Press Release Hotel Parmeshwari

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

B.Ed & B.A.-B.Ed, B.Sc-B.Ed 4 Year Integrated Colleges Students

PANDIT DEENDAYAL UPADHYAYA SHEKHAWATI UNIVERSITY, SIKAR (Sikar – Jhunjhunu State Highway, Katrathal, Sikar-332024 ) B.Ed & B.A.-B.Ed, B.Sc-B.Ed 4 Year Integrated Colleges Students Information S.No. College College Name REG EX NC Code 1 801 AMBIKA TEACHERS TRAINING 185 COLLEGE,MALSISAR 2 802 AMMAN T.T. COLLEGE DHOLAKHERA 184 2 3 803 BABA GANGANATH T.T. COLLEGE 174 4 804 BALAJEE T.T. COLLEGE 190 5 805 BHANWAR KANWAR SUGAN SINGH SHIKSHA 196 MAHAVIDYALAYA 6 806 BHOM SINGHMAHILA T. T. COLLEGE, GHORIWALA 170 KALAN JHUNJHUNU 7 807 BHOM SINGH TEACHERS TRAINING COLLEGE 174 3 8 808 CAREER TEACHERS TRAINING COLLEGE 193 9 809 DHATTARWAL T.T. COLLEGE 181 1 10 810 GANGADHAR TEACHERS TRAINING COLLEGE 180 2 11 811 GOPI KRISHNA PIRAMAL COLL.OF TEACHER 204 EDU,PIRAMAL NAGAR BAGAR 12 812 INDIAN GIRLS COLLEGE OF EDUCATION RIICO 382 JHUNJHUNU 13 813 INDRA GANDHI BALIKA NIKETAN B.ED. COLLEGE, 330 1 ARDAWATA 14 814 J.M. BED COLLEGE, BUHANA, JHUNJHUNU 185 15 815 JIWANI BED. COLLEGE,KHETRI RD,CHIRAWA,JJN 177 16 816 KANORIA BED COLLEGE, MUKUNGARH 177 17 817 KANORIA GIRLS BED COLLEGE MUKUNDGARH 191 18 818 MAA BHARTI TEACHERS TRAINING COLLEGE 185 3 DUNDLOD 19 819 MANU OXFORD T.T. COLLEGE, NAWALGARH 183 20 820 MATA KESHARI DEVI T.T. COLLEGE 384 21 821 MODERN TEACHERS TRAINING COLLEGE 189 22 822 MRS HELENA KAUSHIK WOMENS EDUCATION 193 1 COLLEGE, MALSISAR 23 823 NARESH SHIKSHAK PRASHIKSHAN 92 1 MAHAVIDYALAYA 24 824 NEELKANTH TEACHERS TRAINING COLLEGE 181 1 25 825 NEW INDIAN TEACHERS TRAINING COLLEGE , 175 2 HOUSING BOARD, JHUNJHUNU 26 826 NEW RAJASTHAN T.T. -

Government of India Ministry of Tourism Lok Sabha Unstarred Question No.†319 Answered on 24.06.2019 Tourist Circuit in Rajasth

GOVERNMENT OF INDIA MINISTRY OF TOURISM LOK SABHA UNSTARRED QUESTION NO.†319 ANSWERED ON 24.06.2019 TOURIST CIRCUIT IN RAJASTHAN †319. SHRI SUMEDHANAND SARSWATI: Will the Minister of TOURISM be pleased to state: (a) the names and details of fifty places in the country identified by the Government to be developed as tourist circuits from the tourism point of view; (b) the names and details of the places in the State of Rajasthan linked with the said tourist circuits; (c) whether the Government proposes to include Khatushyamji, Salasar Balaji, Lohargal and Harshnath Bhairav Temple located at Harsh mountain related to Hindu religion in the State of Rajasthan in any of the said tourist circuits; (d) if so, the time by which it is likely to be done; and (e) if not, the reasons therefor? ANSWER MINISTER OF STATE FOR TOURISM (INDEPENDENT CHARGE) (SHRI PRAHLAD SINGH PATEL) (a) to (e): Identification and development of tourism sites is primarily the responsibility of State Governments/Union Territories. However, the Ministry of Tourism under its scheme of Swadesh Darshan- Integrated Development of Theme-Based Tourist Circuits provides Central Financial Assistance to State Governments/Union Territories/Central Agencies for developing tourism infrastructure in the circuits, across the country, having tourist potential in a planned and prioritized manner. The projects under the scheme are identified for development in consultation with the State Governments/UT Administrations and are sanctioned subject to availability of funds, submission of suitable detailed project reports, adherence to scheme guidelines and utilization of funds released earlier. Based on above criteria, Ministry has sanctioned following projects in Rajasthan: (Rs. -

