Lifetime Service Center, Inc. V. Murata Manufacturing Co

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ranking of Stocks by Market Capitalization(As of End of Jan.2018)

Ranking of Stocks by Market Capitalization(As of End of Jan.2018) 1st Section Rank Code Issue Market Capitalization \100mil. 1 7203 TOYOTA MOTOR CORPORATION 244,072 2 8306 Mitsubishi UFJ Financial Group,Inc. 115,139 3 9437 NTT DOCOMO,INC. 105,463 4 9984 SoftBank Group Corp. 98,839 5 6861 KEYENCE CORPORATION 80,781 6 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 73,587 7 9433 KDDI CORPORATION 71,225 8 7267 HONDA MOTOR CO.,LTD. 69,305 9 8316 Sumitomo Mitsui Financial Group,Inc. 68,996 10 7974 Nintendo Co.,Ltd. 67,958 11 7182 JAPAN POST BANK Co.,Ltd. 66,285 12 6758 SONY CORPORATION 65,927 13 6954 FANUC CORPORATION 60,146 14 7751 CANON INC. 58,005 15 6902 DENSO CORPORATION 54,179 16 4063 Shin-Etsu Chemical Co.,Ltd. 53,624 17 8411 Mizuho Financial Group,Inc. 52,124 18 6594 NIDEC CORPORATION 52,025 19 9983 FAST RETAILING CO.,LTD. 51,647 20 4502 Takeda Pharmaceutical Company Limited 50,743 21 7201 NISSAN MOTOR CO.,LTD. 49,108 22 8058 Mitsubishi Corporation 48,497 23 2914 JAPAN TOBACCO INC. 48,159 24 6098 Recruit Holdings Co.,Ltd. 45,095 25 5108 BRIDGESTONE CORPORATION 43,143 26 6503 Mitsubishi Electric Corporation 42,782 27 9022 Central Japan Railway Company 42,539 28 6501 Hitachi,Ltd. 41,877 29 9020 East Japan Railway Company 41,824 30 6301 KOMATSU LTD. 41,162 31 3382 Seven & I Holdings Co.,Ltd. 39,765 32 6752 Panasonic Corporation 39,714 33 4661 ORIENTAL LAND CO.,LTD. 38,769 34 8766 Tokio Marine Holdings,Inc. -

Murata Manufacturing Co., Ltd

Murata Manufacturing Co., Ltd. CONVOCATION NOTICE FOR THE 80th ORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 29, 2016 NOTE 1. THIS DOCUMENT IS A TRANSLATION OF THE OFFICIAL JAPANESE CONVOCATION NOTICE FOR THE 80TH ORDINARY GENERAL MEETING OF REGISTERED SHAREHOLDERS. 2. THIS TRANSLATION IS PROVIDED ONLY AS A REFERENCE TO ASSIST SHAREHOLDERS IN THEIR VOTING AND DOES NOT CONSTITUTE AN OFFICIAL DOCUMENT. 3. IN THE EVENT OF ANY DISCREPANCY BETWEEN THIS TRANSLATED DOCUMENT AND THE JAPANESE ORIGINAL, THE ORIGINAL SHALL PREVAIL. 1 (Securities Code: 6981) CONVOCATION NOTICE FOR THE 80th ORDINARY GENERAL MEETING OF SHAREHOLDERS May 31, 2016 Tsuneo Murata President Statutory Representative Director Member of the Board of Directors Murata Manufacturing Co., Ltd. 10-1, Higashikotari 1-chome, Nagaokakyo-shi, Kyoto, Japan Dear Shareholders: Notice is hereby given that the 80th Ordinary General Meeting of Shareholders will be held as detailed below, and your attendance is cordially requested. In the event that you are unable to attend the meeting, you may exercise your voting rights either by Voting Rights Exercise Form or via the Internet, etc. To do so, we kindly ask that you first examine the Reference Materials for the General Meeting of Shareholders later in this translation (p. 4-21), then exercise your voting rights by 5:00 p.m. on Tuesday, June 28, 2016. 1. Date and time: June 29, 2016 (Wednesday) 10:00 a.m. 2. Location: 10-1, Higashikotari 1-chome, Nagaokakyo-shi, Kyoto, Japan The Hall on the second floor of the Head Office 3. Agenda: Reports 1. Report of the business report, the consolidated financial statement for the 80th fiscal term (From April 1, 2015 to March 31, 2016), and audit reports prepared by the Independent Auditor and the Board of Statutory Auditors on the consolidated financial statement 2. -

