Refinance Application Checklist

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Down Payment and Closing Cost Assistance

STATE HOUSING FINANCE AGENCIES Down Payment and Closing Cost Assistance OVERVIEW STRUCTURE For many low- and moderate-income people, the The structure of down payment assistance programs most significant barrier to homeownership is the down varies by state with some programs offering fully payment and closing costs associated with getting a amortizing, repayable second mortgages, while other mortgage loan. For that reason, most HFAs offer some programs offer deferred payment and/or forgivable form of down payment and closing cost assistance second mortgages, and still other programs offer grant (DPA) to eligible low- and moderate-income home- funds with no repayment requirement. buyers in their states. The vast majority of HFA down payment assistance programs must be used in combi DPA SECOND MORTGAGES (AMORTIZING) nation with a first-lien mortgage product offered by the A second mortgage loan is subordinate to the first HFA. A few states offer stand-alone down payment and mortgage and is used to cover down payment and closing cost assistance that borrowers can combine closing costs. It is repayable over a given term. The with any non-HFA eligible mortgage product. Some interest rates and terms of the loans vary by state. DPA programs are targeted toward specific popula In some programs, the interest rate on the second tions, such as first-time homebuyers, active military mortgage matches that of the first mortgage. Other personnel and veterans, or teachers. Others offer programs offer more deeply subsidized rates on their assistance for any homebuyer who meets the income second mortgage down payment assistance. Some and purchase price limitations of their programs. -

Commercial Mortgage Loans

STRATEGY INSIGHTS MAY 2014 Commercial Mortgage Loans: A Mature Asset Offering Yield Potential and IG Credit Quality by Jack Maher, Managing Director, Head of Private Real Estate Mark Hopkins, CFA, Vice President, Senior Research Analyst Commercial mortgage loans (CMLs) have emerged as a desirable option within a well-diversified fixed income portfolio for their ability to provide incremental yield while maintaining the portfolio’s credit quality. CMLs are privately negotiated debt instruments and do not carry risk ratings commonly associated with public bonds. However, our paper attempts to document that CMLs generally available to institutional investors have a credit profile similar to that of an A-rated corporate bond, while also historically providing an additional 100 bps in yield over A-rated industrials. CMLs differ from public securities such as corporate bonds in the types of protections they offer investors, most notably the mortgage itself, a benefit that affords lenders significant leverage in the relationship with borrowers. The mortgage is backed by a hard, tangible asset – a property – that helps lenders see very clearly the collateral behind their investment. The mortgage, along with other protections, has helped generate historical recovery from defaulted CMLs that is significantly higher than recovery from defaulted corporate bonds. The private CML market also provides greater flexibility for lenders and borrowers to structure mortgages that meet specific needs such as maturity, loan amount, interest terms and amortization. Real estate as an asset class has become more popular among institutional investors such as pension funds, insurance companies, open-end funds and foreign investors. These investors, along with public real estate investment trusts (REITs), generally invest in higher quality properties with lower leverage. -

Mortgage-Backed Securities & Collateralized Mortgage Obligations

Mortgage-backed Securities & Collateralized Mortgage Obligations: Prudent CRA INVESTMENT Opportunities by Andrew Kelman,Director, National Business Development M Securities Sales and Trading Group, Freddie Mac Mortgage-backed securities (MBS) have Here is how MBSs work. Lenders because of their stronger guarantees, become a popular vehicle for finan- originate mortgages and provide better liquidity and more favorable cial institutions looking for investment groups of similar mortgage loans to capital treatment. Accordingly, this opportunities in their communities. organizations like Freddie Mac and article will focus on agency MBSs. CRA officers and bank investment of- Fannie Mae, which then securitize The agency MBS issuer or servicer ficers appreciate the return and safety them. Originators use the cash they collects monthly payments from that MBSs provide and they are widely receive to provide additional mort- homeowners and “passes through” the available compared to other qualified gages in their communities. The re- principal and interest to investors. investments. sulting MBSs carry a guarantee of Thus, these pools are known as mort- Mortgage securities play a crucial timely payment of principal and inter- gage pass-throughs or participation role in housing finance in the U.S., est to the investor and are further certificates (PCs). Most MBSs are making financing available to home backed by the mortgaged properties backed by 30-year fixed-rate mort- buyers at lower costs and ensuring that themselves. Ginnie Mae securities are gages, but they can also be backed by funds are available throughout the backed by the full faith and credit of shorter-term fixed-rate mortgages or country. The MBS market is enormous the U.S. -

