Yuki Asia Umbrella Fund Yuki Japan Rebounding

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Fairy Tail Explodes Onto Home Consoles Today!

FAIRY TAIL EXPLODES ONTO HOME CONSOLES TODAY! Join Natsu, Lucy and the Fairy Tail Guild on a Magical Adventure on the Nintendo Switch™, PlayStaon®4 and Windows PC via Steam®! Hertfordshire, 30th July 2020 - Today, KOEI TECMO Europe and developer GUST Studios released their spellbinding JRPG, FAIRY TAIL, on the Nintendo Switch™, PlayStation®4 computer entertainment system and Windows PC via Steam®. The game, based on the anime and manga of the same name by Hiro Mashima, marks the first time a FAIRY TAIL game has been released on home console in the West! FAIRY TAIL invites players to re-live, or experience for the first time, the series’ enchanting storyline from the popular Tenrou Island arc through to the Tartaros arc, along with all-new never before seen story and quest elements. The magical world of FAIRY TAIL is brought to life with remarkable detail throughout this all-new gaming experience, with phenomenal focus on delivering the type of magic and mystique fans of the worldwide sensation anime and manga series have been craving. Throughout their journey, players will be able to form their dream five-mage battle party from a selection of over 16 iconic characters, including: Natsu, Lucy, Gray, Erza, Wendy, Gajeel, Juvia, Rogue, Kagura, Sherria, Sting, Ichiya, Laxus, Mirajane, Jellal and Gildarts. The character’s unique magic abilities from the series are brought to life within the game, including Unison Raids where characters can combine together to unleash their magic spells at once and overpower enemies. Even Extreme Magic Spells can be used, including Kanna’s Fairy Glitter – which can be activated when magic attacks are combined – to get the upper hand in battle. -

Pokémon Consolidates North American and European

Check out the table for a look into some of the games coming soon for Nintendo 3DS & Wii U: Nintendo 3DS Packaged Games Publisher Release date Paper Mario: Sticker Star Nintendo 7th December 2012 Scribblenauts Unlimited Nintendo 8th February 2013 Wreck-It Ralph Activision 8th February 2013 Super Black Bass Koch Media 15th February 2013 Viking Invasion 2 – Tower Defense Bigben Interactive 22nd February 2013 Crash City Mayhem Ghostlight Ltd 22nd February 2013 Shin Megami Tensei: Devil Survivor Overclocked Ghostlight Ltd 22nd February 2013 Imagine™ Champion Rider 3D UBISOFT February 2013 Sonic & All-Stars Racing Transformed SEGA February 2013 Dr Kawashima’s Devilish Brain Training: Can you stay focused? Nintendo 8th March 2013 Puzzler World 2013 Ideas Pad Ltd 8th March 2013 Jewel Master: Cradle of Egypt 2 Just for Games 13th March 2013 The Hidden Majesco Entertainment Europe 13th March 2013 Pet Zombies Majesco Entertainment Europe 13th March 2013 Face Racers Majesco Entertainment Europe 13th March 2013 Nano Assault Majesco Entertainment Europe 13th March 2013 Hello Kitty Picnic with Sanrio Friends Majesco Entertainment Europe 13th March 2013 Monster High™: Skultimate Roller Maze Little Orbit Europe Ltd 13th March 2013 Mystery Murders: Jack the Ripper Avanquest Software Publishing Ltd 15th March 2013 Puzzler Brain Games Ideas Pad Ltd 29th March 2013 Funfair Party Games Avanquest Software Publishing Ltd 29th March 2013 Midnight Mysteries: The Devil on the Mississippi Avanquest Software Publishing Ltd 29th March 2013 Luigi’s Mansion 2 Nintendo -

