Mty Reports 2020 Fourth Quarter and Annual Results

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

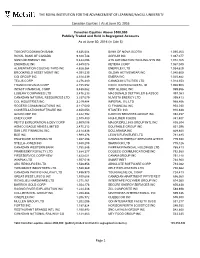

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Women in Leadership at S&P/Tsx Companies

WOMEN IN LEADERSHIP AT S&P/TSX COMPANIES Women in Leadership at WOMEN’S S&P/TSX Companies ECONOMIC Welcome to the first Progress Report of Women on Boards and Executive PARTICIPATION Teams for the companies in the S&P/TSX Composite Index, the headline AND LEADERSHIP index for the Canadian equity market. This report is a collaboration between Catalyst, a global nonprofit working with many of the world’s leading ARE ESSENTIAL TO companies to help build workplaces that work for women, and the 30% Club DRIVING BUSINESS Canada, the global campaign that encourages greater representation of PERFORMANCE women on boards and executive teams. AND ACHIEVING Women’s economic participation and leadership are essential to driving GENDER BALANCE business performance, and achieving gender balance on corporate boards ON CORPORATE and among executive ranks has become an economic imperative. As in all business ventures, a numeric goal provides real impetus for change, and our BOARDS collective goal is for 30% of board seats and C-Suites to be held by women by 2022. This report offers a snapshot of progress for Canada’s largest public companies from 2015 to 2019, using the S&P/TSX Composite Index, widely viewed as a barometer of the Canadian economy. All data was supplied by MarketIntelWorks, a data research and analytics firm with a focus on gender diversity, and is based on a review of 234 S&P/TSX Composite Index companies as of December 31, 2019. The report also provides a comparative perspective on progress for companies listed on the S&P/TSX Composite Index versus all disclosing companies on the TSX itself, signalling the amount of work that still needs to be done. -

Annual Information Form 2019

MTY FOOD GROUP INC. 8210 Trans-Canada Road St-Laurent, Quebec, H4S 1M5 Annual Information Form For the year ended November 30, 2019 February 23, 2020 TABLE OF CONTENTS PRELIMINARY NOTES AND CAUTIONARY STATEMENT .......................................... 5 CORPORATE STRUCTURE .......................................................................................... 6 Name, Address and Incorporation of the Company ...................................................................... 6 Intercorporate Relationships ............................................................................................................. 7 GENERAL DEVELOPMENT OF THE BUSINESS ......................................................... 7 Recent events ................................................................................................................................... 7 3 Year History .................................................................................................................................... 7 DESCRIPTION OF THE BUSINESS OF THE COMPANY ............................................. 9 Overview ............................................................................................................................................. 9 Restaurant Industry ....................................................................................................................... 10 Development of the Business ..................................................................................................... 11 System Sales .................................................................................................................................. -

International Smallcap Separate Account As of July 31, 2017

International SmallCap Separate Account As of July 31, 2017 SCHEDULE OF INVESTMENTS MARKET % OF SECURITY SHARES VALUE ASSETS AUSTRALIA INVESTA OFFICE FUND 2,473,742 $ 8,969,266 0.47% DOWNER EDI LTD 1,537,965 $ 7,812,219 0.41% ALUMINA LTD 4,980,762 $ 7,549,549 0.39% BLUESCOPE STEEL LTD 677,708 $ 7,124,620 0.37% SEVEN GROUP HOLDINGS LTD 681,258 $ 6,506,423 0.34% NORTHERN STAR RESOURCES LTD 995,867 $ 3,520,779 0.18% DOWNER EDI LTD 119,088 $ 604,917 0.03% TABCORP HOLDINGS LTD 162,980 $ 543,462 0.03% CENTAMIN EGYPT LTD 240,680 $ 527,481 0.03% ORORA LTD 234,345 $ 516,380 0.03% ANSELL LTD 28,800 $ 504,978 0.03% ILUKA RESOURCES LTD 67,000 $ 482,693 0.03% NIB HOLDINGS LTD 99,941 $ 458,176 0.02% JB HI-FI LTD 21,914 $ 454,940 0.02% SPARK INFRASTRUCTURE GROUP 214,049 $ 427,642 0.02% SIMS METAL MANAGEMENT LTD 33,123 $ 410,590 0.02% DULUXGROUP LTD 77,229 $ 406,376 0.02% PRIMARY HEALTH CARE LTD 148,843 $ 402,474 0.02% METCASH LTD 191,136 $ 399,917 0.02% IOOF HOLDINGS LTD 48,732 $ 390,666 0.02% OZ MINERALS LTD 57,242 $ 381,763 0.02% WORLEYPARSON LTD 39,819 $ 375,028 0.02% LINK ADMINISTRATION HOLDINGS 60,870 $ 374,480 0.02% CARSALES.COM AU LTD 37,481 $ 369,611 0.02% ADELAIDE BRIGHTON LTD 80,460 $ 361,322 0.02% IRESS LIMITED 33,454 $ 344,683 0.02% QUBE HOLDINGS LTD 152,619 $ 323,777 0.02% GRAINCORP LTD 45,577 $ 317,565 0.02% Not FDIC or NCUA Insured PQ 1041 May Lose Value, Not a Deposit, No Bank or Credit Union Guarantee 07-17 Not Insured by any Federal Government Agency Informational data only. -

