Investor Presentation September 15, 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Discontinued Label Templates

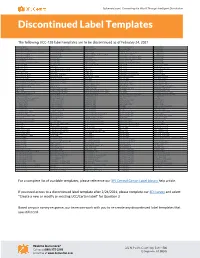

3plcentral.com | Connecting the World Through Intelligent Distribution Discontinued Label Templates The following UCC-128 label templates are to be discontinued as of February 24, 2021. AC Moore 10913 Department of Defense 13318 Jet.com 14230 Office Max Retail 6912 Sears RIM 3016 Ace Hardware 1805 Department of Defense 13319 Joann Stores 13117 Officeworks 13521 Sears RIM 3017 Adorama Camera 14525 Designer Eyes 14126 Journeys 11812 Olly Shoes 4515 Sears RIM 3018 Advance Stores Company Incorporated 15231 Dick Smith 13624 Journeys 11813 New York and Company 13114 Sears RIM 3019 Amazon Europe 15225 Dick Smith 13625 Kids R Us 13518 Harris Teeter 13519 Olympia Sports 3305 Sears RIM 3020 Amazon Europe 15226 Disney Parks 2806 Kids R Us 6412 Orchard Brands All Divisions 13651 Sears RIM 3105 Amazon Warehouse 13648 Do It Best 1905 Kmart 5713 Orchard Brands All Divisions 13652 Sears RIM 3206 Anaconda 13626 Do It Best 1906 Kmart Australia 15627 Orchard Supply 1705 Sears RIM 3306 Associated Hygienic Products 12812 Dot Foods 15125 Lamps Plus 13650 Orchard Supply Hardware 13115 Sears RIM 3308 ATTMobility 10012 Dress Barn 13215 Leslies Poolmart 3205 Orgill 12214 Shoe Sensation 13316 ATTMobility 10212 DSW 12912 Lids 12612 Orgill 12215 ShopKo 9916 ATTMobility 10213 Eastern Mountain Sports 13219 Lids 12614 Orgill 12216 Shoppers Drug Mart 4912 Auto Zone 1703 Eastern Mountain Sports 13220 LL Bean 1702 Orgill 12217 Spencers 6513 B and H Photo 5812 eBags 9612 Loblaw 4511 Overwaitea Foods Group 6712 Spencers 7112 Backcountry.com 10712 ELLETT BROTHERS 13514 Loblaw -

TRADE MISSION Mexico City & Monterrey, Mexico June 11 - 16, 2017

IHA MEXICO TRADE MISSION Mexico City & Monterrey, Mexico June 11 - 16, 2017 ake part in an IHA/International Business Council (IBC) Trade Mission for a turn-key Tintroduction to an international market. Meetings, retail tours, receptions, transportation and hotel details are scheduled in advance, allowing you to focus on your business rather than the logistical details. Trade missions also allow for extensive networking with other industry participants who share common interests and goals. Join the IHA-IBC Trade Mission to meet buyers in Mexico City and Monterrey to increase international sales into the Mexican market. Through retailer and distributor meetings and retail tours, participants will receive a thorough understanding of this key market and obtain a personal network of key home and housewares retailers. SCHEDULE (SUBJECT TO CHANGE) Targeted retailers in Mexico City include: Saturday, June 10 ..........Arrive in Mexico City Amazon Mexico Sunday, June 11 .............Retail Tour Monday, June 12 ............One-on-one Retailer Meetings Casa Palacio / El Palacio de Hierro Tuesday, June 13 ...........One-on-one Retailer Meetings Wednesday, June 14 ......Fly to Monterrey The Home Store Wednesday, June 14 ......Retail Tour Idea Interior / Ideas Thursday, June 15 .........One-on-one Retailer Meetings Domésticas Friday, June 16 ..............One-on-one Retailer Meetings Liverpool Saturday, June 17 ..........Depart Monterrey Sears Tiendas Chedraui Targeted retailers in Monterrey include: Famsa HEB Mexico Home Depot Mexico Lowe’s Mexico Soriana “Participating in the IHA Trade Mission clearly enhanced our credibility with customers. It opened new doors for us and accelerated business development with existing customers. The ability to follow up in person with buyers who had visited us at the International Home + Housewares Show was invaluable. -

