Radio One, Inc

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Audio Today a Focus on African American & Hispanic Audiences April 2014

STATE OF THE MEDIA: AUDIO TODAY A FOCUS ON AFRICAN AMERICAN & HISPANIC AUDIENCES APRIL 2014 STATE OF THE MEDIA: AUDIO TODAY Q2 Copyright © 2014 The Nielsen Company 1 GROWTH AND THE AUDIO LANDSCAPE NATIONAL AUDIENCE HITS ALL-TIME HIGH Growth is a popular word today in America, whether you’re talking about the stock market, entertainment choices, or census trends. Through it all, radio consumption continues to increase; nearly 92% of all Americans 12 or older are tuning to radio in an average week. That’s 244.4 million of us, a record high! 244 MILLION AMERICANS LISTEN TO RADIO EACH WEEK This growth is remarkable considering the variety and number of media choices available to consumers today over-the-air and online via smartphones, tablets, notebooks/desktop computers and digital dashboards. Radio’s hyper-local nature uniquely serves each market which keeps it tied strongly to our daily lives no matter how (or where) we tune in. The radio landscape is also a diverse community of listeners from every corner of America, who reflect the same population trends of the country as a whole. Radio is one of the original mass mediums and as the U.S. population grows and the makeup of our citizens change, radio audiences follow suit. Alongside the national growth headline, both African American and Hispanic audiences have also reached a historic high with more than 71 million tuning in each week. Source: RADAR 120, March 2014, M-SU MID-MID, Total Listeners 12+/Hispanic 12+/African American 12+ 2 STATE OF THE MEDIA: AUDIO TODAY Q2 RADIO’S GROWTH CHART IS DIVERSIFIED Weekly Cume (000) March 2013 June 2013 Sept 2013 Dec 2013 March 2014 All Listeners 12+ 243,177 242,876 242,530 242,186 244,457 Hispanic 12+ 39,586 39,577 39,506 39,380 40,160 African American 12+ 30,987 30,862 30,823 30,742 31,186 71 MILLION AFRICAN AMERICANS AND HISPANICS The focus for this quarter’s Audio Today report is the African American and Hispanic listener; combined these listeners account for nearly a third (29.6%) of the total national audience. -

A Toolkit for Working with the Media

Utilizing the Media to Facilitate Social Change A Toolkit for Working with the Media WEST VIRGINIA FOUNDATION for RAPE INFORMATION and SERVICES www.fris.org 2011 Media Toolkit | 2 TABLE OF CONTENTS Media Advocacy……………………………….. ……….. 3 Building a Relationship with the Media……... ……….. 3 West Virginia Media…………………………………….. 4 Tips for Working with the Media……………... ……….. 10 Letter to the Editor…………………………….. ……….. 13 Opinion Editorial (Op-Ed)…………………….. ……….. 15 Media Advisory………………………………… ……….. 17 Press/News Release………………………….. ……….. 19 Public Service Announcements……………………….. 21 Media Interviews………………………………. ……….. 22 Survivors’ Stories and the Media………………………. 23 Media Packets…………………………………. ……….. 25 Media Toolkit | 3 Media Advocacy Media advocacy can promote social change by influencing decision-makers and swaying public opinion. Organizations can use mass media outlets to change social conditions and encourage political and social intervention. When working with the media, advocates should ‘shape’ their story to incorporate social themes rather than solely focusing on individual accountability. “Develop a story that personalizes the injustice and then provide a clear picture of who is benefiting from the condition.” (Wallack et al., 1999) Merely stating that there is a problem provides no ‘call to action’ for the public. Therefore, advocates should identify a specific solution that would allow communities to take control of the issue. Sexual violence is a public health concern of social injustices. Effective Media Campaigns Local, regional or statewide campaigns can provide a forum for prevention, outreach and raising awareness to create social change. This toolkit will enhance advocates’ abilities to utilize the media for campaigns and other events. Campaigns can include: public service announcements (PSAs), awareness events (Take Back the Night; The Clothesline Project), media interviews, coordinated events at area schools or college campuses, position papers, etc. -

