Paradigm Shift Or Rehashing Corporate-Led Development?

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

23 JANUARY 2021, SATURDAY ✓ Headline STRATEGIC January 23, 2021 COMMUNICATION & Editorial Date INITIATIVES Column SERVICE 1 of 2 Opinion Page Feature Article

23 JANUARY 2021, SATURDAY ✓ Headline STRATEGIC January 23, 2021 COMMUNICATION & Editorial Date INITIATIVES Column SERVICE 1 of 2 Opinion Page Feature Article DENR magbibigay ng technical assistance sa Tawi-Tawi Tumbagaan Island mine rehab January 22, 2021 @ 7:01 PM 12 hours ago Manila, Philippines – Tiniyak ng Department of Environment and Natural Resources (DENR) na handa itong magbigay ng tulong para sa rehabilitasyon ng mined-out site ng Tumbagaan island sa Tawi-Tawi sa naturang lalawigan na kinasasakupan ng Bangsamoro Autonomous Region in Muslim Mindanao (BARMM). Ayon kay Undersecretary for Enforcement, Mining and Muslim Affairs Jim O. Sampulna kahit na ang Tawi-Tawi ay hindi nasa ilalim ng hurisdiksyon ng DENR’s ang ahensya ay nakahandang tumulong sa BARMM’s Ministry of Environment Natural Resources, and Energy (MENRE) para sa kanilang environment inisyatiba. Sinabi pa ni Sampulna na inatasan siya ni DENR Secretary Roy A. Cimatu na maghanda sakaling ang BARMM government ay hihingi ng tulong. “If they will seek technical assistance, we are willing to extend expertise, not just in mining but in all other aspects that BARMM needs such as in lands, forestry, biodiversity, and environment,” ani Sampulna. Nilinaw pa ni Sampulna na ang DENR ay walang awtoridad para magsagawa ng mining operation sa Tawi-Tawi kasunod ng panawagan ng publiko sa DENR na umaksyon sa kautusan ni President Rodrigo Roa Duterte para sa agarang pagpapahinto ng mining activities sa Tambagaan island. “However, the DENR fully supports the order of the President to suspend the mining operations in the said area for its rehabilitation.” “BARMM is now conducting an investigation on the site to fast track the rehabilitation,” sinabi pa ni Sampulna. -

Download Article

Advances in Social Science, Education and Humanities Research, volume 478 Proceedings of the 2nd Tarumanagara International Conference on the Applications of Social Sciences and Humanities (TICASH 2020) The Role of Social Media and Youth Participation in Developing Local Tourism (Case Study On Generasi Pesona Indonesia Lombok) Septia Winduwati*, Universitas Tarumanagara, Indonesia Cahaya Rizka Putri, Kyoto University, Japan *[email protected] ABSTRACT Tourism is a potential industry to be developed, especially in Indonesia, which is rich in cultural diversity and natural biodiversity. Lombok is one of the priority developments in the tourism industry that has evolved over the past five years. The participation of young people in Lombok raised in the form of a volunteer community called GENPI which was first initiated by the youth of the Lombok Sumbawa volunteer community and used social media to disseminate Lombok Tourism. This research focuses on how GenPi develops effective tourism communication strategies through social media. By using the concept of community participation and social media, this research used a descriptive qualitative approach and conducted an in-depth interview as a data collection method. As a result, well-planned communication strategies and uses of social media help develop local tourism. Networking online and offline are essentials to disseminate excellence in the tourism area. Keywords: participation, youth, tourism, social media, GenPi 1. INTRODUCTION in the Top 5 Muslim Friendly Destination as shown in the Halal Tourism Indonesia website; a website managed by Secretariat of According to the Explanation of the Ministry of Halal Tourism who works under the Ministry of Tourism. By the Tourism of the Republic of Indonesia, the 6th KIDi Presentation position it has obtained and also considering its stage of in 2016, the tourism sector is projected to be the most significant development, which arguably fills with many challenges, this profit source in the year 2020. -

Dampak Pembangunan Kawasan Ekonomi Khusus Terhadap Kesejahteraan Masyarakat Di Desa Kuta Pujut Lombok Tengah Nusa Tenggara Barat

