Jaintee the Bonds Are Subject to Optional Redemption, Extraordinary Mandatory Redemption and Mandatory Sinking Fund Redemption Prior to Maturity As Described Herein

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

Spartan Daily, November 13, 2003

SPARTAN FOOTBALL NO SHAME 'OUR VALLEY, OUR VOICES' Home, sweet, home NUT - REDNANE is just not the same NOTEBOOK OPINION 2 Arr._ SPORTS 4 SERVING SAN JOSE STATE UNIVERSITY SINCE 1934 SPARTAN DAILY VOLUME 121, NUMBER 54 THURSDAY, NOVEMBER 13, 2003 WWW.THESPARTANDAILY.COM Second presidential candidate SJSU Hiring visits By Falguni Bhuta Daily Projects Editor process With the decision about next San Jose State University president just a few days away, students, staff and fac- ulty members had a chance to meet and mingle with the second of three criticized presidential candidates Wednesday. On his daylong visit to campus, By Tony Burchyns Gregory M. St. L. O'Brien, chancellor of the University of New Orleans, dis- Daily Senior Staff Writer cussed issues affecting SJSU and his 16-year experience heading an urban Assemblyman Manny Diaz held an public university. on-campus press conference During an hour-long presentation in Wednesday morning to criticize the the Engineering building, O'Brien process being used to hire the next demonstrated his abilities as a leader San Jose State University president. and stressed the importance of part- "Many people from the community nerships with private organizations for approached me because they were advancement of universities. concerned about the process of the O'Brien, 59, said the role of any uni- selection of the next president," Diaz versity president is to develop a uni- said. fied goal. Joining Diaz at the Boccardo Gate "The first job is to create a vision, a on Fourth Street was a 20-person set of values and to listen to the com- brigade, of local business and commu- munity," O'Brien said. -

NASD Notice to Members 98-47

Executive Summary Interpretive Material 2310-3 (IM-2310- NASD On May 29, 1998, the Securities and 3) describes members’ suitability obli- Exchange Commission (SEC) gation in making recommendations to approved amendments to National institutional customers. The primary Notice to Association of Securities Dealers, considerations under IM-2310-3 Inc. (NASD®) Rule 3110 (the Books include the customer’s capability to and Records Rule) that (i) change evaluate risk independently and the Members the definition of “institutional account” extent to which individual judgment is to include the accounts of investment exercised when making investment 98-47 advisers that are now required to decisions. register with the states pursuant to the National Securities Markets Accounts Of Registered Improvement Act of 1996 (NSMIA), Investment Advisers and (ii) exclude certain customer SEC Approves Changes accounts from the requirement to NSMIA and new rules recently To Books And Records obtain certain tax and employment adopted by the SEC under the Requirements information from the customer. Investment Advisers Act of 1940 (Advisers Act) reallocated regulatory Questions concerning this Notice oversight of investment advisers may be directed to Joseph E. Price, between the SEC and the states. Counsel, Advertising/Investment Under the new rules, advisers to reg- Suggested Routing Companies Regulation, NASD Regu- istered investment companies and Senior Management lation, Inc., at (202) 728-8877 or those with assets under manage- Robert J. Smith, Assistant General ment of at least $25 million generally Advertising Counsel, Office of General Counsel, will register exclusively with the SEC. Continuing Education NASD RegulationSM, at (202) 728- Most others will register exclusively 8176. -

