The Bigger Picture a Weekly Snapshot of the Markets Issue No

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

Gildan Activewear Nominates Four New Directors to Board

Gildan Activewear Nominates Four New Directors to Board Montreal, Thursday, March 29, 2018 - Gildan Activewear Inc. (GIL: TSX and NYSE) today announced that its Board of Directors has nominated Maryse Bertrand, Marc Caira, Charles M. Herington and Craig Leavitt as Director nominees to be voted on by the Company’s shareholders at its upcoming Annual Meeting of Shareholders to be held on May 3, 2018 in Montreal, Quebec. “The competitive dynamics in the apparel industry continue to evolve and these proposed director candidates are highly accomplished individuals who will bring a wealth of experience to the Board as the Company continues to grow” said Gildan’s Chairman Bill Anderson. Maryse Bertrand has had a career in law and business spanning over 35 years. Ms. Bertrand is currently an advisor in corporate governance and risk management and is a member of the Boards of Directors of National Bank of Canada, Canada’s sixth largest retail and commercial bank, and Metro Inc., a leader in the grocery and pharmaceutical distribution sectors in Canada. From 2016 to 2017, she was Strategic Advisor and Counsel to Borden Ladner Gervais LLP, and, prior to that she was Vice-President, Real Estate Services, Legal Services and General Counsel at CBC/Radio-Canada, Canada’s public broadcaster. Prior to 2009, Ms. Bertrand was a partner at Davies Ward Phillips and Vineberg LLP, where she specialized in M&A and corporate finance, and served on the firm’s National Management Committee. She was named as Advocatus emeritus (Ad. E.) in 2007 by the Quebec Bar in recognition of her exceptional contribution to the legal profession. -

Manulife Fidelity True North Fund

CANADIAN LARGE CAP EQUITY Code 7143 Volatility meter Low High Manulife Fidelity True North Fund Fund (6) Benchmark (9) Based on 3 year standard deviation How the underlying fund is invested UNDERLYING FUND -> Fidelity True North Fund - O Objective The Fund aims to achieve long term capital growth by investing primarily in Canadian Composition equity securities. Canadian Equity 78.50% United States Equity 9.08% Managed by FIAM LLC Cash & Equivalents 8.47% Fund managers Maxime Lemieux Foreign Equity 2.88% Other 1.07% Inception date February 2001 Manulife inception date January 2009 Total assets $5,079.1 million Underlying fund operating expense (2015) in IMF Equity Industry Financials 17.69% Energy 16.87% Consumer Staples 10.82% Consumer Discretionary 9.79% Industrials 9.30% Information Technology 8.17% Materials 6.24% Other 21.12% Overall past performance This graph shows how a $10,000 investment in this fund would have changed in value over time, Geographic split based on gross returns. Gross rates of return are shown before investment management Canada 78.56% fees have been deducted. The shaded returns represent the underlying fund returns prior to the United States 9.04% Manulife Fund’s inception date. United Kingdom 0.77% Israel 0.55% Japan 0.51% Manulife Fidelity True North Fund - ($18,950) Ireland 0.51% S&P/TSX Composite Cap TR - ($14,386) Bermuda 0.45% Fidelity True North Fund Series O Other 9.61% Top holdings within the underlying fund (As at June 30, 2016) 15,000 Toronto-Dominion Bank 7.41% Loblaw Companies -

Stock-Table-Canada-Newsletter.Pdf

The table below displays stock information as of February 1, 2021. Stock information for March will be available by March 5, 2021. EDWARD JONES STOCKS § Ticker Symbol Ticker Current Opinion Price Recent Forward Est. on Based P/E Forward Est. L-T EPS Growth Estimate PEGY DividendsAnnual Dividend Yield L-T Dividend Growth Estimate DividendsCash Since Invested $10,000 10 Years Ago CategoryInvestment Important Disclosures (High – Low) EPS AS OF 02/01/21 Range Price 52-week S&P / TSX Composite 17692.45 18058.61 - 11172.73 1215.59 14.6 6 1.6 538.38 3.04 12,902 COMMUNICATION SERVICES (8%) Alphabet - US GOOGL BUY 1893.07 1932.08 - 1008.87 61.74 30.7 15 2.0 0.00 0.0 NA 61,902 G AT&T - US T BUY 28.65 38.82 - 26.08 3.33 8.6 3 0.8 2.08 7.3 0 1984 17,934 G/I 12 BCE - Canada BCE.T BUY 54.51 65.28 - 46.03 3.43 15.9 4 1.6 3.33 6.1 4 1881 25,056 G/I Omnicom Group - US OMC BUY 62.86 80.25 - 44.50 5.96 10.5 7 1.0 2.60 4.1 5 1986 18,340 G Rogers Communications - Canada RCI.B.T HOLD 58.05 66.87 - 46.81 3.74 15.5 4 2.1 2.00 3.4 0 2003 23,801 G/I Shaw Communications - Canada SJR.B.T BUY 22.17 26.64 - 17.77 1.47 15.1 4 1.6 1.19 5.4 0 1982 16,259 G/I TELUS - Canada T.T BUY 26.54 27.74 - 18.55 1.30 20.4 5 2.1 1.24 4.7 5 1993 32,613 G/I Verizon Communications - US VZ BUY 54.28 61.95 - 48.84 4.93 11.0 4 1.3 2.51 4.6 2 1984 23,620 G/I CONSUMER DISCRETIONARY (8%) Amazon - US AMZN BUY 3342.88 3552.25 - 1626.03 45.00 74.3 30 2.5 0.00 0.0 NA 194,229 G Canadian Tire - Canada CTC.A.T HOLD 171.48 181.57 - 67.15 12.00 14.3 8 1.3 4.70 2.7 10 1996 33,245 G/I Dollarama - Canada -