Collected Press Clips

Future of Music Coalition press clips following release of radio study November 2002 - January 2003 Study Shows an Increase in Overlap of Radio Playlists; The report by an artists' rights group says that morestations with different formats play the same songs. Industry officials disagree. By Jeff Leeds Los Angeles Times, November 15, 2002 http://www.latimes.com/business/la-fi-radio15nov15,0,4652989.story Ever since the Clinton administration Moreover, the study says, radio handful of giant media companies, loosened restrictions on how many companies that have grown the most including Clear Channel and Viacom radio stations a broadcaster could under deregulation are limiting the Inc.'s Infinity Broadcasting, which own, record label executives have choice of music by operating two or operates more than 180 stations. complained that media consolidation more stations in the same market Radio industry officials dismissed the would lead to bland playlists and with the same music format. The study's conclusions. homogenous programming. report said that Clear Channel Communications Inc., the nation's "The big gap in the logic is that the Now a coalition of musicians and biggest radio conglomerate, has 143 authors don't believe radio stations independent record label executives stations with similar music formats in care about what consumers do," said say they have statistical proof that the same market. Jodie Renk, general manager of Core the relaxation of ownership rules has Callout Research, a firm that tests stifled recording artists and The study contradicts the conclusions new songs with radio listeners. "damaged radio as a public of a September report by the Federal resource." The study was done by the Communications Commission. -

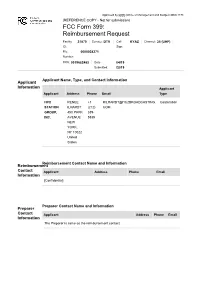

TV Broadcaster Relocation Fund Reimbursement Application

Approved by OMB (Office of Management and Budget) 3060-1178 (REFERENCE COPY - Not for submission) FCC Form 399: Reimbursement Request Facility 31870 Service: DTV Call KYAZ Channel: 25 (UHF) ID: Sign: File 0000028371 Number: FRN: 0019682483 Date 04/19 Submitted: /2019 Applicant Name, Type, and Contact Information Applicant Information Applicant Applicant Address Phone Email Type HC2 RENEE +1 RILHARDT@HC2BROADCASTING. Corporation STATION ILHARDT (212) COM GROUP, 450 PARK 339- INC. AVENUE 5835 NEW YORK, NY 10022 United States Reimbursement Contact Name and Information Reimbursement Contact Applicant Address Phone Email Information [Confidential] Preparer Contact Name and Information Preparer Contact Applicant Address Phone Email Information The Preparer is same as the reimbursement contact. Broadcaster Question Response Information Will the station be sharing equipment with Yes and another broadcast television station or Transition Plan stations (e.g., a shared antenna, co-location on a tower, use of the same transmitter room, multiple transmitters feeding a combiner, etc.)? If yes, enter the facility ID's of the other stations and click 'prefill' to download those stations' licensing information. Briefly describe transition plan Site owner will install an interim antenna for shared use by two stations currently sharing an antenna to continue operation while the shared Main antenna atop the tower is replaced and configured to support three stations. Transmitters Section Question Response Transmitter Related Do you have transmitter related -

United States Federal Communications Commission

UNITED STATES FEDERAL COMMUNICATIONS COMMISSION In Re: ) ) EN BANC HEARING ON ) BROADCAST AND CABLE EQUAL ) EMPLOYMENT OPPORTUNITY RULES ) Volume: 1 Pages: 1 through 138 Place: Washington, D.C. Date: June 24, 2002 HERITAGE REPORTING CORPORATION Official Reporters 1220 L Street, N.W., Suite 600 Washington, D.C. 20005-4018 (202) 628-4888 [email protected] 1 Before the FEDERAL COMMUNICATIONS COMMISSION Washington, D.C. 20554 In Re: ) ) EN BANC HEARING ON ) BROADCAST AND CABLE EQUAL ) EMPLOYMENT OPPORTUNITY RULES ) Commissioners Meeting Room Federal Communication Commission 445 12th Street, S.W. Washington, D.C. Monday, June 24, 2002 The parties met, pursuant to notice of the Commission, at 10:03 a.m. APPEARANCES: On behalf of the FCC: CHAIRMAN MICHAEL K. POWELL COMMISSIONER KATHLEEN ABERNATHY COMMISSIONER MICHAEL COPPS COMMISSIONER KEVIN MARTIN SECRETARY MARLENE DORTCH FORMER COMMISSIONER HENRY RIVERA Panelists - Panel I: HUGH PRICE, President and Chief Executive Officer National Urban League JOAN E. GERBERDING, President American Women in Radio and Television MARILYN KUSHAK, Vice-President Midwest Family Broadcasters Heritage Reporting Corporation (202) 628-4888 2 APPEARANCES: (Cont'd.) Panelists - Panel I: (Cont'd.) GREGORY HESSINGER, National Executive Director American Federation of Radio and Television Artists ANN ARNOLD, Executive Director Texas Association of Broadcasters LINDA BERG, Political Director National Organization for Women ESTHER RENTERIA, President Hispanic Americans for Fairness in Media Panelists - Panel II: CATHERINE L. HUGHES, Founder and Chairperson Radio One, Inc. BELVA DAVIS, Special Projects Reporter KRON-TV, San Francisco, California MICHAEL JACK, President and General Manager WRC-TV, Washington, D.C.; and Vice-President, NBC Diversity REVEREND ROBERT CHASE, Executive Director Office of Communications, United Church of Christ CHARLES WARFIELD, President and Chief Operating Officer ICBC Broadcast Holdings, Inc. -