BANDAI NAMCO Group FACT BOOK 2019 BANDAI NAMCO Group FACT BOOK 2019

BANDAI NAMCO Group FACT BOOK 2019 BANDAI NAMCO Group FACT BOOK 2019 TABLE OF CONTENTS 1 BANDAI NAMCO Group Outline 3 Related Market Data Group Organization Toys and Hobby 01 Overview of Group Organization 20 Toy Market 21 Plastic Model Market Results of Operations Figure Market 02 Consolidated Business Performance Capsule Toy Market Management Indicators Card Product Market 03 Sales by Category 22 Candy Toy Market Children’s Lifestyle (Sundries) Market Products / Service Data Babies’ / Children’s Clothing Market 04 Sales of IPs Toys and Hobby Unit Network Entertainment 06 Network Entertainment Unit 22 Game App Market 07 Real Entertainment Unit Top Publishers in the Global App Market Visual and Music Production Unit 23 Home Video Game Market IP Creation Unit Real Entertainment 23 Amusement Machine Market 2 BANDAI NAMCO Group’s History Amusement Facility Market History 08 BANDAI’s History Visual and Music Production NAMCO’s History 24 Visual Software Market 16 BANDAI NAMCO Group’s History Music Content Market IP Creation 24 Animation Market Notes: 1. Figures in this report have been rounded down. 2. This English-language fact book is based on a translation of the Japanese-language fact book. 1 BANDAI NAMCO Group Outline GROUP ORGANIZATION OVERVIEW OF GROUP ORGANIZATION Units Core Company Toys and Hobby BANDAI CO., LTD. Network Entertainment BANDAI NAMCO Entertainment Inc. BANDAI NAMCO Holdings Inc. Real Entertainment BANDAI NAMCO Amusement Inc. Visual and Music Production BANDAI NAMCO Arts Inc. IP Creation SUNRISE INC. Affiliated Business -

The Impact of Multichannel Game Audio on the Quality of Player Experience and In-Game Performance

The Impact of Multichannel Game Audio on the Quality of Player Experience and In-game Performance Joseph David Rees-Jones PhD UNIVERSITY OF YORK Electronic Engineering July 2018 2 Abstract Multichannel audio is a term used in reference to a collection of techniques designed to present sound to a listener from all directions. This can be done either over a collection of loudspeakers surrounding the listener, or over a pair of headphones by virtualising sound sources at specific positions. The most popular commercial example is surround-sound, a technique whereby sounds that make up an auditory scene are divided among a defined group of audio channels and played back over an array of loudspeakers. Interactive video games are well suited to this kind of audio presentation, due to the way in which in-game sounds react dynamically to player actions. Employing multichannel game audio gives the potential of immersive and enveloping soundscapes whilst also adding possible tactical advantages. However, it is unclear as to whether these factors actually impact a player’s overall experience. There is a general consensus in the wider gaming community that surround-sound audio is beneficial for gameplay but there is very little academic work to back this up. It is therefore important to investigate empirically how players react to multichannel game audio, and hence the main motivation for this thesis. The aim was to find if a surround-sound system can outperform other systems with fewer audio channels (like mono and stereo). This was done by performing listening tests that assessed the perceived spatial sound quality and preferences towards some commonly used multichannel systems for game audio playback over both loudspeakers and headphones. -