Proposal of a Data Processing Guideline for Realizing Automatic Measurement Process with General Geometrical Tolerances and Contactless Laser Scanning

Proposal of a data processing guideline for realizing automatic measurement process with general geometrical tolerances and contactless laser scanning 2018/4/4 Atsuto Soma Hiromasa Suzuki Toshiaki Takahashi Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 1 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for point cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 2 Contents • Introduction of the Project • Problem Statements • Proposed Solution – Proposal of New General Geometric Tolerance (GGT) – Data Processing Guidelines for Point Cloud • Next Steps Copyright (c)2014, Japan Electronics and Information Technology Industries Association, All rights reserved. 3 Introduction of JEITA What is JEITA? The objective of the Japan Electronics and Information Technology Industries Association (JEITA) is to promote healthy manufacturing, international trade and consumption of electronics products and components in order to contribute to the overall development of the electronics and information technology (IT) industries, and thereby to promote further Japan's economic development and cultural prosperity. JEITA’s Policy and Strategy Board > Number of full members: 279> Number of associate members: 117(as of May 13, 2014) - Director companies and chair/subchair companies - Policy director companies (alphabetical) Fujitsu Limited (chairman Masami Yamamoto) Asahi Glass Co., Ltd. Nichicon Corporation Sharp Corporation Azbil Corporation IBM Japan, Ltd. Hitachi, Ltd. Advantest Corporation Nippon Chemi-Con Corporation Panasonic Corporation Ikegami Tsushinki Co., Ltd. Japan Aviation Electronics Industry, Ltd. SMK Corporation Mitsubishi Electric Corporation Nihon Kohden Corporation Omron Corporation NEC Corporation JRC Nihon Musen Kyocera Corporation Sony Corporation Hitachi Metals, Ltd KOA Corporation Fuji Xerox Co., Ltd. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, September 30, 2020 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 99.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 1.1% France 9.9% (a) MercadoLibre, Inc. 11,044 11,954,909 Air Liquide SA 33,000 5,230,820 Australia 3.3% Airbus Group SE(a) 115,226 8,356,836 Aristocrat Leisure Ltd. 382,096 8,332,956 Capgemini SE 100,870 12,941,155 Atlassian Corp. PLC, Class A(a) 34,922 6,348,471 Dassault Systemes 30,100 5,616,121 Cochlear Ltd. 21,100 3,014,527 L’Oreal SA 53,085 17,275,402 CSL Ltd. 90,068 18,605,054 LVMH Moet Hennessy Louis Vuitton SE 60,510 28,312,668 Total 36,301,008 Safran SA(a) 109,109 10,734,920 Canada 3.6% Sartorius Stedim Biotech 23,028 7,948,411 Alimentation Couche-Tard, Inc., Class B 179,500 6,250,922 Teleperformance SA 26,943 8,306,583 Brookfield Asset Management, Inc., Class A 129,004 4,264,872 Total SE 113,620 3,902,001 Canadian National Railway Co. 187,926 20,014,109 Total 108,624,917 Dollarama, Inc. 223,415 8,563,780 Germany 5.5% Total 39,093,683 Adidas AG(a) 18,700 6,039,018 China 9.0% Infineon Technologies AG 652,214 18,383,168 Alibaba Group Holding Ltd.(a) 950,520 34,894,654 Rational AG 13,768 10,799,191 CNOOC Ltd. -

