Universal Registration Document 2020 Universal Registration Document

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Climate and Energy Benchmark in Oil and Gas Insights Report

Climate and Energy Benchmark in Oil and Gas Insights Report Partners XxxxContents Introduction 3 Five key findings 5 Key finding 1: Staying within 1.5°C means companies must 6 keep oil and gas in the ground Key finding 2: Smoke and mirrors: companies are deflecting 8 attention from their inaction and ineffective climate strategies Key finding 3: Greatest contributors to climate change show 11 limited recognition of emissions responsibility through targets and planning Key finding 4: Empty promises: companies’ capital 12 expenditure in low-carbon technologies not nearly enough Key finding 5:National oil companies: big emissions, 16 little transparency, virtually no accountability Ranking 19 Module Summaries 25 Module 1: Targets 25 Module 2: Material Investment 28 Module 3: Intangible Investment 31 Module 4: Sold Products 32 Module 5: Management 34 Module 6: Supplier Engagement 37 Module 7: Client Engagement 39 Module 8: Policy Engagement 41 Module 9: Business Model 43 CLIMATE AND ENERGY BENCHMARK IN OIL AND GAS - INSIGHTS REPORT 2 Introduction Our world needs a major decarbonisation and energy transformation to WBA’s Climate and Energy Benchmark measures and ranks the world’s prevent the climate crisis we’re facing and meet the Paris Agreement goal 100 most influential oil and gas companies on their low-carbon transition. of limiting global warming to 1.5°C. Without urgent climate action, we will The Oil and Gas Benchmark is the first comprehensive assessment experience more extreme weather events, rising sea levels and immense of companies in the oil and gas sector using the International Energy negative impacts on ecosystems. -

Nuclear Hvac

NUCLEAR HVAC ENGIE Axima, your key partner ENGIE Axima your local partner for engineering, procurement, construction and operation maintenance of your nuclear HVAC projects. Gravelines With a network of GravelinesDunkerque Lille Boulogne-sur-Mer Dunkerque Lille Boulogne-sur-MerPenly St-Omer Dieppe Chooz Cherbourg Penly St-Omer Amiens Paluel Dieppe Chooz FlamanvilleCherbourg Amiens Compiègne Cattenom officies Paluel Rouen Flamanville Compiègne Cattenom Phalsbourg Engineering Procurement Construction Rouen PARIS Saint-Brieuc Caen Reims Metz ENGIE_axima RÉFÉRENCES COULEUR Brest Phalsbourg Haguenau • Design of HVAC & air treatment systems, • Qualification of the equipment (either • Installation of HVAC systems in in France ChartresPARIS Nogent/Seine gradient_MONO_WHITE Saint-Brieuc MontaubanCaen Reims Metz 22/10/2015 Brest Nancy HaguenauSTRASBOURG Landivisiau de Bretagne LeChartres Mans Nogent/Seine Troyes 24, rue Salomon de Rothschild - 92288 Suresnes - FRANCE of process fluids, process vacuum, and by analysis or testing). coordination with other work packages. Montauban Tél. : +33 (0)1 57 32 87 00 / Fax : +33 (0)1 57 32 87 87 Quimper Web : www.carrenoir.com WHITE cooling systems, including the preparation Landivisiau de BretagneRennesLe Mans Orléans Troyes Nancy Epinal STRASBOURGColmar Lorient Chaumont • Long-term partnership with reputable • Testing, commissioning, acceptance, Quimper Angers Fessenheim of the technical specifications for the VannesRennes St-LaurentOrléans Epinal MulhouseColmar suppliers for the procurement of all operation -

