Capital Markets Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Parker Review

Ethnic Diversity Enriching Business Leadership An update report from The Parker Review Sir John Parker The Parker Review Committee 5 February 2020 Principal Sponsor Members of the Steering Committee Chair: Sir John Parker GBE, FREng Co-Chair: David Tyler Contents Members: Dr Doyin Atewologun Sanjay Bhandari Helen Mahy CBE Foreword by Sir John Parker 2 Sir Kenneth Olisa OBE Foreword by the Secretary of State 6 Trevor Phillips OBE Message from EY 8 Tom Shropshire Vision and Mission Statement 10 Yvonne Thompson CBE Professor Susan Vinnicombe CBE Current Profile of FTSE 350 Boards 14 Matthew Percival FRC/Cranfield Research on Ethnic Diversity Reporting 36 Arun Batra OBE Parker Review Recommendations 58 Bilal Raja Kirstie Wright Company Success Stories 62 Closing Word from Sir Jon Thompson 65 Observers Biographies 66 Sanu de Lima, Itiola Durojaiye, Katie Leinweber Appendix — The Directors’ Resource Toolkit 72 Department for Business, Energy & Industrial Strategy Thanks to our contributors during the year and to this report Oliver Cover Alex Diggins Neil Golborne Orla Pettigrew Sonam Patel Zaheer Ahmad MBE Rachel Sadka Simon Feeke Key advisors and contributors to this report: Simon Manterfield Dr Manjari Prashar Dr Fatima Tresh Latika Shah ® At the heart of our success lies the performance 2. Recognising the changes and growing talent of our many great companies, many of them listed pool of ethnically diverse candidates in our in the FTSE 100 and FTSE 250. There is no doubt home and overseas markets which will influence that one reason we have been able to punch recruitment patterns for years to come above our weight as a medium-sized country is the talent and inventiveness of our business leaders Whilst we have made great strides in bringing and our skilled people. -

Cairn India Limited

RED HERRING PROSPECTUS Please read Section 60B of the Companies Act, 1956 Dated 27 November, 2006 100% Book Built Issue CAIRN INDIA LIMITED (Incorporated as a public limited company under the Companies Act, 1956 on 21 August, 2006) The registered office of the Company was changed from Lentin Chambers, 3rd Floor, Dalal Street, Fort, Mumbai 400 023 to 401 Dalamal Towers, Nariman Point, Mumbai 400 021, India, its current registered office on 12 October, 2006 Tel: +(91) (22) 2287 2001; Fax: +91 (22) 2287 2002 Principal Business Office: 3rd and 4th Floor, Orchid Plaza, Suncity, Sector 54, Gurgaon, 122 002 Tel: +(91) (124) 414 1360; Fax: +(91) (124) 288 9320; Website: www.cairnindia.com Contact Person: Preeti Chheda; E-mail: [email protected] PUBLIC ISSUE OF 328,799,675 EQUITY SHARES OF RS. 10 EACH (‘‘EQUITY SHARES’’) FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE OF CAIRN INDIA LIMITED (THE ‘‘COMPANY’’) AGGREGATING TO RS. [ɀ] (THE ‘‘ISSUE’’). THERE WILL ALSO BE A GREEN SHOE OPTION OF UP TO 49,319,951 EQUITY SHARES FOR CASH AT A PRICE OF RS. [ɀ] PER EQUITY SHARE AGGREGATING TO RS. [ɀ] (THE ‘‘GREEN SHOE OPTION’’). THE ISSUE AND THE GREEN SHOE OPTION, IF EXERCISED IN FULL, WILL AGGREGATE TO 378,119,626 EQUITY SHARES AMOUNTING TO RS. [ɀ]. THE ISSUE WILL CONSTITUTE 18.63% OF THE FULLY DILUTED POST-ISSUE EQUITY SHARE CAPITAL OF THE COMPANY ASSUMING THAT THE GREEN SHOE OPTION IS NOT EXERCISED AND 20.84% ASSUMING THAT THE GREEN SHOE OPTION IS EXERCISED IN FULL. -

