Study on the Corporate Meetings & Incentive Segment in North America

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Solicitations Warning-Unauthorized Services

Las Vegas Convention Center Las Vegas, Nevada Exhibit Days: November 2 – November 5, 2021 Education Days: November 1 – November 5, 2021 SOLICITATIONS WARNING-UNAUTHORIZED SERVICES Unfortunately, exhibitors are periodically contacted by non-official contractors to offer them “better deals” on items and services at the SEMA Show. Please know that the SEMA Show only contracts with and endorses the Official Service Contractors listed in the (www.SEMAShow.com/esm), under Contact Information. These contractors are held accountable to provide the best possible customer service and ensure consistent and negotiated rates to all exhibitors at the SEMA Show. See Authorized Vendors under Contact Information. Please know SEMA does not sell exhibitor lists / contact information to anyone. Companies often use public information available on the internet to acquire exhibitors’ contact information. Please be assured SEMA only provides an exhibitor list to our Official Service Contractors to inform your company about services they provide at the SEMA Show While not tolerated or endorsed, we do recognize exhibitors will unfortunately be solicited for these services by non-official contractors: Hotel Rooms Floral Carpet Freight Shipping AV/Computer Equipment Photography Exhibit Design/Installation Security Booth Cleaning Vehicle Detailing Directory Guides If you decide to use a non-official contractor, make sure you do the following: Compare prices between contractors. Ask if the price includes everything? Ancillary expenses such as shipping, drayage, or labor may not be included. (Non-approved carpet vendors may not tell you that drayage fees will be incurred.) Confirm any stated representations regarding official contractors are correct by asking the official contractors. -

2018-19 Orange County Convention Center Annual Report

2018-2019 ANNUAL REPORT Greetings, This is a time of great transformation for the Orange County Convention Center. As we continue to build our community together, we are pleased to report this year’s accomplishments and share more about The Center of Hospitality’s future expansion and its continued economic impact in Central Florida. Through the support of our stakeholders and by strengthening relationships with our partners and clients, the Convention Center is embarking on a phenomenal $605 million expansion to provide additional space for our clients’ growing needs and to further enhance our offerings at this world-class campus. The convention and trade show industry is extremely competitive and our unparalleled customer service and additional space will position the OCCC as North America’s most competitive convention center. Year after year, industry leaders and trade publications have ranked the OCCC as one of the most sought after convention centers in North America. We continue to see exciting synergy between our facility, our connected hotels and nearby businesses and destinations. Our world famous theme parks, lodging, dining, retail and Orange County Mayor, Jerry L. Demings entertainment offerings have pushed the Convention Center district to a new level of excellence. We have the right team at the convention center, the support of our Board of County Commissioners, stakeholders and community partners to keep the convention center as one of the greatest global destinations for conventions. Together, we are ushering in a new era of prosperity as we continue Building for the Future. Sincerely, Jerry L. Demings Orange County Mayor AFFECTING GROWTH THROUGH LEADERSHIP Orange County Government The Orange County Convention Center (OCCC) is owned and operated by Orange County Government, led by Orange County Mayor Jerry L. -

Redalyc.Feminist Debate Around 'Trafficking' in Women for the Purpose of Sexual Exploitation in Prostitution

