Shimao Property

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Annual Report on the Most Valuable and Strongest Real Estate Brands June 2020 Contents

Real Estate 25 2020The annual report on the most valuable and strongest real estate brands June 2020 Contents. About Brand Finance 4 Get in Touch 4 Brandirectory.com 6 Brand Finance Group 6 Foreword 8 Executive Summary 10 Brand Finance Real Estate 25 (USD m) 13 Sector Reputation Analysis 14 COVID-19 Global Impact Analysis 16 Definitions 20 Brand Valuation Methodology 22 Market Research Methodology 23 Stakeholder Equity Measures 23 Consulting Services 24 Brand Evaluation Services 25 Communications Services 26 Brand Finance Network 28 © 2020 All rights reserved. Brand Finance Plc, UK. Brand Finance Real Estate 25 June 2020 3 About Brand Finance. Brand Finance is the world's leading independent brand valuation consultancy. Request your own We bridge the gap between marketing and finance Brand Value Report Brand Finance was set up in 1996 with the aim of 'bridging the gap between marketing and finance'. For more than 20 A Brand Value Report provides a years, we have helped companies and organisations of all types to connect their brands to the bottom line. complete breakdown of the assumptions, data sources, and calculations used We quantify the financial value of brands We put 5,000 of the world’s biggest brands to the test to arrive at your brand’s value. every year. Ranking brands across all sectors and countries, we publish nearly 100 reports annually. Each report includes expert recommendations for growing brand We offer a unique combination of expertise Insight Our teams have experience across a wide range of value to drive business performance disciplines from marketing and market research, to and offers a cost-effective way to brand strategy and visual identity, to tax and accounting. -

China Equity Strategy

June 5, 2019 09:40 AM GMT MORGAN STANLEY ASIA LIMITED+ China Equity Strategy | Asia Pacific Jonathan F Garner EQUITY STRATEGIST [email protected] +852 2848-7288 The Rubio "Equitable Act" - Our Laura Wang EQUITY STRATEGIST [email protected] +852 2848-6853 First Thoughts Corey Ng, CFA EQUITY STRATEGIST [email protected] +852 2848-5523 Fran Chen, CFA A new bill sponsored by US Senator Marco Rubio has the EQUITY STRATEGIST potential to cause significant change in the listing domains of [email protected] +852 2848-7135 Chinese firms. After the market close in the US yesterday 4th June the Wall Street Journal published an Op-Ed by US Senator Marco Rubio in which he announced that he intends to sponsor the “Equitable Act” – an acronym for Ensuring Quality Information and Transparency for Abroad-Based Listings on our Exchanges. At this time the text of the bill has not been published and we are seeking additional information about its contents and likelihood of passing. However, our early reaction is that this has the potential to cause significant changes in the domain for listings of Chinese firms going forward with the potential for de- listing of Chinese firms on US exchanges and re-listing elsewhere (most likely Hong Kong). More generally we see this development as part of an increased escalation of tensions between China and the US on multiple fronts which should cap the valuation multiple for China equities, in particular in the offshore index constituents and US-listed parts of the universe. We provide a list of the potentially impacted China / HK names with either primary or secondary listings on Amex, NYSE or Nasdaq. -

Sustainability Development Work Sustainability Development Work

2019 Shimao Group Holdings Limited Sustainability Report Chairman's Message Chairman's Message Harmonic co-existence and empowered development Invest in philanthropy and conserve cultural legacy In 2019, due to the advantage of diverse business and investment Over the years, Shimao adheres its originality and takes social planning in advance, Shimao shifted from the role of city operator responsibility. At present, Shimao is actively engaged in philanthropic to the role of city empowerment, the core of which is framework of sectors, such as cultural inheritance, medical assistance for poverty Big Plane Strategy: body is the property development; wings are the alleviation, community care, life illumination, etc. commercial office, property management, hotel operation, culture and Chairman's Message entertainment; stabilizers are high technology, healthcare, education, In 2019, Shimao continued to invest into the conservation of cultural elder care, finance and etc. The rapid-moving Big Plane will power up legacy and integrated Chinese cultural IP into products and service through those components, injecting the power into the sustainable of Shimao, energizing traditional Chinese culture in current popular development and working on high-quality and better life of people. market. From Quanzhou Shimao • The Palace Museum Maritime Silk Road Museum (temporary name) to The Forbidden City Gallery • Wuyi Activating the new engine of Chinese economy and attracting Mountain Branch, Shimao keeps exploring and practicing and shifted worldwide attention -

