Thailandbased Carrier Starting Shanghai Flights

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

My Personal Callsign List This List Was Not Designed for Publication However Due to Several Requests I Have Decided to Make It Downloadable

- www.egxwinfogroup.co.uk - The EGXWinfo Group of Twitter Accounts - @EGXWinfoGroup on Twitter - My Personal Callsign List This list was not designed for publication however due to several requests I have decided to make it downloadable. It is a mixture of listed callsigns and logged callsigns so some have numbers after the callsign as they were heard. Use CTL+F in Adobe Reader to search for your callsign Callsign ICAO/PRI IATA Unit Type Based Country Type ABG AAB W9 Abelag Aviation Belgium Civil ARMYAIR AAC Army Air Corps United Kingdom Civil AgustaWestland Lynx AH.9A/AW159 Wildcat ARMYAIR 200# AAC 2Regt | AAC AH.1 AAC Middle Wallop United Kingdom Military ARMYAIR 300# AAC 3Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 400# AAC 4Regt | AAC AgustaWestland AH-64 Apache AH.1 RAF Wattisham United Kingdom Military ARMYAIR 500# AAC 5Regt AAC/RAF Britten-Norman Islander/Defender JHCFS Aldergrove United Kingdom Military ARMYAIR 600# AAC 657Sqn | JSFAW | AAC Various RAF Odiham United Kingdom Military Ambassador AAD Mann Air Ltd United Kingdom Civil AIGLE AZUR AAF ZI Aigle Azur France Civil ATLANTIC AAG KI Air Atlantique United Kingdom Civil ATLANTIC AAG Atlantic Flight Training United Kingdom Civil ALOHA AAH KH Aloha Air Cargo United States Civil BOREALIS AAI Air Aurora United States Civil ALFA SUDAN AAJ Alfa Airlines Sudan Civil ALASKA ISLAND AAK Alaska Island Air United States Civil AMERICAN AAL AA American Airlines United States Civil AM CORP AAM Aviation Management Corporation United States Civil -

APRAST/7 Attachment a to the Report A- 1

APRAST/7 Attachment A to the Report LIST OF PARTICIPANTS State/Name Title/Organization Tel/Fax Number e-mail 1. AUSTRALIA 1. Mr. Stephen M. DUFFIELD Manager, Safety Performance Tel.: +61-7-3144 7362 [email protected]; Civil Aviation Safety Authority Fax: +61-7-3144 7575 Canberra ACT 2601 2. Mr. Guillermo Yosef ZAMORA A/Section Head, Operational Safety Analysis Tel.: +61-7-3144 7363 [email protected]; Civil Aviation Safety Authority Canberra ACT 2601 3. Mr. Glenn W. JONES Technical Advisor Tel.: +61-7-31447492 [email protected]; Civil Aviation Safety Authority Fax: +61-7-54992796 [email protected]; (Chairman, Reachout Committee International Society of Air Safety Investigators) 4. Mr. Richard BATT Manager International Tel.: +61-2-6274 6404 [email protected]; Australian Transport Safety Bureau Canberra ACT 2600 2. BANGLADESH 5. Gp. Capt. S. M. Nazmul ANAM Director, Flight Safety & Regulations Tel.: +880-2-890 1406 [email protected]; (Principal Delegate) Flight Safety & Regulations Division Fax: +880-2-890 1418 [email protected]; Civil Aviation Authority of Bangladesh CAAB Headquarters Dhaka - 1229 6. Mr. Salahuddin M. Consultant & Chief Flight Operations Inspector Tel.: +880-2-890 1406 [email protected]; RAHMATULLAH Flight Safety & Regulations Division ext. 3524 Civil Aviation Authority of Bangladesh Fax: +880-2-890 1418 CAAB Headquarters Dhaka – 1229 A- 1 APRAST/7 Attachment A to the Report State/Name Title/Organization Tel/Fax Number e-mail 7. Mr. S. M. Lutful KABIR Assistant Director, IR & Regulations Tel.: +880-2-890 1406 [email protected]; Flight Safety & Regulations Division Fax: +880-2-890 1418 Civil Aviation Authority of Bangladesh CAAB Headquarters Dhaka – 1229 8. -

Insight June 2018 Partnerships Between Airlines: the Strategy to Win the Asian Market

