Inner 9 Flexicap Fund

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Annual Report 2017-18

Godrej Industries Ltd. www.godrejindustries.com ANNUAL REPORT 2017-18 Contents Board of Directors 02 Corporate Information 04 Chairman’s Statement 06 Financial Highlights 11 Notice & Explanatory Statement 13 Board's Report 27 Report on Corporate Governance 93 Auditor’s Report (Consolidated) 113 Consolidated Accounts 120 Auditor's Report (Standalone) 217 Standalone Accounts 224 Statement Pursuant to Section 129 283 1 BOARD OF DIRECTORS A. B. Godrej Chairman N. B. Godrej Managing Director T. A. Dubash Executive Director & Chief Brand Officer J. N. Godrej V. M. Crishna N. S. Nabar Executive Director & President (Chemicals) K. K. Dastur S. A. Ahmadullah A. B. Choudhury A. D. Cooper K. N. Petigara K. M. Elavia Corporate Information AUDITORS : BSR & Co. LLP, Chartered Accountants BOARD COMMITTEES Audit Committee : K. K. Dastur (Chairman) S. A. Ahmadullah K. N. Petigara A. B. Choudhury Nomination & : S. A. Ahmadullah (Chairman) Compensation Committee A. B. Choudhury K. N. Petigara Stakeholders Relationship/ : A. B. Godrej (Chairman) Shareholders Committee N. B. Godrej T. A. Dubash N. S. Nabar Corporate Social : N. B. Godrej (Chairman) Responsibility Committee: T. A. Dubash K. N. Petigara A. B. Choudhury Risk Management Committee : N. B. Godrej (Chairman) T. A. Dubash N. S. Nabar Management Committee : A. B. Godrej (Chairman) N. B. Godrej A. D. Cooper T. A. Dubash N. S. Nabar CHIEF FINANCIAL OFFICER : Clement Pinto COMPANY SECRETARY : Nilufer Shekhawat REGISTERED OFFICE : Godrej One, Pirojshanagar, Eastern Express Highway, Vikhroli (East), Mumbai 400 079. Phone: 022-2518 8010, 2518 8020, 2518 8030 Fax: 022-2518 8066 website: www.godrejindustries.com CIN No.: L24241MH1988PLC097781 4 REGISTRARS & TRANSFER AGENT : Computech Sharecap Ltd. -

Big Power Trade - Futuros National Stock Exchange of India (NSE)

BiG Power Trade - Futuros National Stock Exchange of India (NSE) País / Região Bolsa Produto Horário Futuros (Moeda, National Stock Exchange of India (NSE) Segunda-feira - Sexta-feira: Acções, Índices de 9:15-15:30 IST* Índia www.nseindia.com acções) IB Simbolo Instrumento Simbolo Moeda ACC ACC LIMITED ACC INR ADANIPOWE ADANI POWER LIMITED ADANIPOWER INR AJANTPHAR AJANTA PHARMA LTD AJANTPHARM INR ALBK ALLAHABAD BANK ALBK INR AMARAJABA AMARA RAJA BATTERIES LTD AMARAJABAT INR AMBUJACEM AMBUJA CEMENTS LIMITED AMBUJACEM INR ANDHRABAN ANDHRA BANK ANDHRABANK INR APOLLOHOS APOLLO HOSPITALS ENTERPRISE APOLLOHOSP INR APOLLOTYR APOLLO TYRES LIMITED APOLLOTYRE INR ARVIND ARVIND LTD ARVIND INR ASHOKLEY ASHOK LEYLAND LIMITED ASHOKLEY INR ASIANPAIN ASIAN PAINTS LTD ASIANPAINT INR AUROPHARM AUROBINDO PHARMA LTD AUROPHARMA INR AXISBANK AXIS BANK LTD AXISBANK INR BAJAJ-AUT BAJAJ AUTO LIMITED BAJAJ-AUTO INR BAJAJFINS BAJAJ FINSERV LTD BAJAJFINSV INR BAJFINANC BAJAJ FINANCE LTD BAJFINANCE INR BALKRISIN BALKRISHNA INDUSTRIES LTD BALKRISIND INR BALRAMCHI BALRAMPUR CHINI MILLS LTD BALRAMCHIN INR BANKBAROD BANK OF BARODA BANKBARODA INR BANKINDIA BANK OF INDIA BANKINDIA INR BANKNIFTY Nifty Bank BANKNIFTY INR BATAINDIA BATA INDIA LTD BATAINDIA INR BEL BHARAT ELECTRONICS LTD BEL INR BEML BEML LIMITED BEML INR BERGEPAIN BERGER PAINTS INDIA LTD BERGEPAINT INR BHARATFIN BHARAT FINANCIAL INCLUSION L BHARATFIN INR BHARATFOR BHARAT FORGE LIMITED BHARATFORG INR BHARTIART BHARTI AIRTEL LIMITED BHARTIARTL INR BHEL BHARAT HEAVY ELECTRICALS BHEL INR BIOCON BIOCON LTD BIOCON -