DAMPAK PEMBANGUNAN KAWASAN EKONOMI KHUSUS TERHADAP KESEJAHTERAAN MASYARAKAT DI DESA KUTA PUJUT LOMBOK TENGAH NUSA TENGGARA BARAT SKRIPSI Diajukan Kepada Fakultas Dakwah dan Komunikasi Universitas Islam Negeri Sunan Kalijaga Yogyakarta Untuk memenuhi Sebagai Syarat-syarat Memperoleh Gelar Sarjana Strata I Oleh: LALU MUHAMMAD RIDHO FIRMANSYAH NIM: 15250019 Pembimbing: Dr. H. Zainudin, M.Ag. NIP. 19660827 199903 1 001 PRODI ILMU KESEJAHTERAAN SOSIAL FAKULTAS DAKWAH DAN KOMUNIKASI UNIVERSITAS ISLAM NEGERI SUNAN KALIJAGA YOGYAKARTA 2019 i ii iii iv HALAMAN PERSEMBAHAN Skripsi ini saya persembahkan kepada: Ibu dan Ayah tercinta. Keluarga besarku tercinta, dan seluruh sahabat-sahabat yang selalu memberikan motivasi. v MOTTO “Hidup adalah perjalanan yang sangat mengesankan, jadi jangan sampai tersesat!!!!” (Lalu Muhammad Ridho Firmansyah) “Pendidikan merupakan perlengkapan paling baik untuk hari tua” (Aristoteles) vi KATA PENGANTAR Puji syukur penulis panjatkan kehadirat Allah SWT atas segala rahmat dan hidayah-Nya, sehingga penulis dapat menyelesaikan penyusunan skripsi dengan judul “Dampak Sosial Pembangunan Kawasan Ekonomi Khusus Terhadap Masyarakat di Desa Kuta Pujut Lombok Tengah Nusa Tenggara Barat”. Penulis dapat menyelesaikan skripsi ini dengan baik, sebagai tugas akhir dalam mencapai gelar sarjana strata satu di Jurusan Ilmu Kesejahteraan Sosial Fakultas Dakwah dan Komunikasi Universitas Islam Negeri Sunan Kalijaga Yogyakarta. Segala upaya untuk menjadikan skripsi ini mendekati sempurna telah penulis lakukan, namun karena keterbatasan yang dimiliki penulis maka akan dijumpai kekurangan baik dalam segi penulisan maupun segi ilmiah. Adapun terselesaikannya skripsi ini tentu tidak akan berhasil dengan baik tanpa ada dukungan dari berbagai pihak. Oleh sebab itu, penulis menyampaikan ucapan terimakasih dan penghargaan yang setinggi-tingginya kepada semua pihak yang telah membantu penyusunan skripsi ini terutama kepada: 1. -

Inventarisasi Bahan Galian Logam Di Kab. Malang Dan Kab. Lumajang Dan Eksplorasi Lanjutan Mineralisasi Logam Di Daerah Tempursari (Kab

INVENTARISASI BAHAN GALIAN LOGAM DI KAB. MALANG DAN KAB. LUMAJANG DAN EKSPLORASI LANJUTAN MINERALISASI LOGAM DI DAERAH TEMPURSARI (KAB. LUMAJANG), SEWEDEN (KAB. BLITAR) DAN SUREN LOR (KAB. TRENGGALEK), PROV. JAWA TIMUR Oleh: Wahyu Widodo SUBDIT. MINERAL LOGAM ABSTRACT The Inventory and evaluation of metallic mineral deposits in Pacitan, Ponorogo, Trenggalek, Tulungagung and Blitar districts during the year 2002 were continuously done in Malang and Lumajang districts during the years 2003, accompanied by the Technical Cooperation Work between DMR and JICA/MMAJ within Wilayah Penugasan DJGSM in the scheme of follow-up geology and geochemical explorations in Cu-geochemical anomalous area based on of previous survey result, in Tempursari (Lumajang), Seweden (Blitar and Suren Lor (Trenggalek). The inventory of metallic mineral deposits in Malang and Lumajang districts in order to complete Mineral Resources Data Base were not satisfied. as lack of metallic mineral resource data in both districts. It is only provided as the potency and beneficiation of the mineral resources. The follow-up exploration in Purwoharjo area didn’t show any evident of correlation between the geology and geochemical anomalous of copper mineralization. In Tempursari area (Lumajang) copper mineralization was found to form malachite in strong argillite with fine disseminated pyrite and silicified-stockwork within altered old andesitic rock (Mandalika Fm.) in the right tributary of upper stream of K. Ngrawan. In Seweden area (Blitar) copper mineralization and hydrothermal alteration zone (strong silicified and argilitized) widely spread around K. Putih area. In Suren Lor area (Trenggalek) sphalerite and galena in quartz veins were found in K. Semurup and K. Beloran. -

