Preferred Bank

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2008 – December

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF DECEMBER 2008 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 ACQUISITION OF CONTROL 2 CONVERSION TO STATE CHARTER 3 NEW BRANCH 3 NEW PLACE OF BUSINESS 8 NEW EXTENSION OFFICE 10 HEAD OFFICE RELOCATION 10 HEAD OFFICE REDESIGNATION 11 BRANCH OFFICE RELOCATION 11 PLACE OF BUSINESS RELOCATION 13 DISCONTINUANCE OF BRANCH OFFICE 13 DISCONTINUANCE OF PLACE OF BUSINESS 15 APPLICATION PURSUANT TO SECTION 772 16 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 16 ACQUISITION OF CONTROL 16 NEW BRANCH 17 HEAD OFFICE RELOCATION 17 DISCONTINUANCE OF BRANCH 17 DISCONTINUANCE OF PLACE OF BUSINESS 17 CHANGE OF NAME 18 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 18 ACQUISITION OF CONTROL 19 MAIN OFFICE RELOCATION 20 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 20 DISCONTINUANCE 20 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 21 CREDIT UNION APPLICATION NEW CREDIT UNION 22 MERGER 22 NEW BRANCH OF FOREIGN (OTHER STATE) CREDIT UNION 23 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 23 ACQUISITION OF CONTROL 23 VOLUNTARY SURRENDER OF LICENSE 24 1 BANK APPLICATION NEW BANK Filed: 2 Approved: 4 Opened: 1 AMERICAN CEDARS BANK 500 North Central Avenue, Glendale, Los Angeles County Correspondent: David E. Abshier LECG 550 South Hope Street, Suite 2150 Los Angeles, CA 90071 (213) 243-3700 Filed: 9/28/07 EL CAMINO BANK 20946 Devonshire Street, Chatsworth, Los Angeles County Correspondent: James H. Avery The Avery Company LLC P.O. Box 3009 San Luis Obispo, CA 93403 (805) 544-5477 Filed: 5/9/08 FORD GROUP BANK 3501 Jamboree Road, Newport Beach, Orange County Correspondent: Charles E. -

A Comparison of Korean and Chinese American Banks in California*

한국지역지리학회지 제12 권 제 1 호 (2006) 154-171 The Financial Development of Korean Americans: A Comparison of Korean and Chinese American Banks in California* Hyeon-Hyo Ahn**, Yun-Sun Chung*** 미국에서의 한인 금융: 캘리포니아에서 한국계와 중국계 은행의 비교* 안현효**․ 정연선 *** 요약:본 논문은 캘리포니아의 중국계와 한국계의 양 소수민족은행을 비교하여 한국계 민족은행과 한국계 이민사회의 경제적 관계를 해명하고자 한다. 통상 미국 내 소수민족경제권의 경제적 성과 차이는 문화적 차이 또는 비공식금융의 기여로 설명되는 경우가 많으나 우리는 공식금융제도의 적극적 역할에 주목하여 금융제도와 소수민족경제의 관련성을 강조한다.,, 동시에 한국계 미국은행은 성장 수익성 은행전략 면에서 중국계 소수민족은행과 구분된다는 점을 중시하여, 은행전략 측면에서, 중국계와 한국계가 고객과의 장기적 거래를 중시하는 유사한 관계은행전략을 구사하지만, 은행의 대출분포와 예금분포는 서로 다르다는 점을 지적하였다. 이는 각 소수민족은행이 다른 경영성과를 낳는 이유가 된다. 한국계은행의 경우 대출구조가 사업대출 중심이며, 이자 낳지 않는 예금의 비중이 중국계 민족은행보다 상대적으로 높 은 사실이 한국계 소수민족은행이 높은 성장을 하게 된 배경이다. 따라서 관계은행전략이라는 개념만으로는 다수의 소 수민족은행의 차이를 설명할 수 없으므로, 본 연구는 한국계와 중국계의 이민사회 그 자체의 특수성에 주목하였다. 중 국계 미국인의 경우 인구구성의 이질성과 해외자본의 영향이, 한국계 미국인의 경우 동질적 인구 및 사업구성과 착 한 국계 미국인 금융기관의 경쟁력이 특징적이다. 주요어:소수민족은행, 한국계 미국은행 , 중국계 미국은행 , 관계은행 Abstract :By comparing to Chinese American banks, this research shows the uniqueness of Korean American banks. This article argues that instead of the cultural attributes and/or informal financial institutions, formal financial institutions, such as the ethnic banks studied here, are responsible for the business success of Asians abroad. However, ethnic banks have different development trajectories depending on their respective ethnic communities. Korean American banks are notably different from Chinese American banks in terms of growth, profitability, and banking strategies. -

