UPDATE REPORT As of March 31St, 2013

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

Gildan Activewear Nominates Four New Directors to Board

Gildan Activewear Nominates Four New Directors to Board Montreal, Thursday, March 29, 2018 - Gildan Activewear Inc. (GIL: TSX and NYSE) today announced that its Board of Directors has nominated Maryse Bertrand, Marc Caira, Charles M. Herington and Craig Leavitt as Director nominees to be voted on by the Company’s shareholders at its upcoming Annual Meeting of Shareholders to be held on May 3, 2018 in Montreal, Quebec. “The competitive dynamics in the apparel industry continue to evolve and these proposed director candidates are highly accomplished individuals who will bring a wealth of experience to the Board as the Company continues to grow” said Gildan’s Chairman Bill Anderson. Maryse Bertrand has had a career in law and business spanning over 35 years. Ms. Bertrand is currently an advisor in corporate governance and risk management and is a member of the Boards of Directors of National Bank of Canada, Canada’s sixth largest retail and commercial bank, and Metro Inc., a leader in the grocery and pharmaceutical distribution sectors in Canada. From 2016 to 2017, she was Strategic Advisor and Counsel to Borden Ladner Gervais LLP, and, prior to that she was Vice-President, Real Estate Services, Legal Services and General Counsel at CBC/Radio-Canada, Canada’s public broadcaster. Prior to 2009, Ms. Bertrand was a partner at Davies Ward Phillips and Vineberg LLP, where she specialized in M&A and corporate finance, and served on the firm’s National Management Committee. She was named as Advocatus emeritus (Ad. E.) in 2007 by the Quebec Bar in recognition of her exceptional contribution to the legal profession. -

Manulife Fidelity True North Fund

CANADIAN LARGE CAP EQUITY Code 7143 Volatility meter Low High Manulife Fidelity True North Fund Fund (6) Benchmark (9) Based on 3 year standard deviation How the underlying fund is invested UNDERLYING FUND -> Fidelity True North Fund - O Objective The Fund aims to achieve long term capital growth by investing primarily in Canadian Composition equity securities. Canadian Equity 78.50% United States Equity 9.08% Managed by FIAM LLC Cash & Equivalents 8.47% Fund managers Maxime Lemieux Foreign Equity 2.88% Other 1.07% Inception date February 2001 Manulife inception date January 2009 Total assets $5,079.1 million Underlying fund operating expense (2015) in IMF Equity Industry Financials 17.69% Energy 16.87% Consumer Staples 10.82% Consumer Discretionary 9.79% Industrials 9.30% Information Technology 8.17% Materials 6.24% Other 21.12% Overall past performance This graph shows how a $10,000 investment in this fund would have changed in value over time, Geographic split based on gross returns. Gross rates of return are shown before investment management Canada 78.56% fees have been deducted. The shaded returns represent the underlying fund returns prior to the United States 9.04% Manulife Fund’s inception date. United Kingdom 0.77% Israel 0.55% Japan 0.51% Manulife Fidelity True North Fund - ($18,950) Ireland 0.51% S&P/TSX Composite Cap TR - ($14,386) Bermuda 0.45% Fidelity True North Fund Series O Other 9.61% Top holdings within the underlying fund (As at June 30, 2016) 15,000 Toronto-Dominion Bank 7.41% Loblaw Companies -

Stock-Table-Canada-Newsletter.Pdf

The table below displays stock information as of February 1, 2021. Stock information for March will be available by March 5, 2021. EDWARD JONES STOCKS § Ticker Symbol Ticker Current Opinion Price Recent Forward Est. on Based P/E Forward Est. L-T EPS Growth Estimate PEGY DividendsAnnual Dividend Yield L-T Dividend Growth Estimate DividendsCash Since Invested $10,000 10 Years Ago CategoryInvestment Important Disclosures (High – Low) EPS AS OF 02/01/21 Range Price 52-week S&P / TSX Composite 17692.45 18058.61 - 11172.73 1215.59 14.6 6 1.6 538.38 3.04 12,902 COMMUNICATION SERVICES (8%) Alphabet - US GOOGL BUY 1893.07 1932.08 - 1008.87 61.74 30.7 15 2.0 0.00 0.0 NA 61,902 G AT&T - US T BUY 28.65 38.82 - 26.08 3.33 8.6 3 0.8 2.08 7.3 0 1984 17,934 G/I 12 BCE - Canada BCE.T BUY 54.51 65.28 - 46.03 3.43 15.9 4 1.6 3.33 6.1 4 1881 25,056 G/I Omnicom Group - US OMC BUY 62.86 80.25 - 44.50 5.96 10.5 7 1.0 2.60 4.1 5 1986 18,340 G Rogers Communications - Canada RCI.B.T HOLD 58.05 66.87 - 46.81 3.74 15.5 4 2.1 2.00 3.4 0 2003 23,801 G/I Shaw Communications - Canada SJR.B.T BUY 22.17 26.64 - 17.77 1.47 15.1 4 1.6 1.19 5.4 0 1982 16,259 G/I TELUS - Canada T.T BUY 26.54 27.74 - 18.55 1.30 20.4 5 2.1 1.24 4.7 5 1993 32,613 G/I Verizon Communications - US VZ BUY 54.28 61.95 - 48.84 4.93 11.0 4 1.3 2.51 4.6 2 1984 23,620 G/I CONSUMER DISCRETIONARY (8%) Amazon - US AMZN BUY 3342.88 3552.25 - 1626.03 45.00 74.3 30 2.5 0.00 0.0 NA 194,229 G Canadian Tire - Canada CTC.A.T HOLD 171.48 181.57 - 67.15 12.00 14.3 8 1.3 4.70 2.7 10 1996 33,245 G/I Dollarama - Canada -

