Bank of Xingtai Green Finance Development Project

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Understanding the Regional Transport Contributions of Primary and Secondary PM2.5 Components Over Beijing During a Severe Pollution Episodes

Aerosol and Air Quality Research, 18: 1720–1733, 2018 Copyright © Taiwan Association for Aerosol Research ISSN: 1680-8584 print / 2071-1409 online doi: 10.4209/aaqr.2017.10.0406 Understanding the Regional Transport Contributions of Primary and Secondary PM2.5 Components over Beijing during a Severe Pollution Episodes Wei Wen1,2, Xiaodong He1*, Xin Ma3**, Peng Wei4, Shuiyuan Cheng5, Xiaoqi Wang5, Lei Liu2 1Institute of Urban Meteorology, China Meteorological Administration, Beijing 100089, China 2 Key Laboratory of Atmospheric Chemistry, China Meteorological Administration, Beijing 100081, China 3 National Meteorological Center, Beijing 100081, China 4 Chinese Research Academy of Environment Science, Beijing 100012, China 5 Key Laboratory of Beijing on Regional Air Pollution Control, Beijing University of Technology, Beijing 100124, China ABSTRACT This study applied the CAMx model to study the regional transport of various PM2.5 components in Beijing during a severe pollution episodes. The results revealed that during the episodes, Beijing had the average PM2.5 pollution value of –3 –3 119 µg m . It was 1.58 times of the PM2.5 national air quality standard (75 µg m Level II). The wind speed was low (< 2 m s–1) and relative humidity reached 98%. The anticyclone in Eastern China showed weak local flow fields and southerly winds at the surface and strong temperature inversion under 1000 m, which promote pollution accumulation. The 2– – contribution of monthly regional transport to primary PM2.5 components and SO4 , NO3 , and secondary organic aerosol concentrations in Beijing were 29.6%, 41.5%, 58.7%, and 60.6%, respectively. The emissions from Baoding had the greatest effect on the primary components of PM2.5 (6.1%) in Beijing. -

Inter-Metropolitan Land-Price Characteristics and Patterns in the Beijing-Tianjin-Hebei Urban Agglomeration in China

sustainability Article Inter-Metropolitan Land-Price Characteristics and Patterns in the Beijing-Tianjin-Hebei Urban Agglomeration in China Can Li 1,2 , Yu Meng 1, Yingkui Li 3 , Jingfeng Ge 1,2,* and Chaoran Zhao 1 1 College of Resource and Environmental Science, Hebei Normal University, Shijiazhuang 050024, China 2 Hebei Key Laboratory of Environmental Change and Ecological Construction, Shijiazhuang 050024, China 3 Department of Geography, The University of Tennessee, Knoxville, TN 37996, USA * Correspondence: [email protected]; Tel.: +86-0311-8078-7636 Received: 8 July 2019; Accepted: 25 August 2019; Published: 29 August 2019 Abstract: The continuous expansion of urban areas in China has increased cohesion and synergy among cities. As a result, the land price in an urban area is not only affected by the city’s own factors, but also by its interaction with nearby cities. Understanding the characteristics, types, and patterns of urban interaction is of critical importance in regulating the land market and promoting coordinated regional development. In this study, we integrated a gravity model with an improved Voronoi diagram model to investigate the gravitational characteristics, types of action, gravitational patterns, and problems of land market development in the Beijing-Tianjin-Hebei urban agglomeration region based on social, economic, transportation, and comprehensive land-price data from 2017. The results showed that the gravitational value of land prices for Beijing, Tianjin, Langfang, and Tangshan cities (11.24–63.35) is significantly higher than that for other cities (0–6.09). The gravitational structures are closely connected for cities around Beijing and Tianjin, but loosely connected for peripheral cities. -