Salasar Balaji

Salasar Travel Guide - http://www.ixigo.com/travel-guide/salasar page 1 Cold weather. Carry Heavy woollen, umbrella. When To Max: Min: Rain: 222.0mm Salasar 19.79999923 15.60000038 7060547°C 1469727°C A place of religious importance, Aug Salasar is dotted with various VISIT Cold weather. Carry Heavy woollen, temples. This quiet, sleepy village umbrella. http://www.ixigo.com/weather-in-salasar-lp-1177945 Max: Min: Rain: 99.0mm of Rajasthan sees a lot of devotees 21.70000076 14.30000019 throughout the year. 2939453°C 0734863°C Jan Very cold weather. Carry Heavy woollen. Sep Famous For : City Max: Min: 5.0°C Rain: 0.0mm Cold weather. Carry Heavy woollen. 12.60000038 Max: 20.0°C Min: 14.5°C Rain: 21.0mm 1469727°C Apart from the legends of Lord Hanuman Feb Oct and the holy fire lit by Maharaj Mohandas, Very cold weather. Carry Heavy woollen. Cold weather. Carry Heavy woollen. which is still burning, the sanctity of this Max: Min: Rain: 3.0mm Max: Min: Rain: 0.0mm 20.10000038 16.39999961 place increases with the regular recital of 14.60000038 5.699999809 1469727°C 265137°C 1469727°C 8530273°C Ramayana for the past 8 years. If you are Nov still searching for more, be a part of the fairs Mar Cold weather. Carry Heavy woollen. held on Chaitra Purnima and Ashvin Cold weather. Carry Heavy woollen. Max: Min: Rain: 0.0mm Max: 19.5°C Min: Rain: 3.0mm Purnima for that liberating religious revelry. 15.89999961 8.300000190 13.69999980 8530273°C 734863°C 9265137°C Apr Dec Cold weather. -

Registered Gaushalas in Rajasthan S.N

Registered Gaushalas in Rajasthan S.N. GaushalaName Address Region District TAHSIL Panchayat Samiti Gram Panchayat Gram 1 Kanji House Nagar Nigam Ajmer Panchshil Ajmer URBAN Ajmer AJMER AJMER RURAL 2 Shri Anand Gopal Goshala Anand Gopal Goshala Badi Nagfani Ajmer URBAN Ajmer AJMER SRINAGAR 3 Shri Dayanand Goushala Ajmer Shri Dayanand Goushala Ajmer URBAN Ajmer AJMER SRINAGAR Gopal Krishna Goshala Foy Sagar 4 Shri Gopal Krishna Goshala Foy Sagar Nodal_Office_Ajmer URBAN Ajmer AJMER SRINAGAR 5 Shri Gyanodya Goshala Nareli Gyanodya Goshala Nareli Ajmer URBAN Ajmer AJMER SRINAGAR 6 Shri Nrisingh Gopal Goshala Aradka Nrisingh Gopal Goshala Aradka URBAN Ajmer AJMER SRINAGAR Shri Pushkar Gau Adi Pashushala Lohagan Pushkar Gau Adi Pashushala Lohagal Road 7 ajmer Ajmer URBAN Ajmer AJMER SRINAGAR Shri Pushkar Gou Adi Pashushala Ramngar Pushkar Gou Adi Pashushala Ramngar 8 Pushkar road Pushkar road URBAN Ajmer AJMER SRINAGAR 9 Shri Sita Goshala Paharganj Ajmer Sita Goshala Ajmer URBAN Ajmer AJMER SRINAGAR 10 Shri Hari Goushala Bhamolav Arai Hari Goushala Bhamolav Anrai URBAN Ajmer ARAI ARAI Devnarayan Goshala Seva Samiti Beawar 11 Shri Devnarayan Goshala Seva Samiti Khas Beawar URBAN Ajmer BEAWAR JAWAJA 12 Shri Tijarti Chembers Sarrafan Goshala Tijarti Chembers Sarrafan Goshala Beawar URBAN Ajmer BEAWAR JAWAJA Shri Aacharya Shri Heera Laxmi Gurujain Aacharya Shri Heera Laxmi Gurujain 13 Goushala Devliyakalan Goushala Devliyakalan URBAN Ajmer BHINAY BHINAY 14 Shri Sawaria Seth Goshala Sawaria Seth Goshala Bandhanwara URBAN Ajmer BHINAY BHINAY 15 -

