical Accenture Australia High Tech High Tech (Services) Accolade Wines Consumer Goods Beverage & Tobacco Actelion Pharmaceuticals Australia Life Sciences Pharmaceutical Adama Australia Chemicals Specialty Chemicals adidas Australia Retail & Wholesale Apparel, Fashion, Footwear & Accessories Retail AECOM Services (Non-Financial) Business/Professional Services Aesop Cosmetics Retail & Wholesale Specialty Retail Afton Chemical Asia Pacific LLC Chemicals Specialty Chemicals Aggreko Australia Energy Other Energy AIA Australia Insurance/Reinsurance Life Insurance Aimia Proprietary Loyalty Australia Services (Non-Financial) Services - Other or Combination Air New Zealand - Australia Services (Non-Financial) Services - Other or Combination Akzo Nobel Australia Retail & Wholesale Wholesale Distribution Alcatel-Lucent Australia High Tech High Tech (Manufactured Products & Hardware) Alcon (Novartis) Laboratories Life Sciences Medical Devices & Equipment Australia Alexion Australasia Life Sciences Pharmaceutical All Nippon Airways Co., Other Non-Manufacturing Combination or Other Non- (Sydney Office) Manufacturing Allergan Life Sciences Pharmaceutical Alphapharm Life Sciences Pharmaceutical -

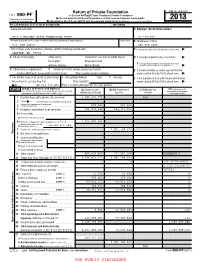

2013 Form 990-Pf

Return of Private Foundation OMB No. 1545-0052 Form 990-PF or Section 4947(a)(1) Trust Treated as Private Foundation Department of the Treasury | Do not enter Social Security numbers on this form as it may be made public. 2013 Internal Revenue Service | Information about Form 990-PF and its separate instructions is at www.irs.gov/form990pf. Open to Public Inspection For calendar year 2013 or tax year beginning , and ending Name of foundation A Employer identification number BILL & MELINDA GATES FOUNDATION TRUST 91-1663695 Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number P.O. BOX 23350 206-709-3100 City or town, state or province, country, and ZIP or foreign postal code C If exemption application is pending, check here~| SEATTLE, WA 98102 G Check all that apply: Initial return Initial return of a former public charity D 1. Foreign organizations, check here ~~| Final return Amended return 2. Foreign organizations meeting the 85% test, Address change Name change check here and attach computation ~~~~| H Check type of organization: X Section 501(c)(3) exempt private foundation E If private foundation status was terminated Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation under section 507(b)(1)(A), check here ~| I Fair market value of all assets at end of yearJ Accounting method: Cash X Accrual F If the foundation is in a 60-month termination (from Part II, col. (c), line 16) Other (specify) under section 507(b)(1)(B), check here ~| | $ 40,563,753,476.