Advisor Managed Accounts: October 2020 Commentary

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

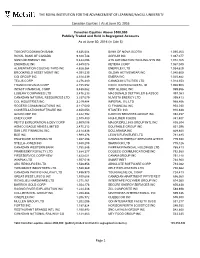

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Power to Do More

2018 2018 Annual Report Annual Report @BoralexInc boralex.com POWER TO DO MORE NOTICE of Annual Meeting of Shareholders Management proxy CIRCULAR 2018 Our thanks to the employees who accepted to appear on the cover page: Van Anh Dang Vu (Kingsey Falls, Québec), Myriam Savage (Thetford Mines, Québec) and Ernani Schnorenberger (Lyon, France). PROFILE Boralex develops, builds and operates renewable energy power facilities in Canada, France, the United Kingdom and the United States. A leader in the Canadian market and France’s largest independent producer of onshore wind power, the Corporation is recognized for its solid experience in optimizing its asset base in four power generation types – wind, hydroelectric, thermal and solar. Boralex has ensured sustained growth by leveraging the expertise and diversification developed for more than 25 years. General HEAD OFFICE WEBSITE www.boralex.com Boralex Inc. Information 36 Lajeunesse Street Kingsey Falls (Québec) Canada J0A 1B0 @BoralexInc Telephone: 819-363-6363 Fax: 819-363-6399 [email protected] BUSINESS OFFICES CANADA UNITED STATES 900 de Maisonneuve Boulevard West 606-1155 Robson Street 39 Hudson Falls Street 24th floor Vancouver, British Columbia South Glens Falls New York Montréal, Québec Canada V6E 1B5 12803 Canada H3A 0A8 Telephone: 1-855-604-6403 United States Telephone: 514-284-9890 Telephone: 518-747-0930 Fax: 514-284-9895 201-174 Mill Street Fax: 518-747-2409 Milton, Ontario Canada L9T 1S2 Telephone: 819-363-6430 | 1-844-363-6430 FRANCE UNITED KINGDOM 71, rue Jean-Jaurès -

Expansion in Full Swing

20 Expansion 20 in full swing Positioning for sustainable growth LE MEILLEUR DE NOS Management FORCES Information CIRCULAR NOTICE of Annual Meeting of Shareholders Notice of Annual Meeting of Shareholders Dear shareholders, We invite you to attend Boralex Inc.’s 2020 annual meeting of shareholders. Items of business When The meeting will be held for the following purposes: May 5, 2021 1. Receive the consolidated financial statements of the 11:00 a.m. (Eastern Daylight Time) Corporation for the financial year ended December 31, 2020 and the independent auditor’s report thereon 2. Elect the directors 3. Appoint the independent auditor Where 4. Adopt a non-binding advisory resolution, the text of which is Virtual meeting via live audio webcast at reproduced on page 15 of the management information circular, https://web.lumiagm.com/262304484 accepting our approach to executive compensation 5. Adopt a resolution, the text of which is reproduced on page 156 of the management information circular, reconfirming and renewing the shareholder rights plan adopted by the board of directors on March 1, 2018 Materials A notice of availability of proxy materials 6. Consider any other business that may properly come before the for our 2020 annual meeting is being meeting or any adjournment thereof. mailed to shareholders on or about March 26, 2021. Notice-and-Access We are providing access to the meeting This year, as permitted by Canadian corporate and securities Materials, the Financial Statements and regulators, Boralex Inc. is using notice-and-access to deliver the annual report to both our registered management information circular of Boralex Inc. -