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

ANNUAL INFORMATION FORM for the YEAR ENDED DECEMBER 31, 2015 February 19, 2016

ENBRIDGE INC. ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2015 February 19, 2016 Enbridge Inc. 2015 Annual Information Form TABLE OF CONTENTS DOCUMENTS INCORPORATED BY REFERENCE As of the date hereof, portions of the MD&A and the audited consolidated financial statements of Enbridge as at and for the year ended December 31, 2015, as filed with the securities commissions or similar authorities in each of the provinces of Canada, as detailed below, are specifically incorporated by reference into and form an integral part of this AIF. These documents are available on SEDAR which can be accessed at www.sedar.com. Page Reference From Annual Financial AIF Statements MD&A GLOSSARY ................................................................................................... 1 PRESENTATION OF INFORMATION ........................................................... 4 12 FORWARD-LOOKING INFORMATION .........................................................5 CORPORATE STRUCTURE ......................................................................... 6 GENERAL DESCRIPTION OF THE BUSINESS ............................................ 7 1-2, 14-19 GENERAL DEVELOPMENT OF THE BUSINESS ....................................... 10 2-4, 8-9, 16-21, 23-39, 59-60, 67-69, 73-74 LIQUIDS PIPELINES ................................................................................... 16 1, 40-52 GAS DISTRIBUTION ................................................................................... 17 1, 52-55 GAS PIPELINES, PROCESSING AND ENERGY SERVICES -

Top News Before the Bell Stocks To

TOP NEWS • A hunt for any storage space turns urgent as oil glut grows With oil depots that normally store crude oil onshore filling to the brim and supertankers mostly taken, energy companies are desperate for more space. The alternative is to pay buyers to take their U.S. crude after futures plummeted to a negative $37 a barrel on Monday. • Corporate America seeks legal protection for when coronavirus lockdowns lift Major U.S. business lobbying groups are asking Congress to pass measures that would protect companies large and small from coronavirus-related lawsuits when states start to lift pandemic restrictions and businesses begin to reopen. • Teck Resources profit falls short as lockdowns, energy unit bite Teck Resources reported a much bigger-than-expected 84% plunge in quarterly profit, hit by shutdowns due to the coronavirus outbreak and weak performance in its energy unit. • U.S. energy industry steps up lobbying for Fed's emergency aid -letters The U.S. energy industry has asked the Federal Reserve to change the terms of a $600 billion lending facility so that oil and gas companies can use the funds to repay their ballooning debts, according to a letter seen by Reuters. • Coca-Cola sees 2nd quarter sales hit from coronavirus lockdown Coca-Cola forecast a significant hit to current-quarter results as restaurants, theaters and other venues that represent about half of the company's revenue remain closed because of the coronavirus pandemic. BEFORE THE BELL Canada's main stock index futures slid as U.S. oil futures continued to trade in the negative after their first ever sub-zero dive on Monday, furthering concerns of a global recession in the coming months. -

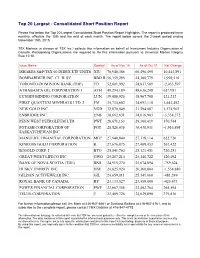

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Enbridge 2012 Corporate Social Responsibility Report Social

ENBRIDGE 2012 CORPORATE SOCIAL RESPONSIBILITY REPORT SOCIAL PERFORMANCE ENBRIDGE 2012 CORPORATE SOCIAL RESPONSIBILITY REPORT TABLE OF CONTENTS ABOUT ENBRIDGE .............................................................. 1 LA6 Percentage of total workforce represented in formal joint management-worker health and safety committees that help ABOUT THE ENBRIDGE 2012 CORPORATE SOCIAL monitor and advise on occupational health and safety RESPONSIBILITY REPORT ................................................. 2 programs. ............................................................................... 43 FORWARD-LOOKING INFORMATION ................................ 3 LA7 Rates of injury, occupational diseases, lost days and absenteeism, and number of work-related fatalities by region AWARDS AND RECOGNITION ............................................ 4 and by gender. ....................................................................... 44 STRATEGY AND PROFILE ................................................. 5 LA8 Education, training, counseling, prevention and risk- control programs in place to assist workforce members, their ORGANIZATIONAL PROFILE ............................................ 5 families or community members regarding serious diseases. REPORT PARAMETERS .................................................. 6 ................................................................................................ 44 GOVERNANCE, COMMITMENTS AND ENGAGEMENT ... 12 LA9 Health and safety topics covered in formal agreements with trade unions. .................................................................. -

