Pageflex Server [Document: D-5B6AB41D 00001]

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Witness Statement of Stuart Sherbrooke Wortley Dated April 2021 Urbex Activity Since 21 September 2020

Party: Claimant Witness: SS Wortley Statement: First Exhibits: “SSW1” - “SSW7” Date: 27.04.21 Claim Number: IN THE HIGH COURT OF JUSTICE QUEEN’S BENCH DIVISION B E T W E E N (1) MULTIPLEX CONSTRUCTION EUROPE LIMITED (2) 30 GS NOMINEE 1 LIMITED (3) 30 GS NOMINEE 2 LIMITED Claimants and PERSONS UNKNOWN ENTERING IN OR REMAINING AT THE 30 GROSVENOR SQUARE CONSTRUCTION SITE WITHOUT THE CLAIMANTS’ PERMISSION Defendants ______________________________________ WITNESS STATEMENT OF STUART SHERBROOKE WORTLEY ________________________________________ I, STUART SHERBROOKE WORTLEY of One Wood Street, London, EC2V 7WS WILL SAY as follows:- 1. I am a partner of Eversheds Sutherland LLP, solicitors for the Claimants. 2. I make this witness statement in support of the Claimants’ application for an injunction to prevent the Defendants from trespassing on the 30 Grosvenor Square Construction Site (as defined in the Particulars of Claim). cam_1b\7357799\3 1 3. Where the facts referred to in this witness statement are within my own knowledge they are true; where the facts are not within my own knowledge, I believe them to be true and I have provided the source of my information. 4. I have read a copy of the witness statement of Martin Philip Wilshire. 5. In this witness statement, I provide the following evidence:- 5.1 in paragraphs 8-21, some recent videos and photographs of incidents of trespass uploaded to social media by urban explorers at construction sites in London; 5.2 in paragraphs 22-27, information concerning injunctions which my team has obtained -

Make+Ppmk Brochure

Date May 2016 A new partnership forged through a shared vision for the design and delivery of high quality architecture. A new Cyprus awaits. The recent growth in property investment supported by the planning incentives announced by the government of Cyprus has opened the door to large- scale building projects and mixed used developments. It’s a golden opportunity to bring growth and prosperity to the economy. Make understands the importance of bringing this kind of potential to life. With an international portfolio of award-winning work – which includes 5 Broadgate and London Wall Place in London, Wynyard Place in Sydney and Pinnacle One in Chengdu – we have the vision and expertise to make it happen. Together with Pachomiou+Kazamias Architects, based in Cyprus, we have established a team with the capability to design and deliver the next generation of pivotal, sustainable schemes that will transform and uplift the island. Make Pachomiou+Kazamias Architects 32 Cleveland Street 8 Panioniou, Palace Heights B501 London , W1T 4JY Strovolos, 2018 Nicosia United Kindom Cyprus T +44(0)20 7363 5151 T +357 22757673 www.makearchitects.com www.ppmkarchitects.com Contact: Stuart Fraser Contact: Panayiotis Pachomiou Contents Introduction 3 About Make 7 Experience Residential Towers 19 Residential 47 Hotels and resorts 69 Pachomiou+Kazamias Architects 89 Practice profile 90 Experience 92 About Make 6 7 About Make – With studios in London, Hong Kong and Sydney, Make is an award-winning international architectural practice with a reputation for challenging convention and pursuing design excellence. Since we opened our doors in 2004, we’ve worked on We’ve developed a rigorous framework for enquiry more than 1,000 projects worldwide covering a wide through which we explore the potential of every brief. -