Wednesday's TSX Breakouts: a Little-Known Stock That's up 38% with a Further 40% Gain Forecast

TOP STORIES Trudeau appoints Jacqueline O’Neill as Canada’s first ambassador for women, peace and security ANALYSIS Wednesday’s TSX breakouts: A little-known stock that’s up 38% with a further 40% gain forecast JENNIFER DOWTY PUBLISHED 7 HOURS AGO FOR SUBSCRIBERS 0 COMMENTS On today’s TSX Breakouts report, there are 30 stocks on the positive breakouts list (stocks with positive price momentum), and 36 securities are on the negative breakouts list (stocks with negative price momentum). Discussed today is a stock that investors with a high risk tolerance may want to put on their radar and conduct further research on. This micro-cap stock is in an uptrend, closing at a record high on May 31. Year-to-date, the share price is up nearly 38 per cent. However, in the absence of any news and elevated market volatility, the share price may drift down to the high 80 cent range in the near-term. There are two analysts who cover the company and both analysts expect the stock to deliver solid double-digit returns over the next 12 months (forecast one-year returns are 54 per cent by one analyst and 26 per cent by another analyst). The security featured today is Redishred Capital Corp. (KUT-X). STORY CONTINUES BELOW ADVERTISEMENT https://www.theglobeandmail.com/investing/markets/inside-th…days-tsx-breakouts-a-little-known-stock-thats-up-38-with-a/ 2019-06-12, 258 PM Page 1 of 14 A brief outline is provided below that may serve as a springboard for further fundamental research. -

Advisor Managed Accounts: October 2020 Commentary

CIBC WOOD GUNDY BLUE HERON ADVISORY GROUP www.blueherongroup.ca I 250 361-2284 [email protected] ADVISOR MANAGED ACCOUNTS: OCTOBER 2020 COMMENTARY We are prone to review our actions to assess what worked as we had hoped and what could be improved upon. Through the early part of this year we are heartened that our investment process based around the equity action call – when to be cautious and raise cash, and when to return to fully invested – have added value for our clients. As the COVID pandemic began to move around the globe in early March uncertainty became apparent and the equity markets deteriorated. Our Equity Action Call moved from green to yellow to red in fairly short order and by rule we raised cash in our managed portfolios. We feel this was a prudent move not just in the context of following our discipline, but also in the general context of uncertainty. Many of our colleagues and investors across the country took similar action so we do not feel this to be a particularly bold or unique call. However, more interesting to us was that by the middle of April the equity markets had started to regain their footing and money began to flow back in. Despite a continuing abundance of uncertainty and economic disruption, stock prices began to rise. By the end of April our Equity Action call had returned to green and our portfolios were again fully invested. This allowed our clients to participate is a substantial rise in equity values over the last 6 months from May through October, double digit gains in many of our portfolios. -

MTY FOOD GROUP INC. 8150 Trans-Canada Highway, Suite 200 St-Laurent, Québec H4S 1M5

MTY FOOD GROUP INC. 8150 Trans-Canada Highway, suite 200 St-Laurent, Québec H4S 1M5 Annual Information Form For the year ended November 30, 2015 February 15, 2016 TABLE OF CONTENTS PRELIMINARY NOTES AND CAUTIONARY STATEMENT .......................................... 5 CORPORATE STRUCTURE .......................................................................................... 7 Name, Address and Incorporation of the Company ...................................................................... 7 Intercorporate Relationships ............................................................................................................. 8 GENERAL DEVELOPMENT OF THE BUSINESS ....................................................... 10 3 Year History .................................................................................................................................. 10 DESCRIPTION OF THE BUSINESS OF THE COMPANY ........................................... 13 Overview ........................................................................................................................................... 13 Brief Description of the Company’s Concepts: ..................................................................... 13 Restaurant Industry ....................................................................................................................... 17 Development of the Business ..................................................................................................... 19 System Sales .................................................................................................................................. -