Mining, Energy & Manufacturing Spring 2021

SPRING 2021 Mining, Energy & Manufacturing Monday, May 31, 2020 • Page B13 The Vaderstad facility at Langbank where 60 new production staff and a second shift will be added to meet growing demand. Vaderstad adding to staff to meet growing demand BY KEVIN WEEDMARK this plant but it doesn’t amount to a whole lot today,” he “We always say draw a 50 km circle around the plant Vaderstad is undergoing a major ramping up of produc- says. “So it’s mostly Canada. Our distribution footprint and that’s really our catchment area,” he says. tion, adding 60 production employees and a second pro- grew over the course of the last little while, so that cer- Wasylyk says one of the biggest challenges of having to duction shift at its Langbank production facility, which tainly helped, but I think the real reason is that it is a qual- EULQJSHROSHLQIURPRXWRIDUHDLVÀQGLQJHQRXJKKRXV- manufactures tillage, drilling and planting machinery for ity machine and performs well, in the Western Canadian ing for them in the local area. WKHDJLQGXVWU\$GGLWLRQDOVXSSRUWVWDͿZLOOEHDGGHGDW conditions in particular.” “That’s probably one of the major challenges quite hon- the Langbank facility as well. +HVD\VRIWKHQHZSURGXFWLRQVWDͿ9DGHUVWDGZLOO estly,” he says. “You’re trying to recruit people of course, Jason Wasylyk, Director of Operations for Vaderstad, be looking for people with a variety of skillsets. but then you’ve got to put them somewhere and it’s not which employs 200 people in Canada, says production is “Welders, painters, assemblers, warehouse folks, ship- always that easy. It might be the biggest challenge. There ramping up because of booming sales. -

Enbridge's Energy Infrastructure Projects

Enbridge’s Energy Infrastructure Projects Last Updated: Aug. 4, 2021 Energy Infrastructure Projects Table of Contents Crude Oil and Liquids Pipelines .................................................................................................... 3 Natural Gas Transmission Pipelines ............................................................................................. 4 Natural Gas Distribution .............................................................................................................. 12 Offshore Projects ........................................................................................................................ 14 Power Generation ....................................................................................................................... 15 Power Transmission ................................................................................................................... 16 Wind Energy ............................................................................................................................... 17 Page 2 of 19 Energy Infrastructure Projects Crude Oil and Liquids Pipelines Line 3 Replacement Program Construction of the $5.3-billion Canadian portion of the Line 3 Replacement Program is complete and began commercial service in December 2019. The $2.9-billion U.S. portion of the Line 3 Replacement Program, known as the Line 3 Replacement Project, consists of replacing existing 34-inch pipe with new 36-inch pipe for 13 miles in North Dakota, 337 miles in Minnesota, and -

Lead the Transition to Low-Carbon Energy by Producing and Using Renewable Natural Gas

A guide to producing and using RNG The Future of Clean Energy Lead the transition to low-carbon energy by producing and using renewable natural gas • Organic waste • Agriculture • Wastewater treatment • Landfills • Food and beverage processing Inside: The RNG advantage How is RNG produced and used? RNG vs. electrification Expert help to get started Get expert help planning and developing your RNG projects This booklet will guide you through everything you need to know to produce and use renewable natural gas (RNG) with Enbridge Gas. We’ll help you leverage RNG as an e!ective solution to achieve climate action goals and create a sustainable future for your company and community. 2 fossil fuels. fossil to alternative A sustainable is RNG? What future clean energy importantrole in Ontario’s RNG will play an energy renewable to waste organic From Renewable Natural Gas Producer Guide Gas Producer Natural Renewable 04 for many sectors. many for benefits are There and use RNG? produce Why 06 carbon fuel. carbon waste into a low- organicTransforming used?and made is RNG How 08 action. change climate take costs manage to approach A reliable electrification RNG vs. 10 benefitting. are others See how stories Success 12 *Source: cga.ca/natural-gas-101/the-renewable-natural-gas-opportunity *Source: treatment and as manure) (such sources agricultural landfill gas, waste, from RNG is produced project started. project RNG your get to Steps RNG projects with expertise Help and wastewater wastewater organic organic . 14 natural gas (CNG). gas natural with compressed fuel costs Reduce Program Transit Municipal 17 quality RNG.