A Possible Seismic Gap and High Earthquake Hazard in the North China Basin

A possible seismic gap and high earthquake hazard in the North China Basin An Yin1,2*, Xiangjiang Yu2,3, Z.-K. Shen2, and Jing Liu-Zeng4 1Structural Geology Group, China University of Geosciences (Beijing), Beijing 100083, China 2Department of Earth, Planetary, and Space Sciences, University of California–Los Angeles, Los Angeles, California 90095-1567, USA 3School of Earth and Space Sciences, Peking University, Beijing 100871, China 4Institute of Geology, China Earthquake Administration, Beijing 100027, China ABSTRACT indicated by a southward increase in eastward In this study we use combined historical records and results of early paleo-earthquake studies GPS velocities across the North China Basin to show that a 160 km seismic gap has existed along the northeast-striking right-slip Tangshan- (Fig. 2A) may have driven current right-slip Hejian-Cixian fault (China) over more than 8400 yr. The seismic gap is centered in Tianjin, a motion along northeast-striking faults via book- city in the North China Basin with a population of 11 million and located ~100 km from Bei- shelf faulting (Fig. 2B). jing, which has a population of 22 million. Current data indicate that the recurrence interval of major earthquakes along the Tangshan-Hejian-Cixian fault is 6700–10,800 yr. This implies SPATIOTEMPORAL PATTERNS OF that a large earthquake with an estimated magnitude of ~M 7.5 is either overdue or will occur SEISMIC RUPTURE within the next 2000–3000 yr along the inferred seismic gap if it is ruptured by a single event. Because of a general lack of surface ruptures Alternatively, the seismic gap may be explained by aseismic creeping, strain transfer between for most major historical earthquakes in the adjacent faults, or much longer recurrence times than the current knowledge indicates. -

A COVID-19 Outbreak — Nangong City, Hebei Province, China, January 2021

China CDC Weekly Outbreak Reports A COVID-19 Outbreak — Nangong City, Hebei Province, China, January 2021 Shiwei Liu1,&; Shuhua Yuan2,&; Yinqi Sun2; Baoguo Zhang3; Huazhi Wang4; Jinxing Lu1; Wenjie Tan1; Xiaoqiu Liu1; Qi Zhang1; Yunting Xia1; Xifang Lyu1; Jianguo Li2,#; Yan Guo1,# On January 3, 2021, Nangong City (part of Xingtai Summary City, Hebei Province with 484,000 residents in 2017) What is known about this topic? reported its first symptomatic case of COVID-19. Coronavirus disease 2019 (COVID-19) is widespread China CDC, Hebei CDC, and Xingtai CDC jointly globally. In China, COVID-19 has been well carried out a field epidemiological investigation and controlled and has appeared only in importation- traced the outbreak. On January 6, Nangong City related cases. Local epidemics occur sporadically in started its first round of population-wide nucleic acid China and have been contained relatively quickly. screening. On January 9, Nangong City was locked What is added by this report? down by conducting control and prevention measures Epidemiological investigation with genome sequence that included staying at home and closing work units traceability analysis showed that the first case of for seven days. As of January 27, 2021, 76 cases had COVID-19 in Nangong City acquired infection from a been reported in Nangong City; among these, 8 were confirmed case from Shijiazhuang City; infection asymptomatic. No additional cases have been reported subsequently led to 76 local cases. All cases were to date, and there were no COVID-19-related deaths associated with the index case, and most were located in the outbreak. in Fenggong Street and did not spread outside of Nangong City. -

Chapter 1: Seismic Activity and Geological Background

CHAPTER 1: SEISMIC ACTIVITY AND GEOLOGICAL BACKGROUND SEISMIC ACTIVITY IN TANGSHAN AND ITS SURROUNDING AREAS Zhu Chuanzhen* The Tangshan earthquake is not an isolated and unexpected event. It has a breeding and formation process. In this paper some inherent observations of the Tangshan earthquake are summarized based on the historical and recent seismic activities in Tangshan and its surrounding areas as well as the characteristics of the Tangshan earthquake sequences itself. Fundamental data necessary for the analysis and study of the damage in the Tangshan earthquake are provided. Meanwhile, some seismic precursors prior to the Tangshan earthquake are also mentioned briefly. I. Summary of Historical Earthquakes China is a country of active seismicity and has also the longest historical earthquake record in the world. The statistics and analysis of historical earthquakes for more than 3000 years show that the distribution of strong earthquakes in China are characterized by the belt shape in space and the reoccurrence in time. Moreover, the stress accumulation and release are non-uniform in time and space within individual seismic zones, and the seismicity is also characterized by having different active periods (Shi Zhenliang et al., 1974). Therefore, it is necessary to investigate the distribution features of strong earthquakes on a larger time and space scale in order to study the processes of the Tangshan earthquake. 1. Strong earthquakes in North China The seismic activity in North China can be considered for the whole area according to the epicentral distribution, focal mechanism, direction of long axis of isoseismals of historical strong earthquakes, as well as the mean crust thickness, geological structure and geomorphology. -

