Amazon Pharmacy and What It Means for You Read

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

CVS Health Faces a New Wave of Disruption

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/1750-6123.htm CVS Health faces a new wave CVS Health of disruption John M. York Rady School of Management and Jacobs School of Engineering, University of California San Diego, La Jolla, California, USA and 333 Ernest Mario School of Pharmacy, Rutgers University, Piscataway, Received 30 January 2020 New Jersey, USA, and Revised 24 August 2020 Kaley Lugo, Lukasz Jarosz and Michael Toscani Accepted 4 February 2021 Ernest Mario School of Pharmacy, Rutgers University, Piscataway, New Jersey, USA Abstract Purpose – The purpose of this teaching case study is to change to examine how Amazon’sthreatmay impact the pharmacy industry as a whole and whether traditional drugstore chains such as Consumer Value Stores (CVS) Health will need to re-think their business strategy, especially in the digital space, to account for potential disruption. Design/methodology/approach – This paper presents a hypothetical case study used as a teaching exercise to guide the learner through a decision-making process. The case starts by presenting a disruption in the retail pharmacy business that the main character must navigate by using real-world data and insights, provided in the case, to formulate a recommendation. Findings – In an extremely competitive and consolidated pharmacy market, Amazon has the potential to change the business entirely. CVS Health will potentially face strong headwinds from Amazon’s PillPack and a downward trend in prescription sales. Regardless of the new competition, CVS Health continues to be innovative in the space. -

Amazon.Com, Inc

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 _________________________ FORM 8-K _________________________ CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 February 2, 2021 Date of Report (Date of earliest event reported) _________________________ AMAZON.COM, INC. (Exact name of registrant as specified in its charter) _________________________ Delaware 000-22513 91-1646860 (State or other jurisdiction of (Commission File Number) (IRS Employer Identification No.) incorporation) 410 Terry Avenue North, Seattle, Washington 98109-5210 (Address of principal executive offices, including Zip Code) (206) 266-1000 (Registrant’s telephone number, including area code) _________________________ Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: ☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) ☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) ☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) ☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Trading Symbol(s) Name of Each Exchange on Which Registered Common Stock, par value $.01 per share AMZN Nasdaq Global Select Market Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). -

Amazon's 2021 Proxy Statement

Notice of 2021 Annual Meeting of Shareholders & Proxy Statement 9:00 a.m., Pacific Time Wednesday, May 26, 2021 Virtual Meeting Site: www.virtualshareholdermeeting.com/AMZN2021 Global Impact Highlights Our People In 2020, Amazon created approximately 500,000 jobs for people with all types of experience, education, and skill levels. In addition to offering starting pay of at least $15 per hour in the U.S., more than double the federal minimum wage, Amazon offers comprehensive benefits, including health care coverage, parental leave, ways to save for the future, and other resources to improve health and well-being. Regular full-time employees get the same health care benefits as our most senior executives starting on their first day on the job. Our top priority during the COVID-19 pandemic has been to help ensure the health and safety of our approximately 1.3 million employees worldwide and to deliver for customers. We are working to achieve this by: • Providing over $2.5 billion in bonuses and incentives to our front-line employees and establishing a relief fund for delivery drivers and seasonal associates. • Making over 150 process updates across operations, including enhanced cleaning, social distancing measures, disinfectant spraying, and temperature checks, as well as providing masks and gloves. • Launching voluntary, free on-site COVID-19 testing at hundreds of sites and conducting tens of thousands of tests a day to keep our front-line employees safe. • Providing an up-to-$80 benefit to hourly employees in the U.S. who get a COVID-19 vaccine off-site. We have also begun building on-site vaccination options at A front-line employee from Amazon’s pharmacy fulfillment many of our operations sites. -

