Annual Report 3

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Borderless, Boundless

Borderless, boundless. 2011 Greater China outbound M&A spotlight Chinese Services Group Contents 1 Foreword 2 Executive summary 4 Methodology 5 Greater China outbound M&A activity 12 Consumer Business & Transportation M&A activity 18 Energy & Resources M&A activity 25 Global Financial Services Industry M&A activity 30 Life Science & Health Care M&A activity 34 Manufacturing M&A activity 40 Technology, Media & Telecommunications M&A activity 46 Private equity M&A activity 54 A view from the other side - a target's perspective of a cross-border M&A deal 57 The impact of the 12th Five Year Plan on outbound M&A opportunities 60 The regulatory roundup 64 Introducing the Chinese Services Group 65 Expanding around the globe… 66 Deloitte's CSG network 67 Contacts 68 Notes Foreword Barclays, IBM, Sony, Tommy Hilfiger and Volvo - all renowned, market-leading champions in their particular fields - and all owned, or partly owned, by a business headquartered in Greater China. As the list goes on, individual names become unimportant. What is of importance is the irrefutable fact that cross-border acquisitions emanating from Greater China have grown of late, not only in stature, as the above can attest to, but also in scope and breadth. The stature of deal-making in this particular market has certainly increased over time. In 2005, less than one-out-of-five (19 percent) transactions were valued at more than US$250m. Over the first six months of 2011, this proportion rose to 27 percent, with the market's growing maturity also evident from a global standpoint. -

Clean Energy Investing: Global Comparison of Investment Returns

Clean Energy Investing: Global Comparison of Investment Returns March 2021 A Joint Report by the International Energy Agency and the Centre for Climate Finance & Investment Table of Contents 03 Executive Summary 05 Introduction 08 Analytical Methods 11 Key Investment Characteristics 14 Results 14 Global Markets 18 Advanced Economies 19 Emerging Market and Developing Economies 20 China 21 Transition Companies 22 The Covid Market Shock 24 Irrational Exuberance? 26 Conclusions 29 Acknowledgments 30 Annex A – Definition of Key Terms 32 Annex B – IEA Scenarios 33 Annex C – Fama-French Five-Factor Model 34 Annex D – Fossil Fuel Portfolio 48 Annex E – Renewable Power Portfolio 2 Executive Summary To shed light on the long-term prospects for clean energy, we investigate the historical financial performance of energy companies around the world in search of broad structural trends. This is the second in a series of joint reports by the International Energy Agency and Imperial College Business School examining the risk and return proposition in energy transitions. In this paper, we extend our coverage of publicly-traded renewable power and fossil fuel companies to the following: 1) global markets, 2) advanced economies, 3) emerging market and developing economies, and 4) China. We calculate the total return and annualized volatility of these portfolios over 5 and 10-year periods. Table 1 shows the 5 and 10-year results, up to December 31, 2020. Table 1 – Summary of Key Findings Global Markets Portfolios Advanced Economies Portfolios Fossil Fuel Renewable -

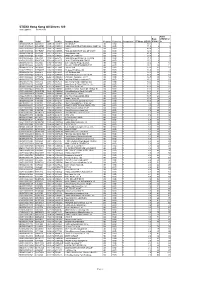

FTSE Publications

2 FTSE Russell Publications FTSE Developed Asia Pacific ex 19 August 2021 Japan ex Controversies ex CW Index Indicative Index Weight Data as at Closing on 30 June 2021 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) a2 Milk 0.1 NEW CJ Cheiljedang 0.1 KOREA GPT Group 0.22 AUSTRALIA ZEALAND CJ CheilJedang Pfd. 0.01 KOREA Green Cross 0.05 KOREA AAC Technologies Holdings 0.16 HONG KONG CJ Corp 0.04 KOREA GS Engineering & Construction 0.07 KOREA ADBRI 0.04 AUSTRALIA CJ ENM 0.05 KOREA GS Holdings 0.06 KOREA Afterpay Touch Group 0.61 AUSTRALIA CJ Logistics 0.04 KOREA GS Retail 0.04 KOREA AGL Energy 0.12 AUSTRALIA CK Asset Holdings 0.5 HONG KONG Guotai Junan International Holdings 0.01 HONG KONG AIA Group Ltd. 4.6 HONG KONG CK Hutchison Holdings 0.64 HONG KONG Haitong International Securities Group 0.02 HONG KONG Air New Zealand 0.02 NEW CK Infrastructure Holdings 0.11 HONG KONG Hana Financial Group 0.36 KOREA ZEALAND Cleanaway Waste Management 0.08 AUSTRALIA Hang Lung Group 0.07 HONG KONG ALS 0.14 AUSTRALIA CLP Holdings 0.5 HONG KONG Hang Lung Properties 0.15 HONG KONG Alteogen 0.06 KOREA Cochlear 0.37 AUSTRALIA Hang Seng Bank 0.44 HONG KONG Altium 0.09 AUSTRALIA Coles Group 0.5 AUSTRALIA Hanjin KAL 0.04 KOREA Alumina 0.1 AUSTRALIA ComfortDelGro 0.08 SINGAPORE Hankook Technology Group 0.1 KOREA Amcor CDI 0.54 AUSTRALIA Commonwealth Bank of Australia 4.07 AUSTRALIA Hanmi Pharmaceutical 0.06 KOREA AmoreG 0.05 KOREA Computershare 0.21 AUSTRALIA Hanmi Science 0.03 KOREA Amorepacific Corp 0.21 KOREA Contact Energy 0.14 NEW Hanon Systems 0.07 KOREA Amorepacific Pfd. -

