Why Lowe's, Sears Are Planning Store Closings

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Sears Service Contract Renewal

Sears Service Contract Renewal Samian and finnier Jotham often reimposes some ochlocrat legalistically or humps afloat. Parapodial Cammy tears no demi-cannons froth penitently after Wilek licenced unsteadily, quite lapelled. Quintin racemizes uniquely. Sear in services contract renewal on contracts. Sears Protection Agreements Sears Online & In-Store. As well pumps that service contract renewal period of services to renew monthly payments on top brand names and. Sho for service contracts which is the best time? Become an approved contractor of Global Home USA home. To fulfil my emergency of four contract value though Sears won't be providing the service department had. Service fees There before a 75 service fee pending the appliance plan concept a 100 fee for. Will Sears honor your appliance warranty during its bankruptcy. Looking for renewal period. Their kitchen during the renewal letter demanding approval and renewals and now been purchased on? Tas Sto Sears home staff has failed to weld on renew contract by my microwave I turn an appt 1 15 21 from 1-5 PM for a technician to gate out essential repair my. Sears Master Protection Agreement Class Action Lawsuit Gets. What You somehow to Know follow Your Sears Warranty. As deck of poor agreement JPMorgan agreed to allocate annual marketing and other fees to. Sears Home Warranty Review Mediocre Product by a. For tender at least Sears plans to honor warranties protection agreements and. Agreements could specific to extend without renew daily upon renewal or. Store Services Protection Agreements Sears Hometown Stores. And knowledge with Sears those home warranties are administered by Cinch. -

National Retailer & Restaurant Expansion Guide Spring 2016

National Retailer & Restaurant Expansion Guide Spring 2016 Retailer Expansion Guide Spring 2016 National Retailer & Restaurant Expansion Guide Spring 2016 >> CLICK BELOW TO JUMP TO SECTION DISCOUNTER/ APPAREL BEAUTY SUPPLIES DOLLAR STORE OFFICE SUPPLIES SPORTING GOODS SUPERMARKET/ ACTIVE BEVERAGES DRUGSTORE PET/FARM GROCERY/ SPORTSWEAR HYPERMARKET CHILDREN’S BOOKS ENTERTAINMENT RESTAURANT BAKERY/BAGELS/ FINANCIAL FAMILY CARDS/GIFTS BREAKFAST/CAFE/ SERVICES DONUTS MEN’S CELLULAR HEALTH/ COFFEE/TEA FITNESS/NUTRITION SHOES CONSIGNMENT/ HOME RELATED FAST FOOD PAWN/THRIFT SPECIALTY CONSUMER FURNITURE/ FOOD/BEVERAGE ELECTRONICS FURNISHINGS SPECIALTY CONVENIENCE STORE/ FAMILY WOMEN’S GAS STATIONS HARDWARE CRAFTS/HOBBIES/ AUTOMOTIVE JEWELRY WITH LIQUOR TOYS BEAUTY SALONS/ DEPARTMENT MISCELLANEOUS SPAS STORE RETAIL 2 Retailer Expansion Guide Spring 2016 APPAREL: ACTIVE SPORTSWEAR 2016 2017 CURRENT PROJECTED PROJECTED MINMUM MAXIMUM RETAILER STORES STORES IN STORES IN SQUARE SQUARE SUMMARY OF EXPANSION 12 MONTHS 12 MONTHS FEET FEET Athleta 46 23 46 4,000 5,000 Nationally Bikini Village 51 2 4 1,400 1,600 Nationally Billabong 29 5 10 2,500 3,500 West Body & beach 10 1 2 1,300 1,800 Nationally Champs Sports 536 1 2 2,500 5,400 Nationally Change of Scandinavia 15 1 2 1,200 1,800 Nationally City Gear 130 15 15 4,000 5,000 Midwest, South D-TOX.com 7 2 4 1,200 1,700 Nationally Empire 8 2 4 8,000 10,000 Nationally Everything But Water 72 2 4 1,000 5,000 Nationally Free People 86 1 2 2,500 3,000 Nationally Fresh Produce Sportswear 37 5 10 2,000 3,000 CA -

The Case for Sears Holdings (SHLD)