A Postmortem for Sears - Transcript

A Postmortem for Sears - Transcript Tom Mullooly: In episode 123, we're going to do a postmortem on Sears Roebuck. Stick around. Welcome to the Mullooly Asset show. I'm your host, Tom Mullooly, and this is episode number 123. One, two, three red light. So today, the day that we're recording this, it looks like Sears Roebuck is going to ask the bankruptcy court to enter liquidation, and that's the end of Sears as we know it. So I thought it would be a good time to just kind of take a walk down memory lane. There's a lot of people in the media today who are comparing Amazon to Sears saying, "Hey, Sears was the Amazon of its day." And I just want to share a couple of things that I've learned over the years about Sears. It was started in 1886 as a mail order company. Richard Sears actually sold watches through a catalog that he put together. A year later, in 1887, he hires a guy named Alvah Roebuck to repair watches. So I guess they had problems with some of the watches that they were selling through their catalog. They then added jewelry, and the mail order business really took off. What helped them, a little bit of history for you, is that in the late 1880s, the US government started a program called rural free delivery, or RFD. Some of you are around my age may remember a TV show after Andy Griffith left. It was called Mayberry RFD, and everybody always wanted to know what RFD stood for. -

Paper Procurement Policy

SEARS HOLDINGS CORPORATION’S SUSTAINABLE PAPER PROCUREMENT POLICY Our Commitments Sears Holdings Corporation and its affiliates, including Sears Roebuck and Co. and Kmart Corporation ("SHC") are committed to having a positive role in promoting the sustainability of forests and other natural resources. The objective of this policy is to encourage a sustainable combination of resources and processes to produce the paper for: • catalogs and retail flyers/circulars • internal use • direct mail Sustainable Fiber SHC will not knowingly source fiber from illegally harvested or traded sources. Our goal is to procure paper sourced from credibly certified forest sources with verified chain-of-custody. We use principles of lifecycle assessment to comparatively rate the environmental impact of paper procurement choices. In practice, this means working with our suppliers to get more accurate understandings of the lifecycle costs of paper choices based on grade types and fiber sources available. Supplier Requirements and Preferred Sustainable Supplier Program We require all of our paper suppliers to meet our supplier requirements. By meeting those requirements and going beyond them, suppliers can also qualify for our preferred sustainable supplier program. The preferred program gives purchasing preference to suppliers who otherwise meet our price, reliability and quality requirements. Supplier Requirements All paper suppliers to SHC must ensure that their products are legally harvested and traded. Paper suppliers to SHC are not permitted to provide paper from "unwanted" forest sources. An Unwanted Source falls within one or more of the following categories: • The source forest is known or suspected of containing high conservation values, except where: o The forest is certified or in progress of certification under a credible certification standard ensuring responsible management practices, or o The forest manager can otherwise demonstrate that the forest and/or surrounding landscape is managed to ensure those values are maintained. -

Court File No. CV-17-11846-00CL SEARS CANADA INC., AND

Court File No. CV-17-11846-00CL SEARS CANADA INC., AND RELATED APPLICANTS TWENTY-SECOND REPORT OF FTI CONSULTING CANADA INC., AS MONITOR SEPTEMBER 7, 2018 Contents Section Page A. INTRODUCTION ....................................................................................................................2 B. PURPOSE ................................................................................................................................5 C. TERMS OF REFERENCE .......................................................................................................6 D. OVERVIEW .............................................................................................................................7 E. ASSET REALIZATIONS ........................................................................................................9 F. DISTRIBUTIONS TO DATE ................................................................................................10 G. CLAIMS AGAINST SEARS CANADA, FORMER CORBEIL AND FORMER SLH .......11 H. EFFECT OF PENSION MOTION ON CREDITOR RECOVERIES ...................................12 I. PENSION MATTERS RELATING TO FORMER CORBEIL AND FORMER SLH .........14 J. TAX IMPLICATIONS ...........................................................................................................17 K. MULTI-JURISDICTIONAL AGREEMENTS AND GOVERNING LAW .........................17 L. SPOUSAL WAIVER .............................................................................................................18 Court File No. -

291550 Berlyfcneowtsyq9tmq

SEARS Corporate Branding Guide, 2009 Executive Edition © Sears Holding Corp. Designed by EyeCon Graphics .......................................................................Our Mission .......................................................................................Our Story .........................................................................Current Brand .............................................................................Why Rebrand? ......................................................Mood and Inspiration ..............................................................................Color Choice The Guide .........................................................................................Type .........................................................................Imagery ................................................................................Logo Design .....................................................................Internal Launch ...........................................................................Employee Gifts ...........................................................................Stationery ..............................................................................The Campaign ....................................................................The New Look Mission To grow our business by providing quality products and services at great value when and where our customers want them, and by building positive, lasting relationships with our customers. Sears’ Vision To be the preferred -