When Being No. 1 Is Not Enough

A Report Prepared by the Civil Rights Forum on Communications Policy When Being No. 1 Is Not Enough: The Impact of Advertising Practices On Minority- Owned & Minority-Formatted Broadcast Stations Kofi Asiedu Ofori Principal Investigator submitted to the Office of Communications Business Opportunities Federal Communications Commission Washington, D.C. All Rights Reserved to the Civil Rights Forum on Communications Policy a project of the Tides Center Synopsis As part of its mandate to identify and eliminate market entry barriers for small businesses under Section 257 of the Telecommunications Act of 1996, the Federal Communications Commission chartered this study to investigate practices in the advertising industry that pose potential barriers to competition in the broadcast marketplace. The study focuses on practices called "no Urban/Spanish dictates" (i.e. the practice of not advertising on stations that target programming to ethnic/racial minorities) and "minority discounts" (i.e. the practice of paying minority- formatted radio stations less than what is paid to general market stations with comparable audience size). The study consists of a qualitative and a quantitative analysis of these practices. Based upon comparisons of nationwide data, the study indicates that stations that target programming to minority listeners are unable to earn as much revenue per listener as stations that air general market programming. The quantitative analysis also suggests that minority-owned radio stations earn less revenues per listener than majority broadcasters that own a comparable number of stations nationwide. These disparities in advertising performance may be attributed to a variety of factors including economic efficiencies derived from common ownership, assessments of listener income and spending patterns, or ethnic/racial stereotypes that influence the media buying process. -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2009 OR o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 001-09553 CBS CORPORATION (Exact name of registrant as specified in its charter) DELAWARE 04-2949533 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification Number) 51 W. 52nd Street New York, NY 10019 (212) 975-4321 (Address, including zip code, and telephone number, including area code, of registrant's principal executive offices) Securities Registered Pursuant to Section 12(b) of the Act: Name of Each Exchange on Title of Each Class Which Registered Class A Common Stock, $0.001 par value New York Stock Exchange Class B Common Stock, $0.001 par value New York Stock Exchange 7.625% Senior Debentures due 2016 American Stock Exchange 7.25% Senior Notes due 2051 New York Stock Exchange 6.75% Senior Notes due 2056 New York Stock Exchange Securities Registered Pursuant to Section 12(g) of the Act: None (Title of Class) Indicate by check mark if the registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act of 1933). Yes ☒ No o Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934. -

VAB Member Stations

2018 VAB Member Stations Call Letters Company City WABN-AM Appalachian Radio Group Bristol WACL-FM IHeart Media Inc. Harrisonburg WAEZ-FM Bristol Broadcasting Company Inc. Bristol WAFX-FM Saga Communications Chesapeake WAHU-TV Charlottesville Newsplex (Gray Television) Charlottesville WAKG-FM Piedmont Broadcasting Corporation Danville WAVA-FM Salem Communications Arlington WAVY-TV LIN Television Portsmouth WAXM-FM Valley Broadcasting & Communications Inc. Norton WAZR-FM IHeart Media Inc. Harrisonburg WBBC-FM Denbar Communications Inc. Blackstone WBNN-FM WKGM, Inc. Dillwyn WBOP-FM VOX Communications Group LLC Harrisonburg WBRA-TV Blue Ridge PBS Roanoke WBRG-AM/FM Tri-County Broadcasting Inc. Lynchburg WBRW-FM Cumulus Media Inc. Radford WBTJ-FM iHeart Media Richmond WBTK-AM Mount Rich Media, LLC Henrico WBTM-AM Piedmont Broadcasting Corporation Danville WCAV-TV Charlottesville Newsplex (Gray Television) Charlottesville WCDX-FM Urban 1 Inc. Richmond WCHV-AM Monticello Media Charlottesville WCNR-FM Charlottesville Radio Group (Saga Comm.) Charlottesville WCVA-AM Piedmont Communications Orange WCVE-FM Commonwealth Public Broadcasting Corp. Richmond WCVE-TV Commonwealth Public Broadcasting Corp. Richmond WCVW-TV Commonwealth Public Broadcasting Corp. Richmond WCYB-TV / CW4 Appalachian Broadcasting Corporation Bristol WCYK-FM Monticello Media Charlottesville WDBJ-TV WDBJ Television Inc. Roanoke WDIC-AM/FM Dickenson Country Broadcasting Corp. Clintwood WEHC-FM Emory & Henry College Emory WEMC-FM WMRA-FM Harrisonburg WEMT-TV Appalachian Broadcasting Corporation Bristol WEQP-FM Equip FM Lynchburg WESR-AM/FM Eastern Shore Radio Inc. Onley 1 WFAX-AM Newcomb Broadcasting Corporation Falls Church WFIR-AM Wheeler Broadcasting Roanoke WFLO-AM/FM Colonial Broadcasting Company Inc. Farmville WFLS-FM Alpha Media Fredericksburg WFNR-AM/FM Cumulus Media Inc. -