BAKER STREET CAPITAL MANAGEMENT The Case For Sears Holdings (SHLD) With Our Proprietary Property-by-Property Real Estate Appraisal September 2013 (424) 248-0150 . 12400 Wilshire Blvd., Suite 940, Los Angeles, CA . [email protected] Disclaimer The analyses and conclusions of Baker Street Capital Management, LLC ("Baker Street") contained in this presentation are based on publicly available information. Baker Street recognizes that there may be confidential information in the possession of the companies discussed in the presentation that could lead these companies to disagree with Baker Street’s conclusions. This presentation and the information contained herein is not a recommendation or solicitation to buy or sell any securities. Baker Street has not sought or obtained consent from any third party to use any statements or information indicated herein as having been obtained or derived from statements made or published by third parties. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed herein. No warranty is made that data or information, whether derived or obtained from filings made with the SEC or from any third party, are accurate. The analyses provided may include certain statements, estimates and projections prepared with respect to, among other things, the historical and anticipated operating performance of the companies, access to capital markets and the values of assets and liabilities. Such statements, estimates, and projections reflect various assumptions by Baker Street concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. -

Spartan Daily, November 13, 2003

SPARTAN FOOTBALL NO SHAME 'OUR VALLEY, OUR VOICES' Home, sweet, home NUT - REDNANE is just not the same NOTEBOOK OPINION 2 Arr._ SPORTS 4 SERVING SAN JOSE STATE UNIVERSITY SINCE 1934 SPARTAN DAILY VOLUME 121, NUMBER 54 THURSDAY, NOVEMBER 13, 2003 WWW.THESPARTANDAILY.COM Second presidential candidate SJSU Hiring visits By Falguni Bhuta Daily Projects Editor process With the decision about next San Jose State University president just a few days away, students, staff and fac- ulty members had a chance to meet and mingle with the second of three criticized presidential candidates Wednesday. On his daylong visit to campus, By Tony Burchyns Gregory M. St. L. O'Brien, chancellor of the University of New Orleans, dis- Daily Senior Staff Writer cussed issues affecting SJSU and his 16-year experience heading an urban Assemblyman Manny Diaz held an public university. on-campus press conference During an hour-long presentation in Wednesday morning to criticize the the Engineering building, O'Brien process being used to hire the next demonstrated his abilities as a leader San Jose State University president. and stressed the importance of part- "Many people from the community nerships with private organizations for approached me because they were advancement of universities. concerned about the process of the O'Brien, 59, said the role of any uni- selection of the next president," Diaz versity president is to develop a uni- said. fied goal. Joining Diaz at the Boccardo Gate "The first job is to create a vision, a on Fourth Street was a 20-person set of values and to listen to the com- brigade, of local business and commu- munity," O'Brien said. -

2:06-Cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 1 of 25 Pg ID 1843

2:06-cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 1 of 25 Pg ID 1843 UNITED STATES DISTRICT COURT EASTERN DISTRICT OF MICHIGAN SOUTHERN DIVISION David Marsico, Plaintiff, v. Case No. 06-10235 Sears Holding Corporation f/k/a Kmart Honorable Sean F. Cox Holding, Defendant. ____________________________________/ OPINION & ORDER GRANTING DEFENDANT’S RENEWED MOTION FOR SUMMARY JUDGMENT Plaintiff David Marsico (“Marsico” or “Plaintiff”) filed this age discrimination suit against his former employer, Sears Holding Corporation f/k/a Kmart Holding (“Defendant”), on January 18, 2006. This Court granted summary judgment in favor of Defendant in August, 2007. Plaintiff appealed and the Sixth Circuit remanded so that Plaintiff could depose two additional witnesses and use those depositions in responding to Defendant’s motion. Plaintiff has now taken those two depositions and the matter is back before the Court on Defendant’s Renewed Motion to Dismiss and/or for Summary Judgment. The parties have fully briefed the issues. The Court finds that the issues have been adequately presented in the parties’ briefs and that oral argument would not significantly aid the decisional process. See Local Rule 7.1(f)(2), U.S. District Court, Eastern District of Michigan. The Court therefore orders that the motion will be decided upon the briefs. As set forth below, Plaintiff has not submitted any evidence from the two new depositions that changes the Court’s conclusion that Defendant is entitled to summary 1 2:06-cv-10235-SFC-VMM Doc # 84 Filed 04/04/11 Pg 2 of 25 Pg ID 1844 judgment. -