INSIGHT JUNE 2018 PARTNERSHIPS BETWEEN AIRLINES: THE STRATEGY TO WIN THE ASIAN MARKET. In a context of intense rivalry, airlines are facing This agreement allows passengers to switch from multiple challenges: high fleet renewal and one flight operated by the first airline to another maintenance costs, advent of new business models, flight operated by the other airline without picking or regulatory changes. Since internal growth or up their luggage or checking-in a second time. competitors’ takeover may be hard, airlines often The cooperation between two companies can go a choose to cooperate with each other. These little further with codeshare agreements. These are partnerships exist in more or less complex forms commercial arrangements in which two or more and constitute crucial levers for airlines to enter a airlines share the same flight. The marketing airline new market or strengthen their position in fast has the ability to publish and sell the seats offered growing areas like Asia. by the operating airline under its own identification number. This cooperation offers a greater selection of flights and thus a greater network coverage. Origin and types of partnerships Finally, the agreement may relate to the airlines’ The beginning of collaborations loyalty programs. The grouping of loyalty programs and lounges access allows travelers to accumulate After the airline deregulation in the 1980s, airlines the loyalty points and therefore to access the same have been facing a rapidly-growing international benefits and service quality while traveling with demand. Travellers were asking for a wide range of different airlines. potential destinations but traditional airlines wasn’t able to cope with the demand; Therefore, airlines These three types of agreements form the basis of needed to find business partners able to expand all bilateral alliances between airlines but also their network coverage. -

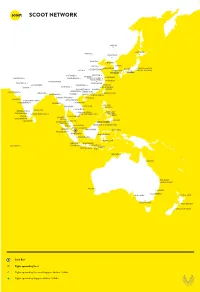

Scoot Network and Interline Destinations

SCOOT NETWORK HARBIN SAPPORO BEIJING SHENYANG TIANJIN DALIAN JINAN SEOUL QINGDAO TOKYO, NARITA ZHENGZHOU OSAKA XI’AN HIROSHIMA TOKYO, HANEDA FUKUOKA NAGOYA CHENGDU NANJING WUHAN SHANGHAI AMRITSAR CHONGQING WUXI / SUZHOU HANGZHOU NINGBO KATHMANDU NEW DELHI NANCHANG LUCKNOW CHANGSHA FUZHOU DHAKA KUNMING QUANZHOU GUANGZHOU XIAMEN TAIPEI AHMEDABAD NANNING SHENZHEN KOLKATA HANOI KAOHSIUNG MANDALAY MACAU HONG KONG LUANG PRABANG HAIKOU MUMBAI VISAKHAPATNAM CHIANG MAI HYDERABAD YANGON VIENTIANE CLARK DANANG BANGKOK MANILA SIEM REAP BENGALURU CHENNAI PHNOM PENH BORACAY COIMBATORE TIRUCHIRAPPALLI HO CHI MINH CITY KALIBO CEBU KOCHI KOH SAMUI PHUKET TRIVANDRUM KRABI COLOMBO DAVAO LANGKAWI HAT YAI KOTA KINABALU PENANG BANDAR SERI BEGAWAN IPOH KUANTAN KUALA LUMPUR MEDAN KUCHING MANADO PEKANBARU SINGAPORE BALIKPAPAN PALEMBANG MAKASSAR JAKARTA SEMARANG MALDIVES BANDUNG SURABAYA LOMBOK YOGYAKARTA BALI DARWIN CAIRNS BRISBANE GOLD COAST PERTH SYDNEY CANBERRA ADELAIDE AUCKLAND MELBOURNE WELLINGTON CHRISTCHURCH Scoot Base Flights operated by Scoot Flights operated by Scoot and Singapore Airlines / SilkAir Flights operated by Singapore Airlines / SilkAir SCOOT NETWORK AMERICA AFRICA EUROPE STOCKHOLM MOSCOW COPENHAGEN NEW YORK SAN FRANCISCO AMSTERDAM BERLIN MANCHESTER DÜSSELDORF LOS ANGELES JOHANNESBURG HEATHROW FRANKFURT PARIS HOUSTON MUNICH ZURICH HONOLULU MILAN FIUMICINO BARCELONA ISTANBUL CAPE TOWN ATHENS SAUDI ARABIA OPERATED BY NOKSCOOT OPERATED BY VANILLA AIR HAKODATE SHENYANG TIANJIN DALIAN DUBAI QINGDAO NANJING JEDDAH TAIPEI AMAMI NAHA *FROM BANGKOK -