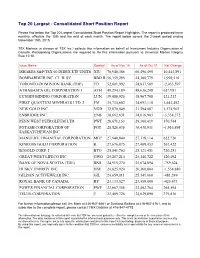

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Stoxx® Canada Total Market Mid Index

STOXX® CANADA TOTAL MARKET MID INDEX Components1 Company Supersector Country Weight (%) EMERA Utilities Canada 3.01 BAUSCH HEALTH Health Care Canada 2.71 WSP GLOBAL Construction & Materials Canada 2.59 Teck Resources Ltd. Cl B Basic Resources Canada 2.48 Canadian Tire Corp. Ltd. Cl A Retail Canada 2.36 ALGONQUIN POWER & UTILITIES Utilities Canada 2.34 CAE Industrial Goods & Services Canada 2.27 CCL INDS.'B' Industrial Goods & Services Canada 2.12 CANADIAN APARTMENT PROP REIT Real Estate Canada 2.11 Kinross Gold Corp. Basic Resources Canada 2.11 TFI INTERNATIONAL Industrial Goods & Services Canada 2.04 LIGHTSPEED POS Technology Canada 1.97 AIR CANADA Travel & Leisure Canada 1.95 Cameco Corp. Energy Canada 1.93 INTER PIPELINE Energy Canada 1.83 TOROMONT INDUSTRIES Industrial Goods & Services Canada 1.81 TOURMALINE OIL Energy Canada 1.81 GILDAN ACTIVEWEAR Consumer Products & Services Canada 1.77 Blackberry Ltd Technology Canada 1.72 RITCHIE BROS.AUCTIONEERS (NYS) Consumer Products & Services Canada 1.68 WEST FRASER TIMBER Basic Resources Canada 1.62 FIRSTSERVICE Real Estate Canada 1.62 NORTHLAND POWER Utilities Canada 1.56 PAN AMER.SILV. (NAS) Basic Resources Canada 1.55 LUNDIN MINING Basic Resources Canada 1.53 ALTAGAS Utilities Canada 1.51 KEYERA CORP Energy Canada 1.51 IA FINANCIAL CORP Insurance Canada 1.51 EMPIRE 'A' Personal Care, Drug & Grocery Stores Canada 1.49 DESCARTES SYSTEMS GROUP Technology Canada 1.44 RIOCAN REIT.TST. Real Estate Canada 1.44 ONEX Financial Services Canada 1.44 TMX GROUP Financial Services Canada 1.41 ARC RESOURCES LTD Energy Canada 1.29 Element Fleet Management Corp. -

Women in Leadership at S&P/Tsx Companies

WOMEN IN LEADERSHIP AT S&P/TSX COMPANIES Women in Leadership at WOMEN’S S&P/TSX Companies ECONOMIC Welcome to the first Progress Report of Women on Boards and Executive PARTICIPATION Teams for the companies in the S&P/TSX Composite Index, the headline AND LEADERSHIP index for the Canadian equity market. This report is a collaboration between Catalyst, a global nonprofit working with many of the world’s leading ARE ESSENTIAL TO companies to help build workplaces that work for women, and the 30% Club DRIVING BUSINESS Canada, the global campaign that encourages greater representation of PERFORMANCE women on boards and executive teams. AND ACHIEVING Women’s economic participation and leadership are essential to driving GENDER BALANCE business performance, and achieving gender balance on corporate boards ON CORPORATE and among executive ranks has become an economic imperative. As in all business ventures, a numeric goal provides real impetus for change, and our BOARDS collective goal is for 30% of board seats and C-Suites to be held by women by 2022. This report offers a snapshot of progress for Canada’s largest public companies from 2015 to 2019, using the S&P/TSX Composite Index, widely viewed as a barometer of the Canadian economy. All data was supplied by MarketIntelWorks, a data research and analytics firm with a focus on gender diversity, and is based on a review of 234 S&P/TSX Composite Index companies as of December 31, 2019. The report also provides a comparative perspective on progress for companies listed on the S&P/TSX Composite Index versus all disclosing companies on the TSX itself, signalling the amount of work that still needs to be done. -