To Download Rajasthan GK

ambitiousbaba.com Online Test Series Best Online Test Series Site for All State Government Jobs Patwari , Police SI , Police Constable 1 etc ambitiousbaba.com Online Test Series Rajasthan GK Index No. of Topic Topics Name Topic 1 Rajasthan Intro Topic 2 History of Rajasthan Topic 3 Geography of Rajasthan Topic 4 Rajasthan Economy Topic 5 Agriculture in Rajasthan Topic 6 Industry and Minerals in Rajasthan Topic 7 Irrigation in Rajasthan Topic 8 Power in Rajasthan Topic 9 Transport in Rajasthan Topic 10 Tourist Centres in Rajasthan Topic 11 Fairs and Festivals in Rajasthan Topic 12 Lokayukta of Rajasthan Topic 13 Nickname of Rajasthan’s City Topic 14 Important Tribes of Rajasthan Topic 15 List of Lake In Rajasthan Topic 16 List of River in Rajasthan Topic 17 List of Temple in Rajasthan Topic 18 Folk Dance In Rajasthan Topic 19 Dam In Rajasthan Topic 20 National Park In Rajasthan Topic 21 Wildlife Sanctuary In Rajasthan Topic 22 List of Thermal Power Plant In Rajasthan Topic 23 List of Solar Power Plant In Rajasthan Topic 24 List of Nuclear Power Plant In Rajasthan Topic 25 UNESCO World Heritage Sites in Rajasthan Best Online Test Series Site for All State Government Jobs Patwari , Police SI , Police Constable 2 etc ambitiousbaba.com Online Test Series Topic 1: Rajasthan Intro Capital (राजधानी ) Jaipur Formation (ननर्ााण) 30 March 1949 Total Area 342,239 km2 (132,139 sq mi) (कुल क्षेत्रफल) Area Rank (क्षेत्र रℂक) 1st Population (जनसंख्या) 68,548,437 Population rank 7th (जनसंख्या रℂक) Density (घनत्व) 200/km2 (520/sq mi) Literacy Rate 66.11% (साक्षरता दर )(%) Sex Ratio 928(F)/1000(M) Legislative Assembly 200 Seats (निधान सभा) Lower House 25 Seats (लोक सभा) Upper House 10 Seats (राजसभा) Number of Districts 33 (नजलों) Language (भाषा) Hindi, Malvi, Dhundhari,Marwari,Dhundhari, Harauti Stadium (स्टेनियर्) Barkatullah Khan Stadium (Jodhpur), SawaiMansingh Stadium (Jaipur) Desert Thar Desert is also known as the Great Indian Desert. -

Final Feasibility Report 1

Consultancy Services for Preparation of Feasibility Report of Two -laning of Km. 39.668 to Km. PUBLIC WORKS DEPARTMENT 205.233 (Design Chainage) of SH-60, SH-20,SH-83, SH-82A & SH-8 comprising the section Government of Rajasthan from Tarnau to Mukundgarh (the “Highway-III”) Via Deedwana, Salasar & Laxmangarh Final Feasibility Report Chapter – 0: Executive Summary Contents CHAPER – 0 Executive Summary 1 Introduction .…………………………………………………………………………………………………… 3 2 Project Description .…………………………………………………………………………………………. 3 3 Traffic Survey and Analysis ...……………………………………………………………………………. 6 4 Engineering Surveys and Investigations.………………………………………………………………………. 10 4.1 Pavement Condition Survey ……..…………………………………………………………….. 13 4.2 Pavement Structural Strength …………………………………………………………………. 14 4.3 Sub Grade Investigation ………..………………………………………………………………… 15 4.4 Existing Pavement Investigation ………………………………………………………………. 19 5 Material Investigation ………………………...………………………………………………………………………. 22 6 Stone Aggregates ……..………………………...………………………………………………………………………. 22 7 Alignment ………………..………………………...……………………………………………………………………… 23 7.1 Climate ………………………………..…..…………………………………………………………….. 24 7.2 Land Use ..…..………………………..…..…………………………………………………………….. 24 7.3 Right of way .………………………..…..…………………………………………………………….. 24 7.4 Roadway .……………………………..…..…………………………………………………………….. 24 7.4.1 Intersections ..…………..…..…………………………………………………………….. 24 7.4.2 Submergence .…………..…..…………………………………………………………….. 27 8 Proposed Alignment ………………..………………………………………………………………………………… 27 9 Bypasses ………………....………………………...……………………………………………………………………. -