Media Release

| INDUSTRIES Media Release Mumbai, May 30, 2011 Consolidated Total Income for FY 2010-11 at ` 4602 crore up by 24% Consolidated PBDIT for FY 2010-11 at ` 466 crore up by 34% Consolidated PBT for FY 2010-11 at ` 323 crore up by 52% Consolidated Net Profit for FY 2010-11 at ` 293 crore up by 44% Board of Directors recommend 175% final dividend Godrej Industries Limited today reported its financial performance for Q4 & FY 2010-2011. Highlights of the financial results for Q4 & FY 2010-11: ` Cr. Q4 Q4 % FY FY % FY 2011 FY 2010 increase 2011 2010 increase Total Income 1431 1099 30% 4602 3716 24% PBDIT 175 123 42% 466 347 34% PBT 134 96 39% 323 213 52% Net Profit 109 76 43% 293 203 44% EPS (`) (annualised) 13.7 9.6 43% 9.2 6.4 44% Final Dividend proposed for FY 2010-11, subject to shareholders’ approval, is ` 1.75 per equity share of ` 1/- each (previous year ` 1.50 per equity share of ` 1/- each). HIGHLIGHTS OF PERFORMANCE (Q4 FY 2010-11) • Total Income increased by 30% to ` 1431 crore. • PBDIT higher by 42% to ` 175 crore. • Profit Before Tax up by 39% to ` 134 crore. • Net Profit increased by 43% to ` 109 crore. CHAIRMAN’S COMMENTS Commenting on the performance for Q4 & FY 2010-11, Mr. A. B. Godrej, Chairman, Godrej Industries Limited, said: “It gives me great pleasure to announce that it has been an excellent year for all our operating businesses thereby reinforcing the efficacy of our business model, our vision and values, and ‘CREATE’, our strategy for growth. -

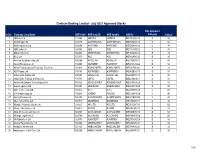

Working July 2021.Xlsx

Centrum Broking Limited - July 2021 Approved Stocks CBL Approved Sr.No Company Long Name BSE Code BSE Scrip ID NSE Symbol ISIN No Category Haircut 1 3M India Ltd 523395 3MINDIA 3MINDIA INE470A01017 D 50 2 Aarti Drugs Ltd 524348 AARTIDRUGS AARTIDRUGS INE767A01016 D 50 3 Aarti Industries Ltd 524208 AARTIIND AARTIIND INE769A01020 C 40 4 ABB India Ltd 500002 ABB ABB INE117A01022 C 40 5 Abbott India Ltd 500488 ABBOTINDIA ABBOTINDIA INE358A01014 B 25 6 ACC Ltd 500410 ACC ACC INE012A01025 B 25 7 Accelya Solutions India Ltd 532268 ACCELYA ACCELYA INE793A01012 E 60 8 Adani Enterprises Ltd 512599 ADANIENT ADANIENT INE423A01024 D 50 9 Adani Ports & Special Economic Zone Ltd 532921 ADANIPORTS ADANIPORTS INE742F01042 A 20 10 ADF Foods Ltd 519183 ADFFOODS ADFFOODS INE982B01019 D 50 11 Aditya Birla Capital Ltd 540691 ABCAPITAL ABCAPITAL INE674K01013 D 50 12 Aditya Birla Fashion & Retail Ltd 535755 ABFRL ABFRL INE647O01011 D 50 13 Advanced Enzyme Technologies Ltd 540025 ADVENZYMES ADVENZYMES INE837H01020 D 50 14 Aegis Logistics Ltd 500003 AEGISLOG AEGISCHEM INE208C01025 D 50 15 Agro Tech Foods Ltd 500215 ATFL ATFL INE209A01019 E 60 16 AIA Engineering Ltd 532683 AIAENG AIAENG INE212H01026 C 40 17 Ajanta Pharma Ltd 532331 AJANTPHARM AJANTPHARM INE031B01049 C 40 18 Akzo Nobel India Ltd 500710 AKZOINDIA AKZOINDIA INE133A01011 C 40 19 Alembic Pharmaceuticals Ltd 533573 APLLTD APLLTD INE901L01018 E 60 20 Alkem Laboratories Ltd 539523 ALKEM ALKEM INE540L01014 B 25 21 Alkyl Amines Chemicals Ltd 506767 ALKYLAMINE ALKYLAMINE INE150B01039 D 50 22 Allcargo Logistics -