Minutes of Offshore Employee Consultative Forum Meeting

Minutes of Offshore Employee Consultative Forum Meeting Start Time 13:00 End Time 14:35 Attendees Dave Ward – Senior Manager (DW) Alison Young – Senior P&O Manager (AY) Craig Shanaghey –President (CS) Catherine Liebnitz – P&O Vice President (CL) Stuart Smith – Operations Director (SS) Derek Donald – Senior HSE Manager (DD) Aimee Ironside – Marketing and Communications Manager (AI) Rebekah Sim – P&O Coordinator (Minute Taker (RS) Employee Reps (ER): John Donnelly – BP contract Tristan Gawn – Dana contract David Dunsmore – Premier contract James Parker – Premier contract Nev Cullen – Shell OMS contract Jonny Peek – Shell OMS contract John Reid – TAQA contract Bob Wilson – TAQA contract Stephen Heaney – Retained contract Referenced Jennifer Reaich – Logistics Coordinator (JR) Fiona Reeks – P&O Business Partner These notes capture the key points. They are not a verbatim account of the meeting. Initials Detail of Discussion AY Thanked everyone for attending today. Introduced herself as Senior P&O Manager and confirmed that there were senior management on the call and CS would also be joining the call to deliver a business update. Advised that she will do a roll call and asked all reps to advise what position they worked in and on what contract and asset: David Dunsmore – CRO on Solan – Premier Contract James Parker – Rotating Equipment Technician on Balmoral – Premier Contract John Reid – Plater on the North Cormorant – TAQA Contract Jonny Peek – Lead Instrument Technician on Nelson – Shell Contract Stephen Heaney – Pipefitter on the Retained Contract Tristan Gawn – Marine Services Team Lead on Triton – Dana Contract Nev Cullen – Technician on Shearwater – Shell Contract John Donnelly – Pipefitter on ETAP – BP Contract Bob Wilson – Material Controller – TAQA Contract AY advised that those attending from Wood are DW – Senior Manager for the Aberdeen Engineering HUB and IRS Fabrication Shop. -

Wood Group Completes Acquisition of Major Subsea Solutions Group MCS

11 September 2008 Wood Group completes acquisition of major subsea solutions group MCS International energy services company John Wood Group PLC (“Wood Group”) announces the acquisition of MCS Ltd (“MCS”). MCS is a global subsea engineering consultancy with a market leading position in riser & mooring design, and a leading offering of advanced engineering and software solutions to the subsea industry. Headquartered in Galway, Ireland, MCS employs approximately 200 people in seven locations around the world. MCS will retain its trading name and continue to be run by its existing management team. MCS had EBIT of €3.3 million for the year ended December 2007 and a gross asset value at that date of €11.4 million. Mike Straughen, Group Director and Chief Executive of Wood Group’s Engineering activities said, “MCS is an exceptional company that we have long admired and I am therefore absolutely delighted that they are joining Wood Group. The acquisition of MCS is part of our ongoing strategy to expand and enhance our capabilities in subsea and deepwater, which is one of the strongest growing markets in our industry. MCS is one of the world’s leading exponents of riser design technology and know-how and this represents an excellent strategic fit which will enable us to deliver comprehensive and leading edge solutions, for subsea and floating production projects worldwide”. Mike Straughen also disclosed that MCS would be joining a newly formed Subsea & Pipelines Technology business grouping within Wood Group, along with sister companies J P Kenny, Multiphase Solutions Inc. (MSi) and Ionik Consulting that will be the largest of its kind in the world. -