Boundary House Final.Pdf

1 HEADER Copy 7-17 Jewry Street London EC3 HIGHLY REVERSIONARY MULTI-LET FREEHOLD CITY OF LONDON INVESTMENT 2 3 HEADER INVESTMENT SUMMARY Copy A WELL LET FREEHOLD WITH EXCITING REPOSITIONING OPPORTUNITIES IN A RAPIDLY CHANGING AREA OF CENTRAL LONDON WHERE THE TRADITIONAL CITY CORE MEETS THE DYNAMIC NEW MEDIA TECH WORLD OF ALDGATE • Freehold. • Located at the crossover between the increasingly vibrant Aldgate district popular with Technology Media Telecommunications (TMT) occupiers and the established City of London financial and insurance heartland. • Close to numerous mainline and underground stations, such as Aldgate, Fenchurch Street and Tower Hill. Also close to the new Crossrail station at Liverpool Street (opening in 2018). • The building comprises 45,062 sq ft of offices over ground and 7 upper floors as well as 7 basement car parking spaces. • Multi-let to include 12 office tenants, producing a total passing rent of £1,319,326 per annum, reflecting very low average rent of approximately £28.24 per sq ft per annum for the ground and upper floor office space. All occupational leases are outside of the L&T Act 1954 (Part II). • Well timed lease events to enable rents to be driven forward in the short to medium term with weighted average terms of 3.70 years to expiry and just over 3.11 years to breaks. • Considerable active management, repositioning, alternative use opportunities in the short to medium term as well as significant medium to long term redevelopment potential, subject to planning. • Offers are sought in the order of £30,850,000, subject to contract and exclusive of VAT. -

PHASE3 Architecture and Design

[email protected] 17 May 2017 BUILDINGS PLACES CITIES [email protected] 17 May 2017 LONDON: DESIGN CAPITAL BUILDINGS / PLACES / CITIES This NLA Insight Study was published by New London Architecture (NLA) in May 2017. It accompanies the NLA exhibition London: Design Capital on display from May–July 2017 and is part of the NLA International Dialogues year-round programme, supporting the exchange of ideas and information across key global markets. New London Architecture (NLA) The Building Centre 26 Store Street London WC1E 7BT Programme Champions www.newlondonarchitecture.org #LDNDesignCapital © New London Architecture (NLA) Programme Supporter ISBN 978-0-9956144-2-0 [email protected] 17 May 2017 2 Contents Forewords 4 Chapter one: London’s global position 6 Chapter two: London’s global solutions 18 Chapter three: London’s global challenges and opportunities 26 Chapter four: London’s global future 32 Project showcase 39 Practice directory 209 Programme champions and supporters 234 References and further reading 239 © Jason Hawkes – jasonhawkes.com [email protected] 17 May 2017 4 5 Creative Capital Global Business As a London based practice with offces based on three continents and London is the world’s global capital for creative design and construction a team of highly creative architects currently engaged in design and skills. Just as the City of London became the fnancial capital of the world, development opportunities around the globe, I welcome the NLA’s latest so London has beneftted from its history, its location, its legal and education insight study and exhibition London: Design Capital for two reasons. -

![Pageflex Server [Document: D-5B6AB47F 00001]](https://docslib.b-cdn.net/cover/2338/pageflex-server-document-d-5b6ab47f-00001-2282338.webp)

Pageflex Server [Document: D-5B6AB47F 00001]

Head Office Address: 5th Floor 30 Market Street Huddersfield West Yorkshire HD1 2HG [email protected] www.sandringham.co.uk PROPERTY MARKET REVIEW NOVEMBER 2019 Our monthly property market review is intended to provide a background to recent developments in property markets, as well as to indicate how some key issues could impact in the future. GROWTH CONFINED TO THE INVESTMENT IN CITY OF LONDON INDUSTRIAL SECTOR COMMERCIAL MARKET INCREASES The latest UK Commercial Property Market Survey from the Savills has reported transactions totalling 1.24bn over 10 deals Royal Institution of Chartered Surveyors (RICS), reports 62% of in the City in October, which is up 73% on September and the second largest month by volume in 2019. respondents believe the commercial property market as a whole is in the downturn phase of the property cycle. At the end of October, the year-to-date transactional volume for the City totalled £6.17bn, which compares to £9.77bn at Projections for the retail sector remain in negative territory, whilst the same point last year and is only 2.3% below the long-term office rents are expected to see little change over the next three average of £6.31bn. months. In contrast, the industrial sector, particularly in prime locations, continues to return solid rental growth projections for the The largest transaction of the month was the acquisition of 40 Leadenhall Street, EC3 by M&G for a reported £400m, coming twelve months in all parts of the UK. representing a capital value of £444 per sq. ft. It is reported by Savills that current investors are long-established NORTHERN ENGLAND AND MIDLANDS and appear to have long-term belief in the UK and London, SEEN AS BEST FOR COMMERCIAL ignoring any current political uncertainty. -