Desafíos ISSN: 0124-4035 [email protected] Universidad del Rosario Colombia Cardozo Lozano, Sandra Milena Feminist Debate around ‘Trafficking’ in Women for the Purpose of Sexual Exploitation in Prostitution Desafíos, vol. 23, núm. 1, enero-junio, 2011, pp. 217-257 Universidad del Rosario Bogotá, Colombia Available in: http://www.redalyc.org/articulo.oa?id=359633169007 How to cite Complete issue Scientific Information System More information about this article Network of Scientific Journals from Latin America, the Caribbean, Spain and Portugal Journal's homepage in redalyc.org Non-profit academic project, developed under the open access initiative Feminist Debate around ‘Trafficking’ in Women for the Purpose of Sexual Exploitation in Prostitution SANDRA MILENA CARDOZO LOZANO* Artículo Recibido: 1 de diciembre de 2010 Artículo Aprobado: 20 de febrero de 2011 Para citar este artículo: Serrano, Enriqueta y Navarrete, Paola (2011). Retos de la adhesión de Turquía a la Unión Europea. Desafíos 23 I, pp. 217-257. Abstract Women trafficking, as a widespread phenomenon, is a complex topic with mani- fold consequences which have a direct bearing on the way in which the problem of trafficking is understood by regulatory institutions and their proposed solutions. The governmental strategy must respond to this multidimensional phenomenon through state tools to counteract the effects of crime and recognize that women, men, children and adolescents may be indiscriminately vulnerable to this scourge. Nevertheless, we must recognize that, due to cultural facts, women and girls constitute the majority of its victims and specific actions are required for them. Key words: feminist debate, trafficking in women, prostitution, sexual exploi- tation, intimate citizenship. -

At Hotel/Convention Center Complexes

what's NEW at Hotel/Hotel/ConventionConvention CCenterenter ComplexesComplexes of North America?America? Things are looking up — and hotehotelsls under constructionconstruction (with(with comple-comple- ttionion expecteexpectedd in or before 2016) and at hotels are going up. With rising lleasteast ninenine moremore coconvenientnvenient coconventionnvention occupancy rates and increased hhotelsotels are inin development.development. CConvenientonvenient hotels areare defi ned as thothosese investment opportunities, hotel tthathat aarere coconnectednnected to a vvenueenue oorr llocatedocated expansions and new builds are adadjacentlyjacently or across tthehe sstreet.treet. AAll-in-onell-in-one compcomplexeslexes incoincorporaterporate meetmeetinging spacspacee increasing and show organizers aandnd guestrooguestroomsms witwithinhin one bbuilding.uilding. DeDespitespite thethe new optimism,optimism, tthehe ddevelop-evelop- now have more options. ment process is still frfraughtaught wiwithth obstacles. ThThismaybemostevidentinsomeofth is may be most evident in some of thee Th e new atmosphere means whewherere nnewew amenities announceannouncedd as hhotelsotels trytry there is a hotel need, a case can likelylikely ttoo ggainain a competitive advantaadvantage.ge. bbee made,made, andand many convention centerscenters ““StayStay Well” rooms, designed by Delos are takintakingg advantaadvantagege of the swingingswinging Loving, LLC, capturedcaptured memediadia attention pendulum. AccordinAccordingg to this latest when thetheyy debuted last Fall -

Senior Passport 2020-2021

Table of Contents Calendar of Events ............................................................................... 2-4 Associate Degree Nursing Students ........................................................ 5 SENIOR Caps, Gowns and Announcements ........................................................ 5 Classes at Other Colleges ........................................................................ 5 Exit Interviews ......................................................................................... 6 PASSPORT Graduation Contract .............................................................................. 6 Incompletes/Correspondence Courses/Christian Service .................... 6 2020-2021 Major Field Achievement Test ................................................................ 6 ETS Proficiency Profile ........................................................................... 7 National Tests .......................................................................................... 7 Professional School Applications ........................................................... 7 Résumé Assistance .................................................................................. 7 Senior Class Organization ...................................................................... 7 Senior Portraits ........................................................................................ 8 Student Teaching .................................................................................... 8 Teacher Certification ............................................................................. -