DC-DC Converter DATA Sheet

MYSSM01806BENL DATA Sheet 1 DC-DC Converter DATA Sheet MYSSM01806BENL 1. Features ・Wide input voltage range. (25V~40V) ・Single Output Voltage/High Current(Iout=6.0A) and Surface Mount Type of Non-insulated DC-DC Converter. ・Small size and low profile. ・High Efficiency product. ・Wide adjustable output voltage by connecting external resistors. (5.0 to 18.0V) ・On/Off function and short circuit protection is built in. 2. Appearance, Dimensions ⑯ ⑬ ⑨ 部半田はみ出し量Projection of solder 1.0 1.0 1.0 1.0 1.0 1.0 1.0 (3.17) 1.54 1.54 1.54 6.08 1.54 1.54 1.54 1.54 (3.17) . MYSSM 01806BENL 22.0 max MURATA ケース 半田付部除く) 20.9±0.4 ( he soldering part withthe case is excluded T (3.17) 1.54 1.54 1.54 6.08 1.54 1.54 1.54 1.54 (3.17) 1.0 1.0 1.0 1.0 1.0 1.0 1.0 ① ④ ⑧ 30.2±0.6 Discontinued << Top View >> << Bottom View >> 端子先端で 【Unit:mm】 Top of pin 12.0 max 0.3 Max. be Tolerance ±0.3mm Toleranc is not accumulated. Marking (1)Manufacturer Parts Number MYSSM01806BENL To(2) Manufacturer ID MURATA (3) Lot No. (4)Pin No.1 Side Marking ○ Note: 1. This datasheet is downloaded from the website of Murata Manufacturing co., ltd. Therefore, it’ s specifications are subject to change or our products in it may be discontinued without advance notice. Please check with our sales representatives or product engineers before ordering. 2. This datasheet has only typical specifications because there is no space for detailed specifications. -

Top 200 Organizations Receiving U.S. Patents in 1997

TOP 200 ORGANIZATIONS RECEIVING U.S. PATENTS IN 1997 Rank Organization No. 1. IBM Corp. 1724 2. Canon K.K. 1381 3. NEC Corp. 1095 4. Motorola, Inc. 1058 5. Fujitsu, Ltd. 903 6. Hitachi, Ltd. 903 7. Mitsubishi Denki K.K. 892 8. Toshiba Corp. 862 9. Sony Corp. 859 10. Eastman Kodak Co. 795 11. Lucent Technologies, Inc. 768 12. Matsushita Electric Industrial Co., Ltd. 746 13. General Electric Co. 664 14. Texas Instruments, Inc. 607 15. Xerox Corp. 606 16. Samsung Electronics Co., Ltd. 582 17. Minnesota Mining and Manufacturing Co. 548 18. Hewlett-Packard Co. 530 19. Nikon Corp. 479 20. U.S. Philips Corp. 473 21. Fuji Photo Film Co., Ltd. 467 22. Siemens A.G. 454 23. Procter & Gamble Co. 406 24. Intel Corp. 405 25. Sharp K.K. 394 26. Bayer A.G. 357 27. Hoechst A.G. 353 28. Ford Motor Co. 351 29. Honda Motor Co., Ltd. 341 30. Ricoh Co., Ltd. 336 31. Micron Technology, Inc. 318 32. Nippondenso Co., Ltd. 312 33. E.I. Du Pont de Nemours & Co. 311 34. General Motors Corp. 277 35. BASF A.G. 276 36. University of California 275 37. Advanced Micro Devices, Inc. 271 38. Robert Bosch GmbH 267 39. Ciba-Geigy Corp. 238 40. Yazaki Corp. 238 41. Seiko Epson Corp. 225 42. Eli Lilly & Co. 222 43. Olympus Optical Co., Ltd. 213 44. Caterpillar, Inc. 212 45. Whitaker Corp. 212 46. Daewoo Electronics Co., Ltd. 211 47. Toyota Jidosha K.K. 211 48. Apple Computer, Inc. 206 49. Hughes Electronic Devices Corp. -