FINAL DISTRIBUTION.Xlsx

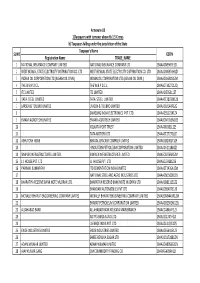

Annexure-1B 1)Taxpayers with turnover above Rs 1.5 Crores b) Taxpayers falling under the jurisdiction of the State Taxpayer's Name SL NO GSTIN Registration Name TRADE_NAME 1 NATIONAL INSURANCE COMPANY LIMITED NATIONAL INSURANCE COMPANY LTD 19AAACN9967E1Z0 2 WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD WEST BENGAL STATE ELECTRICITY DISTRIBUTION CO. LTD 19AAACW6953H1ZX 3 INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) INDIAN OIL CORPORATION LTD.(ASSAM OIL DIVN.) 19AAACI1681G1ZM 4 THE W.B.P.D.C.L. THE W.B.P.D.C.L. 19AABCT3027C1ZQ 5 ITC LIMITED ITC LIMITED 19AAACI5950L1Z7 6 TATA STEEL LIMITED TATA STEEL LIMITED 19AAACT2803M1Z8 7 LARSEN & TOUBRO LIMITED LARSEN & TOUBRO LIMITED 19AAACL0140P1ZG 8 SAMSUNG INDIA ELECTRONICS PVT. LTD. 19AAACS5123K1ZA 9 EMAMI AGROTECH LIMITED EMAMI AGROTECH LIMITED 19AABCN7953M1ZS 10 KOLKATA PORT TRUST 19AAAJK0361L1Z3 11 TATA MOTORS LTD 19AAACT2727Q1ZT 12 ASHUTOSH BOSE BENGAL CRACKER COMPLEX LIMITED 19AAGCB2001F1Z9 13 HINDUSTAN PETROLEUM CORPORATION LIMITED. 19AAACH1118B1Z9 14 SIMPLEX INFRASTRUCTURES LIMITED. SIMPLEX INFRASTRUCTURES LIMITED. 19AAECS0765R1ZM 15 J.J. HOUSE PVT. LTD J.J. HOUSE PVT. LTD 19AABCJ5928J2Z6 16 PARIMAL KUMAR RAY ITD CEMENTATION INDIA LIMITED 19AAACT1426A1ZW 17 NATIONAL STEEL AND AGRO INDUSTRIES LTD 19AAACN1500B1Z9 18 BHARATIYA RESERVE BANK NOTE MUDRAN LTD. BHARATIYA RESERVE BANK NOTE MUDRAN LTD. 19AAACB8111E1Z2 19 BHANDARI AUTOMOBILES PVT LTD 19AABCB5407E1Z0 20 MCNALLY BHARAT ENGGINEERING COMPANY LIMITED MCNALLY BHARAT ENGGINEERING COMPANY LIMITED 19AABCM9443R1ZM 21 BHARAT PETROLEUM CORPORATION LIMITED 19AAACB2902M1ZQ 22 ALLAHABAD BANK ALLAHABAD BANK KOLKATA MAIN BRANCH 19AACCA8464F1ZJ 23 ADITYA BIRLA NUVO LTD. 19AAACI1747H1ZL 24 LAFARGE INDIA PVT. LTD. 19AAACL4159L1Z5 25 EXIDE INDUSTRIES LIMITED EXIDE INDUSTRIES LIMITED 19AAACE6641E1ZS 26 SHREE RENUKA SUGAR LTD. 19AADCS1728B1ZN 27 ADANI WILMAR LIMITED ADANI WILMAR LIMITED 19AABCA8056G1ZM 28 AJAY KUMAR GARG OM COMMODITY TRADING CO. -