"Implementing EPA's Clean Power Plan: a Menu of Options," NACAA

Implementing EPA’s Clean Power Plan: A Menu of Options May 2015 Implementing EPA’s Clean Power Plan: A Menu of Options May 2015 Implementing EPA’s Clean Power Plan: A Menu of Options Acknowledgements On behalf of the National Association of Clean Air Agencies (NACAA), we are pleased to provide Implementing EPA’s Clean Power Plan: A Menu of Options. Our association developed this document to help state and local air pollution control agencies identify technologies and policies to reduce greenhouse gases from the power sector. We hope that states and localities, as well as other stakeholders, find this document useful as states prepare their compliance strategies to achieve the carbon dioxide emissions targets set by the EPA’s Clean Power Plan. NACAA would like to thank The Regulatory Assistance Project (RAP) for its invaluable assistance in developing this document. We particularly thank Rich Sedano, Ken Colburn, John Shenot, Brenda Hausauer, and Camille Kadoch. In addition, we recognize the contribution of many others, including Riley Allen (RAP), Xavier Baldwin (Burbank Water and Power [retired]), Dave Farnsworth (RAP), Bruce Hedman (Institute for Industrial Productivity), Chris James (RAP), Jim Lazar (RAP), Carl Linvill (RAP), Alice Napoleon (Synapse), Rebecca Schultz (independent contractor), Anna Sommer (Sommer Energy), Jim Staudt (Andover Technology Partners), and Kenji Takahashi (Synapse). We would also like to thank those involved in the production of this document, including Patti Casey, Cathy Donohue, and Tim Newcomb (Newcomb Studios). We are grateful to Stu Clark (Washington) and Larry Greene (Sacramento, California), co-chairs of NACAA’s Global Warming Committee, under whose guidance this document was prepared. -

THE RESCUE of ALSTOM Patrick Kron

http://www.ecole.org Seminar Business Life THE RESCUE OF ALSTOM Organised thanks to the patronage of the following companies : Air France Algoé2 by Alstom ANRT ArcelorMittal Patrick Kron Areva2 Cabinet Regimbeau1 Chairman and Chief Executive Officer, Alstom Caisse des Dépôts et Consignations CEA Chaire “management de l’innovation” de l'École polytechnique December 7th, 2007 Chambre de Commerce et d'Industrie de Paris Report by Thomas Paris CNRS Translation by Rachel Marlin Conseil Supérieur de l'Ordre des Experts Comptables Danone Deloitte École des mines de Paris Overview EDF Entreprise & Personnel In 2003, Alstom was on the verge of bankruptcy. How could an ESCP-EAP Fondation Charles Léopold Mayer international, industrial company, more than a hundred years old, pour le Progrès de l'Homme have reached such a position in a rapidly expanding market ? What France Télécom FVA Management was the way out of this situation ? Alstom’s difficulties were the Roger Godino result of a combination of four factors : a technical problem, an Groupe ESSEC HRA Pharma inadequate operational performance, an impossible financial IDRH 1 situation, and the temporary collapse of its most important market. IdVectoR La Poste A rescue operation was hampered because these four factors had to Lafarge be handled simultaneously and the various bodies involved, Ministère de l’Industrie, direction générale des Entreprises including banks, shareholders, clients and employees had to be Paris-Ile de France Capitale Economique convinced that there was a future for Alstom, in spite of feelings of PSA Peugeot Citroën Reims Management School pessimism and general distrust. Acting as a catalyst, the French Renault state took on the challenge of making a successful last-ditch Saint-Gobain Schneider Electric Industrie attempt to turn the company around. -