John Wood Group PLC Annual Report and Accounts 2015 Contents

John Wood Group PLC Annual Report and Accounts 2015 Contents Strategic report Our operations, strategy and business model and how we have performed during 2015 “Against a backdrop of significantly reduced customer activity, the Group delivered EBITA of $470m in line with expectations and 14.5% lower than 2014. Our continued actions to reduce costs, improve efficiency and broaden our service offering through organic initiatives and strategic acquisitions, position us as a strong and balanced business in both the current environment and for when market conditions recover” Robin Watson, Chief Executive Strategic report Governance Financial statements Highlights Financial Summary Total Total Revenue from Profit before tax Adjusted Total Revenue 1 EBITA 1 continuing and exceptional diluted Dividend operations items EPS cents $5,852m $470m $5,001m $320m 84.0cents 30.3 per share 23.2% 14.5% 23.9% 22.8% 15.7% 10.2% (2014: $7,616m) (2014: $550m) (2014: $6,574m) (2014: $414.5m) (2014: 99.6c) (2014: 27.5 cents) Operational Highlights X Relatively resilient performance. EBITA of $470m in line with expectations; 14.5% lower than 2014 X Management focus on operational utilisation X Delivered overhead cost savings of over $148m which will sustain into 2016 X Underlying headcount reduced by over 8,000 people (c. 20%) X Continued progress on strategic acquisitions including expansion into the US brownfield petrochemical market. Total cash expenditure on new acquisitions of $234m X Strong balance sheet and cash generation. Net debt of $290m (0.5x 2015 EBITDA) and cash conversion of 119% X Dividend up 10%. Dividend cover of 2.8 times. -

List of Public Interest Entities

www.pwc.co.uk/transparencyreport List of public interest entities List of public interest entities to accompany Transparency Report Year ended 30 June 2014 2 PricewaterhouseCoopers LLP UK Transparency Report FY14 List of public interest entities Please note – this list includes those 258 audit clients, for whom we issued an audit opinion between 1 July 2013 and 30 June 2014, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC ABERFORTH GEARED INCOME TRUST PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC AFRICAN BARRICK GOLD PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC AGGREKO PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC AMLIN PLC BOS (SHARED APPRECIATION MORTGAGES) NO.6 PLC ARKLE MASTER ISSUER PLC BRADFORD & BINGLEY PLC ARM HOLDINGS PLC BRAMMER PLC ASIA RESOURCE MINERALS Plc (formerly BUMI Plc) BRISTOL & WEST PLC ASIAN TOTAL RETURN INVESTMENT COMPANY PLC BRITISH AMERICAN TOBACCO PLC (formerly Henderson Asian Growth Trust Plc) BRITISH TELECOMMUNICATIONS PLC AVIVA PLC BT GROUP PLC AVON RUBBER PLC BURBERRY GROUP PLC BABCOCK INTERNATIONAL GROUP PLC CAIRN ENERGY PLC BAGLAN MOOR HEALTHCARE PLC CAMELLIA PLC BAILLIE GIFFORD JAPAN TRUST PLC CAPITAL & COUNTIES PROPERTIES PLC BAILLIE GIFFORD SHIN NIPPON PLC CAPITAL GEARING TRUST PLC BANK OF SCOTLAND PLC CARNIVAL PLC BARCLAYS BANK PLC CARPETRIGHT PLC BARCLAYS PLC CARR’S MILLING INDUSTRIES PLC BERENDSEN PLC CATLIN UNDERWRITING BIRMINGHAM -

John Wood Group PLC Half Year Report 2020 Contents

John Wood Group PLC Half Year Report 2020 Contents 01 Highlights Revenue Operating profit 02 Business review 09 Financial review $4,085m $66m 16 Group income statement (2019: $4,788m) (2019: $139m) 17 Group statement of comprehensive income 14.7% 52.5% 18 Group balance sheet 19 Group statement of changes in equity Revenue Profit/(loss) 20 Group cash flow statement (on a like for like basis)1 for the period 21 Notes to the interim financial statements 40 Statement of directors' responsibilities $4,012m $(11)m 41 Independent review report to John Wood Group PLC (2019: $4,535m) (2019: $13m) 42 Information for shareholders 11.5% movement: n/a Adjusted EBITDA2 Basic EPS $305m (2.2) cents (2019: $384m) (2019: 2.1 cents) 20.6% movement: n/a Adjusted EBITDA margin Adjusted diluted EPS 7.5% 10.1 cents (2019: 8.0%) (2019: 18.2 cents) 0.5% 44.5% Adjusted EBITDA Interim (on a like for like basis)1 dividend $299m nil (2019: $361m) (2019: 11.4 cents) 17.1% movement: n/a Adjusted EBITDA margin Net debt (on a like for like basis) excluding leases3 7.5% $1,216m (2019: 8.0%) (2019: $1,773m) 0.5% 31.4% Operating profit before Order exceptional items book4 $101m $7,045m Wood is a global leader (2019: $168m) (2019: $8,427m) 39.9% 16.4% in consulting, projects and operations solutions in energy and the built environment. woodplc.com 02 John Wood Group PLC Half Year Report 2020 Highlights Resilience from strategic broadening across Energy and Built Environment markets and actions to reduce cost, protect margin & cashflow and ensure balance sheet strength. -