June 13, 2015

ANDAMAN Edition PHUKET’S LEADING NEWSPAPER... SINCE 1993 Now NATIONWIDE Takeoff delayed Civil Aviation revamp takes toll on industry INSIDE TODAY June 13 - 19, 2015 PhuketGazette.Net In partnership with The Nation Photo: Mathew Reyes 20 Baht ‘ACCORDING TO CCTV HE WAS ATTACKED BY THE MEN’ Officials warn of leaking cash through pipes LEAKY water pipes landed a Rassada resident with a more than 16,000-baht water bill to pay, prompting Phuket authorities to is- sue a home maintenance advisory Self defence to all island dwellers. The resident was stunned to re- ceive a 16,829-baht water bill for Patong Police the month of May after having be- come accustomed to paying a drop case against maximum of 200 baht. Full Story Page 5 Australian expat Eight netted for By Kongleaphy Keam running illegal POLICE have dropped the case against Austra- gambling site lian expat and Phuket community member Mark POLICE are searching for the head Pendlebury for the fatal stabbing of a nightclub of an online gambling operation af- employee across the street from the island’s famed ter eight Koreans were caught last party strip, Soi Bangla, in March. week running a gambling site out The decision was made by police after CCTV of an apartment in Phuket. footage surfaced backing claims that Mr The arrests follow a report in Pendlebury had acted in self defence when con- March from police in Bangkok fronted by 25-year-old Sanya Khlueawaengmon about the gambling racket. Phuket in the early hours of March 11. Police have been on the trail ever “The video footage, which we are unable to since, said Phuket Provincial Po- reveal to the public at the moment, shows Mr lice Commander Patchara Pendlebury being attacked by a group of men Boonyasit. -

Nok Airlines (NOK TB) Sell (From Buy) Transport - Aviation Target Price: THB9.86 Market Cap: Usd215m Price: THB11.50

Results Review, 15 May 2015 Nok Airlines (NOK TB) Sell (from Buy) Transport - Aviation Target Price: THB9.86 Market Cap: USD215m Price: THB11.50 Macro Risks 2 Dragged by NokScoot Start-Up Growth . 2 0 Value . 02 0 . 02 0 Nok Air posted a surprise 21% YoY drop in core earnings on higher . Nok Airlines (NOK TB) 0 Price Close Relative to Stock Exchange of Thailand Index (RHS) costs overruns due to NokScoot, which has not commenced 0 19 111 operations. Downgrade to SELL with a THB9.86 TP (from THB16.00, 0 18 104 14% downside, 12x FY15F EPS). Its own 1Q15 earnings disappointed as 17 98 yields were still weaker YoY and non-fuel costs may have unlikely come down – prompting us to cut FY15F/FY16F earnings by 33%/20%. 16 91 15 84 Hit by startup costs on idle aircraft. Nok Airlines (Nok Air) recorded a 14 78 surprise 21% YoY drop in its core earnings (after stripping out THB29m 13 71 in forex translation losses and other minor non-recurring items) despite revenue growing 17% YoY. The results were disappointing considering 12 64 the low base 1Q14 earnings – battered by the political turmoil in 11 58 Thailand. Higher costs overruns were attributed to its two idle NokScoot 10 51 120 aircraft, which have yet to commence operations. 100 Delayed launching of NokScoot could prolong losses into 2Q15. 80 NokScoot’s (Nok Air’s long haul low cost carrier arm) delayed launch has 60 been postponed as a result of flight restrictions imposed by China, Japan 40 and South Korea, following International Civil Aviation Organisation 20 Vol Vol m (ICAO) audit checks revealing operational standards safety concerns in Thailand’s aviation sector. -

Executive Summary

Executive Summary Executive Summary The compound annual growth rate of Thai air transport over the past 10 years (2010 – 2019) was 11.4 percent with an average annual growth rate of international passengers of 10.8 percent and average annual growth rate of domestic passengers of 12.1 percent. In 2019, there was a total of 165 million passengers which increased by only 1.8 percent compared to the previous year. Total passengers in 2019 consisted of 89 million internationl passengers which increased by 7.2 percent and 76 million domestic passengers which decreased by 3 percent compared to the previous year and is considered the first domestic passengers decline in 10 years. Considering the proportions of domestic and international passengers in 2019, there were consistent with an average growth rate of flights over 10 years of 9.8 percent per year which consisting of an international flight growth of 9.7 percent per year and domestic flight growth of 9.8 percent per year. In 2019, there was a total of 1.06 million flights which decreased by 2.7 percent from the previous year due to the airlines reduced their domestic flights and increased the number of seats on international routes. As a result, the number of domestic flights decreased by 6.89 percent from the previous year. Considering the air freight volume of Thailand during this period, an overall average volume of air freight growth was 0.8 percent per year. The total volume of air freight in 2019 was 1.49 million tons, showing a 7.9 percent decrease compared to the previous year, most of which were international air freight at Suvarnabhumi Airport. -