NTDOP Strategy December 2018 Update

NTDOP Strategy December 2018 Update Investment Objective Top 10 Holding & Top 5 Sectors The Strategy aims to deliver superior returns by investing in stocks Scrip Names % Holdings from sectors that can benefit from the Next Trillion Dollar GDP growth by focusing on different Multicap stocks Kotak Mahindra Bank Ltd. 11.10 Page Industries Ltd. 10.17 Performance Voltas Ltd. 8.87 Bajaj Finance Ltd. 5.33 5.63X Eicher Motors Ltd. 5.26 65 NTDOP Strategy Nifty 500 City Union Bank Ltd. 4.99 55 L&T Technology Services Ltd. 4.38 45 Bosch Ltd. 4.27 35 Max Financial Services Ltd. 3.97 25 Godrej Industries Ltd. 3.89 15 1.79X Sectors % Allocation 5 Banking & Finance 30.21 -5 FMCG 17.98 Jul-12 Jul-17 Jan-10 Jan-15 Jun-10 Jun-15 Oct-08 Oct-13 Oct-18 Apr-11 Apr-16 Sep-11 Feb-12 Sep-16 Feb-17 Dec-07 Dec-12 Dec-17 Aug-09 Aug-14 Nov-10 Nov-15 Mar-09 Mar-14 May-13 May-18 May-08 Auto & Auto Ancillaries 13.11 Diversified 12.76 29.54 Infotech 8.05 NTDOP Strategy Nifty 500 26.72 26.64 Cash 0.14 17.02 15.53 16.42 15.84 13.01 13.43 13.81 13.26 10.86 Market Capitalization 7.12 5.45 Market Capitalization % Equity 1 year 2 Year 3 Years 4 Years 5 Years 7 Years 10 years Since Large cap 43 -3.00 -0.50 Inception Midcap 51 Smallcap 6 Weighted Average Market Cap (Rs. -