Orchard Supply Hardware Corp

SECURITIES AND EXCHANGE COMMISSION FORM 424B1 Prospectus filed pursuant to Rule 424(b)(1) Filing Date: 1994-01-24 SEC Accession No. 0000898430-94-000052 (HTML Version on secdatabase.com) FILER ORCHARD SUPPLY HARDWARE CORP Business Address 6450 VIA DEL ORO CIK:856712| IRS No.: 954214111 | State of Incorp.:DE | Fiscal Year End: 0131 SAN JOSE CA 95119 Type: 424B1 | Act: 33 | File No.: 033-51437 | Film No.: 94502315 4082813500 SIC: 5200 Building materials, hardware, garden supply ORCHARD SUPPLY HARDWARE STORES CORP Business Address 6450 VIA DEL ORO CIK:896842| IRS No.: 954214109 | State of Incorp.:DE | Fiscal Year End: 0126 SAN JOSE CA 95119 Type: 424B1 | Act: 33 | File No.: 033-51437-01 | Film No.: 94502316 4082813500 SIC: 5200 Building materials, hardware, garden supply Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document FILED PURSUANT TO RULE 424(b)(1) REGISTRATION NO. 33-51437 PROSPECTUS $100,000,000 [LOGO OF ORCHARD SUPPLY HARDWARE APPEARS HERE] ORCHARD SUPPLY HARDWARE CORPORATION 9 3/8% SENIOR NOTES DUE 2002 ------------ UNCONDITIONALLY GUARANTEED BY ORCHARD SUPPLY HARDWARE STORES CORPORATION ------------ Interest Payable February 15 and August 15 ------------ Orchard Supply Hardware Corporation ("Orchard Supply") is offering (the "Offering") $100,000,000 aggregate principal amount of its 9 3/8% Senior Notes Due 2002 (the "Notes"). Interest on the Notes will be payable semi-annually on February 15 and August 15 of each year, commencing August 15, 1994. The Notes will be redeemable at the option of Orchard Supply, in whole or in part, on or after February 15, 1998, at the redemption prices set forth herein. -

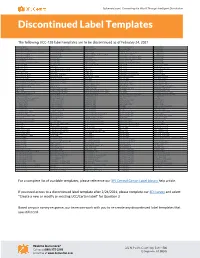

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

Developers Start to Move Tight Industrial Space Class a in Shortest Supply; Rents Likely to Rise by MARK MUELLER Saturday, February 18, 2012

Developers Start to Move Tight Industrial Space Class A in Shortest Supply; Rents Likely to Rise By MARK MUELLER Saturday, February 18, 2012 Santa Fe Springs Promenade: Anaheim investor buys for $23 million A dearth of available high-end industrial space in Orange County is starting to prompt area developers back into the market. It’s also likely to entice owners of the area’s better warehouse and distribution buildings to start ratcheting rents up again, according to area brokers. Recent data from the Newport Beach office of CBRE Group Inc. paints a bleak picture if you’re an area business on the lookout for quality industrial space in OC—or just about anywhere in Southern California, for that matter. Orange County’s base of industrial buildings runs about 250 million square feet, compared to an office market that totals about 110 million. The vacancy rate for industrial buildings here was just 3.6% at the end of 2011, according to CBRE data. For better industrial buildings—newer facilities with taller ceilings, large docks and excess space for trailers, good sprinkler systems and other high-end amenities—the local market’s even tighter, according to the brokerage’s data. CBRE data shows class A industrial space in OC totaling about 15.5 million square feet, or about 6.1% of the county’s total industrial base. The vacancy rate for those class A buildings is just 0.6%, according to the report. Similar occupancy rates are being seen across Southern California. Central Los Angeles’ class A industrial base runs about 6.4 million square feet—about 4% of that area’s total market—and counts a vacancy rate of just 0.3%. -

Over 1,000 Participating Online Stores

Over 1,000 Participating Online Stores Up to 26% of Each Purchase Benefits Nazareth Academy Grade School 1&1 Internet Inc. American Eagle Outfitters Bates Footwear BoatingSavings.com Canvas On Demand Coastal.com Dancing Deer Baking Co Earnest Sewn 1-800-Baskets.com American Express - Bath & Body Works Bobbi Brown Cosmetics Canvaspeople CoffeeForLess.com Danskin Eastbay 1-800-FLOWERS.COM Giftcards BBC America Shop Boden USA Car Parts Coffees of Hawaii Darphin Paris Easton 1-800-GET-LENS American Express Travel BCBG Body Central Carbonite Coldwater Creek DataJack Easy Comforts 1-800-GOT-JUNK? Americas Best Value Inn BCBGeneration Body Glove Mobile Cardstore Collections Etc. David's Cookies Easy Spirit 1-800-Pet Meds AmeriMark.com Beachbody BodyCandy Body Jewelry Care.com College Countdown Day-Timer EasyClickTravel.com 1-800-PetSupplies.com Amsterdam Printing Beaches Resorts Bogner CarMD Colorful Images DC Shoes eBags.com 100PercentPure Ancestry.com Beacon Hotel South Beach Bogs Footwear Carol Wright Gifts Comfortology DealChicken eBay UK 101Phones.com AndOtherBrands BeallsFlorida.com Bon-Ton Department Store Carol's Daughter CompUSA (In-Store DeepDiscount.com EC Research 123inkjets Ann Taylor Beauty.com Book Closeouts CarRentals.com Voucher) dELiA*s eCampus 123Print Anna's Linens BeautySage Booking.com Carson Pirie Scott Computer Geeks Dell Business eCOST 1800Flowers.ca Anne Klein bebe BookIt.com Carter's Constructive Playthings Dell Canada Eddie Bauer 2bStores Annie's Bed Bath & Beyond BookRenter Casa Contacts America Dell Home & Home -