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance for the period ended February 29, 2016 All figures are reported in Canadian dollars unless otherwise noted. This interim management report of fund performance contains financial highlights but does not contain either the complete interim or annual financial statements of the investment fund. If you have not received a copy of the interim financial reports with this interim management report of fund performance, you can get a copy of the interim financial reports or annual financial statements at your request, and at no cost, by calling us toll-free at 1-888-888-3863, by writing to us at Renaissance Investments, 1500 Robert-Bourassa Boulevard, Suite 800, Montreal, QC, H3A 3S6, by visiting the SEDAR website at sedar.com, or by visiting renaissanceinvestments.ca. Unitholders may also contact us using one of these methods to request a copy of the investment fund’s proxy voting policies and procedures, proxy voting disclosure record, or quarterly portfolio disclosure. Management Discussion of Fund Performance . Results of Operations CIBC Asset Management Inc. (CAMI,theManager, or Portfolio Global economic growth remained slow over the period. Concerns Advisor), Picton Mahoney Asset Management (Picton Mahoney), about China’s economic growth and U.S. Federal Reserve Board Triasima Portfolio Management Inc. (Triasima), Connor, Clark & Lunn policy were the two largest factors weighing on the global economic Investment Management Ltd. (CC&L) and Foyston, Gordon & Payne outlook. Commodity prices continued to fall, worsened by a Inc. (Foyston) provide investment advice and investment management strengthening U.S. dollar. Slow global growth and plunging oil prices services to Frontiers Canadian Equity Pool (the Pool). -

DFA Canada Canadian Vector Equity Fund - Class a As of July 31, 2021 (Updated Monthly) Source: RBC Holdings Are Subject to Change

DFA Canada Canadian Vector Equity Fund - Class A As of July 31, 2021 (Updated Monthly) Source: RBC Holdings are subject to change. The information below represents the portfolio's holdings (excluding cash and cash equivalents) as of the date indicated, and may not be representative of the current or future investments of the portfolio. The information below should not be relied upon by the reader as research or investment advice regarding any security. This listing of portfolio holdings is for informational purposes only and should not be deemed a recommendation to buy the securities. The holdings information below does not constitute an offer to sell or a solicitation of an offer to buy any security. The holdings information has not been audited. By viewing this listing of portfolio holdings, you are agreeing to not redistribute the information and to not misuse this information to the detriment of portfolio shareholders. Misuse of this information includes, but is not limited to, (i) purchasing or selling any securities listed in the portfolio holdings solely in reliance upon this information; (ii) trading against any of the portfolios or (iii) knowingly engaging in any trading practices that are damaging to Dimensional or one of the portfolios. Investors should consider the portfolio's investment objectives, risks, and charges and expenses, which are contained in the Prospectus. Investors should read it carefully before investing. Your use of this website signifies that you agree to follow and be bound by the terms and conditions of -

Bmgft-2008-990-Pf.Pdf

Return of Private Foundation OMB No. 1545-0052 Form 990-PF or Section 4947(a)(1) Nonexempt Charitable Trust Department of the Treasury Treated as a Private Foundation Internal Revenue Service Note: The foundation may be able to use a copy of this return to satisfy state reporting requirements. For calendar year 2008, or tax year beginning , 2008, and ending , 20 G Check all that apply: Initial return Final return Amended returnX Address change Name change Name of foundation A Employer identification number Use the IRS label. BILL & MELINDA GATES FOUNDATION TRUST 91-1663695 Otherwise, Number and street (or P.O. box number if mail is not delivered to street address) Room/suite B Telephone number (see page 10 of the instructions) print or type. See Specific PO BOX 23350 (206) 709-3100 City or town, state, and ZIP code C If exemption application is Instructions. pending, check here D 1. Foreign organizations, check here SEATTLE, WA 98102 2. Foreign organizations meeting the 85% test, check here and attach H Check type of organization:X Section 501(c)(3) exempt private foundation computation Section 4947(a)(1) nonexempt charitable trust Other taxable private foundation E If private foundation status was terminated I Fair market value of all assets at end J Accounting method: CashX Accrual under section 507(b)(1)(A), check here of year (from Part II, col. (c), line Other (specify) F If the foundation is in a 60-month termination 16) $ 29,673,548,843. (Part I, column (d) must be on cash basis.) under section 507(b)(1)(B), check here Part I Analysis of Revenue and Expenses (The (d) Disbursements total of amounts in columns (b), (c), and (d) (a) Revenue and (b) Net investment (c) Adjusted net for charitable may not necessarily equal the amounts in expenses per income income purposes books column (a) (see page 11 of the instructions).) (cash basis only) 1 Contributions, gifts, grants, etc., received (attach schedule) 1,856,600,857. -