Company Reliance Industries Limited Tata Consultancy Services

Top 1000 Private Sector Companies (Rank-wise List) Company Reliance Industries Limited Tata Consultancy Services (TCS) Infosys Technologies Ltd Wipro Limited Bharti Tele-Ventures Limited ITC Limited Hindustan Lever Limited ICICI Bank Limited Housing Development Finance Corp. Ltd. TATA Steel Limited Ranbaxy Laboratories Limited HDFC Bank Ltd Tata Motors Limited Larsen & Toubro Limited (L&T) Satyam Computer Services Ltd. Maruti Udyog Limited Bajaj Auto Ltd. HCL Technologies Ltd. Hero Honda Motors Limited Hindalco Industries Ltd Reliance Energy Limited Grasim Industries Limited Jet Airways (India) Ltd. Sun Pharmaceuticals Industries Ltd Cipla Ltd. Gujarat Ambuja Cements Ltd. Videsh Sanchar Nigam Limited The Tata Power Company Limited Sterlite Industries (India) Ltd. Associated Cement Companies Ltd. Nestlé India Ltd. Hindustan Zinc Limited GlaxoSmithKline Pharmaceuticals Limited Siemens India Ltd. Motor Industries Company Limited Mahindra & Mahindra Limited UTI Bank Ltd. Zee Telefilms Limited Bharat Forge Limited ABB Limited i-Flex Solutions Ltd. Dr. Reddy's Laboratories Ltd. Nicholas Piramal India Limited Kotak Mahindra Bank Limited Reliance Capital Ltd. Ultra Tech Cement Ltd. Patni Computer Systems Ltd. Wockhardt Limited Indian Petrochemicals Corporation Limited Biocon India Limited Essar Oil Limited. Asian Paints Ltd. Dabur India Limited Jaiprakash Associates Limited JSW Steel Limited Tata Chemicals Limited Tata Tea Limited Tata Teleservices (Maharashtra) Limited The Indian Hotels Co. Ltd. Glenmark Pharmaceuticals Limited NIRMA Limited Jindal Steel & Power Ltd HCL Infosystems Ltd. Cadila Healthcare Limited Colgate-Palmolive (India) Limited The Great Eastern Shipping Company Limited Aventis Pharma India Ltd Ashok Leyland Limited Pantaloon Retail (India) Limited Indian Rayon And Industries Limited Financial Technologies (India) Ltd United Phosphorus Limited Matrix Laboratories Limited Sesa Goa Limited Lupin Ltd Cummins India Limited Crompton Greaves Limited. -

Report on Corporate Governance

REPORT ON CORPORATE GOVERNANCE COMPANY’S PHILOSOPHY ON denotes the highest rating. The CGR2+ has a lead Independent Director, CORPORATE GOVERNANCE rating implies that according to ICRA’s in line with the accepted best Corporate governance refers to the current opinion, the rated company has practices, to strengthen the framework of rules and practices adopted and follows such practices, focus and quality of discussion through which the board of directors conventions, and codes that would at the Board level. ensures accountability, fairness, provide its financial stakeholders a high and transparency in a company’s level of assurance on the quality of The Board meets at least relationship with all its stakeholders. corporate governance. once in a quarter to review the Company’s quarterly The Company is a part of the 122-year- The SVG1 rating is on a rating scale of performance and financial old Godrej Group, which has established SVG1 to SVG6, where SVG1 denotes results. Board meetings are a reputation for honesty, integrity, and the highest rating. The SVG1 rating governed with a structured sound governance. The Company’s implies that in ICRA’s current opinion, agenda. The Board periodically philosophy on corporate governance the Company belongs to the highest reviews compliance reports with envisages attainment of the highest category on the composite parameters respect to laws and regulations levels of transparency, accountability, of stakeholder value creation and applicable to the Company. and equity in all facets of its operations management as well as corporate Before the commencement of and interactions with its stakeholders, governance practices. the Audit Committee meeting, including shareholders, employees, the members of the Audit lenders, and the government. -

Companies Visited for Placement 2020-21 (As on 15 July 2021) Sr. No

Companies visited for placement 2020-21 (as on 15th July 2021) Sr. No. Company Name 1 Accenture 2 Addverb Technologies 3 Aditya Birla Group 4 ADP (Automatic Data Processing)-Phase 1 5 ADP (Automatic Data Processing)-Phase 2 6 AFCONS Infrastructure Ltd 7 Amazon - Phase 1 8 Amazon - Phase 2 9 Anchanto Pte Ltd. 10 Apisero 11 AppDynamics Technologies India Pvt. Ltd. 12 Atyati Technologies - Phase 1 13 Atyati Technologies - Phase 2 14 Axis My India 15 Axxela Advisory Services LLP 16 Bajaj Auto Ltd. 17 Bharti Airtel 18 Billdesk 19 BNY Mellon Technology 20 Bosch Ltd. 21 Capgemini 22 Caterpillar India Pvt. Ltd. 23 CGI 24 Chubb Business Services India LLP 25 Cientra TechSolution Pvt. Ltd. 26 CITI India - Phase 1 27 CITI India - Phase 2 28 Codenation Innovation Labs 29 Cognizant Technology Solutions (Software Developer (Base+) 30 Cognizant Technology Solutions (Software Developer (Pathfinder - Base++) 31 Credit Suisse 32 Crowdstrike 33 Cummins India Ltd. 34 Dassault Systemes 35 Datametica Solutions Pvt. Ltd. 36 Decimal Point Analytics Pvt. Ltd. 37 DeepTek Medical Imaging Pvt Ltd 38 Deloitte USI Consulting 39 Early Salary 40 ExxonMobil Services & Technology Pvt. Ltd.-Phase 1 41 ExxonMobil Services & Technology Pvt. Ltd.-Phase 2 42 Fidelity Investments - Phase 1 43 Fidelity Investments - Phase 2 44 FORD MOTORS PVT. LTD. 45 Fractal Analytics Pvt. Ltd. Sr. No. Company Name 46 GAIL Ltd. (PSU) 47 Galaxy Surfactants Ltd. 48 Godrej & Boyce 49 Godrej industries Ltd. 50 Goldman Sachs Services Pvt. Ltd. - Phase 1 51 Goldman Sachs Services Pvt. Ltd. - Phase 2 52 Growisto 53 Helium Consulting Private Limited 54 Hindustan Unilever Ltd. -

