Enbridge 2012 Corporate Social Responsibility Report Social

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Market Index Uniflex 10%

Investment and retirement 5% 10% Market Index Uniflex 10% 25% Main Product Features 25% 6-year term (not redeemable before maturity) Guarantee of principal on maturity of 100% Low management fees of 1% per year 10% 15% $500 minimum deposit An easy way to diversify Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Even under a scenario where the return of each share is negative, this product may produce a global positive return Sector diversification of the Market Index Uniflex How it works On the settlement date, a starting level will be determined for each Canadian share included in the portfolio. On the maturity date, a ratio of the closing level over the starting level for each share will be computed. The 8 best performing shares during the 6-year term will be automatically assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) Exposure to 20 Canadian companies included in the S&P/TSX 60 Index Company Sector Company Sector Metro Inc. Scotiabank Consumer staples Loblaw Companies Limited The Toronto-Dominion Bank Royal Bank of Canada Financial services Bank of Montreal Enbridge Inc. Sun Life Financial Inc. TransCanada Corporation Cenovus Energy Inc. Energy Canadian Natural Resources Limited Canadian National Railway Industrials Suncor Energy Inc. -

ANNUAL INFORMATION FORM for the YEAR ENDED DECEMBER 31, 2015 February 19, 2016

ENBRIDGE INC. ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2015 February 19, 2016 Enbridge Inc. 2015 Annual Information Form TABLE OF CONTENTS DOCUMENTS INCORPORATED BY REFERENCE As of the date hereof, portions of the MD&A and the audited consolidated financial statements of Enbridge as at and for the year ended December 31, 2015, as filed with the securities commissions or similar authorities in each of the provinces of Canada, as detailed below, are specifically incorporated by reference into and form an integral part of this AIF. These documents are available on SEDAR which can be accessed at www.sedar.com. Page Reference From Annual Financial AIF Statements MD&A GLOSSARY ................................................................................................... 1 PRESENTATION OF INFORMATION ........................................................... 4 12 FORWARD-LOOKING INFORMATION .........................................................5 CORPORATE STRUCTURE ......................................................................... 6 GENERAL DESCRIPTION OF THE BUSINESS ............................................ 7 1-2, 14-19 GENERAL DEVELOPMENT OF THE BUSINESS ....................................... 10 2-4, 8-9, 16-21, 23-39, 59-60, 67-69, 73-74 LIQUIDS PIPELINES ................................................................................... 16 1, 40-52 GAS DISTRIBUTION ................................................................................... 17 1, 52-55 GAS PIPELINES, PROCESSING AND ENERGY SERVICES -

Section 18.0 – Socio-Economic Impact Assessment Table of Contents

Suncor Energy Inc. Lewis In Situ Project Volume 2 – Environmental Impact Assessment February 2018 SECTION 18.0 – SOCIO-ECONOMIC IMPACT ASSESSMENT TABLE OF CONTENTS PAGE 18.0 SOCIO-ECONOMIC IMPACT ASSESSMENT ...........................................................18 -1 18.1 Introduction .....................................................................................................18 -1 18.2 Study Area ......................................................................................................18 -1 18.2.1 Temporal Boundary ..........................................................................18 -1 18.2.2 Spatial Boundary ..............................................................................18 -1 18.3 Assessment Approach ....................................................................................18 -3 18.3.1 Regulatory Framework .....................................................................18 -3 18.3.2 Socio-economic Issues Identification ................................................18 -3 18.3.3 Valued Socio-Economic Components and Key Indicators ................ 18-3 18.3.4 Assessment Cases ...........................................................................18 -4 18.3.5 Assessment Criteria .........................................................................18 -5 18.3.6 Constraints Planning ........................................................................18 -6 18.4 Methods ..........................................................................................................18 -

Housing Needs Assessment | Regional Municipality of Wood Buffalo

WOOD BUFFALO HOUSING NEEDS ASSESSMENT Wood Buffalo Regional Report Prepared by: Urban Matters CCC 2nd Floor, 9902 Franklin Avenue Fort McMurray, AB T9H 2K5 P: (780) 430-4041 May 2019 TABLE OF CONTENTS FIGURES ..................................................................................................3 TABLES ....................................................................................................3 EXECUTIVE SUMMARY.............................................................................1 KEY FINDINGS ..........................................................................................6 COMMUNITY HOUSING PROFILE .............................................................8 Demographics .........................................................................................8 Current Population .........................................................................9 Age and Gender Profile ..................................................................9 Ethnic and Cultural Identity ..........................................................10 Households ...........................................................................................11 Household Type ...........................................................................11 Household Tenure ........................................................................12 Economy ...............................................................................................12 Income .........................................................................................12 -