Stoxx® Canada Total Market Mid Index

STOXX® CANADA TOTAL MARKET MID INDEX Components1 Company Supersector Country Weight (%) EMERA Utilities Canada 3.01 BAUSCH HEALTH Health Care Canada 2.71 WSP GLOBAL Construction & Materials Canada 2.59 Teck Resources Ltd. Cl B Basic Resources Canada 2.48 Canadian Tire Corp. Ltd. Cl A Retail Canada 2.36 ALGONQUIN POWER & UTILITIES Utilities Canada 2.34 CAE Industrial Goods & Services Canada 2.27 CCL INDS.'B' Industrial Goods & Services Canada 2.12 CANADIAN APARTMENT PROP REIT Real Estate Canada 2.11 Kinross Gold Corp. Basic Resources Canada 2.11 TFI INTERNATIONAL Industrial Goods & Services Canada 2.04 LIGHTSPEED POS Technology Canada 1.97 AIR CANADA Travel & Leisure Canada 1.95 Cameco Corp. Energy Canada 1.93 INTER PIPELINE Energy Canada 1.83 TOROMONT INDUSTRIES Industrial Goods & Services Canada 1.81 TOURMALINE OIL Energy Canada 1.81 GILDAN ACTIVEWEAR Consumer Products & Services Canada 1.77 Blackberry Ltd Technology Canada 1.72 RITCHIE BROS.AUCTIONEERS (NYS) Consumer Products & Services Canada 1.68 WEST FRASER TIMBER Basic Resources Canada 1.62 FIRSTSERVICE Real Estate Canada 1.62 NORTHLAND POWER Utilities Canada 1.56 PAN AMER.SILV. (NAS) Basic Resources Canada 1.55 LUNDIN MINING Basic Resources Canada 1.53 ALTAGAS Utilities Canada 1.51 KEYERA CORP Energy Canada 1.51 IA FINANCIAL CORP Insurance Canada 1.51 EMPIRE 'A' Personal Care, Drug & Grocery Stores Canada 1.49 DESCARTES SYSTEMS GROUP Technology Canada 1.44 RIOCAN REIT.TST. Real Estate Canada 1.44 ONEX Financial Services Canada 1.44 TMX GROUP Financial Services Canada 1.41 ARC RESOURCES LTD Energy Canada 1.29 Element Fleet Management Corp. -

Latest Developments in the Canadian Infrastructures Market

Latest developments in the Canadian infrastructures market December 15, 2017 TABLE OF CONTENTS Latest developments in the SNC-Lavalin sells Montréal headquarters Canadian infrastructures market for $170 million . Brookfield Infrastructure Debt Fund I raises British Columbia Throne Speech $US284 million promises new public transportation and Canada unveils $2 .1 billion transportation healthcare infrastructures budget InstarAGF completes the final close of Janice Fukakusa joins Canada InstarAGF Essential Infrastructure Fund Infrastructure Bank First Action Plan for Québec’s 2030 A new PPP hospital project for Québec? Energy Policy unveiled Over 30 companies respond to request for SNC-Lavalin monetizes part of its pre-qualification for Southwest Ontario infrastructure assets Broadband project Innergex Renewable Energy inc . bcIMC posts 9 .6% annualized return on acquires two wind power projects in infrastructure France Petronas cancels Pacific Northwest LNG ff Pre-qualification of bidders for project . Saskatchewan wind power program Cascades sells stake in Boralex to CDPQ . Infrastructure Ontario to restart Hydro-Québec bids in Massachusetts RFP procurement process for Finch West LRT project Monique Leroux joins Fiera Capital . Government of Canada commits $1 .28 billion to REM project . Call for funding for Henvey Inlet wind power project PSP Investment posts strong performance for 2017 in infrastructure sector Latest developments in the Canadian infrastructures market Copyright (c) Lavery, de Billy, S.E.N.C.R.L. - L.L.P. British Columbia Throne Speech promises new public transportation and healthcare infrastructures In its June 19, 2017 Speech from the Throne, the B .C . minority Liberal government’s objective was to address elector expectations, especially regarding the issues highlighted in the NDP and Green Party platforms . -