Check out the Results

National Safety Council – Maharashtra Chapter Maharashtra Safety Award Competition – 2019 Scheme – I Lowest Average Accident Frequency Rate (A) Factories working up to Two Lakh man-hours in a year Sr Ref. Group Name & Address of Factory Accident Award No. No. Freq. Rate Chemicals & Aquapharm Chemicals Pvt. Ltd., 1 19 0.00 A Plaque Fertilizers Tal:- Mulshi, Dist.Pune Paper, Sugar & Emcure Pharmaceuticals Ltd., 2 49 0.00 A Plaque Pharmaceutical Bhosari, Pune Storage, Handling & Indian Oil Corporation Ltd., 3 70 Distribution of 0.00 A Plaque Small Can Filling Plant, Nagpur Petroleum Products ITD Cementation India Ltd., 4 63 Construction 0.00 A Plaque Track laying Work Project, Mumbai (B) Factories working more than Two Lakh up to Four Lakh man-hours in a year Sr. Ref. Group Name & Address of Factory Accident Award No. No. Freq. Rate Chemicals & Privi Organics India Ltd., Unit-I, 5 113 0.00 A Plaque Fertilizers Mahad, Dist. Raigad 6 128 Heavy Engineering. Nevatia Steel & Alloys Pvt. Ltd., Tarapur, Palghar 0.00 A Plaque 7 93 Light Engineering. Harita Seating Systems Ltd., Ranjangaon, Pune 0.00 A Plaque Storage, Handling & Hindustan Petroleum Corporation Ltd., 8 87 Distribution of 0.00 A Plaque Chakan LPG Plant, Haveli, Pune Petroleum Products Godrej & Boyce Mfg. Co. Ltd., 9 83 Construction 0.00 A Plaque MR1, RMC Plant, Vikhroli West, Mumbai Cement RCCPL Pvt. Ltd., 10 135 0.00 A Plaque Manufacturing Butibori, Nagpur 11 136 Miscellaneous DSM India Pvt. Ltd., Tal. Shirur, Dist. Pune 0.00 A Plaque (C) Factories working more than Four Lakh up to Six Lakh man-hours in a year Sr. -

Godrej Properties Limited

Godrej Properties Limited December 2009 DISCLAIMER Godrej Properties Limited (“Company”) proposes, subject to receipt of requisite approvals, market conditions and other considerations, to make an initial public offer of its equity shares and has filed a draft red herring prospectus (“DRHP”) with the Securities and Exchange Board of India (“SEBI”). The DRHP is available on SEBI website at www.sebi.gov.in, as well as on the websites of the global coordinators and book running lead managers at www.icicisecurities.com and www.kotak.com , and of the book running lead managers at www.idfcsski.com and http://www.nomura.com/asia/services/capital_raising/equity.shtml. Investors should note that investment in equity shares involves a high degree of risk and for details relating to the same, see the section titled “Risk Factors” of the DRHP. This presentation is for informational purposes only and does not constitute an offer or invitation to purchase or subscribe for any securities in any jurisdiction, including the United States. No part of it should form the basis of or be relied upon in connection with any investment decision or any contract or commitment to purchase or subscribe for any securities. None of the securities of the Company may be offered or sold in the United States, without registration under the U.S. Securities Act of 1933, as amended, or pursuant to an exemption from registration therefrom. Investors and prospective investors in securities of the Company are required to make their own independent investigation and appraisal of the business and financial condition of the Company and the nature of the securities. -