Buying a Home: What You Need to Know

Buying a Home: What you need to know n Getting Started n Ready to Buy n Refinancing n Condos n Moving to a Larger Home n Vacation Homes Apply anytime, anywhere Fast and easy Total security for your personal information Personal Service from our Mortgage Planners Go to Blackhawkbank.com Mortgages Home Loans/Apply Online Revised 4.2018 Owning a home has long been “the American In Wisconsin: WHEDA Fannie Mae Advantage: When you use the WHEDA Fannie Mae Advantage, you need less cash dream.” It’s a long-term commitment, but as your to close your loan and you will have lower monthly house equity increases with time (and payments) your payments than with most mortgages. What’s more, you’ll have peace of mind that your rate will never change with home will be a source of financial stability for you. their fixed rate and term. WHEDA FHA Advantage: With the WHEDA FHA Advantage, Wisconsin residents have the flexibility to leverage down payment assistance and other There are many things to think about whether you’re advantages to buy a home with an affordable mortgage. buying your first home, moving up, refinancing, or considering a vacation property. Let’s get the In Illinois: IHDA works with financial partners across Illinois conversation started! to offer programs that help qualified Illinois first-time homebuyers to receive down payment and closing cost assistance. Buying a home can be both exciting and intimidating, so IHDA strives to make the goal of homeownership as streamlined as possible. Be sure to ask your Blackhawk Mortgage Planner for a current list what IDHA offers. -

The Determinants of Attitudes Towards Strategic Default on Mortgages∗

June 2011 The Determinants of Attitudes towards Strategic Default on Mortgages∗ Luigi Guiso European University Institute, EIEF, & CEPR Paola Sapienza Northwestern University, NBER, & CEPR Luigi Zingales University of Chicago, NBER, & CEPR Abstract We use survey data to measure households’ propensity to default on mortgages even if they can afford to pay them (strategic default) when the value of the mortgage exceeds the value of the house. The willingness to default increases both in the absolute and in the relative size of the home- equity shortfall. Our evidence suggests that this willingness is affected both by pecuniary and non- pecuniary factors, such as views about fairness and morality. We also find that exposure to other people who strategically defaulted increases the propensity to default strategically because it conveys information about the probability of being sued. ∗ An earlier version of this paper circulated with the title “Moral and Social Constraints to Strategic Default on Mortgages.” We would like to thank the University of Chicago Booth School of Business and Kellogg School of Management for financial support in establishing and maintaining the Chicago Booth Kellogg School Financial Trust Index. Luigi Guiso is grateful to PEGGED for financial support. We thank Campbell Harvey (editor), Amir Sufi, two anonymous referee and seminar participants at the University of Chicago and New York University for very useful suggestions, Gabriella Santangelo and Filippo Mezzanotti for excellent research assistantship, and Peggy Eppink for editorial help. We also thank Amit Seru for providing us with a time series of actual strategic default within his sample. 1 In 2009, for the first time since the Great Depression, millions of American households found themselves with a mortgage that exceeded the value of their home. -

Predatory Mortgage Loans

CONSUMER Information for Advocates Representing Older Adults CONCERNS National Consumer Law Center® Helping Elderly Homeowners Victimized by Predatory Mortgage Loans Equity-rich, cash poor, elderly homeowners are an attractive target for unscrupulous mortgage lenders. Many elderly homeowners are on fixed or limited incomes, yet need access to credit to pay for home repairs, medical care, property or municipal taxes, and other expenses. The equity they have amassed in their home may be their primary or only financial asset. Predatory lenders seek to capitalize on elders’ need for cash by offer- ing “easy” credit and loans packed with high interest rates, excessive fees and costs, credit insurance, balloon payments and other outrageous terms. Deceptive lending practices, including those attributable to home improvement scams, are among the most frequent problems experienced by financially distressed elderly Americans seeking legal assistance. This is particularly true of minority homeowners who lack access to traditional banking services and rely disproportionately on finance compa- nies and other less regulated lenders. But there are steps advocates can take to assist vic- tims of predatory mortgage loans. • A Few Examples One 70 year old woman obtained a 15-year mortgage in the amount of $54,000 at a rate of 12.85%. Paying $596 a month, she will still be left with a final balloon payment of nearly $48,000 in 2011, when she will be 83 years old. Another 68 year old woman took out a mortgage on her home in the amount of $20,334 in the early 1990s. Her loan was refinanced six times in as many years, bringing the final loan amount to nearly $55,000. -