Depleted Oil Field Is Window Into China's Corruption Crackdown

CHINA An $85 million deal involving three blocks in southern Sumatra and a Chinese oil giant is under investigation. Depleted oil field is window into China’s corruption crackdown BY CHARLIE ZHU, DAVID LAGUE AND FERGUS JENSEN SPECIAL REPORT 1 CHINA CORRUPTION CRACKDOWN LIMAU, INDONESIA, DECEMBER 19, 2014 n a muddy clearing in southern Sumatra, a portable diesel power plant hammers Iaway alongside a wellhead, struggling to extract crude from a depleted reservoir that lies below farmland and rubber plantations. It was much easier to extract cash from a state-owned Chinese oil giant. A subsidiary of China National Petroleum Corporation (CNPC), PetroChina Daqing Oilfield, paid $85 million to pump from three blocks in the ageing Limau field un- der a 2013 contract with Indonesia’s state- owned oil company, Pertamina, according to senior Chinese oil industry officials with knowledge of the transaction. Today, the three Limau blocks squeeze PETRO PURGE: At least a dozen former top managers at China National Petroleum Corporation have out less than three percent of the oil been arrested as part of President Xi Jinping’s anti-corruption drive. Zhou Yongkang (below), a former pumped when output peaked in the 1960s. CNPC boss and rival to Xi, faces charges of corruption and leaking state secrets. A wellhead atop the When PetroChina Daqing announced the depleted Limau field in Indonesia (cover). REUTERS/BOGDAN CRISTEL/JASON LEE/FERGUS JENSEN deal, it didn’t disclose the seller, the price or any other financial details. “We all know it is a ridiculous invest- ment, but I have no idea where the mon- ey has actually ended up,” says a senior billion Chinese oil industry official who has seen $25 The amount that CNPC spent on budget figures for the Limau wells. -

Greater China Oil & Gas M&A and Greenfield FDI Investment Spotlight

Greater China Oil & Gas M&A and greenfield FDI investment spotlight 2013 edition M&A Services 1 Contents Introduction .............................................................................................................................................................. 3 Methodology ............................................................................................................................................................. 4 Global Oil & Gas M&A and greenfield investment activity .................................................................................. 5 Greenfield Oil & Gas investment increasingly giving way to M&A activity across the globe ................................... 6 Where is this investment going? .............................................................................................................................. 6 The Greater China angle .......................................................................................................................................... 8 Foreign investments into China's Oil & Gas sector ................................................................................................. 9 Domestic investment activity in China's Oil & Gas sector ..................................................................................... 11 Greater China's Oil & Gas investments overseas ................................................................................................. 13 Looking forward – Potential deal opportunities and investment themes ....................................................... -

Asia Infrastructure, Energy and Natural Resources (IEN)

Asia Infrastructure, Energy and Natural Resources (IEN) Slaughter and May is a leading international firm with a worldwide corporate, commercial and financing practice. We provide clients with a professional service of the highest quality combining technical excellence and commercial awareness and a practical, constructive approach to legal services. We advise on the full range of matters for infrastructure, energy and natural resources clients in Asia, including projects, mergers and acquisitions, all forms of financing, competition and regulatory, tax, commercial, trading, construction, operation and maintenance contracts as well as general commercial and corporate advice. Our practice is divided into three key practice areas: – Infrastructure – rail and road; ports and airports; logistics; water and waste management. – Energy – power and renewables; oil and gas. – Mining and Minerals – coal, metals and minerals. For each regional project we draw on long‑standing relationships with leading independent law firms in Asia. This brings together individuals from the relevant countries to provide the optimum legal expertise for that particular transaction. This allows us to deliver a first class pan‑Asian and global seamless legal service of the highest quality. Recommended by clients for project agreements and ‘interfacing with government bodies’, Slaughter and May’s team is best-known for its longstanding advice to MTR on some of Hong Kong’s key infrastructure mandates. Projects and Energy – Legal 500 Asia Pacific Infrastructure – rail MTR Corporation Limited – we have advised the • Tseung Kwan O Line: The 11.9‑kilometre MTR Corporation Limited (MTR), a long‑standing Tseung Kwan O Line has 8 stations and links client of the firm and one of the Hong Kong office’s the eastern part of Hong Kong Island with the first clients, on many of its infrastructure and eastern part of Kowloon other projects, some of which are considered to be amongst the most significant projects to be • Disney Resort Line: The 3.3‑kilometre Disney undertaken in Hong Kong. -

