Morningstar® National Bank Quebec Index

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Canadian Credit Card Fees Class Action National Settlement Agreement

CANADIAN CREDIT CARD FEES CLASS ACTION NATIONAL SETTLEMENT AGREEMENT Made on October 28, 2020 (the “Execution Date”) Amended on January 22, 2021 Between COBURN AND WATSON’S METROPOLITAN HOME DBA METROPOLITAN HOME (“Metropolitan Home”) AND MAYNARD’S SOUTHLANDS STABLES LTD., HELLO BABY EQUIPMENT INC., JONATHON BANCROFT-SNELL, 1739793 ONTARIO INC., 9085-4886 QUEBEC INC., PETER BAKOPANOS, MACARONIES HAIR CLUB AND LASER CENTER INC. OPERATING AS FUZE SALON and BANK OF MONTREAL (“BMO”), THE BANK OF NOVA SCOTIA (“BNS”), CANADIAN IMPERIAL BANK OF COMMERCE (“CIBC”) ROYAL BANK OF CANADA (“RBC”), AND THE TORONTO-DOMINION BANK (“TD”) {11005-001/00789904.2} - i - TABLE OF CONTENTS RECITALS ......................................................................................................................................1 SECTION 1 - DEFINITIONS .........................................................................................................4 SECTION 2 - SETTLEMENT APPROVAL ................................................................................21 2.1 Best Efforts ...............................................................................................................21 2.2 Motions Certifying or Authorizing the Canadian Proceedings and for Approvals ..21 2.3 Agreement on Form of Orders .................................................................................23 2.4 Pre-Motion Confidentiality ......................................................................................23 2.5 Sequence of Motions ................................................................................................24 -

Dynamic Power Canadian Growth Fund

SUMMARY OF INVESTMENT PORTFOLIO As at March 31, 2021 The Summary of Investment Portfolio may change due to ongoing portfolio transactions. Updates are available quarterly on our website at www.dynamic.ca 60 days after quarter end, except for June 30, which is the fiscal year end, when they are available after 90 days. The total net asset value of the Fund as at March 31, 2021 was $646,062,000. Percentage of net Percentage of net By Asset Type asset value † Top 25 Holdings asset value † Equities 97.2 Intact Financial Corporation 5.6 Cash and Short Term Instruments (Bank Overdraft) 2.9 Canadian National Railway Company 5.4 Other Net Assets (Liabilities) -0.1 West Fraser Timber Co. Ltd. 5.0 Facebook, Inc., Class "A" 4.2 Microsoft Corporation 4.2 Percentage of net Canadian Pacific Railway Limited 4.1 By Country / Region (1) asset value † Alphabet Inc., Class "C" 4.0 Canada 57.2 National Bank of Canada 4.0 United States 40.0 Amazon.com, Inc. 3.7 Cash and Short Term Instruments (Bank Overdraft) 2.9 Trisura Group Ltd. 3.6 NVIDIA Corporation 3.5 Percentage of net Toronto-Dominion Bank (The) 3.1 By Industry (1)(2) asset value † Brookfield Asset Management Inc., Class "A" 3.1 Financials 26.4 Sherwin-Williams Company (The) 3.0 Information Technology 17.7 Apple Inc. 3.0 Consumer Discretionary 14.6 Visa Inc., Class "A" 2.9 Industrials 14.1 Cash and Short Term Instruments (Bank Overdraft) 2.9 Communication Services 8.2 Royal Bank of Canada 2.9 Materials 7.3 Nuvei Corporation, Subordinated Voting 2.5 Health Care 4.1 Danaher Corporation 2.4 Consumer Staples 3.9 CCL Industries Inc., Class "B" 2.3 Cash and Short Term Instruments (Bank Overdraft) 2.9 CGI Inc. -

Notice of 2009 Annual Meeting of Shareholders And

NOTICE OF 2009 ANNUAL MEETING OF SHAREHOLDERS AND MANAGEMENT PROXY CIRCULAR WHAT'S INSIDE NOTICE OF 2009 ANNUAL SHAREHOLDER MEETING ...................................................................................... 2 MANAGEMENT PROXY CIRCULAR ...................................................................................................................... 3 VOTING YOUR SHARES........................................................................................................................................... 4 BUSINESS OF THE MEETING................................................................................................................................ 10 THE NOMINATED DIRECTORS............................................................................................................................. 12 STATEMENT OF GOVERNANCE PRACTICES.................................................................................................... 19 COMMITTEES........................................................................................................................................................... 24 COMPENSATION OF CERTAIN EXECUTIVE OFFICERS .................................................................................. 29 AIR CANADA'S EXECUTIVE COMPENSATION PROGRAM............................................................................. 34 PERFORMANCE GRAPHS ...................................................................................................................................... 39 OTHER IMPORTANT -