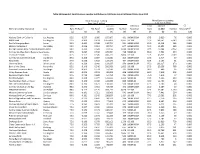

3A Expanded Small Business Lending

Table 3A Expanded. Small Business Lending Institutions in California Using Call Report Data, June 2012 Small Business Lending Micro Business Lending (less than $ million) (less than $ 100k) Total Amount Institution Total Amount CC Name of Lending Institution City Rank TA Ratio1 TBL Ratio1 (1,000) Number Asset Size Rank (1,000) Number Amount/TA1 (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) National Bank of California Los Angeles 95.0 0.537 1.000 187,467 431 100M-500M 67.5 3,020 76 0.000 BBCN Bank Los Angeles 92.5 0.309 0.424 1,557,424 9,537 1B-10B 97.5 168,741 6,149 0.000 Pacific Enterprise Bank Irvine 92.5 0.405 0.549 110,755 591 100M-500M 95.0 11,314 249 0.000 Mission Valley Bank Sun Valley 90.0 0.356 0.564 87,754 647 100M-500M 95.0 12,892 365 0.000 Borrego Springs Bank, National AssociLa Mesa 90.0 0.435 0.628 65,123 3,020 100M-500M 97.5 10,544 2,562 0.000 Community West Bank, National Asso Goleta 87.5 0.227 0.542 129,084 718 500M-1B 85.0 7,591 234 0.000 Tri Counties Bank Chico 87.5 0.173 0.545 436,723 3,804 1B-10B 97.5 43,955 2,289 0.000 Community Commerce Bank Claremont 87.5 0.358 0.687 103,416 365 100M-500M 67.5 2,717 57 0.000 Plaza Bank Irvine 87.5 0.328 0.502 127,075 484 100M-500M 52.5 2,193 61 0.000 Universal Bank West Covina 85.0 0.329 1.000 133,617 170 100M-500M 95.0 133,617 170 0.000 Bank of the Sierra Porterville 85.0 0.148 0.546 206,583 1,602 1B-10B 97.5 20,356 768 0.000 Seacoast Commerce Bank San Diego 82.5 0.363 0.574 57,144 315 100M-500M 30.0 409 16 0.000 Valley Business Bank Visalia 82.5 0.259 0.531 89,428 408 100M-500M 90.0 -

Department of Financial Institutions Summary of Pending Applications As of February 2010

DEPARTMENT OF FINANCIAL INSTITUTIONS SUMMARY OF PENDING APPLICATIONS AS OF FEBRUARY 2010 Assembly Bill 1301 (Gaines) Changes Procedures for Banking Office Applications AB 1301 (Gaines) became law on January 1, 2009. Among the changes made by the new law were to: • Reclassify banking offices as head office, branch office and facility; • Eliminate the place of business and extension of banking office categories; • Eliminate the requirement that banks give advance notice to DFI before opening or relocating a banking office, or redesignating a head office and branch office. Consequently, notice of banking offices that open, relocate or are redesignated on or after January 1, 2009 will only be published after the fact. • Eliminate the Miscellaneous Powers and Provisions chapter of the Financial Code that required banks receive approval to engage in certain activities, e.g., FC 752, FC 772, etc. APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 CONVERSION TO STATE CHARTER 1 ACQUISITION OF CONTROL 1 MERGER 2 NEW BRANCH 2 NEW FACILITY 3 HEAD OFFICE RELOCATION 4 BRANCH OFFICE RELOCATION 4 DISCONTINUANCE OF BRANCH OFFICE 5 DISCONTINUANCE OF FACILITY 7 CHANGE OF NAME 7 INDUSTRIAL BANK APPLICATION CONVERSION TO STATE CHARTER 8 ACQUISITION OF CONTROL 8 PURCHASE OF PARTIAL BUSINESS UNIT 8 NEW BRANCH 8 DISCONTINUANCE OF BRANCH 8 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 9 ACQUISITION OF CONTROL 10 HEAD OFFICE RELOCATION 11 NEW BRANCH 11 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 11 DISCONTINUANCE 12 RELOCATION 12 CHANGE OF NAME 12 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 12 CREDIT UNION APPLICATION MERGER 13 TRANSMITTER OF MONEY ABROAD APPLICATION NEW TRANSMITTER 13 ACQUISITION OF CONTROL 14 VOLUNTARY SURRENDER OF LICENSE 14 ISSUER OF PAYMENT INSTRUMENT APPLICATION NEW PAYMENT INSTRUMENT 14 ISSUER OF TRAVELERS CHECKS VOLUNTARY SURRENDER OF LICENSE 15 1 BANK APPLICATION NEW BANK Approved: 1 FIRST REPUBLIC BANK 111 Pine Street, City and County of San Francisco Correspondent: David F. -

