China and the West Competing Over Infrastructure in Southeast Asia David Dollar

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Physical Geography of Southeast Asia

Physical Geography of SE Asia ©2012, TESCCC World Geography Unit 12, Lesson 01 Archipelago • A group of islands. Cordilleras • Parallel mountain ranges and plateaus, that extend into the Indochina Peninsula. Living on the Mainland • Mainland countries include Myanmar, Thailand, Cambodia, Vietnam, and Laos • Laos is a landlocked country • The landscape is characterized by mountains, rivers, river deltas, and plains • The climate includes tropical and mild • The monsoon creates a dry and rainy season ©2012, TESCCC Identify the mainland countries on your map. LAOS VIETNAM MYANMAR THAILAND CAMBODIA Human Settlement on the Mainland • People rely on the rivers that begin in the mountains as a source of water for drinking, transportation, and irrigation • Many people live in small villages • The river deltas create dense population centers • River create rich deposits of sediment that settle along central plains ©2012, TESCCC Major Cities on the Mainland • Myanmar- Yangon (Rangoon), Mandalay • Thailand- Bangkok • Vietnam- Hanoi, Ho Chi Minh City (Saigon) • Cambodia- Phnom Penh ©2012, TESCCC Label the major cities on your map BANGKOK YANGON HO CHI MINH CITY PHNOM PEHN Chao Phraya River • Flows into the Gulf of Thailand, Bangkok is located along the river’s delta Irrawaddy River • Located in Myanmar, Rangoon located along the river Mekong River • Longest river in the region, forms part of the borders of Myanmar, Laos, and Thailand, empties into the South China Sea in Vietnam Label the important rivers and the bodies of water on your map. MEKONG IRRAWADDY CHAO PRAYA ©2012, TESCCC Living on the Islands • The island nations are fragmented • Nations are on islands are made up of island groups. -

China-Southeast Asia Relations: Trends, Issues, and Implications for the United States

Order Code RL32688 CRS Report for Congress Received through the CRS Web China-Southeast Asia Relations: Trends, Issues, and Implications for the United States Updated April 4, 2006 Bruce Vaughn (Coordinator) Analyst in Southeast and South Asian Affairs Foreign Affairs, Defense, and Trade Division Wayne M. Morrison Specialist in International Trade and Finance Foreign Affairs, Defense, and Trade Division Congressional Research Service ˜ The Library of Congress China-Southeast Asia Relations: Trends, Issues, and Implications for the United States Summary Southeast Asia has been considered by some to be a region of relatively low priority in U.S. foreign and security policy. The war against terror has changed that and brought renewed U.S. attention to Southeast Asia, especially to countries afflicted by Islamic radicalism. To some, this renewed focus, driven by the war against terror, has come at the expense of attention to other key regional issues such as China’s rapidly expanding engagement with the region. Some fear that rising Chinese influence in Southeast Asia has come at the expense of U.S. ties with the region, while others view Beijing’s increasing regional influence as largely a natural consequence of China’s economic dynamism. China’s developing relationship with Southeast Asia is undergoing a significant shift. This will likely have implications for United States’ interests in the region. While the United States has been focused on Iraq and Afghanistan, China has been evolving its external engagement with its neighbors, particularly in Southeast Asia. In the 1990s, China was perceived as a threat to its Southeast Asian neighbors in part due to its conflicting territorial claims over the South China Sea and past support of communist insurgency. -