The Royal Institution for the Advancement

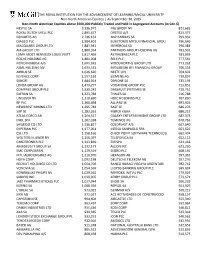

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Non-North American Equities │ As September 30, 2019 Non-North American Equities above $500,000 Publicly Traded and Held in Segregated Accounts (in Cdn $) NESTLE SA 3,136,972 ING GROEP NV 822,665 ROYAL DUTCH SHELL PLC 2,895,677 ORSTED A/S 813,377 NOVARTIS AG 2,736,152 BNP PARIBAS SA 799,331 DIAGEO PLC 1,984,601 SUMITOMO MITSUI FINANCIAL GROU 796,646 MACQUARIE GROUP LTD 1,881,942 IBERDROLA SA 796,483 AIA GROUP LTD 1,880,954 PARTNERS GROUP HOLDING AG 781,932 LVMH MOET HENNESSY LOUIS VUITT 1,817,469 ASTRAZENECA PLC 781,059 ROCHE HOLDING AG 1,801,008 RELX PLC 777,561 NOVO NORDISK A/S 1,695,931 WOOLWORTHS GROUP LTD 771,262 ASML HOLDING NV 1,633,531 MITSUBISHI UFJ FINANCIAL GROUP 766,553 AIRBUS SE 1,626,620 NESTE OYJ 764,602 KEYENCE CORP 1,557,193 SIEMENS AG 739,857 SANOFI 1,484,014 DANONE SA 733,193 LONZA GROUP AG 1,479,277 VODAFONE GROUP PLC 723,852 COMPASS GROUP PLC 1,339,242 DASSAULT SYSTEMES SE 720,751 SAFRAN SA 1,323,784 THALES SA 716,788 UNILEVER NV 1,319,690 HSBC HOLDINGS PLC 707,830 BP PLC 1,300,498 ALLIANZ SE 693,905 NEWCREST MINING LTD 1,295,783 BASF SE 686,276 SAP SE 1,283,261 MERCK KGAA 686,219 ATLAS COPCO AB 1,264,517 GALAXY ENTERTAINMENT GROUP LTD 683,373 ENEL SPA 1,262,338 TEMENOS AG 670,763 SHISEIDO CO LTD 1,236,827 COLOPLAST A/S 667,640 EXPERIAN PLC 1,177,061 INTESA SANPAOLO SPA 663,622 CSL LTD 1,158,166 CHECK POINT SOFTWARE TECHNOLOG 662,404 WOLTERS KLUWER NV 1,156,397 TELEFONICA SA 652,113 CARDTRONICS PLC 1,143,839 ENI SPA 641,418 AMADEUS IT GROUP SA -

PRESS RELEASE Safran: Continued Momentum in Q3 2019

PRESS RELEASE Safran: Continued momentum in Q3 2019 On track to meet 2019 outlook Paris, October 31, 2019 Adjusted data Q3 2019 revenue at Euro 6,095 million, up 14.0% on a reported basis and up 9.8% on an organic basis 9M 2019 revenue at Euro 18,197 million, up 22.5% on a reported basis and up 12.6% on an organic basis 2019 outlook confirmed Consolidated data Consolidated revenue was Euro 6,180 million in Q3 2019 Consolidated revenue was Euro 18,495 million for 9M 2019 Foreword . All figures in this press release represent adjusted [1] data, except where noted. Please refer to the definitions and reconciliation between Q3 2019 and 9M 2019 consolidated revenue and adjusted revenue. Please refer to the definitions contained in the Notes on page 8 of this press statement; . Aerosystems and Aircraft Interiors (former Zodiac Aerospace activities) are fully consolidated in Safran’s financial statements from March 1, 2018; . Organic variations exclude changes in scope (notably the contribution of Aerosystems and Aircraft Interiors in January and February 2019) and currency impacts for the period; . Safran disclosed a new presentation of segment information as of June 30, 2019 (see press release of July 1, 2019); . The 2019 outlook was prepared taking into consideration the full application of IFRS16. Executive commentary CEO Philippe Petitcolin commented: “In the third quarter, we took another step towards meeting our 2019 organic growth revenue target. The 9.8% organic growth is strong considering the comparison basis and in line with year-end outlook. Regarding the MAX grounding, we are supporting Boeing and based on our current production rate of LEAP-1B engines corresponding to 42 aircraft a month, we confirm a production of around 1 800 LEAP engines in 2019.” 1 WorldReginfo - 49595b9c-6546-491f-b69b-1ac6c9717381 Key business highlights 1- Aerospace Propulsion Continuing growth of narrowbody engine deliveries At the end of September 2019, combined shipments of CFM56 and LEAP engines reached 1,643 units, compared with 1,575 in 2018. -

The CFM Engine Saga

The CFM Engine Saga Jean-Paul Ebanga, CFM President Aircraft Builder Council Conference, San Diego September 23, 2013 CFM, CFM56, LEAP and the CFM logo are trademarks of CFM International, a 50/50 joint company between Snecma (Safran group) and GE. The information in this document is CFM Proprietary Information and is disclosed in confidence. It is the property of CFM International and its parent companies, and shall not be used, disclosed to others or reproduced without the express written consent of CFM. If consent is given for reproduction in whole or in part, this notice shall appear in any such reproduction in whole or in part. The information contained in this document may also be controlled by the U.S. and French export control laws. Unauthorized export or re-export is prohibited. 1923 Fokker T2 2 / CFM Proprietary Information subject to restrictions on the cover What is CFM? 3 / CFM Proprietary Information subject to restrictions on the cover CFM is a JV … Most successful World’s largest aircraft Most successful aviation venture engine company aviation partnership • 25000+ engines shipped • 70% share/100+ PAX GE – Safran Agreement • 18K to 50K lbs. thrust • Together since 1974 • Committed until 2040 4 / CFM Proprietary Information subject to restrictions on the cover with a perfect solution line-up … 5 / CFM Proprietary Information subject to restrictions on the cover … using a very lean organization * All activities shared 50/50: R&D, CFM56 and LEAP, a same worksharing engineering, sales and marketing, product support, manufacturing -

CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3)

ENVIRONMENT CARBON FOOTPRINT – CO2 Emissions (Scope 1, 2 & 3) GRI Standards : 402-1: Energy 305-1, 305-2, 305-3,305-4, 305-5: Emissions EXECUTIVE SUMMARY Sanofi has committed to limit the impacts linked to its activities on the environment. One of the major challenges of the Sanofi Planet Mobilization program consists in reducing its Greenhouse Gas (GHG) emissions: • direct emissions related to Scope 1 and 2 (industrial, R&D and tertiary sites, including the medical representative’s fleet) • indirect emissions related to scope 3, associated with the value chain activities (transportation and distribution, purchased goods and services, waste generation, etc.) Carbon Footprint Factsheet 1 Published in April 2021 TABLE OF CONTENTS 1. BACKGROUND ............................................................................................................ 3 2. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 1 & 2 ................................ 3 2.1. Dashboard: objectives and progress ...................................................................... 3 2.2. Key figures ................................................................................................................. 3 2.3. Highlights ................................................................................................................... 4 3. GREENHOUSE GAS EMISSIONS RELATED TO SCOPE 3 ....................................... 6 3.1. Context ....................................................................................................................... 6 3.2. Key -

Quick Install Guide

QIG 253271827A Fast 1704_GB without WPS.book Page 1 Mercredi, 7. octobre 2009 2:47 14 SAGEM F@st™ 1704 Quick Installation Guide QIG 253271827A Fast 1704_GB without WPS.book Page 1 Mercredi, 7. octobre 2009 2:47 14 SAGEM F@stTM 1704 Sagem Communications SAS (hereafter referred to as Sagem Communications) thanks you for choosing the range of SAGEM F@stTM 1704 routers while hoping that it will provide you with full satisfaction. SAGEM F@stTM 1704 products adapt the ADSL function respectively on POTS (ITU G.992.1/3/5 - Appendix A) and on ISDN (ITU G.992.1/3/5 - Appendix B). SAGEM F@stTM 1704 equipment include four ethernet interfaces (LAN1 to LAN4). In addition, this router will provide you with access to all the services provided by your Internet Access Provider, as shown in the diagram below. CE marking: The CE marking certifies that the product complies with the essential requirements of the Directive 1999/5/EC concerning radio equipment and telecommunication equipment, and of Directives 2006/95/EC concerning safety and 2004/108/EC concerning electromagnetic compatibility, defined by the European Parliament and Council to reduce electromagnetic interferences and protect the health and safety of users. The product named SAGEM F@stTM 1704 can be operated in the European Union without restrictions indoor but cannot be operated in France in the whole of the band until further notice. The CE declaration of conformity can be viewed in the support section of the Sagem Communications site www.sagem-communications.com, or it can be obtained from the following address: Sagem Communications SAS - Customer relations department 250, Route de l'Empereur 92500 RUEIL MALMAISON - FRANCE Copyright © Sagem Communications SAS All rights reserved. -

ALSTOM at a GLANCE 2020 at Alstom, We Partner with Our Stakeholders to Optimise Transport Networks by Understanding What Moves People