Extra 15% Off Extra 10%

BLEED 6.25 RELEASE 3 TRIM 6.125 TYPE 5.875 October 30, 2009 12:55 PM family and friends SEPARATOR: SEPARATOR: V.I.P. Night Sunday, December 6th, 6-9pm at Sears, Sears Grand, Sears Essentials, Sears Hardware, Sears Home Appliance Showrooms and The Great Indoors Sears Hometown Stores’ event will be December 14 all day Shop sears.com 12/6 all day to 12/7 4AM Silo’d merch and shadows should be merged to background Silo’d merch get your holiday shopping done in one night! guaranteed best prices ’til Christmas PLUS extra 15% off women’s, men’s and kids’ apparel, intimate apparel, accessories, fragrances, shoes and fi ne jewelry Exclusions apply. See page 2 for details.** TRIM 10.875 TYPE 10.625 BLEED 11.125 extra 10% off almost everything else including tools, auto and more Exclusions apply. See page 2 for details.** extra 5% off electronics Associate discount does not apply. Exclusions apply. See page 2 for details.* save early with enclosed FASHION SAVINGS PASS Additional 15% off regular, sale andDec clearance 6th to 5 pm. prices See pageand details. 5 for pass FRIENDS AND FAMILY MAILER JOB #103868 FC RETIREE/STORE released 10/30/09 km JA #912M008 BLEED 6.25 RELEASE 3 TRIM 6.125 October 30, 2009 1:20 PM TYPE 5.875 PLEASE JOIN US FOR OUR family and friends V.I.P. Night Sunday, December 6, 6-9pm at Sears, Sears Grand, Sears Essentials, Sears Hardware, Sears Home Appliance Showrooms and The Great Indoors On this special night we reward all of our V.I.P.s. -

Why Lowe's, Sears Are Planning Store Closings

Why Lowe’s, Sears Are Planning Store Closings Kmarts are dwindling and Orchard Supply Hardware will shutter ARTICLE AUGUST 23, 2018 Krista Garcia Add Sears and Lowe's to the list of retail shake-ups. Both companies announced shrinking brand portfolios this week, but the factors that necessitated these closures weren't exactly the same. Sears Holdings has been struggling for some time. Earlier this year the troubled retailer said it would close more than 200 stores by the end of 2018. Now it's adding 46 more: 33 Sears stores and 13 Kmart locations are set to shutter in November. The slow death of the mid-market mall has had dire consequences for traditional anchor stores like Sears. With shopping behavior shifting online and the fact that retailers built too many stores during boom times, Sears has found that the number of its brick-and-mortar stores isn't sustainable. Store productivity has been waning for years. The average sales per store have been declining since 2015. And the average sales per square foot have been shrinking for the past five years, falling from $126 in 2013 to $87 in 2018. Why Lowe’s, Sears Are Planning Store Closings: Kmarts are dwindling and Orchard Supply Hardware will shutter 1 ©2020 eMarketer Inc. All rights reserved. Eddie Lampert, CEO and chairman of Sears Holdings, earlier this month offered (in his capacity as a hedge fund manager) more than $400 million for the Kenmore appliance brand, one of Sears' last remaining valuable assets. Last year Sears sold its Craftsman tool brand to Stanley Black & Decker. -

Assignment 2

College: LaGuardia Community College Course: Business 101 Instructor: Janice Karlen Text: Business, 10th Ed; Pride, Hughes, and Kappor Contents: Assignment 2 ..................................................................................................................................................2 Text for assignment 2 .................................................................................................................................3 Assignment 3 ..................................................................................................................................................10 High score..........................................................................................................................................11 Mid Score ...........................................................................................................................................12 Low Score ..........................................................................................................................................13 Text Excerpt for assignment 3 ................................................................................................................14 Syllabus for course.......................................................................................................................................20 *Assignment 1 for this course is not included in this packet because it is a multiple choice quiz. 1 of 26 Assignment 2: Sears/Kmart decision to close stores Students must find articles -