Portfolio of Investments

PORTFOLIO OF INVESTMENTS Variable Portfolio – Partners International Growth Fund, March 31, 2021 (Unaudited) (Percentages represent value of investments compared to net assets) Investments in securities Common Stocks 98.4% Common Stocks (continued) Issuer Shares Value ($) Issuer Shares Value ($) Argentina 0.9% Sartorius Stedim Biotech 30,884 12,710,261 MercadoLibre, Inc.(a) 8,451 12,441,055 Teleperformance SA 30,119 10,981,253 Australia 3.0% Total SE 137,200 6,396,233 Aristocrat Leisure Ltd. 664,347 17,429,567 Total 165,752,414 Cochlear Ltd. 25,500 4,101,802 Germany 4.0% CSL Ltd. 103,017 20,820,136 Adidas AG(a) 20,400 6,372,775 Total 42,351,505 Infineon Technologies AG 592,181 25,195,879 Canada 2.8% Rational AG 15,392 11,956,544 Alimentation Couche-Tard, Inc., Class B 216,700 6,987,096 SAP SE 53,900 6,611,196 (a) Canadian National Railway Co. 275,350 31,954,360 TeamViewer AG 143,772 6,148,594 Total 38,941,456 Total 56,284,988 China 6.2% Hong Kong 4.1% Alibaba Group Holding Ltd.(a) 901,220 25,606,027 AIA Group Ltd. 2,518,000 30,812,188 NetEase, Inc. 909,175 18,695,307 CLP Holdings Ltd. 603,000 5,871,227 TAL Education Group, ADR(a) 267,889 14,425,823 Hang Lung Properties Ltd. 2,855,000 7,452,245 Tencent Holdings Ltd. 349,100 27,860,817 Hong Kong & China Gas Co., Ltd. 2,771,500 4,394,460 Total 86,587,974 Jardine Matheson Holdings Ltd. -

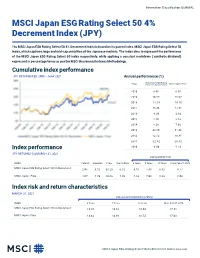

MSCI Japan ESG Rating Select 50 4% Decrement Index (JPY)

Information Classification: GENERAL MSCI Japan ESG Rating Select 50 4% Decrement Index (JPY) The MSCI Japan ESG Rating Select 50 4% Decrement Index is based on its parent index, MSCI Japan ESG Rating Select 50 index, which captures large and mid-cap securities of the Japanese markets. The index aims to represent the performance of the MSCI Japan ESG Rating Select 50 index respectively, while applying a constant markdown (‘synthetic dividend’) expressed in percentage terms as per the MSCI Decrement Indexes Methodology. Cumulative index performance JPY RETURNS FEB 2009 – MAR 2021 Annual performance (%) MSCI Japan ESG Rating YEAR Select 50 4% Decrement MSCI Japan - Price 2020 8.95 6.55 2019 19.57 15.97 2018 -18.54 -16.76 2017 15.26 17.61 2016 -4.39 -2.60 2015 7.59 8.12 2014 8.20 7.60 2013 44.59 51.86 2012 12.52 18.85 2011 -22.42 -20.52 Index performance 2010 -4.00 -1.24 JPY RETURNS (%) MARCH 31, 2021 ANNUALIZED RETURN INDEX 1 Month 3 Months 1 Year Year to Date 3 Years 5 Years 10 Years Since Feb 27, 2009 MSCI Japan ESG Rating Select 50 4% Decrement 2.98 6.52 34.23 6.52 6.08 7.65 6.42 6.77 MSCI Japan - Price 4.07 7.89 40.53 7.89 5.53 7.98 8.23 8.06 Index risk and return characteristics MARCH 31, 2021 ANNUALIZED STANDARD DEVIATION ( %) INDEX 3 Years 5 Years 10 Years Since Feb 27, 2009 MSCI Japan ESG Rating Select 50 4% Decrement 16.37 14.62 16.64 17.38 MSCI Japan - Price 16.62 14.91 16.72 17.08 MSCI Japan ESG Rating Select 50 4% Decrement Index | msci.com Information Classification: GENERAL MSCI Japan ESG Rating Select 50 Index Top 10 constituents Sector Weights Sector Index Wt. -