Non-Competitive Refinancing of Energy Performance Lease/Purchase Agreement

The City of Palm Bay, Florida LEGISLATIVE MEMORANDUM TO: Honorable Mayor and Members of the City Council FROM: Lisa Morrell, City Manager REQUESTING DIRECTOR: Yvonne McDonald, Finance Director DATE: May 21, 2020 RE: Non-Competitive Refinancing of Energy Performance Lease/Purchase Agreement SUMMARY: On July 6, 2018, the City of Palm Bay entered into a Lease Purchase Agreement with the Bank of America for the purpose of funding energy conservation measures pursuant to an energy performance contract between the City of Palm Bay and Honeywell Building Solutions. A total of $4,369,350 was funded for a period of 19 years. The lease purchase agreement, which is subject to annual appropriation, matures on July 6, 2037. One annual debt payment has been made to date. Because of the current low interest rate environment and period when lease/purchase refinancing can occur, there is a short window of opportunity to reduce the current interest rate on the lease/purchase agreement with Bank of America. Under the current lease/purchase agreement, the City can pay off the lease by refinancing at the end of each annual lease period, at a prepayment premium of 102% of the Outstanding Balance. Bank America was contacted regarding refinancing the lease/purchase agreement in lieu of the City having to go out for competitive Request for Proposals in the current market. Bank of America has offered to refinance the agreement at a rate of 2.55%. The current rate is 3.597%. The amount refinanced would include the current principal balance, the prepayment cost and issuance cost. -

Your Step-By-Step Mortgage Guide

Your Step-by-Step Mortgage Guide From Application to Closing Table of Contents In this Guide, you will learn about one of the most important steps in the homebuying process — obtaining a mortgage. The materials in this Guide will take you from application to closing and they’ll even address the first months of homeownership to show you the kinds of things you need to do to keep your home. Knowing what to expect will give you the confidence you need to make the best decisions about your home purchase. 1. Overview of the Mortgage Process ...................................................................Page 1 2. Understanding the People and Their Services ...................................................Page 3 3. What You Should Know About Your Mortgage Loan Application .......................Page 5 4. Understanding Your Costs Through Estimates, Disclosures and More ...............Page 8 5. What You Should Know About Your Closing .....................................................Page 11 6. Owning and Keeping Your Home ......................................................................Page 13 7. Glossary of Mortgage Terms .............................................................................Page 15 Your Step-by-Step Mortgage Guide your financial readiness. Or you can contact a Freddie Mac 1. Overview of the Borrower Help Center or Network which are trusted non- profit intermediaries with HUD-certified counselors on staff Mortgage Process that offer prepurchase homebuyer education as well as financial literacy using tools such as the Freddie Mac CreditSmart® curriculum to help achieve successful and Taking the Right Steps sustainable homeownership. Visit http://myhome.fred- diemac.com/resources/borrowerhelpcenters.html for a to Buy Your New Home directory and more information on their services. Next, Buying a home is an exciting experience, but it can be talk to a loan officer to review your income and expenses, one of the most challenging if you don’t understand which can be used to determine the type and amount of the mortgage process. -

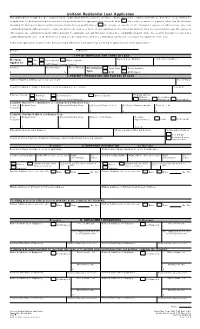

Sample Mortgage Application (PDF)

Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should complete this form as "Borrower" or "Co-Borrower," as applicable. Co-Borrower information must also be provided (and the appropriate box checked) when the income or assets of a person other than the Borrower (including the Borrower's spouse) will be used as a basis for loan qualification or the income or assets of the Borrower's spouse or other person who has community property rights pursuant to state law will not be used as a basis for loan qualification, but his or her liabilities must be considered because the spouse or other person has community property rights pursuant to applicable law and Borrower resides in a community property state, the security property is located in a community property state, or the Borrower is relying on other property located in a community property state as a basis for repayment of the loan. If this is an application for joint credit, Borrower and Co-Borrower each agree that we intend to apply for joint credit (sign below): Borrower Co-Borrower I. TYPE OF MORTGAGE AND TERMS OF LOAN Agency Case Number Lender Case Number Mortgage VA Conventional Other (explain): Applied for: FHA USDA/Rural Housing Service Amount Interest Rate No. of Months Amortization Fixed Rate Other (explain): $%Type: GPM ARM (type): II. PROPERTY INFORMATION AND PURPOSE OF LOAN Subject Property Address (street, city, state & ZIP) No. of Units Legal Description of Subject Property (attach description if necessary) Year Built Purpose of Loan Purchase Construction Other (explain): Property will be: Primary Secondary Refinance Construction-Permanent Residence Residence Investment Complete this line if construction or construction-permanent loan. -