Investing in the Future of Mission-Driven Banks a Guide to Facilitating New Partnerships PUBLISHED BY

Federal Deposit Insurance Corporation Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships PUBLISHED BY: Federal Deposit Insurance Corporation 550 17th Street, NW, Washington, D.C. 20429 877-ASK FDIC (877-275-3342) The Federal Deposit Insurance Corporation (FDIC) has taken steps to ensure that the information and data presented in this publication are accurate and current. However, the FDIC makes no express or implied warranty about such information or data, and hereby expressly disclaims all legal liability and responsibility to persons or entities that use or access this publication and its content, based on their reliance on any information or data included. The FDIC welcomes comments or suggestions about this publication or our Minority Depository Institutions (MDI) Program. Contact the MDI Program at [email protected]. When citing this publication, please use the following: Investing in the Future of Mission-Driven Banks, Federal Deposit Insurance Corporation, Washington, D.C. (October 2020), https://www.fdic.gov/mdi. Investing in the Future of Mission-Driven Banks A Guide to Facilitating New Partnerships Contents Executive Summary .......................................................................................................... 1 Overview ........................................................................................................................... 2 Minority Depository Institutions ................................................................................. 2 Community -

Main Street Flushing Queens, New York Floor Plans

NEW, MODERN, RETAIL OR CORPORATE HQ IN THE HEART OF FLUSHING MAIN STREET FLUSHING QUEENS, NEW YORK FLOOR PLANS ST 133’-5” +/- 41 ROAD Size Main Street Retail 5,000 SF st ELECTRICAL 41 Road Shops 2,634 SF ROOM ENTRANCE INTO FOOD HALL Asking Rent $350 PSF Possession 46’-6” +/- 12 Months 5,000 SF Neighbors 83’-9” Flushing Public Library, Cathay Pacific Bank, Chase Bank, CitiBank, East West Bank, Bank of America, Bank of China, HSBC, TD Bank, Bank of China, Macy’s, Starbucks, Nike, Adidas, Converse, Nordstrom Rack MAIN STREET 83’-3” +/- MAIN STREET RETAIL 41ST ROAD TR ELEV. ROO 774 S 724 S S 4 S GOLDEN TOWN FOOD HALL MAIN STREET 41ST ROAD SHOPS DEPOSITS: $278,693,000 DEPOSITS: $124,865,000 DEPOSITS: $245,718,000 LOCATED IN AN ACTIVE DEPOSITS: $353,682,000 DEPOSITS: $1,340,000,000 DEPOSITS: $1,493,185,000 RETAIL AND BANKING DEPOSITS: $406,825,000 CORRIDOR DEPOSITS: $385,477,000 DEPOSITS: $51,875,000 DEPOSITS: $275,059,000 DEPOSITS: $216,642 DEPOSITS: $179,017,000 DEPOSITS: $6,993,000 DEPOSITS: $156,821,000 DEPOSITS: $419,442,000 DEPOSITS: $68,087,000 DEPOSITS: $72,816 DEPOSITS: $474,587,000 MAIN STREET AND ROOSEVELT AVENUE FORM THE DISTRICT’S COMMERCIAL CROSSROADS, WITH A DENSE AND ECLECTIC MIX OF CULTURAL SMALL BUSINESSES, NATIONAL RETAILERS, AND FINANCIAL INSTITUTIONS 2017 TRANSPORTATION RIDERSHIP REPORT Flushing-Main Street is the Main Street in Flushing gets more The 7 train, the LIRR and 20 BUSIEST station in Queens and foot traffic than anywhere else in MTA bus routes make up the the 12th busiest in the city New York after Times Square -