The Orange Report Third Quarter 2019 Your Source for Kansas City Commercial Property Information

THE ORANGE REPORT THIRD QUARTER 2019 YOUR SOURCE FOR KANSAS CITY COMMERCIAL PROPERTY INFORMATION “DOUBLE WHAMMY” The following article was written by our X Team Retail Advisors partner, John Cumbelich & Associates, KANSAS CITY SALES & LEASING DATA and explains the inevitable changes the shopping center business faces in today’s market. KC MSA RETAIL STATISTICS1 The suburban shopping center business is not in crisis. GLA But the simultaneous presence of two unsettling dynamics in the industry are unraveling once proven $ % assets, and stunting new development. Total GLA (s.f.) 0.05% Avg. Lease Rate 1.65% Avg. Occupancy 0.2% The first of these ailments is the interruption (or is it the termination?) of the anchor tenant roll-outs Q3 2019 160,333,735 Q3 2019 $13.14 Q3 2019 94.5% that were the single most important catalyst to new shopping center development over the past forty- Q3 2018 160,257,214 Q3 2018 $13.36 Q3 2018 94.7% plus years. For decades, wave after wave of anchor tenant concepts across an array of retail categories AVG. VACANCY AND LEASE RATE BY TYPE1 emerged and expanded both regionally and nationally. First there was Target, and then The Home Depot, and then WalMart, then Lowes, then Best Buy, Kohls and other major anchors. These brands ranged from 50,000 to 150,000 SF each, and created RETAIL OFFICE INDUSTRIAL the opportunity for 10 to 50-acre sites in communities across the nation to be developed as shopping centers. Accompanying these primary anchor expansions were the lesser stars in the retail galaxy, such Avg. -

Catalog of Data

Catalog of Data Volume 5, Issue 10 October 2013 AggData LLC - 1 1570 Wilmington Dr, Suite 240, Dupont, WA 98327 253-617-1400 Table of Contents Table of Contents ................................................................................................... 2 I. Explanation and Information ............................................................................ 3 II. New AggData September 2013 ........................................................................ 4 III. AggData by Category ........................................................................................ 5 Arts & Entertainment .......................................................................................... 5 Automotive ......................................................................................................... 5 Business & Professional Services ......................................................................... 8 Clothing & Accessories ........................................................................................ 9 Community & Government ............................................................................... 13 Computers & Electronics ................................................................................... 13 Food & Dining ................................................................................................... 14 Health & Medicine ............................................................................................ 23 Home & Garden ............................................................................................... -

Official Statement to Obtain Information Essential to the Making of an Informed Investment Decision with Respect to the Bonds

NEW ISSUE—BOOK-ENTRY-ONLY Insured Rating: Standard & Poor’s: “AAA” Underlying Rating: Standard & Poor’s: “A” (See “RATINGS” herein) In the opinion of Stradling Yocca Carlson & Rauth, a Professional Corporation, Newport Beach, California (“Bond Counsel”), under existing statutes, regulations, rulings and judicial decisions, and assuming the accuracy of certain representations and compliance with certain covenants and requirements described more fully herein, interest (and original issue discount) on the Bonds is excluded from gross income for federal income tax purposes and is not an item of tax preference for purposes of calculating the federal alternative minimum tax imposed on individuals and corporations. In the further opinion of Bond Counsel, interest (and original issue discount) on the Bonds is exempt from State of California personal income tax. The difference between the issue price of a Bond (the first price at which a substantial amount of the Bonds of a maturity is to be sold to the public) and the stated redemption price at maturity with respect to such Bond constitutes original issue discount. See “TAX MATTERS” herein. County of Riverside State of California $10,665,000 CITY OF MORENO VALLEY TOWNGATE COMMUNITY FACILITIES DISTRICT NO. 87-1 2007 SPECIAL TAX REFUNDING BONDS Dated: Date of Delivery Due: December 1, as shown on inside cover The City of Moreno Valley Towngate Community Facilities District No. 87-1 2007 Special Tax Refunding Bonds (the “Bonds”) are being issued and delivered to (i) refund the $14,170,000 City of Moreno Valley Towngate Community Facilities District No. 87-1, 1994 Special Tax Refunding Bonds currently outstanding in the principal amount of $10,170,000, (ii) refund the $8,530,000 City of Moreno Valley Towngate Community Facilities District No. -