Notice of Annual and Special Meeting of Shareholders and Management Proxy Circular

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR June 7, 2018, Montreal, Québec April 13, 2018 NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that the annual and special meeting of the shareholders (the “Meeting”) of Dollarama Inc. (the “Corporation”) will be held at Hotel Ruby Foo’s, 7655 Décarie Boulevard, Montreal, Québec on June 7, 2018 at 9:00 a.m. (Montreal time) for the following purposes: (1) to receive the consolidated financial statements of the Corporation for the fiscal year ended January 28, 2018, together with the auditor’s report thereon; (2) to elect the nine (9) directors named in the accompanying management proxy circular (the “Circular”) for the ensuing year; (3) to appoint the auditor of the Corporation for the ensuing year and to authorize the directors to fix its remuneration; (4) to consider and, if deemed appropriate, adopt a special resolution authorizing an amendment to the articles of the Corporation pursuant to Section 173 of the Canada Business Corporations Act to subdivide the number of common shares of the Corporation, whether issued or unissued, on a three for one basis, such that each common share will become three common shares, as more particularly described in the Circular; (5) to consider and, if deemed appropriate, adopt an advisory non-binding resolution on the Corporation’s approach to executive compensation, as more particularly described in the Circular; and (6) to transact such other business as may properly be brought before the Meeting or any adjournment thereof. Additional information on matters to be put before the Meeting is set forth in the Circular. -

Week 39: Ending September 25, 2020 an Introduction for Subscribers, New and Old

The Sunday Investor Week 39: Ending September 25, 2020 An Introduction For subscribers, new and old. First of all, thank you to all my subscribers, including brand new ones and for those Basic fundamental metrics such as return on equity, price-earnings ratios, free cash who signed up to receive this newsletter almost a year ago when I first started The flow per share, earnings per share, and interest coverage ratios – they’re all freely Sunday Investor. Administering this website has brought out the true passion I available on many websites in the form of stock screeners, but even some of the have for the investing industry and each time I get a new subscriber, it motivates best stock screeners don’t allow you to filter for exactly what you need. me to keep going. I hope you find The Sunday Investor to be a reliable and useful source as you seek to achieve your investment goals. Here you will find the tools you need to keep track of your Canadian and U.S. equity holdings. I maintain a weekly total return tracker for all S&P/TSX Composite Prior to starting my website, I had been noticing a gap in the information the and S&P 500 issuers, and provide several fundamental monthly reports depending average investor has access to on popular investment and financial planning on your investment strategy. I routinely write about the importance of developing websites. While a lot of data is publicly available, many websites do a poor job of a low-volatile portfolio aimed at maximizing the Sharpe Ratio, behavioural finance compiling this information into a format that is easily digestible. -

Steward International Enhanced Index Fund Holdings 053121

STEWARD INTERNATIONAL Page 1 of 5 ENHANCED INDEX FUND HOLDINGS May 31, 2021 CROSSMARKGLOBAL.COM NAME SHARES MARKET VALUE ABB LTD ADR 64,430 $2,199,640.20 AEGON NV 32,878 $155,184.16 AGNICO EAGLE MINES LTD 7,540 $540,995.00 ALCON INC 20,870 $1,454,221.60 ALGONQUIN POWER & UTILITI 41,230 $629,994.40 ALIBABA GRP. HLDG. LT ADR 23,220 $4,968,151.20 AMERICA MOVIL SAB DE ADR 57,060 $877,012.20 ANGLOGOLD ASHANTI LTD ADR 7,390 $175,660.30 ARCELORMITTAL SA 14,583 $475,259.97 ARGENX SE ADR 2,290 $638,887.10 ASE TECH. HLDG. CO LT ADR 55,075 $441,701.50 ASML HLDG. NV 10,907 $7,367,351.29 BAIDU INC ADR 4,353 $854,363.31 BANCO BILBAO VIZCAYA ADR 130,110 $810,585.30 BANCO BRADESCO SA ADR 199,171 $1,011,788.68 BANCO DE CHILE ADR 9,779 $196,166.74 BANCO SANTANDER CHILE ADR 5,574 $119,227.86 BANCO SANTANDER SA ADR 310,085 $1,305,457.85 BANCOLOMBIA SA ADR 2,090 $62,741.80 BANK OF MONTREAL 19,410 $2,038,438.20 BARCLAYS PLC ADR 81,079 $857,815.82 BARRICK GOLD CORP 53,503 $1,288,352.24 BAUSCH HEALTH COS INC 12,258 $394,217.28 BCE INC 45,525 $2,263,503.00 BEIGENE LTD ADR 950 $340,584.50 BHP BILLITON PLC ADR 26,820 $1,629,315.00 BHP GRP. LTD ADR 37,960 $2,813,215.60 BILIBILI INC ADR 2,570 $275,452.60 BK OF NOVA SCOTIA COM NPV 35,430 $2,384,439.00 BP PLC ADR 78,282 $2,053,336.86 BRF SA ADR 30,790 $151,794.70 BROOKFIELD ASSET MGT. -