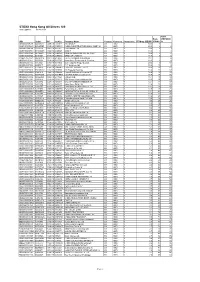

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018

STOXX Hong Kong All Shares 180 Last Updated: 03.04.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 83.1 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 71.5 2 2 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 49.4 3 3 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 42.9 4 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 41.6 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 33.3 6 7 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 31.0 7 6 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 27.1 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.2 9 10 HK0027032686 6465874 0027.HK 646587 GALAXY ENTERTAINMENT GP. HK HKD Y 20.1 10 11 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 19.0 11 12 KYG2177B1014 BYZQ077 1113.HK HK50CI CK Asset Holdings Ltd HK HKD Y 18.8 12 9 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 18.2 14 15 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 16.7 15 14 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.1 16 16 HK2388011192 6536112 2388.HK 653611 BOC Hong Kong (Holdings) Ltd. -

SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® Etfs Stock Code: 3073 Website

SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 1st October 2020 to 31st March 2021 SPDR® FTSE® Greater China ETF A Sub-Fund of the SPDR® ETFs Stock Code: 3073 Website: www.spdrs.com.hk/etf/fund/fund_detail_3073_EN.html Interim Report 2021 Contents Page Condensed Statement of Financial Position (Unaudited) 2 Condensed Statement of Comprehensive Income (Unaudited) 3 Condensed Statement of Changes in Equity (Unaudited) 4 Condensed Statement of Cash Flows (Unaudited) 5 Notes to the Unaudited Condensed Financial Statements 6 Investment Portfolio (Unaudited) 10 Statement of Movements in Portfolio Holdings (Unaudited) 41 Derivative Financial Instruments (Unaudited) 42 Performance Record (Unaudited) 42 Administration and Management 43 1 SPDR® FTSE® Greater China ETF a Sub-Fund of the SPDR® ETFs Interim Report 2021 CONDENSED STATEMENT OF FINANCIAL POSITION (UNAUDITED) As at 31st March 2021 31.03.2021 30.09.2020 Notes HK$ HK$ Assets Current assets Investments 1,385,908,557 969,438,426 Derivative financial instruments 54,331 47,229 Amounts due from brokers – 1,529,953 Dividends receivable 994,452 1,771,941 Other receivables 6(i) 122,017 347,255 Margin deposits 104,721 1,032,223 Cash at bank 6(f) 3,100,556 2,423,717 Total Assets 1,390,284,634 976,590,744 Liabilities Current liabilities Derivative financial instruments – 14 Amounts due to brokers – 1,500,560 Audit fee payable 154,612 309,225 Trustee fee payable 6(e) 382,474 270,773 Management fee payable 6(d) 684,377 481,283 Tax provision 156,265 214,282 Total Liabilities 1,377,728 2,776,137 Equity Net assets attributable to unitholders 4 1,388,906,906 973,814,607 The notes on pages 6 to 9 form part of these financial statements. -

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2017

STOXX Hong Kong All Shares 180 Last Updated: 01.08.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 80.6 1 1 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.5 2 2 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 50.8 3 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 41.3 4 4 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 32.0 5 7 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 31.8 6 5 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 31.1 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.0 8 8 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 20.6 9 10 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 20.0 10 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.0 11 11 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 18.3 12 12 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.4 13 13 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 15.4 14 16 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. -