UK P&L 161107 MAR.Xlsx

Messels December 2016 Rec Last UK FTSE 100 Stocks Open price Close/last %chg Index Relative 30-Nov 30-Dec BP/ LN Equity BP PLC 459.45 509.6 10.9% 5.29% 5.6% 30-Nov 30-Dec RRS LN Equity Randgold Resources Ltd 5700 6415 12.5% 5.29% 7.3% 30-Nov 30-Dec RIO LN Equity Rio Tinto PLC 2990 3158.5 5.6% 5.29% 0.3% 30-Nov 30-Dec BA/ LN Equity BAE Systems PLC 600.5 591.5 -1.5% 5.29% -6.8% 30-Nov 30-Dec CRH LN Equity CRH PLC 2660 2830 6.4% 5.29% 1.1% 30-Nov 30-Dec CRDA LN Equity Croda International PLC 3262 3196 -2.0% 5.29% -7.3% 30-Nov 30-Dec AHT LN Equity Ashtead Group PLC 1567 1580 0.8% 5.29% -4.5% 30-Nov 30-Dec BNZL LN Equity Bunzl PLC 2060 2109 2.4% 5.29% -2.9% 30-Nov 30-Dec EXPN LN Equity Experian PLC 1510 1574 4.2% 5.29% -1.1% 30-Nov 30-Dec WOS LN Equity Wolseley PLC 4645 4962 6.8% 5.29% 1.5% 30-Nov 30-Dec GSK LN Equity GlaxoSmithKline PLC 1495.5 1562 4.4% 5.29% -0.8% 30-Nov 30-Dec BRBY LN Equity Burberry Group PLC 1429 1497 4.8% 5.29% -0.5% 30-Nov 30-Dec RB/ LN Equity Reckitt Benckiser Group PLC 6763 6886 1.8% 5.29% -3.5% 30-Nov 30-Dec MRW LN Equity Wm Morrison Supermarkets PLC 217.5 230.7 6.1% 5.29% 0.8% 13-Dec 30-Dec ITV LN Equity ITV PLC 192.1 206.4 7.4% 2.50% 4.9% 20-Dec 30-Dec REL LN Equity RELX PLC 1417 1449 2.3% 1.40% 0.9% 30-Nov 30-Dec MCRO LN Equity Micro Focus International PLC 2111 2179 3.2% 5.29% -2.1% 30-Nov 30-Dec BARC LN Equity Barclays PLC 215.95 223.45 3.5% 5.29% -1.8% 06-Dec 30-Dec DLG LN Equity Direct Line Insurance Group PLC 354.8 369.4 4.1% 5.35% -1.2% 30-Nov 30-Dec PRU LN Equity Prudential PLC 1548.5 1627.5 5.1% 5.29% -0.2% -

U.K.-Louisiana Links

LOUISIANA Custom-Fit Opportunity U.K.-LOUISIANA LINKS RECENT NEWS In January 2015, Louisiana Gov. Bobby Jindal visited the United Kingdom as part of an economic development effort. While there, he also addressed the Henry Jackson Society regarding foreign policy. FOREIGN DIRECT INVESTMENT The United Kingdom is the most frequent investor in Louisiana, with 29 projects since 2003 accounting for over $1.4 billion in capital expenditure and over 2,200 jobs. CONTACT INFORMATION Sanchia Kirkpatrick In June 2013, Hunting Energy Services completed a $19.6 million investment in its new Louisiana Chief Representative, United Kingdom facility. [email protected] T +44.0.7793222939 In December 2012, Drax Biomass announced plans to build a wood pellet facility and a storage- and-shipping facility in Louisiana, creating 63 direct jobs, 143 new indirect jobs and $120 million in James J. Coleman, Jr., OBE capital expenditure. Great Britain www.gov.uk/government/work/usa BP’s $98.3 million dollar facility in Louisiana converts energy grasses into cellulosic biofuels. The T 504.524.4180 facility employs more than 75 advanced process/manufacturing professionals and engineers. Judge James F. McKay III Louisiana companies have also established a presence in the UK. including fourteen direct Honorary Consul, Ireland investments in the U.K. since 2003 that have resulted in capital expenditures totaling $253 million [email protected] and the creation of 422 jobs. T 504.412.6050 TRADE Exports The U.K. stands as one of Louisiana’s top export markets, with over $1.99 billion in Louisiana exports there in 2014. Top Louisiana exports to the U.K. -