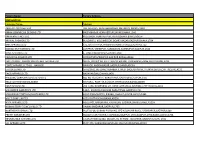

Factory Name

Factory Name Factory Address BANGLADESH Company Name Address AKH ECO APPARELS LTD 495, BALITHA, SHAH BELISHWER, DHAMRAI, DHAKA-1800 AMAN GRAPHICS & DESIGNS LTD NAZIMNAGAR HEMAYETPUR,SAVAR,DHAKA,1340 AMAN KNITTINGS LTD KULASHUR, HEMAYETPUR,SAVAR,DHAKA,BANGLADESH ARRIVAL FASHION LTD BUILDING 1, KOLOMESSOR, BOARD BAZAR,GAZIPUR,DHAKA,1704 BHIS APPARELS LTD 671, DATTA PARA, HOSSAIN MARKET,TONGI,GAZIPUR,1712 BONIAN KNIT FASHION LTD LATIFPUR, SHREEPUR, SARDAGONI,KASHIMPUR,GAZIPUR,1346 BOVS APPARELS LTD BORKAN,1, JAMUR MONIPURMUCHIPARA,DHAKA,1340 HOTAPARA, MIRZAPUR UNION, PS : CASSIOPEA FASHION LTD JOYDEVPUR,MIRZAPUR,GAZIPUR,BANGLADESH CHITTAGONG FASHION SPECIALISED TEXTILES LTD NO 26, ROAD # 04, CHITTAGONG EXPORT PROCESSING ZONE,CHITTAGONG,4223 CORTZ APPARELS LTD (1) - NAWJOR NAWJOR, KADDA BAZAR,GAZIPUR,BANGLADESH ETTADE JEANS LTD A-127-131,135-138,142-145,B-501-503,1670/2091, BUILDING NUMBER 3, WEST BSCIC SHOLASHAHAR, HOSIERY IND. ATURAR ESTATE, DEPOT,CHITTAGONG,4211 SHASAN,FATULLAH, FAKIR APPARELS LTD NARAYANGANJ,DHAKA,1400 HAESONG CORPORATION LTD. UNIT-2 NO, NO HIZAL HATI, BAROI PARA, KALIAKOIR,GAZIPUR,1705 HELA CLOTHING BANGLADESH SECTOR:1, PLOT: 53,54,66,67,CHITTAGONG,BANGLADESH KDS FASHION LTD 253 / 254, NASIRABAD I/A, AMIN JUTE MILLS, BAYEZID, CHITTAGONG,4211 MAJUMDER GARMENTS LTD. 113/1, MUDAFA PASCHIM PARA,TONGI,GAZIPUR,1711 MILLENNIUM TEXTILES (SOUTHERN) LTD PLOTBARA #RANGAMATIA, 29-32, SECTOR ZIRABO, # 3, EXPORT ASHULIA,SAVAR,DHAKA,1341 PROCESSING ZONE, CHITTAGONG- MULTI SHAF LIMITED 4223,CHITTAGONG,BANGLADESH NAFA APPARELS LTD HIJOLHATI, -

Waterlogging Risk Assessment of the Beijing-Tianjin- Hebei Urban Agglomeration in the Past 60 Years

Waterlogging Risk Assessment of the Beijing- Tianjin-Hebei Urban Agglomeration in the Past 60 Years Yujie Wang Nanjing University of Information Science and Technology JIANQING ZHAI ( [email protected] ) National Climate Center, CMA https://orcid.org/0000-0001-7793-3966 Lianchun Song National Climate Center, CMA Research Article Keywords: Hazard, Exposure, Vulnerability, Waterlogging risk, Beijing-Tianjin-Hebei Posted Date: February 10th, 2021 DOI: https://doi.org/10.21203/rs.3.rs-162526/v1 License: This work is licensed under a Creative Commons Attribution 4.0 International License. Read Full License 1 Waterlogging Risk Assessment of the Beijing-Tianjin- 2 Hebei Urban Agglomeration in the Past 60 Years 3 4 Yujie Wang1,2, Jianqing Zhai 3, Lianchun Song3 5 1 Key Laboratory of Meteorological Disaster, Ministry of Education/International Joint Research 6 Laboratory on Climate and Environment Change/Collaborative Innovation Center on Forecast 7 and Evaluation of Meteorological Disasters, Nanjing University of Information Science and 8 Technology, Nanjing 210044, China 9 2 School of Atmospheric Sciences, Nanjing University of Information Science and Technology, 10 Nanjing 210044, China 11 3 National Climate Center, CMA, Beijing 100081, China 12 13 Corresponding author: Jianqing Zhai E-mail: [email protected] 1 14 ABSTRACT 15 In the context of global climate change and rapid urbanization, the risk of urban 16 waterlogging is one of the main climate risks faced by the Beijing-Tianjin-Hebei (BTH) 17 urban agglomeration. In this study, we obtain the urban waterlogging risk index of the 18 BTH urban agglomeration and assess waterlogging risks in the built-up area of the BTH 19 for two time periods (1961–1990 and 1991–2019). -