Chubb Scoot Protect

Chubb Scoot Protect A travel insurance designed for NokScoot passengers and underwritten by Chubb Insurance Singapore Limited Chubb Scoot Protect Your well-deserved vacation can be disrupted by inconveniences like losing your baggage, experiencing flight delays or even having to see a doctor overseas. Make Chubb ScootSM Protect travel insurance part of your travel plans be prepared for such contingencies. Wherever your travels may take you, you can now travel with ease and confidence knowing that you have the right coverage. Chubb Scoot Protect Destination Covered Locations 1. ASEAN means Thailand, Indonesia, and Malaysia. 2. Asia Pacific means Brunei, Cambodia, Laos, Myanmar, Philippines, Vietnam Australia, New Zealand, China, Hong Kong, Macau, India, Japan, Sri Lanka and Taiwan. Trip Type One Way Trip Travel Covers travel commencing in Singapore and ending at your Destination. Round Trip Travel Covers travel commencing and ending in Singapore. What Do We Cover Chubb Scoot Protect offers great coverage and essential benefits to meet your travel needs. Our plans are specially designed to meet the protection and budget needs of individual travellers like you. Coverage includes overseas medical arrangements, flight cancellations, travel delays and misconnections and baggage losses, among others. Now you can travel with lower risk and fewer worries! © 2016 Chubb. Coverages underwritten by one or more subsidiary companies. Not all coverages available in all jurisdictions. Chubb® and its respective logos, and Chubb. Insured.SM are protected -

Monthly OTP January 2020

Monthly OTP January 2020 ON-TIME PERFORMANCE AIRLINES Contents On-Time is percentage of flights that depart or arrive within 15 minutes of schedule. Global OTP rankings are only assigned to all Airlines/Airports where OAG has status coverage for at least 80% of the scheduled flights. Regional Airlines Status coverage will only be based on actual gate times rather than estimated times. This may result in some airlines / airports being excluded from this report. If you would like to review your flight status feed with OAG, please email [email protected] MAKE SMARTER MOVES Airline Monthly OTP – January 2020 Page 1 of 1 Home GLOBAL AIRLINES – TOP 50 AND BOTTOM 50 TOP AIRLINE ON-TIME FLIGHTS On-time performance BOTTOM AIRLINE ON-TIME FLIGHTS On-time performance Airline Arrivals Rank No. flights Size Airline Arrivals Rank No. flights Size 6O Orbest 100.0% 1 1 329 RS Air Seoul, Inc 42.7% 162 1,034 216 TA TACA International Airlines 97.2% 2 308 277 WO Swoop 42.8% 161 1,062 215 FA Safair 95.8% 3 2,304 156 AI Air India 43.3% 160 16,764 38 GA Garuda Indonesia 95.3% 4 12,708 51 WG Sunwing Airlines Inc. 43.7% 159 3,250 135 JH Fuji Dream Airlines 94.6% 5 2,480 153 3H Air Inuit 45.2% 158 1,479 198 HR Hahn Air 94.1% 6 18 324 SV Saudi Arabian Airlines 55.4% 157 18,105 35 BC Skymark Airlines 93.7% 7 4,920 111 AC Air Canada 55.4% 156 45,239 9 CM Copa Airlines 93.6% 8 10,499 65 JT Lion Air 55.8% 155 18,265 34 SATA International-Azores XQ SunExpress 92.7% 9 2,827 148 S4 56.1% 154 479 255 Airlines S.A. -

RESTARTING INTERNATIONAL AIR TRAVEL WITHIN ASEAN a White Paper from the Aviation Studies Institute (ASI) at the Singapore University of Technology and Design (SUTD)

RESTARTING INTERNATIONAL AIR TRAVEL WITHIN ASEAN A White Paper from the Aviation Studies Institute (ASI) at the Singapore University of Technology and Design (SUTD) Author: Brendan Sobie, Sobie Aviation Pte Ltd. Commissioned and Edited by: Peter L. Jackson, Director, ASI Date: December 2020 Executive Summary While the global aviation industry has been decimated by the COVID-19 pandemic, the ten Southeast Asian countries which comprise the Association of Southeast Asian Nations (ASEAN) have experienced passenger traffic declines that have been much sharper than the global and Asia-Pacific averages. Data from Kuala Lumpur International Airport and other sources also indicate that international travel within ASEAN has declined even more than travel connecting with non-ASEAN countries. Globally, regional international traffic is expected to recover faster than intercontinental international traffic. This is happening in Europe, the Americas, the Middle East and Africa but it has not yet happened in ASEAN. ASEAN’s domestic aviation market started recovering in May and June, 2020, as countries lifted restrictions on internal travel. Domestic passenger levels in ASEAN are now at around 50% of normal levels overall. However, revenues for domestic travel are much lower than for cross-border travel. Due to the suspension of nearly all international passenger travel and the fact domestic revenues are very limited, many ASEAN airlines are unable to cover fixed costs and are suspending or delaying aircraft lease payments. Airline bankruptcies and collapses are expected, particularly if international air travel in ASEAN does not resume within the next few months. ASEAN airlines have a pressing need to rebuild revenue streams. -