CEBI Research China Property

CEBI Research China Property Sector Report ─ China Property Fine tuning policy yet to boost sales volume ñ Housing policy shows signal of relaxation especially after Local’s Dominic Chan Two sessions Senior Equity Analyst ñ Debt financing surged with lower funding cost in Jan 2019, [email protected] reflecting a loose credit conditions. (852) 2916-9631 ñ Relatively stable in RMB currency YTD ñ Chinese property companies met its 2018 sales target, but home sales growth is likely to slow down in 2019 27 Feb 2019 ñ Maintain our bullish view on COLI (688 HK) and Logan Property (3380 HK) More fine tuning policies to come: China property sector continued to rebound in 2019. During the working conference held by Ministry of Housing and Urban-Rural Development of China by the end of 2018, the ministry highlighted 10 key tasks in 2019, including stabilize home and land prices in 2019. Meanwhile, more cities announced fine-tuning policies on property market, we expect more to come in the near future. Debt refinancing surged by 90% in Jan2019: As per our Key Data previous report, debt repayment for China property companies Avg.19 E P/E (x) 5.88 Avg.19E P/B (x) 1.32 will soar from 2019 to 2021. However, China property succeed to Avg.18 E Dividend Yield (%) 5.20 raise money by debt refinancing in recent months. According to Source: Bloomberg, CEBI the data of CRIC,the amount of debt issuance in Jan2019 was Rmb109.6bn, surged by 91.8% MoM. RMB appreciated against US dollars: As developers are Sector Performance (%) having a high level of foreign-denominated debt, RMB 1-mth 7.6 depreciation will weigh on their profitabilities and cash flows. -

Accelerated Scale Expansion to Further Stretch Balance Sheet

September 20, 2016 COMMENT Sunac China Holdings (1918.HK) HK$5.87 Equity Research Accelerated scale expansion to further stretch balance sheet News On Sept 18, Sunac announced a potential transaction with Legend (3396.HK, Sept 19 close HK$20; Neutral; covered by Simon Cheung) to acquire 42 property projects in 16 cities with total unsold GFA of 7.3mn sqm for consideration of Rmb13.8bn, pending approval from shareholders of the companies. The consideration is comprised of Rmb3.6bn equity interest in companies that hold interests in the properties and assumption of Rm10.2bn of external debt, shareholders’ loan and accrued but unpaid interest. It will be paid in cash including Rmb5.5bn in 2016 and the rest in 2017 if the deal completes in early 2017 according to mgmt. Analysis As we highlighted in "Sunac China: Downgrade to Neutral on weak profitability and rising leverage" (Aug 31, 2016), we expect Sunac to continue its aggressive scale expansion at the expense of lower margins and higher leverage, and the proposed transaction comes at an even more accelerated pace than we anticipated. Based on the disclosed details, we note: 1) If completed, Sunac’s attributable landbank size will increase by 18% to GFA36.5mn sqm from 1H16 and geographic coverage will expand by 8 new cities to a total of 35 cities while the share of its attributable land bank in tier- 1/2/3 cities will change to 9%/67%/24% from 10%/75%/15% as of 1H16 (Ex. 1). 2) Stripping out one-off gains, the assets generated c.Rmb0.2bn net profit in 2015 (equivalent to 6% of Sunac's 2015 core profit) due to a deceleration in sales and margin slippage as per Simon Cheung. -

Overseas Regulatory Announcement

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. This announcement does not constitute an offer to sell or the solicitation of an offer to buy any securities in the United States or any other jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities referred to herein will not be registered under the Securities Act, and may not be offered or sold in the United States except pursuant to an exemption from, or a transaction not subject to, the registration requirements of the Securities Act. Any public offering of securities to be made in the United States will be made by means of a prospectus. Such prospectus will contain detailed information about the company making the offer and its management and financial statements. The Company does not intend to make any public offering of securities in the United States. (Incorporated in the Cayman Islands with limited liability) (Stock code: 813) OVERSEAS REGULATORY ANNOUNCEMENT This overseas regulatory announcement is issued pursuant to Rule 13.10B of the Rules Governing the Listing of Securities (the “Listing Rules”) on The Stock Exchange of Hong Kong Limited (the “Stock Exchange”). Reference is made to the announcement of Shimao Property Holdings Limited (the “Company”) dated 5 December 2017 in relation to the issue of the Additional Notes (the “Announcement”). -

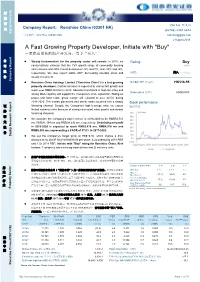

A Fast Growing Property Developer, Initiate with "Buy"