Production Supplier List

Microsoft Top 100 Production Suppliers Based on FY18 spend for commercially available hardware products AAC ACOUSTIC TECHNOLOGIES MONOLITHIC POWER SYSTEMS, INC. AAVID THERMALLOY LLC MULTI-FINELINE ELECTRONIX, INC. ALLEGRO MICROSYSTEMS, INC. MURATA MANUFACTURING CO., LTD. ALPS ELECTRIC COMPANY NEXPERIA USA, INC. AMD NIDEC COPAL AMPHENOL NIDEC SEIMITSU ASIA VITAL COMPONENTS NINGBO SANHUAN MAGSOUND CO., LTD. BEST EVER INDUSTRIES LIMITED NIPPON MEKTRON, LTD BOYD CORPORATION NVIDIA CORPORATION CASETEK COMPUTER (SUZHOU) CO., LTD. NXP SEMICONDUCTORS CHICONY ON SEMICONDUCTOR CHICONY POWER OSRAM CHILISIN ELECTRONICS CORP. PANASONIC COMPEQ MANUFACTURING CO., LTD. PEGATRON CYMMETRIK PENN ENGINEERING CYNTEC CO. LTD. PHILIPS PLDS DAEWON CHEMICAL CO., LTD. REALTEK SEMICONDUCTOR CORPORATION DELTA ELECTRONICS INC. SAMSUNG ELECMECH DIODE INC SAMSUNG SDI DONGGUAN LOYALSTAR INDUSTRIAL CO., LTD. SAMSUNG SEMICONDUCTOR DURACELL (CHINA) LTD. SEAGATE DYNAPACK INTERNATIONAL TECHNOLOGY CORP. SHENZHEN FRD SCIENCE & TECHNOLOGY CO., LTD. FIRST ENGINEERING SHENZHEN SUNWAY COMMUNICATION CO., LTD. FIT FOXCONN INTERCONNECT TECHNOLOGIES SHIN ZU SHING CO., LTD. FOXLINK SILEGO TECHNOLOGY INC FREESCAE SIMPLO TECHNOLOGY CO., LTD. FTP TECHNOLOGY INC STANLEY BLACK AND DECKER GOERTEK INC. STARLITE PRINTER LIMITED HANNSTAR BOARD STMICROELECTRONICS HON HAI PRECISION INDUSTRY CO., LTD. SUNG WEI HONDA PRINTING SUNLORD HYNIX SEMICONDUCTOR SUZHOU ANJIE TECHNOLOGY CO., LTD. IBIDEN CO., LTD. SYNAPTICS INNOVATOR ELECTRONIC SHENZHEN CO., LTD. TAIYO YUDEN INTEL TEXAS INSTRUMENTS INTER-TECHNICAL TOSHIBA JINLONG TPK TOUCH SOLUTIONS, INC. JU TENG INTERNATIONAL HOLDING CO., LTD. TRIPOD TECHNOLOGY CORPORATION KOMI GLOBAL TXC CORPORATION KYOCERA/AVX UNIMICRON TECHNOLOGY CORP LAIRD TECHNOLOGIES VISHAY ELECTRONICS INC. LITE-ON WALSIN LITTELFUSE WELL SIN TECHNOLOGY LOROM INDUSTRIAL CO., LTD. WESTERN DIGITAL CORPORATION LUXSHARE ICT WINBOND MARVELL SEMICONDUCTOR X-CON ELECTRONICS LIMITED MEDIATEK INC. -

Business Report

BUSINESS REPORT FOR THE 83RD FISCAL TERM FROM APRIL 1, 2018 TO MARCH 31, 2019 10-1, Higashikotari 1-chome, Nagaokakyo-shi, Kyoto, Japan Murata Manufacturing Co., Ltd. Tsuneo Murata Chairman of the Board, President and Representative Director Business Report From April 1, 2018 to March 31, 2019 1. Matters Concerning Status of the Company Group (1) Main business areas The Company Group is an electronic component manufacturer that primarily engages in manufacturing and sales of electronic components and related products primarily of ceramic material, Components (such as capacitors and piezoelectric products) and Modules (communications modules and power supplies), and conducts vertically integrated technological development and manufacturing, from inorganic and organic chemical materials, to ceramics and electronic components. Through the creation of original products that utilize a technological base featuring uniquely developed and accumulated materials development, process development, product design, manufacturing technology, and software, analysis, and evaluation to support the above, the Company Group conducts sales for various electronic components that are used in products such as AV devices, communications devices, computers and peripheral devices, automotive electronics, and home electric devices. (2) Business progress and results 1) Business conditions For the fiscal year under review, in the global economic environment, the U.S. economy showed strong momentum due to continued growth in employment and private income. On the other hand, China suffered from the clear impact of trade frictions with the U.S., while political uncertainty in Europe coincided with the weakening of the region’s economy, slowing down the world economy more strongly towards the end of the fiscal year. -