Earth Moves U.S

Earth moves U.S. GOVERNMENTWORLD ™ GEOGRAPHYHISTORY from the Esri GeoInquiries collection for World Geography Target audience – World geography learners Time required – 15 minutes Activity Examine seismic and volcanic activity patterns around the world relative to tectonic plate boundaries, physical features on the earth’s surface, and cities at risk. World Geography C3:D2.Geo.1.6-8. Construct maps to represent and explain the spatial patterns of cultural Standards and environmental characteristics. Learning Outcomes • Locate zones of significant seismic or volcanic activity. • Describe the relationship between zones of high seismic or volcanic activity and tectonic plate boundaries. Map URL: http://esriurl.com/worldGeoInquiry3 Ask Where are global earthquakes located? ʅ Click the link above to launch the map. ʅ Examine the yellow dots on the map that represent earthquakes with a magnitude of 5.7+. ? What patterns do you see on the map? [Answers will vary. Many earthquakes occur on the western coast of North and South America, along the eastern coast of Asia, and along the islands of the Pacific Rim. The pattern follows the Ring of Fire. Earthquakes occur in the Atlantic and Indian Oceans.] Acquire Where are the largest earthquakes on Earth? ʅ With the Details button depressed, click the button, Show Contents. ʅ Click the Earthquakes Magnitude 5.7+ layer name, and then click the Show Table button. – Each record in this table represents one point on the map. ʅ Click the Magnitude column heading (field) and choose Sort Descending. ʅ Highlight the first 20 records (highest magnitude earthquakes). (See the Select Features in a Table ToolTip on the next page for details.) ? Where are the blue highlighted high-magnitude earthquakes located on the map? [Mostly in the Ring of Fire, Southeast Asia, and west coast of South America] Explore Where are the active volcanoes on Earth? ʅ In the top-right corner of the table, click the X to close the table. -

Media Advisory: Reminder to RSVP

REMINDER TO RSVP BEFORE MARCH 14, 2019 4th Annual Meeting of New Development Bank in Cape Town, South Africa Media are invited to attend the Fourth Annual Meeting of the New Development Bank (NDB) in Cape Town, South Africa. The theme is “Partnership for Sustainable Development,” recognising the importance of strengthening collective efforts and partnerships to bridge the infrastructure gap and addressing the development needs of the Bank’s member countries and other emerging markets and developing countries. The 4th Annual Meeting will bring together senior government officials from BRICS countries, leaders of multilateral and national development institutions, distinguished scholars, prominent commercial bankers, captains of industry, legal experts and representatives of civil society organizations. The meeting will present an excellent opportunity to reflect on the global development agenda and the role that the NDB could play in financing infrastructure and sustainable development. Media are invited as follows: Date: April 1-2, 2019 Venue: Cape Town International Convention Centre (CTICC) Convention Square, 1 Lower Long Street, Cape Town, South Africa Journalists who wish to attend the Annual Meeting are kindly invited to rsvp to [email protected] and [email protected] before March 14, 2019. Registration is essential, as media houses will not be granted access to the venue without prior screening. The closing date for registration is close of business, 18 March 2019. Registered and accredited media may start collecting their name badges from March 30, 2019 at the registration desk at CTICC 2. Please bring a form of identification, either an ID or a Passport as well as your media accreditation cards. -

Remapping Global Economic Governance: Rising Powers and Global Development Finance

Global Development Policy Center GEGI POLICY BRIEF 004• 10/2017 GLOBAL ECONOMIC GOVERNANCE INITIATIVE Remapping Global Economic Governance: Rising Powers and Global Development Finance Kevin P. Gallagher is KEVIN P. GALLAGHER AND WILLIAM N. KRING Professor of Global Development Policy at Boston University’s ABSTRACT Pardee School of Global The landscape of the global financial architecture has changed significantly in the ten years since the Studies and directs the Global global financial crisis. Over the past decade, the scale of financing available for short-term liquidity Development Policy Center. needs has increased more than threefold and the scale of development finance has roughly doubled. His latest books are The China According to data we compiled for this policy brief, there is now more than $15 trillion in short-term Triangle: Latin America’s liquidity assistance available in the world economy and $6 trillion in development finance. Perhaps China Boom and the Fate of most significant is the fact that the vast majority of this growth—63 percent of the growth in liquid- the Washington Consensus ity finance and over 90 percent of the growth in development finance—has come from contributions and Ruling Capital: Emerging by emerging market and developing countries (EMDs). Sixty-three percent of all liquidity finance is Markets and the Reregulation housed with the EMDs, and 80 percent of all development bank finance. What is more, more than of Cross-Border Finance. three quarters of this finance is national—in the form of currency reserves and national development William N. Kring is Assistant banks. Director and Research Fellow at the Global Development Policy This new financing brings real benefits to an architecture that has long been under stress, especially Center. -