Godrej Industries Limited Regd Office: Pirojshanagar, Eastern Express Highway, Vikhroli, Mumbai 400 079

Godrej Industries Limited Regd Office: Pirojshanagar, Eastern Express Highway, Vikhroli, Mumbai 400 079 Results communication –Q3 FY 2007-08 Mumbai, January 29, 2008 Q3 FY 2007- 08 PBDIT up by 162%; 9M FY 2007-08 PAT grows 44%, PBT up by 38%; Fast Forward into the future… Godrej Industries Ltd., a diversified Indian company with several business interests ranging from chemicals, processed foods and beverages, animal feeds, poultry, rural retailing, pest management services, property development, agri-products to branded tea, confectionery, household insecticides and BPO among others, today announced its financial results for the quarter ended 31st December 2007. Highlights Q3/9M FY 2007-08 • Successful placement of QIP issue, raising Rs. 600 crore • Q3 FY 2007-08 - PBDIT higher at Rs. 29.0 crore; up by 162% • 9M FY 2007-08 - PBT increases by 38% to Rs. 82.9 crore • 9M FY 2007-08 - Net Profit at Rs. 88.1 crore; higher by 44% • EPS 9M FY 2007-08 at Rs. 3.7 (annualised) • Ranked as 9th Fastest Wealth Creator and 65th Biggest Wealth Creator (2002-07) Announcing the results, Mr. Adi Godrej, Chairman, Godrej Industries Limited said, ‘‘The results for the quarter and nine months reflect the company’s ability to deliver and sustain growth. GIL successfully placed an equity issue of Rs. 600 crore with QIBs which would help accelerate the growth plans of the company and its subsidiaries. Our Oleo Chemicals business continued to register an impressive performance in the third quarter of the current year. Our subsidiary, Godrej Properties continues its accelerated growth in the real estate market and is fast developing multiple projects in cities like Mumbai, Bangalore, Pune, Kolkata, Hyderabad and Mangalore. -

Inner 9 Flexicap Fund

Modera erate tely Mod High to e H w at ig o er h L d o M V e r y w H Tata Flexi Cap Fund o i L g (An open ended dynamic equity scheme investing across large cap, mid cap, small cap stocks.) h Riskometer Investors understand that their principal As on 31st July 2021 PORTFOLIO will be at Very High Risk INVESTMENT STYLE Company name No. of Market Value % of Company name No. of Market Value % of Primarily focuses on investing in equity and equity related Shares Rs. Lakhs Assets Shares Rs. Lakhs Assets instruments of well researched companies across market Equity & Equity Related Total 185889.49 93.44 Leisure Services capitalization. Auto Jubilant Foodworks Ltd. 115000 4341.42 2.18 INVESTMENT OBJECTIVE Eicher Motors Ltd. 102000 2580.86 1.30 Easy Trip Planners Ltd. 500000 2045.50 1.03 The investment objective of the Scheme is to generate capital Auto Ancillaries Pesticides appreciation over medium to long term. However, there is no MRF Ltd. 4750 3795.60 1.91 Astec Lifesciences Ltd. 173000 2401.59 1.21 assurance or guarantee that the investment objective of the Scheme will be achieved. The scheme does not assure or guarantee any Banks Bayer Cropscience Ltd. 34921 2017.88 1.01 returns. ICICI Bank Ltd. 2200000 15015.00 7.55 Petroleum Products DATE OF ALLOTMENT HDFC Bank Ltd. 560000 7988.12 4.02 Reliance Industries Ltd. 565000 11499.45 5.78 September 06,2018 Axis Bank Ltd. 761500 5398.27 2.71 Pharmaceuticals Kotak Mahindra Bank Ltd. 225000 3723.30 1.87 Dr Reddys Laboratories Ltd.