Government of India Ministry of Tourism Lok Sabha

GOVERNMENT OF INDIA MINISTRY OF TOURISM LOK SABHA STARRED QUESTION NO.*3 ANSWERED ON 17.07.2017 DEVELOPMENT OF TOURIST SPOTS IN U.P. AND RAJASTHAN *3. SHRI RAJESH KUMAR DIWAKER: Will the Minister of TOURISM be pleased to state: (a) whether the Government has taken initiatives or is planning to develop the tourist spots in the States of Uttar Pradesh and Rajasthan; (b) if so, the details thereof; (c) the details of the places identified for such development; (d) whether any Detailed Project Report has been sought from the State Governments in this regard; and (e) if so, the details thereof? ANSWER MINISTER OF STATE FOR TOURISM (INDEPENDENT CHARGE) (DR. MAHESH SHARMA) (a) to (e): A Statement is laid on the Table of the House. ******** STATEMENT IN REPLY TO LOK SABHA STARRED QUESTION NO.*3 ANSWERED ON 17.07.2017 REGARDING DEVELOPMENT OF TOURIST SPOTS IN U.P. AND RAJASTHAN. (a) to (e): Taking initiative and planning to develop tourist spots is primarily the responsibility of the State Governments/Union Territory Administrations, including the State Governments of Uttar Pradesh and Rajasthan. The Ministry of Tourism extends Central Financial Assistance for projects submitted by the State Government and Union Territories for places identified by them for tourism development. The details of projects for which Central Financial Assistance has been extended to the State Government of Uttar Pradesh and Rajasthan is given below: Projects sanctioned under Prasad Scheme (i) Development of Mathura-Vrindavan as Mega Tourist Circuit (Ph-II) for Rs.14.92 crore during 2014-15 in the State of Uttar Pradesh. -

Proposal Shreee Salasar Balaji Rajasthan

Dear Sir, About Salasar Dham:- Salasar Balaji or Salasar Dham is a place of religious importance for the devotees of Lord Hanumana. It is located in the town of Salasar, on NH-65 near Sujangarh in Churu district, Rajasthan. It is located near the pilgrim centers of Rani Sati Temple and Khatushyamji. The temple of Balaji which is another name of Hanuman is situated in the middle of Salasar and attracts innumerable worshippers throughout the year especially on Chaitra Purnima and Ashvin Purnima. The temple of Salasar Balaji is now considered to be a Shakti Sthal (a place of power) and Swayambhu (self creation) by faith, belief, miracles and wish fulfillments of the devotees. The idol of Balaji here is different from all other idols of Lord Hanumana. Hanumana possess round face with moustache and beard making it the most unique idol among the other idols of Hanumana all over the world. Highlights of the Salasar Dham:- Some of the regular activities of the temple which is very touching as per devotees values and social beliefs. • Regular worships of the deity. • Performing Aarti on fixed time slots. • Feasting of Brahmins and other mendicants. • Recitation of Ramayana . • Recitation of Kirtan & Bhajans . • Arrangement for Savamanis. • Recitation of Sundar Kand on every Tuesday in union by the singers. • Arrangement of stay for the visitors. • Even Regular Visit of Celebrities on monthly basis like Navjyot Singh Siddhu, Lakhbir Singh Lakkha, Swami Avdheshanand Giri ji Maharaj, Sanjay Dutt, Nisha Kothari etc. While the worship of the deity is managed by the Brahmins priests from the Dadhich clan, the temple is managed and maintained by the trust Hanuman Sewa Samiti. -