股 票 研 [Table_Title] Van Liu 刘斐凡 Company Report: Ronshine China (03301 HK) 究 (86755) 2397 6672 Equity Research 公司报告: 融信中国 (03301 HK) [email protected] 2 August 2018 A[Table_summary] Fast Growing Property Developer, Initiate with "Buy" 一家快速增长的地产开发商,首予“买入” 公 Steady fundamentals for the property sector will remain. In 2018, we Rating:[Table_Rank] Buy 司 conservatively estimate that the YoY growth range of commodity housing Initial sales amount and GFA should be between -5% and 0%, and -10% and -5%, 报 respectively. We also expect stable ASP, decreasing saleable areas and 评级: 买入 (首次覆盖) 告 steady investment. Company Report Ronshine China Holdings Limited ("Ronshine China") is a fast growing 6[Table_Price]-18m TP 目标价 : HK$16.55 property developer. Contracted sales is expected to extend fast growth and reach over RMB120.0 bn in 2018. Abundant land bank in high-tier cities and Share price 股价: HK$9.000 strong M&A capacity will support the Company's scale expansion. Riding on proper unit land costs, gross margin will rebound to over 22.5% during 告 2018-2020. The shares placement and senior notes issuance hint a steady Stock performance 证 financing channel. Despite the Company's high leverage ratio, we expect 股价表现 报 limited solvency risks because of strong contracted sales growth and steady 券 [Table_QuotePic] 究 financing channels. 研 研 We estimate the Company’s total revenue in 2018-2020 to be RMB58,741 究 mn, RMB81,154 mn and RMB98,033 mn, respectively. Underlying net profit 券 in 2018-2020 is expected to reach RMB3,476 mn, RMB4,976 mn and 报 RMB6,086 mn, representing a CAGR of 67.0% in 2017-2020. -

Annual Results for the Year Ended 31 December 2019

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement. (Incorporated in the Cayman Islands with limited liability) (Stock code: 813) ANNUAL RESULTS FOR THE YEAR ENDED 31 DECEMBER 2019 RESULTS HIGHLIGHTS 1. Contracted sales in 2019 reached RMB260.066 billion, representing a significant year on-year increase of 47.6%. Contracted gross floor area increased from 10.687 million sq.m. in 2018 to 14.656 million sq.m. in 2019, representing a significant year-on-year increase of 37.1%. 2. As at 31 December 2019, the Group’s land bank was approximately 76.79 million sq.m. (before interests). During the year of 2019, the Group acquired land bank of 30.92 million sq.m. (before interests). 3. Revenue increased by 30.4% to RMB111.517 billion (2018: RMB85.513 billion). Revenue from hotels, commercial properties operation, property management income, and others increased by 35.2% to RMB6.226 billion. 4. Gross profit increased by 26.6% to RMB34.131 billion (2018: RMB26.949 billion). Gross profit margin was 30.6%. 5. Net profit from core business for the year increased by 30.6% to approximately RMB15.325 billion (2018: RMB11.732 billion). Net profit from core business attributable to shareholders for the year increased by 22.5% to approximately RMB10.478 billion (2018: RMB8.551 billion). -

Pengyuan Credit Rating (Hong Kong) Co.,Ltd

Property China Credit profiles to improve on lower land acquisitions and solid sales Contents Summary Summary ............................................ 1 Overall policy stance on property industry remains unchanged: we expect the Chinese governments will continue its tight control policies on Property sales ..................................... 2 property industry in 2019 to avoid unwanted overheating in the industry. In Land acquisition .................................. 4 our view, the governments will continue to clamp down the shadow banking financing in the industry and encourage the credit growth through more Property funding ................................. 6 regulated financing channels. On the other hand, with property price under Working capital efficiency ................... 7 control and inventory came off from its peak, a further severe tightening on the industry is unlikely, in our opinion. Industry consolidation ......................... 8 Residential property sales momentum likely to continue but at a slightly Profitability and Cash Flow ................. 9 softer pace: residential property sales value was better than the market Leverage .......................................... 10 expected in the first nine months of 2018, with property sales value rising 16% year over year, according to National Bureau of Statistics (NBS). We Sampled Property Issuers ................ 11 expect to see residential property sales value to grow around 10-15% in the Glossary ........................................... 13 fourth quarter of 2018, and continue to grow at around 10% in 2019, with 3- 4% growth in sales volume and 5-6% growth in average selling price (ASP). Land acquisitions to slow down further and market sentiment unlikely to rebound: we expect the land acquisition activities to continue slow down noticeably in 2019, with the land sale value to grow at around low teen level over the next 12 months. -