Accepted Lenders with City and State-2020-12-31-14-49-16.Xlsx

Main Street Lending Program ‐ Accepted Lenders As of 2020‐12‐31 14:49:16 Eastern Standard Time/EST Lender Institution Name Lender City Lender State 1ST CONSTITUTION BANK CRANBURY NJ 1ST STATE BANK SAGINAW MI 1ST SUMMIT BANK JOHNSTOWN PA ABANCA CORP BANCARIA MIAMI BR MIAMI FL ACADEMY BANK, N.A. KANSAS CITY MO ACCESS BANK OMAHA NE ADAMS BANK & TRUST OGALLALA NE AFFILIATED BANK, NATIONAL ASSOCIATION BEDFORD TX AIMBANK LITTLEFIELD TX ALERUS FINANCIAL, NATIONAL ASSOCIATION GRAND FORKS ND ALLEGIANCE BANK HOUSTON TX ALLIANCE BANK LAKE CITY MN ALLIED FIRST BANK, SB OSWEGO IL ALMA BANK ASTORIA NY ALTAMAHA BANK AND TRUST COMPANY VIDALIA GA AMERANT BANK, NATIONAL ASSOCIATION CORAL GABLES FL AMERICAN BANK & TRUST WESSINGTON SPRINGS SD AMERICAN BANK & TRUST COMPANY INC. BOWLING GREEN KY AMERICAN BANK AND TRUST COMPANY TULSA OK AMERICAN BANK OF COMMERCE WOLFFORTH TX AMERICAN BANK, NATIONAL ASSOCIATION LE MARS IA AMERICAN BANK, NATIONAL ASSOCIATION DALLAS TX AMERICAN BUSINESS BANK LOS ANGELES CA AMERICAN EQUITY BANK MINNETONKA MN AMERICAN NATIONAL BANK OF TEXAS, THE TERRELL TX AMERICAN STATE BANK ARP TX AMERICA'S CHRISTIAN CREDIT UNION GLENDORA CA AMERIS BANK ATLANTA GA AMERISERV FINANCIAL BANK JOHNSTOWN PA ANB BANK DENVER CO ANECA FEDERAL CREDIT UNION SHREVEPORT LA APEX BANK CAMDEN TN APOLLO BANK MIAMI FL AQUESTA BANK CORNELIUS NC ARVEST BANK FAYETTEVILLE AR ASSOCIATED BANK, NATIONAL ASSOCIATION GREEN BAY WI ATLANTIC CAPITAL BANK, NATIONAL ASSOCIATION ATLANTA GA AXOS BANK SAN DIEGO CA B1BANK BATON ROUGE LA BANC OF CALIFORNIA, NATIONAL ASSOCIATION SANTA -

1 1St Bank Yuma 1St Capital Bank 1St Financial Bank USA 1St Security

1st Bank Yuma 1st Capital Bank 1st Financial Bank USA 1st Security Bank of Washington 1st Source Bank 21st Century Bank Academy Bank, National Association ACNB Bank ACS Association Adams Bank & Trust Affiliated Bank, National Association Affinity FCU Alaska USA FCU Albany Bank and Trust Company, National Association Alerus Financial, National Association Allegiance Bank Alliance Bank Alliance Community Bank Ally Bank Alpine Bank Altabank Altra FCU Alva State Bank & Trust Company Amarillo National Bank Amerant Bank, National Association Amerasia Bank American AG Credit, ACA American Bank & Trust American Bank Center American Bank of Baxter Springs American Bank of Commerce American Bank of the North American Bank, National Association American Bank, National Association American Business Bank American Community Bank & Trust American Continental Bank American Exchange Bank American Momentum Bank American National Bank American National Bank American National Bank of Minnesota American Plus Bank, National Association American River Bank American Riviera Bank American Savings Bank, FSB 1 American State Bank American State Bank America's Christian CU Ameris Bank ANB Bank Anchor State Bank Andover State Bank Aquesta Bank Arbor Bank Arcata Economic Development Corporation Arizona FCU Arkansas Capital Corporation Armstrong Bank Arvest Bank Assemblies of God CU Associated Bank, National Association Atlantic Capital Bank, National Association Atlantic Union Bank Austin Bank, Texas National Association Avid bank Avidia Bank Axos Bank BAC Community -