SHOPPING for YOUR HOME LOAN: SETTLEMENT COST BOOKLET Table of Contents

Shopping for your home loan Settlement cost booklet January 2014 This booklet was initially prepared by the U.S. Department of Housing and Urban Development. The Consumer Financial Protection Bureau (CFPB) has made technical updates to the booklet to reflect new mortgage rules under Title XIV of the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act). A larger update of this booklet is planned in the future to reflect the integrated mortgage disclosures under the Truth in Lending Act and the Real Estate Settlement Procedures Act and other changes under the Dodd-Frank Act, and to align with other CFPB resources and tools for consumers as part of the CFPB’s broader mission to educate consumers. Consumers are encouraged to visit the CFPB’s website at consumerfinance.gov/owning-a-home to access interactive tools and resources for mortgage shoppers, which are expected to be available beginning in 2014. 2 SHOPPING FOR YOUR HOME LOAN: SETTLEMENT COST BOOKLET Table of contents Table of contents ........................................................................................................ 3 1. Introduction .......................................................................................................... 6 2. Before you buy ..................................................................................................... 7 2.1 Are you ready to be a homeowner? ........................................................... 7 3. Determining what you can afford ...................................................................... -

FICO Mortgage Credit Risk Managers Handbook

FICO Mortgage Credit Risk Manager’s Best Practices Handbook Craig Focardi Senior Research Director Consumer Lending, TowerGroup September 2009 Executive Summary The mortgage credit and liquidity crisis has triggered a downward spiral of job losses, declining home prices, and rising mortgage delinquencies and foreclosures. The residential mortgage lending industry faces intense pressures. Mortgage servicers must better manage the rising tide of defaults and return financial institutions to profitability while responding quickly to increased internal, regulatory, and investor reporting requirements. These circumstances have moved management of mortgage credit risk from backstage to center stage. The risk management function cuts across the loan origination, collections, and portfolio risk management departments and is now a focus in mortgage servicers’ strategic planning, financial management, and lending operations. The imperative for strategic focus on credit risk management as well as information technology (IT) resource allocation to this function may seem obvious today. However, as recently as June 2007, mortgage lenders continued to originate subprime and other risky mortgages while investing little in new mortgage collections and infrastructure, technology, and training for mortgage portfolio management. Moreover, survey results presented in this Handbook reveal that although many mortgage servicers have increased mortgage collections and loss mitigation staffing, few servicers have invested sufficiently in data management, predictive analytics, scoring and reporting technology to identify the borrowers most at risk, implement appropriate treatments for different customer segments, and reduce mortgage re-defaults and foreclosures. The content of this Handbook is based on a survey that FICO, a leader in decision management, analytics, and scoring, commissioned from TowerGroup, a leading research and advisory firm focusing on the strategic application of technology in financial services. -

1 I. Introduction Interest Rates, Financial Leverage, and Asset Values Are

I. Introduction Interest rates, financial leverage, and asset values are among the most important variables in the economy. Many economists, policy makers, and investors believe that these variables may affect each other; therefore, manipulation of some variables may cause desired changes in the others. While interest rates are traditionally the variable that the Federal Reserve monitors and tries to influence, research on the recent financial crisis highlights the importance of financial leverage in the economy (see, e.g. Geanakoplos (2009), Acharya and Viswanathan (2011), among others). Recognizing this, Federal Reserve researchers are investigating whether changing requirements for mortgages’ loan-to-value ratios based on the economic environment could improve financial stability.1 The effectiveness of such policies would depend on how the loan to value ratios and property values exactly interact with each other, as well as whether and how they are endogenously determined. For example, if the two variables are only endogenously correlated and do not affect each other, policies that tries to manipulate the loan to value ratios to affect property values would have little effect. A natural starting point to understand the interactions between the loan to value ratios and property values is to understand their long-run equilibrium relationship. However, the existing literature is virtually silent on this very important issue. 1 See the speech by Ben S. Bernanke at the Annual Meeting of the American Economic Association at Philadelphia: http://www.federalreserve.gov/newsevents/speech/bernanke20140103a.htm. 1 This paper develops a very simple theoretical model in which commercial real estate mortgage interest rates, leverage, and property values are jointly determined.