Avison Young Commercial Real Estate Investment Review

Fall 2018 Avison Young Commercial Real Estate Investment Review North America and Europe Partnership. Performance. Contents Overview 05 Canada Investment Market Overview 43 Memphis 71 London 11 U.S. Investment Market Overview 44 Miami 72 Manchester 45 Minneapolis Canada 46 Nashville Germany 17 Calgary 47 New Jersey 74 Berlin 18 Edmonton 48 New York 75 Duesseldorf Montreal 19 49 Oakland 76 Frankfurt 20 Ottawa 50 Orange County 77 Hamburg 21 Toronto Orlando 51 78 Munich Vancouver 22 52 Philadelphia Phoenix Romania United States 53 Pittsburgh 54 80 Bucharest 24 Atlanta 55 Raleigh-Durham 25 Austin 56 Sacramento More from Avison Young 26 Boston San Antonio 57 Company Overview 27 Charlotte 84 58 San Diego County 28 Chicago 86 Publications and Social Media 59 San Francisco 29 Cleveland 87 Contact Us 60 San Jose/Silicon Valley 30 Columbus, OH 61 San Mateo 31 Dallas 62 St. Louis 32 Denver 63 Tampa 33 Detroit Washington, DC 34 Fairfield County 64 West Palm Beach 35 Fort Lauderdale 65 Westchester County 36 Hartford 66 37 Houston Mexico 38 Indianapolis 39 Jacksonville 68 Mexico City Disclaimer 40 Las Vegas United Kingdom The statistics contained in this report were obtained from sources deemed reliable, including Altus InSite, Avison Young, Collette, Plante & Associés, Commercial Edge, CoStar Group 41 Long Island Inc., Desjarlais Prévost Inc., Gettel Network, Property Data Ltd., Real Capital Analytics, Inc., RealNet Canada, RealTrack, Reis Services, LLC, and Thomas Daily GmbH. However, Avison Young (Canada) Inc. does not guarantee the accuracy or completeness of the information presented, nor does it assume any responsibility or liability for any errors or omissions. -

8 Fenchurch Place

A | A 8 FENCHURCH PLACE LONDON EC3 The Amundi Collection 8 Fenchurch Place – London INVESTMENT SUMMARY 8 Fenchurch Place is located in a prime EC3 City of London location, in the heart of the world’s largest insurance district. Comprehensively refurbished in 2012. 98,647 sq ft of highly specified office and ancillary accommodation arranged over lower ground, ground, mezzanines and five upper floors. Fully let on effective full repairing and insuring terms to a diverse mix of five tenants from the insurance, professional services and charitable sectors. Secure income with a WAULT of just under 9 years to lease expiries and 7 years to tenant break options. Current passing rent of £4,399,900 per annum, equating to an attractive low rent of only £44.60 per sq ft overall, compared to prime City rents which are currently in excess of £65.00 per sq ft. Reversionary income profile with five upcoming rent reviews occurring in 2019 and 2020. Held on a long leasehold interest from Network Rail Infrastructure Limited (originally British Railways Board) for a remaining term of circa 169 years at a peppercorn rent. Potential asset management opportunities in the short to medium term to add value and enhance the running yield. Offers are invited in excess of £78,600,000, subject to contract and exclusive of VAT, for our client’s Long Leasehold interest in 8 Fenchurch Place. This represents an attractive net initial yield of 5.50% and a capital value of £797 per sq ft, assuming acquisition costs of 1.80% through the purchase of the Luxembourg SARL. -

52-54 Lime Street (Scalpel) - S278 Highway Changes to Accommodate New Development (HTM 1234) Report Of: for Decision Director of the Built Environment