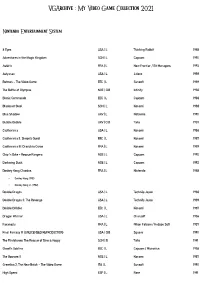

Vgarchive : My Video Game Collection 2021

VGArchive : My Video Game Collection 2021 Nintendo Entertainment System 8 Eyes USA | L Thinking Rabbit 1988 Adventures in the Magic Kingdom SCN | L Capcom 1990 Astérix FRA | L New Frontier / Bit Managers 1993 Astyanax USA | L Jaleco 1989 Batman – The Video Game EEC | L Sunsoft 1989 The Battle of Olympus NOE | CiB Infinity 1988 Bionic Commando EEC | L Capcom 1988 Blades of Steel SCN | L Konami 1988 Blue Shadow UKV | L Natsume 1990 Bubble Bobble UKV | CiB Taito 1987 Castlevania USA | L Konami 1986 Castlevania II: Simon's Quest EEC | L Konami 1987 Castlevania III: Dracula's Curse FRA | L Konami 1989 Chip 'n Dale – Rescue Rangers NOE | L Capcom 1990 Darkwing Duck NOE | L Capcom 1992 Donkey Kong Classics FRA | L Nintendo 1988 • Donkey Kong (1981) • Donkey Kong Jr. (1982) Double Dragon USA | L Technōs Japan 1988 Double Dragon II: The Revenge USA | L Technōs Japan 1989 Double Dribble EEC | L Konami 1987 Dragon Warrior USA | L Chunsoft 1986 Faxanadu FRA | L Nihon Falcom / Hudson Soft 1987 Final Fantasy III (UNLICENSED REPRODUCTION) USA | CiB Square 1990 The Flintstones: The Rescue of Dino & Hoppy SCN | B Taito 1991 Ghost'n Goblins EEC | L Capcom / Micronics 1986 The Goonies II NOE | L Konami 1987 Gremlins 2: The New Batch – The Video Game ITA | L Sunsoft 1990 High Speed ESP | L Rare 1991 IronSword – Wizards & Warriors II USA | L Zippo Games 1989 Ivan ”Ironman” Stewart's Super Off Road EEC | L Leland / Rare 1990 Journey to Silius EEC | L Sunsoft / Tokai Engineering 1990 Kings of the Beach USA | L EA / Konami 1990 Kirby's Adventure USA | L HAL Laboratory 1993 The Legend of Zelda FRA | L Nintendo 1986 Little Nemo – The Dream Master SCN | L Capcom 1990 Mike Tyson's Punch-Out!! EEC | L Nintendo 1987 Mission: Impossible USA | L Konami 1990 Monster in My Pocket NOE | L Team Murata Keikaku 1992 Ninja Gaiden II: The Dark Sword of Chaos USA | L Tecmo 1990 Rescue: The Embassy Mission EEC | L Infogrames Europe / Kemco 1989 Rygar EEC | L Tecmo 1987 Shadow Warriors FRA | L Tecmo 1988 The Simpsons: Bart vs. -

Pokémon Consolidates North American

Títulos físicos para a Nintendo 3DS Editora Data de lançamento Paper Mario: Sticker Star Nintendo 7 de dezembro de 2012 Scribblenauts Unlimited Nintendo 8 de fevereiro de 2013 Wreck-It Ralph Activision 2013 Super Black Bass Rising Star Games 2013 Farmscapes Denda Publishers B.V. 2013 Viking Invasion 2 – Tower Defense Bigben Interactive 22 de fevereiro de 2013 Crash City Mayhem Ghostlight Ltd 22 de fevereiro de 2013 Shin Megami Tensei: Devil Survivor Overclocked Ghostlight Ltd 22 de fevereiro de 2013 Imagine™ Champion Rider 3D UBISOFT Fevereiro de 2013 Sonic & All-Stars Racing Transformed SEGA Fevereiro 2013 Dr Kawashima’s Devilish Brain Training: Can you stay focused? Nintendo 8 de março de 2013 Puzzler World 2013 Ideas Pad Ltd 2013 Jewel Master: Cradle of Egypt 2 Rising Star Games 2013 The Hidden Majesco Entertainment Europe 2013 Pet Zombies Majesco Entertainment Europe 2013 Face Racers Majesco Entertainment Europe 2013 Nano Assault Majesco Entertainment Europe 2013 Hello Kitty Picnic with Sanrio Friends Majesco Entertainment Europe 2013 Monster High™: Skultimate Roller Maze (UK) Maze (Benelux & Nordics) Little Orbit Europe Ltd Março de 2013 Mystery Murders: Jack the Ripper Avanquest Software Publishing Ltd 2013 Puzzler Brain Games Ideas Pad Ltd 2013 Funfair Party Games Avanquest Software Publishing Ltd 2013 Midnight Mysteries: The Devil on the Mississippi Avanquest Software Publishing Ltd 29 de março de 2013 Luigi’s Mansion 2 Nintendo Março de 2013 Capcom Monster Hunter 3 Ultimate (Distributed by Nintendo) Março de 2013 Castlevania: -