Media Advisory: Reminder to RSVP

REMINDER TO RSVP BEFORE MARCH 14, 2019 4th Annual Meeting of New Development Bank in Cape Town, South Africa Media are invited to attend the Fourth Annual Meeting of the New Development Bank (NDB) in Cape Town, South Africa. The theme is “Partnership for Sustainable Development,” recognising the importance of strengthening collective efforts and partnerships to bridge the infrastructure gap and addressing the development needs of the Bank’s member countries and other emerging markets and developing countries. The 4th Annual Meeting will bring together senior government officials from BRICS countries, leaders of multilateral and national development institutions, distinguished scholars, prominent commercial bankers, captains of industry, legal experts and representatives of civil society organizations. The meeting will present an excellent opportunity to reflect on the global development agenda and the role that the NDB could play in financing infrastructure and sustainable development. Media are invited as follows: Date: April 1-2, 2019 Venue: Cape Town International Convention Centre (CTICC) Convention Square, 1 Lower Long Street, Cape Town, South Africa Journalists who wish to attend the Annual Meeting are kindly invited to rsvp to [email protected] and [email protected] before March 14, 2019. Registration is essential, as media houses will not be granted access to the venue without prior screening. The closing date for registration is close of business, 18 March 2019. Registered and accredited media may start collecting their name badges from March 30, 2019 at the registration desk at CTICC 2. Please bring a form of identification, either an ID or a Passport as well as your media accreditation cards. -

Remapping Global Economic Governance: Rising Powers and Global Development Finance

Global Development Policy Center GEGI POLICY BRIEF 004• 10/2017 GLOBAL ECONOMIC GOVERNANCE INITIATIVE Remapping Global Economic Governance: Rising Powers and Global Development Finance Kevin P. Gallagher is KEVIN P. GALLAGHER AND WILLIAM N. KRING Professor of Global Development Policy at Boston University’s ABSTRACT Pardee School of Global The landscape of the global financial architecture has changed significantly in the ten years since the Studies and directs the Global global financial crisis. Over the past decade, the scale of financing available for short-term liquidity Development Policy Center. needs has increased more than threefold and the scale of development finance has roughly doubled. His latest books are The China According to data we compiled for this policy brief, there is now more than $15 trillion in short-term Triangle: Latin America’s liquidity assistance available in the world economy and $6 trillion in development finance. Perhaps China Boom and the Fate of most significant is the fact that the vast majority of this growth—63 percent of the growth in liquid- the Washington Consensus ity finance and over 90 percent of the growth in development finance—has come from contributions and Ruling Capital: Emerging by emerging market and developing countries (EMDs). Sixty-three percent of all liquidity finance is Markets and the Reregulation housed with the EMDs, and 80 percent of all development bank finance. What is more, more than of Cross-Border Finance. three quarters of this finance is national—in the form of currency reserves and national development William N. Kring is Assistant banks. Director and Research Fellow at the Global Development Policy This new financing brings real benefits to an architecture that has long been under stress, especially Center. -

A Study on Dutertenomics: Drastic Policy Shift in PPP Infrastructure Development in the Philippines

投稿論文/Contributions A Study on Dutertenomics: Drastic Policy Shift in PPP Infrastructure Development in the Philippines Susumu ITO Chuo University, Tokyo, Japan Abstract This paper studies Dutertenomics of the Philippines which is regarded as drastic policy shift in PPP, Public-private partnership, infrastructure development. While Aquino administration focused on PPP-based infrastructure development as a priority policy, the Duterte administration launched "Dutertenomics", a large-scale infrastructure development plan of about 8 trillion pesos, about 160 billion USD, over 6 years in 2017 which mainly depends on national budget and ODA as financial source rather than PPP. This triggered debate of "PPP vs ODA" in the Philippines. The paper discusses PPP related policies and measures implemented by Aquino administration including government organization, project development fund, PPP fund and relaxation of single borrowers' limit. Dutertenomics will be discussed from the point of view of 1) acceleration of infrastructure development, 2) shift from PPP to ODA, 3) hybrid PPP and 4) financial sources. The paper also examines changes in infrastructure development and its policy in the three decades after Marcos administration since 1986 as a background of these policy shift. The paper discusses that the issue is not about the "PPP vs ODA" but how to promote complementary relations between the public sector and PPP; in other words “PPP and ODA”. Keyword: Public-private partnership, Infrastructure, Philippines Table of Contents Abstract .......................................................................................................................... -