Committees: Dates: Corporate Projects Board 13 April 2015 Projects Sub 06 May 2015 Subject: Public Gateway 1 & 2 Project Proposal: 52-54 Lime Street (Scalpel) - s278 Highway Changes to Accommodate New Development (HTM 1234) Report of: For Decision Director of the Built Environment Project Summary 1. Context The 52-54 Lime Street development (also known as the Scalpel) will be the new European headquarters of American insurance firm WR Berkley. It is located at the corner of Leadenhall Street and Lime Street, opposite Lloyds of London, in the Ward of Aldgate. Planning permission for the development was granted on 11 June 2013 and varied on 15 May 2014. This project relates to the Section 278 highway works that are necessary to integrate the development into the public highway and must be delivered in time for the building‟s practical completion (estimated November 2017). The s278 Agreement was concluded on 28 January 2015. In a wider context, Leadenhall Street forms part of the Strategic Road Network (SRN) as defined by the Traffic Management Act 2004. 2. Brief description The project involves highway changes to accommodate the of project new development as shown in Appendix 1. These include: (a) Improving footways at Leadenhall Street, Lime Street and Billiter Street; (b) Installing two communal utility chambers; (c) Upgrading the existing traffic management gate at Lime Street to a security-rated gate; and (d) Removal of redundant crossover and the provision of a new crossover at the loading bay entrance. 3. Consequences if If the project is not approved, the development will not project not integrate seamlessly with the highway surrounding it. -

View Data Sheet

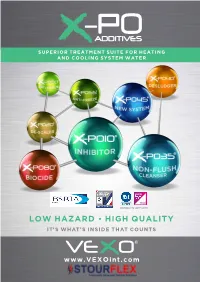

SUPERIOR TREATMENT SUITE FOR HEATING AND COOLING SYSTEM WATER ENDORSED FOR VEXOTM X-PO10 www.VEXOint.com How neglecting your hydronic thermal fluid can affect your bottom line Your investment reduces as dirty system water slowly erodes your OPEX and reputation. YOUR INVESTMENT Erosion corrosion Reduction in efficacy of inhibitor Harbouring bacteria proliferation Settlement of sediment Non-repeatable commissioning readings Delayed project handovers Landlord losing tenants could lead to litigation Efficiency losses PROGRESSIVELY LESS ROI Lifecycle losses Damage to reputation WHAT’S LEFT OF YOUR INVESTMENT Page 2 VEXO Additives Ver. 1.0 11/06/2021 Why do you need superior additive protection on your closed system? The problem with dirty water Water is the main means of closed system 1. Scale formation temperature distribution. It affects every single piece of equipment and every single person in 2. Corrosion the spaces that you manage. Wherever there is system water, four problems will occur: scale 3. Microbial growth formation, corrosion, fouling and microbial growth. 4. Fouling & sludge At the heart of your facility is a perfectly good heating or cooling system. Potential dangers hiding It loses its energy in closed system water. and transfer capacity to a fouled and dirty circulatory system. LIMESCALE METALLIC SLUDGE This leads to BACTERIAL BIOFILM bad distribution, breakdowns, cold spots and energy waste. You could be losing 10% energy or What dirty system water more from dirty system water. canVEXO Proposal do ifDoc left Ver. 1.0 untreated. -

Annual Report 2013 OUR

SHARED KNOWLEDGE. KNOWLEDGE. Annual Report 2013 Annual Henderson Group plc Annual Report 2013 Contents Performance highlights Strategic report Underlying profit before tax Investment outperformance 1 Our mission 1 year 2 Growth and globalisation £190.1m 82% of assets 3 years 4 Chairman’s statement 82 6 Chief Executive’s review 190.1 78 73 9 Business model and strategy 160.0 153.0 66 69 12 Our people, our talent 59 14 Distribution and client services 18 Our products, our core capabilities 28 Property and Private Equity 30 Risk management 34 Financial review 2011 2012 2013 2011 2012 2013 38 Key performance indicators 40 Sustainability Governance Net flows Net cash 44 Corporate governance 56 Board of Directors £2.5bn £56.3m 58 Directors’ report 61 Directors’ remuneration report 2.5 56.3 78 Directors’ responsibilities statement 0 79 Independent auditors’ report Financial statements 17.9 81 Financial statements (3.9) 0 Other information 134 Glossary (6.4) (28.0) 136 Shareholder information 2011 2012 2013 2011 2012 2013 138 Summary of movement in AUM 139 Five year financial summary Diluted earnings per share Dividends per share 14.9p 8.00p 14.9 8.00 7.15 12.5 12.3 7.00 2011 2012 2013 2011 2012 2013 In this report THIS SYMBOL WILL DIRECT YOU TO MORE INFORMATION WITHIN THIS REPORT. This report and additional information about the Group can be found online at henderson.com/group Strategic report Our mission is to be a trusted global asset manager focused on delivering excellent performance and service to our clients. -