23Rd Annual D.I.C.E. Awards Winners

UNDER EMBARGO UNTIL THURSDAY, FEB. 13, 2020, AT 9:45 PM PST (FRIDAY, FEB. 14 AT 12:45 AM EST) 23rd D.I.C.E. AWARDS HONORS VIDEO GAME INDUSTRY’S MOST OUTSTANDING ACHIEVEMENTS Irreverent Indie Favorite Untitled Goose Game Snatches Game of the Year LAS VEGAS – Feb. 13, 2020 – The votes are in and a fan-favorite independent game is ruling the roost at the 23rd D.I.C.E. (Design, Innovate, Communicate, Entertain) Awards, the annual gathering of the interactive entertainment industry. Hosted by The Academy of Interactive Arts & Sciences (AIAS), this year’s Game of the Year was awarded to Untitled Goose Game, a critically-acclaimed game from indie developer House House and publisher Panic, in which players take the reins of the titular goose to manipulate and torment the inhabitants of a proper little English village. The AIAS is the industry’s notable 30,000-member non-profit organization dedicated to the advancement and recognition of the interactive arts. Tonight, the Academy membership honored games in 23 award categories. Control led the evening with four awards, Game of the Year winner Untitled Goose Game had three wins, and Death Stranding nabbed two. Other top honorees include Sayonara Wild Hearts for Portable Game of the Year; Mortal Kombat 11 for Fighting Game of the Year; Pistol Whip for Immersive Game of the Year; FIFA 20 for Sports Game of the Year; The Outer Worlds for Role-Playing Game of the Year; and Disco Elysium for Outstanding Achievement in Story, among others. “The 23rdAnnual D.I.C.E. -

Annual Report 2019

Annual Report 2019 for the fiscal year ended March 31, 2019 Nintendo Co., Ltd. Table of Contents Information on the Company ....................................................................................................................................... 2 I. Overview of the Company ............................................................................................................................... 2 1. Key financial data and trends .......................................................................................................................... 2 2. Description of business ................................................................................................................................... 3 3. Subsidiaries and associates ............................................................................................................................. 4 II. Business Overview .......................................................................................................................................... 6 1. Management policy, management environment, issues to address ................................................................. 6 2. Risk factors ..................................................................................................................................................... 7 3. Analysis of financial position, operating results and cash flow by the management ...................................... 9 4. Research and development activities ........................................................................................................... -

KOEITECMOINFORMATION Notice Regarding Breach of Data of UK

KOEI TECMO INFORMATION December 25, 2020 KOEI TECMO HOLDINGS CO., LTD. Notice regarding breach of data of UK subsidiary (updated) KOEI TECMO HOLDINGS CO., LTD. (KOEI TECMO) reported on December 22, 2020 that the website operated by its UK subsidiary KOEI TECMO EUROPE LIMITED (KTE) possibly had some of the user information collected on its website leaked online. The issue continues to be under investigation, and the current status is as follows: 1. Leaked information Within the website operated by KTE, the “Forum” page and the registered user information (approximately 65,000 entries) has been determined to the data that may have been breached. The user data that may have been leaked through hacking is perceived to be the (optional) account names and related password (encrypted) and/or registered e-mail address. The “Forum” does not contain any credit card information. In addition, at this point a breach of data has not taken place in any other sites or pages other than the “Forum”. 2. Perpetrator At this point, the perpetrator of the hacking has not yet been identified. The method and process are still under investigation, but it has been determined that the possibility of it being a ransomware attack is low. In addition, up to this point there are no confirmed demands or treats towards KOEI TECMO or KTE. 3. Measures being taken At the same time as temporarily closing the KTE website, KOEI TECMO has taken the step to completely cut off KTE from its internal network. Since the possibility of e-mail addresses being leaked has been confirmed, in accordance with the EU General Data Protection Regulation (GDPR), KOEI TECMO has reported to the GDPR the possibility of a breach of personal information. -