General Assembly

GENERAL ASSEMBLY THIRTY-FIFTH REGULAR SESSION corr. 2 OF THE GENERAL ASSEMBLY June 5-7, 2005 Fort Lauderdale, Florida, U.S.A. INFORMATION BULLETIN 1. Site of the General Assembly Session The thirty-fifth regular session of the General Assembly will be held from June 5 to 7, 2005, in Fort Lauderdale, Florida. The sessions and meetings will be held in the Floridian Ballroom on the third level of the Fort Lauderdale/Broward County Convention Center. Other meetings will take place in other designated rooms at the Convention Center. The inaugural session will take place on Sunday, June 5 in the Grand Floridian Ballroom of the Convention Center offered by the host country, and will be followed by a reception in honor of the delegates. A full schedule of events and detailed information can be obtained from the OAS website: http://www.oas.org/XXXVGA. 2. National Coordinating Office National Coordinator: Administrative Director: Ambassador Ronald D. Godard Penelope Williams Special Coordinator for the 2005 OASGA Office of International Conferences Fifth Floor, SA-15 Room 1517, IO/OIC U.S. Department of State U.S. Department of State Washington, D.C., 20522 Washington, D.C. 20520 Phone: (703) 516-1773 Phone: (202) 647-8336 Fax: (703) 516-1772 Fax: (202) 647-1301 E mail: [email protected] 3. Hotels The host country has made advance room allocations for members of delegations, permanent observers and press members in the official hotels listed below. The host country will provide accommodations only at the Hyatt Pier 66 Hotel for Foreign Ministers (Heads of Delegation); other delegates are expected to fund their own expenses. -

MERC Commission Meeting

MERC Commission Meeting August 4, 2021 12:30 pm Zoom Virtual Meeting Metro respects civil rights Metro fully complies with Title VI of the Civil Rights Act of 1964 and related statutes that ban discrimination. If any person believes they have been discriminated against regarding the receipt of benefits or services because of race, color, national origin, sex, age or disability, they have the right to file a complaint with Metro. For information on Metro’s civil rights program, or to obtain a discrimination complaint form, visit www.oregonmetro.gov/civilrights or call 503-813-7514. Metro provides services or accommodations upon request to persons with disabilities and people who need an interpreter at public meetings. If you need a sign language interpreter, communication aid or language assistance, call 503-797-1890 or TDD/TTY 503-797-1804 (8 a.m. to 5 p.m. weekdays) 5 business days before the meeting. All Metro meetings are wheelchair accessible. For up-to-date public transportation information, visit TriMet’s website at www.trimet.org. Thông báo về sự Metro không kỳ thị của إشعاربعدمالتمييز من Metro tôn trọng dân quyền. Muốn biết thêm thông tin về chương trình dân quyền Metro تحترم Metroالحقو اقلمدنية. للمزيد من المعلومات حولبرنامج Metroللحقو اقلمدنية أو شكوى của Metro, hoặc muốn lấy đơn khiếu nại về sự kỳ thị, xin xem trong ضادلتمييز،يُ رجى زيارةالموقع www.oregonmetro.gov/civilrights. إنكنت بحاجة ,www.oregonmetro.gov/civilrights. Nếu quý vị cần thông dịch viên ra dấu bằng tay إلى مساعدةفياللغة، يجبعليك مقدماًبرقمالھاتف 1890-97 (7-503 من السا عة 8 صباحاًحتى trợ giúp về tiếp xúc hay ngôn ngữ, xin gọi số 503-797-1890 (từ 8 giờ sáng đến 5 giờ السا عة 5 مساءاً ، أيام إلى الجمعة)ق بل 5خمسة ( ) أيام عمل من موعد . -