Waterman Times 2014

www.watermangroup.com | 2014 watermantimes STIRLING PRIZE WINNER Liverpool’s newly rebuilt Everyman Theatre has won the prestigious RIBA Stirling Prize for best new building of the year. Contents ON THE COVER ARTICLES Stirling Prize Winner 02 | Brief News Liverpool’s newly rebuilt Everyman Theatre has 06 | Victoria Gate won the prestigious RIBA Stirling Prize for best Waterman are providing Structural and Building Services on new building of the year. Victoria Gate a 42,000m2 retail development in Leeds. Welcome to the 2014 edition Page 14 08 | Friars Walk of the Waterman Times. Newport has been undergoing major regeneration led by the city’s 2020 Vision. Part of the city centre’s revitalisation is formed by Friars Walk, a new shopping centre, being This publication is more substantial than normal developed by Queensberry Real Estate. because we wished to inform you about our increasing range of projects and news. 10 | Gotham City Henderson Global Investors has secured planning permission Over the last twelve months, we had an interesting from the City of London for its £391m mixed-use tower building time on a wide range of developments such as scheme at 40 Leadenhall Street, set in London’s dynamic “Gotham City”, Battersea Power Station and Brent insurance district. Cross in London. In Leeds, the first phase of the Victoria Gate retail centre has recently commenced 12 | Vivid Sydney 2014 construction and we are providing an all encompassing 16 | UTS Broadway engineering service on this development. Another 18 | Port Glasgow Shared Campus significant retail project which has also commenced on 20 | Specialist Service - Air Quality site is at Newport, the details of which are covered in 22 | A83 Rest and be Thankful this edition of the Waterman Times. -

1808956 Fen Court Office-Brochure Update V2.Pdfpdf

ONE FEN COURT Newly completed office space from 15,000 sq ft in an outstanding NEW island landmark building at the heart of the City cluster. Contemporary design by internationally acclaimed Eric Parry Architects CITY featuring a unique rooftop garden and large dedicated ICON entrance and reception. A CENTRAL LONDON ADDRESS ALLIED WORLD ASSURANCE LIBERTY LLOYD’S OF RSA LONDON TOKIO MARINE KILN WILLIS TOWERS WATSON AON SWISS RE MARKEL AMLIN STANDARD LIFE ACCENTURE QBE INSURANCE WELLS FARGO ARGO INSURANCE ONE FEN COURT CITY CORE LOCATION WALKING DISTANCE TO HIGHLY CONNECTED ALL THE CITY’S BARS RESTAURANTS AND RETAIL 6 TUBE STATIONS WITHIN 10 MINUTES WALK LEADENHALL STREET LEADENHALL STREET BILLITER STREET Fen Court Retail Units THE SCALPEL Retail Cafés, Bars & Restaurants Offices LLOYD’S OF 3 MINUTES WALK FROM LONDON LEADENHALL COURT 40 LEADENHALL STREET LEADENHALL MARKET THE COMPLETION FENCHURCH STREET WILLIS THE DUE 2022 LIME STREET BUILDING WILLIS BUILDING STATION LEADENHALL PLACE FENCHURCH AVENUE BILLITER STREET RETAIL GRACECHURCH STREET COMPLETION DUE 2022 East India Arms 1 MINUTE FROM FENCHURCH PLACE LIME STREET FENCHURCH STREET F E N C O U R T LLOYD’S OF LONDON LONDON STREET C U L L U M S T R E E T CULLUM STREET FENCHURCH STREET FENCHURCH STREET LONDON STREET FENCHURCH STREET LLOYD’S OF LONDON 20 FENCHURCH STREET DUNSTER COURT PHILPOT LANE FENCHURH PLANTATION MINCING LANE AVENUE PLACE LIME STREET R O O D L A N E CRUTCHED FRIARS MINSTER M A R K L A N E COURT FEN COURT HART STREET E T R E S T ENTRANCE P L A N T A T I O N L A N E C H U R C H E N FENCHURCH STREET F One Fen Court Walking Distances 3 mins Fenchurch Street 6 mins Monument 7 mins Aldgate 9 mins Tower Hill 7 mins Bank 9 mins Liverpool Street Direct access from Fenchurch Street Station to the entrance at One Fen Court and thoroughfare through to Lloyd’s of London.