Buy Amazon.Com

10 September 2018 Internet Amazon.com Provided for the exclusive use of Research Research at Provisional Access on 2018-09-12T02:14+00:00. DO NOT REDISTRIBUTE Deutsche Bank Research Rating Company Date Buy Amazon.com 10 September 2018 Company Update North America United States Reuters Bloomberg Exchange Ticker Price at 4 Sep 2018 (USD) 2,039.51 TMT AMZN.OQ AMZN US NSM AMZN Price target 2,300.00 Internet 52-week range 2,039.51 - 938.60 Pharma the latest Rx for Amazon's Healthcare Ambitions Valuation & Risks Lloyd Walmsley Prime + Whole Foods + PillPack sets stage for more holistic healthcare offering We believe Amazon's ~$1B acquisition of PillPack ( link ), which has pharmacy Research Analyst licenses in 49 states, could accelerate Amazon's move into healthcare more +1-212-250-7063 broadly, increasing the value of the Prime service and overall consumer wallet Kunal Madhukar, CFA share in a large part of the economy. PillPack currently delivers medications in Research Analyst pre-sorted dose packaging, coordinates refills and renewals, and makes sure +1-212-250-0237 shipments are sent on time. We see Amazon likely to expand this effort to helping customers more holistically manage health, using prescription information to Chris Kuntarich help educate customers on their conditions and merchandise over-the-counter Research Associate medicine, healthcare supplies and healthy food to customers and to sell +1-904-520-4899 advertising. Amazon is further looking at healthcare through its JV with Berkshire Hathaway and JP Morgan, which just hired a COO. Amazon has a history of Seth Gilbert starting small, testing the market and fine-tuning the service, before launching a Research Associate full fledged commercial operations. -

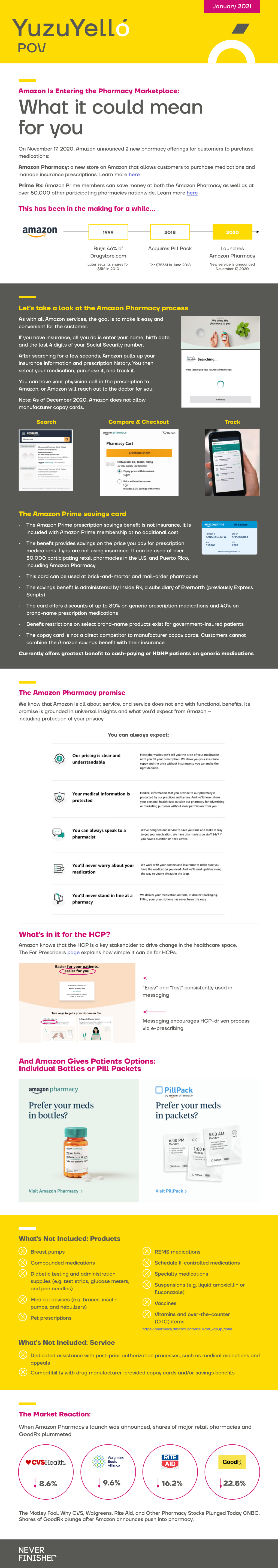

Rx Space: What It Means for You

Amazon Enters the Nick Conway SVP, Head of Product Rx Space: What It Means for You On Tuesday, November 17, Amazon announced the launch of Amazon Pharmacy, a new store on their platform that allows consumers to complete a prescription transaction, as well as the Amazon Prime Prescription Savings Benefit. Access the full announcement here. Amazon acquired PillPack in 2018, and the new offerings leverage PillPack’s infrastructure and software, so this announcement doesn’t come as a complete surprise. However, the announcement has implications for consumers as well as the broader Rx market. What’s New Amazon Home Delivery Pharmacy allows The Amazon Prime Prescription (PrimeRx) customers to purchase their prescription Savings Benefit gives Prime members access medications directly from Amazon (instead of to savings (up to 80% on generics, 40% on going to a retail pharmacy such as Walgreens brand names) on medications at over 50,000 or Walmart). Using a secure pharmacy profile, participating pharmacies nationwide when members can add their insurance information, paying without insurance, including Amazon manage prescriptions and choose payment Pharmacy. PrimeRx is a partnership with ESI’s options before checking out. Prime members InsideRx subsidiary that offers a cash card (like receive unlimited, free two-day delivery on Good Rx). Members also receive free two-day orders from Amazon Pharmacy included with delivery. their membership. Amazon Pharmacy is available to customers age 18 and older in all states except Hawaii, Illinois, Kentucky, Louisiana and Minnesota. 1 : : Amazon Enters the Rx Space: What It Means for You Cash paying consumers stand to benefit most from Amazon’s PrimeRx. -