Qualified Hotel Projects

House Committee on Ways and Means Interim Committee Report - Qualified Hotel Projects INTERIM CHARGE On November 25, 2019, the Speaker of the House issued the following charge to the House Committee on Ways & Means: “Monitor the agencies and programs under the Committee’s jurisdiction and oversee the implementation of relevant legislation passed by the 86th Legislature. Conduct active oversight of all associated rulemaking and other governmental actions taken to ensure intended legislative outcome of all legislation, including the following: H.B. 4347, which relates to the use of hotel occupancy, sales, and mixed beverage tax revenue for qualified projects. Examine the effectiveness and efficiency of the hotel projects, qualified hotel projects, and uses of local hotel occupancy tax revenue. Examine the negative fiscal impact to the state resulting from the dedication of the state portion of those taxes.” TEXAS HOTEL & LODGING ASSOCIATION In response to the interim charge above, the Texas Hotel & Lodging Association (THLA) partnered with the affected cities, consultants who specialize in convention center hotel projects, and the broader travel and tourism industry and undertook a survey to determine the effectiveness and efficiency of all qualified hotel projects across the state. The THLA is a nonprofit trade association with over 5,000 members that represents all segments of the lodging and tourism industry including hotel operators, convention and visitor bureaus, chambers of commerce, and vendors who work within the hospitality industry. THLA has grown to become the largest state hotel association in the nation. The following report contains the results of the THLA survey along with an analysis and history of the qualified hotel project program. -

A Comparative Analysis Between Indiana's Human Trafficking Laws and the International Legal Framework

DID INDIANA DELIVER IN ITS FIGHT AGAINST HUMAN TRAFFICKING?: A COMPARATIVE ANALYSIS BETWEEN INDIANA'S HUMAN TRAFFICKING LAWS AND THE INTERNATIONAL LEGAL FRAMEWORK May Li* INTRODUCTION The victims of modern slavery have many faces. They are men and women, adults and children. Yet, all are denied basic human dignity and freedom . We must join together as a Nation and global community to provide that safe haven by protecting victims and prosecuting traffickers. With improved victim identification, medical and social services, training for first responders, and increasedpublic awareness, the men, women, and children who have suffered this scourge can overcome the bonds of modern slavery, receive protection and justice, and successfully reclaim their rightful independence. Fightingmodern slavery and human trafficking is a shared responsibility.' A. Human Trafficking: The Numbers "Human trafficking, or 'trafficking in persons,' is an affront to human dignity that links communities across the world in a web of money, exploitation and victimization." 2 It is a multi-dimensional issue that "violates human rights, endangers economic growth, thrives on corruption, and poses a real threat to the well-being and human development of men, women, and children, be it committed across or within national borders."3 * J.D. Candidate, 2014, Indiana University Robert H. McKinney School of Law; B.A., 2007, Boston College, Chestnut Hill, Massachusetts. I would like to thank Professor Catherine A. Lemmer, Head of Information Services, Ruth Lilly Law Library, Indiana University Robert H. McKinney School of Law, Ummi Jalilova, and Jennifer Heider, and members of the Indiana International & ComparativeLaw Review for their assistance with this Note. -

Keeping the Competitive Edge of a Convention and Exhibition Center in MICE Environment: Identification of Event Attributes for L

sustainability Article Keeping the Competitive Edge of a Convention and Exhibition Center in MICE Environment: Identification of Event Attributes for Long-Run Success Jaeyoung An 1, Hany Kim 2,* and Dongkeun Hur 3 1 BEXCO, Busan 48060, Korea; [email protected] 2 Department of Tourism and Convention, Pusan National University, Busan 46241, Korea 3 Gyeongju Hwabaek International Convention Center (HICO), Gyeongju 38116, Korea; [email protected] * Correspondence: [email protected] Abstract: Understanding the weaknesses and strengths of event attributes plays a significant role in business survivability, specifically the meetings, incentives, conventions, and exhibitions (MICE) industry, in which the business environment is competitive. To be in business and survive long-term, service and product offerings must satisfy the needs of clients. In the case of the MICE industry, clients include event organizers, planners, and attendees. Thus, the IPA (importance-performance analysis) was conducted with hopes to provide valuable insight into the MICE industry to identify and evaluate their offering (attributes) that can assist Convention and Visitors Bureaus (CVBs) to establish better operational strategies that maintain their economic sustainability. Furthermore, this study also addressed the event planners and organizers’ perceptions toward the environment and social sustainability, measuring the importance and performance of ecofriendly venues and Citation: An, J.; Kim, H.; Hur, D. the availability of disabled access, which showed neither significant importance nor performance. Keeping the Competitive Edge of a Convention and Exhibition Center in However, as the main purpose of the research was to examine the essential venue selection criteria MICE Environment: Identification of based on the perceptional lens of the event organizer and planners to MICE operators on achieving Event Attributes for Long-Run business sustainability, the findings of this study provide strategical direction to establish, maintain, Success. -