Salasar Balaji

Salasar Balaji Salasar Balaji or Salasar Dham in India is a place of man, the Thakur of that village ordered the idol to be religious importance for the devotees of Hanuman. It is shifted to Salasar and placed at the temple for the re- located in the town of Salasar, on National Highway 65 ligious rituals to be performed. He brought two bulls, near Sujangarh in Churu district, Rajasthan. The temple placed the idol on its cart and left them in the open courts of Balaji, another name of Hanuman, is situated in the believing to build the temple at the place where the bulls middle of Salasar and attracts innumerable worshippers would stop. The place where the bulls stopped was given throughout the year. On Chaitra Purnima and Ashvin the present name of Salasar. Many of the villagers, shop- Purnima, large fairs are organised that attract devotees keepers and traders shifted their living to Salasar and thus as they pay homage to the deity. a new village was formed. Salasar Balaji is in the religious circuit that includes the pilgrim centres of Rani Sati Temple and Khatushyamji, which are both located close to it. Initially a small con- 2 Temple struction, the temple of Salasar Balaji is now considered to be a Shakti Sthal (a place of power) and Swayambhu 2.1 Deity (self creation) by faith, belief, miracles and wish fulfil- ments of the devotees. The principal deity of the temple is Hanuman who re- ceives veneration along with other deities. Of the idols of Hanuman found in Hindustan, that at Salasar Balaji is unique because it has a round face with moustache and 1 Legend beard. -

Download PDF Here

district_name block_name bank_name branch_name status shg_name CHURU BEEDASAR BANK OF BARODA BOB BIDASAR DIST CHURU Y JASNATH JI CHURU BEEDASAR BANK OF BARODA BOB BIDASAR DIST CHURU Y SARSWATI SHG CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y SHREE KRISHNA SHG CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y KARNI MATA CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y ANN NATHJI MAHARAJ CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y TEJA JI CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y KARNI MATA CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y BALAJI CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y ROOPNATH CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y BABA RAMDEV CHURU BEEDASAR BANK OF BARODA INYARA,CHURU,RAJ Y JETHMALJI MAHARAJ CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y THAKUR JI CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y VISAWKARMA CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y SHANKAR JI CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y SHREE GANESH CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y BHAGAT SINGH CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y LAXMI MATA CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y DADA JI CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y SHREE KARISHNA CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y TOLE NATH JI CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK DARIBA Y SHREE KRISHNA CHURU BEEDASAR BARODA RAJASTHAN KSHETRIYA GRAMEEN BANK -

Revised Tentative Seat Matrix for B.Pharm and D.Pharm Courses (2020-21)

Office of the Chairman, Pharmacy Counseling Board 2020, RUHS College of Dental Sciences, Jaipur REVISED TENTATIVE SEAT MATRIX FOR B.PHARM AND D.PHARM COURSES (2020-21) # Revised tentative seat matrix in compliance to Hon'ble Court order dated 10.08.2018 in writ petition no. SBCWP no. 1571/2021 12.02.2021 Government college Seats S. No. College B.Pharm D.Pharm 1 Public Health Training Institute, SMS Medical College, Jaipur 302004 -- 60 Private colleges Seats S. No. College B.Pharm D.Pharm 2. Aishwarya College of Pharmacy, Rajender Nagar, Chitrakoot Nagar -- 51 Extn., RTO, Udaipur 313001 3. Akashdeep College of Pharmacy, Mansarovar, Jaipur -- 51 4. Alok College of Pharmacy, Bedla Road, Fatehpur Gizwa Road, -- 51 Udaipur 5. Alwar Pharmacy College, MIA, Alwar 85 51 6. Aman Pharmacy College Dhola Kheda, Udaipurwati, Jhunjhunu 51 51 7. Apex College of Pharmacy, Village Fatepur, Near Nagla Dhor, Sh-21, -- 51 Teh. Roopwas, Dist. Bhartapur 8. Arya College of Pharmacy, Kukus, Jaipur 85 51 9. Aryabhatt College of Pharmacy, Kayad Road, Chachiyawas, Ajmer -- 51 10. Asian College of Pharmacy, Near Police Anveshan Bhawan, Badi Main -- 51 Road, Udaipur 313004 11. Bharti Institute of Pharmacy Science, Nathwala, Sriganganagar -- 51 335001 12. Bharti Pharmacy College, Snehlata Poddar Colony, Near NH-52, -- 51 Reengus, Sikar 332404 13. Biyani Institute of Pharmaceuticals Sciences, Champapura, Kalwar -- 51 Road, Jaipur 14. BLM College of Pharmacy, Village Rajota, Teh. Khetri, Distt. -- 51 Jhunjhunu 15. Bombay Institute of Pharmacy, Hanumangarh -- 51 Page 1 of 4 Seats S. No. College B.Pharm D.Pharm 16. CLG Pharmacy College, Sumerpur, Dist. Pali -- 51 17.