The Hawaiian Islands Case Study Robert F

FEATURE Origin of Horticulture in Southeast Asia and the Dispersal of Domesticated Plants to the Pacific Islands by Polynesian Voyagers: The Hawaiian Islands Case Study Robert F. Bevacqua1 Honolulu Botanical Gardens, 50 North Vineyard Boulevard, Honolulu, HI 96817 In the islands of Southeast Asia, following the valleys of the Euphrates, Tigris, and Nile tuber, and fruit crops, such as taro, yams, the Pleistocene or Ice ages, the ancestors of the rivers—and that the first horticultural crops banana, and breadfruit. Polynesians began voyages of exploration into were figs, dates, grapes, olives, lettuce, on- Chang (1976) speculates that the first hor- the Pacific Ocean (Fig. 1) that resulted in the ions, cucumbers, and melons (Halfacre and ticulturists were fishers and gatherers who settlement of the Hawaiian Islands in A.D. 300 Barden, 1979; Janick, 1979). The Greek, Ro- inhabited estuaries in tropical Southeast Asia. (Bellwood, 1987; Finney, 1979; Irwin, 1992; man, and European civilizations refined plant They lived sedentary lives and had mastered Jennings, 1979; Kirch, 1985). These skilled cultivation until it evolved into the discipline the use of canoes. The surrounding terrestrial mariners were also expert horticulturists, who we recognize as horticulture today (Halfacre environment contained a diverse flora that carried aboard their canoes many domesti- and Barden, 1979; Janick, 1979). enabled the fishers to become intimately fa- cated plants that would have a dramatic impact An opposing view associates the begin- miliar with a wide range of plant resources. on the natural environment of the Hawaiian ning of horticulture with early Chinese civili- The first plants to be domesticated were not Islands and other areas of the world. -

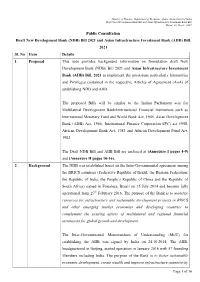

(NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl

Ministry of Finance, Department of Economic Affairs, Government of India Draft New Development Bank Bill and Asian Infrastructure Investment Bank Bill Dated- 04-March- 2021 Public Consultation Draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl. No Item Details 1 Proposal This note provides background information on formulation draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 to implement the provisions particularly Immunities and Privileges contained in the respective Articles of Agreement (AoA) of establishing NDB and AIIB. The proposed Bills will be similar to the Indian Parliament acts for Multilateral Development Bank/International Financial Institutions such as International Monetary Fund and World Bank Act, 1945, Asian Development Bank (ADB) Act, 1966, International Finance Corporation (IFC) act 1958, African Development Bank Act, 1983 and African Development Fund Act, 1982. The Draft NDB Bill and AIIB Bill are enclosed at (Annexure I pages 4-9) and (Annexure II pages 10-16). 2 Background The NDB was established based on the Inter-Governmental agreement among the BRICS countries (Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa) signed in Fortaleza, Brazil on 15 July 2014 and became fully operational from 27th February 2016. The purpose of the Bank is to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging market economies and developing countries to complement the existing efforts of multilateral and regional financial institutions for global growth and development. The Inter-Governmental Memorandum of Understanding (MoU) for establishing the AIIB was signed by India on 24.10.2014. -