Companies/ Industries

Companies/ Industries June 6 — June 12, 2016 • After years of red ink, the retailer may sell its best-known brands • "Leaner, meaner, but with no reason to walk through the door" Once upon a time, Sears was the trading above $100, closed at $13-30 in decline as Americans spend differ• Amazon.com and Walmart of U.S. mer• late May. Some mall owners are eager ently and on different things. People are chandising. Customers could order just to replace its stores with those of more buying fewer clothes, spending more about anything for delivery-even a kit vibrant tenants. And on May 26, the on dining and other experiences, and to build a 10-room colonial-style house- company said it would consider selling saving more. In the mid-'8os, 45 percent from the Sears catalog, a compendium some of its crown jewels: the Kenmore of consumer spending went to goods, of the American dream with a reach appliance, DieHard battery, and the remainder to services. Today those into the rural parts of the country that Craftsman tool brands. figures are 31 percent and 69 percent, helped make Sears, Roebuck America's "They have been in a desperate respectively, according to Customer largest merchant. Sears helped create state for a number of years," says Matt Growth's Johnson. When Americans the shopping mall in the 1950s, working McGinley, an analyst at Evercore ISI, do buy goods, they're shifting where with developers to build the retail the lone Wall Street firm still covering they shop-not just to online, but to off- centers that grew with the exodus to the company. -

47X69 Eastfield Mall Directory 2012

DEPARTMENT STORES Macy’s Sears JUNIOR ANCHORS 115 Old Navy Rave Cinemas 117 P13 P12 P11 WOMEN’S APPAREL K10 118 119 120 121 122 123 124 125 126 127 128 129 129 Aeropostale 122 Airbrush Junction P9 K4 K5 K6 K8 130 131 132 137 130 American Eagle Outfitters P8 K3 K9 X 152 126 Asian Imports 150 149 148 147 146 145 144 128 Bling Bling P7 P1 P5 P4 P3 153 141 143 140 111 Born & Raised USA 139 138 150 Chic 114 K2 154 113 124 Christopher & Banks 156 109 Deb Shops & Deb Plus 112 157 169 Eblens 111 117 Hot Topic 158 149 Journeys 110 134 Old Navy 118 Olympia Sports 165 Primo Apparel LEGEND 109 107 Rainbow K1 ATM 105 Surdoué 108 113 Swagger Bus 107 Family Restroom Alfani Macy's 106 165 167 168 Food Court American Rag Macy's Atticus Hot Topic 105 166 Kiddie Rides Champion Eblens Mail Born & Raised Coach Macy's 104 169 Mall Services 101 102 Columbia Olympia Management Office Dickies Eblens Fox Racing Olympia Public Safety Guess Macy's Restrooms Levi's Born & Raised Eblens Strollers Macy's Telephones LOVEsick Hot Topic Nautica Macy's UPS North Face Born & Raised Wheelchairs Ralph Lauren Macy's Rude Hot Topic Coca-Cola Vending Machine Tommy Hilfiger Macy's Cash for Cell Phones Under Armor Olympia MEN’S APPAREL 129 Aeropostale SHOES CELL PHONES HEALTH & BEAUTY 130 American Eagle Outfitters 112 Radio Shack 127 Bath & Body Works 122 Airbrush Junction 128 Bling Bling K-10 Sprint by Archtelecom 106 Chinese Chair Massage 130 American Eagle Outfitters 109 Deb Shops & Deb Plus 123 Sprint by Nexgen Wireless 120 Dr. -

NASDAQ Welcomes Sears Holdings Corporation

NASDAQ Welcomes Sears Holdings Corporation New York, N.Y. — The Nasdaq Stock Market, Inc. (NASDAQ®; NASDAQ: NDAQ) today welcomed Sears Holdings Corporation (NASDAQ: SHLD) as a newly listed company. The event was commemorated by the newly formed Sears Holdings Corp. ringing the Opening Bell at NASDAQ’s MarketSite in Times Square. Sears Holdings Corporation unites two powerful brands, Kmart and Sears. Kmart has been a NASDAQ-listed company since 2003 and Sears was listed on the New York Stock Exchange for 95 years. “Sears and Kmart are two of the great iconic American companies, and true to their status they have embraced new ways of thinking,” said Bob Greifeld, president and CEO of The NASDAQ Stock Market. “We look forward to partnering with Sears Holdings as it moves forward and continues to make history. By listing on NASDAQ today, it joins some of the most innovative retailers in the world.” NASDAQ® is the largest electronic screen-based equity securities market in the United States. With approximately 3,300 companies, it lists more companies and, on average, trades more shares per day than any other U.S. market. It is home to companies that are leaders across all areas of business including technology, retail, communications, financial services, transportation, media and biotechnology. NASDAQ is the primary market for trading NASDAQ-listed stocks. For more information about NASDAQ, visit the NASDAQ Web site at www.nasdaq.com or the NASDAQ Newsroom at www.nasdaq.com/newsroom/. # # # Media Contact: Bethany Sherman 212.401.8714.