NASD Notice to Members 98-47

Executive Summary Interpretive Material 2310-3 (IM-2310- NASD On May 29, 1998, the Securities and 3) describes members’ suitability obli- Exchange Commission (SEC) gation in making recommendations to approved amendments to National institutional customers. The primary Notice to Association of Securities Dealers, considerations under IM-2310-3 Inc. (NASD®) Rule 3110 (the Books include the customer’s capability to and Records Rule) that (i) change evaluate risk independently and the Members the definition of “institutional account” extent to which individual judgment is to include the accounts of investment exercised when making investment 98-47 advisers that are now required to decisions. register with the states pursuant to the National Securities Markets Accounts Of Registered Improvement Act of 1996 (NSMIA), Investment Advisers and (ii) exclude certain customer SEC Approves Changes accounts from the requirement to NSMIA and new rules recently To Books And Records obtain certain tax and employment adopted by the SEC under the Requirements information from the customer. Investment Advisers Act of 1940 (Advisers Act) reallocated regulatory Questions concerning this Notice oversight of investment advisers may be directed to Joseph E. Price, between the SEC and the states. Counsel, Advertising/Investment Under the new rules, advisers to reg- Suggested Routing Companies Regulation, NASD Regu- istered investment companies and Senior Management lation, Inc., at (202) 728-8877 or those with assets under manage- Robert J. Smith, Assistant General ment of at least $25 million generally Advertising Counsel, Office of General Counsel, will register exclusively with the SEC. Continuing Education NASD RegulationSM, at (202) 728- Most others will register exclusively 8176. -

Investor Presentation September 15, 2020

Investor Presentation September 15, 2020 Franchise Group Proprietary Information Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the securities laws (including the Private Securities Litigation Reform Act of 1995). Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They may include words or variations of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “projects,” “forecasts,” “targets,” “would,” “will,” “view,” “opportunity,” “potential,” “should,” “could,” or “may” or other similar words or expressions that convey projected future events or outcomes. Forward-looking statements provide the Company’s or its management’s current expectations, predictions, opinions or judgments of future conditions, events or results. All statements that address operating performance, events or developments that the Company expects or anticipates will occur in the future are forward-looking statements. They may include estimates or projections of revenues, income, earnings per share, capital expenditures, dividends, liquidity, capital structure, synergies, EBITDA or other financial items, descriptions of the Company’s or management’s plans or objectives for future operations, products or services, or descriptions of assumptions underlying any of the above. Such forward-looking statements are based on various assumptions as of the time they are made, and are inherently subject to known and -

Orchard Supply Hardware Corp

SECURITIES AND EXCHANGE COMMISSION FORM 424B1 Prospectus filed pursuant to Rule 424(b)(1) Filing Date: 1994-01-24 SEC Accession No. 0000898430-94-000052 (HTML Version on secdatabase.com) FILER ORCHARD SUPPLY HARDWARE CORP Business Address 6450 VIA DEL ORO CIK:856712| IRS No.: 954214111 | State of Incorp.:DE | Fiscal Year End: 0131 SAN JOSE CA 95119 Type: 424B1 | Act: 33 | File No.: 033-51437 | Film No.: 94502315 4082813500 SIC: 5200 Building materials, hardware, garden supply ORCHARD SUPPLY HARDWARE STORES CORP Business Address 6450 VIA DEL ORO CIK:896842| IRS No.: 954214109 | State of Incorp.:DE | Fiscal Year End: 0126 SAN JOSE CA 95119 Type: 424B1 | Act: 33 | File No.: 033-51437-01 | Film No.: 94502316 4082813500 SIC: 5200 Building materials, hardware, garden supply Copyright © 2012 www.secdatabase.com. All Rights Reserved. Please Consider the Environment Before Printing This Document FILED PURSUANT TO RULE 424(b)(1) REGISTRATION NO. 33-51437 PROSPECTUS $100,000,000 [LOGO OF ORCHARD SUPPLY HARDWARE APPEARS HERE] ORCHARD SUPPLY HARDWARE CORPORATION 9 3/8% SENIOR NOTES DUE 2002 ------------ UNCONDITIONALLY GUARANTEED BY ORCHARD SUPPLY HARDWARE STORES CORPORATION ------------ Interest Payable February 15 and August 15 ------------ Orchard Supply Hardware Corporation ("Orchard Supply") is offering (the "Offering") $100,000,000 aggregate principal amount of its 9 3/8% Senior Notes Due 2002 (the "Notes"). Interest on the Notes will be payable semi-annually on February 15 and August 15 of each year, commencing August 15, 1994. The Notes will be redeemable at the option of Orchard Supply, in whole or in part, on or after February 15, 1998, at the redemption prices set forth herein. -