Annual Report 2019

(Incorporated in the Cayman Islands with limited liability) Stock Code: 813 ANNUAL REPORT 2019 CONTENTS 4 Corporate Information 6 Five Years Financial Summary 8 Chairman’s Statement 16 Management Discussion and Analysis 36 Report of the Directors 48 Corporate Governance Report 68 Directors and Senior Management Profiles 72 Information for Shareholders 73 Independent Auditor’s Report 78 Consolidated Balance Sheet 80 Consolidated Statement of Comprehensive Income 82 Consolidated Statement of Changes in Equity 84 Consolidated Statement of Cash Flows 85 Notes to the Consolidated Financial Statements 2 Shimao Property Holdings Limited Annual Report 2019 NATIONWIDE QUALITY LAND RESERVES Penetrated in 120 cities, with 349 projects, a total area of 76.79 million sq.m. (before interests) land bank (as at 31 December 2019) Shimao Property Holdings Limited Annual Report 2019 3 NATIONWIDE QUALITY LAND RESERVES Zhejiang District Central China District Shandong District Hangzhou Shimao Changsha Shimao Shine Jinan Shimao Skyscraper Begonia Bay City City Hangzhou Shimao Honor Zhengzhou Shine City Zibo Shine City of China Hefei Shimao Cloud Jinan Jade Palace Wenzhou Wuyue Valus Jinan Shimao Metropolis Wenzhou Shimao Yue Hefei Shimao Classic Qingdao Shimao Noble Hong Bay Chinese Chic Town Jiaxing Shimao Shine City Hefei Shimao Jade Mansion N orthern China District Western District Beijing Shimao Loong Chengdu Shimao City Palace Yinchuan Shimao Yuexi Beijing Royal Palace Chongqing Shimao Shine Beijing Classic Chinese City Chic Chongqing Shimao Tianjin Shimao -

Wang Jianlin Wanda Group

10 Property.FIN.qxp_Layout 1 13/9/16 5:41 pm Page 113 Week in China China’s Tycoons Property Wang Jianlin Wanda Group the “football mayor” while Dalian Wanda became a household name in China thanks to its all-conquering football team which “My dominated the Chinese league in the 1990s. philosophy is always the Big break same: be close In 1991, Wanda was one of the state entities with the picked to become a ‘pilot’ joint stock firm. government, Wang got the controlling shareholder of and distance Wanda, which then began to expand beyond myself from Liaoning. politics” Wang came up with the idea of the Wanda Plaza: mega residential and commercial complexes. Local governments welcomed these huge projects with land and other incentives By late 2015 Wanda had 133 Wanda Plazas and 84 hotels nationwide with total leasable area of 26 million square metres. Going global At the apex of Chinese politics stands a group In 2012 Bo Xilai was arrested and lost out to Xi of elites known as the hongerdai, or children Jinping, another hongerdai, in the race to or grandchildren of the revolutionary leaders become China’s supreme leader. It didn’t seem who helped the Communist Party to seize to have affected Wang. power in 1949. Wang is among the blue bloods Indeed, it was after 2012 that Wang began to (“red bloods” may be politically more spend aggressively overseas. His trophy buys appropriate): his father had taken part in and include London properties, UK yacht maker survived the Red Army’s Long March. -

Stoxx® China Total Market Index

TOTAL MARKET INDICES 1 STOXX® CHINA TOTAL MARKET INDEX Stated objective Key facts The STOXX Total Market (TMI) Indices cover 95% of the free-float » With 95% coverage of the free-float market cap of the relevant market cap of the relevant investable stock universe by region or investable stock universe per region, the index forms a unique country. The STOXX Global TMI serves as the basis for all regional benchmark for a truly global investment approach and country TMI indices. All TMI indices offer exposure to global equity markets with the broadest diversification within the STOXX equity universe in terms of regions, currencies and sectors. Descriptive statistics Index Market cap (EUR bn.) Components (EUR bn.) Component weight (%) Turnover (%) Full Free-float Mean Median Largest Smallest Largest Smallest Last 12 months STOXX China Total Market Index 1,228.5 625.9 2.8 0.9 63.8 0.0 10.2 0.0 5.4 STOXX China Total Market Index 1,618.2 824.5 3.6 1.2 84.1 0.1 10.2 0.0 5.4 Supersector weighting (top 10) Country weighting Risk and return figures1 Index returns Return (%) Annualized return (%) Last month YTD 1Y 3Y 5Y Last month YTD 1Y 3Y 5Y STOXX China Total Market Index 1.6 12.4 18.0 18.7 41.2 21.0 18.8 17.6 5.7 7.0 STOXX China Total Market Index 0.0 7.5 17.8 8.5 29.7 0.6 11.2 17.5 2.7 5.2 Index volatility and risk Annualized volatility (%) Annualized Sharpe ratio2 STOXX China Total Market Index 12.0 15.8 15.7 19.1 21.6 1.6 1.1 1.0 0.3 0.3 STOXX China Total Market Index 10.6 14.8 15.1 19.0 20.8 0.1 0.7 1.1 0.1 0.2 Index to benchmark Correlation Tracking error (%) STOXX China Total Market Index 1.0 1.0 0.9 0.9 0.9 3.4 4.6 5.4 8.3 9.5 Index to benchmark Beta Annualized information ratio STOXX China Total Market Index 1.1 1.0 1.0 0.9 0.9 5.2 1.5 0.1 0.3 0.1 1 For information on data calculation, please refer to STOXX calculation reference guide.