Top News Before the Bell Stocks To

TOP NEWS • A hunt for any storage space turns urgent as oil glut grows With oil depots that normally store crude oil onshore filling to the brim and supertankers mostly taken, energy companies are desperate for more space. The alternative is to pay buyers to take their U.S. crude after futures plummeted to a negative $37 a barrel on Monday. • Corporate America seeks legal protection for when coronavirus lockdowns lift Major U.S. business lobbying groups are asking Congress to pass measures that would protect companies large and small from coronavirus-related lawsuits when states start to lift pandemic restrictions and businesses begin to reopen. • Teck Resources profit falls short as lockdowns, energy unit bite Teck Resources reported a much bigger-than-expected 84% plunge in quarterly profit, hit by shutdowns due to the coronavirus outbreak and weak performance in its energy unit. • U.S. energy industry steps up lobbying for Fed's emergency aid -letters The U.S. energy industry has asked the Federal Reserve to change the terms of a $600 billion lending facility so that oil and gas companies can use the funds to repay their ballooning debts, according to a letter seen by Reuters. • Coca-Cola sees 2nd quarter sales hit from coronavirus lockdown Coca-Cola forecast a significant hit to current-quarter results as restaurants, theaters and other venues that represent about half of the company's revenue remain closed because of the coronavirus pandemic. BEFORE THE BELL Canada's main stock index futures slid as U.S. oil futures continued to trade in the negative after their first ever sub-zero dive on Monday, furthering concerns of a global recession in the coming months. -

Roadside Management Classification

I.R. I.R. 196A I.R. 196G 196D I.R. 225 I.R. I.R. I.R. 196B 196 196C I.R. 196F I.R. 196E I.R. 223 WOOD BUFFALO NATIONAL PARK I.R. Colin-Cornwall Lakes I.R. 224 Wildland 196H Provincial Park I.R. 196I La Butte Creek Wildland P. Park Ca ribou Mountains Wildland Provincial Park Fidler-Greywillow Wildland P. Park I.R. 222 I.R. 221 I.R. I.R. 219 Fidler-Greywillow 220 Wildland P. Park Fort Chipewyan I.R. 218 58 I.R. 5 I.R. I.R. 207 8 163B 201A I.R . I.R. I.R. 201B 164A I.R. 215 163A I.R. WOOD BU I.R. 164 FFALO NATIONAL PARK 201 I.R Fo . I.R. 162 rt Vermilion 163 I.R. 173B I.R. 201C I.R. I.R. 201D 217 I.R. 201E 697 La Crete Maybelle Wildland P. Park Richardson River 697 Dunes Wildland I.R. P. Park 173A I.R. 201F 88 I.R. 173 87 I.R. 201G I.R. 173C Marguerite River Wildland Provincial Park Birch Mountains Wildland Provincial Park I.R. 174A I.R. I.R. 174B 174C Marguerite River Wildland I.R. Provincial Park 174D Fort MacKay I.R. 174 88 63 I.R. 237 686 Whitemud Falls Wildland FORT Provincial Park McMURRAY 686 Saprae Creek I.R. 226 686 I.R. I.R 686 I.R. 227 I.R. 228 235 Red Earth 175 Cre Grand Rapids ek Wildland Provincial Park Gipsy Lake I.R. Wildland 986 238 986 Cadotte Grand Rapids Provincial Park Lake Wildland Gregoire Lake Little Buffalo Provincial Park P. -