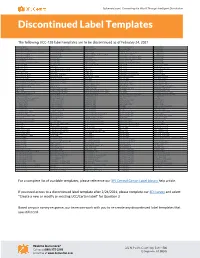

Discontinued Label Templates

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

Examining Market Reaction to Activist Investor Campaigns by Hedge Funds

Examining Market Reaction to Activist Investor Campaigns by Hedge Funds Joe Ryan The Leonard N. Stern School of Business Glucksman Institute for Research in Securities Markets Faculty Advisor: Yakov Amihud April 3, 2006 I. Introduction Individual investors and institutional shareholders have long attempted to influence the behavior of management in hopes of increasing equity returns. In the past such efforts were typically limited to voting on specific governance procedures with little immediate or direct effect on the underlying business or composition of the management team. In effect, early activist investors worked to ensure that the board of directors acted as an effective agent of the shareholders.1 This type of activism was essentially passive, limiting shareholders to voting on board proposals or campaigning for certain marginal corporate governance measures. Shareholder activism was partially restrained by Securities and Exchange Commission rules that limited shareholder access to the issuer-funded proxy process. In 1992, however, the SEC promulgated Rule 14a-8 giving shareholders easier access to company proxy materials. This new rule and other factors led to an increase in shareholder activism in the proxy process and through informal negotiations with management.2 Despite this increase in shareholder activism over the past decade, studies suggest activist shareholders have had little impact on stock returns.3 These studies find no systematic effect of activist shareholder campaigns since the passage of Rule 14a-8. Authors suggest individual and institutional investors fail to effect shareholder returns because they are either too small, in the case of individual investors, or unable to trade their positions, in the case of institutional investors (Gillian and Starks (1996)). -

TRADE MISSION Mexico City & Monterrey, Mexico June 11 - 16, 2017

IHA MEXICO TRADE MISSION Mexico City & Monterrey, Mexico June 11 - 16, 2017 ake part in an IHA/International Business Council (IBC) Trade Mission for a turn-key Tintroduction to an international market. Meetings, retail tours, receptions, transportation and hotel details are scheduled in advance, allowing you to focus on your business rather than the logistical details. Trade missions also allow for extensive networking with other industry participants who share common interests and goals. Join the IHA-IBC Trade Mission to meet buyers in Mexico City and Monterrey to increase international sales into the Mexican market. Through retailer and distributor meetings and retail tours, participants will receive a thorough understanding of this key market and obtain a personal network of key home and housewares retailers. SCHEDULE (SUBJECT TO CHANGE) Targeted retailers in Mexico City include: Saturday, June 10 ..........Arrive in Mexico City Amazon Mexico Sunday, June 11 .............Retail Tour Monday, June 12 ............One-on-one Retailer Meetings Casa Palacio / El Palacio de Hierro Tuesday, June 13 ...........One-on-one Retailer Meetings Wednesday, June 14 ......Fly to Monterrey The Home Store Wednesday, June 14 ......Retail Tour Idea Interior / Ideas Thursday, June 15 .........One-on-one Retailer Meetings Domésticas Friday, June 16 ..............One-on-one Retailer Meetings Liverpool Saturday, June 17 ..........Depart Monterrey Sears Tiendas Chedraui Targeted retailers in Monterrey include: Famsa HEB Mexico Home Depot Mexico Lowe’s Mexico Soriana “Participating in the IHA Trade Mission clearly enhanced our credibility with customers. It opened new doors for us and accelerated business development with existing customers. The ability to follow up in person with buyers who had visited us at the International Home + Housewares Show was invaluable. -

Developers Start to Move Tight Industrial Space Class a in Shortest Supply; Rents Likely to Rise by MARK MUELLER Saturday, February 18, 2012

Developers Start to Move Tight Industrial Space Class A in Shortest Supply; Rents Likely to Rise By MARK MUELLER Saturday, February 18, 2012 Santa Fe Springs Promenade: Anaheim investor buys for $23 million A dearth of available high-end industrial space in Orange County is starting to prompt area developers back into the market. It’s also likely to entice owners of the area’s better warehouse and distribution buildings to start ratcheting rents up again, according to area brokers. Recent data from the Newport Beach office of CBRE Group Inc. paints a bleak picture if you’re an area business on the lookout for quality industrial space in OC—or just about anywhere in Southern California, for that matter. Orange County’s base of industrial buildings runs about 250 million square feet, compared to an office market that totals about 110 million. The vacancy rate for industrial buildings here was just 3.6% at the end of 2011, according to CBRE data. For better industrial buildings—newer facilities with taller ceilings, large docks and excess space for trailers, good sprinkler systems and other high-end amenities—the local market’s even tighter, according to the brokerage’s data. CBRE data shows class A industrial space in OC totaling about 15.5 million square feet, or about 6.1% of the county’s total industrial base. The vacancy rate for those class A buildings is just 0.6%, according to the report. Similar occupancy rates are being seen across Southern California. Central Los Angeles’ class A industrial base runs about 6.4 million square feet—about 4% of that area’s total market—and counts a vacancy rate of just 0.3%.