The Bigger Picture a Weekly Snapshot of the Markets Issue No

Equity Research 1 (800) 455-5778 www.globalsec.com The Bigger Picture A weekly snapshot of the markets Issue No. 305 June 22, 2015 Big reshuffle in ranks of biggest Canadian companies since June ‘08 Elvis Picardo, CFA In the previous commodity-fuelled bull market that imploded so spectacularly in 2008, the TSX Composite reached a record high of 15,154.77 on June 6 of that year. The index then plunged 50% in the next six months as the global credit crisis savaged equity markets worldwide, before commencing a long, multi-year climb that enabled it to surpass the 15,000 level six years later. While the TSX reached a new all-time high of 15,685.13 on September 3, 2014, it is presently about 900 points below that peak. Comparing the biggest companies by market capitalization in June 2008 with the biggest companies now generated some interesting insights. The TSX-60 was used to compare changes in market capitalization over this period. 1. As can be seen in Table 1, there has been a massive reshuffle in the ranks of the biggest Canadian companies. The three biggest Canadian companies as of June 2008 – Blackberry, EnCana, and Potash – have seen about 75% of their market value on average get vaporized since then. Five stocks have retained their Top Ten rank, which includes three banks – Royal Bank, TD Bank (currently 1 and 2 respectively), and Bank of Nova Scotia – plus Manulife, and Suncor. 2. While three of the companies that were among the 30 biggest on the TSX in June 2008 were subsequently acquired (Petro-Canada, Talisman and Nexen), as many as seven in the bottom half of the TSX-60 by size were also acquired (Fording, Shoppers Drug Mart, Tim Hortons, Inmet, Nova Chemicals, Uranium One, and Nordion). -

Short List of Nominees IR Magazine Awards – Canada 2020

IR Magazine Awards – Canada 2020 Short list of nominees AWARDS BY RESEARCH Best overall investor relations (large cap) Agnico Eagle Mines CN Fortis RBC Suncor Energy TC Energy Corporation Best overall investor relations (mid-cap) ARC Resources Canadian Tire Corporation Endeavour Mining Intact Financial Corporation WSP Best overall investor relations (small cap) Aecon Group Altus Group Boralex Hudbay Minerals Precision Drilling Corporation Best investor relations officer (large cap) Agnico Eagle Mines Brian Christie CGI Lorne Gorber CN Paul Butcher Fortis Stephanie Amaimo RBC Asim Imran TD Bank Group Gillian Manning IR Magazine Awards – Canada 2020 Short list of nominees Best investor relations officer (small to mid-cap) Alamos Gold Scott Parsons Altus Group Camilla Bartosiewicz ARC Resources Kris Bibby* Endeavour Mining Martino De Ciccio Gibson Energy Mark Chyc-Cies WSP Isabelle Adjahi *Kris Bibby is now CFO of ARC Resources Best IR by a senior management team (large cap) Agnico Eagle Mines Sean Boyd, CEO & David Smith, CFO Fortis Barry Perry, CEO & Jocelyn Perry, CFO Nutrien Pedro Farah, CFO & Chuck Magro, CEO RBC Rod Bolger, CFO & David McKay, CEO Suncor Energy Alister Cowan, CFO & Mark Little, CEO TC Energy Corporation Russell Girling, CEO & Donald Marchand, CFO Best IR by a senior management team (small to mid-cap) Alamos Gold John McCluskey, CEO & Jamie Porter, CFO Altus Group Angelo Bartolini, CFO & Robert Courteau, CEO ARC Resources Van Dafoe**, CFO & Myron Stadnyk***, CEO Patrick Bouisset, executive vice president & Endeavour Mining Sébastien De Montessus, CEO Precision Drilling Corporation Carey Ford, CFO & Kevin Neveu, CEO **Van Dafoe retired in February 2020 and was succeeded as CFO by Kris Bibby ***Myron Stadnyk was succeeded as CEO by Terry Anderson in February 2020.