Agreement on the New Development Bank – Fortaleza, July 15

Agreement on the New Development Bank – Fortaleza, July 15 Agreement on the New Development Bank The Governments of the Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa, collectively the BRICS countries, RECALLING the decision taken in the fourth BRICS Summit in New Delhi in 2012 and subsequently announced in the fifth BRICS Summit in Durban in 2013 to establish a development bank; RECOGNIZING the work undertaken by the respective finance ministries; CONVINCED that the establishment of such a Bank would reflect the close relations among the BRICS countries, while providing a powerful instrument for increasing their economic cooperation; MINDFUL of a context where emerging market economies and developing countries continue to face significant financing constraints to address infrastructure gaps and sustainable development needs; Have agreed on the establishment of the New Development Bank (NDB), hereinafter referred to as the Bank, which shall operate in accordance with the provisions of the annexed Articles of Agreement, that constitute an integral part of this Agreement. Article 1 Purpose and Functions The Bank shall mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies and developing countries, complementing the existing efforts of multilateral and regional financial institutions for global growth and development. To fulfill its purpose, the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments. It shall also cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank. -

New South–South Co-Operation and the Brics New Development Bank

NEW SOUTH–SOUTH CO-OPERATION AND THE BRICS NEW DEVELOPMENT BANK BY ZHU JIEJIN INTRODUCTION The establishment of the BRICS New Development Bank (NDB) marks a milestone in BRICS co- operation and is a symbolic achievement in the reform of global financial governance. It will help to promote the financing of infrastructure among developing countries, improve global governance and propel the revival of the global economy. From China’s perspective, the NDB will be the first international financial organisation to be headquartered in China and will help promote China’s influence in the international development system while raising its profile as a responsible power. At present, there are a number of misperceptions surrounding the role of the NDB. Some mistakenly view it as an institution whose objective is to challenge the post-Second World War international economic order, reverse the Bretton Wood System, overturn the US’ finance hegemony, and eventually plunge global finance governance into chaos. Rather, as the first international development finance institution proposed by several developing great powers since the Second World War, the foundation and strategic positioning of the NDB lies in new South–South co-operation. Its purpose is to act as an innovate international financing mechanism to better serve the needs of developing countries in terms of infrastructure and sustainable development, rather than challenging or replacing the existing multilateral development institutions. WHY ESTABLISH THE NDB? Developing countries face enormous investment and financing gaps to fund infrastructure development. These have only worsened since the global financial crisis in 2008. The failure by the multilateral development banks controlled by developed countries to make up the gap prompted BRICS to establish a new development bank. -

Multilateral Development Banks: Overview and Issues for Congress

Multilateral Development Banks: Overview and Issues for Congress Updated February 11, 2020 Congressional Research Service https://crsreports.congress.gov R41170 Multilateral Development Banks: Overview and Issues for Congress Summary Multilateral development banks (MDBs) provide financial assistance to developing countries in order to promote economic and social development. The United States is a member, and donor, to five major MDBs: the World Bank and four regional development banks, including the African Development Bank, the Asian Development Bank, the European Bank for Reconstruction and Development, and the Inter-American Development Bank. The MDBs primarily fund large infrastructure and other development projects and provide loans tied to policy reforms by the government. The MDBs provide non-concessional financial assistance to middle-income countries and some creditworthy low-income countries on market- based terms. They also provide concessional assistance, including grants and loans at below- market rate interest rates, to low-income countries. The Role of Congress in U.S. Policy at the MDBs Congress plays a critical role in U.S. participation in the MDBs through funding and oversight. Congressional legislation is required for the United States to make financial contributions to the banks. Appropriations for the concessional windows occur regularly, while appropriations for the non-concessional windows are less frequent. Congress exercises oversight over U.S. participation in the MDBs, managed by the Treasury Department, through confirmations of U.S. representatives at the MDBs, hearings, and legislative mandates. For example, legislative mandates direct the U.S. Executive Directors to the MDBs to advocate certain policies and how to vote on various issues at the MDBs. -