Corporate Management Policy Briefing for the Fiscal Year Ending

Corporate Management Policy Briefing for Fiscal Year Ending March 2021 Nintendo Co., Ltd. Q & A Summary If you quote any or all of this Q&A, please display the URL of this website or insert a link to this website. Q1 Mario Kart Live: Home Circuit looks like it will be a unique integrated hardware-software entertainment title. Can you talk a little about the concept and how it was developed? Also, what is your approach to the Nintendo Switch software lineup going forward? A1 Shuntaro Furukawa (Representative Director and President): We recently announced our software lineup for the second half of this fiscal year (ending March 2021). It starts with the release of Super Mario 3D All-Stars on September 18, followed by Mario Kart Live: Home Circuit in October. Koei Tecmo Games will also release Hyrule Warriors: Age of Calamity in November. (Nintendo will publish this title in overseas markets.) And then next year, we have more titles slated for release, including Super Mario 3D World + Bowser's Fury. Nintendo Switch is just now entering what we consider the middle of its lifecycle, so there are many more titles currently under development to be released in the next fiscal year (ending March 2022) and beyond. Shinya Takahashi (Director, Senior Managing Executive Officer): Mario Kart Live: Home Circuit is based on the concept of using a game console to control an RC kart equipped with a camera. The concept was proposed by a U.S. company, Velan Studios, whose founders were involved with us during development of a Wii U title. -

Results Briefing Session for the Fiscal Year Ended March 31, 2019

Financial Results Briefing Session Fiscal Year Ended March 31, 2019 May 13, 2019 SQUARE ENIX HOLDINGS CO., LTD. Statements made in this document with respect to SQUARE ENIX HOLDINGS CO., LTD. and its consolidated subsidiaries' (together, “SQUARE ENIX GROUP") plans, estimates, strategies and beliefs are forward‐looking statements about the future performance of SQUARE ENIX GROUP. These statements are based on management's assumptions and beliefs in light of information available to it at the time these material were drafted and, therefore, the reader should not place undue reliance on them. Also, the reader should not assume that statements made in this document will remain accurate or operative at a later time. A number of factors could cause actual results to be materially different from and worse than those discussed in forward‐looking statements. Such factors include, but not limited to: 1. changes in economic conditions affecting our operations; 2. fluctuations in currency exchange rates, particularly with respect to the value of the Japanese yen, the U.S. dollar and the Euro; 3. SQUARE ENIX GROUP’s ability to continue to win acceptance of our products and services, which are offered in highly competitive markets characterized by the continuous introduction of new products and services, rapid developments in technology, and subjective and changing consumer preferences; 4. SQUARE ENIX GROUP’s ability to expand international success with a focus on our businesses; and 5. regulatory developments and changes and our ability to respond and adapt to those changes. The forward‐looking statements regarding earnings contained in these materials were valid at the time these materials were drafted. -

BLADESTORM: NIGHTMARE’ New Assets Reveal Battle System and ‘Edit Mode’ Details

KOEI TECMO EUROPE ANNOUNCES NEW RELEASE DATE FOR ‘BLADESTORM: NIGHTMARE’ New assets reveal battle system and ‘Edit Mode’ details 9 January 2015- Koei Tecmo Europe announced today an updated release date for its upcoming title ‘Bladestorm: Nightmare’. The Hundred Years War epic will be unleashed in Australia and New Zealand on 19 March 2015 for the PlayStation®4 computer entertainment system and Xbox One, the all-in-one games and entertainment system from Microsoft. There will also be a PlayStation®3 computer entertainment system digital only version available at the same time. Koei Tecmo also released a set of assets, offering a first glimpse at the character edit mode and showcasing the Troop Command battle system that makes this title stand out in the strategy genre. In Bladestorm: Nightmare the player is called to create a mercenary and accept missions that will advance the English or the French cause in the course of the Hundred Year War. The successful completion of these missions depends on a variety of elements that put the player’s fighting abilities, strategy, tactical and leadership skills to the test. The Mercenary does not ride to the field alone, but as the commander of an army unit chosen to fit each individual situation as some missions are better fought with foot soldiers, others with lances, archers, light cavalry, or a combination of melee, ranged and mounted units. Furthermore the battle system has been updated to allow simultaneous control of up to four army units. This gives the game even more strategic edge, as the units can be repositioned at any time and ordered to take certain actions that will help the mission succeed (e.g.