Eligible Financial Institutions

Eligible & Participating Financial Institutions 1199 SEIU FEDERAL CREDIT UNION 121 FINANCIAL CREDIT UNION 1880 BANK 1ST BANK 1ST BANK OF SEA ISLE CITY 1ST BERGEN FEDERAL CREDIT UNION 1ST CAMERON STATE BANK 1ST CAPITAL BANK 1ST CHOICE CREDIT UNION 1ST COLONIAL COMMUNITY BANK 1ST COMMUNITY BANK 1ST COMMUNITY FEDERAL CREDIT UNION 1ST CONSTITUTION BANK 1ST COOPERATIVE FEDERAL CREDIT UNION 1ST FINANCIAL BANK USA 1ST GATEWAY CREDIT UNION 1ST LIBERTY FEDERAL CREDIT UNION 1ST MARINER BANK 1ST MIDAMERICA CREDIT UNION 1ST NORTHERN CALIFORNIA CREDIT UNION 1ST SECURITY BANK OF WASHINGTON 1ST STATE BANK 1ST SUMMIT BANK 1ST UNITED BANK 1ST UNITED SERVICES CREDIT UNION 2 RIVERS AREA CREDIT UNION 21ST CENTURY BANK 360 FEDERAL CREDIT UNION 4FRONT CREDIT UNION 5 STAR COMMUNITY CREDIT UNION 5STAR BANK A C P E FEDERAL CREDIT UNION A.B.&W. CU. INC. A.O.D. FEDERAL CREDIT UNION AAC CREDIT UNION ABA CARD SOLUTIONS, INC. ABACUS FEDERAL SAVINGS BANK ABBEY CREDIT UNION, INC. ABBOTT LABORATORIES ECU ABBYBANK ABERDEEN FCU ABERDEEN PROVING GROUND FCU ABILENE FEDERAL CREDIT UNION ABINGTON BANK ABNB FEDERAL CREDIT UNION ABRI CREDIT UNION ACADEMY BANK, NATIONAL ASSOCIATION ACADIA FEDERAL CREDIT UNION ACADIAN FEDERAL CREDIT UNION ACADIANA MEDICAL FEDERAL CREDIT UNION ACCENTRA CREDIT UNION ACCESS BANK ACCESS CREDIT UNION ACCESS FEDERAL CREDIT UNION ACCESS NATIONAL BANK ACCESSBANK TEXAS ACME CONTINENTAL CREDIT UNION ACTORS FEDERAL CREDIT UNION ADAMS BANK AND TRUST ADIRONDACK BANK ADIRONDACK REGIONAL FCU ADMIRALS BANK ADRIAN STATE BANK ADVANCE FINANCIAL FEDERAL CREDIT UNION -

Shareholder & Client Letter for 2013 Annual Meeting

April 12, 2013 Dear Shareholders and Clients, This letter serves as announcement of our upcoming Avidbank Holdings, Inc., 2013 Annual Shareholders’ meeting as well as provides an update on our Bank’s progress after a record-setting year in 2012. The 2013 Annual Shareholders’ Meeting will take place on July 10th at 10:00 a.m. at The Sheraton Hotel in Palo Alto. A formal notice along with the Company’s Annual Report and Proxy Statement will be mailed at a later date prior to the meeting. The meeting is slightly later than in years past because our management team has been focused on a number of initiatives which we look forward to updating you on at the meeting. As discussed in last year’s annual meeting, the main objective for 2012 was to improve our “franchise value” by growing loans and deposits through greater market awareness while maintaining credit quality. Although we still have a lot of hard work to do, we are pleased to report that we have met most of our objectives. Below are some of the financial highlights from 2012 as discussed in our earnings release on March 12, 2013. • Pre-tax income grew by 47% to $4,800,000 • Loans grew by 19% to $247,000,000 • Deposits grew by 22% to $375,000,000 • Total Assets grew by 21% to $416,000,000 • Our positive Net Income increased book value per share by 15% to $12.19 • Avidbank was awarded The Findley Reports highest ranking as a “Super Premier Performing” Bank for the second year in a row. -