Restaurants Convenient to Spokane Convention Center

Restaurants Convenient to Spokane Convention Center MacKenzie River Pizza, Grill & Pub - Downtown 818 W. Riverside Ave. Spokane, WA 99201 Phone: (509) 315-4447 Website: www.mackenzieriverpizza.com Description: Featuring an incredible array of delectable dishes, always flavorful, fresh and served up in heaping portions. The acclaimed gourmet pizzas are offered on a variety of crusts with toppings from classic pepperoni to pesto, ricotta and sun-dried tomato. We also offer hearty sandwiches served warm on fresh baked bread, Montana-sized salads, pastas that will wow your taste buds and home-style entrees to satisfy your cravings. The Melting Pot of Spokane 707 W Main Ave, Crescent Building, Skywalk Level Spokane, WA 99201 Phone: (509) 926-8000 Website: www.meltingpot.com/spokane/welcome Description: At the Melting Pot, fondue truly becomes a memorable four course dining experience where patrons can dip into something different and discover all the ingredients for the perfect night out including a relaxed atmosphere, private tables, attentive service, fine wines, private banquet room and great memories. Reservations are recommended. Nordstrom Cafe River Park Square, 3rd Level, 828 W Main, River Park Square Spokane, WA 99201 Phone: (509) 455-6111 Website: www.nordstrom.com Description: Yummy paninis, soups, salads and desserts! The Onion Bar & Grill 302 W Riverside Ave Spokane, WA 99201 Phone: (509) 747-3852 Website: www.theonion.biz Description: Fun, fast and friendly. Serving pasta, fajitas, chicken platters, gourmet salads, and a wide variety of hamburgers. Lots of imported & domestic draft beers and cocktails. We love kids! Can accommodate groups of 10 or more. Has private dining area. -

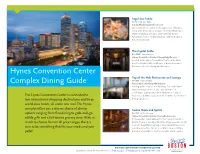

Hynes Convention Center Complex Dining Guide

Legal Sea Foods I5 | $$ | 617-266-7775 Copley Place | legalseafoods.com Our restaurant is located on the upper level of Copley Place, with direct indoor access to both the Westin and Marriott hotels as well as to the Prudential Center. Panoramic floor-to-ceiling windows overlook Boston’s historic South End. The Capital Grille B4 | $$$$ | 617-262-8900 Hynes Convention Center | thecapitalgrille.com Located in the Hynes Convention Center in the Back Bay, The Capital Grille steakhouse is Boston’s premier destination for fine dining and fine wine. Hynes Convention Center Top of the Hub Restaurant and Lounge C4 | $$$ | 617-536-1775 Complex Dining Guide Prudential Center | topofthehub.net Soaring 52 floors above the Back Bay, Top of the Hub’s award winning cuisine, service and ambiance of comfortable sophistication blend with the serenity of The Hynes Convention Center is connected to Boston’s best skyline views to deliver a truly one-of-a-kind two international shopping destinations and three dining experience. world-class hotels, all under one roof. The Hynes complex offers you a diverse choice of dining Towne Stove and Spirits options ranging from fine dining to grab-and-go, C3 | $$$ | 617-247-0400 Hynes Convention Center | towneboston.com edible gifts and a full-service grocery store. With so Conveniently located adjacent to the Hynes Convention much to choose from in all price ranges, there is Center, Towne is a unique Back Bay dining experience built around a delightful mingling of international flavors and sure to be something that fits your needs and your solid American fare.