Flood Susceptibility Based Geomorphological Approach in Sitiarjo Village, Sumbermanjing Wetan, Malang Regency

Flood Susceptibility Based Geomorphological Approach in Sitiarjo Village, Sumbermanjing Wetan, Malang Regency Maulana Yudinugroho1, Krishna Aji Wijaya1, Isna Pujiastuti1, Ratih Winastuti1,Muhammad Thariq1, Muhammad Fariq1, Djati Mardiatno1 1Department of Environmental Geography, Faculty of Geography, Universitas Gadjah Mada, Indonesia Correspondence: [email protected] Abstract. Sitiarjo is an agriculture area located at a downstream part of Penguluran Watershed System. Due to geometric factor of the watershed system and heavy rainfall on wet season, this village has been flooded annually in the last 10 years. There were no casulaties reported but the impact caused the economic losses. The aim of this research was to identify the geomorphological characteristics related to spatial distribution of flood susceptibility in Sitiarjo Village, Sumbermanjing Wetan, Malang Regency. The data were collected from secondary data e.g. maps, report from agency and other source and primary data from observation and investigation in the field. The geomorphological map was resulted from secondary data from DEM and geological map. Distance to river, river flow density, and slope parameters were used to compose the flood susceptibility map. Each parameter validated through fieldwork. Geomorphological map was used to analyze the flood susceptibility distribution in Sitiarjo. Results showed geomorphological characteristics are well correlated with the flood susceptibility distribution. 1. Introduction The consequences of Indonesia’s geographic feature as the region located in monsoonal zone is that there are only two seasons occurred, wet and dry season. Several places in Indonesia are vulnerable to flood event in wet season due to high rainfall. Flood occurred in many places of Indonesia. Sitiarjo Village is one of many areas that are often flooded. -

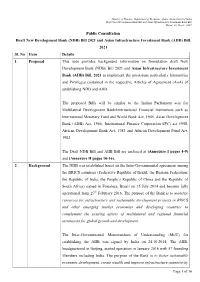

(NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl

Ministry of Finance, Department of Economic Affairs, Government of India Draft New Development Bank Bill and Asian Infrastructure Investment Bank Bill Dated- 04-March- 2021 Public Consultation Draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 Sl. No Item Details 1 Proposal This note provides background information on formulation draft New Development Bank (NDB) Bill 2021 and Asian Infrastructure Investment Bank (AIIB) Bill, 2021 to implement the provisions particularly Immunities and Privileges contained in the respective Articles of Agreement (AoA) of establishing NDB and AIIB. The proposed Bills will be similar to the Indian Parliament acts for Multilateral Development Bank/International Financial Institutions such as International Monetary Fund and World Bank Act, 1945, Asian Development Bank (ADB) Act, 1966, International Finance Corporation (IFC) act 1958, African Development Bank Act, 1983 and African Development Fund Act, 1982. The Draft NDB Bill and AIIB Bill are enclosed at (Annexure I pages 4-9) and (Annexure II pages 10-16). 2 Background The NDB was established based on the Inter-Governmental agreement among the BRICS countries (Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa) signed in Fortaleza, Brazil on 15 July 2014 and became fully operational from 27th February 2016. The purpose of the Bank is to mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging market economies and developing countries to complement the existing efforts of multilateral and regional financial institutions for global growth and development. The Inter-Governmental Memorandum of Understanding (MoU) for establishing the AIIB was signed by India on 24.10.2014. -

Agreement on the New Development Bank – Fortaleza, July 15

Agreement on the New Development Bank – Fortaleza, July 15 Agreement on the New Development Bank The Governments of the Federative Republic of Brazil, the Russian Federation, the Republic of India, the People’s Republic of China and the Republic of South Africa, collectively the BRICS countries, RECALLING the decision taken in the fourth BRICS Summit in New Delhi in 2012 and subsequently announced in the fifth BRICS Summit in Durban in 2013 to establish a development bank; RECOGNIZING the work undertaken by the respective finance ministries; CONVINCED that the establishment of such a Bank would reflect the close relations among the BRICS countries, while providing a powerful instrument for increasing their economic cooperation; MINDFUL of a context where emerging market economies and developing countries continue to face significant financing constraints to address infrastructure gaps and sustainable development needs; Have agreed on the establishment of the New Development Bank (NDB), hereinafter referred to as the Bank, which shall operate in accordance with the provisions of the annexed Articles of Agreement, that constitute an integral part of this Agreement. Article 1 Purpose and Functions The Bank shall mobilize resources for infrastructure and sustainable development projects in BRICS and other emerging economies and developing countries, complementing the existing efforts of multilateral and regional financial institutions for global growth and development. To fulfill its purpose, the Bank shall support public or private projects through loans, guarantees, equity participation and other financial instruments. It shall also cooperate with international organizations and other financial entities, and provide technical assistance for projects to be supported by the Bank. -