Canadian Focus List

RBC Dominion Securities Inc. Canadian Focus List March 1, 2017 | Quarterly Report Portfolio Advisory Group – Equities What’s inside 3 Portfolio positions Waiting for the baton to be passed 4 Sector commentary The Canadian Focus List delivered a solid return amid a search for clarity on U.S. policy direction. 8 Alimentation Couche-Tard Inc. Portfolio increase 9 Canadian National Railway Improved global economic data helped Markets were surprisingly calm during Portfolio increase set the market on an upward trajectory the Portfolio’s winter 2017 quarter with 10 Canadian Pacific Railway Ltd. in early 2016. Despite initial trepidation, volatility holding at historically low the election of a U.S. president set on levels. We believe it is reasonable to Portfolio decrease slashing tax rates, increasing fiscal expect moments of market anxiety in 11 Cott Corporation spending, and cutting regulatory red the months to come as policy-related Portfolio removal tape stoked investor enthusiasm for headlines influence expectations for 12 Dollarama Inc. higher potential corporate earnings future tax rates, fiscal spending levels, and set the stage for the market’s next and regulatory oversight. In such an Portfolio increase leg higher late last year. We have now environment, we believe clients are well 13 Imperial Oil Ltd. entered a period where investors are served by the Focus List’s prudent mix Portfolio removal looking for signs that the baton is in of economically sensitive and defensive 14 Magna International Inc. the process of being passed from policy positions in addition to adherence to Portfolio increase rhetoric to tangible action. the Portfolio’s core tenet of emphasizing high-quality, well-managed businesses. -

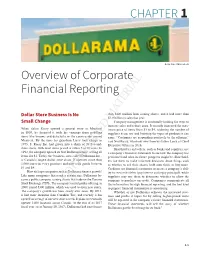

Overview of Corporate Financial Reporting CHAPTER 1

cc01OverviewOfCorporateFinancialReporting.indd01OverviewOfCorporateFinancialReporting.indd PagePage 1-11-1 19/01/1819/01/18 2:232:23 PMPM f-0157f-0157 //208/WB02258/9781119407003/ch01/text_s208/WB02258/9781119407003/ch01/text_s CHAPTER 1 kevin brine/Shutterstock Overview of Corporate Financial Reporting Dollar Store Business Is No than $420 million from issuing shares, and it had more than $2.9 billion in sales that year. Small Change Company management is continually looking for ways to increase sales and reduce costs. It recently increased the max- When Salim Rossy opened a general store in Montreal imum price of items from $3 to $4, widening the number of in 1910, he fi nanced it with his earnings from peddling suppliers it can use and boosting the types of products it can items like brooms and dishcloths in the countryside around carry. “Customers are responding positively to the off ering,” Montreal. By the time his grandson Larry took charge in said Neil Rossy, who took over from his father Larry as Chief 1973, S. Rossy Inc. had grown into a chain of 20 fi ve-and- Executive Offi cer in 2016. dime stores, with most items priced at either 5 or 10 cents. In Shareholders and others, such as banks and suppliers, use 1992, the company opened its fi rst Dollarama store, selling all a company’s fi nancial statements to see how the company has items for $1. Today, the business, now called Dollarama Inc., performed and what its future prospects might be. Sharehold- is Canada’s largest dollar store chain. It operates more than ers use them to make informed decisions about things such 1,000 stores in every province and now sells goods between as whether to sell their shares, hold onto them, or buy more. -