49232-001: Beijing-Tianjin-Hebei Air Quality Improvement Program

Beijing–Tianjin–Hebei Air Quality Improvement–Hebei Policy Reforms Program (RRP PRC 49232) SECTOR ASSESSMENT: ENERGY Sector Road Map 1. Sector Performance, Problems, and Opportunities 1. In 2009, the People’s Republic of China (PRC) became the world’s largest energy consumer. In 2014, the PRC consumed 4.26 billion tons of standard coal equivalent (tce), which accounted for 23% of the global energy consumption. As the national government’s effort on improving energy efficiency progresses, the PRC’s energy consumption has grown at a slower rate than the overall economy since 2006. Energy intensity has improved by 13.4% in 2011– 2014 with reduction of 4.9% in 2014 compared to 2013.1 The government launched various command and control measures to address energy conservation, especially in energy intensive secondary industry. A distinctive characteristic of the PRC’s energy sector is its heavy reliance to coal. The share of coal in PRC’s primary energy consumption remained over 70% although the 2014 annual coal consumption declined for the first time in the last 2 decades by 2.9% compared to 2013.2 However the figure is much higher than the global average. The PRC government has set a target to reduce the share of coal in primary energy consumption to 62% by 2020. In parallel, although slowly, the PRC makes gradual progress in increasing the share of renewable energy generation in its energy mix. The PRC became a world leader in wind power, hydropower generation, and in solar photovoltaic manufacturing. The share of non-fossil fuel sources in the PRC’s energy consumption has increased from 7.8% in 2009 to 11.3% in 2014. -

Minimum Wage Standards in China August 11, 2020

Minimum Wage Standards in China August 11, 2020 Contents Heilongjiang ................................................................................................................................................. 3 Jilin ............................................................................................................................................................... 3 Liaoning ........................................................................................................................................................ 4 Inner Mongolia Autonomous Region ........................................................................................................... 7 Beijing......................................................................................................................................................... 10 Hebei ........................................................................................................................................................... 11 Henan .......................................................................................................................................................... 13 Shandong .................................................................................................................................................... 14 Shanxi ......................................................................................................................................................... 16 Shaanxi ...................................................................................................................................................... -