Perunutan Aliran Sungai Bawah Tanah Dalam Rangka Pengembangan Sumber Daya Air Daerah Karst

Perunutan Aliran Sungai Bawah Tanah...(Heni Rengganis, Wawan Herawan, dan Wulan Seizarwati) PERUNUTAN ALIRAN SUNGAI BAWAH TANAH DALAM RANGKA PENGEMBANGAN SUMBER DAYA AIR DAERAH KARST TRACKING THE UNDERGROUND RIVER IN THE DEVELOPMENT OF WATER RESOURCES IN THE KARST AREAS Heni Rengganis1), Wawan Herawan2), Wulan Seizarwati3) 1,2,3)Pusat Penelitian dan Pengembangan Sumber Daya Air Jl. Ir. H. Juanda 193, Bandung, Jawa Barat, Indonesia. E-mail : [email protected] Diterima: 16 Desember 2015; Direvisi: Januari 2016; Disetujui: 14 maret 2016 ABSTRAK Tracer technique dikenal secara luas sebagai salah satu metode yang digunakan untuk mencari hubungan antar goa atau sistem sungai bawah tanah di daerah karst. Di daerah karst Blitar Selatan telah teridentifikasi sejumlah sumber air berupa mata air, sungai bawah tanah, dan beberapa aliran sungai yang keluar menuju ke laut Selatan. Perunutan aliran sungai bawah tanah menggunakan tracer technique telah dilaksanakan dengan tujuan untuk mendapatkan data dan informasi sistem aliran di sekitar Goa Umbul Tuk, sehingga sumber air ini selanjutnya dapat dikembangkan pemanfaatannya sebagai nilai tambah penyediaan air baku di Kabupaten Blitar. Pengujian dilaksanakan dengan menggunakan bahan perunut buatan berupa garam NaCl dan pengukuran dilakukan dengan menggunakan alat ukur daya hantar listrik (EC meter). Hasil pengukuran menunjukkan adanya alur sungai bawah tanah yang menghubungkan antara Goa Rowo dengan Goa Umbul Tuk, dengan debit aliran terusan dari Umbul Tuk menuju Laut Selatan sebesar 360 l/s (Maret 2012), yang sangat berpotensi untuk dimanfaatkan. Pemanfaatan aliran ini, selain untuk kebutuhan penduduk sekitar, berpotensi juga untuk pemenuhan kebutuhan pariwisata baru di pantai Pangi Laut Selatan, yang mana pada saat ini masih belum dikembangkan. -

New South–South Co-Operation and the Brics New Development Bank

NEW SOUTH–SOUTH CO-OPERATION AND THE BRICS NEW DEVELOPMENT BANK BY ZHU JIEJIN INTRODUCTION The establishment of the BRICS New Development Bank (NDB) marks a milestone in BRICS co- operation and is a symbolic achievement in the reform of global financial governance. It will help to promote the financing of infrastructure among developing countries, improve global governance and propel the revival of the global economy. From China’s perspective, the NDB will be the first international financial organisation to be headquartered in China and will help promote China’s influence in the international development system while raising its profile as a responsible power. At present, there are a number of misperceptions surrounding the role of the NDB. Some mistakenly view it as an institution whose objective is to challenge the post-Second World War international economic order, reverse the Bretton Wood System, overturn the US’ finance hegemony, and eventually plunge global finance governance into chaos. Rather, as the first international development finance institution proposed by several developing great powers since the Second World War, the foundation and strategic positioning of the NDB lies in new South–South co-operation. Its purpose is to act as an innovate international financing mechanism to better serve the needs of developing countries in terms of infrastructure and sustainable development, rather than challenging or replacing the existing multilateral development institutions. WHY ESTABLISH THE NDB? Developing countries face enormous investment and financing gaps to fund infrastructure development. These have only worsened since the global financial crisis in 2008. The failure by the multilateral development banks controlled by developed countries to make up the gap prompted BRICS to establish a new development bank.