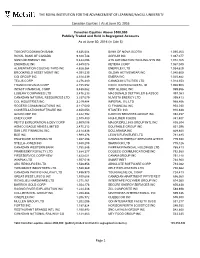

THE ROYAL INSTITUTION for the ADVANCEMENT of LEARNING/Mcgill UNIVERSITY

THE ROYAL INSTITUTION FOR THE ADVANCEMENT OF LEARNING/McGILL UNIVERSITY Canadian Equities │ As at June 30, 2016 Canadian Equities Above $500,000 Publicly Traded and Held in Segregated Accounts As at June 30, 2016 (in Cdn $) TORONTO DOMINION BANK 9,836,604 BANK OF NOVA SCOTIA 1,095,263 ROYAL BANK OF CANADA 9,328,748 AGRIUM INC 1,087,077 SUNCOR ENERGY INC 5,444,096 ATS AUTOMATION TOOLING SYS INC 1,072,165 ENBRIDGE INC 4,849,078 KEYERA CORP 1,067,040 ALIMENTATION COUCHE-TARD INC 4,628,364 ENERFLEX LTD 1,054,629 BROOKFIELD ASSET MGMT INC 4,391,535 GILDAN ACTIVEWEAR INC 1,040,600 CGI GROUP INC 4,310,339 EMERA INC 1,025,882 TELUS CORP 4,276,480 CANADIAN UTILITIES LTD 1,014,353 FRANCO-NEVADA CORP 4,155,552 EXCO TECHNOLOGIES LTD 1,008,903 INTACT FINANCIAL CORP 3,488,562 WSP GLOBAL INC 999,856 LOBLAW COMPANIES LTD 3,476,233 MACDONALD DETTWILER & ASSOC 997,083 CANADIAN NATURAL RESOURCES LTD 3,337,079 NUVISTA ENERGY LTD 995,413 CCL INDUSTRIES INC 3,219,484 IMPERIAL OIL LTD 968,856 ROGERS COMMUNICATIONS INC 3,117,080 CI FINANCIAL INC 954,030 CONSTELLATION SOFTWARE INC 2,650,053 STANTEC INC 910,638 GOLDCORP INC 2,622,792 CANYON SERVICES GROUP INC 892,457 ONEX CORP 2,575,400 HIGH LINER FOODS 841,407 PEYTO EXPLORATION & DEV CORP 2,509,098 MAJOR DRILLING GROUP INTL INC 838,304 AGNICO EAGLE MINES LIMITED 2,475,212 EQUITABLE GROUP INC 831,396 SUN LIFE FINANCIAL INC 2,414,836 DOLLARAMA INC 829,840 BCE INC 1,999,278 LEON'S FURNITURE LTD 781,495 ENGHOUSE SYSTEMS LTD 1,867,298 CANADIAN ENERGY SERVICES &TECH 779,690 STELLA-JONES INC 1,840,208 SHAWCOR LTD 775,126 -

Retirement Strategy Fund 2060 Description Plan 3S DCP & JRA

Retirement Strategy Fund 2060 June 30, 2020 Note: Numbers may not always add up due to rounding. % Invested For Each Plan Description Plan 3s DCP & JRA ACTIVIA PROPERTIES INC REIT 0.0137% 0.0137% AEON REIT INVESTMENT CORP REIT 0.0195% 0.0195% ALEXANDER + BALDWIN INC REIT 0.0118% 0.0118% ALEXANDRIA REAL ESTATE EQUIT REIT USD.01 0.0585% 0.0585% ALLIANCEBERNSTEIN GOVT STIF SSC FUND 64BA AGIS 587 0.0329% 0.0329% ALLIED PROPERTIES REAL ESTAT REIT 0.0219% 0.0219% AMERICAN CAMPUS COMMUNITIES REIT USD.01 0.0277% 0.0277% AMERICAN HOMES 4 RENT A REIT USD.01 0.0396% 0.0396% AMERICOLD REALTY TRUST REIT USD.01 0.0427% 0.0427% ARMADA HOFFLER PROPERTIES IN REIT USD.01 0.0124% 0.0124% AROUNDTOWN SA COMMON STOCK EUR.01 0.0248% 0.0248% ASSURA PLC REIT GBP.1 0.0319% 0.0319% AUSTRALIAN DOLLAR 0.0061% 0.0061% AZRIELI GROUP LTD COMMON STOCK ILS.1 0.0101% 0.0101% BLUEROCK RESIDENTIAL GROWTH REIT USD.01 0.0102% 0.0102% BOSTON PROPERTIES INC REIT USD.01 0.0580% 0.0580% BRAZILIAN REAL 0.0000% 0.0000% BRIXMOR PROPERTY GROUP INC REIT USD.01 0.0418% 0.0418% CA IMMOBILIEN ANLAGEN AG COMMON STOCK 0.0191% 0.0191% CAMDEN PROPERTY TRUST REIT USD.01 0.0394% 0.0394% CANADIAN DOLLAR 0.0005% 0.0005% CAPITALAND COMMERCIAL TRUST REIT 0.0228% 0.0228% CIFI HOLDINGS GROUP CO LTD COMMON STOCK HKD.1 0.0105% 0.0105% CITY DEVELOPMENTS LTD COMMON STOCK 0.0129% 0.0129% CK ASSET HOLDINGS LTD COMMON STOCK HKD1.0 0.0378% 0.0378% COMFORIA RESIDENTIAL REIT IN REIT 0.0328% 0.0328% COUSINS PROPERTIES INC REIT USD1.0 0.0403% 0.0403% CUBESMART REIT USD.01 0.0359% 0.0359% DAIWA OFFICE INVESTMENT -