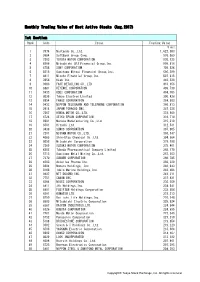

Monthly Trading Value of Most Active Stocks (Aug.2017) 1St Section

Monthly Trading Value of Most Active Stocks (Aug.2017) 1st Section Rank Code Issue Trading Value \ mil. 1 7974 Nintendo Co.,Ltd. 1,622,583 2 9984 SoftBank Group Corp. 976,569 3 7203 TOYOTA MOTOR CORPORATION 930,125 4 8306 Mitsubishi UFJ Financial Group,Inc. 909,616 5 6758 SONY CORPORATION 708,524 6 8316 Sumitomo Mitsui Financial Group,Inc. 606,599 7 8411 Mizuho Financial Group,Inc. 507,815 8 3656 KLab Inc. 442,526 9 9983 FAST RETAILING CO.,LTD. 416,156 10 6861 KEYENCE CORPORATION 409,739 11 9433 KDDI CORPORATION 404,785 12 8035 Tokyo Electron Limited 390,426 13 6954 FANUC CORPORATION 364,683 14 9432 NIPPON TELEGRAPH AND TELEPHONE CORPORATION 360,813 15 2914 JAPAN TOBACCO INC. 347,336 16 7267 HONDA MOTOR CO.,LTD. 331,600 17 6724 SEIKO EPSON CORPORATION 316,710 18 6981 Murata Manufacturing Co.,Ltd. 315,310 19 6501 Hitachi,Ltd. 312,531 20 3436 SUMCO CORPORATION 307,805 21 7201 NISSAN MOTOR CO.,LTD. 306,147 22 4063 Shin-Etsu Chemical Co.,Ltd. 304,964 23 8058 Mitsubishi Corporation 279,198 24 7269 SUZUKI MOTOR CORPORATION 275,401 25 4502 Takeda Pharmaceutical Company Limited 268,170 26 5713 Sumitomo Metal Mining Co.,Ltd. 267,163 27 7270 SUBARU CORPORATION 260,785 28 4503 Astellas Pharma Inc. 260,220 29 8604 Nomura Holdings, Inc. 246,943 30 8766 Tokio Marine Holdings,Inc. 242,505 31 9437 NTT DOCOMO,INC. 241,211 32 7751 CANON INC. 237,831 33 6594 NIDEC CORPORATION 236,259 34 5411 JFE Holdings,Inc. -

Convocation Notice for the 85Th Ordinary General Meeting of Registered Shareholders

Murata Manufacturing Co., Ltd. CONVOCATION NOTICE FOR THE 85th ORDINARY GENERAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 29, 2021 LOCATION: “Genji Ballroom” on the third floor of HOTEL GRANVIA KYOTO NOTE 1. THIS DOCUMENT IS A TRANSLATION OF THE OFFICIAL JAPANESE CONVOCATION NOTICE FOR THE 85TH ORDINARY GENERAL MEETING OF REGISTERED SHAREHOLDERS. 2. THIS TRANSLATION IS PROVIDED ONLY AS A REFERENCE TO ASSIST SHAREHOLDERS IN THEIR VOTING AND DOES NOT CONSTITUTE AN OFFICIAL DOCUMENT. 3. IN THE EVENT OF ANY DISCREPANCY BETWEEN THIS TRANSLATED DOCUMENT AND THE JAPANESE ORIGINAL, THE ORIGINAL SHALL PREVAIL. * Please understand that gifts to shareholders who attend the meeting will not be provided. 1 The Murata Philosophy Murata Philosophy was created by founder Akira Murata in 1954. Since then, the world around us has dramatically changed, and technologies have continued to evolve. However, the thoughts embodied in our philosophy will always remain the same. All employees share these thoughts and exercise them in their daily work. Murata Philosophy We contribute to the advancement of society by enhancing technologies and skills applying scientific approach creating innovative products and solutions being trustworthy and, together with all our stakeholders, thankful for the increase in prosperity. 2 (Securities Code: 6981) CONVOCATION NOTICE FOR THE 85th ORDINARY GENERAL MEETING OF SHAREHOLDERS June 4, 2021 Norio Nakajima President and Representative Director Murata Manufacturing Co., Ltd. 10-1, Higashikotari 1-chome, Nagaokakyo-shi, Kyoto, Japan Dear Shareholders: Notice is hereby given that the 85th Ordinary General Meeting of Shareholders of Murata Manufacturing Co., Ltd. (the “Company”) will be held as detailed below.