20080319 Trading Notice Functional 0049

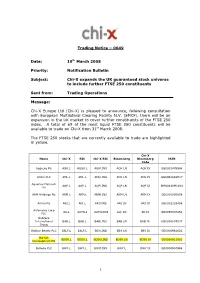

Trading Notice – 0049 Date: 19 th March 2008 Priority: Notification Bulletin Subject: Chi-X expands the UK guaranteed stock universe to include further FTSE 250 constituents Sent from: Trading Operations Message: Chi-X Europe Ltd (Chi-X) is pleased to announce, following consultation with European Multilateral Clearing Facility N.V. (EMCF), there will be an expansion in the UK market to cover further constituents of the FTSE 250 index. A total of 69 of the most liquid FTSE 250 constituents will be available to trade on Chi-X from 31 st March 2008. The FTSE 250 stocks that are currently available to trade are highlighted in yellow. Chi-X Name Chi-X RIC Chi-X RIC Bloomberg Bloomberg ISIN Code Aggreko Plc AGK.L AGGK.L AGKl.INS AGK LN AGK IX GB0001478998 Amlin PLC AML.L AML.L AMLl.INS AML LN AML IX GB00B2988H17 Aquarius Platinum AQP.L AQP.L AQPl.INS AQP LN AQP IX BMG0440M1284 Ltd ARM Holdings Plc ARM.L ARM.L ARMl.INS ARM LN ARM IX GB0000595859 Arriva Plc ARI.L ARI.L ARIl.INS ARI LN ARI IX GB0002303468 Autonomy Corp AU.L AUTN.L AUTNl.INS AU/ LN AU IX GB0055007982 PLC Babcock International BAB.L BAB.L BABl.INS BAB LN BAB IX GB0009697037 Group Balfour Beatty PLC BALF.L BALF.L BBYl.INS BBY LN BBY IX GB0000961622 Barratt BDEV.L BDEV.L BDEVl.INS BDEV LN BDEV IX GB0000811801 Development Plc Bellway PLC BWY.L BWY.L BWYl.INS BWY.L BWY IX GB0000904986 1 Biffa PLC BIFF.L BIFF.L BIFFl.INS BIFF LN BIFF IX GB00B129PL77 Bradford & Bingley BB.L BB.L BBl.INS BB/ LN BB IX GB0002228152 PLC Bunzl PLC BNZL.L BNZL.L BNZLl.INS BNZL LN BNZL IX GB00B0744B38 Burberry -