Power to Do More

2018 2018 Annual Report Annual Report @BoralexInc boralex.com POWER TO DO MORE NOTICE of Annual Meeting of Shareholders Management proxy CIRCULAR 2018 Our thanks to the employees who accepted to appear on the cover page: Van Anh Dang Vu (Kingsey Falls, Québec), Myriam Savage (Thetford Mines, Québec) and Ernani Schnorenberger (Lyon, France). PROFILE Boralex develops, builds and operates renewable energy power facilities in Canada, France, the United Kingdom and the United States. A leader in the Canadian market and France’s largest independent producer of onshore wind power, the Corporation is recognized for its solid experience in optimizing its asset base in four power generation types – wind, hydroelectric, thermal and solar. Boralex has ensured sustained growth by leveraging the expertise and diversification developed for more than 25 years. General HEAD OFFICE WEBSITE www.boralex.com Boralex Inc. Information 36 Lajeunesse Street Kingsey Falls (Québec) Canada J0A 1B0 @BoralexInc Telephone: 819-363-6363 Fax: 819-363-6399 [email protected] BUSINESS OFFICES CANADA UNITED STATES 900 de Maisonneuve Boulevard West 606-1155 Robson Street 39 Hudson Falls Street 24th floor Vancouver, British Columbia South Glens Falls New York Montréal, Québec Canada V6E 1B5 12803 Canada H3A 0A8 Telephone: 1-855-604-6403 United States Telephone: 514-284-9890 Telephone: 518-747-0930 Fax: 514-284-9895 201-174 Mill Street Fax: 518-747-2409 Milton, Ontario Canada L9T 1S2 Telephone: 819-363-6430 | 1-844-363-6430 FRANCE UNITED KINGDOM 71, rue Jean-Jaurès -

STOXX Canada 240 Last Updated: 02.10.2017

STOXX Canada 240 Last Updated: 02.10.2017 Rank Rank (PREVIOU ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) S) CA7800871021 2754383 RY.TO RY Royal Bank of Canada CA CAD Y 95.2 1 1 CA8911605092 2897222 TD.TO TDpD Toronto-Dominion Bank CA CAD Y 87.8 2 2 CA0641491075 2076281 BNS.TO BNS Bank of Nova Scotia CA CAD Y 65.0 3 3 CA29250N1050 2466149 ENB.TO IPL Enbridge Inc. CA CAD Y 57.8 4 4 CA8672241079 B3NB1P2 SU.TO T.SU Suncor Energy Inc. CA CAD Y 49.2 5 6 CA1363751027 2180632 CNR.TO TCNR Canadian National Railway Co. CA CAD Y 45.7 6 5 CA0636711016 2076009 BMO.TO BMO Bank of Montreal CA CAD Y 41.6 7 7 CA89353D1078 2665184 TRP.TO TRP TransCanada Corp. CA CAD Y 36.3 8 8 CA05534B7604 B188TH2 BCE.TO B BCE Inc. CA CAD Y 35.6 9 9 CA56501R1064 2492519 MFC.TO 274642 Manulife Financial Corp. CA CAD Y 33.9 10 10 CA1360691010 2170525 CM.TO 217052 Canadian Imperial Bank of Comm CA CAD Y 32.2 11 13 CA1363851017 2171573 CNQ.TO TCNQ Canadian Natural Resources Ltd CA CAD Y 31.6 12 12 CA1125851040 2092599 BAMa.TO TEBC.A BROOKFIELD ASSET MANAGEMENT CA CAD Y 31.5 13 11 CA13645T1003 2793115 CP.TO 279311 Canadian Pacific Railway Ltd. CA CAD Y 20.8 14 15 CA8667961053 2566124 SLF.TO 256612 Sun Life Financial Inc. CA CAD Y 20.6 15 14 CA87971M1032 2381093 T.TO BCT TELUS CA CAD Y 18.0 16 16 CA01626P4033 2011646 ATDb.TO 201164 ALIMENTATION CCH.TARD CA CAD Y 16.2 17 18 CA5592224011 2554475 MG.TO MG.A Magna International Inc. -