The Pharmaceutical Industry in Brazil

Wind Energy in Quebec Flanders Investment & Trade - Montreal I August 2012 WIND ENERGY IN QUEBEC Mieke Pynnaert – Flemish Economic Representative Alice Mihaly - Commercial Assistant Montreal, 1 August 2012 Table of Contents 1. Introduction ................................................................................................................................................................ 4 The capturing system of the wind .................................................................................................................................. 4 2. Wind energy production in the world ........................................................................................................................ 6 3. Wind energy industry in Quebec and its characteristics ............................................................................................ 7 Wind energy potential in Quebec ................................................................................................................................... 7 A growing industry in Quebec ........................................................................................................................................ 8 Wind energy projects in Quebec .................................................................................................................................... 9 Economic impact .......................................................................................................................................................... 12 4. -

Women in Leadership at S&P/Tsx Companies

WOMEN IN LEADERSHIP AT S&P/TSX COMPANIES Women in Leadership at WOMEN’S S&P/TSX Companies ECONOMIC Welcome to the first Progress Report of Women on Boards and Executive PARTICIPATION Teams for the companies in the S&P/TSX Composite Index, the headline AND LEADERSHIP index for the Canadian equity market. This report is a collaboration between Catalyst, a global nonprofit working with many of the world’s leading ARE ESSENTIAL TO companies to help build workplaces that work for women, and the 30% Club DRIVING BUSINESS Canada, the global campaign that encourages greater representation of PERFORMANCE women on boards and executive teams. AND ACHIEVING Women’s economic participation and leadership are essential to driving GENDER BALANCE business performance, and achieving gender balance on corporate boards ON CORPORATE and among executive ranks has become an economic imperative. As in all business ventures, a numeric goal provides real impetus for change, and our BOARDS collective goal is for 30% of board seats and C-Suites to be held by women by 2022. This report offers a snapshot of progress for Canada’s largest public companies from 2015 to 2019, using the S&P/TSX Composite Index, widely viewed as a barometer of the Canadian economy. All data was supplied by MarketIntelWorks, a data research and analytics firm with a focus on gender diversity, and is based on a review of 234 S&P/TSX Composite Index companies as of December 31, 2019. The report also provides a comparative perspective on progress for companies listed on the S&P/TSX Composite Index versus all disclosing companies on the TSX itself, signalling the amount of work that still needs to be done. -

ANNUAL INFORMATION FORM Year Ended December 31, 2019

SNC-LAVALIN GROUP INC. ANNUAL INFORMATION FORM Year Ended December 31, 2019 February 27, 2020 TABLE OF CONTENTS INTERPRETATION .................................................................................................................................... 3 CAUTION REGARDING FORWARD-LOOKING STATEMENTS ................................................................... 3 1. CORPORATE STRUCTURE ........................................................................................................... 5 1.1 INCORPORATION OF THE COMPANY .............................................................................. 5 1.2 SUBSIDIARIES, JOINT ARRANGEMENTS AND ASSOCIATES .............................................. 5 2. GENERAL DEVELOPMENT OF THE BUSINESS ............................................................................. 7 3. DESCRIPTION OF THE BUSINESS .............................................................................................. 11 3.1 GENERAL ....................................................................................................................... 11 3.2 REVENUE BACKLOG ....................................................................................................... 14 3.3 RISK FACTORS ................................................................................................................ 14 3.4 NUMBER OF EMPLOYEES .............................................................................................. 14 3.5 SOCIAL AND OTHER IMPORTANT POLICIES: THE VALUES THAT GUIDE US .................