Stoxx® Hong Kong 210 Index

BROAD INDICES 1 STOXX® HONG KONG 210 INDEX Stated objective Key facts STOXX global benchmark indices provide a broad yet liquid »Broad and liquid benchmarks for market regions and countries representation of different regions and countries. worldwide The indices are derived from their respective Total Market Index (TMI). They are weighted according to free-float market cap and » Broad number of components cover about 95% of the free-float market cap of the relevant region or country. » Serve as benchmarks for their respective regions/actively managed funds » Serve as an underlying for a variety of financial products, are used for academic research and receive wide media coverage Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX Hong Kong 210 Index 781.3 392.1 1.9 0.5 49.9 0.2 12.7 0.0 7.7 STOXX Hong Kong Total Market Index 816.2 405.0 1.4 0.4 49.9 0.1 12.3 0.0 N/A Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX Hong Kong 210 Index 0.6 12.5 19.0 57.5 93.5 7.6 18.9 18.6 15.9 13.7 STOXX Hong Kong Total Market Index 0.7 12.2 18.6 51.6 83.5 8.1 18.4 18.2 14.5 12.6 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX Hong Kong 210 Index 11.4 12.6 11.9 16.9 17.6 0.9 1.5 1.5 0.9 0.7 STOXX Hong Kong Total Market Index 11.2 12.5 11.8 16.9 18.6 1.0 1.4 1.5 0.8 0.6 Index to benchmark Correlation Tracking error (%) STOXX Hong Kong 210 Index 1.0 1.0 1.0 1.0 0.9 0.3 0.3 0.3 1.1 7.0 Index to benchmark Beta Annualized information ratio STOXX Hong Kong 210 Index 1.0 1.0 1.0 1.0 0.9 -1.8 1.7 1.5 1.1 0.1 1 For information on data calculation, please refer to STOXX calculation reference guide. -

Large Financial Buffers Seen Aiding Mega Qatar Infrastructure Projects

IMF LOAN | Page 2 MASALA ISSUE | Page 4 It’s cheap Brics bank to food or ‘hell’ sell $500mn in Egypt rupee bond Sunday, October 16, 2016 Muharram 15, 1438 AH GLOBAL VALUE: Page 20 Kia Motors rises to GULF TIMES 69th in Interbrand’s 2016 Best Global BUSINESS Brands report Large fi nancial buff ers seen aiding mega Qatar infrastructure projects By Pratap John fi cation in Qatar and will continue to ing cuts, tightening liquidity conditions, expansion. BMI Research also expects Chief Business Reporter drive the country’s GDP growth over the and widespread investor uncertainty, the GCC countries to increasingly turn next decade. BMI said. to the external bond markets for fi nanc- That said, Auberty felt that growth From 2017, it expects a notable diver- ing, in order to rebalance defi cit cover- iven Qatar’s large fi nancial buff - rates would remain well below aver- gence in growth between these states, age away from foreign exchange reserves ers, main infrastructure projects age annual growth of 13% seen between with the UAE and Qatar outperforming, while easing the pressure on domestic Gin the country will carry on, a 2005 and 2014. while Saudi Arabia will be the laggard. banks. senior analyst has said. For Qatar, huge fi nancial reserves and Nearly two years after the start of the Saudi Arabia is reportedly seeking to “As such, we do not expect Qatar to still-strong revenues from the country’s collapse in global energy prices, the eco- borrow up to $8bn from international signifi cantly draw down on its reserves gas sector will ensure continued public nomic outlook for the six GCC econo- banks before the end of the year, and we or assets,” said Raphaele Auberty, Mena sector spending ahead of the FIFA World mies has clearly deteriorated. -

Clean Energy Investing: Globla Comparison of Investment Returns

Clean Energy Investing: Global Comparison of Investment Returns March 2021 A Joint Report by the International Energy Agency and the Centre for Climate Finance & Investment Table of Contents 03 Executive Summary 05 Introduction 08 Analytical Methods 11 Key Investment Characteristics 14 Results 14 Global Markets 18 Advanced Economies 19 Emerging Market and Developing Economies 20 China 21 Transition Companies 22 The Covid Market Shock 24 Irrational Exuberance? 26 Conclusions 29 Acknowledgments 30 Annex A – Definition of Key Terms 32 Annex B – IEA Scenarios 33 Annex C – Fama-French Five-Factor Model 34 Annex D – Fossil Fuel Portfolio 48 Annex E – Renewable Power Portfolio 2 Executive Summary To shed light on the long-term prospects for clean energy, we investigate the historical financial performance of energy companies around the world in search of broad structural trends. This is the second in a series of joint reports by the International Energy Agency and Imperial College Business School examining the risk and return proposition in energy transitions. In this paper, we extend our coverage of publicly-traded renewable power and fossil fuel companies to the following: 1) global markets, 2) advanced economies, 3) emerging market and developing economies, and 4) China. We calculate the total return and annualized volatility of these portfolios over 5 and 10-year periods. Table 1 shows the 5 and 10-year results, up to December 31, 2020. Table 1 – Summary of Key Findings Global Markets Portfolios Advanced Economies Portfolios Fossil Fuel Renewable