Expansion in Full Swing

20 Expansion 20 in full swing Positioning for sustainable growth LE MEILLEUR DE NOS Management FORCES Information CIRCULAR NOTICE of Annual Meeting of Shareholders Notice of Annual Meeting of Shareholders Dear shareholders, We invite you to attend Boralex Inc.’s 2020 annual meeting of shareholders. Items of business When The meeting will be held for the following purposes: May 5, 2021 1. Receive the consolidated financial statements of the 11:00 a.m. (Eastern Daylight Time) Corporation for the financial year ended December 31, 2020 and the independent auditor’s report thereon 2. Elect the directors 3. Appoint the independent auditor Where 4. Adopt a non-binding advisory resolution, the text of which is Virtual meeting via live audio webcast at reproduced on page 15 of the management information circular, https://web.lumiagm.com/262304484 accepting our approach to executive compensation 5. Adopt a resolution, the text of which is reproduced on page 156 of the management information circular, reconfirming and renewing the shareholder rights plan adopted by the board of directors on March 1, 2018 Materials A notice of availability of proxy materials 6. Consider any other business that may properly come before the for our 2020 annual meeting is being meeting or any adjournment thereof. mailed to shareholders on or about March 26, 2021. Notice-and-Access We are providing access to the meeting This year, as permitted by Canadian corporate and securities Materials, the Financial Statements and regulators, Boralex Inc. is using notice-and-access to deliver the annual report to both our registered management information circular of Boralex Inc. -

13 March 2003 Mr. Alex Himelfarb Clerk of the Privy Council and Secretary to the Cabinet

13 March 2003 Mr. Alex Himelfarb Clerk of the Privy Council and Secretary to the Cabinet Langevin Block 80 Wellington Street Ottawa, Ontario K1A 0A3 Bernard A. Courtois Executive Counsel Dear Mr. Himelfarb: BCE & Bell Canada Subject: Canada Gazette – Notice No. DGTP-001-03 Petition to the Governor in Council from Quebecor Média inc. under Section 12 of the Telecommunications Act in regard to the following CRTC Decision: Quebecor Média inc. – Alleged anti-competitive cross-subsidization of Bell ExpressVu, Telecom Decision CRTC 2002-61 These comments are filed on behalf of BCE Inc. and Bell Canada in response to the petition by Quebecor Média inc. (“Quebecor”) to the Governor in Council regarding Telecom Decision CRTC 2002-61 (“the Decision”). In its application of 4 April 2002, filed with the CRTC pursuant to Part VII of the CRTC Telecommunications Rules of Procedure, Quebecor alleged that BCE has been using profits generated by Bell Canada to anti-competitively cross-subsidize the entry of Bell ExpressVu Limited Partnership (“ExpressVu”) into the Quebec broadcasting distribution market. Quebecor argued that mechanisms put in place by the Commission to prevent cross-subsidization of ExpressVu by Bell Canada be activated in order to prevent Bell Canada, the dominant player in local telephone service, from becoming the dominant broadcasting distribution undertaking (“BDU”). In its Decision of 8 October 2002, the Commission found that Bell Canada was not, in fact, inappropriately cross-subsidizing ExpressVu, and furthermore, that ExpressVu was not the dominant BDU that Quebecor warned about: [T]he Commission remains of the view that the existing mechanisms, including those recently modified in Decision 2002- 34, are appropriate and sufficient to prevent inappropriate cross- subsidization of ExpressVu by Bell Canada, at the expense of users of telecommunications services. -

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance

Frontiers Canadian Equity Pool Interim Management Report of Fund Performance for the period ended February 29, 2016 All figures are reported in Canadian dollars unless otherwise noted. This interim management report of fund performance contains financial highlights but does not contain either the complete interim or annual financial statements of the investment fund. If you have not received a copy of the interim financial reports with this interim management report of fund performance, you can get a copy of the interim financial reports or annual financial statements at your request, and at no cost, by calling us toll-free at 1-888-888-3863, by writing to us at Renaissance Investments, 1500 Robert-Bourassa Boulevard, Suite 800, Montreal, QC, H3A 3S6, by visiting the SEDAR website at sedar.com, or by visiting renaissanceinvestments.ca. Unitholders may also contact us using one of these methods to request a copy of the investment fund’s proxy voting policies and procedures, proxy voting disclosure record, or quarterly portfolio disclosure. Management Discussion of Fund Performance . Results of Operations CIBC Asset Management Inc. (CAMI,theManager, or Portfolio Global economic growth remained slow over the period. Concerns Advisor), Picton Mahoney Asset Management (Picton Mahoney), about China’s economic growth and U.S. Federal Reserve Board Triasima Portfolio Management Inc. (Triasima), Connor, Clark & Lunn policy were the two largest factors weighing on the global economic Investment Management Ltd. (CC&L) and Foyston, Gordon & Payne outlook. Commodity prices continued to fall, worsened by a Inc. (Foyston) provide investment advice and investment management strengthening U.S. dollar. Slow global growth and plunging oil prices services to Frontiers Canadian Equity Pool (the Pool).