Amazon Part I

RESEARCHNovember REPORT23, 2020 Amazon PartNovember I: The Retail 23, 2020 Business Insert Picture in Master View Ticker AMZN Amazon.com, Inc. Market Cap (MM) $1,555,127 Amazon Part I: The Retail P/E 2021E 79.09x Business 52 Week Performance Since the QUIC Consumers team first purchased shares of 250 Amazon.com in November 2016, the company has grown dramatically, entered into new business lines, and seen its share price more than triple. In light of the COVID pandemic and how much Amazon has evolved in recent years, the Consumers team believed it 190 was a good time to re-evaluate Amazon’s growth prospects going forward and how the company should (roughly) be valued considering these growth prospects. Given the size and complexity of Amazon, our review of the business will be split into two parts 130 with Part I focusing on the retail business and Part II focusing on AWS and the company’s other bets. 70 As CEO Jeff Bezos famously wrote in his 1997 letter to shareholders, 01-Oct-19 01-Mar-20 01-Aug-20 “It’s All About the Long Term” when talking about Amazon.com. For this reason, the Consumers team chose to build a 10-year financial AMZN S&P 100 Index model wherein we projected revenue and EBIT for the company’s North America and International segments through 2030. While not an extremely detailed model, we believe that in the case of Amazon, Consumers it is better to be approximately right than precisely wrong. We then applied a 25x multiple to our 2030 EBIT projection to arrive at a value Bronwyn Ferris of ~$1.7T for Amazon’s retail business, which is more than the market capitalization of the entire company today. -

+ + Acdelco 15773661 GM Original Equipment Automatic Transmission

7/2/2020 Amazon.com: ACDelco 15773661 GM Original Equipment Automatic Transmission Fluid Cooler Lower Line: Automotive Skip to main content Hello, Sign in Returns 0 Automotive Parts & Accessories Account & Lists & Orders Try Prime Cart Hello Best Sellers Customer Service Today's Deals New Releases Find a Gift Whole Foods Summer hobby inspiration Select your address Automotive Your Garage Deals & Rebates Best Sellers Parts Accessories Tools & Equipment Car Care Motorcycle & Powersports Truck This fits your: 2005 Chevrolet Silverado 1500 Base 5.3L V8 Gas O… Check Fit Your Garage (1) See all products that fit this vehicle This product fits this position on your 2005 Chevrolet Silverado 1500: • Lower Automotive › Replacement Parts › Engine Cooling & Climate Control › Coolers & Accessories › Engine Oil Coolers & Kits ACDelco 15773661 GM Original Subm $25.60 Equipment Automatic Transmission & FREE Shipping. Details & FREE Returns Subm Fluid Cooler Lower Line by ACDelco Arrives: Friday, July 10 Details 50 ratings | 13 answered questions Subm Fastest delivery: Sunday, July 5 Price: $25.60 & FREE Shipping. Details & FREE Returns Details Get $60 off instantly: Pay $0.00 upon approval for the In Stock. Amazon Rewards Visa Card. Available at a lower price from other sellers that may not Q1Qttyy:: 1 offer free Prime shipping. GM-recommended replacement part for your GM AdAdd tdo t Coa Crtart vehicle’s original factory component Offering the quality, reliability, and durability of GM OE SuBbumy Nitow Manufactured to GM OE specification for fit, form, and -