Learning from the Fort Mcmurray Wildland/Urban Interface Fire Disaster

Institute for Catastrophic Institut de prévention Loss Reduction des sinistres catastrophiques Building resilient communities Bâtir des communautés résilientes Why some homes survived: Learning from the Fort McMurray wildland/urban interface fire disaster By Alan Westhaver, M.Sc. March 2017 Why some homes survived: Learning from the Fort McMurray wildland/urban interface fire disaster By Alan Westhaver, M.Sc. March 2017 ICLR research paper series – number 56 Published by Institute for Catastrophic Loss Reduction 20 Richmond Street East, Suite 210 Toronto, Ontario, Canada M5C 2R9 This material may be copied for purposes related to the document as long as the author and copyright holder are recognized. The opinions expressed in this paper are those of the author and not necessarily those of the Institute for Catastrophic Loss Reduction. Nothing in this report is intended to place blame or impart fault for home losses, nor should it be interpreted as doing so. The content of this report is solely to encourage improved preparedness for wildfires in the future by reducing the vulnerability of homes and other structures in the wildland/urban interface to igniting during a wildland fire event. Cover photos: Alan Westhaver ISBN: 978-1-927929-06-3 Copyright©2017 Institute for Catastrophic Loss Reduction ICLR’s mission is to reduce the loss of life and property caused by severe weather and earthquakes through the identification and support of sustained actions that improve society’s capacity to adapt to, anticipate, mitigate, withstand and recover from natural disasters. ICLR is achieving its mission through the development and implementation of its programs Open for business, to increase the disaster resilience of small businesses, Designed for safer living, which increases the disaster resilience of homes, and RSVP cities, to increase the disaster resilience of communities. -

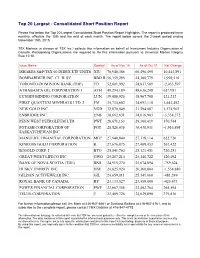

Top 20 Largest - Consolidated Short Position Report

Top 20 Largest - Consolidated Short Position Report Please find below the Top 20 Largest Consolidated Short Position Report Highlights. The report is produced twice monthly, effective the 15th and the end of each month. The report below covers the 2-week period ending November 15th, 2015. TSX Markets (a division of TSX Inc.) collects this information on behalf of Investment Industry Organization of Canada. Participating Organizations are required to file this information pursuant to Universal Market Integrity Rule 10.10. Issue Name Symbol As of Nov 15 As of Oct 31 Net Change ISHARES S&P/TSX 60 INDEX ETF UNITS XIU 70,940,386 60,496,495 10,443,891 BOMBARDIER INC. CL 'B' SV BBD.B 56,359,295 54,360,779 1,998,516 TORONTO-DOMINION BANK (THE) TD 52,801,992 54,837,589 -2,035,597 ATHABASCA OIL CORPORATION J ATH 49,294,189 48,636,208 657,981 LUNDIN MINING CORPORATION LUN 39,088,920 38,967,708 121,212 FIRST QUANTUM MINERALS LTD. J FM 35,734,602 34,091,110 1,643,492 NEW GOLD INC. NGD 32,870,049 31,294,087 1,575,962 ENBRIDGE INC. ENB 30,662,631 34,016,903 -3,354,272 PENN WEST PETROLEUM LTD. PWT 28,671,163 28,300,419 370,744 POTASH CORPORATION OF POT 28,520,036 30,436,931 -1,916,895 SASKATCHEWAN INC. MANULIFE FINANCIAL CORPORATION MFC 27,940,840 27,318,114 622,726 KINROSS GOLD CORPORATION K 27,676,875 27,409,453 267,422 B2GOLD CORP. -

Mining, Energy & Manufacturing Spring 2021

SPRING 2021 Mining, Energy & Manufacturing Monday, May 31, 2020 • Page B13 The Vaderstad facility at Langbank where 60 new production staff and a second shift will be added to meet growing demand. Vaderstad adding to staff to meet growing demand BY KEVIN WEEDMARK this plant but it doesn’t amount to a whole lot today,” he “We always say draw a 50 km circle around the plant Vaderstad is undergoing a major ramping up of produc- says. “So it’s mostly Canada. Our distribution footprint and that’s really our catchment area,” he says. tion, adding 60 production employees and a second pro- grew over the course of the last little while, so that cer- Wasylyk says one of the biggest challenges of having to duction shift at its Langbank production facility, which tainly helped, but I think the real reason is that it is a qual- EULQJSHROSHLQIURPRXWRIDUHDLVÀQGLQJHQRXJKKRXV- manufactures tillage, drilling and planting machinery for ity machine and performs well, in the Western Canadian ing for them in the local area. WKHDJLQGXVWU\$GGLWLRQDOVXSSRUWVWDͿZLOOEHDGGHGDW conditions in particular.” “That’s probably one of the major challenges quite hon- the Langbank facility as well. +HVD\VRIWKHQHZSURGXFWLRQVWDͿ9DGHUVWDGZLOO estly,” he says. “You’re trying to recruit people of course, Jason Wasylyk, Director of Operations for Vaderstad, be looking for people with a variety of skillsets. but then you’ve got to put them somewhere and it’s not which employs 200 people in Canada, says production is “Welders, painters, assemblers, warehouse folks, ship- always that easy. It might be the biggest challenge. There ramping up because of booming sales. -