Evaluating Morphoscopic Trait Frequencies of Southeast Asians and Pacific Islanders

University of Montana ScholarWorks at University of Montana Graduate Student Theses, Dissertations, & Professional Papers Graduate School 2014 Evaluating Morphoscopic Trait Frequencies of Southeast Asians and Pacific Islanders Melody Dawn Ratliff The University of Montana Follow this and additional works at: https://scholarworks.umt.edu/etd Let us know how access to this document benefits ou.y Recommended Citation Ratliff, Melody Dawn, "Evaluating Morphoscopic Trait Frequencies of Southeast Asians and Pacific Islanders" (2014). Graduate Student Theses, Dissertations, & Professional Papers. 4275. https://scholarworks.umt.edu/etd/4275 This Thesis is brought to you for free and open access by the Graduate School at ScholarWorks at University of Montana. It has been accepted for inclusion in Graduate Student Theses, Dissertations, & Professional Papers by an authorized administrator of ScholarWorks at University of Montana. For more information, please contact [email protected]. EVALUTATING MORPHOSCOPIC TRAIT FREQUENCIES OF SOUTHEAST ASIANS AND PACIFIC ISLANDERS By MELODY DAWN RATLIFF Bachelor of Arts, University of Tennessee, Knoxville, TN 2012 Master’s Thesis Presented in partial fulfillment of the requirements for the degree of Master of Arts in Anthropology The University of Montana Missoula, MT May 2014 Approved by: Sandy Ross, Dean of The Graduate School Graduate School Randall R. Skelton, Ph.D., Chair Department of Anthropology Ashley H. McKeown, Ph.D., Co-Chair Department of Anthropology Jeffrey M. Good, Ph.D., Co-Chair Division of Biological Sciences Joseph T. Hefner, Ph.D., D-ABFA Co-Chair JPAC-CIL, Hickam AFB, HI COPYRIGHT by Melody Dawn Ratliff 2014 All Rights Reserved ii Ratliff, Melody, M.A., May 2014 Anthropology Evaluating Morphoscopic Trait Frequencies of Southeast Asians and Pacific Islanders Chairperson: Randall Skelton, Ph.D. -

The New Development Bank Request for Proposal (This Is Not a Purchase

The New Development Bank Request for Proposal (This is not a Purchase Order) 1. Introduction The New Development Bank (NDB) is issuing a Request for Proposal (RFP) to invite qualified suppliers to provide proposals to NDB’s S-AD-2019-00160 Outsourcing Administrative support project. Please refer to the following information or attached TOR (Service Scope) for detailed requirements. Those interested and qualified companies please register into NDB’s e-procurement system to be NDB’s registered suppliers and participate in the bidding process (please be noted the contact information provided in registration especially email address must be correct as all communications regarding the bid including RFP distribution and award notice will be sent through it). NDB will choose the most suitable one(s) from the shortlisted suppliers. NDB at its sole discretion reserves the right to reject all proposals in accordance with its internal policy and guidelines. 2. RFP Schedule Please be noted the following activities could take place in the RFP process. NDB will inform the specific arrangements in advance and the suppliers are requested to respond timely. Activity Date Distribution of RFP March, 6 ,c2020 Deadline for Questions March, 26, 2020 Proposal Response Due March 27, 2020 Negotiation on contract Tbc Signing Contract tbc Project Kick Off tbc 3. Instruction to bidders 3.1 Contact Information Please use the following contact information for all correspondence with NDB concerning this RFP. Suppliers who solicit information about this RFP either directly or indirectly from other sources will be disqualified. Mr. Ivan Nepeivoda Address: 33rd Floor, BRICS Tower, No. 333, Lujiazui Ring Road, Pudong, Shanghai 上海浦东陆家嘴环路 333 号,金砖大厦 33 层 Email: [email protected] 3.2 Submission of Proposals Proposals shall be prepared in English.