COUNTRY SECTION China Other Facility for the Collection Or Handling

Validity date from COUNTRY China 05/09/2020 00195 SECTION Other facility for the collection or handling of animal by-products (i.e. Date of publication unprocessed/untreated materials) 05/09/2020 List in force Approval number Name City Regions Activities Remark Date of request 00631765 Qixian Zengwei Mealworm Insect Breeding Cooperatives Qixian Shanxi CAT3 06/11/2014 Professional 0400ZC0003 SHIJIAZHUANG SHAN YOU CASHMERE PROCESSING Shijiazhuang Hebei CAT3 08/06/2020 CO.LTD. 0400ZC0004 HEBEI LIYIMENG CASHMERE PRODUCTS CO.LTD. Xingtai Hebei CAT3 08/06/2020 0400ZC0005 HEBEI VENICE CASHMERE TEXTILE CO.,LTD. Xingtai Hebei CAT3 08/06/2020 0400ZC0008 HEBEI HONGYE CASHMERE CO.,LTD. Xingtai Hebei CAT3 08/06/2020 0400ZC0009 HEBEI AOSHAWEI VILLUS PRODUCTS CO.,LTD Xingtai Hebei CAT3 08/06/2020 0400ZC0010 HEBEI JIAXING CASHMERE CO.,LTD Xingtai Hebei CAT3 26/05/2021 0400ZC0011 QINGHE COUNTY ZHENDA CASHMERE PRODUCTS CO., Xingtai Hebei CAT3 26/05/2021 LTD 0400ZC0012 HEBEI HUIXING CASHMERE GROUP CO.,LTD Xingtai Hebei CAT3 26/05/2021 0400ZC0014 ANPING JULONG ANIMAL BY PRODUCT CO.,LTD. Hengshui Hebei CAT3 08/06/2020 0400ZC0015 Anping XinXin Mane Co.,Ltd Hengshui Hebei CAT3 08/06/2020 0400ZC0016 ANPING COUNTY RISING STAR HAIR BRUSH Hengshui Hebei CAT3 08/06/2020 CORPORATION LIMITED 0400ZC0018 HENGSHUI PEACE FITNESS EQUIPMENT FACTORY Hengshui Hebei CAT3 08/06/2020 1 / 32 List in force Approval number Name City Regions Activities Remark Date of request 0400ZC0019 HEBEI XIHANG ANIMAL FURTHER DEVELOPMENT Hengshui Hebei CAT3 08/06/2020 CO.,LTD. 0400ZC0020 Anping Dual-horse Animal ByProducts Factory Hengshui Hebei CAT3 08/06/2020 0400ZC0021 HEBEI YUTENG CASHMERE PRODUCTS CO.,LTD. -

49028-002: Hebei Elderly Care Development Project

Social Monitoring Report #1 Semiannual Report December 2018 People’s Republic of China: Hebei Elderly Care Development Project Prepared by Shanghai Yiji Construction Consultants Co., Ltd. for the Hebei Provincial Government and the Asian Development Bank. 2 CURRENCY EQUIVALENTS (as of 31 December 2018) Currency unit – Chinese Yuan (CNY) CNY1.00 = $0.15 $1.00 = CNY6.88 ABBREVIATIONS ADB – Asian Development Bank HD – house demolition HH – household LA – land acquisition PMO – project management office PRC – People’s Republic of China RP – resettlement plan WEIGHTS AND MEASURES mu – 666.67 m2 square meter – m2 NOTE In this report, "$" refers to US dollars. This social monitoring report is a document of the borrower. The views expressed herein do not necessarily represent those of ADB's Board of Directors, Management, or staff, and may be preliminary in nature. In preparing any country program or strategy, financing any project, or by making any designation of or reference to a particular territory or geographic area in this document, the Asian Development Bank does not intend to make any judgments as to the legal or other status of any territory or area. ADB-financed Hebei Elderly Care Development Project (Loan 3536-PRC) Resettlement Monitoring and Evaluation Report (No. 1, as of 31 December 2018) 1 CONTENTS 1 EXECUTIVE SUMMARY ................................................................................................................... 1 1.1 INTRODUCTION ....................................................................................................................... -

Download This Article in PDF Format

E3S Web of Conferences 53, 03016 (2018) https://doi.org/10.1051/e3sconf/20185303016 ICAEER 2018 Studies on Regional Green Development Based on Social Network Analysis Yuan Huang1, Zongling Wang 1, Yi Zeng 1,* 1China National Institute of Standardization, No.4, Zhichun Road, Haidian District, Beijing 100191, China Abstract. Under the guidance of five development concepts, we should grasp regional overall economic, innovation, and traffic associated structure macroscopically, and analyze cities' status and role within the region when planning the regional green design. Through systematically considering regional overall structure, relationship between subjects and individual differences without prejudice to the ecological environment, it can play the greatest role of traffic led, city led, and market led, which can achieve regional green development. We build the traffic interaction network model, economic correlation network model, and innovation-driven network model to analyze network structures, identify key nodes and provide methodological guidance for regional green development plan. We bring Beijing-Tianjin-Hebei Urban Agglomeration for the case study and draw the following conclusions. The traffic interaction network is closer than the economic correlation network and the innovation-driven network, and the economic correlation network is closer than the innovation-driven network. The three networks all have a high degree of centralization, which means there is a great difference among cities. Beijing, Tianjin, Shijiazhuang develop relatively well, however, Chengde, Hengshui and Zhangjiakou relatively fall behind. Dezhou has a foundation to promote transportation integration and lacks the economic momentum and innovation driven. Chengde should increase the degree of innovation and communication to build connection with other cities.