AIRLINES Monthly

AIRLINES monthly OTP SEPTEMBER 2017 Contents GLOBAL AIRLINES GLOBAL RANKING Top and bottom Regional airlines Latin North EMEA ASPAC American and America Caribbean Notes: % On-Time is percentage of flights that depart or Update: Status coverage as of September 2017 will only arrive within 15 minutes of schedule. be based on actual gate times rather than estimated times. Source: OAG flightview. Any reuse, publication or distribution This may result in some airlines/airports being excluded from of report data must be attributed to OAG flightview. this report. Global OTP rankings are assigned to all airlines/ Global OTP rankings are assigned to all Airports airports where OAG has status coverage for at least 80% where OAG has status coverage for at least 80% of the of scheduled flights. If you would like to review your flight scheduled flights. status feed with OAG please [email protected] AIRLINE MONTHLY OTP – SEPTEMBER 2017 Global airlines – top and bottom BOTTOM AIRLINE ON-TIME TOP AIRLINE ON-TIME FLIGHTS On-time performance On-time performance FLIGHTS Airline Arrivals Rank Flights Rank Airline Arrivals Rank Flights Rank HR Hahn Air 100.0% 1 18 395 JY Intercaribbean Airways Ltd 32.3% 156 1,187 245 DVR Divi Divi Air 94.7% 2 344 324 9V AVIOR Airlines 44.0% 155 798 277 Q6 Volaris Costa Rica 94.7% 3 228 346 ME Middle East Airlines 47.5% 154 2,319 181 JH Fuji Dream Airlines 93.6% 4 2,040 188 3H Air Inuit 49.2% 153 1,495 227 HA Hawaiian Airlines 93.5% 5 7,742 86 ZH Shenzhen Airlines 49.9% 152 20,137 29 HX Hong Kong Airlines 92.4% 6 3,173 150 D7 Airasia X 52.2% 151 1,648 216 SATA International-Azores TW T'way Air 92.0% 7 1,847 208 S4 55.9% 150 791 278 Airlines S.A. -

Freight Talk

freight talk TO: ALL SIA CARGO AGENTS BDM 6A.01 013 29 January 2015 Dear Sir/Madam, SIA CARGO MANAGES SILKAIR AND NOKSCOOT CARGO CAPACITY Singapore Airlines Cargo is pleased to announce that we will be managing the cargo capacity on flights operated by SilkAir from April 2015, and through an interline arrangement, also flights operated by NokScoot from May 2015. SilkAir is an established and fully-owned subsidiary of Singapore Airlines that operates more than 350 flights a week to 48 destinations, across Asia and Australia from its base in Singapore. Services to Cairns, Australia are planned from May 2015. NokScoot is a new low-cost airline based in Bangkok (DMK), Thailand operating wide-body B777-200 aircraft. Subject to regulatory approval, NokScoot plans to commence commercial flights in May 2015, operating services between Don Mueang Airport (DMK) and Nanking (NKG) in China, Tokyo (NRT) and Osaka (KIX) in Japan, and Seoul (ICN), Korea. What does this mean for you? • Wider network of more than 110 destinations that offers you multiple choice of flight frequencies through both Singapore and Don Mueang airports. • Seamless transfer and common service standards, including the same short connecting times for your shipments between flights operated by SIA Cargo, Scoot, SilkAir and NokScoot -- airlines within the Singapore Airlines Group. • For your convenience, SIA Cargo air waybills, including e-air waybills, are to be used on flights operated by Scoot, SilkAir and NokScoot. The operating carrier code is “MI” for SilkAir and “XW” for NokScoot. • You also have the convenience of using the same online platform such as the SIA Cargo shipment tracking service through the SIA Cargo website, www.siacargo.com , and online booking platforms such as CCN Hub and other cargo community systems to make reservations and other transactions.