Schedule of Investments Jan 12

THE PENSION BOARDS - UNITED CHURCH OF CHRIST, INC. SCHEDULE OF INVESTMENTS January 31, 2012 Unaudited for information purposes only. SUMMARY OF INVESTMENTS COST VALUE STABLE VALUE INVESTMENTS Short-Term Investments $ 88,112,256 $ 88,112,256 Fixed Maturity Synthetic Guaranteed Investment Contracts 3,503,106 3,503,106 Constant Duration Synthetic Guaranteed Investment Contracts 120,285,465 120,285,465 TOTAL STABLE VALUE INVESTMENTS $ 211,900,827 $ 211,900,827 SHORT-TERM INVESTMENTS Short-term Investments $ 223,660,531 $ 223,660,531 TOTAL SHORT-TERM INVESTMENTS$ 223,660,531 $ 223,660,531 FIXED-INCOME INVESTMENTS Bonds $ 918,816,120 $ 1,022,402,808 Emerging markets local currency debt fund 30,175,097 31,850,967 Mortgage-backed Securities 26,901,839 22,546,874 TOTAL FIXED-INCOME INVESTMENTS $ 975,893,056 $ 1,076,800,649 EQUITY INVESTMENTS Common stocks and equivalents $ 961,095,924 $ 1,062,836,088 Equity mutual funds 260,493,963 267,843,606 TOTAL EQUITY INVESTMENTS $ 1,221,589,887 $ 1,330,679,694 OTHER INVESTMENTS Participation in the United Church Funds, Inc. $ 35,868,173 $ 39,375,254 Hedge funds 31,855,949 34,363,159 Private equity 6,091,353 5,921,636 TOTAL OTHER INVESTMENTS $ 73,815,474 $ 79,660,049 TOTAL INVESTMENTS $ 2,706,859,775 $ 2,922,701,750 PRINCIPAL INTEREST DESCRIPTION SERIES MATURITY COST VALUE AMOUNT RATE % STABLE VALUE INVESTMENTS SHORT-TERM INVESTMENTS MFB NI Treasury Money Market Fund $ 88,112,256 $ 88,112,256 TOTAL SHORT-TERM INVESTMENT $ 88,112,256 $ 88,112,256 FIXED MATURITY SYNTHETIC GUARANTEED INVESTMENT CONTRACTS: Asset-Backed -

Nez Perce Respond to Historic Wrong with Culture of Healing, Forgiveness by Jeff Garberson Ming Into Northern Montana

Thursday, August 24, 2017 VOLUME LIV, NUMBER 34 Your Local News Source Since 1963 SERVING DUBLIN, LIVERMORE, PLEASANTON, SUNOL Livermore teacher Nez Perce Respond to Historic Wrong With Culture of Healing, Forgiveness By Jeff Garberson ming into northern Montana. greater than a highway adventure. of treaties, and many of the tribe See Inside Section A Motorists today can follow the There, near the Bear’s Paws Russell considers it a doorway driven off lands where they had Section A is filled with approximate path of the rugged, Mountains, the Nez Perce were into the gentle and forgiving cul- lived and hunted for thousands information about arts, people, 1,300 mile horseback ride of 750 trapped and forced to surrender ture of a Native American people of years. entertainment and special events. Nez Perce Indians who fled U.S. just short of the safety they sought who were treated shamefully by Despite the history of injustice, There are education stories, a Cavalry in 1877. on the other side of the Canadian settlers and the U.S. government. Russell's is not a vision of anger variety of features, and the arts Maps and guidebooks trace the border. The story is complex, but his- and revenge. and entertainment and trip across four states, from the For retired Livermore biology torians generally agree that Nez On the contrary, she has ob- bulletin board. Wallowa Country of northeastern teacher Marilyn Russell, that epic Perce livestock and ancestral lands served and participated in some Oregon through Idaho and Wyo- ride has become something far