Federal Communications Commission Washington, D.C. 20554

Federal Communications Commission Washington, D.C. 20554 October 30, 2007 DA 07-4454 In Reply Refer to: 1800B3-TSN Released: October 30, 2007 Mr. Roy E. Henderson 1110 West William Cannon Drive Suite 402 Austin, TX 78745 In re: AM Broadcast Auction No. 84 Roy E. Henderson KNUZ(AM), Bellville, Texas Facility ID No. 48653 File No. BMJP-20050118ADC Application for Major Modification to AM Broadcast Station Dear Mr. Henderson: This letter refers to the above-noted application filed by Roy E. Henderson (“Henderson”) for major modification to the facilities of station KNUZ(AM), Bellville, Texas, seeking to change the community of license from Bellville to Katy, Texas. For the reasons set forth below, we dismiss the application. Background. Henderson timely filed his FCC Form 175 application to change the KNUZ(AM) community of license during the filing window for AM Auction No. 84 (“Auction 84”).1 Because the application was determined not to be mutually exclusive with any other proposal filed in the Auction 84 filing window, Henderson was invited to file his complete FCC Form 301 application by January 18, 2005.2 Henderson timely filed his complete FCC Form 301 application on January 18, 2005. Henderson proposes a change in community of license as well as a change to the KNUZ(AM) technical facilities. In connection with the community change, Henderson was instructed to submit an amendment addressing the implications of the proposed community change under Section 307(b) of the Communications Act of 1934, as amended, which directs the Commission to make a “fair, efficient, and equitable” distribution of radio service among communities in the United States.3 Henderson timely filed his Section 307(b) amendment on July 15, 2005. -

Attachment B - Second Adjacent Waiver Requests FCC 14-211

Attachment B - Second Adjacent Waiver Requests FCC 14-211 # Group # File No. BNPL City State Applicant Name 2nd waiver station(s) 1 2 20131112ALD BIRMINGHAM AL CALVARY OF BIRMINGHAM WDJC-FM 2 2 20131113BUA BIRMINGHAM AL GREATER BIRMINGHAM MINISTRIES, INC. WDJC-FM 3 2 20131112BVI BIRMINGHAM AL LOVE COMMANDMENT MINISTRIES WDJC-FM 4 2 20131024ANR BIRMINGHAM AL THE CHURCH IN BIRMINGHAM CORPORATION WDJC-FM 5 6 10 20131112AIY FORT SMITH AR IGLESIA GOZO DE MI ALMA KTCS-FM, KLSZ-FM 7 10 20131114BDO FORT SMITH AR THE HOLY FAMILY EDUCATIONAL ASSOCIATION OFKTCS-FM, SEBASTIAN KLSZ-FM COUNTY 8 9 91 20131112AMG ORLANDO FL HAITIAN RELIEF RADIO AND COMMUNITY SERVICES,WRUM(FM) INC. 10 11 94 20131106ASJ OAKLAND PARK FL THE OMEGA CHURCH INTERNATIONAL MINISTRY WLYF(FM) 12 13 96 20131114BLS FORT LAUDERDALE FL GENESIS CENTER FOR GROWTH AND DEVELOPMENT,WEDR(FM), INC. WKIS(FM) 14 96 20131113AEU HALLANDALE FL THE TRUTH WILL SET YOU FREE INC. WEDR(FM), WKIS(FM) 15 96 20131029AHM HIALEAH GARDENS FL IGLESIA MISIONERA PREGONEROS DE JUSTICIA DEWEDR(FM), FLORIDA, INC. WKIS(FM) 16 96 20131113BSY MIAMI SHORES FL BARRY UNIVERSITY WEDR(FM), WKIS(FM) 17 18 100 20131104AAW MIAMI FL SACRED FARM MINISTRIES WEDR(FM), WRTO-FM 19 20 102 20131105AJQ KISSIMMEE FL OSCEOLA CHRISTIAN PREPARATORY SCHOOL LLCWWKA(FM) 21 22 105 20131113BIO MIAMI FL 1MIAMI, INC. WFEZ(FM), WCMQ-FM 23 105 20131106ALS MIAMI FL TABERNACLE OF GLORY COMMUNITY CENTER INC.WFEZ(FM), WCMQ-FM 24 105 20131114BCD MIAMI BEACH FL CALVARY CHAPEL OF MIAMI BEACH, INC. WFEZ(FM), WCMQ-FM 25 105 20131113BUT NORTH MIAMI FL ACTION FOR BETTER FUTURE WFEZ(FM), WCMQ-FM 26 27 109 20131107ANM DANIA FL SOUTH FLORIDA FM INC. -