ALSTOM AT A GLANCE 2020 At Alstom, we partner with our stakeholders to optimise transport networks by understanding what moves people. We are proud to work together to reinvent mobility and make transport easier and more intuitive. Leading the way to sustainable and smart mobility – naturally Henri Poupart-Lafarge Alstom Chairman and CEO “The role of Alstom is not only to provide rolling stock, services and maintenance but to offer mobility solutions to a world in profound transformation. Alstom is in an excellent position to shape tomorrow’s mobility: efficient, sustainable and connected.” URBAN ROLLING STOCK CUSTOMISED MAINLINE ROLLING SERVICES STOCK A COMPLETE INTEGRATED URBAN SYSTEMS RANGE OF MOBILITY LOCOMOTIVES SOLUTIONS INFRASTRUCTURE COMPONENTS SIGNALLING 03 Leading the way to greener and smarter mobility, worldwide We believe that mobility must be sustainable. Alstom’s teams view these challenges as an opportunity, and a duty, to help society move forward. We innovate to design transport systems that are the sustainable and durable backbone of a multimodal transport future. TAKE PART IN Submission deadline: THE INNOVATION 31 July 2020 AWARDS 2020 OUR STRATEGY SHARE YOUR CREATIVITY GROWTH INNOVATION EFFICIENCY by offering in smarter and powered by Alstom greater value greener mobility digital AiM in Motion to our customers solutions Driven by the One Alstom team, Agile, Inclusive and Responsible I NOVE YOU Inaugurated in 2008, this internal annual GREEN & SMART INNOVATION competition aims to reinforce Road electromobility the innovation culture and strategy in Alstom Group. Eco-design Green and traction GREEN MOBILITY manufacturing Multimodality SMART and Flow MOBILITY Autonomous management trains Data driven rail mobility 04 A localised organisation, a touch point wherever you are We are global and local, working with stakeholders at every level to support the development of the world’s most advanced transport networks and local communities. -

Commitment in Action

Commitment in action Plazza 2020-2021 Book Together, let's transform the Group Committed men, women and communities Plazza is at the heart of our commitment, and the communities selected for this issue are the perfect illustration of this. Each of them is working toward at least one of the aspects of the Engage 2025 strategy presented below. You can identify them by using the Group's colour codes. Gervais Pellissier Deputy Chief Executive Officer, Reinvent our profession as an operator People & Transformation Accelerate in high-growth regions I am writing to you in this new issue of The communities presented in this the Plazza Book amid unprecedented issue are relevant in more ways than disruptions. The health crisis has pushed one. Whether it be about networks, Place Data and AI at the heart of our innovation model us to accelerate our adaptations to the the sustainability of our customer new ways of working with a focus on relationships, our roots in growing regions Build the business of tomorrow together maintaining the Group's activities. It has or the development of our employees' been a catalyst for the new practices that skills, they reflect the four ambitions of each of you has had a chance to test out the Engage 2025 strategic plan and its Sustainably commit to inclusion and the planet in your everyday lives. sustainable commitment to society. Plazza has been in the heart of these The already-porous boundaries between changes, acting as a beacon, as a meeting the professional and personal spheres point, to support your many initiatives. -

Safranin 2013

SAFRAN IN 2013 2013 REGISTRATION DOCUMENT WorldReginfo - ad8c403d-4ac5-44b4-b8b3-bd5c47afcfb7 SAFR_1402217_RA_2013_GB_CouvDocRef.indd 1 26/03/14 12:12 Contents GROUP PROFILE 1 1 PRESENTATION OF THE GROUP 8 5.3 Developing human potential 203 5.4 Aiming for excellence in health, 1.1 Overview 10 safety and environment 214 1.2 Group strategy 14 5.5 Involving our suppliers and partners 224 1.3 Group businesses 15 5.6 Investing through foundations 1.4 Competitive position 32 and corporate sponsorship 224 1.5 Research and development 32 5.7 CSR reporting methodology and Statutory 1.6 industrial investments 37 Auditors’ report 226 1.7 Sites and production plants 38 1.8 Safran Group purchasing strategy 43 6 CORPORATE GOVERNANCE 232 1.9 Safran quality performance and policy 43 6.1 Board of Directors and Executive 1.10 Safran+ progress initiative 44 Management 234 6.2 Executive Corporate Officer 2 REVIEW OF OPERATIONS IN 2013 compensation 263 AND OUTLOOK FOR 2014 46 6.3 Share transactions performed by Corporate Officers and other managers 272 2.1 Comments on the Group’s performance 6.4 Audit fees 274 in 2013 based on adjusted data 48 6.5 Report of the Chairman 2.2 Comments on the consolidated of the Board of Directors 276 financial statements 66 6.6 Statutory Auditors’ report 2.3 Comments on the parent company on the report prepared by the Chairman financial statements 69 of the Board of Directors 290 2.4 Outlook for 2014 71 2.5 Subsequent events 71 7 INFORMATION ABOUT THE COMPANY, 3 THE CAPITAL AND SHARE FINANCIAL STATEMENTS 72 OWNERSHIP 292 3.1