Interim Financial Statements the Accompanying Interim Financial Statements Have Not Been Reviewed by the External Auditors of the Funds

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING The accompanying financial statements have been prepared by RBC Global Asset Management Inc. (“RBC GAM”) as manager of the RBC GAM Investment Funds (the “Funds”) and approved by the Board of Directors of RBC GAM. We are responsible for the information contained within the financial statements. We have maintained appropriate procedures and controls to ensure that timely and reliable financial information is produced. The financial statements have been prepared in compliance with International Financial Reporting Standards (“IFRS”) (and they include certain amounts that are based on estimates and judgments). The significant accounting policies, which we believe are appropriate for the Funds, are described in Note 3 to the financial statements. Damon G. Williams, FSA, FCIA, CFA Heidi Johnston, CPA, CA Chief Executive Officer Chief Financial Officer RBC Global Asset Management Inc. RBC GAM Funds August 8, 2019 Unaudited Interim Financial Statements The accompanying interim financial statements have not been reviewed by the external auditors of the Funds. The external auditors will be auditing the annual financial statements of the Funds in accordance with Canadian generally accepted auditing standards. 2019 INTERIM FINANCIAL STATEMENTS SCHEDULE OF INVESTMENT PORTFOLIO (unaudited) (in $000s) RBC QUBE CANADIAN EQUITY FUND June 30, 2019 Fair % of Net Fair % of Net Holdings Security Cost Value Assets Holdings Security Cost Value Assets CANADIAN EQUITIES Energy (cont.) Communication Services 698 900 Seven Generations Energy Ltd. $ 5 166 $ 4 487 814 300 BCE Inc. $ 46 682 $ 48 516 1 152 100 Suncor Energy Inc. 47 790 47 063 2 500 Cogeco Communications Inc. 231 235 639 600 TC Energy Corp. -

STOXX Canada 240 Last Updated: 02.01.2018

STOXX Canada 240 Last Updated: 02.01.2018 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 99.5 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 90.5 2 2 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 64.6 3 3 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 54.0 4 4 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 50.8 5 5 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 44.7 6 6 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 43.3 7 7 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 36.1 8 8 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 35.8 9 11 CA89353D1078 2665184 TRP.TO TRP TransCanada Corp. CA CAD Y 35.6 10 9 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 34.5 11 10 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 33.4 12 12 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENT CA CAD Y 32.9 13 13 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 22.4 14 14 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. CA CAD Y 21.1 15 15 CA87971M1032 2381093 T.TO BCT TELUS CA CAD Y 18.8 16 16 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 18.3 17 17 CA5592224011 2554475 MG.TO MG.A Magna International Inc. -

RBC LPIM Canadian Technical and Quantitative Total Return Securities

December 2018 RBC LPIM Canadian Technical And Quantitative Total Return Securities GLOBAL INVESTMENT SOLUTIONS FOR THE INFORMATION OF INVESTORS IN OUTSTANDING RBC LPIM CANADIAN TECHNICAL AND QUANTITATIVE TOTAL RETURN SECURITIES ONLY Investment Objective: EQUITY INVESTMENT – DECEMBER 2018 The Debt Securities have been designed to provide As of November 30, 2018, the Portfolio was allocated 70% to an Equity Investment and 30% to a Fixed Income Investment. investors with “long” exposure to the Bank’s Indicated dividend yield on the Underlying Equity Securities as of November 30, 2018 was 1.69% and weighted indicated dividend proprietary 6-factor quantitative model (the yield on the Underlying Equity Securities as of November 30, 2018 was 1.63%. “Model”), with the ability to allocate to a Fixed Dividend Yield Income Investment based on whether the stocks in Sector Symbol Company Weight (%) Rank the S&P/TSX Composite Index (the “Index”) exhibit Energy PKI Parkland Fuel Corp. 6.97% 3.00 13 bearish trends to such an extent that the stocks of Industrials AC Air Canada 8.64% 0.00 30 less than 20 issuers are eligible for notional inclusion ARE Aecon Group Inc. 6.85% 2.67 23 in the Equity Investment as determined by the BAD Badger Daylighting Ltd. 5.79% 1.69 10 Consumer Discretionary GIL Gildan Activewear Inc. 7.85% 1.36 26 Model. The goal of this strategy is to be exposed to MTY MTY Food Group Inc. 6.62% 0.91 5 the performance of the stocks selected by the GC Great Canadian Gaming Corp. 5.79% 0.00 8 Model, including dividends and other distributions, Consumer Staples ATD.B Alimentation Couche-Tard Inc.