July Coalition Meeting CMSD East Professional Development Center Friday, July 12, 2019 9:30Am-11:30Am Welcome and Introductions

July Coalition Meeting CMSD East Professional Development Center Friday, July 12, 2019 9:30am-11:30am Welcome and Introductions 2 3 Our mission: To work together to create healthy environments for young children in Cuyahoga County. Our vision: Cuyahoga County is a community that provides all children ages 0-8 with the opportunity to establish healthy lifestyles in the environments where they live, learn, sleep, and play. 4 EAHS Strategic Plan can be found at: www.earlyageshealthystages.org Things We Did Well • The ability to network and connect with ours • Better understanding of working group objectives • Great feedback and report out from all working groups • Rich dialogue during working group • Progress of the work shown in working groups • Clearer understanding of the action orientated agenda Things You Ask that We Improve Upon • Working together with less negativity-be positive when communicating • Members of working groups attending consistently especially Co-Facilitators • Providing more context on action steps- still overwhelmed with all the papers 8 Recap of June’s Meeting • OHP Event – Best day for event, what is the intent of the event? – Who would like to be on the committee to assist with planning? • Presentation – Theresa Flood, A’Sarah Green- East Cleveland Public Library • Working Groups – Healthy Eating planning Resource Market event for the community on July 24, 2019 – Social & Emotional and Healthcare Access working together on overlap of ACE’s – Family Engagement is attending and supporting PBS “Be My Neighbor” family engagement event on August 9, 2019. – Healthcare Access will be attending Forum for CHW in October 9 Partner Presentation Stacey Stangel– Central State University Extension The Expanded Food and Nutrition Education Program (EFNEP) is a nutrition education program addressing nutrition and physical activity behaviors of low-income families. -

A Critical Ideological Analysis of Mass Mediated Language

Western Michigan University ScholarWorks at WMU Master's Theses Graduate College 8-2006 Democracy, Hegemony, and Consent: A Critical Ideological Analysis of Mass Mediated Language Michael Alan Glassco Follow this and additional works at: https://scholarworks.wmich.edu/masters_theses Part of the Mass Communication Commons Recommended Citation Glassco, Michael Alan, "Democracy, Hegemony, and Consent: A Critical Ideological Analysis of Mass Mediated Language" (2006). Master's Theses. 4187. https://scholarworks.wmich.edu/masters_theses/4187 This Masters Thesis-Open Access is brought to you for free and open access by the Graduate College at ScholarWorks at WMU. It has been accepted for inclusion in Master's Theses by an authorized administrator of ScholarWorks at WMU. For more information, please contact [email protected]. DEMOCRACY, HEGEMONY, AND CONSENT: A CRITICAL IDEOLOGICAL ANALYSIS OF MASS MEDIA TED LANGUAGE by Michael Alan Glassco A Thesis Submitted to the Faculty of the Graduate College in partial fulfillment'of the requirements for the Degreeof Master of Arts School of Communication WesternMichigan University Kalamazoo, Michigan August 2006 © 2006 Michael Alan Glassco· DEMOCRACY,HEGEMONY, AND CONSENT: A CRITICAL IDEOLOGICAL ANALYSIS OF MASS MEDIATED LANGUAGE Michael Alan Glassco, M.A. WesternMichigan University, 2006 Accepting and incorporating mediated political discourse into our everyday lives without conscious attention to the language used perpetuates the underlying ideological assumptions of power guiding such discourse. The consequences of such overreaching power are manifestin the public sphere as a hegemonic system in which freemarket capitalism is portrayed as democratic and necessaryto serve the needs of the public. This thesis focusesspecifically on two versions of the Society of ProfessionalJournalist Codes of Ethics 1987 and 1996, thought to influencethe output of news organizations.