January 2016

DEPARTMENT OF BUSINESS OVERSIGHT SUMMARY OF PENDING APPLICATIONS AS OF JANUARY 2016 APPLICATION TYPE PAGE NO. BANK APPLICATION NEW BANK 1 MERGER 1 CONVERSION TO STATE CHARTER 2 ACQUISITION OF CONTROL 2 PURCHASE OF PARTIAL BUSINESS UNIT 3 NEW BRANCH 3 NEW FACILITY 3 HEAD OFFICE RELOCATION 4 BRANCH RELOCATION 4 FACILITY RELOCATION 5 DISCONTINUANCE OF BRANCH OFFICE 5 DISCONTINUANCE OF FACILITY 7 PREMIUM FINANCE COMPANY APPLICATION NEW PREMIUM FINANCE COMPANY 7 ACQUISITION OF CONTROL 8 TRUST COMPANY APPLICATION SALE OF PARTIAL BUSINESS UNIT 8 FOREIGN (OTHER NATION) BANK APPLICATION NEW OFFICE 8 DISCONTINUANCE OF OFFICE 9 CHANGE OF NAME 9 FOREIGN (OTHER STATE) BANK APPLICATION NEW FACILITY 9 CREDIT UNION APPLICATION MERGER 10 CONVERSION TO STATE CHARTER 10 MONEY TRANSMITTER APPLICATION NEW TRANSMITTER 11 ACQUISITION OF CONTROL 12 1 BANK APPLICATION NEW BANK Approved: 1 CORE COMMERCIAL BANK 4490 Von Karman Avenue, Newport Beach, Orange County Correspondent: James B. Jones Carpenter & Company 5 Park Plaza, Suite 950, Irvine, CA 92614 949-281-8888 Filed: 7/1/15 Approved: 11/18/15 MERGER Filed: 2 Approved: 1 Effected: 4 BANK OF SANTA BARBARA, THE, Santa Barbara, to merge with and into AMERICAN RIVIERA BANK, Santa Barbara Filed: 8/31/15 Approved: 12/15/15 Effected: 01/01/16 CALIFORNIA BANK & TRUST, San Diego, to merge with and into ZB, NA, Salt Lake City, Utah Effected: 12/31/15 COUNTY COMMERCE BANK, Ventura, to merge with and into CITIZENS BUSINESS BANK, Ontario Filed: 11/13/15 Approved: 01/06/16 FIRST MOUNTAIN BANK, Big Bear Lake, to merge with -

APPROVED BANKING INSTITUTIONS for ATTORNEY FIDUCIARY ACCOUNTS (Pursuant to 22 NYCRR Rule 1.15 (B)(1), Part 1300) *September 2021

The New York Lawyers’ Fund for Client Protection 119 Washington Avenue Albany, New York 12210 800-442-FUND APPROVED BANKING INSTITUTIONS FOR ATTORNEY FIDUCIARY ACCOUNTS (Pursuant to 22 NYCRR Rule 1.15 (b)(1), Part 1300) *September 2021 Please note, effective on April 1, 2021, the Administrative Board of the Courts approved rule changes proposed by the Lawyers' Fund which have expanded New York's Dishonored Check Notice Reporting Rule to include reporting of overdrafts on all attorney trust, special and escrow accounts. The new rules also prohibit attorneys from carrying overdraft protection on attorney trust, special and escrow accounts. To remain approved, banking institutions must update their written agreements with the Lawyers’ Fund to include overdraft reporting. Attorneys continuing to use these banking institutions should confirm with the banking institution that it has updated its written agreement to provide notice of dishonored/overdraft checks to the Lawyers’ Fund. Abacus Federal Savings Bank** Bank of Richmondville** ABN-AMRO, Bank N.V. Bank OZK (AR)** Access Federal Credit Union** Bank of Utica** Adirondack Trust Company** Bank on Buffalo (div. of CNB Bank)** Adirondack Bank, N.A.** Bank United, N.A. Alden State Bank ** Berkshire Bank** ALMA Bank ** Bethpage FCU** BNY Mellon, N.A. (PA) Alpine Capital Bank** Boston Safe Deposit & Trust Company (MA) Alternatives Federal Credit Union** Bridgehampton National Bank (BNB) Amalgamated Bank of New York Brooklyn Cooperative Federal Credit Union** Amerasia Bank** Brown Brothers Harriman & Co. American Community Bank** Canandaigua National Bank & Trust Co.** AmeriCU Federal Credit Union** Capital Communications, FCU Apple Bank for Savings ** Capital One Bank, N.A.** Ballston Spa National Bank Carthage Federal Savings Bank** Bank Hapoalim B.M.