Enbridge's Energy Infrastructure Projects

Enbridge’s Energy Infrastructure Projects Last Updated: Aug. 4, 2021 Energy Infrastructure Projects Table of Contents Crude Oil and Liquids Pipelines .................................................................................................... 3 Natural Gas Transmission Pipelines ............................................................................................. 4 Natural Gas Distribution .............................................................................................................. 12 Offshore Projects ........................................................................................................................ 14 Power Generation ....................................................................................................................... 15 Power Transmission ................................................................................................................... 16 Wind Energy ............................................................................................................................... 17 Page 2 of 19 Energy Infrastructure Projects Crude Oil and Liquids Pipelines Line 3 Replacement Program Construction of the $5.3-billion Canadian portion of the Line 3 Replacement Program is complete and began commercial service in December 2019. The $2.9-billion U.S. portion of the Line 3 Replacement Program, known as the Line 3 Replacement Project, consists of replacing existing 34-inch pipe with new 36-inch pipe for 13 miles in North Dakota, 337 miles in Minnesota, and -

Lead the Transition to Low-Carbon Energy by Producing and Using Renewable Natural Gas

A guide to producing and using RNG The Future of Clean Energy Lead the transition to low-carbon energy by producing and using renewable natural gas • Organic waste • Agriculture • Wastewater treatment • Landfills • Food and beverage processing Inside: The RNG advantage How is RNG produced and used? RNG vs. electrification Expert help to get started Get expert help planning and developing your RNG projects This booklet will guide you through everything you need to know to produce and use renewable natural gas (RNG) with Enbridge Gas. We’ll help you leverage RNG as an e!ective solution to achieve climate action goals and create a sustainable future for your company and community. 2 fossil fuels. fossil to alternative A sustainable is RNG? What future clean energy importantrole in Ontario’s RNG will play an energy renewable to waste organic From Renewable Natural Gas Producer Guide Gas Producer Natural Renewable 04 for many sectors. many for benefits are There and use RNG? produce Why 06 carbon fuel. carbon waste into a low- organicTransforming used?and made is RNG How 08 action. change climate take costs manage to approach A reliable electrification RNG vs. 10 benefitting. are others See how stories Success 12 *Source: cga.ca/natural-gas-101/the-renewable-natural-gas-opportunity *Source: treatment and as manure) (such sources agricultural landfill gas, waste, from RNG is produced project started. project RNG your get to Steps RNG projects with expertise Help and wastewater wastewater organic organic . 14 natural gas (CNG). gas natural with compressed fuel costs Reduce Program Transit Municipal 17 quality RNG. -

UNIFLEX OPERATION on the Settlement Date, a Starting Level Will Be Determined for SECTOR DIVERSIFICATION of the Each Canadian Share Included in the Portfolio

CANADIAN MARKET INDEX UNIFLEX OPERATION On the settlement date, a starting level will be determined for SECTOR DIVERSIFICATION OF THE each Canadian share included in the portfolio. CANADIAN MARKET INDEX UNIFLEX On the maturity date, a ratio of the closing level over the starting level for each share will be computed. 5% 10% The 8 best performing shares during the 6-year term will be automatically 10% assigned a fixed return of 60%, regardless of whether the actual return was positive or negative. The remaining 12 shares will be assigned their actual return. The global return (maximum 60%) will be calculated by averaging these 20 returns. 25% 25% The value at maturity will be the highest value between: the initial deposit; or the initial deposit PLUS global return (maximum 60%) 10% 15% MAIN PRODUCT FEATURES 6-year term (not redeemable before maturity) An easy way to diversify Guarantee of principal on maturity of 100% Cut-off age: 64 y/o (registered) and 70 y/o (non-registered) Low management fees of 1% per year Even under a scenario where the return of each share is $500 minimum deposit negative, this product may produce a global positive return EXPOSURE TO 20 CANADIAN COMPANIES INCLUDED IN THE S&P/TSX 60 INDEX COMPANY COMPANY PROFILE SECTOR Metro Inc. Operates as a food distributor Loblaw Companies Limited Operates as a food distributor Consumer staples Enbridge Inc. Produces crude oil and natural gas TransCanada Corporation Transports and markets natural gas Husky Energy Inc. Explores for, produces and markets crude oil and natural gas Energy Encana Corporation Produces crude oil Suncor Energy Inc.