View Complaint

1 2 3 4 5 6 7 8 9 10 11 UNITED STATES DISTRICT COURT 12 CENTRAL DISTRICT OF CALIFORNIA 13 WESTERN DIVISION 14 ______________, Individually and on ) Case No. 2:20-cv-11444 Behalf of All Others Similarly ) 15 Situated, ) CLASS ACTION ) 16 Plaintiff, ) COMPLAINT FOR VIOLATIONS OF ) THE FEDERAL SECURITIES LAW 17 vs. ) ) 18 GOODRX HOLDINGS, INC., ) DOUGLAS HIRSCH, TREVOR ) 19 BEZDEK and KARSTEN ) VOERMANN, ) 20 ) Defendants. ) 21 ) DEMAND FOR JURY TRIAL 22 23 24 25 26 27 28 1 Plaintiff _____________ (“plaintiff”), individually and on behalf of all others 2 similarly situated, alleges the following based upon information and belief as to the 3 investigation conducted by plaintiff’s counsel, which included, among other things, a 4 review of U.S. Securities and Exchange Commission (“SEC”) filings by GoodRx 5 Holdings, Inc. (“GoodRx” or the “Company”) and securities analyst reports, press 6 releases, and other public statements issued by, or about, the Company. Plaintiff 7 believes that substantial additional evidentiary support will exist for the allegations set 8 forth herein after a reasonable opportunity for discovery. 9 NATURE OF THE ACTION 10 1. This is a federal securities class action brought on behalf of all purchasers 11 of GoodRx Class A common stock (the “Class”) between September 23, 2020 and 12 November 16, 2020, inclusive (the “Class Period”), seeking to pursue remedies under 13 the Securities Exchange Act of 1934 (the “Exchange Act”). 14 JURISDICTION AND VENUE 15 2. The claims asserted herein arise under §§10(b) and 20(a) of the Exchange 16 Act, 15 U.S.C. -

Request for Reconsideration After Final Action

Under the Paperwork Reduction Act of 1995 no persons are required to respond to a collection of information unless it displays a valid OMB control number. PTO Form 1960 (Rev 10/2011) OMB No. 0651-0050 (Exp 09/20/2020) Request for Reconsideration after Final Action The table below presents the data as entered. Input Field Entered SERIAL NUMBER 88242157 LAW OFFICE ASSIGNED LAW OFFICE 123 MARK SECTION MARK https://tmng-al.uspto.gov/resting2/api/img/88242157/large LITERAL ELEMENT PILLPACK STANDARD CHARACTERS YES USPTO-GENERATED IMAGE YES The mark consists of standard characters, without claim to any particular font style, MARK STATEMENT size or color. OWNER SECTION (current) NAME A9.com, Inc. STREET 101 Lytton Avenue CITY Palo Alto STATE California ZIP/POSTAL CODE 94301 COUNTRY/REGION/JURISDICTION/U.S. TERRITORY United States OWNER SECTION (proposed) NAME A9.com, Inc. STREET 101 Lytton Avenue CITY Palo Alto STATE California ZIP/POSTAL CODE 94301 COUNTRY/REGION/JURISDICTION/U.S. TERRITORY United States EMAIL [email protected] EVIDENCE SECTION EVIDENCE FILE NAME(S) ORIGINAL PDF FILE evi_38104128234-20200220191511227000_._PILLPACK_88242157.pdf CONVERTED PDF FILE(S) \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0002.JPG (89 pages) \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0003.JPG \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0004.JPG \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0005.JPG \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0006.JPG \\TICRS\EXPORT18\IMAGEOUT18\882\421\88242157\xml2\RFR0007.JPG -