List of Public Interest Entities

APPENDIX A LIST OF PUBLIC INTEREST ENTITIES Please note this list includes those 300 audit clients, for whom we issued an audit opinion between 1 July 2011 and 30 June 2012, who have issued transferable securities on a regulated market (as defined in the Statutory Auditors (Transparency) Instrument 2008 (POB 01/2008). 4IMPRINT GROUP PLC ABERFORTH GEARED INCOME TRUST PLC ACCIDENT EXCHANGE GROUP PLC AEA TECHNOLOGY GROUP PUBLIC LIMITED COMPANY AFRICAN BARRICK GOLD PLC AGGREKO PLC AIRE VALLEY MORTGAGES 2004 - 1 PLC AIRE VALLEY MORTGAGES 2005-1 PLC AMLIN PLC ANGLIAN WATER SERVICES FINANCING PLC ARKLE MASTER ISSUER PLC ARM HOLDINGS PLC ASTERAND PLC AVON RUBBER PLC BABCOCK INTERNATIONAL GROUP PLC BAGLAN MOOR HEALTHCARE PLC BAILLIE GIFFORD JAPAN TRUST PLC BAILLIE GIFFORD SHIN NIPPON PLC BANK OF SCOTLAND PLC BARCLAYS BANK PLC BARCLAYS PLC BERENDSEN PLC BG ENERGY CAPITAL PLC BG GROUP PLC BIRMINGHAM AIRPORT (FINANCE) PLC BLACKROCK LATIN AMERICAN INVESTMENT TRUST BOS (SHARED APPRECIATION MORTGAGES) NO. 1 PLC BOS (SHARED APPRECIATION MORTGAGES) NO. 2 PLC BOS (SHARED APPRECIATION MORTGAGES) NO.3 PLC BOS (SHARED APPRECIATION MORTGAGES) NO.4 PLC BRADFORD & BINGLEY PLC BRAMMER PLC BRISTOL & WEST PLC BRITISH AMERICAN TOBACCO PLC BRITISH TELECOMMUNICATIONS PLC BT GROUP PLC BUMI PLC BURBERRY GROUP PLC CAMELLIA PLC CAPE PLC CAPITAL & COUNTIES PROPERTIES PLC CAPITAL GEARING TRUST PLC CAPITAL SHOPPING CENTRES DEBENTURE PLC CAPITAL SHOPPING CENTRES GROUP PLC CAPITAL SHOPPING CENTRES PLC CARPETRIGHT PLC CATLIN UNDERWRITING CENTAUR MEDIA PLC CENTRICA PLC CHELTENHAM -

Ief-I Q3 2020

Units Cost Market Value INTERNATIONAL EQUITY FUND-I International Equities 96.98% International Common Stocks AUSTRALIA ABACUS PROPERTY GROUP 1,012 2,330 2,115 ACCENT GROUP LTD 3,078 2,769 3,636 ADBRI LTD 222,373 489,412 455,535 AFTERPAY LTD 18,738 959,482 1,095,892 AGL ENERGY LTD 3,706 49,589 36,243 ALTIUM LTD 8,294 143,981 216,118 ALUMINA LTD 4,292 6,887 4,283 AMP LTD 15,427 26,616 14,529 ANSELL LTD 484 8,876 12,950 APA GROUP 14,634 114,162 108,585 APPEN LTD 11,282 194,407 276,316 AUB GROUP LTD 224 2,028 2,677 AUSNET SERVICES 9,482 10,386 12,844 AUSTRALIA & NEW ZEALAND BANKIN 19,794 340,672 245,226 AUSTRALIAN PHARMACEUTICAL INDU 4,466 3,770 3,377 BANK OF QUEENSLAND LTD 1,943 13,268 8,008 BEACH ENERGY LTD 3,992 4,280 3,824 BEGA CHEESE LTD 740 2,588 2,684 BENDIGO & ADELAIDE BANK LTD 2,573 19,560 11,180 BHP GROUP LTD 16,897 429,820 435,111 BHP GROUP PLC 83,670 1,755,966 1,787,133 BLUESCOPE STEEL LTD 9,170 73,684 83,770 BORAL LTD 6,095 21,195 19,989 BRAMBLES LTD 135,706 987,557 1,022,317 BRICKWORKS LTD 256 2,997 3,571 BWP TRUST 2,510 6,241 7,282 CENTURIA INDUSTRIAL REIT 1,754 3,538 3,919 CENTURIA OFFICE REIT 154,762 199,550 226,593 CHALLENGER LTD 2,442 13,473 6,728 CHAMPION IRON LTD 1,118 2,075 2,350 CHARTER HALL LONG WALE REIT 2,392 8,444 8,621 CHARTER HALL RETAIL REIT 174,503 464,770 421,358 CHARTER HALL SOCIAL INFRASTRUC 1,209 2,007 2,458 CIMIC GROUP LTD 4,894 73,980 65,249 COCA-COLA AMATIL LTD 2,108 12,258 14,383 COCHLEAR LTD 1,177 155,370 167,412 COMMONWEALTH BANK OF AUSTRALIA 12,637 659,871 577,971 CORONADO GLOBAL RESOURCES INC 1,327