How Technology Is Designing the Future of Health Care

How technology is designing the future of health care UNDERWRITTEN BY TABLE OF CONTENTS 01 Former Google CEO Schmidt says 17 The Future of Life Sciences and AI ‘will have its biggest impact’ in Healthcare — Transform Patient health care Experience with Adapting Digital Technology like Hybrid Cloud and AI 04 ‘More Amazon and less pharmacy’: one exec on the company’s strategy for prescription drugs 21 How digital pharmacies can expand access to specialized care 07 Measuring blood sugar in real time is a game changer for patients — 23 There’s a gold rush in health tech. and a health tech success story Here’s how the smart money stays ahead 10 How Cityblock Health is tapping into technology to better care for 25 Illumina CEO insists GRAIL merger Medicaid patients will be good for competition, and ultimately, patients 14 From big tech to small tech: A health care visionary pushes for 28 Amazon, Salesforce execs weigh in a patient-centric approach to on how tech can help with Covid — technology and how it can’t HOW TECHNOLOGY IS DESIGNING THE FUTURE OF HEALTH CARE TABLE OF CONTENTS In medical parlance, “stat” means important and urgent, and that’s what we’re all about — quickly and smartly delivering good stories. We take you inside science labs and hospitals, biotech boardrooms, and political backrooms. We dissect crucial discoveries. We examine controversies and puncture hype. We hold individuals and institutions accountable. We introduce you to the power brokers and personalities who are driving a revolution in human health. These are the stories that matter to us all. -

Amazon Jumps Into the Pharmacy Business

Amazon Jumps into The Pharmacy Business On November 17, 2020, the online retail giant, Amazon, announced the creation of Amazon Pharmacy, an online pharmacy through which medications can be ordered for home delivery. Amazon Pharmacy will serve patients 18 years and older across 45 states including West Virginia, and it will accept most forms of insurance, including FSA and HSA. In addition to free deliveries, Amazon Prime members will receive discounts (up to 80% on generic medications and up to 40% on brand-name drugs). These customers can also get a prescription savings benefit card to use at up to 50,000 pharmacies including local retailers. Of note, Amazon Pharmacy will not deliver Schedule II medications and it will not supply vitamins and supplements. Amazon’s plan to enter the pharmacy business has been in the works for several years now, notably after their acquisition of PillPack in 2018.1,2 TJ Parker, Vice President of Amazon Pharmacy, and co-founder of PillPack, stated that the reason behind the launch of Amazon Pharmacy is to make it easier for people to get their medications, and also to help them to better understand the cost. Jamil Ghani, Vice President of Amazon Prime, added that they think the new benefit will add tremendous value to members.1 The launch of Amazon Pharmacy sent shock waves across the retail pharmacy market, as many dominant players saw a dip in the value of their stocks. CVS and Walgreens Boots Alliance stock shares both dropped approximately 9%, Rite Aid’s stock suffered a 15% drop, while GoodRx saw a 22.5% erosion.1,2 Large chain pharmacies have always relied on steady flow of shoppers, who come in to pick up their prescription in addition to other items. -

Amazon Pharmacy Member

November 24, 2020 FAQ Amazon Pharmacy/ PillPack 1. I saw Amazon Pharmacy in the news. Can I use Amazon for my prescriptions? Will it be covered under my benefit? Amazon/PillPack pharmacies do participate in network and are an option for the member to use, like any other retail pharmacy. Amazon Pharmacy is currently not available to residents of Hawaii, Illinois, Kentucky, Louisiana and Minnesota. PillPack is licensed nationwide, but does not currently deliver to Hawaii. Customers can also use flexible spending accounts or health savings accounts to buy prescriptions on the service. 2. If I choose to use Amazon for my prescriptions, how will it affect my copay or costs? Your copay is set as part of your benefit plan and does not change based on which pharmacy you choose to fill your prescription. However, the Amazon/PillPack pharmacy only offers a 30-day, retail prescription option. If you are receiving 90-day supplies from a different pharmacy and move your prescription to Amazon, your copay could change from a 90-day copay to a retail 30-day copay. Please check your benefit plan to decide if this is the right decision for you. 3. I want to transfer my prescription to Amazon Pharmacy. How do I do that? Doctors can send prescriptions directly to Amazon Pharmacy, or patients can request a transfer from an existing retail pharmacy. Below are instructions taken from the Amazon Pharmacy website: https://pharmacy.amazon.com/how-it-works?ref_=ap_lp_main 6811 © Prime Therapeutics LLC 07/20 4. I currently get my medications from another mail order pharmacy, such as AllianceRx Walgreens Prime or Express Scripts.